Protein Binding Assays Market by Technology (Equillibrium Dialysis, Ultrafiltration, Ultracentrifugation, Gel Filtration Chromatography), End User (Pharmaceutical & Biotechnology Companies, Contract Research Organization) - Global Forecast to 2023

[97 Pages Report] The protein binding assay market is projected to reach USD 425.7 million in 2023 from USD 231.3 million in 2017, at CAGR of 10.7% during the forecast period. The base year considered for the study is 2017, and the forecast for the market size is provided for the period between 2018 and 2023.

Objectives of the Study

- To define, describe, and forecast the protein binding assay market on the basis of technology, end user, and regions

- To provide detailed information about factors influencing market growth (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically analyze the micromarkets with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four major regional segments, namely, North America, Europe, Asia Pacific, and the Rest of the World (RoW)

- To profile the key players in the market and comprehensively analyze their market positions and core competencies

- To track and analyze competitive developments such as partnerships, agreements, and joint ventures; mergers and acquisitions; product development; and research and development activities in the protein binding assay market

Drivers

Rise in drug discovery activities

The global shortage of novel drugs and the demand for advanced drug therapies have both increased the focus on drug discovery. Most pharmaceutical and biotechnology companies are striving to cater to the demand for new drugs, leading to an increase in drug discovery activities. According to Statista, around 7,493 drugs entered the preclinical stage in 2017; this number is expected to reach 8,040 in 2018. This is translating into an increase in the total number of drug candidates being screened every year. Protein binding studies, carried out during the early stage of drug development, are a major part of the preclinical process.

Growing pressure to reduce drug discovery and development costs

The discovery and development of a drug is a very cost-intensive process as it requires major investments in terms of capital, human resources, and technological expertise. It also requires strict adherence to regulations on testing and manufacturing standards before a new drug can be prescribed to the general population. Moreover, if the drug fails in the later stages of development, the entire investment is lost. Thus, to avoid such late-stage attritions in drug development, pharmaceutical companies are investing extensively in early stage, preclinical testing methods.

Research Methodology

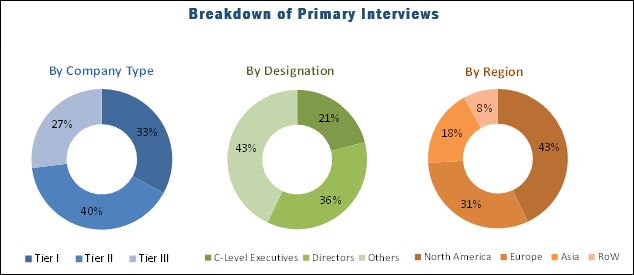

Top-down and bottom-up approaches were used to validate the size of the global protein binding assay market and estimate the size of various other dependent submarkets. Major players in the market were identified through secondary research and their market presence was studied through primary and secondary research. Secondary research included the study of the annual and financial reports of top market players, white papers, medical journals, certified publications, articles from recognized authors, directories, and databases such as Statista, WHO, OECD, American Association for Clinical Chemistry (AACC), European Federation of Pharmaceutical Industries and Associations (EFPIA), International Trade Association, NCBI, and National Health Service (NHS). Primary research included extensive interviews with key opinion leaders such as CEOs, directors, and marketing executives. The percentage splits, shares, and breakdowns of the segments were determined using secondary sources and verified through primary sources. This data is consolidated and added to detailed inputs and analysis from MarketsandMarkets and presented in this report.

To know about the assumptions considered for the study, download the pdf brochure

The key players operating in the protein binding assay market are Thermo Fisher Scientific (US), GE Healthcare (US), Danaher (US), and Merck (Germany).

Target Audience:

- Government and academic institutes

- Protein binding assay providers

- R&D departments

- Contract research organizations

- Pharmaceutical & biotechnology companies

- Consulting firms

- Government associations

Collaborations, Agreements, and Partnerships

|

Year |

Nature of Agreement |

Company 1 |

Company 2 |

Description |

|

2018 |

Partnership |

Thermo Fisher |

The Montreal Neurological Institute (The Neuro) of McGill University (Canada) |

To accelerate the understanding of neurological disease by focusing on about 30 proteins associated with Parkinson’s disease, amyotrophic lateral sclerosis (ALS), hereditary spastic paraplegias, epileptic encephalopathies, and ataxias |

|

2017 |

Collaboration |

Sovicell |

3B |

Sovicell and 3B Pharmaceutical collaboratively launched a novel service that quantifies the plasma protein binding capacity of a drug |

Acquisitions

|

Year |

Nature of Agreement |

Company 1 |

Company 2 |

Synergy |

|

2017 |

Acquisition |

Absorption Systems |

TGA Sciences (US) |

To expand its expertise in research & GxP assay development and position itself closer to customers in the Boston or Cambridge biotech hub |

|

2017 |

Acquisition |

Eurofins Scientific |

DiscoverX (US) |

To expand its product offerings and footprint in the drug discovery market |

Scope of the Report

The research report categorizes the global protein binding assay market into the following segments and subsegments:

Protein binding assay Market, by Technology

- Equilibrium dialysis

- Ultrafiltration

- Ultracentrifugation

- Other technologies (chromatography (size exclusion/gel filtration), surface plasmon resonance, and transil partitioning)

Protein binding assay Market, by End User

- Pharmaceutical & biotechnology companies

- Contract research organizations (CROs)

- Other end users (academic institutes and government organizations)

Protein binding assay Market, by Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- RoE

-

Asia Pacific

- China

- India

- RoAPAC

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Company Information

Detailed analysis and profiling of additional market players (up to 5)

The global protein binding assay market is projected to reach USD 425.7 million in 2023 from USD 256.1 million in 2018, at CAGR of 10.7% during the forecast period. Market growth is largely driven by factors such as the growing number of drug discovery activities, increasing pressure to reduce drug discovery and development costs, and the increase in pharmaceutical R&D expenditure. The growing CRO industry is also expected to provide a wide range of growth opportunities for players in this market.

In this report, the market has been categorized based on technology, end user, and region. On the basis of technology, the protein binding assay market is segmented into equilibrium dialysis, ultrafiltration, ultracentrifugation, and other technologies. In 2018, the equilibrium dialysis segment is expected to account for the largest share of the protein binding assay market. The large share and high growth rate of this segment can be attributed to the advantages associated with the use of equilibrium dialysis, which include physical simplicity, low costs, and high accuracy. The simpler workflow equilibrium dialysis also makes it the preferred choice for protein binding studies.

On the basis of end user, the protein binding assay market is divided into pharmaceutical & biotechnology companies, CROs, and other end users. CROs segment is expected grow at highest CAGR during the forecast period. The adoption of protein binding assays in CROs is mainly driven by the need for cost-effective protein binding services.

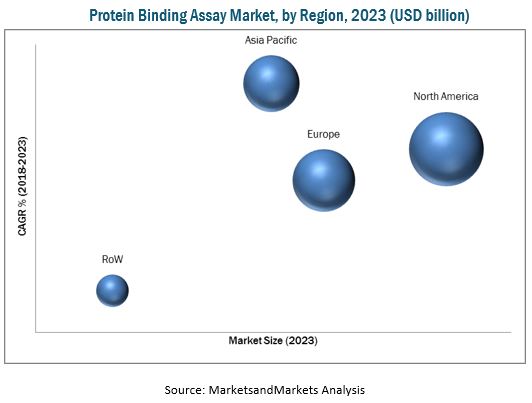

In 2018, North America is expected to account for the largest share of the global protein binding assay market, while Asia Pacific is expected to grow at the highest rate during the forecast period. The dominant share of the North American market is primarily due to its well-established pharmaceutical industry, the presence of leading pharmaceutical and biotechnology companies, and high R&D investments in this region.

Issues concerning existing technologies are a major constraint for market growth. In silico-based prediction models are also expected to challenge market growth to a certain extent.

The key players operating in the protein binding assay market are Thermo Fisher Scientific (US), GE Healthcare (US), Danaher (US), and Merck (Germany). A majority of leading players in the protein binding assay market focus on both organic and inorganic growth strategies such as collaborations, partnerships, acquisitions, and agreements to maintain and enhance their market share in the protein binding assay market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Covered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions for the Study

3 Executive Summary (Page No. - 24)

4 Premium Insights (Page No. - 27)

4.1 Protein Binding Assay: Market Overview

4.2 Europe: Protein Binding Assay Market, By Technology & Country (2018)

4.3 Protein Binding Assay Market, By Technology (2018 vs 2023)

4.4 Geographic Snapshot of the Protein Binding Assay Market

5 Market Overview (Page No. - 30)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Rise in Drug Discovery Activities

5.2.1.2 Growing Pressure to Reduce Drug Discovery and Development Costs

5.2.1.3 Increase in Pharmaceutical R&D Expenditure

5.2.2 Restraints

5.2.2.1 Issues With Existing Technologies

5.2.3 Opportunities

5.2.3.1 Growing CRO Industry

5.2.4 Challenges

5.2.4.1 Development of in Silico-Based Prediction Models

6 Protein Binding Assay Market, By Technology (Page No. - 34)

6.1 Introduction

6.2 Equilibrium Dialysis

6.3 Ultrafiltration

6.4 Ultracentrifugation

6.5 Other Technologies

7 Protein Binding Assay Market, By End User (Page No. - 44)

7.1 Introduction

7.2 Pharmaceutical & Biotechnology Companies

7.3 Contract Research Organizations

7.4 Other End Users

8 Protein Binding Assay Market, By Region (Page No. - 52)

8.1 Introduction

8.2 North America

8.2.1 US

8.2.2 Canada

8.3 Europe

8.3.1 Germany

8.3.2 UK

8.3.3 France

8.3.4 Rest of Europe

8.4 Asia Pacific

8.4.1 China

8.4.2 India

8.4.3 Rest of Asia Pacific

8.5 Rest of the World

9 Competitive Landscape (Page No. - 72)

9.1 Market Overview

9.2 Market Ranking Analysis, 2018

9.3 Competitive Situation and Trends

9.3.1 Collaborations, Agreements, and Partnerships

9.3.2 Acquisitions

10 Company Profiles (Page No. - 74)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

10.1 Merck

10.2 Thermo Fisher Scientific

10.3 GE Healthcare

10.4 Sovicell GmbH

10.5 Absorption Systems

10.6 Htdialysis

10.7 Eurofins Scientific

10.8 Admecell

10.9 3b Pharmaceuticals

10.10 Biotium

10.11 Danaher Corporation

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 91)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.4 Available Customizations

11.5 Related Reports

11.6 Author Details

List of Tables (63 Tables)

Table 1 Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 2 Protein Binding Assay Market, By Technology, Protein Binding Vials/Tubes (Units)

Table 3 Protein Binding Assay Market for Equilibrium Dialysis, By Region, 2016–2023 (USD Million)

Table 4 North America: Protein Binding Assay Market for Equilibrium Dialysis, By Country, 2016–2023 (USD Million)

Table 5 Europe: Protein Binding Assay Market for Equilibrium Dialysis, By Country, 2016–2023 (USD Million)

Table 6 APAC: Protein Binding Assay Market for Equilibrium Dialysis, By Country, 2016–2023 (USD Million)

Table 7 Protein Binding Assay Market for Ultrafiltration, By Region, 2016–2023 (USD Million)

Table 8 North America: Protein Binding Assay Market for Ultrafiltration, By Country, 2016–2023 (USD Million)

Table 9 Europe: Protein Binding Assay Market for Ultrafiltration, By Country, 2016–2023 (USD Million)

Table 10 APAC: Protein Binding Assay Market for Ultrafiltration, By Country, 2016–2023 (USD Million)

Table 11 Protein Binding Assay Market for Ultracentrifugation, By Region, 2016–2023 (USD Million)

Table 12 North America: Protein Binding Assay Market for Ultracentrifugation, By Country, 2016–2023 (USD Million)

Table 13 Europe: Protein Binding Assay Market for Ultracentrifugation, By Country, 2016–2023 (USD Million)

Table 14 APAC: Protein Binding Assay Market for Ultracentrifugation, By Country, 2016–2023 (USD Million)

Table 15 Protein Binding Assay Market for Other Technologies, By Region, 2016–2023 (USD Million)

Table 16 North America: Protein Binding Assay Market for Other Technologies, By Country, 2016–2023 (USD Million)

Table 17 Europe: Protein Binding Assay Market for Other Technologies, By Country, 2016–2023 (USD Million)

Table 18 APAC: Protein Binding Assay Market for Other Technologies, By Country, 2016–2023 (USD Million)

Table 19 Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 20 Protein Binding Assay Market for Pharmaceutical & Biotechnology Companies, By Region, 2016–2023 (USD Million)

Table 21 North America: Protein Binding Assay Market for Pharmaceutical & Biotechnology Companies, By Country, 2016–2023 (USD Million)

Table 22 Europe: Protein Binding Assay Market for Pharmaceutical & Biotechnology Companies, By Country, 2016–2023 (USD Million)

Table 23 APAC: Protein Binding Assay Market for Pharmaceutical & Biotechnology Companies, By Country, 2016–2023 (USD Million)

Table 24 Protein Binding Assay Market for Contract Research Organizations, By Region, 2016–2023 (USD Million)

Table 25 North America: Protein Binding Assay Market for Contract Research Organizations, By Country, 2016–2023 (USD Million)

Table 26 Europe: Protein Binding Assay Market for Contract Research Organizations, By Country, 2016–2023 (USD Million)

Table 27 APAC: Protein Binding Assay Market for Contract Research Organizations, By Country, 2016–2023 (USD Million)

Table 28 Protein Binding Assay Market for Other End Users, By Region, 2016–2023 (USD Million)

Table 29 North America: Protein Binding Assay Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 30 Europe: Protein Binding Assay Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 31 APAC: Protein Binding Assay Market for Other End Users, By Country, 2016–2023 (USD Million)

Table 32 Protein Binding Assay Market, By Region, 2016–2023 (USD Million)

Table 33 North America: Protein Binding Assay Market, By Country, 2016–2023 (USD Million)

Table 34 Europe: Protein Binding Assay Market, By Country, 2016–2023 (USD Million)

Table 35 APAC: Protein Binding Assay Market, By Country, 2016–2023 (USD Million)

Table 36 North America: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 37 North America: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 38 US: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 39 US: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 40 Canada: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 41 Canada: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 42 Europe: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 43 Europe: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 44 Germany: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 45 Germany: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 46 UK: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 47 UK: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 48 France: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 49 France: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 50 RoE: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 51 RoE: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 52 APAC: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 53 APAC: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 54 China: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 55 China: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 56 India: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 57 India: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 58 RoAPAC: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 59 RoAPAC: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 60 RoW: Protein Binding Assay Market, By Technology, 2016–2023 (USD Million)

Table 61 RoW: Protein Binding Assay Market, By End User, 2016–2023 (USD Million)

Table 62 Collaborations, Agreements, and Partnerships, 2015–2018

Table 63 Acquisitions, 2015-2018

List of Figures (21 Figures)

Figure 1 Research Design

Figure 2 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Equilibrium Dialysis Top Register the Highest Growth in the Market During the Forecast Period

Figure 7 Pharmaceutical & Biotechnology to Dominate the Market During the Forecast Period

Figure 8 Geographic Snapshot of Protein Binding Assay Market

Figure 9 Increasing Drug Discovery Activities—The Primary Growth Driver of the Protein Binding Assay Market

Figure 10 Equilibrium Dialysis to Continue to Dominate the Protein Binding Assay Market in the Forecast Period

Figure 11 APAC to Be the Fastest-Growing Market From 2018 to 2023

Figure 12 Protein Binding Assay Market: Drivers, Restraints, Opportunities, and Challenges

Figure 13 Global Pharmaceutical R&D Spending (2010–2024)

Figure 14 North America: Protein Binding Assay Market Snapshot

Figure 15 Asia Pacific: Protein Binding Assay Market Snapshot

Figure 16 Rank of Companies in the Protein Binding Assay Market, 2018

Figure 17 Merck: Company Snapshot (2017)

Figure 18 Thermo Fisher Scientific: Company Snapshot (2017)

Figure 19 GE Healthcare: Company Snapshot (2017)

Figure 20 Eurofins Scientific: Company Snapshot (2017)

Figure 21 Danaher Corporation: Company Snapshot (2017)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Protein Binding Assays Market