Professional Dental Care Market by Type (Toothbrush (Electric, Battery-powered), Toothpaste, Mouthwash, Denture Products, Dental Accessories (Whitening Products, Breath Freshener, Dental Floss, Dental Water Jet)) - Global Forecast to 2021

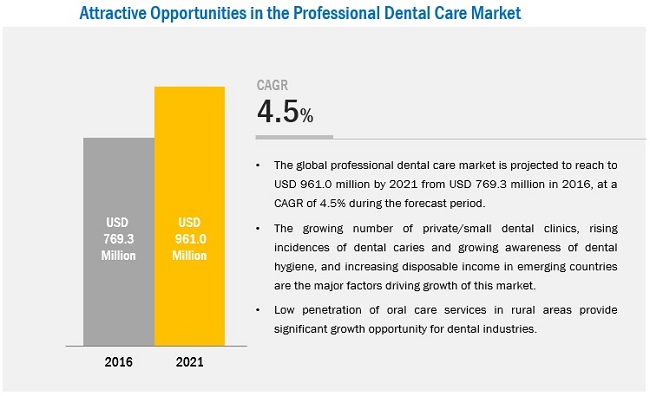

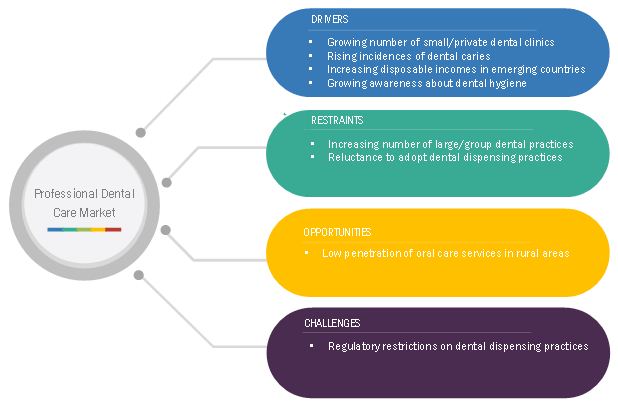

[178 Pages Report] The global professional dental care market is estimated to grow at a CAGR of 4.5% from 2016 to 2021 to reach USD 961.0 Million by 2021. Factors such as growing number of small/ private dental clinics, rising incidences of dental caries, increasing disposable incomes in emerging countries, growing awareness about dental hygiene, and economic gains for dental practitioners are the major factors driving the growth of the global market. However, increasing number of large/group dental practices and reluctance to adopt dental dispensing practices by dental practitioners are expected to restrain the growth of this market to certain extent.

In this report, the market is segmented on the basis of type-of-product, and region. On the basis of product type, the market is segmented into toothpastes, toothbrushes, mouthwashes/rinses, denture products, dental accessories/ancillaries, and other professional dental care products. The toothpastes segment accounted for the largest share of the global dental dispensing Products market in 2015 owing to its wide utilization by the end-users. The toothbrushes market is expected to register highest growth during the forecast period of 2016-2021. The technological advancement in the electric toothbrushes in recent years is expected to drive the growth of this segment in coming years. The dental accessories/ancillaries market is further segmented into cosmetic whitening products, breath fresheners, dental floss, and dental water jet. Owing to the increased demand for the daily teeth whitening products, the cosmetic whitening products accounted for the largest share of the dental accessories/ancillaries market.

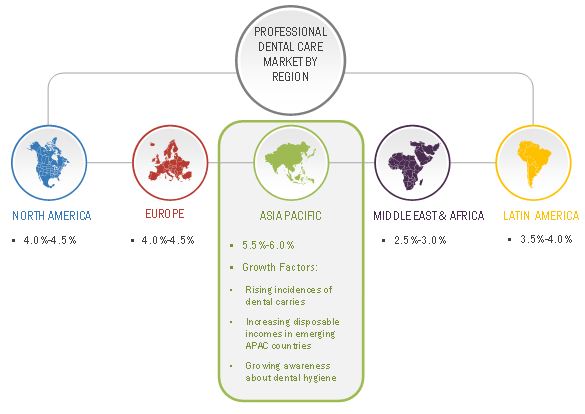

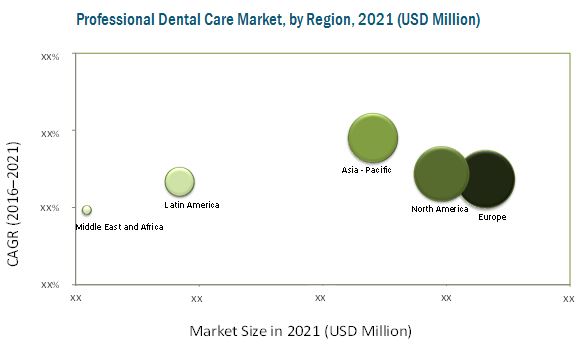

Geographically, the global professional dental care market is segmented into North America, Europe, Asia-Pacific, and the Rest of the World. In 2015, Europe commanded a major share of the market. However, Asia-Pacific is expected to witness the highest growth rate during the forecast period. Growth in the Asia-Pacific market can be attributed to rising geriatric population, increasing awareness about dental health, and medical tourism will drive the growth of this market in the APAC.

Some of the prominent players in the professional dental care market include Colgate-Palmolive Company (U.S.), The Procter & Gamble Company (U.S.), Unilever plc (U.K.), Johnson & Johnson (U.S.), Young Innovation, Inc. (U.S.), Ultradent Products, Inc. (U.S.), GC Corporation (Japan), GlaxoSmithKline plc (U.K.), Dr. Fresh, LLC (U.S.), 3M Company (U.S.), Koninklijke Philips N.V. (Netherlands), and Sunstar (Japan).

Target Audience:

- Manufacturers of professional dental care products

- Distributors of dental care products

- Dental R&D institutes

- Dental laboratories

- Government associations and dental practitioners

- Market research and consulting firms

- Venture capitalists and investors

To know about the assumptions considered for the study, download the pdf brochure

Scope of the Report:

The research report categorizes the dental dispensing Products market into the following segments and subsegments:

Global Professional Dental Care Market, by Type

-

Toothpastes

- Pastes

- Gels

- Polishes

- Powders

-

Toothbrushes

- Manual Toothbrushes

- Electric Toothbrushes

- Battery-Powered Toothbrushes

- Toothbrush Heads

-

Mouthwashes/Rinses

- Non-medicated Mouthwashes

- Medicated Mouthwashes

-

Dental Accessories/Ancillaries

- Cosmetic Whitening Products

- Breath Fresheners

- Dental Flosses

- Dental Water Jets

-

Denture Products

- Cleansers

- Fixatives

- Other Denture Products

- Other Professional Dental Care Products

Global Professional Dental Care Market, by Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- Italy

- France

- U.K.

- Spain

- Rest of Europe (RoE)

-

Asia-Pacific

- China

- Japan

- India

- Australia

- Rest of Asia-Pacific (RoAPAC)

-

Rest of the World (RoW)

- Latin America

- Middle East and Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the Rest of Asia-Pacific professional dental care market into South Korea, New Zealand, and others

- Further breakdown of the Latin American dental dispensing products market into Brazil, Mexico, and Rest of Latin America

- Further breakdown of the Rest of Europe professional dental care market into Belgium, Russia, the Netherlands, and Rest of European countries

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

Market Dynamics

Growing number of small/private dental clinics

In recent years, there has been a significant increase in the number of dentists across the globe, owing to which, the number of dental practices has also increased. The US is one of the major markets for dental dispensing products mainly due to the large number of dental practices in the country, increasing expenditure on dental care, and widespread awareness about oral hygiene.

APAC, on the other hand, is the fastest-growing region for the Oral Care products market mainly due to the increasing number of dentists and dental practices in the region, growing disposable incomes, and rising awareness about oral hygiene. In India, every year, approximately 12,000 to 15,000 new practices are started in the country. Similarly, the number of dentists in China increased from around 111,000 in 2010 to 137,100 in 2015.

This growing number of dentists and the subsequent increase in the number of dental practices will increase the adoption of oral care products, which is expected to drive growth in the professional dental care products market.

Toothbrush segment to register highest growth

In this report, the professional dental care products market is segmented on the basis of type-of-product, and region. On the basis of product type, the market is segmented into toothpastes, toothbrushes, mouthwashes/rinses, denture products, dental accessories/ancillaries, and other professional dental care products. The toothpastes segment accounted for the largest share of the global dental dispensing products market in 2015 owing to its wide utilization by the end-users.

The toothbrushes market is expected to register highest growth during the forecast period of 2016-2021. The significant growth of this segment is mainly attributed to the technological advancements in the electric toothbrushes. The electric toothbrushes are connected to the Bluetooth technology so that one can analyze their teeth and maintain their oral conditions. For instance, in July 2016, Koninklijke Philips N.V. (Netherlands) launched the Sonicare FlexCare Platinum Connected, a Bluetooth-connected power toothbrush for adults.

Asia Pacific: High Growth Opportunity for professional dental care products

During the forecast period, Asia Pacific countries, such as India and China, are expected to offer significant growth opportunities in the professional dental care products market. The rising incidences of dental carries, rapidly growing geriatric population, increasing disposable incomes in emerging APAC countries, and growing awareness about dental hygiene are major factors fueling market growth in APAC. Rising medical tourism and the low penetration of oral care services in the rural areas are the key areas of opportunity in the APAC market.

Moreover, key companies are focused on creating awareness about dental hygiene in emerging APAC countries to broaden the end-user base for their products. For instance, in April 2015, Johnson and Johnson’s Listerine Brand launched “Bring Out the Bold”, a global marketing and dental care awareness campaign, targeting customers from China, Brazil, India, and other emerging countries.

Product Launches-The Major Growth Strategy Adopted By Top Players

Several key players are adopting several organic and inorganic growth strategies (such as product launches; agreements, collaborations, and partnerships; mergers and acquisitions; and expansions) to garner larger shares in the market.

Key Questions

- With increasing disposable income and growing awareness about dental hygiene, which are the high growth segments within professional dental care market providing opportunities of growth?

- Which form of toothpaste is most preferred across several countries?

- As developed economies are reaching saturation, what are the geographic growth opportunities in the dental dispensing products market offered by the less developed economies?

- What are the growth strategies of key market players in this market?

The professional dental care market is expected to witness significant growth in the coming years. Factors such as the growing number of small/private dental clinics, rising incidences of dental caries, increasing disposable income in emerging countries, rising awareness about dental hygiene, an economic gain for dental practitioners are the major factors driving the growth of the global market. The global market is projected to USD 961.0 Million by 2021 from USD 769.3 Million in 2016, at a CAGR of 4.5% from 2016 to 2021. However, the rising trend of group/large dental practices and reluctance by dental practitioners towards the dental dispensing practices are expected to restrain the growth of the dental dispensing products market to certain extent.

This study includes the estimation of professional dental care market based on type-of-products and region. On the basis of product types, this market is segmented into toothpastes, toothbrushes, mouthwashes/rinses, dental accessories/ancillaries, denture products, and other professional dental care products. The toothpastes segment accounted for the largest share of the global market in 2015. The toothbrushes segment is expected to register fastest growth during the forecast period of 2016-2021. The significant growth of this segment is mainly attributed to the recent technological advancements in the electric toothbrushes.

In 2015, Europe dominated the dental dispensing products market followed by North America, Asia-pacific, and Rest of the World. This is mainly due to the region’s aging population, governmental expenditure on oral healthcare across Europe, availability of huge amount of private dental practitioners in European countries, and growing awareness about dental hygiene. However, Asia-Pacific is expected to witness the fastest growth rate during the forecast period. Growth in the Asia-Pacific dental dispensing products market can be attributed to the increasing number of geriatric population, growing number of dental diseases, growing dental expenditure, increasing number of dental hospitals and clinics, and growing dental tourism across APAC countries.

The global professional dental care market is characterized by the presence of a large number of players. Amidst intense market competition, major players are continuously focusing on achieving higher market shares through new product launches, expansions, and mergers and acquisitions in the market. The global market is fragmented in nature, with a large number of companies continuously trying to mark their presence. The market is led by Colgate-Palmolive Company (U.S.), The Procter & Gamble Company (U.S.), Unilever plc (U.K.), Johnson & Johnson (U.S.), Young Innovation, Inc. (U.S.), Ultradent Products, Inc. (U.S.), GC Corporation (Japan), GlaxoSmithKline plc (U.K.), Dr. Fresh, LLC (U.S.), 3M Company (U.S.), Koninklijke Philips N.V. (Netherlands), and Sunstar (Japan).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Approach

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Professional Dental Care Market Size Estimation

2.3 Professional Dental Care Market Breakdown and Data Triangulation

2.4 Professional Dental Care Market Share Estimation

2.5 Assumptions for the Study

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 29)

4.1 Market Overview

4.2 Market Size, By Type, 2016 vs 2021

4.3 Geographic Snapshot (2015)

4.4 Dental Dispensing Products Market: Geographic Mix

4.5 Dental Dispensing Products Market: Developing vs Developed Countries (2016–2021)

5 Professional Dental Care Market Overview (Page No. - 34)

5.1 Introduction

5.2 Dental Dispensing Products Market Dynamics

5.2.1 Professional Dental Care Market Drivers

5.2.1.1 Growing Number of Small/Private Dental Clinics

5.2.1.2 Rising Incidence of Dental Caries

5.2.1.3 Increasing Disposable Incomes in Emerging Countries

5.2.1.4 Growing Awareness About Dental Hygiene

5.2.1.5 Economic Gains for Dental Practitioners

5.2.2 Professional Dental Care Market Restraints

5.2.2.1 Increasing Number of Large/Group Dental Practices

5.2.2.2 Reluctance to Adopt Dental Dispensing Practices

5.2.3 Professional Dental Care Market Opportunities

5.2.3.1 Low Penetration of Oral Care Services in Rural Areas

5.2.4 Professional Dental Care Market Challenges

5.2.4.1 Regulatory Restrictions on Dental Dispensing Practices

6 Professional Dental Care Market, By Type (Page No. - 41)

6.1 Introduction

6.2 Toothpastes

6.2.1 Pastes

6.2.2 Gels

6.2.3 Polishes

6.2.4 Powders

6.3 Toothbrushes

6.3.1 Manual Toothbrushes

6.3.2 Electric Toothbrushes

6.3.3 Battery-Powered Toothbrushes

6.3.4 Toothbrush Heads

6.4 Mouthwashes/Rinses

6.4.1 Non-Medicated Mouthwashes

6.4.2 Medicated Mouthwashes

6.5 Dental Accessories/Ancillaries

6.5.1 Cosmetic Whitening Products

6.5.2 Breath Fresheners

6.5.3 Dental Flosses

6.5.4 Dental Water Jets

6.6 Denture Products

6.6.1 Cleansers

6.6.2 Fixatives

6.6.3 Other Denture Products

6.7 Other Professional Dental Care Products

7 Professional Dental Care Market, By Region (Page No. - 69)

7.1 Introduction

7.2 North America

7.2.1 U.S.

7.2.2 Canada

7.3 Europe

7.3.1 Germany

7.3.2 Italy

7.3.3 France

7.3.4 U. K.

7.3.5 Spain

7.3.6 Rest of Europe

7.4 Asia-Pacific

7.4.1 China

7.4.2 Japan

7.4.3 India

7.4.4 Australia

7.4.5 Rest of Asia-Pacific

7.5 Rest of the World

7.5.1 Latin America

7.5.2 Middle East and Africa

8 Competitive Landscape (Page No. - 136)

8.1 Introduction

8.2 Competitive Situations and Trends

8.2.1 Product Launches

8.2.2 Expansions

8.2.3 Acquisitions

8.2.4 Partnerships

8.2.5 Product Acquisitions

8.3 Product Portfolio Analysis

9 Company Profiles (Page No. - 142)

9.1 Introduction

(Business Overview, Products & Services, Key Insights, Recent Developments, SWOT Analysis, Ratio Analysis, MnM View)*

9.2 Colgate-Palmolive Company

9.3 The Procter & Gamble Company

9.4 Young Innovations, Inc.

9.5 Ultradent Products, Inc.

9.6 Unilever PLC

9.7 Glaxosmithkline PLC

9.8 GC Corporation

9.9 Koninklijke Philips N.V.

9.10 Dr. Fresh, LLC

9.11 3M Company

10 Key Innovators (Page No. - 164)

10.1 Introduction

10.2 The Procter & Gamble Company

10.3 Koninklijke Philips N.V.

11 Appendix (Page No. - 166)

11.1 Insights of Industry Experts

11.2 Discussion Guide

11.3 Other Developments

11.4 Knowledge Store: Marketsandmarkets’ Subscription Portal

11.5 Introducing RT: Real-Time Market Intelligence

11.6 Available Customizations

11.7 Related Reports

11.8 Author Details

List of Tables (172 Tables)

Table 1 Number of Dental Clinics in the U.S. (2008 vs 2010 vs 2012)

Table 2 Number of Dentists Worldwide, 2011 vs 2012

Table 3 Number of Private Dental Practitioners

Table 4 Growing Number of Small/Private Dental Clinics to Drive Market Growth During the Forecast Period

Table 5 Number of Large Dental Clinics in the U.S., 2008 vs 2012

Table 6 Increasing Number of Large/Group Dental Practices May Hinder the Growth of the Professional Dental Care Market

Table 7 Low Penetration of Oral Care Services in Rural Areas Offers Significant Growth Opportunities for Players in the Market

Table 8 Regulatory Restrictions, A Challenge for Market Players

Table 9 Global Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 10 Global Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 11 Global Toothpastes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 12 Major Brands of Toothpastes

Table 13 Global Pastes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 14 Global Gels Market Size, By Country/Region, 2014–2021 (USD Million)

Table 15 Global Polishes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 16 Global Powders Market Size, By Country/Region, 2014–2021 (USD Million)

Table 17 Global Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 18 Global Toothbrushes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 19 Global Manual Toothbrushes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 20 Global Electric Toothbrushes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 21 Global Battery-Powered Toothbrushes Market Size, By Country/Region, 2014–2021 (USD Million)

Table 22 Global Toothbrush Heads Market Size, By Country/Region, 2014–2021 (USD Million)

Table 23 Global Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 24 Global Mouthwashes/Rinses Market Size, By Country/Region, 2014–2021 (USD Million)

Table 25 Global Non-Medicated Mouthwashes/Rinses Market Size, By Country/Region, 2014–2021 (USD Million)

Table 26 Global Medicated Mouthwashes/Rinses Market Size, By Country/Region, 2014–2021 (USD Million)

Table 27 Global Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 28 Global Dental Accessories/Ancillaries Market Size, By Country/Region, 2014–2021 (USD Million)

Table 29 Global Dental Cosmetic Whitening Products Market Size, By Country/Region, 2014–2021 (USD Million)

Table 30 Global Breath Fresheners Market Size, By Country/Region, 2014–2021 (USD Million)

Table 31 Global Dental Flosses Market Size, By Country/Region, 2014–2021 (USD Million)

Table 32 Global Dental Water Jets Market Size, By Country/Region, 2014–2021 (USD Million)

Table 33 Global Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 34 Global Denture Products Market Size, By Country/Region, 2014–2021 (USD Million)

Table 35 Global Denture Cleansers Market Size, By Country/Region, 2014–2021 (USD Million)

Table 36 Global Denture Fixatives Market Size, By Country/Region, 2014–2021 (USD Million)

Table 37 Global Other Denture Products Market Size, By Country/Region, 2014–2021 (USD Million)

Table 38 Global Other Professional Dental Care Products Market Size , By Country/Region, 2014–2021 (USD Million)

Table 39 Global Professional Dental Care Market Size, By Region, 2014–2021 (USD Million)

Table 40 North America: Professional Dental Care Market Size, By Country, 2014–2021 (USD Million)

Table 41 North America: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 42 North America: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 43 North America: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 44 North America: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 45 North America: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 46 North America: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 47 Growing Number of Dental Practices to Drive the Professional Dental Care Market in the U.S.

Table 48 U.S.: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 49 U.S.: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 50 U.S.: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 51 U.S.: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 52 U.S.: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 53 U.S.: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 54 Licensed Dentists in Canada, By Province, 2000-2013

Table 55 Canada: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 56 Canada: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 57 Canada: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 58 Canada: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 59 Canada: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 60 Canada: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 61 Europe: Spending on Oral Healthcare Services (Eur Billion)

Table 62 Europe: Professional Dental Care Market Size, By Country, 2014–2021 (USD Million)

Table 63 Europe: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 64 Europe: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 65 Europe: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 66 Europe: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 67 Europe: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 68 Europe: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 69 Germany: Number of Dental Professionals, 2007/2008 vs 2012/2013

Table 70 Germany: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 71 Germany: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 72 Germany: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 73 Germany: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 74 Germany: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 75 Germany: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 76 Italy: Number of Dental Professionals

Table 77 Italy: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 78 Italy: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 79 Italy: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 80 Italy: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 81 Italy: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 82 Italy: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 83 France: Number of Dental Practitioners

Table 84 France: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 85 France: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 86 France: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 87 France: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 88 France: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 89 France: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 90 U.K.: Number of Dental Professionals

Table 91 U.K.: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 92 U.K.: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 93 U.K.: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 94 U.K.: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 95 U.K.: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 96 U.K.: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 97 Spain: Number of Dental Professionals

Table 98 Spain: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 99 Spain: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 100 Spain: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 101 Spain: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 102 Spain: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 103 Spain: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 104 RoE: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 105 RoE: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 106 RoE: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 107 RoE: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 108 RoE: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 109 RoE: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 110 Asia-Pacific: Professional Dental Care Market Size, By Country, 2014–2021 (USD Million)

Table 111 Asia-Pacific: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 112 Asia-Pacific: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 113 Asia-Pacific: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 114 Asia-Pacific: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 115 Asia-Pacific: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 116 Asia-Pacific: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 117 China: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 118 China: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 119 China: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 120 China: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 121 China: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 122 China: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 123 Japan: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 124 Japan: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 125 Japan: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 126 Japan: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 127 Japan: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 128 Japan: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 129 India: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 130 India: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 131 India: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 132 India: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 133 India: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 134 India: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 135 Australia: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 136 Australia: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 137 Australia: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 138 Australia: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 139 Australia: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 140 Australia: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 141 RoAPAC: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 142 RoAPAC: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 143 RoAPAC: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 144 RoAPAC: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 145 RoAPAC: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 146 RoAPAC: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 147 RoW: Professional Dental Care Market Size, By Region, 2014–2021 (USD Million)

Table 148 RoW: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 149 RoW: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 150 RoW: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 151 RoW: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 152 RoW: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 153 RoW: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 154 Latin America: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 155 Latin America: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 156 Latin America: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 157 Latin America: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 158 Latin America: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 159 Latin America: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 160 Middle East and Africa: Professional Dental Care Market Size, By Type, 2014–2021 (USD Million)

Table 161 Middle East and Africa: Toothpastes Market Size, By Type, 2014–2021 (USD Million)

Table 162 Middle East and Africa: Toothbrushes Market Size, By Type, 2014–2021 (USD Million)

Table 163 Middle East and Africa: Mouthwashes/Rinses Market Size, By Type, 2014–2021 (USD Million)

Table 164 Middle East and Africa: Denture Products Market Size, By Type, 2014–2021 (USD Million)

Table 165 Middle East and Africa: Dental Accessories/Ancillaries Market Size, By Type, 2014–2021 (USD Million)

Table 166 Growth Strategy Matrix, 2013–2016

Table 167 Recent Developments in Dental Dispensing Products Market

Table 168 Recent Developments in Dental Dispensing Products Market

Table 169 Recent Developments in Professional Dental Care Market

Table 170 Recent Developments in Professional Dental Care Market

Table 171 Recent Developments in Dental Dispensing Products Market

Table 172 Major Players Competing in the Dental Dispensing Products Market

List of Figures (26 Figures)

Figure 1 Dental Care Products: Distribution Channel

Figure 2 Research Design

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Bottom-Up Approach

Figure 5 Top-Down Approach

Figure 6 Data Triangulation Methodology

Figure 7 Global Professional Dental Care Market Size, By Type, 2016 vs 2021 (USD Million)

Figure 8 Geographic Snapshot: Global Dental Dispensing Products Market

Figure 9 Product Launches—The Major Growth Strategy Adopted By Top Players

Figure 10 Low Penetration of Oral Care Services in Rural Areas Provide Growth Opportunities for the Professional Dental Care Market

Figure 11 Toothpastes Segment to Dominate the Dental Dispensing Products Market During the Forecast Period

Figure 12 U.S. Dominated the Professional Dental Care Market in 2015

Figure 13 Asia-Pacific to Register the Highest Growth Rate During the Forecast Period

Figure 14 Developing Countries to Register Higher Growth in the Forecast Period

Figure 15 Professional Dental Care Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Geographic Snapshot (2015): the U.S. Accounted for the Largest Share of the Dental Dispensing Products Market

Figure 17 Europe: Professional Dental Care Market Snapshot

Figure 18 APAC: Professional Dental Care Market Snapshot

Figure 19 Key Developments Registered in the Dental Dispensing Products Market Between 2013 & 2016

Figure 20 Battle for Market Share: Product Launches Accounted for the Largest Share of the Total Developments Pursued By the Top Market Players Between 2013 & 2016

Figure 21 Colgate-Palmolive Company: Company Snapshot (2015)

Figure 22 The Procter & Gamble Company: Company Snapshot (2015)

Figure 23 Unilever PLC: Company Snapshot (2015)

Figure 24 Glaxosmithkline PLC: Company Snapshot (2015)

Figure 25 Koninklijke Philips N.V.: Company Snapshot (2015)

Figure 26 3M Company: Company Snapshot (2015)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Professional Dental Care Market