Public Safety in-Building Wireless DAS System Market by System Component (Antennas, Cabling, Distributed Antenna System (DAS) Headend and Remote Unit, and Repeaters), Service (Professional and Managed), Application, and Region - Global Forecast to 2021

[125 Pages Report] The global public safety in-building wireless Distributed Antenna System (DAS) market is estimated to grow from USD 404.2 Million in 2016 to USD 1,740.1 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 33.9% from 2016 to 2021.

The objectives of the report are to define, describe, and forecast the global public safety in-building wireless DAS system market on the basis of system components, services, business models, applications, and regions, to provide the impact analysis of market dynamics that describes the factors currently driving as well as restraining the growth of the market, along with their impact on short, medium, and long terms. The report also provides detailed information regarding the key factors influencing the market growth and forecasts the market size of market segments with respect to five main regions, namely, North America, Europe, Asia-Pacific (APAC), the Middle East and Africa (MEA), and Latin America. The base year considered for the study is 2015 and the market size is forecast from 2016 to 2021.

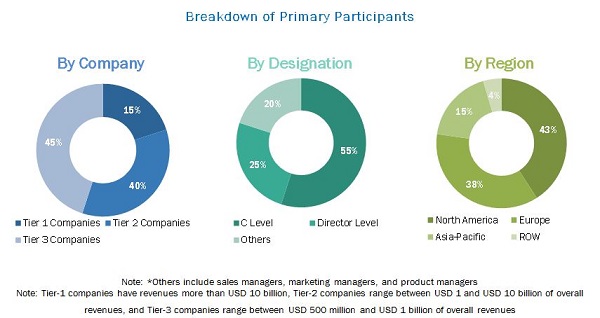

The research methodology used to estimate and forecast the public safety in-building wireless DAS system market captured data on key vendor revenues through secondary research. The vendors products and solution offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of key players (companies) and their shares in the market. This overall market size was used in the top-down procedure to estimate the sizes of other individual markets via percentage splits from secondary and primary research. The data triangulation and market breakdown procedures have been used to complete the overall market engineering process and to derive the exact statistics for all segments and subsegments. The breakdown of profiles of primaries is depicted in the below figure:

To know about the assumptions considered for the study, download the pdf brochure

Key Target Audience:

- In-building Wireless Solution Providers

- Wireless Carriers

- Telecommunication Service Providers

- Public Safety Responders

- Departments of Security

- Building Owners

- Local Emergency Medical Services (EMS) Organizations

- Equipment and Device Manufacturers

Scope of the Report

The research report segments the public safety in-building wireless DAS system market into the following submarkets:

By System Component:

- Antennas

- Cabling

- Distributed Antenna System (DAS) Headend and Remote Unit

- Repeaters

By Service:

- Professional Services

- Managed Services

By Business Model:

- Carrier

- Enterprise

- Host

By Application:

- Enterprise Office Complex

- Education Complex

- Malls and Retail Complex

- Healthcare Complex

- Transportation Complex

- Religious Complex

- Hospitality

- Others

By Region:

- North America

- Europe

- Asia-Pacific (APAC)

- Middle East and Africa (MEA)

- Latin America

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the companys specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of product portfolio of each company

Geographic Analysis

- Further breakdown of the North American market

- Further breakdown of the European market

- Further breakdown of the APAC market

- Further breakdown of the MEA market

- Further breakdown of the Latin American market

Company Information

- Detailed analysis and profiling of additional market players

MarketsandMarkets forecasts the public safety in-building wireless Distributed Antenna System (DAS) market to grow from USD 404.2 Million in 2016 to USD 1,740.1 Million by 2021, at a Compound Annual Growth Rate (CAGR) of 33.9% from 2016 to 2021. The implementation of safety codes such as National Fire Protection Association (NFPA) and the International Code Council (ICC) in buildings mandated by governments acts as a major driver for public safety in-building wireless DAS system market across the globe. Other drivers include growing critical need of consistent and reliable public safety network globally, growing trends towards smart cities and buildings, and major number of calls and data originating inside the building premises.

The scope of this report covers the public safety in-building wireless DAS system market by system component, service, business model, application, and region. The DAS headend and remote unit system is expected to grow at the highest rate among all system components from 2016 to 2021, due to its data intensive services with extended coverage into buildings, high-end performance, and discrete carrier access & control. The managed services segment in the services segment is expected to grow at the highest rate, as it provides superior customer experience with 24Χ7 support. In the application segment, the hospitality sector is expected to grow with the highest CAGR from 2016 to 2021. The carrier business model is expected to grow at the highest CAGR in the business model segment.

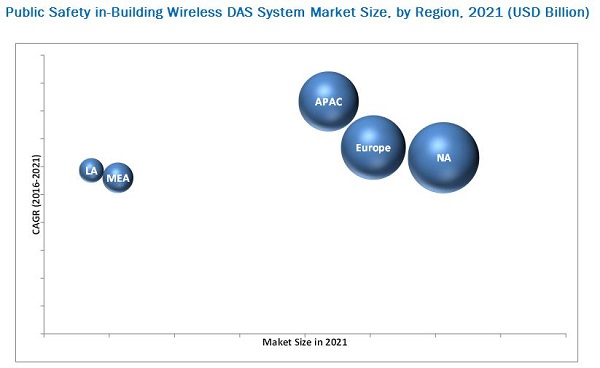

North America is expected to have the largest market share in the public safety in-building wireless DAS system market from 2016 to 2021, due to the desire for continuous connectivity among the people of the region, along with increase in data traffic over the area. Asia-Pacific (APAC) offers potential growth in the number of in-building deployments due to increasing number of large infrastructure and buildings over the vast region of APAC and the adoption of micro-base stations in the region, which leads to APAC having the highest CAGR among all other regions.

However, high installation cost acts as a major restraining factor for the market. Some of the challenges faced by the market are complexity in design and installation of building wireless solutions, security and privacy concerns, intrusion in network due to building materials and size.

Some of the major vendors in the market are Alcatel-Lucent, AT&T, Inc., Commscope, Inc., Ericsson, Verizon Communications, Inc., Anixter Inc., Cobham PLC, Corning Incorporated, Smiths Group PLC, and TE Connectivity Ltd. These players adopted various strategies such as new product launches, partnerships, agreements, collaborations, mergers & acquisitions, and business expansions to cater to the needs of the public safety in-building wireless DAS system market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown and Data Triangulation

3 Executive Summary (Page No. - 23)

4 Premium Insights (Page No. - 27)

4.1 Attractive Market Opportunities in the Market

4.2 Public Safety In-Building Wireless Das System Market: By System Component and Service

4.3 Global Market By Application

4.4 Lifecycle Analysis, By Region (2016)

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Evolution

5.3 Market Segmentation

5.3.1 By System Component

5.3.2 By Service

5.3.3 By Application

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Growing Critical Need of Consistent and Reliable Public Safety Networks Worldwide

5.4.1.2 Increasing Mandatory Implementation of Safety Codes in Buildings By Governments

5.4.1.3 Growing Trend Towards Smart Cities and Buildings

5.4.1.4 Maximum Number of Calls and Data Originates Inside the Building Premises

5.4.2 Restraints

5.4.2.1 High Installation Cost

5.4.3 Opportunities

5.4.3.1 Technological Advancements Such as 4g Lte

5.4.3.2 Use of Fiber-Based and Digitally Intelligent Das Such as Iddas

5.4.3.3 Development of Large Multi-Story Buildings Necessitates In-Building Wireless Solutions

5.4.4 Challenges

5.4.4.1 Complexity in Design and Installation of Building Wireless Solutions

5.4.4.2 Security and Privacy Concerns

6 Industry Trends (Page No. - 39)

6.1 Introduction

6.2 Value Chain Analysis

6.3 System Architecture

6.4 Strategic Benchmarking

7 Public Safety In-Building Wireless Das System Market Analysis, By System Component (Page No. - 42)

7.1 Introduction

7.2 Antennas

7.3 Cabling

7.4 Das Headend and Remote Unit

7.5 Repeater

8 Market Analysis, By Service (Page No. - 49)

8.1 Introduction

8.2 Managed Services

8.3 Professional Services

9 Public Safety In-Building Wireless Das System Market Analysis, By Application (Page No. - 54)

9.1 Introduction

9.2 Enterprise Office Complex

9.3 Education Complex

9.4 Malls and Retail Complex

9.5 Healthcare Complex

9.6 Hospitality

9.7 Transportation Complex

9.8 Religious Complex

9.9 Others

10 Geographic Analysis (Page No. - 63)

10.1 Introduction

10.2 North America

10.3 Europe

10.4 Asia-Pacific (APAC)

10.5 Middle East and Africa (MEA)

10.6 Latin America

11 Competitive Landscape (Page No. - 78)

11.1 Overview

11.2 Competitive Situation and Trends

11.2.1 New Product Launches/Enhancements

11.2.2 Partnerships, Collaborations, and Agreements

11.2.3 Mergers and Acquisitions

12 Company Profiles (Page No. - 84)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

12.1 Introduction

12.2 Verizon Communications, Inc.

12.3 Ericsson

12.4 Alcatel-Lucent SA

12.5 AT&T Inc.

12.6 Commscope, Inc.

12.7 Anixter, Inc.

12.8 Cobham, PLC.

12.9 Corning, Inc.

12.10 Smiths Group, PLC.

12.11 TE Connectivity, Ltd.

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 118)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real-Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (39 Tables)

Table 1 Global Market Size, By System, 20162021 (USD Million)

Table 2 Public Safety In-Building Wireless Das System Market Size, By System Component, 20142021 (USD Million)

Table 3 Market Size, By Region, 20142021 (USD Million)

Table 4 Antennas: Market Size, By Region, 20142021 (USD Million)

Table 5 Cabling: Market Size, By Region, 20142021 (USD Million)

Table 6 Das Headend and Remote Unit: Market Size, By Region, 20142021 (USD Million)

Table 7 Repeaters: Market Size, By Region, 20142021 (USD Million)

Table 8 Market Size, By Service, 20142021 (USD Million)

Table 9 Public Safety In-Building Wireless Das Services Market Size, By Region, 20142021 (USD Million)

Table 10 Managed Services: Market Size, By Region, 20142021 (USD Million)

Table 11 Professional Services: Market Size, By Region, 20142021 (USD Million)

Table 12 Market Size, By Application 20142021 (USD Million)

Table 13 Enterprise Office Complex: Market Size, By Region, 20142021 (USD Million)

Table 14 Education Complex: Market Size, By Region, 20142021 (USD Million)

Table 15 Malls and Retail Complex: Market Size, By Region, 20142021 (USD Million)

Table 16 Healthcare Complex: Market Size, By Region, 20142021 (USD Million)

Table 17 Hospitality: Market Size, By Region, 20142021 (USD Million)

Table 18 Transportation Complex: Market Size, By Region, 20142021 (USD Million)

Table 19 Religious Complex: Market Size, By Region, 20142021 (USD Million)

Table 20 Others: Market Size, By Region, 20142021 (USD Million)

Table 21 Public Safety In-Building Wireless Das System Market Size, By Region, 20142021 (USD Billion)

Table 22 North America: Market Size, By System Component, 20142021 (USD Million)

Table 23 North America: Market Size, By Service, 20142021 (USD Million)

Table 24 North America: Market Size, By Application, 20142021 (USD Million)

Table 25 Europe: Market Size, By System Component, 20142021 (USD Million)

Table 26 Europe: Market Size, By Service, 20142021 (USD Million)

Table 27 Europe: Market Size, By Application, 20142021 (USD Million)

Table 28 Asia-Pacific: Market Size, By System Component, 20142021 (USD Million)

Table 29 Asia-Pacific: Market Size, By Service, 20142021 (USD Million)

Table 30 Asia-Pacific: Market Size, By Application, 20142021 (USD Million)

Table 31 Middle East and Africa: Market Size, By System Component, 20142021 (USD Million)

Table 32 Middle East and Africa: Market Size, By Service, 20142021 (USD Million)

Table 33 Middle East and Africa: Market Size, By Application, 20142020 (USD Million)

Table 34 Latin America: Public Safety In-Building Wireless Das System Market Size, By System Component, 20142021 (USD Million)

Table 35 Latin America: Market Size, By Service, 20142021 (USD Million)

Table 36 Latin America: Market Size, By Application, 20142021 (USD Million)

Table 37 New Product Launches/Enhancements, 20142016

Table 38 Partnerships, Collaborations, and Agreements, 20142016

Table 39 Mergers and Acquisitions, 20142016

List of Figures (47 Figures)

Figure 1 Public Safety In-Building Wireless Das System Market: Research Design

Figure 2 Breakdown of Primary Interview: By Company Type, Designation, and Region

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation

Figure 6 The North American Market has the Largest Share in the Global Public Safety In-Building Wireless Das System Market, 2016

Figure 7 Public Safety In-Building Wireless Das System (By System Component and Service) Snapshot, 2016 vs 2021

Figure 8 Partnerships, Agreements, and Collaborations are Expected to Be the Differentiating Trends for the Top Companies

Figure 9 Mandatory Public Safety Codes for Buildings are Pushing Market

Figure 10 System Components Contributes the Largest Market Share in the Public Market

Figure 11 Enterprise Office Complex By Application and North America By Region Accounted for the Highest Shares in the Market

Figure 12 North America is the Leading Market Due to the Higher Adoption of Das Headend and Remote Unit

Figure 13 Evolution of the Public Safety In-Building Wireless Das System Market

Figure 14 Market By System Component

Figure 15 Market By Service

Figure 16 Market By Application

Figure 17 Market Drivers, Restraint, Opportunities, and Challenges

Figure 18 Value Chain Architecture

Figure 19 System Architecture

Figure 20 Strategic Benchmarking

Figure 21 North America is Expected to Lead the Public Safety In-Building Wireless Das System in Terms of Market Size During the Forecast Period

Figure 22 North America is Expected to Dominate A Large Part of the Market During the Forecast Period

Figure 23 Enterprise Office Complex is Expected to Lead the Public Safety Wireless Das System Market By Application During the Forecast Period

Figure 24 Asia-Pacific: an Attractive Destination for the Public Safety In-Building Wireless Das System Market, 20162021

Figure 25 The Market in Asia-Pacific is Expected to Grow at the Highest Rate From 2016 to 2021

Figure 26 North America Market Snapshot

Figure 27 The System Component Market is Expected to Dominate the Market From 2016 to 2021

Figure 28 Asia-Pacific Market Snapshot

Figure 29 Partnership, Agreement, and Collaboration Was the Key Growth Strategy in the Last Three Years

Figure 30 Market Evaluation Framework

Figure 31 Battle for Market Share: Market Players Adopted Partnership, Agreement, and Collaboration as the Key Strategy

Figure 32 Region-Wise Revenue Mix of the Top 5 Market Players

Figure 33 Verizon Communications, Inc.: Company Snapshot

Figure 34 Verizon Communications, Inc.: SWOT Analysis

Figure 35 Ericsson: Company Snapshot

Figure 36 Ericsson: SWOT Analysis

Figure 37 Alcatel-Lucent SA: Company Snapshot

Figure 38 Alcatel-Lucent SA: SWOT Analysis

Figure 39 AT&T Inc.: Company Snapshot

Figure 40 AT&T Inc.: SWOT Analysis

Figure 41 Commscope, Inc.: Company Snapshot

Figure 42 Commscope, Inc.: SWOT Analysis

Figure 43 Anixter, Inc.: Company Snapshot

Figure 44 Cobham PLC.: Company Snapshot

Figure 45 Corning, Inc.: Company Snapshot

Figure 46 Smiths Group PLC.: Company Snapshot

Figure 47 TE Connectivity Ltd.: Company Snapshot

Growth opportunities and latent adjacency in Public Safety in-Building Wireless DAS System Market