Market for Proximity Marketing by Location (Indoor, and Outdoor), Technology (Wi-Fi, BLE Beacons, NFC, GPS Geofencing), Hardware (Sensors, RFID Tags), Software (Location Analytics), Service, Application - Global Forecast to 2022

The proximity marketing market is expected to be worth USD 52.46 Billion by 2022, at a CAGR of 29.8% between 2016 and 2022. The base year considered for the study is 2015 and the forecast period is between 2016 and 2022.

Objective of the Study:

- To define, describe, and forecast the proximity marketing market, in terms of value, segmented on the basis of location, technology, software, services, and application

- To define, describe, and forecast the market, in terms of value and volume, segmented on the basis of hardware.

- To forecast the market size (in terms of value) for various segments with respect to four major regions, namely, North America, Europe, Asia-Pacific (APAC), and Rest of the World (RoW)

- To provide detailed information regarding the major factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and contribution to the total market

- To analyze opportunities in the market for various stakeholders by identifying high-growth segments of the proximity marketing

- To analyze the competitive environment prevailing in the market through the Porter’s five forces analytical framework

- To strategically profile the key players in the market and comprehensively analyze their market share and core competencies along with detailing the competitive landscape

- To analyze strategic developments such as joint ventures, mergers & acquisitions, new product developments, and R&D in the proximity marketing market

In the modern world of advanced technologies, proximity marketing is a promising and upcoming medium in the field of information and advertising across sectors. The proximity marketing market was valued at USD 9.01 Billion in 2015 and is expected to reach USD 52.46 Billion by 2022, at a CAGR of 29.8% during the forecast period. Proximity marketing is gaining traction among retailers to send special offers to their customers when they come within proximity of a certain retail outlet’s location. Proximity marketing is the perfect way to target the desired audiences and is expected to be widely accepted by marketers in the years to come. The growth of the market is propelled by the increased focus on business intelligence and rising market competitiveness along with the growing adoption of smartphones and proximity technology. The market is further driven by factors such as increasing technological advancements in location-based services, increased use of beacons, and growing need for better customer services & response.

The scope of this report covers the proximity marketing market on the basis of location, technology, hardware, software, service, application, and geography. The indoor proximity marketing held the largest share of the proxmarket on the basis of location. On the basis of offering, the hardware segment led the global market in 2015. The market for BLE beacons-based proximity marketing is expected to grow at the highest CAGR during the forecast period owing to its applications in multi-channel marketing and in product distribution in the retail industry.

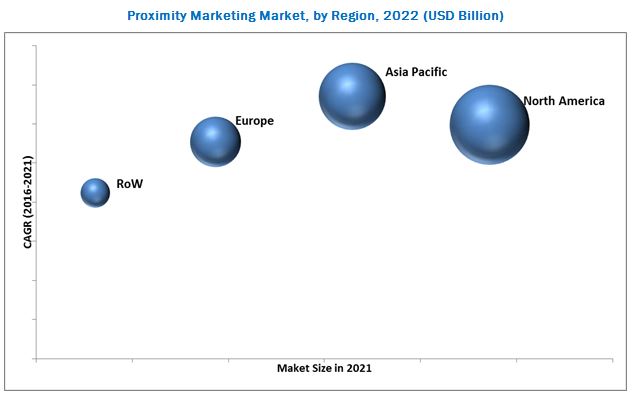

The retail and e-commerce application led the proximity marketing market in terms of in 2015 and the trend is expected to continue till 2022. The market for deployment and integration services is expected to register the highest growth rate during the forecast period. North America held the largest share of the market in 2015, while the APAC region is expected to grow at the highest CAGR during the forecast period. In 2015, the intensity of competitive rivalry, threat of new entrants, and bargaining power of buyers had a high impact on the proximity marketing.

North America held the largest share of the proximity marketing market in 2015, whereas APAC is expected to register the highest growth rate in this market between 2015 and 2022. The increase in smartphone penetration, availability of mobile Internet, growing use of mobile applications & mobile web, and introduction of 4G network by the carriers are some of the factors responsible for the dominance of North America in the market.

The major factors restraining the growth of market are the concerns regarding security & privacy, low awareness among end users, and lack of expert workforce. Moreover, understanding the consumer behavior poses a key challenge for proximity marketing market players.

The major players in this market include Apple Inc. (U.S.), Google Inc. (U.S.), Microsoft Corporation (U.S.), Qualcomm Inc. (U.S.), Zebra Technologies Corporation (U.S.), Bluvision Inc. (U.S.), Estimote Inc. (U.S.), inMarket Media LLC (Italy), Proxama PLC (U.K.), ROXIMITY (U.S.), Shopkick Inc. (U.S.), Swirl Networks (U.S.), and Unacast (U.S.), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

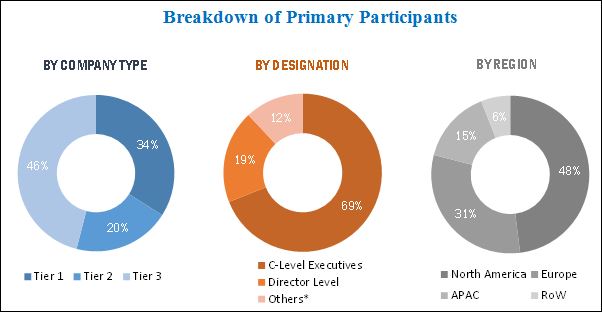

2.1.2.3 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Share Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Research Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Opportunities for the Growth of the Proximity Marketing Market

4.2 Market for Proximity Marketing, By Location

4.3 Software Market Expected to Grow at the Highest CAGR During the Forecast Period in the Market

4.4 Market for Proximity Marketing, By Service

4.5 North America Held A Major Share of the Overall Market in 2015

4.6 Market for Proximity Marketing, By Application

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Segmentation

5.2.1 By Location

5.2.2 By Technology

5.2.3 By Hardware

5.2.4 By Software

5.2.5 By Service

5.2.6 By Application

5.2.7 By Geography

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increased Focus on Business Intelligence (BI) and Rising Market Competitiveness

5.3.1.2 Growing Adoption of Smartphones and Proximity Technology

5.3.1.3 Increasing Technological Advancements in Location-Based Services

5.3.1.4 Increased Use of Beacons and Growing Availability of Spatial Data and Analytical Tools

5.3.2 Restraints

5.3.2.1 Concerns Regarding Security & Privacy

5.3.2.2 Low Awareness Among End Users and Lack of Expert Workforce

5.3.3 Opportunities

5.3.3.1 Rising Demand for Internet of Things (IOT) and Emergence of the Cloud Platform

5.3.3.2 High Demand for Mobile Computing and Trending Social Media

5.3.4 Challenges

5.3.4.1 Challenges in Understanding Consumer Behaviour

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Value Chain Analysis

6.3 Porter’s Five Forces Analysis

6.3.1 Intensity of Competitive Rivalry

6.3.2 Threat of Substitutes

6.3.3 Bargaining Power of Buyers

6.3.4 Bargaining Power of Suppliers

6.3.5 Threat of New Entrants

7 Market, By Location (Page No. - 56)

7.1 Introduction

7.2 Indoor Proximity Marketing

7.3 Outdoor Proximity Marketing

8 Market, By Technology (Page No. - 59)

8.1 Introduction

8.2 Wi-Fi

8.3 BLE Beacons

8.4 Near Field Communication (NFC)

8.5 GPS Geofencing

8.6 Others

9 Market, By Hardware (Page No. - 71)

9.1 Introduction

9.2 Sensors

9.3 RFID Tags

9.4 Others

10 Market, By Software (Page No. - 77)

10.1 Introduction

10.2 Content Management System

10.3 Location Analytics

10.4 Context Accelerator and Geofencing

10.5 Others

11 Market, By Service (Page No. - 82)

11.1 Introduction

11.2 Consulting Services

11.3 Deployment & Integration Services

11.4 Application Support & Maintenance Services

12 Market, By Application (Page No. - 85)

12.1 Introduction

12.2 Retail and E-Commerce

12.3 Healthcare

12.4 Infrastructural

12.4.1 Media and Entertainment

12.4.1.1 Sports and Events

12.4.1.2 Museums

12.4.2 Transporation and Logistics

12.4.3 Hospitality

12.5 Banking, Financial Services, and Insurance (BFSI)

12.6 Other Applications

13 Proximity Marketing Market, By Geography (Page No. - 110)

13.1 Introduction

13.2 North America

13.2.1 U.S.

13.2.2 Canada

13.2.3 Mexico

13.3 Europe

13.3.1 U.K.

13.3.2 Germany

13.3.3 France

13.3.4 Rest of Europe

13.4 Asia-Pacific (APAC)

13.4.1 China

13.4.2 Japan

13.4.3 India

13.4.4 South Korea

13.4.5 Rest of APAC

13.5 Rest of the World (RoW)

13.5.1 Middle East & Africa

13.5.2 South America

14 Competitive Landscape (Page No. - 141)

14.1 Overview

14.2 Market Ranking Analysis of the Proximity Marketing Market

14.3 Competitive Situation and Trends

14.3.1 New Product Launches/New Product Developments

14.3.2 Partnerships & Agreements

14.3.3 Expansions, Investments and Patents

14.3.4 Mergers & Acquisitions

15 Company Profiles (Page No. - 153)

(Overview, Products and Services, Financials, Strategy & Development)*

15.1 Introduction

15.2 Google Inc.

15.3 Microsoft Corporation

15.4 Apple Inc.

15.5 Zebra Technologies Corporation

15.6 Qualcomm Inc.

15.7 Inmarket LLC

15.8 Swirl Networks Inc.

15.9 Shopkick

15.10 Estimote Inc.

15.11 Unacast

15.12 Bluvision, Inc.

15.13 Roximity

15.14 Proxama PLC

15.15 Scanbuy Inc.

*Details on Overview, Products and Services, Financials, Strategy & Development Might Not Be Captured in Case of Unlisted Companies.

16 Appendix (Page No. - 184)

16.1 Insights of Industry Experts

16.2 Discussion Guide

16.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

16.4 Introducing RT: Real-Time Market Intelligence

16.5 Available Customizations

16.6 Related Reports

List of Tables (71 Tables)

Table 1 Proximity Marketing Market, By Technology, 2013–2022 (USD Billion)

Table 2 Proximity Marketing Market, By Application, 2013–2022 (USD Billion)

Table 3 Proximity Marketing Market, By Region, 2013–2022 (USD Billion)

Table 4 Quantification of the Overall Porter’s Analysis

Table 5 Proximity Marketing Market, By Location, 2013–2022 (USD Billion)

Table 6 Comparison Between Wi-Fi, BLE and NFC

Table 7 Proximity Marketing Market, By Technology, 2013–2022 (USD Billion)

Table 8 Wi-Fi–Based Proximity Marketing Market, By Application, 2013–2022 (USD Billion)

Table 9 BLE Beacons-Based Proximity Marketing Market, By Application, 2013–2022 (USD Billion)

Table 10 NFC-Based Proximity Marketing Market, By Application, 2013–2022 (USD Billion)

Table 11 GPS Geofencing-Based Proximity Marketing Market, By Application, 2013–2022 (USD Billion)

Table 12 Market Based on Other Technologies, By Application, 2013–2022 (USD Billion)

Table 13 Market, By Type, 2013–2022 (USD Billion)

Table 14 Market, By Hardware, 2013–2022 (USD Billion)

Table 15 Market Volume, By Hardware, 2013–2022 (Million Units)

Table 16 Difference Between Active and Passive RFID Tags

Table 17 Market, By Software, 2013–2022 (USD Billion)

Table 18 Market, By Service, 2013–2022 (USD Billion)

Table 19 Market, By Application, 2013–2022 (USD Billion)

Table 20 Market for Retail and E-Commerce Application, By Region, 2013–2022 (USD Million)

Table 21 Market for Retail and E-Commerce Application in North America, By Country, 2013–2022 (USD Million)

Table 22 Market for Retail and E-Commerce Application in Europe, By Country, 2013–2022 (USD Million)

Table 23 Market for Retail and E-Commerce Application in APAC, By Country, 2013–2022 (USD Million)

Table 24 Market for Retail and E-Commerce Application in RoW, By Region, 2013–2022 (USD Million)

Table 25 Market for Healthcare Application, By Region, 2013–2022 (USD Million)

Table 26 Market for Healthcare Application in North America, By Country, 2013–2022 (USD Million)

Table 27 Market for Healthcare Application in Europe, By Country, 2013–2022 (USD Million)

Table 28 Market for Healthcare Application in APAC, By Country, 2013–2022 (USD Million)

Table 29 Market for Healthcare Application in RoW, By Region, 2013–2022 (USD Million)

Table 30 Market for Infrastructural Application, By Region, 2013–2022 (USD Million)

Table 31 Market for Infrastructural Application in North America, By Country, 2013–2022 (USD Million)

Table 32 Market for Infrastructural Application in Europe, By Country, 2013–2022 (USD Million)

Table 33 Market for Infrastructural Application in APAC, By Country, 2013–2022 (USD Million)

Table 34 Market for Infrastructural Application in RoW, By Region, 2013–2022 (USD Million)

Table 35 Market for BFSI Application, By Region, 2013–2022 (USD Million)

Table 36 Market for BFSI Application in North America, By Country, 2013–2022 (USD Million)

Table 37 Market for BFSI Application in Europe, By Country, 2013–2022 (USD Million)

Table 38 Market for the BFSI Application in APAC, By Country, 2013–2022 (USD Million)

Table 39 Market for BFSI Application in RoW, By Region, 2013–2022 (USD Million)

Table 40 Market for Other Applications, By Region, 2013–2022 (USD Million)

Table 41 Market for Other Applications in North America, By Country, 2013–2022 (USD Million)

Table 42 Market for Other Applications in Europe, By Country, 2013–2022 (USD Million)

Table 43 Market for Other Applications in APAC, By Country, 2013–2022 (USD Million)

Table 44 Market for Other Applications in RoW, By Region, 2013–2022 (USD Million)

Table 45 Market, By Region, 2013–2022 (USD Billion)

Table 46 Market in North America, By Country, 2013–2022 (USD Billion)

Table 47 Market in North America, By Application, 2013–2022 (USD Million)

Table 48 Market in U.S., By Application, 2013–2022 (USD Million)

Table 49 Market in Canada, By Application, 2013–2022 (USD Million)

Table 50 Market in Mexico, By Application, 2013–2022 (USD Million)

Table 51 Market in Europe, By Country, 2013–2022 (USD Billion)

Table 52 Market in Europe, By Application, 2013–2022 (USD Million)

Table 53 Market in U.K., By Application, 2013–2022 (USD Million)

Table 54 Market in Germany, By Application, 2013–2022 (USD Million)

Table 55 Market in France, By Application, 2013–2022 (USD Million)

Table 56 Market in Rest of Europe, By Application, 2013–2022 (USD Million)

Table 57 Market in APAC, By Country, 2013–2022 (USD Billion)

Table 58 Market in APAC, By Application, 2013–2022 (USD Million)

Table 59 Market in China, By Application, 2013–2022 (USD Million)

Table 60 Market in Japan, By Application, 2013–2022 (USD Million)

Table 61 Market in India, By Application, 2013–2022 (USD Million)

Table 62 Market in South Korea, By Application, 2013–2022 (USD Million)

Table 63 Market in Rest of APAC, By Application, 2013–2022 (USD Million)

Table 64 Market in RoW, By Region, 2013–2022 (USD Billion)

Table 65 Market in RoW, By Application, 2013–2022 (USD Million)

Table 66 Market in Middle East & Africa, By Application, 2013–2022 (USD Million)

Table 67 Market in South America, By Application, 2013–2022 (USD Million)

Table 68 New Product Launches

Table 69 Partnerships, Contracts, Agreements, and Joint Ventures

Table 70 Expansions, Investments, and Patents

Table 71 Mergers & Acquisitions

List of Figures (76 Figures)

Figure 1 Market Segmentation

Figure 2 Proximity Marketing Market: Research Design

Figure 3 Process Flow of Market Size Estimation

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Data Triangulation

Figure 7 Proximity Marketing Market, 2013–2022 (USD Billion)

Figure 8 Proximity Marketing Market, By Type, 2016 vs 2022 (USD Billion)

Figure 9 Proximity Marketing Market, By Technology, 2013–2022 (USD Billion)

Figure 10 Proximity Marketing Market, By Application, 2016 vs 2022 (USD Billion)

Figure 11 APAC Market Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 12 Proximity Marketing Market Expected to Exhibit High Growth Between 2016 and 2022

Figure 13 Indoor Proximity Marketing Held the Largest Market Share in 2015

Figure 14 Location Analytics Software Expected to Exhibit the Highest Growth During the Forecast Period

Figure 15 Deployment and Integration Services Expected to Grow at the Highest CAGR During the Forecast Period

Figure 16 APAC Expected to Grow at the Highest CAGR During the Forecast Period

Figure 17 Market for Infrastructual Application Expected to Grow at the Highest CAGR Between 2016 and 2022

Figure 18 Proximity Marketing Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Value Chain Analysis: Proximity Marketing Market

Figure 20 Porter’s Five Forces Analysis, 2015

Figure 21 Proximity Marketing Market: Porter’s Five Forces Analysis (2015)

Figure 22 High Impact of Intensity of Competitive Rivalry in the Proximity Marketing in 2015

Figure 23 Low Impact of Threat of Substitutes in the Proximity Marketing in 2015

Figure 24 High Impact of the Bargaining Power of Buyers in the Proximity Marketing in 2015

Figure 25 Medium Impact of Bargaining Power of Suppliers in the Proximity Marketing in 2015

Figure 26 High Impact of the Threat of New Entrants High in the Proximity Marketing in 2015

Figure 27 Proximity Marketing Market, By Location, 2016 vs 2022 (USD Billion)

Figure 28 BLE Beacons–Based Proximity Marketing Expected to Grow at the Highest CAGR in the Proximity Marketing Market

Figure 29 Wi-Fi–Based Proximity Marketing Market, By Application, 2016 vs 2022 (USD Billion)

Figure 30 BLE Beacons-Based Proximity Marketing Market, By Application, 2016 vs 2022 (USD Billion)

Figure 31 NFC-Based Proximity Marketing Market, By Application, 2016 vs 2022 (USD Billion)

Figure 32 Types of Geofencing Action Triggers

Figure 33 GPS Geofencing-Based Proximity Marketing Market, By Application, 2016 vs 2022 (USD Billion)

Figure 34 Market Based on Other Technologies, By Application, 2016 vs 2022 (USD Billion)

Figure 35 Proximity Marketing Market, By Type, 2016 vs 2022 (USD Billion)

Figure 36 Proximity Marketing Market, By Hardware, 2016 vs 2022 (USD Billion)

Figure 37 Proximity Marketing Market, By Software, 2016 vs 2022 (USD Billion)

Figure 38 Proximity Marketing Market, By Service, 2016 vs 2022 (USD Billion)

Figure 39 Applications of Proximity Marketing Market

Figure 40 Proximity Marketing Market, By Application, 2016 vs 2022 (USD Billion)

Figure 41 Proximity Marketing Market in Retail and E-Commerce Application, By Region, 2016 vs 2022 (USD Million)

Figure 42 Proximity Marketing Market for Healthcare Application, By Region, 2016 vs 2022 (USD Million)

Figure 43 Different Media and Entertainment Applications in the Proximity Marketing Market

Figure 44 Market for Infrastructural Application, By Region, 2016 vs 2022 (USD Million)

Figure 45 Market for BFSI Application, By Region, 2016 vs 2022 (USD Million)

Figure 46 Market for Other Applications, By Region, 2016 vs 2022 (USD Million)

Figure 47 Proximity Marketing Market, By Geography

Figure 48 Geographic Snapshot of Proximity Marketing Market: Rapidly Growing Markets Emerging as New Hotspots

Figure 49 APAC Expected to Register the Highest Growth Rate During the Forecast Period

Figure 50 Proximity Marketing Market, By Region, 2016 vs 2022 (USD Billion)

Figure 51 U.S. Held A Major Share of the North American Proximity Marketing Market in 2015

Figure 52 Market in North America, By Country, 2016 vs 2022 (USD Billion)

Figure 53 Market in North America, By Application, 2016 vs 2022 (USD Million)

Figure 54 Market in Europe, By Country, 2016 vs 2022 (USD Billion)

Figure 55 Market in Europe, By Application, 2016 vs 2022 (USD Million)

Figure 56 Snapshot of the Proximity Marketing in APAC (China–The Most Lucrative Market in 2015)

Figure 57 Market in APAC, By Country, 2016 vs 2022 (USD Billion)

Figure 58 Market in APAC, By Application, 2016 vs 2022 (USD Million)

Figure 59 Market in RoW, By Region, 2016 vs 2022 (USD Billion)

Figure 60 Market in RoW, By Application, 2016 vs 2022 (USD Million)

Figure 61 Companies Adopted New Product Developments and Partnerships & Agreements as the Key Growth Strategies Between 2013 and 2015

Figure 62 Zebra Technologies Corporation Grew at the Highest Rate Between 2013 and 2015

Figure 63 Key Player Market Ranking, 2015

Figure 64 Market Evolution Framework—Strategy of Partnerships and Agreements Fueled Growth and Innovation in the Market Between 2013 and 2015

Figure 65 Battle for Market Share: New Product Launches and Partnerships & Agreements Were the Key Strategies Between 2013 and 2015

Figure 66 Geographic Revenue Mix of the Top 5 Proximity Marketing Market Players

Figure 67 Google Inc.: Company Snapshot

Figure 68 Google Inc.: SWOT Analysis

Figure 69 Microsoft Corporation: Company Snapshot

Figure 70 Microsoft Corporation: SWOT Analysis

Figure 71 Apple Inc.: Company Snapshot

Figure 72 Apple Inc.: SWOT Analysis

Figure 73 Zebra Technologies Corporation:Company Snapshot

Figure 74 Zebra Technologies Corporation: SWOT Analysis

Figure 75 Qualcomm Inc. Company Snapshot

Figure 76 Proxama PLC: Company Snapshot

Research Methodology:

The research methodology used to estimate and forecast the proximity marketing market begins with capturing data on key vendor revenues through secondary research. The vendor offerings are also taken into consideration to determine the market segmentation. The bottom-up procedure was employed to arrive at the overall market size of the global market from the revenue of the key market players. After arriving at the overall market size, the total market has been split into several segments and subsegments, which were then verified through primary research by conducting extensive interviews with key people such as CEOs, VPs, directors, and executives. The data triangulation and market breakdown procedures have been employed to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments. The breakdown of the profiles of primary respondents has been depicted in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

This report provides valuable insights into the ecosystem of the proximity marketing market. The major players in this industry include Apple Inc. (U.S.), Google Inc. (U.S.), Microsoft Corporation (U.S.), Qualcomm Inc. (U.S.), Zebra Technologies Corporation (U.S), Bluvision Inc. (U.S.), Estimote Inc. (U.S.), inMarket Media LLC (Italy), Proxama PLC (U.K.), ROXIMITY (U.S.), Shopkick Inc. (U.S.), Swirl Networks (U.S.), and Unacast (U.S.), among others.

Please visit 360Quadrants to see the vendor listing of Affiliate Marketing Software

Key Target Audience

- Raw material and manufacturing equipment suppliers

- Semiconductor foundries

- Original equipment manufacturers (OEMs)

- Smart device manufacturers and network providers

- ODM and OEM technology solution providers

- Mobile content developers and aggregators

- Mobile commerce and advertising companies

- Research organizations

- Technology standards organizations, forums, alliances, and associations

- Technology investors and venture capitalists

- Governments, financial institutions, and investment communities

- Analysts and strategic business planners

- End users

Scope of the Report:

The research report segments the proximity marketing market into the following submarkets:

By Location:

- Indoor

- Outdoor

By Technology:

- Wi-Fi

- BLE Beacon

- Near Field Communication (NFC)

- GPS Geofencing

- Others

By Hardware:

- Sensors

- RFID Tags

- Others

By Software:

- Content Management System

- Location Analytics

- Context Accelerator and Geofencing

- Others

By Service:

- Consulting Services

- Deployment & Integration Services

- Application Support & Maintenance Services

By Application:

- Retail & E-Commerce

- Healthcare

-

Infrastructural

-

Media & Entertainment

- Sports & Events

- Museums

- Transportation & Logistics

- Hospitality

-

Media & Entertainment

- Banking, Financial Services, and Insurance (BFSI)

- Other Applications

By Geography:

-

North America

- U.S.

- Canada

- Mexico

-

Europe

- U.K

- Germany

- France

- Rest of Europe

-

Asia-Pacific (APAC)

- China

- Japan

- India

- South Korea

- India

- Rest of APAC

-

Rest of the World (RoW)

- Middle East and Africa

- South America

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report.

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

- Additional regional analysis

Growth opportunities and latent adjacency in Market