Prostate Cancer Therapeutics Market (2010-2020) (Opportunity Analysis, Pipeline Assessment and Global Market Forecast)

Prostate cancer is the most frequently diagnosed cancer in men. In terms of loss of life from any disease, prostate cancer ranks eleventh; and it ranks sixth in terms of cancer-related mortality in men. The prostate cancer market has a huge demand for new and novel drugs that address unmet needs such as improved survival time, less toxicity, increased progression free survival, increased effectiveness, and lower cost.

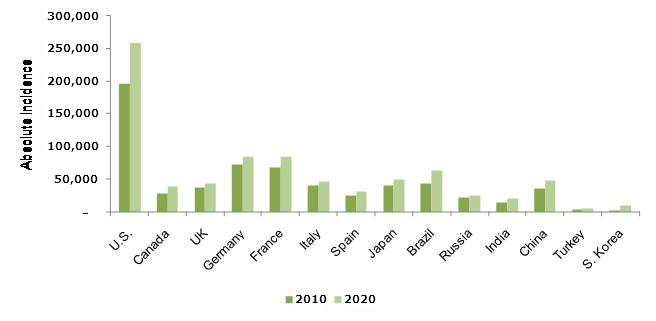

This report studies the market from 2005 to 2020 covering 21 major drugs categorized into four therapies; namely hormonal therapy, chemotherapy, immunotherapy, and targeted therapy. Out of 21 drugs, 13 are currently commercially available in the market and 8 are in pipeline. Growing prostate cancer population (25% increase in the incidence of prostate cancer in mature countries and 40% increase in emerging countries, from 2010 to 2020) is an impetus for the growth of the market. This factor, along with increasing number of innovative drugs estimated to get launched in short-term future and increasing old age male population are driving the growth of the market at an expected CAGR of 9% from 2010 to 2020. In 2010, among the mature markets, U.S. was the major contributor; accounting for 35% of the total sales of prostate cancer drugs and amongst the emerging countries, China contributed to the share of about 2% of the overall prostate cancer therapeutics market.

As far as drugs are concerned, Taxotere accounted for 23% of the total sales of prostate cancer drugs in 2010. Astrazeneca PLC is a leading market player with the share of 30% in the total prostate cancer therapeutics market, in 2010. However, by 2020, Astrazeneca will lose its market share by 19%, due to entry of new players such as Active Biotech, Bristol Myers-Squibb, Teva Pharmaceuticals Industries Ltd, and Johnson & Johnson (entered the market in 2011, with its key drug Zytiga).

Players are implementing various growth strategies in the market to gain a competitive edge. New products launch, product pipelines, agreements and collaborations, clinical trials, and acquisitions were certain major strategies adopted by the players from January 2006 to September 2011.

Scope of the report

This research report evaluates the lung cancer drugs market with respect to the current and pipeline drugs. The report analyzes geography; forecasting revenue, and trends in each of the following submarkets:

Global prostate cancer hormonal therapy drugs market -

- LHRH antagonists - Firmagon

- LHRH analogs - Zoladex, Lupron, Eligard, Vantas, and Decapeptyl

- Antiandrogens - Casodex

- Pipeline drugs for hormonal therapy - Zytiga, MDV3100, and TAK700

Global prostate cancer chemotherapy drugs market -

- Off patent drugs - Taxotere, mitoxantrone, and Emcyt

- Patented drugs - Jevtana

Global prostate cancer immunotherapy drugs market-

- Patented drug - Provenge

- Pipeline drug - ipilimumab

Global prostate cancer targeted therapy drugs market-

- Angiogenesis inhibitor - lanreotide, TASQ, Zaltrap

- Apoptosis inducing - custirsen sodium

- Signal transduction inhibitor - Sprycel

The geographies covered under the report are -

North America

- U.S.

- Canada

Europe

- U.K.

- Germany

- Italy

- France

- Spain

Emerging countries

- Brazil

- Russia

- India

- China

- Turkey

- South Korea

Each section provides market data, market drivers, trends and opportunities, key players, and competitive outlook. This report also provides market tables for covering the sub-segments and micro-markets. Additionally, it makes ways for company profiles that cover all the sub-segments. The report has been made by keeping past trends, current happenings, and future forecasts in consideration.

Prostate is a compound tubuloalveolar exocrine gland of the male reproductive system in most mammals. Prostate cancer is a form of cancer that develops in the prostate. Most prostate cancers are slow growing; however, there are cases of aggressive prostate cancers. The cancer cells may metastasize (spread) from the prostate to other parts of the body, particularly bones and lymph node. Prostate cancer is the second leading cause of new cancer cases in men across the globe and the sixth leading cause of death due to cancer in men.

Epidemiologic studies have found that incidence and mortality due to cancer differ according to race and ethnicity. Comparing the geographic regions based on incidence of prostate cancer, North America ranks first; followed by Australia, Europe, and Africa. Asia has the lowest incidence. Such an upward incidence trend can be attributed to the old age, lifestyle factors such as diet rich in red meat and smoking. Recent studies show that males above 65 years of age are at higher risk. In Asia, the percentage of population above 65 years is low in comparison to the European and American countries. Statistically, 3,820 people/million in North America, 9,325 people/million in Europe, and 866 people/million in Asia were diagnosed with prostate cancer in 2010. Prostate cancer accounts for 5.8% of cancer deaths in men.

Prostate Cancer Incidence, By Country, 2010 & 2020

Source: Globocan, MarketsandMarkets Analysis

Currently, in market there are three types of therapies available for the treatment of patients with advanced stage of prostate cancer. These are hormonal therapy, chemotherapy, and newly launched immunotherapy. However, a new therapy; namely targeted therapy is in pipeline and is expected to be launched in short term future. Choice of therapy for treatment is done by considering some key factors such as age of the patient, disease stage, and affordability of the patient. Overall, hormonal therapy is the most widely used therapy for the treatment of patients with prostate cancer, due to the factors such as high level diagnosis rate at stage II of prostate cancer, better safety, and efficacy profile than chemotherapy and its increasing usage as adjuvant therapy with surgery and radiation therapy.

Mature markets offer good scope for early adoption of innovative and costly therapy options compared to emerging markets. Besides, the market is highly dynamic and is going to show tremendous growth in this decade (2010-2020) due to estimated launch of many innovative drugs in short term future, which will enable entry of new companies the prostate cancer therapeutics market.

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 MARKET SHARE

1.5.3 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.4 ASSUMPTIONS

2 EXECUTIVE SUMMARY

3 MARKET OVERVIEW

3.1 DEFINING PROSTATE CANCER

3.1.1 RISK FACTORS

3.1.1.1 Age

3.1.1.2 Race

3.1.1.3 Family history/genetics

3.1.1.4 Diet/lifestyle factors

3.1.1.5 Obesity

3.1.1.6 Infection/Inflammation of the prostate gland

3.1.2 DISEASE SYMPTOMS

3.1.3 DIAGNOSIS

3.1.3.1 Digital rectal exam (DRE)

3.1.3.2 Prostate specific antigen (PSA) blood test

3.1.3.3 Prostate biopsy

3.1.3.4 Ultrasound

3.1.3.5 Bone scan

3.1.3.6 CT scan & MRI

3.1.3.7 PET & SPECT scan

3.1.3.8 Lymph node biopsy

3.1.3.9 ProstaScint monoclonal antibody scan

3.1.4 PROSTATE CANCER PREVALENCE

3.1.5 INCIDENCE & MORTALITY

3.2 STAGES OF PROSTATE CANCER

3.2.1 STAGE I

3.2.2 STAGE II

3.2.3 STAGE III

3.2.4 STAGE IV

3.3 MARKET STRUCTURE

3.3.1 KEY THERAPIES

3.3.1.1 Chemotherapy

3.3.1.2 Hormonal therapy

3.3.1.3 Immunotherapy

3.3.1.4 Targeted therapy

4 MARKET DYNAMICS

4.1 INTRODUCTION

4.2 DRIVERS

4.2.1 INNOVATIVE DRUGS DRIVING THE MARKET

4.2.2 INCREASE IN RESEARCH & DEVELOPMENT IN ONCOLOGY THERAPEUTIC AREA

4.2.3 DEVELOPMENTS IN GENOMICS & PROTEOMICS

4.3 RESTRAINTS

4.3.1 ADVERSE EVENTS OF TREATMENT

4.3.2 COST ASSOCIATED WITH THE TREATMENT

4.3.3 LOW SUCCESS RATE IN CLINICAL TESTING FOR ONCOLOGY DRUGS

4.4 OPPORTUNITIES

4.4.1 LIMITED PLAYERS IN THE MARKET

4.4.2 GROWING OLDER MALE POPULATION

4.4.3 OFF LABEL PRESCRIPTION FOR PROSTATE CANCER

4.4.4 TREND OF INCREASE IN PHARMACEUTICAL EXPENDITURE BY EMERGING MARKETS

4.4.5 ONCOLOGY IS THE LARGEST THERAPEUTIC MARKET WITH HIGH UNMET NEEDS

4.5 MARKET SHARE

4.5.1 BY COMPANY

4.5.2 BY GEOGRAPHY

4.5.3 BY THERAPY

4.6 BURNING ISSUES

4.6.1 HIGH COST OF TREATMENT RELATIVE TO MODEST DRUG BENEFIT

4.6.2 ESTIMATED INCREASE IN COMPETITION DUE TO ADDITION OF PROSTATE CANCER INDICATION TO EXISTING DRUGS

4.7 WINNING IMPERATIVES

4.7.1 STRATEGY OF GEOGRAPHICAL EXPANSION IN EMERGING MARKETS

4.7.2 STRATEGY OF PRODUCT EDUCATION COUPLED WITH PRODUCTION CAPACITY EXPANSION

5 PRODUCT MARKET

5.1 HORMONAL THERAPY

5.1.1 LUTEINIZING HORMONE-RELEASING HORMONE (LHRH) ANTAGONISTS

5.1.1.1 FIRMAGON

5.1.2 LUTEINIZING HORMONE-RELEASING HORMONE (LHRH) ANALOGS

5.1.2.1 LUPRON

5.1.2.2 ZOLADEX

5.1.2.3 DECAPEPTYL

5.1.2.4 ELIGARD

5.1.2.5 VANTAS

5.1.3 ANTI-ANDROGENS

5.1.3.1 CASODEX

5.2 CHEMOTHERAPY

5.2.1 TAXOTERE

5.2.2 JEVTANA

5.2.3 MITOXANTRONE (NOVANTRONE)

5.2.4 ESTRAMUSTINE (EMCYT)

5.3 IMMUNOTHERAPY

5.3.1 PROVENGE

6 PIPELINE DRUGS MARKET

6.1 HORMONAL THERAPY

6.1.1 ABIRATERONE ACETATE

6.1.2 MDV3100

6.1.3 TAK700

6.2 TARGETED THERAPY

6.2.1 ANGIOGENESIS INHIBITORS

6.2.1.1 LANREOTIDE

6.2.1.2 TASQUINIMOD (TASQ)

6.2.1.3 ZALTRAP

6.2.2 APOPTOSIS INDUCING

6.2.2.1 CUSTIRSEN SODIUM

6.2.3 SIGNAL TRANSDUCTION INHIBITOR

6.2.3.1 SPRYCEL

6.3 IMMUNOTHERAPY

6.3.1 IPILIMUMAB

7 GEOGRAPHICAL ANALYSIS

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.2.1 U.S.

7.2.2 CANADA

7.3 EUROPE

7.3.1 U.K.

7.3.2 GERMANY

7.3.3 FRANCE

7.3.4 ITALY

7.3.5 SPAIN

7.4 JAPAN

7.5 EMERGING MARKETS

7.5.1 BRAZIL

7.5.2 RUSSIA

7.5.3 INDIA

7.5.4 CHINA

7.5.5 TURKEY

7.5.6 SOUTH KOREA

8 COMPETITIVE LANDSCAPE

8.1 KEY STRATEGIES

9 COMPANY PROFILES

9.1 ABBOTT LABORATORIES

9.1.1 OVERVIEW

9.1.2 PRODUCTS & SERVICES

9.1.3 FINANCIALS

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 ACTIVE BIOTECH

9.2.1 OVERVIEW

9.2.2 PRODUCTS & SERVICES

9.2.3 FINANCIALS

9.2.4 STRATEGY

9.2.5 DEVELOPMENTS

9.3 ASTRAZENECA PLC

9.3.1 OVERVIEW

9.3.2 PRODUCTS & SERVICES

9.3.3 FINANCIALS

9.3.4 STRATEGY

9.3.5 DEVELOPMENT

9.4 ASTELLAS PHARMA INC

9.4.1 OVERVIEW

9.4.2 PRODUCTS & SERVICES

9.4.3 FINANCIALS

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 BRISTOL-MYERS SQUIBB

9.5.1 OVERVIEW

9.5.2 PRODUCTS & SERVICES

9.5.3 FINANCIALS

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 DENDREON CORPORATION

9.6.1 OVERVIEW

9.6.2 PRODUCTS & SERVICES

9.6.3 FINANCIALS

9.6.4 STRATEGY

9.6.5 DEVELOPMENTS

9.7 ENDO PHARMACEUTICALS INC (INDEVUS PHARMACEUTICALS INC)

9.7.1 OVERVIEW

9.7.2 PRODUCTS & SERVICES

9.7.3 FINANCIALS

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

9.8 IPSEN

9.8.1 OVERVIEW

9.8.2 PRODUCTS & SERVICES

9.8.3 FINANCIALS

9.8.4 STRATEGY

9.8.5 DEVELOPMENTS

9.9 JOHNSON & JOHNSON

9.9.1 OVERVIEW

9.9.2 PRODUCTS & SERVICES

9.9.3 FINANCIALS

9.9.4 STRATEGY

9.9.5 DEVELOPMENTS

9.10 PFIZER INC

9.10.1 OVERVIEW

9.10.2 PRODUCTS & SERVICES

9.10.3 FINANCIALS

9.10.4 STRATEGY

9.10.5 DEVELOPMENTS

9.11 SANOFI-AVENTIS

9.11.1 OVERVIEW

9.11.2 PRODUCTS & SERVICES:

9.11.3 FINANCIALS

9.11.4 STRATEGY

9.11.5 DEVELOPMENTS

9.12 TEVA PHARMACEUTICAL INDUSTRIES LTD

9.12.1 OVERVIEW

9.12.2 PRODUCTS & SERVICES

9.12.3 FINANCIALS

9.12.4 STRATEGY

9.12.5 DEVELOPMENTS

9.13 TAKEDA PHARMACEUTICAL CO. LTD

9.13.1 OVERVIEW

9.13.2 PRODUCTS & SERVICES

9.13.3 FINANCIALS

9.13.4 STRATEGY

9.13.5 DEVELOPMENTS

9.14 OTHERS

9.14.1 FERRING PHARMACEUTICALS

9.14.1.1 OVERVIEW

9.14.1.2 PRODUCTS & SERVICES

9.14.1.3 FINANCIALS

9.14.1.4 STRATEGY

9.14.1.5 DEVELOPMENTS

9.14.2 TOLMAR INC

9.14.2.1 OVERVIEW

9.14.2.2 PRODUCTS & SERVICES

9.14.2.3 FINANCIALS

9.14.2.4 STRATEGY

9.14.2.5 DEVELOPMENTS

LIST OF TABLES

TABLE 1 GLOBAL PROSTATE CANCER DRUGS MARKET REVENUE, BY PRODUCTS, 2005 – 2020 ($MILLION)

TABLE 2 CHEMOTHERAPY MARKET REVENUE, BY PRODUCTS, 2005 - 2020 ($MILLION)

TABLE 3 CHEMOTHERAPY MARKET REVENUE, BY GEOGRAPHY, 2005 - 2020 ($MILLION)

TABLE 4 HORMONAL THERAPY MARKET REVENUE, BY PRODUCTS, 2005 - 2020 ($MILLION)

TABLE 5 HORMONAL THERAPY MARKET REVENUE, BY GEOGRAPHY, 2005 - 2020 ($MILLION)

TABLE 6 IMMUNOTHERAPY MARKET REVENUE, BY PRODUCTS, 2005 - 2020 ($MILLION)

TABLE 7 IMMUNOTHERAPY MARKET REVENUE, BY GEOGRAPHY, 2005 - 2020 ($MILLION)

TABLE 8 TARGETED THERAPY MARKET REVENUE, BY PRODUCTS, 2005 - 2020 ($MILLION)

TABLE 9 TARGETED THERAPY MARKET REVENUE, BY GEOGRAPHY, 2005 - 2020 ($MILLION)

TABLE 10 FIRMAGON REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 11 FIRMAGON REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 12 LUPRON REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 13 LUPRON REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 14 ZOLADEX REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 15 ZOLADEX REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 16 DECAPEPTYL REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 17 DECAPEPTYL REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 18 ELIGARD REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 19 ELIGARD REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 20 VANTAS REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 21 VANTAS REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 22 CASODEX REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 23 CAOSDEX REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 24 TAXOTERE REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 25 TAXOTERE REVENUES, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 26 JEVTANA REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 27 JEVTANA REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 28 MITOXANTRONE REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 29 MITOXANTRONE REVENUES, BY GEOGRAPHY, 2005-2020 ($THOUSAND)

TABLE 30 EMCYT REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 31 EMCYT REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 32 PROVENGE REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 33 PROVENGE REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 34 ABIRATERONE ACETATE REVENUES, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 35 ABIRATERONE ACETATE REVENUE, BY COUNTRY, 2015 - 2020 ($THOUSAND)

TABLE 36 MDV3100 REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 37 MDV3100 REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 38 TAK700 REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 39 TAK700 REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 40 LANREOTIDE REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 41 LANREOTIDE REVENUE, BY COUNTRY 2015-2020 ($THOUSAND)

TABLE 42 TASQUINIMOD REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 43 TASQUINIMOD REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 44 ZALTRAP REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 45 ZALTRAP REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 46 CUSTIRSEN SODIUM REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 47 CUSTIRSEN SODIUM REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 48 SPRYCEL REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 49 SPRYCEL REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 50 IPILIMUMAB REVENUE, BY GEOGRAPHY, 2005 - 2020 ($THOUSAND)

TABLE 51 IPILIMUMAB REVENUE, BY COUNTRY, 2005 - 2020 ($THOUSAND)

TABLE 52 PROSTATE CANCER DRUGS MARKET, BY GEOGRAPHY, 2005 - 2020 ($MILLION)

TABLE 53 PROSTATE CANCER DRUGS MARKET, BY COUNTRY, 2005 - 2020 ($MILLION)

TABLE 54 NORTH AMERICA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 55 U.S: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 56 U.S: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 57 CANADA PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 58 CANADA PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 59 EUROPE PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 60 U.K: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 61 U.K: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 62 GERMANY: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 63 GERMANY: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 64 FRANCE: PROSTATE CANCER DRUGS MARKET, BY THERAPY 2005 - 2020 ($THOUSAND)

TABLE 65 FRANCE: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 66 ITALY: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 67 ITALY: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 68 SPAIN: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 69 SPAIN: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 70 JAPAN: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 71 JAPAN: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 72 EMERGING MARKETS: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 73 BRAZIL PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 74 BRAZIL: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 75 RUSSIA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 76 RUSSIA: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 77 INDIA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 78 INDIA: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 79 CHINA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 80 CHINA: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 81 TURKEY: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 82 TURKEY: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 83 SOUTH KOREA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2005 - 2020 ($THOUSAND)

TABLE 84 SOUTH KOREA: PROSTATE CANCER DRUGS MARKET, BY PRODUCTS, 2005 - 2020 ($THOUSAND)

TABLE 85 KEY COMPANIES FOCUSING ON DEVELOPMENT OF PIPELINE DRUGS

TABLE 86 KEY COMPANIES FOCUSING ON COMMERCIALIZATION OF NEW PRODUCTS

TABLE 87 ACQUISITIONS & MERGERS, 2009 - 2011

TABLE 88 COLLABORATIONS/PARTNERSHIPS/AGREEMENTS/JOINT VENTURES, 2008 - 2011

TABLE 89 NEW PRODUCTS DEVELOPMENT, 2009 - 2011

TABLE 90 EXPANSION/NEW FACILITY/INVESTMENT, 2009

TABLE 91 FDA APPROVALS/GOVERNMENT GRANTS, 2008 - 2011

TABLE 92 PRECLINICAL STUDY, 2008 - 2011

TABLE 93 CLINICAL TRIALS - PHASE I

TABLE 94 CLINICAL TRIALS - PHASE II

TABLE 95 CLINICAL TRIALS - PHASE III

TABLE 96 NEW DRUG APPLICATION & MARKETING AUTHORIZATION APPLICATION, 2008 - 2011

TABLE 97 OTHERS, 2008 – 2011

TABLE 98 ABBOTT: SALES AND R&D EXPENSES, 2008 – 2010 ($MILLION)

TABLE 99 ACTIVE BIOTECH: RESEARCH REVENUE AND R&D EXPENSES 2008 – 2010 ($MILLION)

TABLE 100 ASTRAZENECA PLC: R&D PIPELINE FOR PROSTATE CANCER TREATMENT

TABLE 101 ASTRAZENECA PLC: REVENUE AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 102 ASTRAZENECA PLC: REVENUE, BY BUSINESS SEGMENTS, 2008 - 2010 ($MILLION)

TABLE 103 ASTRAZENECA PLC: REVENUE, BY GEOGRAPHY, 2008 - 2010 ($MILLION)

TABLE 104 ASTELLAS PHARMA INC: R&D PIPELINE FOR PROSTATE CANCER TREATMENT

TABLE 105 ASTELLAS PHARMA INC: REVENUE AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 106 ASTELLAS PHARMA INC: SALES, BY GEOGRAPHY, 2008 - 2010 ($MILLION)

TABLE 107 BRISTOL-MYERS SQUIBB: R&D PIPELINE FOR PROSTATE CANCER TREATMENT

TABLE 108 BRISTOL-MYERS SQUIBB: SALES AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 109 BRISTOL-MYERS SQUIBB: SALES, BY GEOGRAPHY, 2008 - 2010 ($MILLION)

TABLE 110 BRISTOL-MYERS SQUIBB: REVENUE, BY BUSINESS SEGMENTS, 2008 - 2009 ($MILLION)

TABLE 111 DENDREON CORPORATION: REVENUE AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 112 ENDO PHARMACEUTICALS INC: REVENUE AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 113 ENDO PHARMACEUTICALS INC: REVENUE, BY BUSINESS SEGMENTS, 2008 - 2010 ($MILLION)

TABLE 114 IPSEN: R&D PIPELINE FOR PROSTATE CANCER TREATMENT

TABLE 115 IPSEN: REVENUE AND R&D EXPENDITURE, 2008 - 2010 ($MILLION)

TABLE 116 IPSEN: REVENUE, BY GEOGRAPHY, 2008 - 2010 ($MILLION)

TABLE 117 IPSEN: REVENUE, BY BUSINESS SEGMENTS, 2008 - 2010 ($MILLION)

TABLE 118 JOHNSON & JOHNSON: REVENUE AND R&D EXPENSES, 2008 – 2010 ($MILLION)

TABLE 119 JOHNSON & JOHNSON: REVENUE, BY BUSINESS SEGMENTS, 2008 – 2010 ($MILLION)

TABLE 120 JOHNSON & JOHNSON: REVENUE, BY GEOGRAPHY, 2008 – 2010 ($BILLION)

TABLE 121 PFIZER INC: REVENUE AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 122 PFIZER INC: REVENUE BY BUSINESS SEGMENTS, 2008 - 2010 ($MILLION)

TABLE 123 PFIZER INC: REVENUE, BY GEOGRAPHY, 2008 - 2010 ($MILLION)

TABLE 124 SANOFI-AVENTIS: SALES AND R&D EXPENSES, 2008 - 2010 ($MILLION)

TABLE 125 SANOFI-AVENTIS: SALES, BY BUSINESS SEGMENTS, 2008 - 2010 ($MILLION)

TABLE 126 SANOFI-AVENTIS: SALES, BY GEOGRAPHY, 2009 - 2010 ($MILLION)

TABLE 127 TEVA PHARMACEUTICAL INDUSTRIES LTD: REVENUE AND R&D EXPENSES 2008 - 2010 ($MILLION)

TABLE 128 TEVA PHARMACEUTICAL INDUSTRIES LTD: REVENUE, BY GEOGRAPHY, 2008 - 2010 ($MILLION)

TABLE 129 TEVA PHARMACEUTICAL INDUSTRIES LTD: REVENUE, BY BUSINESS SEGMENTS, 2008 – 2010 ($MILLION)

TABLE 130 TAKEDA PHARMACEUTICALS: REVENUE AND R&D EXPENSES, 2008 - 2011 ($MILLION)

TABLE 131 TAKEDA PHARMACEUTICALS: REVENUE, BY GEOGRAPHY, 2008 - 2011 ($MILLION)

TABLE 132 TAKEDA PHARMACEUTICALS: REVENUE, BY BUSINESS SEGMENTS, 2008 - 2010 ($MILLION)

LIST OF FIGURES

FIGURE 1 PROSTATE CANCER DISEASE OVERVIEW

FIGURE 2 PROSTATE CANCER DISEASE OVERVIEW, BY COUNTRY, 2010

FIGURE 3 PROSTATE CANCER TREATMENT OPTIONS, BY STAGES

FIGURE 4 PROSTATE CANCER DRUGS: MARKET SEGMENTATION, BY THERAPY

FIGURE 5 CHEMOTHERAPY DRUGS: MARKET SEGMENTATION, BY DRUGS

FIGURE 6 HORMONAL THERAPY DRUGS: MARKET SEGMENTATION, BY DRUGS

FIGURE 7 IMMUNOTHERAPY DRUGS: MARKET SEGMENTATION, BY DRUGS

FIGURE 8 TARGETED THERAPY DRUGS: MARKET SEGMENTATION, BY DRUGS

FIGURE 9 PROSTATE CANCER TREATMENT OPTIONS, BY THERAPY

FIGURE 10 CHEMOTHERAPY MARKET, BY GEOGRAPHY, 2010 – 2020

FIGURE 11 HORMONAL THERAPY MARKET, BY GEOGRAPHY, 2010 – 2020

FIGURE 12 IMMUNOTHERAPY MARKET, BY GEOGRAPHY, 2015 & 2020

FIGURE 13 TARGETED THERAPY MARKET, BY GEOGRAPHY, 2015 & 2020

FIGURE 14 DISTRIBUTION OF GLOBAL R&D PROJECTS, BY THERAPEUTIC SEGMENTS, 2010 (%)

FIGURE 15 SUCCESS RATE IN CLINICAL TRIALS, BY CANCER TYPES

FIGURE 16 FAILURE RATE OF CANCER DRUGS VS NON CANCER DRUGS (PHASE WISE)

FIGURE 17 GROWING MALE POPULATION, 2010 – 2050

FIGURE 18 EXPENDITURE ON MEDICINES, BY GEOGRAPHY, 2010 VS 2015

FIGURE 19 MARKET REVENUE, BY TOP 10 THERAPEUTIC SEGMENTS ($BILLION)

FIGURE 20 MARKET SHARE, BY COMPANY, 2010 VS 2020 (%)

FIGURE 21 MARKET SHARE, BY GEOGRAPHY, 2010 VS 2020 (%)

FIGURE 22 MARKET SHARE, BY THERAPY, 2010 VS 2020 (%)

FIGURE 23 U.S: PREVALENCE & INCIDENCE OF PROSTATE CANCER, 2008 - 2020

FIGURE 24 U.S: CANCER CARE EXPENDITURES FOR TOP FIVE CANCER SITES, 2010 & 2020 ($BILLION)

FIGURE 25 U.S: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 26 CANADA PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 27 U.K: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 28 GERMANY: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 29 FRANCE: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 30 ITALY: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 31 SPAIN: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 32 JAPAN: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 33 BRAZIL: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 34 RUSSIA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 – 2020 ($THOUSAND)

FIGURE 35 INDIA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 36 CHINA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 37 TURKEY: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 38 SOUTH KOREA: PROSTATE CANCER DRUGS MARKET, BY THERAPY, 2010 - 2020 ($THOUSAND)

FIGURE 39 GROWTH STRATEGIES, 2008 - 2011

FIGURE 40 ACTIVE BIOTECH: PIPELINE PRODUCTS, BY THERAPY AREA, 2010

FIGURE 41 ASTRAZENECA PLC: SHARE OF BUSINESS SEGMENTS IN TOTAL REVENUE, 2009 – 2010 (%)

FIGURE 42 ASTRAZENECA PLC: SHARE OF GEOGRAPHIC REVENUE IN TOTAL REVENUE, 2009 VS 2010

FIGURE 43 ASTELLAS PHARMA INC: SHARE OF GEOGRAPHIC REVENUE IN TOTAL REVENUE, 2009 VS 2010

FIGURE 44 BRISTOL-MYERS SQUIBB: SHARE OF GEOGRAPHIC REVENUE IN TOTAL REVENUE, 2009 VS 2010 (%)

FIGURE 45 BRISTOL-MYERS SQUIBB: SHARE OF BUSINESS SEGMENTS IN TOTAL REVENUE, 2009 VS 2010 (%)

FIGURE 46 IPSEN: SHARE OF GEOGRAPHIC REVENUE IN TOTAL REVENUE, 2009 VS 2010

FIGURE 47 JOHNSON & JOHNSON: SHARE OF BUSINESS SEGMENTS IN TOTAL REVENUE, 2009 VS 2010

FIGURE 48 PFIZER INC: SHARE OF BUSINESS SEGMENTS IN TOTAL REVENUE, 2009 VS 2010 (%)

FIGURE 49 SANOFI-AVENTIS: SHARE OF BUSINESS SEGMENTS IN TOTAL REVENUE, 2009 VS 2010

FIGURE 50 SANOFI-AVENTIS: SALES, BY GEOGRAPHY 2009 VS 2010 ($MILLION)

FIGURE 51 TEVA PHARMACEUTICAL INDUSTRIES LTD: REVENUE, BY GEOGRAPHY, 2009 VS 2010 ($MILLION)

FIGURE 52 TEVA PHARMACEUTICAL INDUSTRIES LTD: SHARE OF BUSINESS SEGMENTS IN TOTAL SALES, 2009 VS 2010 (%)

FIGURE 53 TAKEDA PHARMACEUTICALS: REVENUE, BY GEOGRAPHY, 2009 - 2010 ($MILLION)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Prostate Cancer Therapeutics Market