Public Cloud Market by Service Model (Infrastructure as a Service, Platform as a Service, Software as a Service, Organization Size (Large enterprises, Small and Medium Enterprises (SMEs)), Vertical and Region - Global Forecast to 2027

Public Cloud Market Summary

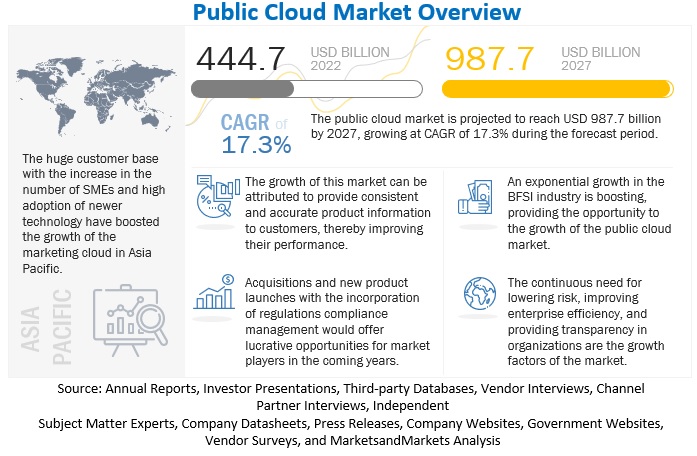

The global public cloud market was valued at USD 444.7 billion in 2022 and is projected to reach USD 987.7 billion by 2027, growing at a CAGR of 17.3% from 2021 to 2027. Public cloud refers to an IT model where providers deliver resources such as computing, storage, applications, and development environments over the public internet on-demand. While offering scalability and cost advantages, businesses must carefully choose providers and manage unpredictable usage to avoid overspending.

Key Market Trends & Insights

- Technological Drivers: Integration of Big Data, AI, and ML enhances data accessibility, visualization, and operational efficiency, driving public cloud adoption.

- Restraints: Limited technical expertise and resistance to change in developing regions slow the transition to cloud-based infrastructure.

- Opportunities: Hosting applications in the public cloud improves efficiency and reduces costs through economies of scale and faster deployment.

- Challenges: High costs for cloud data storage and bandwidth, along with data egress fees, can increase total cost of ownership.

- Regional Insights – US: The US holds the largest market share with a strong base of cloud providers and high adoption across industries; accounts for 44% of global public cloud revenue.

- Regional Insights – France: Expected to record the highest CAGR, driven by digital transformation initiatives, government support, and increased private sector adoption despite security concerns.

Market Size & Forecast

- 2022 Market Size: USD 444.70 Billion

- 2027 Projected Market Size: USD 987.70 Billion

- CAGR (2021–2027): 17.3%

- Largest Market in 2022: United States

To know about the assumptions considered for the study, Request for Free Sample Report

Public Cloud Market Dynamics

Public Cloud Market Drivers: Big Data, AI, and ML integration with cloud

The increasing uptake of big data, Al, ML, and other technologies are predicted to fuel market expansion. These technologies are transforming the public cloud market because they enable users to monitor, analyze, and visualize raw data. Businesses may improve the accessibility and usability of complex data while also improving their visualization skills by integrating these developing technologies with cloud-based solutions. Due to the growing use of Al and ML technologies, businesses today use more data and experience fewer storage issues. Additionally, these technologies assist firms in increasing productivity, improving decision-making, and reducing operational costs. Businesses use solutions powered by Al to enhance their operational, strategic, and insight-driven capabilities. Al is capable of automating challenging and time-consuming processes to increase productivity and carry out data analysis without the need for manual input. With the combination of big data, Al, and ML, organizations that offer cloud solutions and services are always focusing on R&D projects, product upgrades, and new product launches. IT professionals can also monitor and manage critical workflows using Al. Secondary data indicates that Microsoft has introduced Azure Health Data Services. It is a platform as a service (PaaS) designed to handle transactional and analytical workloads. It aggregates health information, runs Al on the cloud, and only accepts Protected Health Information (PHI). Therefore, it is anticipated that big data, AI, and ML will increasingly be adopted, leading to public cloud market expansion.

Restraint: Businesses in developing regions limit level of technical expertise

Implementing cutting-edge technology to completely automate and streamline their business processes is helping organizations speed up the process of becoming digitally oriented. Due to the public cloud's benefits, particularly its lower costs and enhanced business agility, it is now an essential part of enterprise IT strategies. In order to properly integrate and run cloud services in enterprises, it is now even more important to have technical experts on staff as well as effective change management. An organization's ability to transition is significantly hampered by employee resistance to adapt to changes and broaden its skill sets. Additionally, businesses now emphasize increasing profits more than more of emphasis on increasing profits than on developing employee skills through appropriate training. Moreover, in order to avoid upfront expenditures, firms are reluctant to accept the maturation process and are content to continue with traditional infrastructures or software services. These problems lead to a skills scarcity and may result in business saturation due to competitors' potential huge investments in updating their business operations and service offerings. These factors would allow rivals the chance to expand their client and public cloud market share, which can cost firms that don't adopt new developments both customers and money.

Public Cloud Market Opportunity: Improved effectiveness for hosting applications in public cloud

Public cloud providers can offer their services at a lower price than the majority of companies can do on their relative to economies of scale. This improved efficiency leads to cost reductions for businesses that move to the public cloud. The public cloud also enables a higher application density, which lowers expenses for businesses even further. Hosting applications in the public cloud can improve the efficiency of users' enterprises. Businesses that move their applications and data to the public cloud can take advantage of the provider's economies of scale. Additionally, businesses may use fewer servers and run more applications, which boosts productivity and reduces expenses. Organizations may frequently launch new applications or services in the public cloud much more quickly than they could if they were to develop them internally. This is because the public cloud already has the necessary infrastructure in place, allowing businesses to start using it immediately. All they need to do is provide the materials.

Public Cloud Market Challenge: Higher costs associated with cloud data storage

Even while the cloud is less expensive in terms of setup costs, maintenance costs, and support costs, the overall cost of ownership depends on the amount of data that needs to be saved. Storing large data sets in cloud databases or data lakes can be expensive. More bandwidth is required for cloud services than for on-premises solutions because data transfer is crucial to their operation. Cloud services are usually more expensive than options offered on-premises due to the higher cost associated with this increased bandwidth need. Additionally, the majority of cloud providers charge a data egress fee if customers decide to move their data out of the cloud. These fees remain the same whether the data is moved to a different cloud or returned to its original place. AWS charges USD 0.01 per GB for transfers to public IP addresses, while data delivery to Amazon's cloud is free. To prevent businesses from erasing their data from the cloud where it now resides, organizations must pay data egress costs, which are often highly expensive.

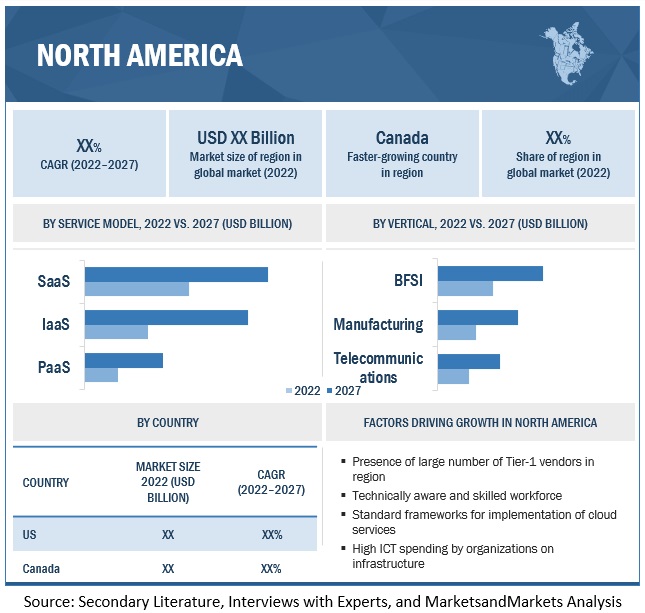

US to account for largest market size during forecast period

The geographic analysis of the North America IT services market is segmented into country, including US and Canada. In the public cloud market, the US is projected to hold the biggest public cloud market share in 2022, and the pattern is anticipated to last through 2027. Additionally, the US is home to well-established end-user sectors and suppliers that are constantly adjusting to modern technology for increased business productivity and labor efficiency. Several small and large public cloud solution providers, including AWS, Microsoft, Google, VMware, Salesforce, Oracle, and IBM, are based in the US and are among the major forces behind the expansion of the public cloud market in the nation. According to secondary data, 94% of US company IT decision-makers employ at least one kind of public cloud deployment. Further, Cloud storage is the main IT/operational priority for 64% of US infrastructure for the upcoming year. Businesses in the US rely on managed service providers and global service integrators to help them with their cloud migration projects. 44% of global public cloud provider revenue and 51% of the world's hyperscale data centre capacity are based in the US.

To know about the assumptions considered for the study, download the pdf brochure

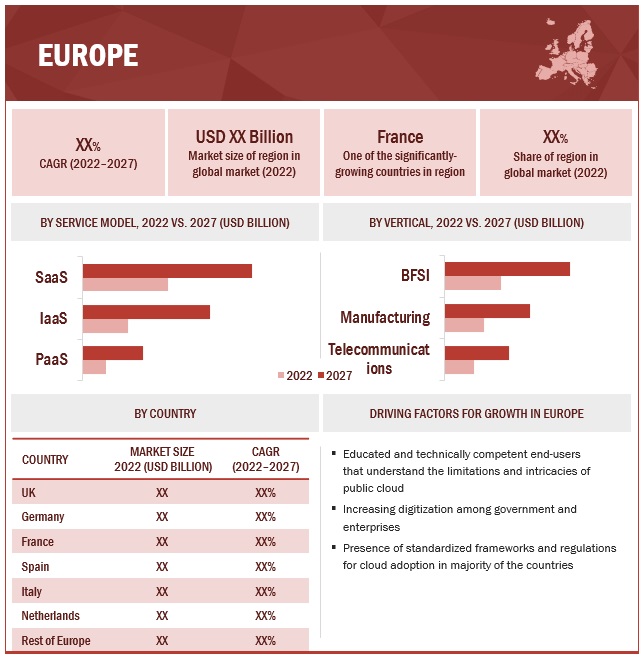

France to account for highest CAGR during the forecast period

France's economy is stable, and more people are supporting attempts to undergo digital transformation. Due to the public cloud's low TCO advantages, firms in France are quickly embracing it. The region's end users are technically skilled but they are cutting back on IT spending to enhance their Rol. The French government has cautiously deployed cloud technology choices for data storage and service delivery. The public sector is investing more money in the public cloud as it is focused on giving its operations cloud technology solutions that are comparable to those utilized by the private sector. Although there are several data centers all across the country that offer cloud services to customers, they are not yet being utilized to their fullest extent. The leading cloud service providers are expanding their businesses in France. According to secondary data, a cloud-first approach for governmental organizations is emphasized in the French government's economic recovery plan. Despite ongoing concerns about data security and national sovereignty, a lot of enterprises in the country are now utilizing the public cloud.

Public Cloud Market Players

Some of the major public cloud market vendors are AWS (US), Microsoft (US), Google (US), Salesforce (US), Alibaba Cloud (China), Oracle (US), IBM (US), SAP (Germany), Tencent (China), Workday (US), Fujitsu (Japan), VMWare (US), Rackspace (US), HPE (US), Adobe (US), NEC (Japan), Cisco (US), Dell Technologies (US), ServiceNow (US), OVH (France), Huawei (China), Verizon (US), OrangeGroup (France), NetApp (US), dinCloud (US), Vultr (US), Megaport (Australia), AppScale (US), Zymr (US), Genesis Cloud (Germany), Ekco (Ireland), Tudip Technologies (India), ORock Technologies (US), and CloudFlex (Nigeria).

Public Cloud Market Report Scope

|

Report Metrics |

Details |

|

Market value in 2027 |

USD 987.7 Billion |

|

Market value in 2022 |

USD 444.7 Billion |

|

Market Growth Rate |

17.3% CAGR |

|

Largest Market |

Europe |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Segments Covered |

Service Models, Organization Sizes, Verticals, and Regions |

|

Geographies Covered |

North America, Europe, Asia Pacific, Middle East and Africa, and Latin America |

|

Companies Covered |

Some of the major public cloud market vendors are AWS (US), Microsoft (US), Google (US), Salesforce (US), Alibaba Cloud (China), Oracle (US), IBM (US), SAP (Germany), Tencent (China), Workday (US), Fujitsu (Japan), VMWare (US), Rackspace (US), HPE (US), Adobe (US), NEC (Japan), Cisco (US), Dell Technologies (US), ServiceNow (US), OVH (France), Huawei (China), Verizon (US), OrangeGroup (France), NetApp (US), dinCloud (US), Vultr (US), Megaport (Australia), AppScale (US), Zymr (US), Genesis Cloud (Germany), Ekco (Ireland), Tudip Technologies (India), ORock Technologies (US), and CloudFlex (Nigeria) |

This research report categorizes the public cloud market based on service types, organization sizes, deployment modes, business functions, verticals, and regions.

Based on the Service Model:

- Infrastructure as a Service

- Platform as a Service

- Software as a Service

Based on the Organization Sizes:

- Large enterprises

- Small and Medium Enterprises (SMEs)

Based on the Verticals:

- BFSI

- Telecommunication

- IT & ITeS

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utility

- Media & Entertainment

- Healthcare & Life Sciences

- Other Verticals

Based on the Region:

-

North America

- United States

- Canada

-

Europe

- United Kingdom

- Germany

- France

- Italy

- Spain

- Netherlands

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Singapore

- Australia

- South Korea

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- United Arab Emirates

- South Africa

- Qatar

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Rest of Latin America

Recent Developments:

- In October 2022, UBS and Microsoft announced landmark expansion of their partnership to accelerate UBS’s public cloud footprint over the next five years. Through this transformational initiative, UBS plans to have more than 50% of its applications, including critical workloads, running on Microsoft Azure, now UBS’s primary cloud platform. The partnership furthers UBS’s “cloud-first” strategy and the modernization of its global technology estate.

- In September 2022, to support the whole Salesforce Customer 360 platform, Salesforce announced Salesforce Genie, a hyperscale real-time data engine. Every business can use Genie to transform data into customer magic and offer seamless, highly customized experiences in sales, service, marketing, and commerce that dynamically adjust to changing customer information and wants in real time.

- In September 2022, IBM announced four additional varieties of IBM Cloud VPC with the latest release, which will all support vGPUs. With the help of vGPUs, users can process their data quickly, even when using workloads that require a lot of arithmetic, such as 3D applications, ML, or high-performance computing. GPUs, however, were traditionally restricted to bare metal for traditional clusters.

- In September 2022, Workday introduced a new industry initiative to accelerate customer cloud transformations through a wide-ranging partner ecosystem. Industry Accelerators also emphasize Workday's compatibility with other essential software providers and programs in ecosystems important to each industry, such as electronic health records, regulatory reporting, and tax compliance solutions.

- In July 2021, AWS announced the general availability of Amazon EBS io2 Block Express volumes, with Amazon EC2 R5b instances powered by the AWS Nitro System to provide the best NAS performance available on EC2. The io2 Block Express volumes also would support io2 features such as Multi-Attach and Elastic Volumes.

Frequently Asked Questions (FAQ):

What is the public cloud market size?

What is public cloud?

Which country are early adopters of public cloud?

Which are key verticals adopting public cloud?

- BFSI

- Telecommunication

- IT & ITeS

- Government & Public Sector

- Retail & Consumer Goods

- Manufacturing

- Energy & Utility

- Media & Entertainment

- Healthcare & Life Sciences

- Other Verticals

Who are the top players in public cloud market?

What are the main drivers and challenges of public cloud market?

How will AI/ML impact the public cloud market?

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing cloud spending driving demand for public cloud services- Big data, AI, and ML integration with cloud- Increased return on investments with lower infrastructure and storage costsRESTRAINTS- Growing security concerns- Businesses in developing regions limit level of technical expertiseOPPORTUNITIES- Improved effectiveness for hosting applications in public cloud- Collaboration in market to grow for serverless applications- Increased use of internet and expansion of digital contentCHALLENGES- Higher costs associated with cloud data storage- Fear of vendor lock-in

-

5.3 CASE STUDY ANALYSISCNS TREASURY TO LOWER EXPENSES AND IMPROVE PERFORMANCE OF ITS TREASURY RISK MANAGEMENT APPLICATION WITH HELP OF RACKSPACE TECHNOLOGYEKCO HELPED HARNEY WESTWOOD & RIEGELS LLP TO TRANSITION FROM MSP TO GLOBAL OR PUBLIC CLOUDVMWARE CLOUD ON AWS OFFERS CLOUD AGILITY WITHOUT CHALLENGES OF FULL MIGRATIONCITRIX ENABLES AUTODESK TO ADVANCE ITS DIGITIZATIONANKABUT ESTABLISHED BEST EDUCATION CLOUD WITH HUAWEI FULL CLOUD STACK SERVICES

-

5.4 ECOSYSTEM

- 5.5 VALUE CHAIN ANALYSIS

-

5.6 PATENT ANALYSIS

-

5.7 PRICING ANALYSISAVERAGE SELLING PRICES OF KEY PLAYERS, BY SERVICEAVERAGE SELLING PRICE TRENDS

-

5.8 TECHNOLOGY ANALYSISARTIFICIAL INTELLIGENCEBIG DATAINTERNET OF THINGSDATA ANALYTICSMACHINE LEARNING

-

5.9 PORTER’S FIVE FORCES ANALYSISTHREAT FROM NEW ENTRANTSTHREAT FROM SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSDEGREE OF COMPETITION

-

5.10 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATORY IMPLICATIONS AND INDUSTRY STANDARDSGENERAL DATA PROTECTION REGULATIONSEC RULE 17A-4ISO/IEC 27001SYSTEM AND ORGANIZATION CONTROLS 2 TYPE II COMPLIANCEFINANCIAL INDUSTRY REGULATORY AUTHORITYFREEDOM OF INFORMATION ACTHEALTH INSURANCE PORTABILITY AND ACCOUNTABILITY ACT

- 5.11 KEY CONFERENCES AND EVENTS, 2022–2023

-

5.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.13 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

6.1 INTRODUCTIONSERVICE MODELS: PUBLIC CLOUD MARKET DRIVERS

-

6.2 INFRASTRUCTURE AS A SERVICENEED TO ENHANCE INFRASTRUCTURE SCALABILITY AND PERFORMANCE

-

6.3 PLATFORM AS A SERVICENEED TO FIX PUBLIC PAAS ISSUES DUE TO LEGAL CONSTRAINTS ON CONTROL, SECURITY, AND COMPLIANCE

-

6.4 SOFTWARE AS A SERVICEGROWING NEED TO STRING TOGETHER DISPARATE DATA OBJECTS, EVENTS, AND AUTOMATION

-

7.1 INTRODUCTIONORGANIZATION SIZE: PUBLIC CLOUD MARKET DRIVERS

-

7.2 LARGE ENTERPRISESNEED TO INCREASE PENETRATION IN PUBLIC CLOUD LANDSCAPE TO SERVE BETTER SERVICE QUALITY

-

7.3 SMALL AND MEDIUM-SIZED ENTERPRISESCLOUD SERVICES TO EMPOWER SMES TO HOST THEIR APPLICATIONS

-

8.1 INTRODUCTIONVERTICALS: PUBLIC CLOUD MARKET DRIVERS

-

8.2 BANKING, FINANCIAL SERVICES, AND INSURANCEPUBLIC CLOUD DECREASES EXPENSES, ENCOURAGES INNOVATION, AND INCREASES FLEXIBILITY

-

8.3 ENERGY AND UTILITIESPUBLIC CLOUD HELPS ACCELERATE BUSINESS DECISIONS BY REFRESHING DATA WAREHOUSE STRATEGY

-

8.4 GOVERNMENT AND PUBLIC SECTORNEED TO RESOLVE SECURITY AND PRIVACY CONCERNS

-

8.5 TELECOMMUNICATIONSFEAR OF VENDOR LOCK-IN TO BE PERVASIVE

-

8.6 IT AND ITESINVEST IN NEW TECHNOLOGIES TO GAIN EFFICIENCY, INNOVATION, AND ATTRACT CONSUMERS

-

8.7 RETAIL AND CONSUMER GOODSRETAILERS MOVE TO CLOUD TO CREATE NEW CUSTOMER EXPERIENCES

-

8.8 MANUFACTURINGACCESSING MANUFACTURING DATA VIA CLOUD TO BE BETTER SERVICE THAN USING INTERNAL IT INFRASTRUCTURE

-

8.9 MEDIA AND ENTERTAINMENTHYBRID AND/OR MULTI-CLOUD DEPLOYMENTS ALLOW WORKLOADS TO BE SHIFTED ACROSS PUBLIC AND PRIVATE INFRASTRUCTURES

-

8.10 HEALTHCARE AND LIFE SCIENCESPATIENT DATA ACCESSED REMOTELY USING PUBLIC CLOUD

- 8.11 OTHER VERTICALS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICANORTH AMERICA: PUBLIC CLOUD MARKET DRIVERSUS- Presence of public cloud providers to drive marketCANADA- Government initiatives and security advancements to fuel adoption of public cloud services

-

9.3 EUROPEEUROPE: PUBLIC CLOUD MARKET DRIVERSUK- Higher adoption rate of cloud technologies to boost marketGERMANY- SMES adopting public cloud for cost reduction to drive marketFRANCE- French government support for adoption of cloud technologies driving marketSPAIN- Need to solve vendor lock-in issue to boost marketITALY- Need to accelerate digital transformation to drive marketNETHERLANDS- High internet penetration to drive marketREST OF EUROPE

-

9.4 ASIA PACIFICASIA PACIFIC: CLOUD COMPUTING MARKET DRIVERSCHINA- Need to ensure data security in public cloud to drive marketJAPAN- High involvement of SMEs in cloud adoption to boost marketAUSTRALIA- Continuous upgrades to companies’ IT infrastructure to drive marketSINGAPORE- Growing investments in new technologies to drive marketINDIA- Increasing access to internet to boost adoption of cloud servicesSOUTH KOREA- Increasing number of vendors and attractive kick-start packages to drive marketREST OF ASIA PACIFIC

-

9.5 MIDDLE EAST AND AFRICAMIDDLE EAST AND AFRICA: PUBLIC CLOUD MARKET DRIVERSKINGDOM OF SAUDI ARABIA- Lack of skilled local professionals to drive marketUNITED ARAB EMIRATES- Rising digital transformation to boost marketQATAR- Rising government investments and economic development to drive marketSOUTH AFRICA- High adoption of cloud services by startups due to low costs to drive marketREST OF MIDDLE EAST AND AFRICA

-

9.6 LATIN AMERICALATIN AMERICA: PUBLIC CLOUD MARKET DRIVERSBRAZIL- Growing digital transformation engagement to drive marketMEXICO- Major digital transformation in telecom industry to boost marketREST OF LATIN AMERICA

- 10.1 INTRODUCTION

- 10.2 MARKET EVALUATION FRAMEWORK

- 10.3 MARKET SHARE OF KEY VENDORS PUBLIC CLOUD MARKET IN 2022

-

10.4 KEY PLAYER STRATEGIES/RIGHT TO WINOVERVIEW OF STRATEGIES BY KEY PUBLIC CLOUD VENDORS

- 10.5 MARKET SHARE OF TOP VENDORS

- 10.6 HISTORICAL REVENUE ANALYSIS OF LEADING PLAYERS

-

10.7 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.8 COMPANY PRODUCT FOOTPRINT ANALYSISCOMPETITIVE BENCHMARKING OF KEY PLAYERS

-

10.9 EVALUATION QUADRANT FOR STARTUPS/SMESPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

10.10 SME/STARTUP PRODUCT FOOTPRINT ANALYSISCOMPETITIVE BENCHMARKING

- 10.11 COMPETITIVE SCENARIO

-

11.1 MAJOR PLAYERSAWS- Business overview- Services offered- Recent developments- MnM viewMICROSOFT- Business overview- Services offered- Recent developments- MnM viewGOOGLE- Business overview- Products/Services offered- Recent developments- MnM viewSALESFORCE- Business overview- Services offered- Recent developments- MnM viewALIBABA CLOUD- Business overview- Services offered- Recent developments- MnM viewORACLE- Business overview- Services offered- Recent developmentsIBM- Business overview- Products/Services offered- Recent developmentsSAP- Business overview- Services offered- Recent developmentsTENCENT- Business overview- Services offered- Recent developmentsWORKDAY- Business overview- Services offered- Recent developments

-

11.2 OTHER PLAYERSFUJITSUVMWARERACKSPACEHPEADOBENECCISCODELL TECHNOLOGIESOVHHUAWEIVERIZONORANGE GROUPNETAPP

-

11.3 STARTUP/SMEDINCLOUDVULTRMEGAPORTAPPSCALEZYMRGENESIS CLOUDEKCOTUDIP TECHNOLOGIESOROCK TECHNOLOGIESCLOUDFLEX

-

12.1 INTRODUCTIONRELATED MARKETLIMITATIONS

- 12.2 CLOUD COMPUTING MARKET

- 12.3 CLOUD STORAGE MARKET

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2019–2021

- TABLE 2 FACTOR ANALYSIS

- TABLE 3 TOP PATENT OWNERS

- TABLE 4 PUBLIC CLOUD MARKET: PRICING LEVELS

- TABLE 5 MARKET: AVERAGE PRICING LEVELS (USD)

- TABLE 6 PORTER’S FIVE FORCES ANALYSIS: MARKET

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 ROW: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 MARKET: KEY CONFERENCES AND EVENTS

- TABLE 12 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- TABLE 13 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 14 MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 15 PUBLIC CLOUD MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 16 INFRASTRUCTURE AS A SERVICE: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 17 INFRASTRUCTURE AS A SERVICE: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 18 PLATFORM AS A SERVICE: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 19 PLATFORM AS A SERVICE: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 20 SOFTWARE AS A SERVICE: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 21 SOFTWARE AS A SERVICE: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 22 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 23 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 24 LARGE ENTERPRISES: PUBLIC CLOUD MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 25 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 26 LARGE ENTERPRISES: MARKET FOR NORTH AMERICA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 27 LARGE ENTERPRISES: MARKET FOR NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 28 LARGE ENTERPRISES: MARKET FOR EUROPE, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 29 LARGE ENTERPRISES: MARKET FOR EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 30 LARGE ENTERPRISES: MARKET FOR ASIA PACIFIC, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 31 LARGE ENTERPRISES: MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 32 LARGE ENTERPRISES: MARKET FOR MIDDLE EAST AND AFRICA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 33 LARGE ENTERPRISES: MARKET FOR MIDDLE EAST AND AFRICA, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 34 LARGE ENTERPRISES: MARKET FOR LATIN AMERICA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 35 LARGE ENTERPRISES: MARKET FOR LATIN AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 36 SMES: PUBLIC CLOUD MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 37 SMES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 38 SMES: MARKET FOR NORTH AMERICA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 39 SMES: MARKET FOR NORTH AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 40 SMES: MARKET FOR EUROPE, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 41 SMES: MARKET FOR EUROPE, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 42 SMES: MARKET FOR ASIA PACIFIC, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 43 SMES: MARKET FOR ASIA PACIFIC, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 44 SMES: MARKET FOR MIDDLE EAST AND AFRICA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 45 SMES: MARKET FOR MIDDLE EAST AND AFRICA, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 46 SMES: MARKET FOR LATIN AMERICA, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 47 SMES: MARKET FOR LATIN AMERICA, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 48 PUBLIC CLOUD MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 49 MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 50 BFSI: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 51 BFSI: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 52 ENERGY AND UTILITIES: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 53 ENERGY AND UTILITIES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 54 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 55 GOVERNMENT AND PUBLIC SECTOR: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 56 TELECOMMUNICATIONS: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 57 TELECOMMUNICATIONS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 58 IT AND ITES: PUBLIC CLOUD MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 59 IT AND ITES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 60 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 61 RETAIL AND CONSUMER GOODS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 62 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 63 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 64 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 65 MEDIA AND ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 66 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 67 HEALTHCARE AND LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 68 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 69 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 70 MARKET, BY REGION, 2017–2021 (USD BILLION)

- TABLE 71 MARKET, BY REGION, 2022–2027 (USD BILLION)

- TABLE 72 NORTH AMERICA: PUBLIC CLOUD MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 73 NORTH AMERICA: MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 74 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 75 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 76 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 77 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 78 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 79 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 80 US: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 81 US: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 82 CANADA: PUBLIC CLOUD MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 83 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 84 EUROPE: MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 85 EUROPE: MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 86 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 87 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 88 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 89 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 90 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 91 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 92 UK: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 93 UK: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 94 GERMANY: PUBLIC CLOUD MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 95 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 96 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 97 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 98 SPAIN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 99 SPAIN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 100 ITALY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 101 ITALY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 102 NETHERLANDS: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 103 NETHERLANDS: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 104 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 105 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 106 ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 107 ASIA PACIFIC: MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 108 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 109 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 110 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 111 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 112 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 113 ASIA PACIFIC: PUBLIC CLOUD MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 114 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 115 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 116 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 117 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 118 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 119 AUSTRALIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 120 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 121 SINGAPORE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 122 INDIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 123 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 124 SOUTH KOREA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 125 SOUTH KOREA: PUBLIC CLOUD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 126 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 127 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 128 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 129 MIDDLE EAST AND AFRICA: MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 130 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 131 MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 132 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 133 MIDDLE EAST AND AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 134 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 135 MIDDLE EAST AND AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 136 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 137 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 138 UAE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 139 UAE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 140 QATAR: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 141 QATAR: PUBLIC CLOUD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 142 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 143 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 144 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 145 REST OF MIDDLE EAST AND AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 146 LATIN AMERICA: MARKET, BY SERVICE MODEL, 2017–2021 (USD BILLION)

- TABLE 147 LATIN AMERICA: MARKET, BY SERVICE MODEL, 2022–2027 (USD BILLION)

- TABLE 148 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 149 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 150 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 151 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 152 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD BILLION)

- TABLE 153 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD BILLION)

- TABLE 154 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 155 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 156 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 157 MEXICO: PUBLIC CLOUD MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 158 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD BILLION)

- TABLE 159 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD BILLION)

- TABLE 160 MARKET SHARE OF KEY VENDORS IN 2022

- TABLE 161 COMPANY FOOTPRINT, BY SERVICE MODEL

- TABLE 162 COMPANY FOOTPRINT, BY REGION

- TABLE 163 OVERALL COMPANY FOOTPRINT

- TABLE 164 SME/STARTUP SERVICE MODEL FOOTPRINT

- TABLE 165 SME/STARTUP REGION FOOTPRINT

- TABLE 166 SME/STARTUP OVERALL FOOTPRINT

- TABLE 167 MARKET: DETAILED LIST OF KEY STARTUP/SME

- TABLE 168 MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, 2019–2022

- TABLE 169 PUBLIC CLOUD MARKET: DEALS, 2019–2022

- TABLE 170 AWS: BUSINESS OVERVIEW

- TABLE 171 AWS: SERVICES OFFERED

- TABLE 172 AWS: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 173 AWS: DEALS

- TABLE 174 MICROSOFT: BUSINESS OVERVIEW

- TABLE 175 MICROSOFT: SERVICES OFFERED

- TABLE 176 MICROSOFT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 177 MICROSOFT: DEALS

- TABLE 178 GOOGLE: BUSINESS OVERVIEW

- TABLE 179 GOOGLE: PRODUCTS/SERVICES OFFERED

- TABLE 180 GOOGLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 181 GOOGLE: DEALS

- TABLE 182 SALESFORCE: BUSINESS OVERVIEW

- TABLE 183 SALESFORCE: SERVICES OFFERED

- TABLE 184 SALESFORCE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 185 SALESFORCE: DEALS

- TABLE 186 ALIBABA CLOUD: BUSINESS OVERVIEW

- TABLE 187 ALIBABA CLOUD: SERVICES OFFERED

- TABLE 188 ALIBABA CLOUD: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 189 ALIBABA CLOUD: DEALS

- TABLE 190 ORACLE: BUSINESS OVERVIEW

- TABLE 191 ORACLE: SERVICES OFFERED

- TABLE 192 ORACLE: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 193 ORACLE: DEALS

- TABLE 194 IBM: BUSINESS OVERVIEW

- TABLE 195 IBM: PRODUCTS/SERVICES OFFERED

- TABLE 196 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 197 IBM: DEALS

- TABLE 198 SAP: BUSINESS OVERVIEW

- TABLE 199 SAP: SERVICES OFFERED

- TABLE 200 SAP: SERVICE LAUNCHES AND BUSINESS EXPANSIONS

- TABLE 201 SAP: DEALS

- TABLE 202 TENCENT: BUSINESS OVERVIEW

- TABLE 203 TENCENT: SERVICES OFFERED

- TABLE 204 TENCENT: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 205 TENCENT: DEALS

- TABLE 206 WORKDAY: BUSINESS OVERVIEW

- TABLE 207 WORKDAY: SERVICES OFFERED

- TABLE 208 WORKDAY: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 209 WORKDAY: DEALS

- TABLE 210 CLOUD COMPUTING MARKET, BY VERTICAL, 2017–2021 (USD BILLION)

- TABLE 211 CLOUD COMPUTING MARKET, BY VERTICAL, 2022–2027 (USD BILLION)

- TABLE 212 CLOUD STORAGE MARKET, BY REGION, 2018–2021 (USD MILLION)

- TABLE 213 CLOUD STORAGE MARKET, BY REGION, 2022–2027 (USD MILLION)

- FIGURE 1 PUBLIC CLOUD MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKUP OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 DATA TRIANGULATION

- FIGURE 4 MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – APPROACH 1 (SUPPLY SIDE): REVENUE OF SERVICES FROM PUBLIC CLOUD VENDORS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH (SUPPLY SIDE): COLLECTIVE REVENUE OF PUBLIC CLOUD VENDORS

- FIGURE 7 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH: SUPPLY-SIDE ANALYSIS (1/2)

- FIGURE 8 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): MARKET

- FIGURE 9 MARKET SNAPSHOT, 2022–2027

- FIGURE 10 TOP MARKET SEGMENTS IN TERMS OF GROWTH RATE

- FIGURE 11 SAAS SEGMENT TO ACCOUNT FOR LARGEST MARKET BY 2027

- FIGURE 12 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE BY 2027

- FIGURE 13 BANKING, FINANCIAL SERVICES, AND INSURANCE TO BE DOMINANT VERTICAL BY 2027

- FIGURE 14 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 15 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE GROWTH

- FIGURE 16 SAAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 17 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SHARE IN 2022

- FIGURE 18 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR LARGEST MARKET SHARE IN 2022

- FIGURE 19 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

- FIGURE 20 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: MARKET

- FIGURE 21 MARKET ECOSYSTEM

- FIGURE 22 PUBLIC CLOUD MARKET: VALUE CHAIN ANALYSIS

- FIGURE 23 NUMBER OF PATENTS PUBLISHED, 2011–2021

- FIGURE 24 TOP TEN PATENT APPLICANTS (GLOBAL) IN 2021

- FIGURE 25 PORTER’S FIVE FORCES ANALYSIS: MARKET

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP VERTICALS

- FIGURE 27 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 28 MARKET: TRENDS/DISRUPTIONS IMPACTING BUYERS

- FIGURE 29 SAAS SEGMENT TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

- FIGURE 30 LARGE ENTERPRISES SEGMENT TO ACCOUNT FOR LARGER MARKET SIZE IN 2022

- FIGURE 31 BANKING, FINANCIAL SERVICES, AND INSURANCE VERTICAL TO ACCOUNT FOR LARGEST MARKET SIZE IN 2022

- FIGURE 32 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE BY 2027

- FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 34 EUROPE: MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: REGIONAL SNAPSHOT

- FIGURE 36 MARKET EVALUATION FRAMEWORK, 2019–2022

- FIGURE 37 MARKET: VENDOR SHARE ANALYSIS

- FIGURE 38 HISTORICAL FIVE-YEAR REVENUE ANALYSIS OF LEADING PLAYERS, 2017–2021

- FIGURE 39 MARKET (GLOBAL): COMPANY EVALUATION QUADRANT, 2021

- FIGURE 40 PUBLIC CLOUD MARKET: SME EVALUATION QUADRANT, 2021

- FIGURE 41 AWS: COMPANY SNAPSHOT

- FIGURE 42 MICROSOFT: COMPANY SNAPSHOT

- FIGURE 43 GOOGLE: COMPANY SNAPSHOT

- FIGURE 44 SALESFORCE: COMPANY SNAPSHOT

- FIGURE 45 ALIBABA CLOUD: COMPANY SNAPSHOT

- FIGURE 46 ORACLE: COMPANY SNAPSHOT

- FIGURE 47 IBM: COMPANY SNAPSHOT

- FIGURE 48 SAP: COMPANY SNAPSHOT

- FIGURE 49 TENCENT: COMPANY SNAPSHOT

- FIGURE 50 WORKDAY: COMPANY SNAPSHOT

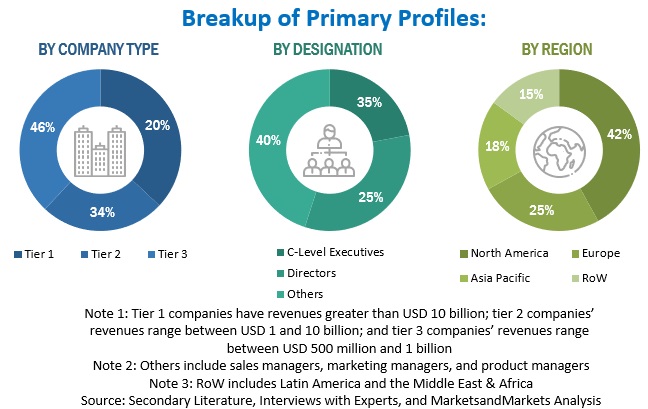

The study involved four major activities in estimating the size of the public cloud market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across value chains through primary research. The bottom-up approach was employed to estimate the overall market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

The market size of companies offering public cloud was derived on the basis of the secondary data available through paid and unpaid sources and by analyzing the product portfolios of major companies in the ecosystem and rating the companies based on their product capabilities and business strategies. In the secondary research process, various sources were referred to for identifying and collecting information for the study. Secondary sources included annual reports, press releases, and investor presentations of companies and product data sheets; white papers; journals; certified publications; and articles from recognized authors, government websites, directories, and databases.

Secondary research was majorly used to obtain the key information related to the industry’s supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives; all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, including Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from public cloud services vendors, industry associations, and independent consultants; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, the latest trends disrupting the market, new use cases implemented, data on revenue collected from products and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped in understanding various trends related to technology, component, deployment, and region. Demand-side stakeholders, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Security Officers (CSOs), the installation teams of governments/end users using public cloud services, and digital initiatives project teams, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current use, which would affect the overall public cloud market.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

To make the estimates and forecasts for the public cloud market and other dependent submarkets, both top-down and bottom-up approaches were used. The bottom-up procedure was deployed to arrive at the overall market size using the revenues and offerings of the key companies in the market. With data triangulation methods and validation through primary interviews, the exact value of the overall parent market size was determined and confirmed using this study. The overall market size was then used in the top-down procedure to estimate the size of the other individual markets via percentage splits of the market segments.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment. The data was triangulated by studying various factors and trends from the demand and supply sides in BFSI, telecommunications, IT and ITeS, government and public sector, retail and consumer goods, manufacturing, energy and utilities, media and entertainment, healthcare and life sciences, and other verticals

Report Objectives

- To define, describe, and forecast the public cloud market by services model, enterprise size, vertical, and region.

- To forecast the market size of regional segments: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

- To strategically analyze the market’s subsegments with respect to individual growth trends, prospects, and contributions to the total market.

- To provide detailed information related to major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the market.

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for major players.

- To comprehensively analyze the core competencies of key players

- To analyze the recession impact on regional segments: North America, Europe, Asia Pacific, Middle East and Africa, and Latin America.

- To track and analyze competitive developments, such as mergers and acquisitions, new product developments, and partnerships and collaborations, in the market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Public Cloud Market