Pump Jack Market by Well Type (Vertical and Horizontal), Application (Onshore and Offshore), Weight (Less Than 100,000 Lbs, 100,000 Lbs to 300,000 Lbs, and More Than 300,000 Lbs), and by Region - Global Trends and Forecast to 2022

[151 Pages Report] The global pump jack market was estimated to be USD 2.77 Billion in 2016, and is expected to grow at a CAGR of 4.88% to reach USD 3.63 Billion by 2022. The increasing maturing oil fields are expected to drive the market of pump jack.

The years considered for the study are as follows:

- Base Year- 2016

- Estimated Year- 2017

- Projected Year- 2022

- Forecast Period- 2017 to 2022

The year 2016 has been considered as the base year for company profiles. Where information was unavailable for the base year, the prior year has been considered.

Objectives of the Study

- To define, describe, and forecast the global market by well type, application, weight, and region, in terms of value

- To provide detailed information regarding the major factors, such as drivers, restraints, opportunities, and industry-specific challenges, influencing the growth of market

- To strategically analyze the market with respect to individual growth trends, future prospects, and the contribution of each segment to the market

- To strategically profile key players and comprehensively analyze their market shares and core competencies

- To track and analyze competitive developments, such as contracts & agreements, expansions and investments, new product launches, and mergers & acquisitions of this market

Research Methodology

This research study involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg BusinessWeek, Factiva, and OneSource, to identify and collect information useful for a technical, market-oriented, and commercial study of market. Primary sources are mainly industry experts from core and related industries, service providers, environmental, regulatory and authorities, shipbroking and charter service providers, standards and certification organizations of companies, and organizations related to all the segments of this industrys value chain. The points given below explain the research methodology.

- Study of the annual revenues and market developments of the major players that provide pump jack to oil operating companies

- Analyses the requirement for pump jack of oil platforms

- Assessment of pump jack provisions of key operating companies and analyzing their spending patterns

- Study of the market trends in various regions and countries with regard to pump jack

- Study of the contracts and developments related to the market by key players across different regions

- Finalization of market size by triangulating the supply-side and demand-side data, which includes product developments, supply chain, and annual revenues of pump jack companies across the globe

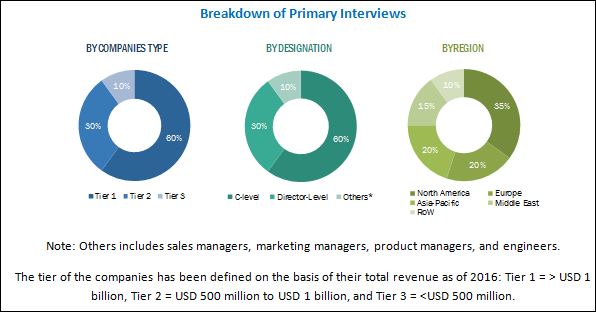

After arriving at the overall market size, the total market has been split into several segments and sub-segments. The figure given below illustrates the breakdown of primaries, on the basis of company type, designation, and region, conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

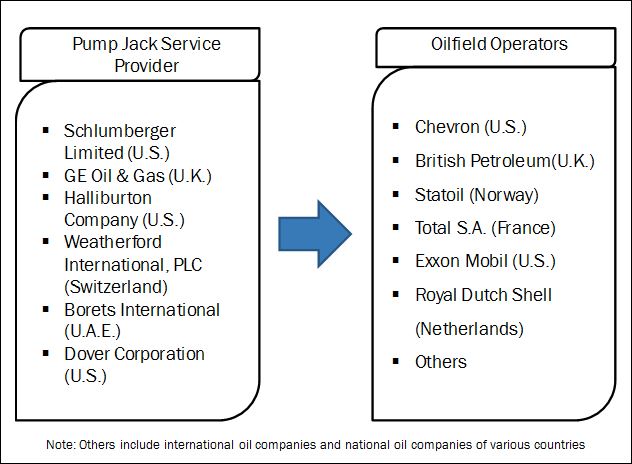

The ecosystem of this market consists of oilfield operating companies and service providers for different types of services. The figure below shows the market ecosystem along with the major companies.

The pump jack service providing companies that provides installation, maintenance, and transportation services includes Schlumberger Limited (U.S.), Halliburton Company (U.S.), General Electric Oil & Gas (U.K.), Weatherford International, PLC (Switzerland), Borets International (U.A.E.), Dover Corporation (U.S.), Rimera Group (U.A.E.), Dansco Manufacturing (U.S.), Hess Corporation (U.S.), and Tenaris S.A. (Luxembourg) among others. These are the end-users in this market.

Target Audience:

The reports target audience includes:

- Pump jack manufacturer

- National oil companies

- International oil companies

- Onshore platform operators

- Associations and industry bodies

- Consulting companies dealing with the artificial lift industry

- Onshore logistics authorities

Scope of the Report:

By Well Type

- Vertical Well

- Horizontal Well

By Application

- Onshore

- Offshore

By Weight

- Less than 100,000 lbs

- 100,000 lbs300,000 lbs

- More than 300,000 lbs

By Region

- North America

- Asia-Pacific

- Middle East & Africa

- Europe

- Central & South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations as per the clients specific needs. The following customization options are available for this report:

Regional Analysis

Further breakdown of region and country-specific analysis

Company Information

Detailed analyses and profiling of additional market players (up to five)

The global pump jack market is projected to grow at a CAGR of 4.88%, from 2017 to 2022, to reach a market size of USD 3.63 Billion by 2022. Increasing matured oil fields and large number of stripper wells in North America along with improving crude oil production from these mature wells, have been a subject of focus around major oil producing regions, owing to oil price downturn.

The report segments the market, on the basis of vertical well and horizontal well type. The vertical well segmented accounted for the largest market share in 2016, driven by the demand from the North American market. Pump jack is the most commonly employed, low cost installation, and efficient method in vertical wells. Pump jacks in horizontal wells is still a challenging task. The application of pump jacks is also limited in the horizontal well market.

The report also segments the market, on the basis of the weight of equipment into less than 100,000 lbs, 100,000 lbs to 300,000 lbs, and more than 300,000 lbs. The 100,000 lbs to 300,000 lbs was the largest market and is projected to maintain its edge over the other segments owing to its capability of serving different type of wells.

The report also segments the market, on the basis of onshore and offshore applications. The use of pump jack is limited to onshore application with very less use in offshore application, due to large space footprint. Onshore fields offer the requisite surface area and well spacing for the installation of pump jacks. Moreover, onshore fields allow for easy maintenance and repair, as they are easily accessible or well connected to monitoring facilities.

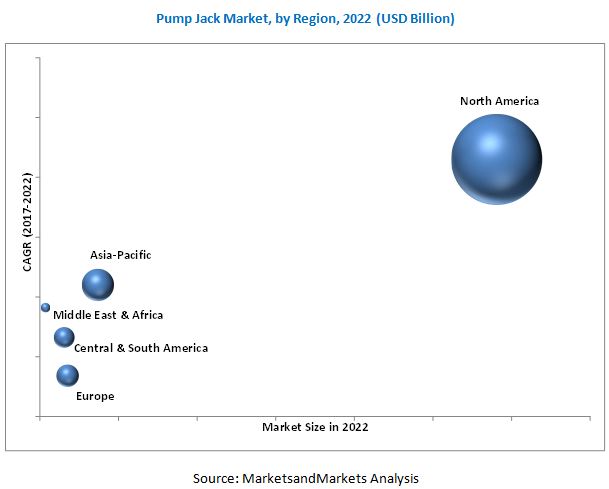

In this report, the market has been categorized, on the basis of region, into North America, Asia-Pacific, the Middle East and Africa, Europe, and South and Central America. The market in North America led the market, with the largest market share, by value, in 2016, and this trend is projected to continue till 2022. The market in Asia-Pacific will also play an important role in driving the demand for pump jacks.

The North American market is expected to grow at the highest CAGR during the forecast period. This growth is due to abundance of stripper wells in the U.S. and increasing number of mature oil fields which are near to the end of its economic life.

Large space footprint and limitation of offshore applications and moderate to high maintenance costs are the restraints for the market. Pump jack manufacturers are implementing new technologies, such as remotely monitoring of pump jack activities and adapting new renewable based operating methods to reduce the operating cost for pump jacks.

The leading players in the industry, based on their recent developments and other strategic industrial activities, includes Schlumberger Limited (U.S.), Halliburton (U.S.), General Electric Oil & Gas (U.K.), Weatherford International, PLC (Switzerland), Dover Corporation (U.S.), and Borets International (U.A.E.), among others.

In terms of growth strategies, market players have been focusing on expansions and investments to expand their product portfolio and increase their market size as well as strengthen their market foothold in the regional market. Pump jack manufacturing companies are opening new manufacturing facilities and service centers in the Americas to serve their customers in an efficient manner. There is a mix of both organic and inorganic growth strategies that companies are using to stay relevant in the market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.2 Market Size Estimation

2.3 Data Triangulation

2.4 Research Assumptions

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Market Dynamics

5.1.1 Introduction

5.1.2 Drivers

5.1.3 Opportunities

5.1.4 Challenges

5.1.5 Restriants

6 Market By Well Type

6.1 Introduction

6.2 Vertical Well

6.3 Horizontal Well

7 Market By Weight

7.1 Introduction

7.2 Market Analysis

7.2.1 Less Than 100,000 lbs

7.2.2 100,000 lbs to 300,000 lbs

7.2.3 More Than 300,000 lbs

8 Market By Application

8.1 Introduction

8.2 Onshore

8.3 Offshore

9 Market By Region

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.3 Europe

9.3.1 Russia

9.3.2 Kazakhstan

9.3.3 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 Indonesia

9.4.3 Australia

9.4.4 India

9.4.5 Rest of Asia-Pacific

9.5 Central & South America

9.5.1 Brazil

9.5.2 Venezuela

9.5.3 Mexico

9.5.4 Colombia

9.5.5 Ecuador

9.5.6 Rest of Central & South America

9.6 Middle East & Africa

9.6.1 Oman

9.6.2 Kuwait

9.6.3 Saudi Arabia

9.6.4 Angola

9.6.5 UAE

9.6.6 Nigeria

9.6.7 Rest of Middle East & Africa

10 Competitive Landscape

10.1 Overview

10.2 Marekt Ranking, 2016

10.2.1 Competitive Situation & Trends

10.2.2 Visionary Leaders

10.2.3 Innovators

10.2.4 Dynamic Differentiators

10.2.5 Emerging Companies

10.3 Competitive Leadership Mapping: Market

10.4 Competitive Benchmarking

10.4.1 Strength of Product Portfolio (25 Companies)

10.4.2 Business Strategy Excellecne (25 Companies)

11 Company Profiles

(Business Overview, Products & Services, Market Developments)

11.1 Introduction

11.2 Schlumberger Limited

11.3 General Electric Company

11.4 Weatherford International

11.5 Halliburton

11.6 Dover Corporation

11.7 Borets International

11.8 Tenaris S.A.

11.9 National Oilwell Varco

11.10 Hess Corporation

11.11 Star Hydraulics

11.12 Dansco Manufacturing, Inc

11.13 Pentag Gears & Oilfield Equipment, Ltd

11.14 L S Petrochem Equipment Corporation

11.15 Cook Pump Company

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets Subscription Portal

12.4 Introducing RT: Real Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (78 Tables)

Table 1 Global Market Snapshot

Table 2 Global Market Size, By Well Type, 20152022 (USD Million)

Table 3 Vertical Well: Market Size, By Well Type, 20152022 (USD Million)

Table 4 Horizontal Well: Market Size, By Well Type, 20152022 (USD Million)

Table 5 Global Market Share, By Weight, 20152022 (USD Million)

Table 6 Less Than 100,000 lbs Market Size, By Region, 20152022 (USD Million)

Table 7 100,000 lbs to 300,000 lbs Market Size, By Region, 20152022 (USD Million)

Table 8 More Than 300,000 lbs Market Size, By Region, 20152022 (USD Million)

Table 9 Global Market Size, By Application, 20152022 (USD Million)

Table 10 Onshore: Market Size, By Application, 20152022 (USD Million)

Table 11 Offshore: Market Size, By Application, 20152022 (USD Million)

Table 12 Global Market Size, By Region, 20152022 (USD Million) 56

Table 13 North America: Market Size, By Well Type, 20152022 (USD Million)

Table 14 North America: By Market Size, By Application, 20152022 (USD Million)

Table 15 North America: By Market Size, By Weight, 20152022 (USD Million)

Table 16 North America: By Market Size, By Country, 20152022 (USD Million)

Table 17 U.S.: Market Size, By Well Type, 20152022 (USD Million)

Table 18 U.S.: By Market Size, By Weight, 20152022 (USD Million)

Table 19 Canada: Market Size, By Well Type, 20152022 (USD Million)

Table 20 Canada: By Market Size, By Weight, 20152022 (USD Million)

Table 21 Europe: Market Size, By Well Type, 20152022 (USD Million)

Table 22 Europe: By Market Size, By Application, 20152022 (USD Million)

Table 23 Europe: By Market Size, By Weight, 20152022 (USD Million)

Table 24 Europe: By Market Size, By Country, 20152022 (USD Million)

Table 25 Russia: Market Size, By Well Type, 20152022 (USD Million)

Table 26 Russia: By Market Size, By Weight, 20152022 (USD Million)

Table 27 Kazakhstan: Market Size, By Well Type, 20152022 (USD Thousand)

Table 28 Kazakhstan: By Market Size, By Weight, 20152022 (USD Thousand)

Table 29 Rest of Europe: Market Size, By Well Type, 20152022 (USD Thousand)

Table 30 Rest of Europe: By Market Size, By Weight, 20152022 (USD Million)

Table 31 Asia-Pacific: Market Size, By Well Type, 20152022 (USD Million)

Table 32 Asia-Pacific: By Market Size, By Application, 20152022 (USD Million)

Table 33 Asia-Pacific: By Market Size, By Weight, 20152022 (USD Million)

Table 34 Asia-Pacific: By Market Size, By Country, 20152022 (USD Million)

Table 35 China: Market Size, By Well Type, 20152022 (USD Million)

Table 36 China: By Market Size, By Weight, 20152022 (USD Million)

Table 37 India: Market Size, By Well Type, 20152022 (USD Thousand)

Table 38 India: By Market Size, By Weight, 20152022 (USD Thousand)

Table 39 Indonesia: Market Size, By Well Type, 20152022 (USD Million)

Table 40 Indonesia: By Market Size, By Weight, 20152022 (USD Million)

Table 41 Australia: Market Size, By Well Type, 20152022 (USD Thousand)

Table 42 Australia: By Market Size, By Weight, 20152022 (USD Thousand)

Table 43 Rest of Asia-Pacific: Market Size, By Well Type, 20152022 (USD Million)

Table 44 Rest of Asia-Pacific: By Market Size, By Weight, 20152022 (USD Million)

Table 45 Central & South America: Market Size, By Well Type, 20152022 (USD Million)

Table 46 Central & South America: By Market Size, By Application, 20152022 (USD Million)

Table 47 Central & South America: By Market Size, By Country, 20152022 (USD Million)

Table 48 Central & South America: By Market Size, By Weight, 20152022 (USD Million)

Table 49 Venezuela: Market Size, By Well Type, 20152022 (USD Million)

Table 50 Venezuela: By Market Size, By Weight, 20152022 (USD Million)

Table 51 Brazil: Market Size, By Well Type, 20152022 (USD Thousand)

Table 52 Brazil: By Market Size, By Weight, 20152022 (USD Million)

Table 53 Mexico: Market Size, By Well Type, 20152022 (USD Million)

Table 54 Mexico: By Market Size, By Weight, 20152022 (USD Million)

Table 55 Colombia: Market Size, By Well Type, 20152022 (USD Million)

Table 56 Colombia: By Market Size, By Weight, 20152022 (USD Million)

Table 57 Ecuador: Market Size, By Well Type, 20152022 (USD Thousand)

Table 58 Ecuador: By Market Size, By Weight, 20152022 (USD Million)

Table 59 Rest of Central & South America: Market Size, By Well Type, 20152022 (USD Thousand)

Table 60 Rest of Central & South America: By Market Size, By Weight, 20152022 (USD Million)

Table 61 Middle East & Africa: Market Size, By Well Type, 20152022 (USD Million)

Table 62 Middle East & Africa: By Market Size, By Application, 20152022 (USD Million)

Table 63 Middle East & Africa: By Market Size, By Weight, 20152022 (USD Million)

Table 64 Middle East & Africa: By Market Size, By Country, 20152022 (USD Million)

Table 65 Angola: Market Size, By Well Type, 20152022 (USD Thousand)

Table 66 Angola: By Market Size, By Weight, 20152022 (USD Thousand)

Table 67 Oman: Market Size, By Well Type, 20152022 (USD Thousand)

Table 68 Oman: By Market Size, By Weight, 20152022 (USD Million)

Table 69 Nigeria: Market Size, By Well Type, 20152022 (USD Thousand)

Table 70 Nigeria: By Market Size, By Weight, 20152022 (USD Thousand)

Table 71 Kuwait: Market Size, By Well Type, 20152022 (USD Thousand)

Table 72 Kuwait: By Market Size, By Weight, 20152022 (USD Thousand)

Table 73 Saudi Arabia: Market Size, By Well Type, 20152022 (USD Thousand)

Table 74 Saudi Arabia: By Market Size, By Weight, 20152022 (USD Thousand)

Table 75 U.A.E.: Market Size, By Well Type, 20152022 (USD Thousand)

Table 76 U.A.E.: By Market Size, By Weight, 20152022 (USD Thousand)

Table 77 Rest of the Middle East & Africa: Market Size, By Well Type, 20152022 (USD Thousand)

Table 78 Rest of the Middle East & Africa: By Market Size, By Weight, 20152022 (USD Million)

List of Figures (37 Figures)

Figure 1 Global Market: Research Design

Figure 2 Global Market Size Estimation Methodology: Bottom-Up Approach

Figure 3 Market Size Estimation Methodology: Top-Down Approach

Figure 4 Data Triangulation

Figure 5 Assumptions of the Research Study

Figure 6 Estimated Market Shares of the Market, By Region (Value), 2017

Figure 7 The North American Market is Expected to Lead the Market, 20172022

Figure 8 Global Market, By Weight, 20172022 (USD Billion)

Figure 9 Global Market, By Well Type, 20172022 (USD Billion)

Figure 10 Attractive Opportunities in the Market

Figure 11 Global Market Share, By Well Type, 20172022

Figure 12 The 100,000 lbs300,000 lbs Weight Segment is Expected to Hold the Largest Market Share of Market, 2022

Figure 13 The Vertical Well Pump Jack Segment Held the Largest Market Share in 2016

Figure 14 North America: the Largest Market During the Forecast Period

Figure 15 Market Dynamics: Global Market

Figure 16 Oil Consumption in BRICS Economies, 2014 & 2015

Figure 17 Oil Wells Drilled in the U.S., Horizontal Vis-ΐ-Vis Vertical, 20102015

Figure 18 The Vertical Well Segment Accounted for the Largest Market Share in 2016

Figure 19 Global Market Share (Value), By Application, 2016

Figure 20 100,000 lbs to 300,000 lbs Segment Would Drive the Growth of the Market, 2017 & 2022

Figure 21 The Onshore Segment Accounted for the Largest Market Share in 2016

Figure 22 Regional CAGR Snapshot (2016): the Asia-Pacific Region is Emerging as A New Hotspot for the Market

Figure 23 North America: the Fastest Growing Market, 2017 &2022

Figure 24 North America: Market Overview

Figure 25 Asia Pacific: Market Overview

Figure 26 Companies Adopted Expansions and Investments and Mergers & Acquisitions as Its Key Growth Strategies, 20122017

Figure 27 Market Ranking, Pump Jack, 2016

Figure 28 Market Evaluation Framework, 20122017

Figure 29 Battle for Market Share (20122017): Expansions and Investments Was the Key Strategy Adopted By the Players in the Market

Figure 30 General Electric Oil and Gas: Company Snapshot

Figure 31 Schlumberger Limited: Company Snapshot

Figure 32 Weatherford International, PLC: Company Snapshot

Figure 33 Halliburton Company: Company Snapshot

Figure 34 National Oilwell Varco, Inc.: Company Snapshot

Figure 35 Borets International Limited: Company Snapshot 116

Figure 36 Dover Corporation: Company Snapshot 119

Figure 37 Tenaris S.A.: Company Snapshot 124

Growth opportunities and latent adjacency in Pump Jack Market