Public Transport Operations Management Market - Global Forecast to 2029

The public transport operations management market is projected to grow from USD XX billion in 2024 to USD XX billion by 2029, at a CAGR of XX% during the forecast period.

Public transport operations management focuses on monitoring networks and adjusting timetables to optimize service effectiveness for passengers, even amid fluctuating demand or disruptions. Control centers, typically managed by public transport operators or agencies, are vital in coordinating these efforts in real-time. Effective operations management addresses common challenges such as overcrowding during peak hours, delays that cause passengers to miss connections, and disruptions from private traffic affecting bus and tram services. It also involves deploying replacement vehicles or routes during service outages, adjusting service frequency based on real-time data and passenger demand, and ensuring smooth operations during events with exceptionally high demand, such as sports games, festivals, and trade fairs.

To know about the assumptions considered for the study, Request for Free Sample Report

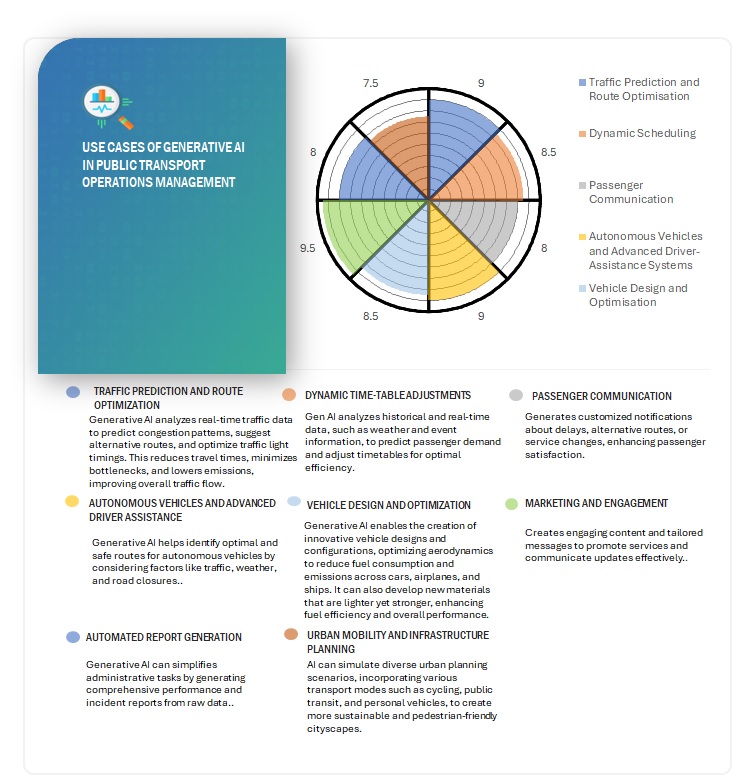

USE CASES OF AI/GENERATIVE AI IN PUBLIC TRANSPORT OPERATIONS MANAGEMENT MARKET

Generative AI significantly improves public transport operations with a series of novel use cases. Transportation management has always been a complex industry. Rising fleet rates, shortage of drivers, and shifts in consumer needs have constantly created challenges to optimize time and cost. However, the emergence of Generative Artificial Intelligence (GenAI) presents a new opportunity. To help evaluate the possible effects of infrastructure projects such as bridges, roads, and tunnels on customers' behaviour, generative AI can create synthetic data to model future events. AI assists in comprehending risks and consequences by examining these situations, which improves decision-making for expensive and dangerous infrastructure upgrades.

Generative AI can help enhance the efficiency of crucial functions of public transport operations management, such as personalized customer communication, virtual assistance for customer support, educating passengers on using transit apps, incident reporting, and others. Traffic issues and traveling time can be reduced by adopting generative AI tools to evaluate traffic data in real-time, predict congestion patterns, and identify alternative routes. Traffic light timings can be changed by generative based on the present scenario to ensure public transportation's safe and smooth use.

Public Transport Operations Management Market Dynamics

Driver: Rising concerns of vehicle safety to drive the market

Safety is the primary concern for any fleet operator. Any emergency or accident might lead to disastrous results; therefore, public transportation operations management solutions offering safety management as one of the features are gaining fleet managers’ attention. With technology advancements and increasing digitization, organizations generate enormous amounts of data but struggle to gain significant benefits. Big data analytics brings the actual value of data to improve operational efficiencies and customer satisfaction at reduced costs. The rapid increase in big data applications has led to the need to develop innovative technologies to optimize cost-efficiency. Thus, these factors are expected to drive the demand for new analytics platforms and data storage centers.

Restraint: Environmental disturbance causing problems for GPS connectivity

The atmospheric inference is one of the main problems hampering GPS connectivity. The GPS should give an accurate location for it to be functional. The most up-to-date navigation service, Google Maps, also provides a place that is 3–10 meters accurate. These services also give the best result under certain conditions, such as the users should be preferably in ideal conditions, being outdoors rather than indoors, being in a city, and having strong internet connectivity. The GPS signal must travel huge distances through the atmosphere and multiple satellites to reach the mobile phone. This loss of GPS tracking can impact route optimization, fleet coordination, and real-time updates, hindering the efficiency of public transport operations.

Opportunity: Vehicle Integration with artificial intelligence extends profitable opportunities

Recent advancements in AI have paved the ground for the public transport industry to see unprecedented growth. Government and responsible groups need help managing thousands of vehicles and drivers. On a large scale, challenges can be minor or disruptive. These challenges include using outdated software, unauthorized or underused asset usage, fluctuating fuel prices, and managing cars spread across the country efficiently. Al's integration with automobiles greatly enhances public transportation operations by increasing effectiveness, dependability, and passenger satisfaction. Al-driven systems make it possible to track vehicles in real-time and optimize deployment and route planning according to passenger demands and traffic circumstances. Al-powered predictive maintenance reduces operations disruptions and breakdowns by guaranteeing prompt vehicle servicing.

Challenge: Inaccurate geocoding can be a challenge in managing transport operations

Geocoding is used to evaluate geographic coordinates with given addresses. It is crucial for various verticals such as transportation, logistics, etc. However, as important as geocoding is, its accuracy is always ignored. Various complex challenges impact how error-free locations are mapped and understood. From incomplete address datasets to inconsistent formats, geocoding providers must navigate various obstacles to deliver high-quality results.

MARKET ECOSYSTEM

The public transport operations management market is highly fragmented and comprises many vendors who offer solutions to a specific or niche market segment. Several changes in the public transport operations management market have occurred in recent years. Currently, the vendors are involved in various partnerships and collaborations to develop comprehensive solutions that address a wide range of requirements. PTV Group (Germany), Conduent (US), Geotab (Canada), Hexagon (Sweden), Tourmo (US), and Siemens (Germany) are some of the major players operating in this ecosystem.

To know about the assumptions considered for the study, download the pdf brochure

Solutions segment to account for the largest market share during the forecast period

The solutions segment is expected to increase quickly because of the rapid development of digitalized technologies for transport management. The rise in the deployment of IoT sensors has led to a massive increase in data generation, resulting in high demand for analytics solutions. Public transport operations management solutions are being applied in many industry verticals across regions. Apart from the various parameters that contribute to the market’s growth, the other factors expected to drive the market growth include expanding urbanization, increasing vehicles and mobility, rising government initiatives, and technological evolution within infrastructures.

Smart Energy Management segment to register higher CAGR during the forecast period

Smart energy management is used for load balancing or power optimization solutions of EV charging infrastructure. It is playing a crucial role in the growth of public transport operations management. It resolves the central issue of the limited capacity of local infrastructures to tackle the rising energy demands of EV charging. It enables operators to monitor, manage, and adjust energy consumption, ensuring optimal charging and demand response.

By region, Europe accounts for the largest market share during the forecast period.

The public transport operations management market in Europe is considered a high-growth market due to many factors, such as the increase in digitization, the economic stability of its countries, technological advancements, and the adoption of advanced fleet management technologies. The UK, France, Italy, Spain, Russia, and Germany are among the nations boosting the region's public transport operations management market.

Key Market Players

The major players in the public transport operations management market include PTV Group (Germany), SWARCO (Austria), Conduent (US), Geotab (Canada), Hexagon (Sweden), Tourmo (US), Siemens (Germany), UTI Group (France), Arya Omnitalk (India), FLEETO (India), Optibus (Israel), Via Transportation (US), Trapeze Group (Canada), Ubisense (UK), Giro (US), and Coencorp (Canada). These players have adopted various growth strategies, such as partnerships, agreements, and product launches & enhancements, to expand their footprint in the public transport operations management market.

Recent Developments:

- In November 2024, the BACS consortium, along with construction company Almabani, partnered with Siemens Mobility and successfully completed Riyadh Metro's Blue Line (Line 1) and Red Line (Line 2) projects. The project covers a distance of 64 kilometers, and these lines are installed with 67 Siemens Mobility Inspiro trains to initiate fully automated and driverless operations more efficiently.

- In October 2024, PTV Group announced the launch of PTV Hub, the first SaaS solution that is a cloud-based modeling platform for mobility planning, design, and optimization. It integrates PTV's renowned desktop software with web-based features to enhance productivity and accessibility.

- In December 2023, Conduent Transportation, a smart mobility solution provider, launched a digitalized platform to transform and ease the functionality of ticket vending machines. This platform has improved customer experience by enabling contactless ticket purchases and card top-ups. Italy’s Trenord is the first transit agency to adopt the platform, which was deployed on 250 ticket vending machines across the Lombardy region.

- In June 2022, Geotab launched the Fleet Electrification Knowledge Center, a one-stop resource hub for fleet leaders to learn about the journey to electrification, from the initial adoption of Electric vehicles (EVs) to streamlining and optimizing operations.

- In May 2022, Geotab partnered with General Motors to provide government agencies in the US with an integrated OEM solution. This solution provides instant connectivity via OnStar-equipped vehicles without the need for additional hardware installation. Government fleets will benefit from real-time visibility, quick access to data, and the right to use all other technology innovations from Geotab.

Frequently Asked Questions (FAQ):

What is the definition of the public transport operations management market?

What is the size of the public transport operations management market?

What are the major drivers in the public transport operations management market?

Who are the key players operating in the public transport operations management market?

What are the opportunities for new entrants in the public transport operations management market?

Growth opportunities and latent adjacency in Public Transport Operations Management Market