Quantum Computing Software Market by Component (Software, Services), Deployment Mode (Cloud, On-Premises), Organization Size, Technology, Application (Optimization, Simulation), Vertical (BFSI, Government), and Region - Global Forecast to 2026

Updated on : March 06, 2023

Quantum Computing Software Market Size

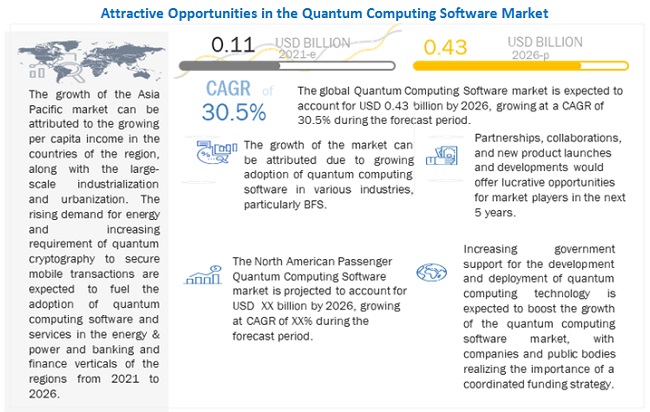

The global quantum computing software market size in terms of revenue was estimated to be worth $0.11 billion in 2021 and is poised to reach $0.43 billion by 2026, growing at a CAGR of 30.5% from 2021 to 2026.

The major factors driving the growth of the quantum computing software market include the growing adoption of quantum computing software in the BFSI vertical, government support for the development and deployment of the technology, and the increasing number of strategic alliances for research and development.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 Impact

Quantum computing technology was witnessing increasing global demand during the pre-COVID-19 period, as companies were making strategic partnerships and collaborations and undertaking patent registrations to enhance their position in the market. During the pre-COVID-19 scenario, the key factor driving the growth of the quantum computing market was the rising investments by governments of different countries in the development of quantum computing technology.

The growth of the quantum computing market is primarily driven by technological advancements in quantum computing technology. The demand for quantum computing systems and services post-COVID-19 is expected to increase owing to the rise in the adoption of quantum computing technology in drug discovery. However, the stability and error correction issues in quantum computing technology are expected to restrain the market growth.

Market Dynamics

Driver: Growing adoption of quantum computing software in banking, financial services, and insurance vertical

Quantum computing is gaining traction in the banking, financial services, and insurance (BFSI) vertical, where companies are highly focusing on increasing the speed of trade activities, transactions, and data processing manifolds. One of the potential applications of quantum computing is simulation. Quantum computing helps to identify effective and efficient ways to manage financial risks. The processing time and costs of high-quality solutions can increase exponentially if conventional computers are used in financial institutions, while quantum computers can carry out operations faster at optimized costs, resulting in cost savings and the creation of new opportunities for revenue generation.

Financial institutions that can harness quantum computing software are likely to observe significant benefits. They will be able to more effectively analyze large or unstructured data sets, which could help banks and other related domains to make better decisions and improve customer service. The potential benefit of quantum computing in the financial services segment includes providing relevant and required solutions for cybersecurity to safeguard the financial data of consumers using next-generation cryptography. Moreover, the detection of fraudulent activities by recognizing the behavior patterns of consumers is increasing with the help of quantum computing technology, which leads to proactive fraud risk management. The optimization of portfolio management of assets with interdependencies and predictive analytics in customer behavior can be done by combining quantum computing with artificial intelligence (AI). In addition, a combination of quantum computing and blockchain technology is expected to lead to the development of the most hack-proof technology in this era of IoT. The combination is also expected to significantly increase the transaction speed and reduce processing costs in the BFSI vertical, thereby reducing infrastructure downtime.

Restraint: Technical and implementation challenges

The engineering of quantum computing is still in the research stage. Besides, the implementation of quantum computing solutions in real-time applications has various technical challenges. Quantum computers are susceptible to interaction with the environment since any interaction can collapse the state function. The development of universal computers, which can be used for real-time applications, is only theoretically proved, and the exact contribution of quantum computing solutions to the existing computing methods is not yet clear. These factors have developed a gap between research labs, investment companies, and the enterprise ecosystem, which consequently is expected to hamper the growth of the global quantum computing market.

Opportunity: Growing adoption of quantum computing technology in healthcare vertical

The research and development related to biopharmaceuticals, right from the drug discovery to its production, is expensive, lengthy, and risky. A new drug typically takes 10–15 years to progress from the discovery to the launching stage, and the capital related to it exceeds USD 2.0 billion. The success rate of developing new drugs is less than 10% from their entry into the clinical development stage to their launch. Biopharmaceutical companies count on a few blockbuster drugs to realize the payback of more than USD 180.0 billion that the industry spends annually on research and development activities related to new drugs.

Quantum computers provide powerful tools for studying complex systems such as human physiology and the impact of drugs on biological systems and living organisms. These computers are expected to be used in a number of applications in pharmaceutical research and development, especially during the early phases of drug discovery and development. Computational tools are the key components in drug discovery and development. In a number of instances, they have significantly shortened the time consumed by companies on drug optimization. Researchers rely on high-performance computing of powerful supercomputers or massive, parallel processing systems for carrying out in silico modeling of molecular structures, mapping the interactions between a drug and its target, and developing a simulation of the metabolism, distribution, and interaction of a drug in a human body.

Challenge: Lack of highly skilled professionals

Quantum computing is a new and promising technology. The implementation of this technology requires a pool of technically skilled professionals. Hence, finding professionals with the required skillset is a major challenge for the industry players. Governments of different countries and manufacturers of quantum computers are planning to start training sessions related to the technology to tackle this challenge. For instance, D-Wave Systems is providing training modules to its customers to make them aware of the functioning of quantum computers. However, the high cost associated with these modules is a challenge for businesses aiming to train their employees. Moreover, as these modules are complex, understanding them is a time-consuming and difficult process. As a result, manufacturers of quantum computers have to reduce their profit margins by additionally investing in different post-sales activities.

Services, by component segment to account for a larger market size during the forecast period

Services segment is leading the quantum computing software market in 2021. The growth of the services segment can be attributed to the increasing investments by start-ups in research and development related to quantum computing technology. Quantum computing software and services are used in optimization, simulation, and machine learning applications, thereby leading to optimum utilization costs and highly efficient operations in various industries.

SME’s, by organization size segment to grow at a higher CAGR during the forecast period

Among the organization size, the large enterprises is projected to dominate the market, while the SME’s segment is projected to record a higher growth rate during the forecast period. . Large enterprises are the major adopters of quantum computing software and services. Although quantum computing technology is still in the nascent stage, SMEs and large enterprises are realizing and learning the importance of the technology to solve complex optimization problems. These enterprises are focusing on delivering enhanced customer experiences and gaining a leading edge in the market.

Machine learning by application segment to grow at a higher CAGR during the forecast period

The machine learning segment is estimated to grow with the highest CAGR during the forecast period. The potential use of quantum computing and machine learning is expected to lead to advancements in clinical research and the transformation of medical practices. Machine learning applications are capable of eliminating most diagnostic errors related to image reading.

Healthcare & life sciences, by vertical segment to grow at a higher CAGR during the forecast period

The healthcare & life sciences vertical is expected to grow at the highest CAGR during the forecast period. Quantum computing technology enables scientists to develop medical and diagnostics tools that are ultra-precise and ultra-personalized. Moreover, quantum sensors can be used in magnetic resonance imaging (MRI) machines for ultra-precise measurements. These developments can enhance the quality of healthcare services. Various applications of quantum computing in the healthcare industry include optimization of radiotherapy treatments, creation of protein models, generation of targeted cancer drug therapies, and analysis of DNA.

To know about the assumptions considered for the study, download the pdf brochure

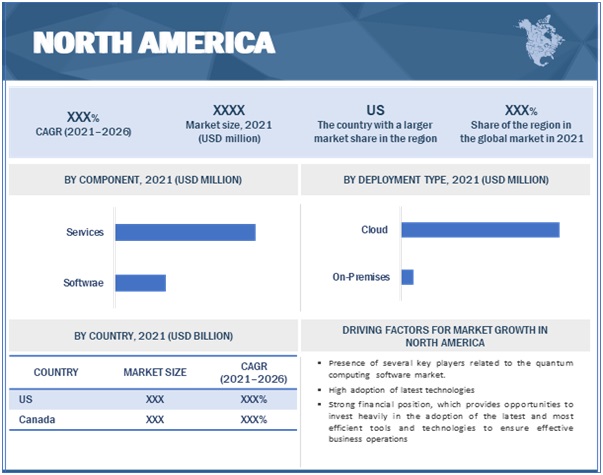

North America to account for the largest market size during the forecast period

North America is one of the most prominent regions in the quantum computing software market. The growth of the quantum computing software market in North America can be attributed to the fact that the region is home to the leading players of the market; quantum computing solutions and services are also witnessing increased adoption in the aerospace & defense, chemical, and BFSI industries of the region.

The US and Canada are the leading contributors to the growth of the quantum computing software market in North America. This region is a key market for quantum computing software and services as it is home to a number of key players such as D-Wave Systems (Canada), 1QB Information Technologies (US), IBM (US), and Amazon (US). Additionally, the Government of the US is actively supporting advancements in quantum computing applications. In December 2018, the Government of the US passed a bill that was aimed to invest ~USD 1.2 billion in the development of quantum technology. The government of the country is expected to leverage quantum computing for solving significant and complex problems and challenges related to molecular modeling, machine learning, physics, material sciences, chemical simulations, data discovery, etc.

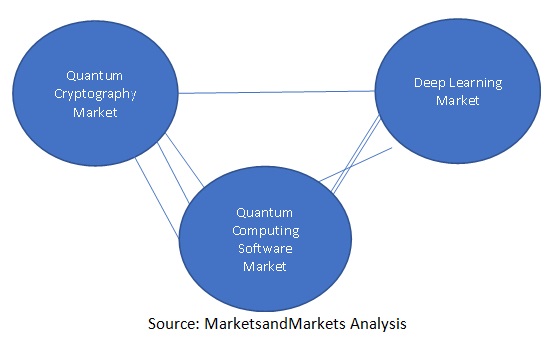

Market Interconnection

Market Players

The report includes the study of prominent players such as IBM Corporation (US), Microsoft Corporation (US), Amazon Web Services, Inc. (US), D-Wave Systems Inc (Canada), Rigetti Computing (US), Google LLC (US), Honeywell International Inc. (US), QC Ware (US), 1QBit (US), Huawei Technologies Co., Ltd. (China), Accenture plc (Ireland), Cambridge Quantum Computing (England), Fujitsu Limited (Japan), Riverlane (UK), Zapata Computing (US), Quantum Circuits, Inc. (US), Quantica Computacao (India), XANADU Quantum Technologies (Canada), VeriQloud (France), Quantastica (Finland), AVANETIX (Germany), Kuano (England), Rahko (UK), Ketita Labs (Estonia), and Aliro Quantum (US). The study includes an in-depth competitive analysis of these key players in the quantum computing software market with their company profiles, recent developments, and key market strategies.

Scope of the Report

|

Report Metrics |

Details |

|

Market size value in 2021 |

USD 0.11 Billion |

|

Market size value in 2026 |

USD 0.43 Billion |

|

Growth rate |

CAGR of 30.5% |

|

Market size available for years |

2017–2026 |

|

Base year considered |

2020 |

|

Forecast period |

2021–2026 |

|

Forecast units |

Value (USD Million) |

|

Segments covered |

component, deployment mode, organization size, technology, application, vertical, and region |

|

Regions covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

IBM, Microsoft, AWS, D-Wave Systems, Rigetti, Google, Honeywell, QC Ware, 1Qbit, Huawei, Accenture, Cambridge Quantum Computing, Fujitsu, Riverlane, Zapata, Quantum Circuits, Quantica Computacao, XANADU, VeriQloud, Quantastica , AVANETIX, Kuano, Rahko, Ketita Labs, and Aliro Quantum. |

This research report categorizes the quantum computing software market to forecast revenues and analyze trends in each of the following submarkets:

Based on Component, the Quantum Computing Software market has the following segments:

- Solutions

- Services

- Quantum as a Service

- Consulting Services

Based on deployment mode, the market has the following segments:

- Cloud and On-premises

Based on organization size, the Quantum Computing Software market has the following segments:

- SMEs

- Large Enterprises

Based on technology, the market has the following segments:

- Superconducting Qubits

- Trapped Ions

- Quantum Annealing

- Other Technologies

Based on application, the Quantum Computing Software market has the following segments:

- Optimization

- Machine Learning

- Simulation

- Others

Based on application, the market has the following segments:

- Aerospace & Defense

- BFSI

- Healthcare & Life Sciences

- Energy & Utility

- Chemical

- Transportation & Logistics, Government

- Education

Based on regions, the Quantum Computing Software has the following segments:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

APAC

- China

- Japan

- South Korea

- Rest of APAC

-

Row

- Latin America

- MEA

Recent Developments:

- In June 2021, Honeywell announced that Honeywell Quantum Solutions (HQS) and Cambridge Quantum Computing (CQC) will combine to form what the companies said will be the largest, most advanced standalone quantum computing company in the world, setting the pace for what is projected to become a USD 1 trillion quantum computing industry over the next 3 decades.

- In February 2021, D-Wave Systems has announced the introduction of Leap quantum cloud service in Singapore. Developers, researchers, and businesses in Singapore can now access D-Wave’s Advantage quantum computer, hybrid quantum/classical solvers, and the QAE in real-time via Leap to increase the development of business-critical, in-production hybrid applications.

- In December 2020, QC Ware and IonQ collaborated to perform an experiment that demonstrated that machine learning on near-term quantum computers can achieve the same or improved level of accuracy as classical computers and can be faster than them.

- In August 2020, Amazon Web Services announced the release of Amazon Braket, which can be accessed through both classically powered circuit simulators and quantum computers of D-Wave Systems, IonQ, and Rigetti Computing.

- In November 2019, IBM partnered with the Unitary Fund to provide grants and priority access to certain IBM Q systems. Similar to the quantum computing mission of IBM, the Unitary Fund aims to create a quantum technology industry that benefits most people in terms of the adoption of quantum technology.

Frequently Asked Questions (FAQ):

What are the growth drivers for quantum computing software market?

Below are some of the growth drivers for quantum computing software market:

- Increasing Investment in Quantum Computing Research and Development

- Demand for More Powerful Computing Solutions

- Advancements in Quantum Computing Hardware

- Potential for Quantum Computing to Disrupt Existing Industries

- Increasing Number of Quantum Computing Startups

What is the projected market value of the global Quantum Computing Software market?

Which region have the highest market share Quantum Computing Software market?

Which component segment is expected to witness a higher adoption rate in the coming years?

Who are the major vendors in the Quantum Computing Software market?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 47)

1.1 INTRODUCTION TO COVID-19

1.2 COVID-19 HEALTH ASSESSMENT

FIGURE 1 COVID-19: GLOBAL PROPAGATION

FIGURE 2 COVID-19 PROPAGATION: SELECT COUNTRIES

1.3 COVID-19 ECONOMIC ASSESSMENT

FIGURE 3 REVISED GROSS DOMESTIC PRODUCT FORECASTS FOR SELECT G20 COUNTRIES IN 2020

1.3.1 COVID-19 ECONOMIC IMPACT—SCENARIO ASSESSMENT

FIGURE 4 CRITERIA IMPACTING THE GLOBAL ECONOMY

FIGURE 5 SCENARIOS IN TERMS OF RECOVERY OF THE GLOBAL ECONOMY

1.4 OBJECTIVES OF STUDY

1.5 MARKET DEFINITION

1.5.1 INCLUSIONS AND EXCLUSIONS

1.6 MARKET SCOPE

1.6.1 MARKET SEGMENTATION

1.6.2 YEARS CONSIDERED FOR STUDY

1.7 CURRENCY

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2020

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 57)

2.1 RESEARCH DATA

FIGURE 6 GLOBAL QUANTUM COMPUTING SOFTWARE MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS WITH EXPERTS

2.1.2.1 Breakup of primary profiles

FIGURE 7 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY, DESIGNATION, AND REGION

2.1.2.2 Key industry insights

2.2 MARKET BREAKUP AND DATA TRIANGULATION

FIGURE 8 DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 9 RESEARCH METHODOLOGY: APPROACH

FIGURE 10 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (SUPPLY SIDE): REVENUE OF SOFTWARE/SERVICES IN QUANTUM COMPUTING SOFTWARE MARKET

FIGURE 11 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 2 BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE OF SOFTWARE/SERVICES IN MARKET

2.4 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.5 ASSUMPTIONS FOR STUDY

2.6 LIMITATIONS OF STUDY

3 EXECUTIVE SUMMARY (Page No. - 66)

FIGURE 12 QUANTUM COMPUTING SOFTWARE MARKET SIZE, 2021–2026

FIGURE 13 SERVICES SEGMENT, BASED ON COMPONENT, TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 14 QUANTUM AS A SERVICE SEGMENT, BASED ON SERVICES, TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

FIGURE 15 CLOUD-BASED DEPLOYMENT MODE TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 16 SMES, BASED ON ORGANIZATION SIZE, TO EXHIBIT HIGHER GROWTH RATE DURING FORECAST PERIOD

FIGURE 17 OPTIMIZATION SEGMENT, BASED ON APPLICATION, TO LEAD MARKET DURING FORECAST PERIOD

FIGURE 18 GROWING SEGMENTS IN MARKET, 2021–2026

FIGURE 19 MARKET: REGIONAL SNAPSHOT

4 PREMIUM INSIGHTS (Page No. - 71)

4.1 ATTRACTIVE OPPORTUNITIES IN QUANTUM COMPUTING SOFTWARE MARKET

FIGURE 20 GROWING GOVERNMENT SUPPORT FOR DEVELOPMENT AND DEPLOYMENT OF QUANTUM COMPUTING TECHNOLOGY TO DRIVE MARKET GROWTH DURING FORECAST PERIOD

4.2 ASIA PACIFIC MARKET, BY COMPONENT AND COUNTRY

FIGURE 21 SERVICES SEGMENT AND CHINA TO HOLD LARGEST SHARES OF ASIA PACIFIC MARKET IN 2021

4.3 MARKET: MAJOR COUNTRIES

FIGURE 22 SOUTH KOREA TO GROW AT HIGHEST RATE DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 73)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 23 QUANTUM COMPUTING SOFTWARE MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Growing adoption of quantum computing software in banking, financial services, and insurance vertical

5.2.1.2 Government support for development and deployment of quantum computing technology

5.2.1.3 Increasing number of strategic alliances for research and development

5.2.2 RESTRAINTS

5.2.2.1 Technical and implementation challenges

5.2.3 OPPORTUNITIES

5.2.3.1 Growing adoption of quantum computing technology in healthcare vertical

5.2.3.2 Growing need for high-level computing performance

5.2.4 CHALLENGES

5.2.4.1 Lack of highly skilled professionals

5.3 IMPACT OF COVID-19 ON QUANTUM COMPUTING SOFTWARE MARKET

5.3.1 PRE-COVID-19

5.3.2 POST-COVID-19

5.4 CASE STUDY ANALYSIS

5.4.1 USE OF QUANTUM COMPUTING IN ADVANCED MACHINE LEARNING

5.4.2 EXPLORING QUANTUM COMPUTING IN FINANCIAL SERVICES

5.4.3 USE OF QUANTUM COMPUTING TO IMPROVE ANALYSIS OF MEDICAL IMAGES

5.4.4 DEVELOPMENT OF NEW CHEMICALS WITH QUANTUM COMPUTING

5.4.5 TRADING OPTIMIZATION WITH QUANTUM COMPUTING

5.5 VALUE CHAIN ANALYSIS

FIGURE 24 VALUE CHAIN ANALYSIS: MARKET

5.6 ECOSYSTEM

TABLE 4 ECOSYSTEM: QUANTUM COMPUTING SOFTWARE MARKET

5.7 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 IMPACT OF EACH FORCE ON MARKET

FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: MARKET

5.7.1 THREAT FROM NEW ENTRANTS

5.7.2 THREAT OF SUBSTITUTES

5.7.3 BARGAINING POWER OF SUPPLIERS

5.7.4 BARGAINING POWER OF BUYERS

5.7.5 INTENSITY OF COMPETITIVE RIVALRY

5.8 PATENT ANALYSIS

TABLE 6 RECENT PATENTS RELATED TO QUANTUM COMPUTING SOFTWARE MARKET

5.9 PRICING MODEL ANALYSIS

TABLE 7 AVERAGE SELLING PRICE RANGE OF QUANTUM COMPUTING SYSTEMS

TABLE 8 AVERAGE SELLING PRICE RANGE OF QUANTUM COMPUTING AS A SERVICE

5.10 TRADE ANALYSIS

TABLE 9 IMPORT DATA FOR AUTOMATIC DATA-PROCESSING MACHINES, BY COUNTRY, 2015–2019 (USD MILLION)

TABLE 10 EXPORT DATA FOR AUTOMATIC DATA-PROCESSING MACHINES, BY COUNTRY, 2015–2019 (USD MILLION)

5.11 REGULATORY LANDSCAPE

5.11.1 GENERAL DATA PROTECTION REGULATION

5.11.2 HEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT OF 1996

5.11.3 GOVERNANCE, RISK, AND COMPLIANCE

5.11.4 P1913 -SOFTWARE-DEFINED QUANTUM COMMUNICATION

5.11.5 P7130 - STANDARD FOR QUANTUM TECHNOLOGIES DEFINITIONS

5.11.6 P7131 - STANDARD FOR QUANTUM COMPUTING PERFORMANCE METRICS AND BENCHMARKING

6 QUANTUM COMPUTING SOFTWARE MARKET, BY COMPONENT (Page No. - 88)

6.1 INTRODUCTION

6.1.1 COMPONENT: COVID-19 IMPACT

FIGURE 26 SERVICES SEGMENT TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 11 MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 12 MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

6.2 SOFTWARE

6.2.1 SOFTWARE: MARKET DRIVERS

TABLE 13 SOFTWARE: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 14 SOFTWARE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3 SERVICES

TABLE 15 SERVICES: MARKET SIZE, BY TYPE, 2017–2019 (USD MILLION)

TABLE 16 SERVICES: MARKET SIZE, BY TYPE, 2020–2026 (USD MILLION)

TABLE 17 SERVICES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 18 SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.1 QUANTUM COMPUTING AS A SERVICE (QAAS)

6.3.2 QUANTUM AS A SERVICE: QUANTUM COMPUTING SOFTWARE MARKET DRIVERS

TABLE 19 QUANTUM AS A SERVICE: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 20 QUANTUM AS A SERVICE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

6.3.3 CONSULTING SERVICES

6.3.4 CONSULTING SERVICES: MARKET DRIVERS

TABLE 21 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 22 CONSULTING SERVICES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7 QUANTUM COMPUTING SOFTWARE MARKET, BY ORGANIZATION SIZE (Page No. - 97)

7.1 INTRODUCTION

7.1.1 ORGANIZATION SIZE: COVID-19 IMPACT

FIGURE 27 SMES SEGMENT TO EXHIBIT HIGHER CAGR DURING FORECAST PERIOD

TABLE 23 MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 24 MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

7.2 LARGE ENTERPRISES

7.2.1 LARGE ENTERPRISES: MARKET DRIVERS

TABLE 25 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 26 LARGE ENTERPRISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

7.3 SMALL AND MEDIUM ENTERPRISES

7.3.1 SMES: MARKET DRIVERS

TABLE 27 SMES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 28 SMES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8 QUANTUM COMPUTING SOFTWARE MARKET, BY DEPLOYMENT MODE (Page No. - 103)

8.1 INTRODUCTION

8.1.1 DEPLOYMENT MODE: COVID-19 IMPACT

FIGURE 28 CLOUD-BASED DEPLOYMENT MODE TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

TABLE 29 MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 30 MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

8.2 ON-PREMISES

8.2.1 ON-PREMISES: MARKET DRIVERS

TABLE 31 ON-PREMISES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 32 ON-PREMISES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

8.3 CLOUD

8.3.1 CLOUD: MARKET DRIVERS

TABLE 33 CLOUD: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 34 CLOUD: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9 QUANTUM COMPUTING SOFTWARE MARKET, BY APPLICATION (Page No. - 108)

9.1 INTRODUCTION

9.1.1 APPLICATION: COVID-19 IMPACT

FIGURE 29 MACHINE LEARNING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 35 MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 36 MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

9.2 OPTIMIZATION

9.2.1 OPTIMIZATION: MARKET DRIVERS

TABLE 37 OPTIMIZATION: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 38 OPTIMIZATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.3 MACHINE LEARNING

9.3.1 MACHINE LEARNING: MARKET DRIVERS

TABLE 39 MACHINE LEARNING: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 40 MACHINE LEARNING: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.4 SIMULATION

9.4.1 SIMULATION: MARKET DRIVERS

TABLE 41 SIMULATION: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 42 SIMULATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

9.5 OTHERS

TABLE 43 OTHERS: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 44 OTHERS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

10 QUANTUM COMPUTING SOFTWARE MARKET, BY TECHNOLOGY (Page No. - 116)

10.1 QUANTUM ARTIFICIAL INTELLIGENCE

10.2 QUANTUM MACHINE LEARNING

10.3 QUANTUM COMPUTING AND INTERNET OF THINGS

10.4 QUANTUM COMMUNICATION TECHNOLOGY

10.5 QUANTUM COMPUTING ACADEMIA

10.6 CYBERSECURITY TRANSFORMATION

11 QUANTUM COMPUTING SOFTWARE MARKET, BY VERTICAL (Page No. - 118)

11.1 INTRODUCTION

11.1.1 VERTICAL: COVID-19 IMPACT

FIGURE 30 HEALTHCARE & LIFE SCIENCES VERTICAL TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 45 MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 46 MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

11.2 AEROSPACE & DEFENSE

11.2.1 AEROSPACE & DEFENSE: MARKET DRIVERS

TABLE 47 AEROSPACE & DEFENSE: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 48 AEROSPACE & DEFENSE: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.3 BANKING, FINANCIAL SERVICES, AND INSURANCE

11.3.1 BFSI: MARKET DRIVERS

TABLE 49 BFSI: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 50 BFSI: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.4 HEALTHCARE & LIFE SCIENCES

11.4.1 HEALTHCARE & LIFE SCIENCES: QUANTUM COMPUTING SOFTWARE MARKET DRIVERS

TABLE 51 HEALTHCARE & LIFE SCIENCES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 52 HEALTHCARE & LIFE SCIENCES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.5 ENERGY & UTILITIES

11.5.1 ENERGY & UTILITIES: MARKET DRIVERS

TABLE 53 ENERGY & UTILITIES: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 54 ENERGY & UTILITIES: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.6 CHEMICAL

11.6.1 CHEMICAL: MARKET DRIVERS

TABLE 55 CHEMICAL: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 56 CHEMICAL: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.7 TRANSPORTATION & LOGISTICS

11.7.1 TRANSPORTATION & LOGISTICS: MARKET DRIVERS

TABLE 57 TRANSPORTATION & LOGISTICS: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 58 TRANSPORTATION & LOGISTICS: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.8 GOVERNMENT

11.8.1 GOVERNMENT: MARKET DRIVERS

TABLE 59 GOVERNMENT: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 60 GOVERNMENT: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

11.9 EDUCATION

11.9.1 EDUCATION: MARKET DRIVERS

TABLE 61 EDUCATION: MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 62 EDUCATION: MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12 QUANTUM COMPUTING SOFTWARE MARKET, BY REGION (Page No. - 131)

12.1 INTRODUCTION

FIGURE 31 APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 63 MARKET SIZE, BY REGION, 2017–2019 (USD MILLION)

TABLE 64 MARKET SIZE, BY REGION, 2020–2026 (USD MILLION)

12.2 NORTH AMERICA

12.2.1 NORTH AMERICA: QUANTUM COMPUTING SOFTWARE MARKET DRIVERS

12.2.2 NORTH AMERICA: COVID-19 IMPACT

12.2.3 NORTH AMERICA: REGULATORY IMPLICATIONS

12.2.3.1 Health insurance portability and accountability act of 1996

12.2.3.2 California consumer privacy act

12.2.3.3 Gramm–leach–bliley act

12.2.3.4 Health information technology for economic and clinical health act

12.2.3.5 Sarbanes oxley act

12.2.3.6 United States securities and exchange commission

12.2.3.7 International organization for standardization 27001

12.2.3.8 California consumer privacy act

12.2.3.9 Federal information security management act

12.2.3.10 Federal information processing standards

FIGURE 32 NORTH AMERICA MARKET SNAPSHOT

TABLE 65 NORTH AMERICA: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 66 NORTH AMERICA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 67 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 68 NORTH AMERICA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 69 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 70 NORTH AMERICA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 71 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 72 NORTH AMERICA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 73 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 74 NORTH AMERICA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 75 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 76 NORTH AMERICA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 77 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 78 NORTH AMERICA: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.2.4 US

TABLE 79 US: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 80 US: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 81 US: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 82 US: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 83 US: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 84 US: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 85 US: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 86 US: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 87 US: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 88 US: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 89 US: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 90 US: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.2.5 CANADA

TABLE 91 CANADA: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 92 CANADA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 93 CANADA: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 94 CANADA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 95 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 96 CANADA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 97 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 98 CANADA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 99 CANADA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 100 CANADA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 101 CANADA: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 102 CANADA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.3 EUROPE

12.3.1 EUROPE: MARKET DRIVERS

12.3.2 EUROPE: COVID-19 IMPACT

12.3.3 EUROPE: REGULATORY IMPLICATIONS

12.3.3.1 General data protection regulation

12.3.3.2 European committee for standardization

12.3.3.3 European technical standards institute

TABLE 103 EUROPE: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 104 EUROPE: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 105 EUROPE: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 106 EUROPE: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 107 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 108 EUROPE: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 109 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 110 EUROPE: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 111 EUROPE: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 112 EUROPE: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 113 EUROPE: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 114 EUROPE: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 115 EUROPE: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 116 EUROPE: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.3.4 GERMANY

TABLE 117 GERMANY: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 118 GERMANY: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 119 GERMANY: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 120 GERMANY: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 121 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 122 GERMANY: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 123 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 124 GERMANY: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 125 GERMANY: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 126 GERMANY: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 127 GERMANY: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 128 GERMANY: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.3.5 UK

TABLE 129 UK: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 130 UK: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 131 UK: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 132 UK: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 133 UK: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 134 UK: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 135 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 136 UK: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 137 UK: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 138 UK: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 139 UK: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 140 UK: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.3.6 FRANCE

12.3.7 REST OF EUROPE

12.4 ASIA PACIFIC

12.4.1 ASIA PACIFIC: QUANTUM COMPUTING SOFTWARE MARKET DRIVERS

12.4.2 ASIA PACIFIC: COVID-19 IMPACT

12.4.3 ASIA PACIFIC: REGULATORY IMPLICATIONS

12.4.3.1 Privacy commissioner for personal data

12.4.3.2 Act on the protection of personal information

12.4.3.3 Critical information infrastructure

12.4.3.4 International organization for standardization 27001

12.4.3.5 Personal data protection act

FIGURE 33 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 141 ASIA PACIFIC: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 142 ASIA PACIFIC: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 143 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 144 ASIA PACIFIC: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 145 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 146 ASIA PACIFIC: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 147 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 148 ASIA PACIFIC: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 149 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 150 ASIA PACIFIC: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 151 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 152 ASIA PACIFIC: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 153 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 154 ASIA PACIFIC: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.4.4 CHINA

TABLE 155 CHINA: QUANTUM COMPUTING SOFTWARE MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 156 CHINA: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 157 CHINA: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 158 CHINA: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 159 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 160 CHINA: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 161 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 162 CHINA: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 163 CHINA: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 164 CHINA: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 165 CHINA: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 166 CHINA: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

12.4.5 JAPAN

12.4.6 SOUTH KOREA

12.4.7 REST OF ASIA PACIFIC

12.5 REST OF THE WORLD

12.5.1 REST OF THE WORLD: QUANTUM COMPUTING SOFTWARE MARKET DRIVERS

12.5.2 REST OF THE WORLD: COVID-19 IMPACT

TABLE 167 ROW: MARKET SIZE, BY COMPONENT, 2017–2019 (USD MILLION)

TABLE 168 ROW: MARKET SIZE, BY COMPONENT, 2020–2026 (USD MILLION)

TABLE 169 ROW: MARKET SIZE, BY SERVICE, 2017–2019 (USD MILLION)

TABLE 170 ROW: MARKET SIZE, BY SERVICE, 2020–2026 (USD MILLION)

TABLE 171 ROW: MARKET SIZE, BY DEPLOYMENT MODE, 2017–2019 (USD MILLION)

TABLE 172 ROW: MARKET SIZE, BY DEPLOYMENT MODE, 2020–2026 (USD MILLION)

TABLE 173 ROW: MARKET SIZE, BY ORGANIZATION SIZE, 2017–2019 (USD MILLION)

TABLE 174 ROW: MARKET SIZE, BY ORGANIZATION SIZE, 2020–2026 (USD MILLION)

TABLE 175 ROW: MARKET SIZE, BY APPLICATION, 2017–2019 (USD MILLION)

TABLE 176 ROW: MARKET SIZE, BY APPLICATION, 2020–2026 (USD MILLION)

TABLE 177 ROW: MARKET SIZE, BY VERTICAL, 2017–2019 (USD MILLION)

TABLE 178 ROW: MARKET SIZE, BY VERTICAL, 2020–2026 (USD MILLION)

TABLE 179 ROW: MARKET SIZE, BY COUNTRY, 2017–2019 (USD MILLION)

TABLE 180 ROW: MARKET SIZE, BY COUNTRY, 2020–2026 (USD MILLION)

12.5.3 LATIN AMERICA

12.5.4 MIDDLE EAST AND AFRICA

13 COMPETITIVE LANDSCAPE (Page No. - 184)

13.1 OVERVIEW

13.2 MARKET EVALUATION FRAMEWORK

FIGURE 34 QUANTUM COMPUTING SOFTWARE MARKET EVALUATION FRAMEWORK

13.3 MARKET RANKING

FIGURE 35 MARKET RANKING IN 2020

13.4 MARKET SHARE ANALYSIS

TABLE 181 MARKET: DEGREE OF COMPETITION

FIGURE 36 MARKET SHARE ANALYSIS OF COMPANIES IN MARKET

13.5 KEY MARKET DEVELOPMENTS

FIGURE 37 KEY DEVELOPMENTS IN MARKET FOR 2019–2021

13.5.1 NEW PRODUCT LAUNCHES

TABLE 182 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2021

13.5.2 DEALS

TABLE 183 QUANTUM COMPUTING SOFTWARE MARKET: DEALS, 2019–2021

13.6 COMPANY EVALUATION MATRIX

TABLE 184 COMPANY PRODUCT FOOTPRINT

TABLE 185 COMPANY APPLICATION FOOTPRINT

TABLE 186 COMPANY REGION FOOTPRINT

TABLE 187 COMPANY COMPONENT FOOTPRINT

13.6.1 STAR

13.6.2 EMERGING LEADER

13.6.3 PERVASIVE

13.6.4 PARTICIPANT

FIGURE 38 GLOBAL QUANTUM COMPUTING SOFTWARE MARKET, COMPANY EVALUATION MATRIX

13.7 START-UP/SME EVALUATION MATRIX, 2021

13.7.1 PROGRESSIVE COMPANY

13.7.2 RESPONSIVE COMPANY

13.7.3 DYNAMIC COMPANY

13.7.4 STARTING BLOCK

FIGURE 39 GLOBAL QUANTUM COMPUTING SOFTWARE: STARTUP/SME EVALUATION MATRIX, 2021

14 COMPANY PROFILES (Page No. - 198)

14.1 INTRODUCTION

14.2 MAJOR PLAYERS

(Business overview, Recent developments, COVID-19-related developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats)*

14.2.1 IBM

TABLE 188 IBM: BUSINESS OVERVIEW

FIGURE 40 IBM: COMPANY SNAPSHOT

TABLE 189 IBM: PRODUCTS OFFERED

TABLE 190 IBM: QUANTUM COMPUTING SOFTWARE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 191 IBM: MARKET: DEALS

14.2.2 MICROSOFT

TABLE 192 MICROSOFT: BUSINESS OVERVIEW

FIGURE 41 MICROSOFT: COMPANY SNAPSHOT

TABLE 193 MICROSOFT: PRODUCTS OFFERED

TABLE 194 MICROSOFT: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 195 MICROSOFT: MARKET: DEALS

14.2.3 AWS

TABLE 196 AWS: BUSINESS OVERVIEW

FIGURE 42 AWS: COMPANY SNAPSHOT

TABLE 197 AWS: PRODUCTS OFFERED

TABLE 198 AWS: QUANTUM COMPUTING SOFTWARE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.4 D-WAVE SYSTEMS

TABLE 199 D-WAVE SYSTEMS: BUSINESS OVERVIEW

TABLE 200 D-WAVE SYSTEMS: PRODUCTS OFFERED

TABLE 201 D-WAVE SYSTEMS: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 202 D-WAVE SYSTEM: MARKET: DEALS

TABLE 203 D-WAVE SYSTEMS: MARKET: OTHER DEVELOPMENTS

14.2.5 RIGETTI COMPUTING

TABLE 204 RIGETTI COMPUTING: BUSINESS OVERVIEW

TABLE 205 RIGETTI COMPUTING: PRODUCTS OFFERED

TABLE 206 RIGETTI COMPUTING: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 207 RIGETTI COMPUTING: MARKET: DEALS

TABLE 208 RIGETTI COMPUTING: MARKET: OTHER DEVELOPMENTS

14.2.6 GOOGLE

TABLE 209 GOOGLE: BUSINESS OVERVIEW

FIGURE 43 GOOGLE: COMPANY SNAPSHOT

TABLE 210 GOOGLE: PRODUCTS OFFERED

TABLE 211 GOOGLE: QUANTUM COMPUTING SOFTWARE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 212 GOOGLE: MARKET: OTHER DEVELOPMENTS

14.2.7 HONEYWELL

TABLE 213 HONEYWELL: BUSINESS OVERVIEW

FIGURE 44 HONEYWELL: COMPANY SNAPSHOT

TABLE 214 HONEYWELL: PRODUCTS OFFERED

TABLE 215 HONEYWELL: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 216 HONEYWELL: MARKET: DEALS

14.2.8 QC WARE

TABLE 217 QC WARE: BUSINESS OVERVIEW

TABLE 218 QC WARE: PRODUCTS OFFERED

TABLE 219 QC WARE: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 220 QC WARE: MARKET: DEALS

14.2.9 1QBIT

TABLE 221 1QBIT: BUSINESS OVERVIEW

TABLE 222 1QBIT: PRODUCTS OFFERED

TABLE 223 1QBIT: QUANTUM COMPUTING SOFTWARE MARKET: DEALS

TABLE 224 1QBIT: MARKET: OTHER DEVELOPMENTS

14.2.10 CAMBRIDGE QUANTUM COMPUTING

TABLE 225 CAMBRIDGE QUANTUM COMPUTING: BUSINESS OVERVIEW

TABLE 226 CAMBRIDGE QUANTUM COMPUTING: PRODUCTS OFFERED

TABLE 227 CAMBRIDGE QUANTUM COMPUTING: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 228 CAMBRIDGE QUANTUM COMPUTING: MARKET: DEALS

TABLE 229 CAMBRIDGE QUANTUM COMPUTING: MARKET: OTHER DEVELOPMENTS

14.2.11 FUJITSU

TABLE 230 FUJITSU: BUSINESS OVERVIEW

FIGURE 45 FUJITSU: COMPANY SNAPSHOT

TABLE 231 FUJITSU: PRODUCTS OFFERED

TABLE 232 FUJITSU: MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

TABLE 233 FUJITSU: MARKET: DEALS

14.2.12 HUAWEI

TABLE 234 HUAWEI: BUSINESS OVERVIEW

FIGURE 46 HUAWEI: COMPANY SNAPSHOT

TABLE 235 HUAWEI: PRODUCTS OFFERED

TABLE 236 HUAWEI: QUANTUM COMPUTING SOFTWARE MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS

14.2.13 ACCENTURE

TABLE 237 ACCENTURE: BUSINESS OVERVIEW

FIGURE 47 ACCENTURE: COMPANY SNAPSHOT

TABLE 238 ACCENTURE: PRODUCTS OFFERED

TABLE 239 ACCENTURE: MARKET: OTHER DEVELOPMENTS

14.3 OTHER PLAYERS

14.3.1 RIVERLANE

14.3.2 ZAPATA COMPUTING

14.3.3 QUANTUM CIRCUITS

14.3.4 QUANTICA COMPUTACAO

14.3.5 XANADU

14.3.6 QUANTASTICA

14.3.7 VERIQLOUD

14.3.8 AVANETIX

14.3.9 KUANO

14.3.10 RAHKO

14.3.11 KETITA LABS

14.3.12 ALIRO QUANTUM

*Details on Business overview, Recent developments, COVID-19-related developments, MNM view, Key strengths/Right to win, Strategic choices made, and Weaknesses and competitive threats might not be captured in case of unlisted companies.

15 ADJACENT/RELATED MARKETS (Page No. - 245)

15.1 QUANTUM CRYPTOGRAPHY MARKET

15.1.1 LIMITATIONS OF THE STUDY

15.1.2 MARKET OVERVIEW

15.1.3 QUANTUM CRYPTOGRAPHY MARKET, BY COMPONENT

TABLE 240 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, 2017–2019 (USD THOUSAND)

TABLE 241 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 242 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.3.1 Solutions

TABLE 243 SOLUTIONS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 244 SOLUTIONS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 245 SOLUTIONS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.3.2 Services

TABLE 246 SERVICES: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 247 SERVICES: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 248 SERVICES: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.4 QUANTUM CRYPTOGRAPHY MARKET, BY SERVICES

TABLE 249 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, 2017–2019 (USD THOUSAND)

TABLE 250 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 251 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.4.1 Consulting and Advisory Services

TABLE 252 CONSULTING AND ADVISORY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 253 CONSULTING AND ADVISORY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 254 CONSULTING AND ADVISORY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.4.2 Deployment and Integration Services

TABLE 255 DEPLOYMENT AND INTEGRATION: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 256 DEPLOYMENT AND INTEGRATION: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 257 DEPLOYMENT AND INTEGRATION: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.4.3 Support and Maintenance Services

TABLE 258 SUPPORT AND MAINTENANCE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 259 SUPPORT AND MAINTENANCE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 260 SUPPORT AND MAINTENANCE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.5 QUANTUM CRYPTOGRAPHY MARKET, BY SECURITY TYPE

TABLE 261 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, 2017–2019 (USD THOUSAND)

TABLE 262 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 263 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.5.1 Network security

TABLE 264 NETWORK SECURITY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 265 NETWORK SECURITY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 266 NETWORK SECURITY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.5.2 Application security

TABLE 267 APPLICATION SECURITY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 268 APPLICATION SECURITY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 269 APPLICATION SECURITY: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.6 QUANTUM CRYPTOGRAPHY MARKET, BY VERTICAL

TABLE 270 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, 2017–2019 (USD THOUSAND)

TABLE 271 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 272 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 273 GOVERNMENT AND DEFENSE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 274 GOVERNMENT AND DEFENSE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 275 GOVERNMENT AND DEFENSE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 276 BANKING, FINANCIAL SERVICES, AND INSURANCE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 277 BANKING, FINANCIAL SERVICES, AND INSURANCE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 278 BANKING, FINANCIAL SERVICES, AND INSURANCE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 279 HEALTHCARE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 280 HEALTHCARE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 281 HEALTHCARE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 282 AUTOMOTIVE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 283 AUTOMOTIVE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 284 AUTOMOTIVE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

15.1.7 QUANTUM CRYPTOGRAPHY MARKET, BY REGION

TABLE 285 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, 2017–2019 (USD THOUSAND)

TABLE 286 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 287 QUANTUM CRYPTOGRAPHY MARKET SIZE, BY REGION, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 288 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, 2017–2019 (USD THOUSAND)

TABLE 289 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 290 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 291 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, 2017–2019 (USD THOUSAND)

TABLE 292 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 293 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 294 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, 2017–2019 (USD THOUSAND)

TABLE 295 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 296 AMERICAS: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 297 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, 2017–2019 (USD THOUSAND)

TABLE 298 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 299 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 300 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, 2017–2019 (USD THOUSAND)

TABLE 301 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 302 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 303 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, 2017–2019 (USD THOUSAND)

TABLE 304 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 305 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 306 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, 2017–2019 (USD THOUSAND)

TABLE 307 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 308 EUROPE: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 309 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, 2017–2019 (USD THOUSAND)

TABLE 310 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 311 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 312 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, 2017–2019 (USD THOUSAND)

TABLE 313 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 314 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 315 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, 2017–2019 (USD THOUSAND)

TABLE 316 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 317 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 318 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, 2017–2019 (USD THOUSAND)

TABLE 319 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 320 ASIA PACIFIC: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY VERTICAL, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 321 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, 2017–2019 (USD THOUSAND)

TABLE 322 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 323 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY COMPONENT, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 324 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, 2017–2019 (USD THOUSAND)

TABLE 325 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 326 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SERVICE, POST-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 327 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, 2017–2019 (USD THOUSAND)

TABLE 328 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, BY SECURITY TYPE, PRE-COVID-19 SCENARIO, 2019–2025 (USD THOUSAND)

TABLE 329 MIDDLE EAST AND AFRICA: QUANTUM CRYPTOGRAPHY MARKET SIZE, POST-COVID-19 SCENARIO, BY SECURITY TYPE, 2019–2025 (USD THOUSAND)

15.2 DEEP LEARNING MARKET

15.2.1 MARKET DEFINITION

15.2.2 MARKET OVERVIEW

15.2.3 DEEP LEARNING MARKET, BY OFFERING

TABLE 330 DEEP LEARNING MARKET, BY OFFERING, 2015–2023 (USD MILLION)

15.2.3.1 Hardware

TABLE 331 DEEP LEARNING MARKET, BY HARDWARE, 2015–2023 (USD MILLION)

15.2.3.2 Processor

TABLE 332 DEEP LEARNING MARKET, BY PROCESSOR, 2015–2023 (USD MILLION)

TABLE 333 DEEP LEARNING MARKET, BY PROCESSOR, 2015–2023 (THOUSAND UNITS)

15.2.3.3 Memory

15.2.3.4 Network

TABLE 334 DEEP LEARNING HARDWARE MARKET, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 335 DEEP LEARNING HARDWARE MARKET, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

15.2.4 SOFTWARE

TABLE 336 DEEP LEARNING MARKET, BY SOFTWARE, 2015–2023 (USD MILLION)

TABLE 337 DEEP LEARNING SOFTWARE MARKET, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 338 DEEP LEARNING SOFTWARE MARKET, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

15.2.5 SERVICES

TABLE 339 DEEP LEARNING MARKET, BY SERVICE, 2015–2023 (USD MILLION)

TABLE 340 DEEP LEARNING SERVICE MARKET, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 341 DEEP LEARNING SERVICE MARKET, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

15.2.6 DEEP LEARNING MARKET, BY APPLICATION

TABLE 342 DEEP LEARNING MARKET, BY APPLICATION, 2015–2023 (USD MILLION)

15.2.6.1 Image recognition

TABLE 343 DEEP LEARNING MARKET FOR IMAGE RECOGNITION, BY OFFERING, 2015–2023 (USD MILLION)

15.2.6.2 Signal recognition

TABLE 344 DEEP LEARNING MARKET FOR SIGNAL RECOGNITION, BY OFFERING, 2015–2023 (USD MILLION)

15.2.6.3 Data mining

TABLE 345 DEEP LEARNING MARKET FOR DATA MINING, BY OFFERING, 2015–2023 (USD MILLION)

15.2.7 DEEP LEARNING MARKET, BY END USER INDUSTRY

TABLE 346 DEEP LEARNING MARKET, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 347 DEEP LEARNING MARKET FOR HEALTHCARE, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 348 DEEP LEARNING MARKET FOR HEALTHCARE, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 349 DEEP LEARNING MARKET FOR MANUFACTURING, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 350 DEEP LEARNING MARKET FOR MANUFACTURING, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 351 DEEP LEARNING MARKET FOR AUTOMOTIVE, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 352 DEEP LEARNING MARKET FOR AUTOMOTIVE, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 353 DEEP LEARNING MARKET FOR AGRICULTURE, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 354 DEEP LEARNING MARKET FOR AGRICULTURE, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 355 DEEP LEARNING MARKET FOR RETAIL, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 356 DEEP LEARNING MARKET FOR RETAIL, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 357 DEEP LEARNING MARKET FOR SECURITY, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 358 DEEP LEARNING MARKET FOR HR, BY APPLICATION, 2015–2023 (USD MILLION)

TABLE 359 DEEP LEARNING MARKET FOR MARKETING, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 360 DEEP LEARNING MARKET FOR LAW, BY OFFERING, 2015–2023 (USD MILLION)

TABLE 361 DEEP LEARNING MARKET FOR FINTECH, BY OFFERING, 2015–2023 (USD MILLION)

15.2.8 DEEP LEARNING MARKET, BY REGION

TABLE 362 DEEP LEARNING MARKET, BY REGION, 2015–2023 (USD MILLION)

TABLE 363 DEEP LEARNING MARKET IN NORTH AMERICA, BY COUNTRY, 2015–2023 (USD MILLION)

TABLE 364 DEEP LEARNING MARKET IN EUROPE, BY COUNTRY, 2015–2023 (USD MILLION)

TABLE 365 DEEP LEARNING MARKET IN UK, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 366 DEEP LEARNING MARKET IN GERMANY, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 367 DEEP LEARNING MARKET IN FRANCE, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 368 DEEP LEARNING MARKET IN APAC, BY COUNTRY, 2015–2023 (USD MILLION)

TABLE 369 DEEP LEARNING MARKET IN CHINA, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 370 DEEP LEARNING MARKET IN INDIA, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 371 DEEP LEARNING MARKET IN ROW, BY REGION, 2015–2023 (USD MILLION)

TABLE 372 DEEP LEARNING MARKET IN MIDDLE EAST AND AFRICA, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

TABLE 373 DEEP LEARNING MARKET IN SOUTH AMERICA, BY END-USER INDUSTRY, 2015–2023 (USD MILLION)

16 APPENDIX (Page No. - 298)

16.1 DISCUSSION GUIDE

16.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

16.3 AVAILABLE CUSTOMIZATIONS

16.4 RELATED REPORTS

16.5 AUTHOR DETAILS

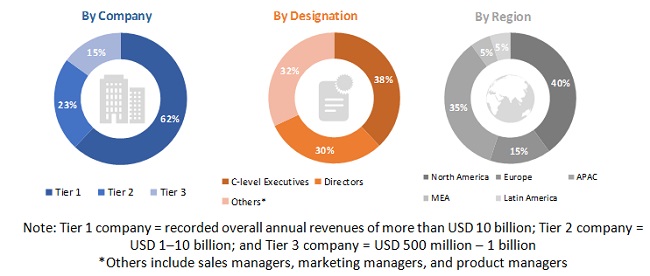

The study involved four major activities to estimate the current market size for the Quantum Computing Software market. An exhaustive secondary research was done to collect information on the Quantum Computing Software market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain using primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakup and data triangulation procedures were used to estimate the market size of the segments and sub segments of Quantum Computing Software market.

Secondary Research

In the secondary research process, various secondary sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies, and white papers, certified publications, and articles from recognized associations and government publishing sources. Several journals were also referred to, such as the International Journal of Computer Science and Information Technology and Security (IJCSITS), ScienceDirect, ResearchGate, Academic Journals, and Scientific.Net. Secondary research was mainly used to obtain key information about industry insights, market’s monetary chain, overall pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market- and technology-oriented perspectives

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. The primary sources from the supply side included industry experts, such as chief executive officers (CEOs), chief technology officers (CTOs), chief operating officers (COOs), vice presidents (VPs), managing directors (MDs), technology and innovation directors, and related key executives from different key companies and organizations operating in the quantum computing software market.

Given below is the breakup of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the size of the global Quantum Computing Software market and various other dependent submarkets in the overall market. An exhaustive list of all the players offering services in the Quantum Computing Software market was prepared while using the top-down approach. The market share for all the players in the market was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each player was evaluated based on its component (solutions and services), location (on board and instation), functional model, transportation mode (roadways, railways, and airways and waterways), and region. The aggregate of all companies’ revenues was extrapolated to reach the overall market size.

Further, each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from the industry leaders, such as Chief Executive Officers (CEOs), Vice Presidents (VPs), directors, and marketing executives.

Data Triangulation

After arriving at the overall market size using the market size estimation processes as explained above, the market was split into several segments and subsegments. The data triangulation and market breakup procedures were employed, wherever applicable to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To determine and forecast the global quantum computing software market based on component (software and services), organization size, deployment mode, application, technology, vertical, and region from 2020 to 2026, and analyze various macroeconomic and microeconomic factors that affect market growth

- To forecast the size of the market segments with respect to four major regions: North America, Europe, Asia Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information about the major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market

- To analyze each submarket with respect to individual growth trends, prospects, and contributions to the quantum computing software market

- To analyze the opportunities in the market for stakeholders by identifying the high-growth segments of the market

- To profile the key market players; provide a comparative analysis on the basis of business overviews, regional presence, product offerings, business strategies, and key financials; and illustrate the competitive landscape of the market

- To track and analyze competitive developments, such as mergers and acquisitions, product launches and developments, partnerships and collaborations, and research and development (R&D), in the market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix which gives a detailed comparison of the product portfolio of each company

Company Information

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Quantum Computing Software Market