Software Testing and QA Services Market - Global Forecast to 2030

The software testing and QA services market is currently experiencing strong growth, with projections indicating a significant increase in market size. Estimates suggest a notable expansion from its value of USD XX.X billion in 2025 to USD XX.X billion by 2030, reflecting a robust CAGR of XX.X% over the forecast period. The increasing emphasis on delivering high-quality digital products, the rising importance of regulatory compliance, and the need to reduce time-to-market are driving this growth. The demand is further fueled by the growing complexity of software applications, the widespread adoption of Agile and DevOps methodologies, and the rising trend of digital transformation across industries. Additionally, the rise of Industry 4.0, artificial intelligence, and IoT has created new opportunities for software testing and QA services, particularly in sectors such as manufacturing, healthcare, retail, BFSI, and logistics, as organizations seek to ensure seamless automation, security, and process optimization.

Market Dynamics

Driver: Increasing adoption of digital transformation and Agile/DevOps practices

The accelerating digital transformation journey across industries is fueling the demand for software testing and QA services as enterprises prioritize speed, agility, and customer experience. Agile and DevOps frameworks have redefined delivery cycles, requiring continuous testing and automation to ensure defect-free releases. Businesses are increasingly relying on test automation frameworks, AI-enabled testing tools, and shift-left approaches to integrate QA early in the development process. This ensures faster time-to-market without compromising quality. The emphasis on digital-first strategies across BFSI, healthcare, retail, and manufacturing is creating sustained demand for QA providers who can align testing with broader business objectives, innovation goals, and customer-centric outcomes.

Restraint: Vendor lock-in and fragmented tool ecosystems

A key restraint in the software testing and QA services market arises from fragmented tool landscapes and the risk of vendor lock-in. Enterprises often operate hybrid environments comprising legacy systems, cloud platforms, and third-party SaaS applications, each requiring distinct testing approaches. Proprietary testing solutions frequently lack interoperability, creating challenges in integrating QA into enterprise-wide DevOps pipelines. This not only inflates testing costs but also hinders scalability across complex digital ecosystems. The dependence on a narrow set of tools or vendors further reduces flexibility, preventing organizations from adopting best-fit innovations. As enterprises demand unified, end-to-end testing ecosystems, this fragmentation remains a significant growth bottleneck.

Opportunity: Expanding role of AI-driven and predictive quality engineering

The growing application of AI and machine learning in quality engineering presents a transformative opportunity for the software testing and QA services market. Enterprises are looking beyond traditional test automation and adopting AI-powered platforms that provide predictive analytics, automated defect detection, intelligent test case prioritization, and self-healing capabilities. By embedding AI into QA workflows, businesses can significantly reduce manual intervention, lower defect leakage, and optimize testing coverage in shorter cycles. Vendors that position themselves with AI-centric solutions can differentiate in a competitive market by delivering not just defect-free applications but also resilience and superior customer experience. As industries adopt IoT, cloud-native, and AI-driven applications, predictive quality engineering will become an enterprise-level priority.

Challenge: Balancing accelerated delivery with compliance and risk management

A critical challenge for enterprises lies in reconciling the pressure for accelerated product launches with the growing importance of compliance, data security, and risk governance. Highly regulated sectors such as BFSI, healthcare, and telecom demand rigorous compliance with data privacy, cybersecurity, and industry-specific standards. However, Agile and DevOps methodologies prioritize rapid release cycles, often creating friction between speed and governance. Testing providers must embed compliance-by-design, security validation, and risk management frameworks directly into Agile pipelines to avoid slowing delivery. The inability to strike this balance exposes enterprises to regulatory penalties, reputational damage, and customer distrust. As businesses scale digital offerings, ensuring continuous compliance without compromising agility has become a strategic imperative for QA providers.

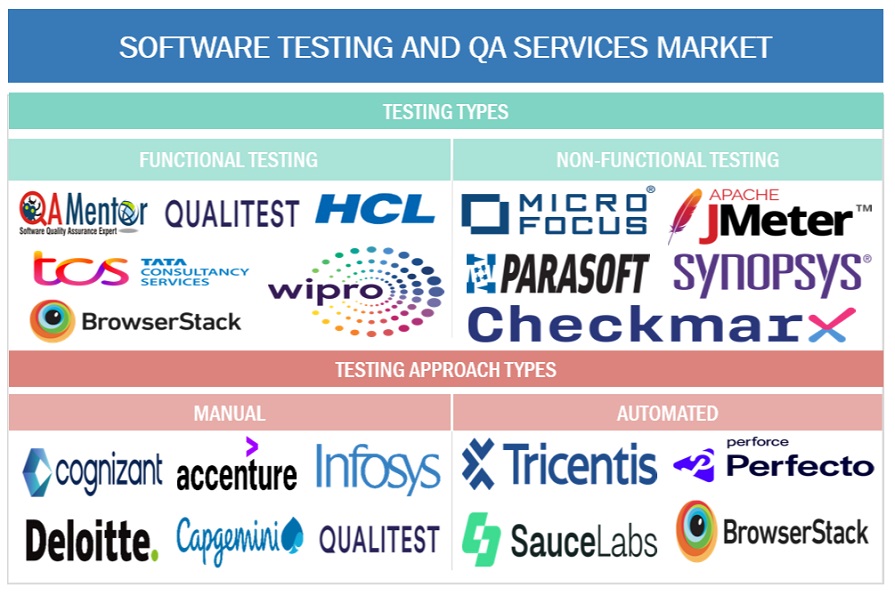

Software Testing and QA Services Market Ecosystem

Note: The above diagram only shows the representation of the software testing and QA services market ecosystem; it is not limited to the companies represented above

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

By testing type, the non-functional testing segment is expected to grow at the fastest rate during the forecast period.

Non-functional testing is poised to see rapid expansion in the software testing and QA services sector due to its ability to validate performance, security, scalability, and usability across diverse digital environments. Applications such as load testing, penetration testing, and usability validation enable businesses to safeguard data, ensure reliability, and deliver seamless user experiences. The fast adoption of non-functional testing is driven by rising cybersecurity threats, increasing reliance on cloud-native platforms, and the need for resilient systems capable of supporting large-scale operations. As businesses aim to remain competitive and compliant, non-functional testing plays a pivotal role in strengthening software quality, meeting regulatory standards, and enabling long-term customer trust.

By industry vertical, the BFSI segment is expected to account for the largest market share during the forecast period.

The BFSI sector is projected to dominate the software testing and QA services market, owing to its stringent compliance requirements, high transaction volumes, and the critical need for uninterrupted service delivery. With the rapid growth of digital banking, mobile payment platforms, fintech applications, and online insurance services, financial institutions are increasingly prioritizing robust testing frameworks to ensure security, performance, and regulatory alignment. The sector’s reliance on automation testing, continuous integration, and advanced security validation has further accelerated the adoption of QA services. Driven by rising cyber risks, evolving customer expectations, and strict industry mandates, BFSI continues to invest heavily in software testing and QA initiatives, reinforcing its position as the largest revenue-contributing vertical in the market.

By region, the Asia Pacific is set to experience the fastest growth rate during the forecast period.

The Asia Pacific region is projected to witness the fastest growth in the software testing and QA services market between 2025 and 2030, driven by rapid digital adoption and large-scale enterprise modernization initiatives. Countries such as India, China, Japan, and Singapore are at the forefront of deploying Agile, DevOps, and automation-based testing solutions to accelerate software delivery and improve product quality. The rise of start-ups, expansion of cloud-native platforms, and significant investments in fintech, e-commerce, and telecom services are creating strong demand for end-to-end QA services. Growing cybersecurity concerns, coupled with stricter compliance mandates across sectors such as BFSI, healthcare, and retail, are further boosting the adoption of specialized testing services, including security testing, performance testing, and usability validation. Additionally, the expanding IT outsourcing and service delivery ecosystem in the Asia Pacific has made the region a global hub for cost-effective and scalable QA offerings. These factors, combined with the region’s young digital-first workforce and increasing enterprise investments, firmly position Asia Pacific as the fastest-growing market for software testing and QA services during the forecast period.

Key Market Players

The software testing and QA services market is highly competitive, with providers leveraging both organic and inorganic strategies such as product launches, technology innovations, acquisitions, partnerships, and geographic expansions. Prominent players include Accenture (Ireland), Capgemini (France), Cognizant (US), Infosys (India), Wipro (India), TCS (India), HCL Technologies (India), Deloitte (UK), Qualitest (US), Tricentis (Austria), Micro Focus (UK), Parasoft (US), Synopsys (US), Checkmarx (Israel), Sauce Labs (US), BrowserStack (India), and Perfecto (US). Alongside these established players, specialized testing tool providers such as LoadRunner (Micro Focus – UK) and JMeter (Apache – US) continue to play an essential role in performance and automation testing.

Recent Developments:

- In July 2025, Qualitest was named a Silver Sponsor at NSTC 2025 and delivered a featured session titled “Demystifying Quality using AI.” This position placed Qualitest at the forefront of AI-powered quality engineering discourse and showcased thought leadership to a global QA audience.

- In June 2025, BrowserStack launched BrowserStack AI, a suite of AI-powered agents embedded directly within its testing platform. These agents span test planning, authoring, maintenance, accessibility, and visual review—boosting productivity by up to 50% and reducing test creation time by over 90%.

- In June 2025, Tricentis launched Agentic Test Automation, an autonomous, AI-powered platform that generates tests from natural-language prompts, heals broken scripts, and achieves up to 60% productivity gains for enterprise QA teams.

- In March 2025, UiPath rolled out Test Cloud, embedding AI agents like Autopilot for Testers and Agent Builder into its platform. Cisco’s implementation halved manual testing time, achieving 36% greater efficiency, double the feature delivery pace, 50% fewer outages, and a 93% reduction in troubleshooting.

- In July 2024, Accenture expanded its AI-driven testing capabilities by integrating generative AI into its Intelligent Test Automation platform, aiming to reduce defect leakage and improve predictive quality engineering for enterprise clients.

Frequently Asked Questions (FAQ):

What are software testing and QA services?

Software testing and quality assurance (QA) services involve systematic processes, methodologies, and tools used to identify and fix defects, validate functionality, ensure performance, and maintain security across applications and digital systems. These services cover functional testing, automation testing, performance testing, security testing, usability testing, and continuous testing within DevOps pipelines. The objective is to improve software reliability, reduce time-to-market, and enhance user experience.

What is the total CAGR expected to be recorded for the software testing and QA services market during 2024-2030?

The Software testing and QA services market is expected to record a CAGR of XX.X% from 2025-2030.

Which are the major growth enablers catalyzing the software testing and QA services market?

The growth of the software testing and QA services market is primarily catalyzed by the increasing demand for advanced automation, the adoption of cloud-based testing platforms, and the integration of continuous testing within DevOps practices. The expansion of mobile and IoT ecosystems is creating a significant requirement for end-to-end validation across devices, while the growing threat landscape is pushing organizations to invest in security and compliance testing. Furthermore, the rising trend of outsourcing software testing functions to specialized providers is enabling enterprises to enhance efficiency, cut costs, and maintain scalability in an increasingly complex digital environment.

What are the software testing and QA service offering types prevailing in the market?

The software testing and QA services market encompasses a broad range of offerings that address different aspects of the software development lifecycle. These include functional testing to ensure software features perform as intended, performance and load testing to assess scalability under stress conditions, and security testing to identify vulnerabilities and strengthen resilience. In addition, the market is witnessing growing adoption of test automation and continuous testing frameworks that align with Agile and DevOps practices. Specialized offerings such as mobile application testing, compliance validation, usability testing, and IoT testing are also gaining prominence, reflecting the diverse needs of modern enterprises.

Who are the key vendors in the software testing and QA services market?

The competitive landscape of the software testing and QA services market features a mix of global consulting firms, technology service providers, and specialized testing companies. Leading players include Accenture (Ireland), Capgemini (France), Cognizant (US), Infosys (India), Wipro (India), Tata Consultancy Services or TCS (India), HCL Technologies (India), and Deloitte (UK), all of which offer comprehensive testing solutions as part of their digital service portfolios. In addition, specialized QA vendors such as Qualitest (US/Israel), Tricentis (Austria), Micro Focus (UK), Parasoft (US), Synopsys (US), Checkmarx (Israel), BrowserStack (India), Sauce Labs (US), and Perfecto (US) are contributing significantly by providing advanced tools, automation platforms, and domain-specific testing expertise to enterprises worldwide. .

- 1.1 STUDY OBJECTIVES

-

1.2 MARKET DEFINITIONINCLUSIONS AND EXCLUSIONS

-

1.3 MARKET SCOPEMARKET SEGMENTATIONYEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

-

2.1 RESEARCH DATASECONDARY DATAPRIMARY DATA- BREAKUP OF PRIMARY PROFILES- KEY INDUSTRY INSIGHTS

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

-

2.3 MARKET SIZE ESTIMATIONTOP-DOWN APPROACHBOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR THE PLAYERS IN THE SOFTWARE TESTING AND QA SERVICES MARKET

- 4.2 SOFTWARE TESTING AND QA SERVICES MARKET: TESTING TYPE

- 4.3 NORTH AMERICA: SOFTWARE TESTING AND QA SERVICES MARKET, BY TESTING APPROACH TYPE AND SERVICE MODEL

- 4.4 SOFTWARE TESTING AND QA SERVICES MARKET, BY REGION

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERSRESTRAINTSOPPORTUNITIESCHALLENGES

- 5.3 EVOLUTION OF SOFTWARE TESTING AND QA SERVICES

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.6 INVESTMENT AND FUNDING SCENARIO

- 5.7 IMPACT OF AI/GEN AI ON SOFTWARE TESTING AND QA SERVICES MARKET

- 5.8 CASE STUDY ANALYSIS

-

5.9 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- CLOUD COMPUTING- CONTAINERIZATION & VIRTUALIZATION- AUTOMATION TECHNOLOGIESCOMPLEMENTARY TECHNOLOGIES- ARTIFICIAL INTELLIGENCE & MACHINE LEARNING- BIG DATA & ANALYTICS- CYBERSECURITYADJACENT TECHNOLOGIES- BLOCKCHAIN- INTERNET OF THINGS (IOT)- AUGMENTED REALITY / VIRTUAL REALITY (AR/VR)REGULATORY LANDSCAPE- REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- KEY REGULATIONSPATENT ANALYSIS- METHODOLOGY- PATENTS FILED, BY DOCUMENT TYPE, 2016–2025- INNOVATION AND PATENT APPLICATIONS- TOP APPLICANTSPRICING ANALYSIS- AVERAGE SELLING PRICE OF TESTING TYPE, BY KEY PLAYERS, 2025- AVERAGE SELLING PRICE, BY SERVICE MODEL, 2025KEY CONFERENCES AND EVENTS, 2025-2026PORTER FIVE FORCES ANALYSIS- THREAT FROM NEW ENTRANTS- THREAT OF SUBSTITUTES- BARGAINING POWER OF SUPPLIERS- BARGAINING POWER OF BUYERS- INTENSITY OF COMPETITION RIVALRYTRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSKEY STAKEHOLDERS AND BUYING CRITERIA- KEY STAKEHOLDERS IN THE BUYING PROCESS- BUYING CRITERIASPECIALIZED TESTING DOMAINS- MOBILE APP TESTING- API & INTEGRATION TESTING- IOT & EMBEDDED TESTING- ERP & SAAS APPLICATION TESTING- AI/ML & GENERATIVE AI TESTING- DATA & ANALYTICS TESTING- CLOUD & VIRTUALIZATION TESTING- CROWDSOURCED TESTINGTEST ENVIRONMENT & TOOLS- TEST ENVIRONMENT SERVICES- TEST DATA MANAGEMENT SERVICES- TEST MANAGEMENT & COLLABORATION TOOLS- CONTINUOUS TESTING PLATFORMS & AUTOMATION FRAMEWORKS

-

6.1 INTRODUCTIONTESTING TYPE: SOFTWARE TESTING AND QA SERVICES MARKET DRIVERS

-

6.2 FUNCTIONAL TESTINGUNIT TESTINGSYSTEM TESTINGINTEGRATION TESTINGUSER ACCEPTANCE TESTINGAPI TESTINGOTHERS (SMOKE TESTING, SANITY TESTING, AND REGRESSION TESTING)

-

6.3 NON-FUNCTIONAL TESTINGPERFORMANCE & LOAD TESTINGSECURITY TESTINGUSABILITY & ACCESSIBILITY TESTINGCOMPLIANCE & REGULATORY TESTING

-

7.1 INTRODUCTIONTESTING APPROACH TYPE: SOFTWARE TESTING AND QA SERVICES MARKET DRIVERS

- 7.2 MANUAL TESTING

- 7.3 AUTOMATED TESTING

-

8.1 INTRODUCTIONSERVICE MODEL: SOFTWARE TESTING AND QA SERVICES MARKET DRIVERS

- 8.2 MANAGED TESTING SERVICES

- 8.3 PROFESSIONAL TESTING SERVICES

- 8.4 SPECIALIZED TESTING SERVICES

-

9.1 INTRODUCTIONDEPLOYMENT MODEL: SOFTWARE TESTING AND QA SERVICES MARKET DRIVERS

- 9.2 CLOUD-BASED TESTING

- 9.3 ON-PREMISES TESTING

-

9.4 HYBRID TESTINGSOFTWARE TESTING AND QA SERVICES MARKET, BY VERTICAL (MARKET SIZE & FORECAST TO 2030 – IN VALUE (USD)

-

10.1 INTRODUCTIONVERTICAL: SOFTWARE TESTING AND QA SERVICES MARKET DRIVERS

- 10.2 IT & TELECOM

- 10.3 BFSI

- 10.4 HEALTHCARE & LIFE SCIENCES

- 10.5 RETAIL & E-COMMERCE

- 10.6 MANUFACTURING & AUTOMOTIVE

- 10.7 ENERGY & UTILITIES

- 10.8 GOVERNMENT & PUBLIC SECTOR

- 10.9 OTHERS (LOGISTICS, EDUCATION, GAMING, AND MEDIA & ENTERTAINMENT)

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: MARKET DRIVERSNORTH AMERICA: MACROECONOMIC OUTLOOKUSCANADA

-

11.3 EUROPEEUROPE: MARKET DRIVERSEUROPE: MACROECONOMIC OUTLOOKUNITED KINGDOMGERMANYFRANCEREST OF EUROPE (NETHERLANDS, POLAND, AUSTRIA, AND MORE)

-

11.4 ASIA PACIFICASIA PACIFIC: MARKET DRIVERSASIA PACIFIC: MACROECONOMIC OUTLOOKCHINAJAPANINDIAAUSTRALIA & NEW ZEALANDREST OF ASIA PACIFIC (SOUTH KOREA, ASEAN, BANGLADESH, PAKISTAN, SRI LANKA, AND MORE)

-

11.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: MARKET DRIVERSMIDDLE EAST AND AFRICA: MACROECONOMIC OUTLOOKKSAUAESOUTH AFRICAREST OF MIDDLE EAST AND AFRICA (IRAQ, KUWAIT, IRAN, QATAR, AND MORE)

-

11.6 LATIN AMERICALATIN AMERICA: MARKET DRIVERSLATIN AMERICA: MACROECONOMIC OUTLOOKBRAZILARGENTINAREST OF LATIN AMERICA (MEXICO, COLOMBIA, ECUADOR, AND MORE)

- 12.1 OVERVIEW

-

12.2 KEY PLAYER’S STRATEGIES/RIGHT TO WIN, 2022-2025OVERVIEW OF STRATEGIES ADOPTED BY KEY SOFTWARE TESTING AND QA SERVICES VENDORS

-

12.3 REVENUE ANALYSIS OF KEY PLAYERS, 2020 - 2024MARKET-SPECIFIC REVENUE ANALYSIS, 2020 - 2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

-

12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2024- COMPANY FOOTPRINT- REGION FOOTPRINT- TESTING TYPE FOOTPRINT- SERVICE MODEL FOOTPRINT- VERTICAL FOOTPRINT

-

12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024- DETAILED LIST OF KEY STARTUPS/SMES- COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.9 COMPETITIVE SCENARIOPRODUCT LAUNCHES AND ENHANCEMENTSDEALS

- 13.1 INTRODUCTION

-

13.2 KEY PLAYERSQA MENTORACCENTURECAPGEMINICOGNIZANTINFOSYSWIPROTCS (TATA CONSULTANCY SERVICES)HCL TECHNOLOGIESDELOITTE- QUALITEST- TRICENTIS- MICRO FOCUS- PARASOFT- SYNOPSYS- CHECKMARX- LOADRUNNER (MICRO FOCUS)- JMETER (APACHE)- SAUCE LABS- BROWSERSTACK- PERFECTO

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGE STORE: MARKETANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

Growth opportunities and latent adjacency in Software Testing and QA Services Market