Propylene Carbonate Market by Application (Solvent, Catalyst, Electrolyte, Additives, Cleaners), End-Use Industry (Paints & Coatings, Pharmaceuticals, Cosmetics & Personal Care, Textile, Energy & Power), Region - Global Forecast to 2030

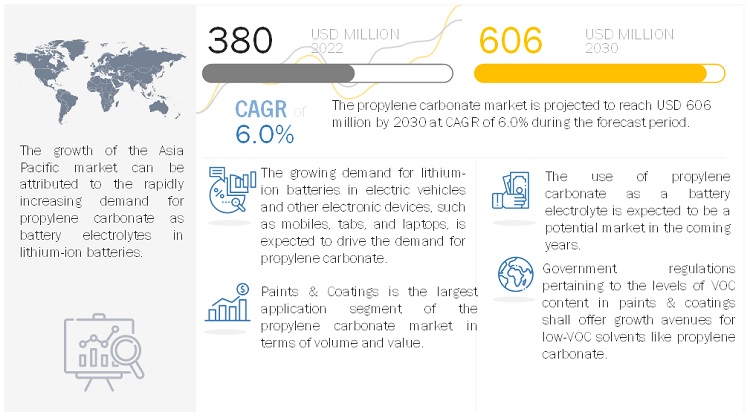

The propylene carbonate market is projected to grow from USD 380 million in 2022 to USD 606 million by 2030, at a CAGR of 6.0% from 2022 to 2030. The rising demand from the paint and coatings end-use industry is expected to drive the propylene carbonate market during the forecast period.

Attractive Opportunities in the Propylene Carbonate Market

To know about the assumptions considered for the study, Request for Free Sample Report

Propylene carbonate Market Dynamics

Drivers: Increasing demand for propylene carbonate as an electrolyte in lithium-ion batteries

The growth in the global propylene carbonate market is mainly driven by the increasing use of lithium-ion batteries in different types of electric vehicles, such as electric buses, trucks, bikes, and passenger vehicles, due to the superior properties of lithium-ion batteries, such as lightweight and higher energy density compared to nickel-cadmium and nickel-metal hydride batteries. The expanding automotive industry with increased production of electric vehicles to reduce carbon emissions is driving the demand for lithium-ion batteries and, thus, propylene carbonate.

Besides Li-ion batteries, the global demand for paints & coatings will also be a key growth driver in the propylene carbonates market. Government regulations pertaining to the levels of VOC content in paints & coatings shall offer growth avenues for low-VOC solvents like propylene carbonate. Being VOC-free, this can be a potential hot spot for Propylene carbonate in this sector. Propylene carbonate is also used in the synthesis of polyether polyols, which is further used in the manufacturing of polyurethanes and polyurethane foams.

Restraints:Less shelf life of propylene carbonate

Under typical storage circumstances, propylene carbonate is stable. Propylene carbonate, on the other hand, may decompose in the presence of an acid, base, metal oxide, or salt, releasing CO2. Thermal stability will be affected by these materials. In any case, the pressure might build up within closed containers, potentially causing the container to burst. Although such a problem can be tackled with the help of advanced research and development in the packaging industry as many manufacturers are providing custom packing under advised conditions, which helps to overcome the shelf-life problem of propylene carbonate up to a certain extent.

Opportunities: Growing of propylene carbonate in lithium-ion battery electrolyte

The growing demand for propylene carbonate in lithium-ion battery electrolytes is mainly due to the widespread use of lithium-ion batteries in electric vehicles. Currently, there is a huge dependence on oil as fuel in the transportation system; almost 70% of the oil is being used in transport vehicles. This dependency has led to rising concerns among both environmentalists and economists. Increasing awareness about environmental issues has led to the adoption of electric vehicles. The global fleet of electric cars recently exceeded 10 million units, and 3.0 million electric cars were sold in 2020 as part of the transition toward a clean energy system (Source: IEA Global EVOutlook 2021). The widespread use of electric vehicles in countries such as the US, France, China, Japan, Germany, and the UK, has inevitably led to the rising adoption of Li-ion batteries, which, in turn, is increasing the demand for Propylene carbonate. The global manufacturing capacity of lithium-ion cells for electric cars and energy storage is about 150 GWh per year.

Lithium-ion batteries are being used in mobile phones, laptops, tabs, and other electronic devices, and the demand for these devices is growing rapidly throughout the globe. Thus, the growing demand for Propylene carbonate in Li-ion battery electrolytes is driving the market.

Challenges: Significant fluctuations in oil & gas prices

The price and availability of raw materials are the key factors for propylene carbonate manufacturers to determine the cost structure of their products. The raw materials used to manufacture propylene carbonate include propylene glycol, propylene oxide, and CO2. Most of these raw materials are crude oil-based derivatives that are vulnerable to fluctuations in commodity prices.

The increasing global demand for crude oil and the unrest in the Middle East are major factors responsible for the fluctuating prices of propylene carbonates. The Propylene carbonate market is also affected by high transport costs, driven by the rising fuel prices and high manufacturing costs resulting from the increased energy costs. Manufacturers of propylene carbonate have responded to the increase in manufacturing costs by ensuring that the rise in prices is asymmetrically shared, with end-users paying the majority share. Hence, the fluctuating oil & gas prices act as a challenge for the propylene carbonate market.

“The solvents application segment accounted for the largest market share in 2021.”

Based on application, the solvents application segment accounted for the largest share of the propylene carbonate market in 2021. Propylene carbonate is a VOC (Volatile Organic Compound)-free clear polar solvent having a high boiling point and flash points. Companies in the propylene carbonate market are tapping into income sources in applications requiring a clear (water white) product or high purity. LyondellBasell - a global plastics, chemicals, and refining company is building its product portfolio in propylene carbonate that can be used as an isocyanate and unsaturated polyester resin cleanup solvent.

Companies in the Propylene carbonate market are broadening their revenue streams via textile dye carriers and cleaner applications. Polar additives for clay gellants, foundry binder catalysts, and electrolytes in lithium batteries are triggering the demand for propylene carbonate.

“The paints & coatings end-use industry segment accounted for the largest market share in 2021.”

Based on the end-use industry, the paints & coatings segment accounted for the largest share in 2021, as It is used as a high-boiling solvent and film-forming auxiliary, especially in poly (vinyl fluoride) and poly (vinylidene fluoride) systems. Propylene carbonate is also more eco-efficient compared to other solvents used in wire enamel coating applications. As a reactive diluent, it can reduce the viscosity of isocyanates or polyurethane pre-polymers in two-component polyurea systems.

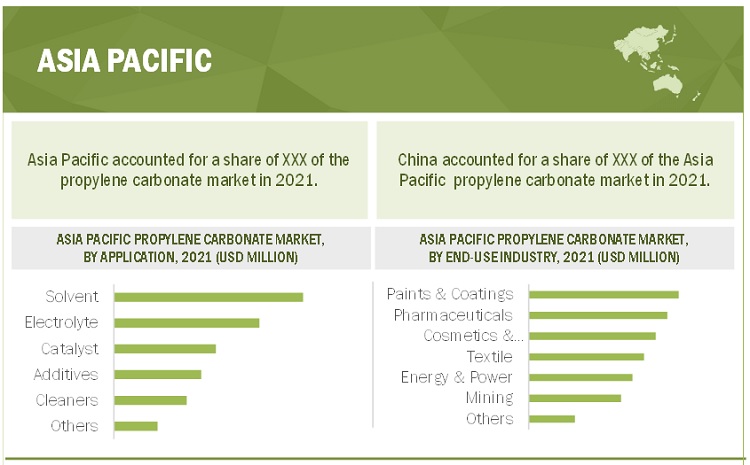

“Asia Pacific accounted for the largest share of the propylene carbonate market in 2021.”

By region, Asia Pacific is estimated to be the largest market for propylene carbonate in 2021. The demand for propylene carbonate in this region is mainly propelled by its increasing use as a solvent in the paints & coatings industry in countries such as China, Japan, Korea, Thailand, Taiwan, Singapore, and Malaysia. The increasing demand for lithium-ion batteries from the electronics and automotive industries in the Asia Pacific region is also expected to drive the lithium-ion battery electrolyte and thereby, the Propylene carbonate market.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

BASF SE (Germany), Hunstman International LLC (US), LyondellBasell Industries B.V. (Netherlands), Empower Materials (US), Tedia Carl Roth GmbH (Germany), TCI Chemicals (India) Pvt. Ltd. (Japan), Shandong Shida Shenghua Chemical Group Co., Ltd. (China), Linyi Evergreen Chemical Co., Ltd (China), Daze Group (Headquarters, Taixing Fengming Chemical Industry (China), MegaChem Ltd (Singapore), and Hi-Tech Spring Chemical (China) are some of the leading players operating in the Propylene carbonate market.

Scope of the Report

|

Report Metric |

Details |

|

Years considered for the study |

2017-2027 |

|

Base Year |

2021 |

|

Forecast period |

2022–2027 |

|

Units considered |

Volume (Units); Value (USD Million) |

|

Segments |

Application, End-use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

The key players in this market are BASF SE (Germany), Hunstman International LLC (US), LyondellBasell Industries B.V. (Netherlands), Empower Materials (US), Tedia Carl Roth GmbH (Germany), TCI Chemicals (India) Pvt. Ltd. (Japan), Shandong Shida Shenghua Chemical Group Co., Ltd. (China), Linyi Evergreen Chemical Co., Ltd (China), Daze Group (Headquarters, Taixing Fengming Chemical Industry (China), MegaChem Ltd (Singapore), and Hi-Tech Spring Chemical (China) |

This report categorizes the global propylene carbonate market based on application, end-use industry and region.

On the basis of application, the propylene carbonate market has been segmented as follows:

- Solvent

- Catalyst

- Electrolyte

- Additives

- Cleaners

- Others (Chemical Intermediates, Plasticizers)

On the basis of end-use industry, the propylene carbonate market has been segmented as follows:

- Cosmetics & Personal Care

- Paints & Coatings

- Pharmaceuticals

- Textile

- Energy & Power

- Mining

- Others

On the basis of region, the propylene carbonate market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Frequently Asked Questions (FAQ):

What is propylene carbonate? What are its applications?

Propylene carbonate is a polar aprotic solvent, it is a low toxicity, biodegradable, non-corrosive colorless liquid with a high boiling point, low vapor pressure, and EPA VOC exemption. Propylene carbonate is used in various applications such as solvent, catalyst, electrolyte, additives, cleaners, etc.

Who are the major players involved in this market?

BASF SE, Hunstman International LLC, LyondellBasell Industries B.V., SMC, Huntsman International LLC, Empower Materials, Tedia Carl Roth GmbH, TCI Chemicals (India) Pvt. Ltd., Shandong Shida Shenghua Chemical Group Co., Ltd., Linyi Evergreen Chemical Co., Ltd, Daze Group, Taixing Fengming Chemical Industry (China), MegaChem Ltd (Singapore), and Hi-Tech Spring Chemical are some of the leading players operating in the propylene carbonate market.

What is the biggest challenge to the growth of the propylene carbonate market?

Significant fluctuations in oil & gas prices are the biggest challenge to the growth of the propylene carbonate market

Which application leads the growth of the propylene carbonate market?

The solvent segment would assist the growth of the propylene carbonate market.

Which are the top countries driving the propylene carbonate market demand?

China, US and Germany are the countries driving the propylene carbonate demand. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 MARKET SCOPE

1.3.1 MARKETS COVERED

1.3.2 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY & PRICING

1.5 LIMITATIONS

1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

2.1.2.1 Key data from primary sources

2.1.2.2 Key industry insights

2.1.2.3 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

2.4 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 SIGNIFICANT OPPORTUNITIES IN THE GLOBAL PROPYLENE CARBONATE MARKET

4.2 PROPYLENE CARBONATE MARKET, BY APPLICATION

4.3 PROPYLENE CARBONATE MARKET, BY END-USE INDUSTRY

4.4 PROPYLENE CARBONATE MARKET, BY REGION

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET SEGMENTATION

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.2 RESTRAINTS

5.3.3 OPPORTUNITIES

5.3.4 CHALLENGES

5.4 PORTER’S FIVE FORCES ANALYSIS

5.5 VALUE CHAIN ANALYSIS

5.6 SUPPLY CHAIN ANALYSIS OF PROPYLENE CARBONATE

5.7 TECHNOLOGY ANALYSIS/ROUTES FOR PC SYNTHESIS (Introduction, Chemical reaction of the process, advantages and disadvantages of the process will be covered for each route listed below)

5.7.1 PROPYLENE GLYCOL WITH PHOSGENE

5.7.2 TRANSESTERIFICATION OF PROPYLENE GLYCOL WITH ALKYL CARBONATE

5.7.3 DIRECT OXIDATION OF OLEFINS WITH CARBON DIOXIDE

5.7.4 CYCLOADDITION OF CARBON DIOXIDE WITH PROPYLENE OXIDE

5.7.5 PROPYLENE CARBONATE SYNTHESIS FROM UREA AND PROPYLENE GLYCOL

5.8 CASE STUDY ANALYSIS

5.9 PATENT ANALYSIS

5.10 AVERAGE SELLING PRICE TREND

5.11 COVID-19 IMPACT

5.12 TRADE DATA STATISTICS

5.13 TRENDS/ DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.14 TARIFF AND REGULATORY LANDSCAPE

5.15 ECOSYSTEM/MARKET MAP

6 GLOBAL PROPYLENE CARBONATE MARKET, BY APPLICATION

6.1 INTRODUCTION

6.2 SOLVENT

6.3 CATALYST

6.4 ELECTROLYTE

6.5 ADDITIVES

6.6 CLEANERS

6.7 OTHERS (CHEMICAL INTERMEDIATES, PLASTICIZER)

7 GLOBAL PROPYLENE CARBONATE MARKET, BY END-USE INDUSTRY

7.1 INTRODUCTION

7.2 COSMETICS & PERSONAL CARE

7.3 PAINTS & COATINGS

7.4 PHARMACEUTICALS

7.5 TEXTILE

7.6 ENERGY & POWER

7.7 MINING

7.8 OTHERS

8 GLOBAL PROPYLENE CARBONATE MARKET, BY REGION

8.1 INTRODUCTION

8.2 ASIA PACIFIC

8.2.1 CHINA

8.2.2 INDIA

8.2.3 JAPAN

8.2.4 SOUTH KOREA

8.2.5 THAILAND

8.2.6 MALAYSIA

8.2.7 AUSTRALIA & NEW ZEALAND

8.2.8 REST OF ASIA PACIFIC

8.3 EUROPE

8.3.1 GERMANY

8.3.2 U.K.

8.3.3 ITALY

8.3.4 FRANCE

8.3.5 SPAIN

8.3.6 REST OF EUROPE

8.4 NORTH AMERICA

8.4.1 U.S.

8.4.2 CANADA

8.4.3 MEXICO

8.5 MIDDLE EAST & AFRICA

8.5.1 SAUDI ARABIA

8.5.2 UAE

8.5.3 QATAR

8.5.4 KUWAIT

8.5.5 REST OF MIDDLE EAST & AFRICA

8.6 SOUTH AMERICA

8.6.1 BRAZIL

8.6.2 ARGENTINA

8.6.3 REST OF LATIN AMERICA

9 COMPETITIVE LANDSCAPE

9.1 OVERVIEW

9.2 MARKET SHARE ANALYSIS/MARKET RANKING OF KEY PLAYERS

9.3 KEY MARKET DEVELOPMENTS

9.4 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY, 2021

9.5 COMPETITIVE BENCHMARKING

9.6 SME MATRIX, 2021

10 COMPANY PROFILES

(Business Overview, Products & Services, Key Insights, Recent Developments, Business Strategy) *

10.1 KEY PLAYERS

10.1.1 BASF SE

10.1.2 HUNTSMAN INTERNATIONAL LLC.

10.1.3 LYONDELLBASELL INDUSTRIES HOLDINGS B.V.

10.1.4 EMPOWER MATERIALS

10.1.5 ANMOL CHEMICALS GROUP

10.1.6 KOWA INDIA PVT.LTD.

10.1.7 REACTCHEM CO. LTD.

10.1.8 SHENGHUA GROUP HOLDINGS CO. LTD.

10.1.9 TAIXING FENGMING CHEMICAL

10.1.10 LIXING CHEMICAL

10.1.11 SAE MANUFACTURING SPECIALTIES CORP

10.1.12 GJ CHEMICAL

10.1.13 MIL-SPEC INDUSTRIES

10.1.14 HAIHANG INDUSTRY

10.1.15 SHANDONG SHIDA SHENGHUA CHEMICAL CO LTD.

10.1.16 LINYI EVERGREEN CHEMICAL CO., LTD.

*Details on Business Overview, Products & Services, Key Insights, Recent Developments, and Business Strategy might not be captured in case of unlisted companies

Note: The above list of companies will be updated over the course of study

11 APPENDIX

11.1 INSIGHTS FROM INDUSTRY EXPERTS

11.2 DISCUSSION GUIDE

11.3 INTRODUCING RT: REAL TIME MARKET INTELLIGENCE

11.4 AVAILABLE CUSTOMIZATIONS

11.5 RELATED REPORTS

The study involved four major activities to estimate the size of propylene carbonate market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

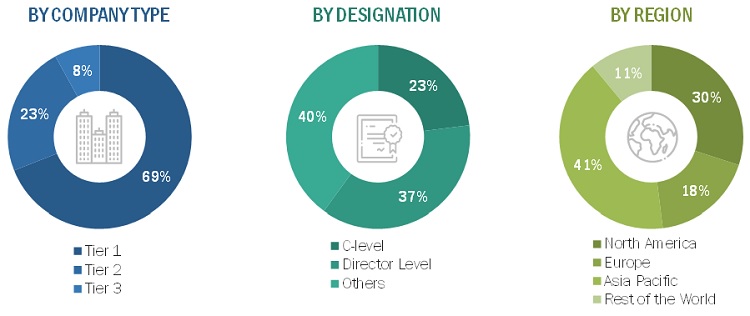

The propylene carbonate market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, distributors, and end users. Various primary sources from the supply and demand sides of the propylene carbonate market have been interviewed to obtain qualitative and quantitative information.

The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the propylene carbonate industry.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down and bottom-up approaches have been used to estimate and validate the size of the propylene carbonate market.

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Propylene Carbonate Market: Bottom-Up Approach 1

Source: MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Report Objectives

- To define, describe, and forecast the size of the propylene carbonate market, in terms of value and volume

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on application, end-use industry and region

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, and Middle East & Africa, and South America along with their key countries

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market

- To strategically profile key market players and comprehensively analyze their core competencies2

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Propylene Carbonate Market