Product Information Management (PIM) Market by Component, Solution (Multi-domain, and Single Domain), Deployment Type, Organization Size, Vertical (Consumer Goods & retail, IT & Telecom, and Media & Entertainment) and Region - Global Forecast to 2027

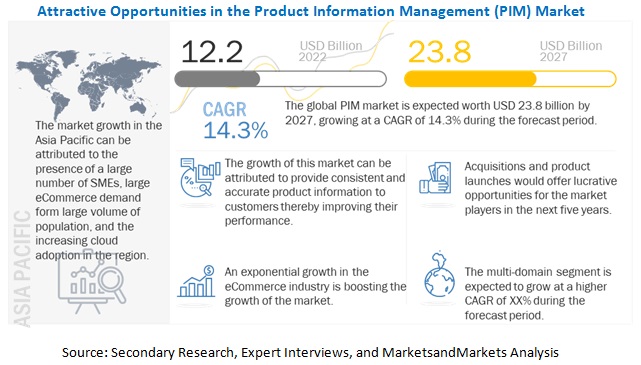

The global Product information management market size to grow from USD 12.2 billion in 2022 to USD 23.8 billion by 2027, at a Compound Annual Growth Rate (CAGR) of 14.3% during the forecast period. The major growing factor of PIM market is an increase in investment of advanced technologies. The need to boost team productivity, manage product data, data syndication, and thriving eCommerce industry are the major factors that are propelling the growth of PIM market caross all regions.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact

COVID-19 had positive impact on the growth of product information management market, COVID-19 led to restriction on physical contact across all the region. The governments across various countries including France, India, Iran, China, US, UK, and others imposed locdown in order to prevent the spread of COVID-19, which boosted the adoption of PIM across businesses and organizations around the world to maintain productivity and data syndication across various channels. During the lockdown the eCommerce sale increased rapidly in order to prevent physical contact, which boosted the adoption of PIM across consumer goods & retail industry. PIM helped retailers to manage product information effectively and implement multi-channel marketing strategy.

Market Dynamics

Driver: Focus on attaining seamless omnichannel syndication

Omnichannel syndication does not mean simultaneous use of channels; rather, it is the integration of all available channels within a firm. Seamless omnichannel syndication is gaining traction across retail and manufacturing industries to offer customers the ability to shop and interact with businesses when and where it is most convenient for them. Omnichannel shoppers spend more on each transaction, generate more overall profit, and are more valuable over their lifetime than single-channel shoppers; therefore, organizations are opting for omnichannel syndication. However, the lack of accurate product information across multiple channels is affecting businesses. PIM can collaborate with product syndication systems such as Productsup to ensure that product information is available for omnichannel across all channels. It is also projected to boost market growth during the forecast period.

Restraint: Misapprehensions related to data security and privacy risks

PIM involves data collection and transmission from one channel to another. The synchronization and publishing of the data across channels are also involved with the PIM system. Due to the lack of proper knowledge about security frameworks and their implementation, many companies generally have the perception that PIM solutions might lead to data breaches in their highly abstracted data sets. Hence, companies prefer vendors that can customize their existing systems to manage their product information and withstand the competition. Similarly, a few SMEs still want to adopt cloud-based Product information management solutions withdrew their decision due to privacy concerns associated with the cloud. For instance, in October 2020, Pfizer suffered a data breach because of email addresses, home addresses, full names, and other Health Insurance Portability and Accountability Act (HIPAA)-related information from unsecured cloud storage. Another major reason is that the company was reluctant to adopt a cloud-based solution due to system integration complexities

Opportunity: Rising investments in automation to enable quicker decisions

With the ever-rising competition and business growth, companies across the globe are looking to automate their business operations, processes, equipment, types of machinery, and data management. Automation helps in saving time and human intervention. It also helps reduce the number of recurring manual tasks, minimize costs, and increase efficiencies. Thus, companies across various industries are implementing and adopting technologies and solutions that can help them achieve automation and save time. In the retail industry, a company has to deal with various kinds of products and related data, such as Stock-Keeping Unit (SKU), images, video, documentation, and others, manually managing this data and uploading it to a spreadsheet, PDF, or website which gets time-consuming. Product information management solutions automate the data curation and syndication process while eliminating data-related inconsistencies. Similarly, PIM solutions provide data to all digital platforms by reducing both time and errors and easily testing product data for errors and consistency. Owing to this, companies are looking to eliminate time-consuming tasks associated with PIM. Such factors will likely create huge opportunities for PIM solution providers during the forecast period.

Challenge: Complex data governance and system integration

Though PIM offers various benefits, such as managing and distributing data across all platforms, business organizations face several issues while integrating PIM solutions with the existing IT platforms. The solution offered by vendors may not be compatible with the existing setup of an organization due to data inconsistencies or poor management of files. Further, companies across various verticals are required to establish a proper governance policy that ensures consistency across product catalogs for achieving standardized data. Governance policies of companies must be designed to accommodate new changes and requirements and accommodate the new PIM system. Though few of the existing vendors in the market offer solutions that enable companies to amend the government regulations and guidelines, with the changing technologies, government norms and regulations must also adapt to a customized solution, making PIM adoption more challenging.

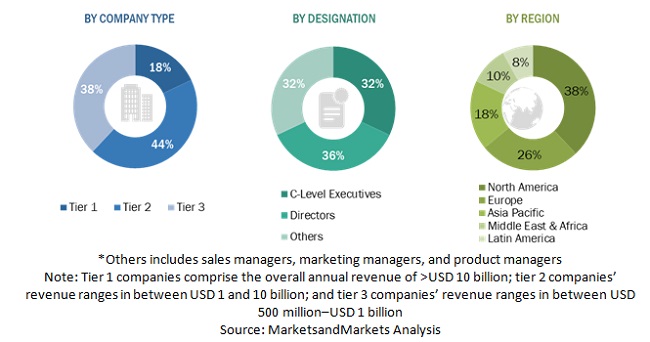

North America to account for largest market size during the forecast period

The geographic analysis of the product information management market is segmented into regions, including North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. In 2022, North America has captured majority of the share of PIM market, as the US and Canada are rapidly adopting PIM solutions in order to centralize product information, manage product attributes, and push product information easily across multiple channels. Moreover, the region has the presence of top vendors, including IBM, Oracle, Informatica, Salsify, Aprimo, and others.

To know about the assumptions considered for the study, download the pdf brochure

As per enterprise size, large enterprises segment to hold largest market size during the forecast period

The PIM market by organization size is sub segmented into SMEs and large enterprises. As per organization size, large enterprises segment to hold largest market size during the forecast period. The adoption rate of PIMs across large enterprises is comparatively higher than in SMEs. Large enteprises have high budgets compared to SMEs and large enteprises heavily invest in advanced technologies is one of the prime factor for higher adoption of PIM across large enterprises. PIMs offer solutions to manage massive customer data generated across firms. Factors driving the adoption of PIM solutions are low cost, easy installation, and the higher adoption rate of newer technologies. This is expected to grow even more during the forecast period.

Product Information Management Companies

The product information management solutions vendors have implemented various types of organic as well as inorganic growth strategies, such as new product launches, product upgradations, partnerships and agreements, business expansions, and mergers and acquisitions to strengthen their offerings in the market. Some of the major PIM market vendors are Oracle (US), SAP (US), IBM (US), Informatica (US), Pimcore (Austria), Akeneo (France), inriver (Sweden), Winshuttle (US), Riversand (US), Salsify (US), Aprimo (US), Stibo Systems (Denmark), Contentserv (Switzerland), Mobius (India), Perfion (Denmark), Profisee (US), Censhare (Germany), Vinculum (India), PIMworks (US), Truecommerce (US), Vimedici (Germany), Magnitude Software (US), Plytix (Denmark), and Syndigo (US).

Scope of the Report

|

Report Metrics |

Details |

|

Market size available for years |

2017–2027 |

|

Base year considered |

2022 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million (USD) |

|

Segments covered |

Component, Organization Size, Deployment Type, Verticals and Regions |

|

Geographies covered |

North America, Europe, APAC, Middle East & Agrica, and Latin America |

|

List of Companies in Product Information Management |

Oracle (US), SAP (US), IBM (US), Informatica (US), Pimcore (Austria), Akeneo (France), inriver (Sweden), Winshuttle (US), Riversand (US), Salsify (US), Aprimo (US), Stibo Systems (Denmark), Contentserv (Switzerland), Mobius (India), Perfion (Denmark), Profisee (US), Censhare (Germany), Vinculum (India), PIMworks (US), Truecommerce (US), Vimedici (Germany), Magnitude Software (US), Plytix (Denmark), and Syndigo (US). |

This research report categorizes the PIM market based on Component, Orgaization Size, Deployment Type, Verticals and Regions.

By Component:

-

Solutions

- Multi-Domain

- Single Domain

-

Services

- Consulting and Implementation

- Training, Support and Maintenance

By Organization Size:

- Large Enterprises

- SMEs

By Deployment Type:

- On-premises

- Cloud

By Verticals:

- Banking, Financial Services, and Insurance

- Consumer goods & retail

- Manufacturing

- IT & telecom

- Transportation & logistics

- Media & entertainment

- Other verticals (include education, and travel& hospitality)

By Region:

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Australia and New Zealand

- Rest of Asia Pacific

-

Middle East & Africa

- Kingdom of Saudi Arabia

- UAE

- South Africa

- Rest of Middle East & Africa

-

Latin America

- Brazil

- Mexico

- Argentina

- Rest of Latin America

Recent Developments:

- In May 2022, Pimcore introduced a new version of its Pimcore 10.4, with significant importance on User Experience (UX), security, API improvements, and performance optimizations. With the new version, organizations can preview data or product information from any device, such as mobile, desktop, and tablet devices

- In March 2022, Akeneo announced at its annual conference, Unlock 2022, the launch of the Akeneo App Store as a part of new product features and benefits debuting in its Spring 2022 Release. As a part of this latest collection of SaaS updates, the company also announced new capabilities and enhancements to Akeneo PXM Studio, including a sneak preview of a powerful new Tailored Imports feature, improvements to its Shared Catalogs and Onboarder products, and the launch of its latest Community Edition and managed services version

- In July 2021, Pimcore introduced Pimcore X, a data importer. It connects Pimcore to clients' digital applications and enables them to access, import, and update data managed within Pimcore with many technologies and protocols, such as REST or GraphQL

- In June 2020, Oracle released the implementation guide for Oracle Product Information Management version 12.1. This new version enables users to efficiently define responsibilities, users, suppliers, and customers; set up item catalogs and categories and item templates; manage item statuses; change policies for item catalogs; define new item requests; manage display formats; and define report templates. It also enables users to create user-defined attributes and functions; administer item business rules; create change categories, types, item structures, repositories, content, and management of eBusiness suite attachments; set up inbound product data and global data synchronization; and implement roles and role-based security

- In August 2019, SAP launched its Product Content Hub, which is a cloud-based PIM solution. Its capabilities include product data management, product data model management, users and workflows, and data feed management. This new product offers master product data for customer-facing systems, including the SAP Commerce Cloud Solution, and its user interface enables business users to effectively create and manage high-quality product data across marketing channels

Frequently Asked Questions (FAQ):

What is PIM?

According to Akeneo, the PIM solution provides a single place for collecting, managing, and enriching product information, creating a product catalog and distributing it to sales and eCommerce channels, and creating and delivering compelling product experiences in a faster and easier way.

According to Sales Layer, the process of managing and enhancing product information and all related digital assets (product images, videos, personalization renderings, product catalog categorization, and more) is referred to as PIM. This process aims to successfully sell the products across omnichannel and multichannel touchpoints while delivering an engaging shopping experience. Product information managed using a PIM solution centralizes data collection and handling. Creating, updating, or publishing data once in PIM would reflect the changes automatically across all connected marketplaces.

Which regions are early adopter of PIM solutions?

North America and Europe are at the initial stage towards adoption of PIM solutions.

Which are key verticals adopting PIM solutions?

Key verticals adopting PIM solutions include BFSI, consumer goods & retail, manufacturing, IT & telecom, media & entertainment, healthcare & life sciences, transportation & logistics, and other verticals. Other verticals include education and travel & hospitality.

Which are the key vendors exploring PIM space?

The key vendors exploring PIM includes Oracle (US), SAP (US), IBM (US), Informatica (US), Pimcore (Austria), Akeneo (France), inriver (Sweden), Winshuttle (US), Riversand (US), Salsify (US), Aprimo (US), Stibo Systems (Denmark), Contentserv (Switzerland), Mobius (India), Perfion (Denmark), Profisee (US), Censhare (Germany), Vinculum (India), PIMworks (US), Truecommerce (US), Vimedici (Germany), Magnitude Software (US), Plytix (Denmark), and Syndigo (US). .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 24)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 MARKET SEGMENTATION

1.3.2 REGIONS COVERED

1.3.3 YEARS CONSIDERED

1.4 CURRENCY CONSIDERED

TABLE 1 UNITED STATES DOLLAR EXCHANGE RATE, 2018–2021

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 29)

2.1 RESEARCH DATA

FIGURE 1 PRODUCT INFORMATION MANAGEMENT MARKET: RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Secondary sources

2.1.2 PRIMARY DATA

TABLE 2 PRIMARY INTERVIEWS

2.1.2.1 Key industry insights

2.1.2.2 Breakup of primary profiles

2.2 MARKET BREAKUP AND DATA TRIANGULATION

2.3 MARKET SIZE ESTIMATION

FIGURE 2 PRODUCT INFORMATION MANAGEMENT MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

2.3.1 TOP-DOWN APPROACH

FIGURE 3 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING PRODUCT INFORMATION MANAGEMENT SOLUTIONS AND SERVICES (1/2)

FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY—APPROACH 1 (TOP-DOWN): REVENUE OF VENDORS OFFERING PRODUCT INFORMATION MANAGEMENT SYSTEM SOLUTIONS AND SERVICES (2/2)

FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY – (SUPPLY SIDE): CAGR PROJECTIONS FROM SUPPLY SIDE

2.3.2 BOTTOM-UP APPROACH

FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2, BOTTOM-UP (SUPPLY SIDE): COLLECTIVE REVENUE FROM ALL SOLUTIONS/SERVICES OF PRODUCT INFORMATION MANAGEMENT MARKET

FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY - BOTTOM-UP (DEMAND-SIDE): SHARE OF COMPONENTS THROUGH OVERALL PRODUCT INFORMATION MANAGEMENT SPENDING

2.4 MARKET REVENUE ESTIMATION

FIGURE 8 ILLUSTRATION OF COMPANY PRODUCT INFORMATION MANAGEMENT REVENUE ESTIMATION

2.5 MARKET FORECAST

TABLE 3 FACTOR ANALYSIS

2.6 ASSUMPTIONS

2.7 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 42)

FIGURE 9 PRODUCT INFORMATION MANAGEMENT MARKET: GLOBAL SNAPSHOT

FIGURE 10 TOP GROWING SEGMENTS IN MARKET

FIGURE 11 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 12 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 13 CLOUD SEGMENT TO HOLD LARGER MARKET SIZE DURING FORECAST PERIOD

FIGURE 14 TOP VERTICALS IN MARKET (USD MILLION)

FIGURE 15 NORTH AMERICA TO HOLD LARGEST MARKET SIZE DURING FORECAST PERIOD

4 PREMIUM INSIGHTS (Page No. - 48)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN PRODUCT INFORMATION MANAGEMENT MARKET

FIGURE 16 DRASTIC GEOGRAPHIC CHANGE AND TECHNOLOGICAL EVOLUTION TO DRIVE PRODUCT INFORMATION MANAGEMENT GROWTH

4.2 MARKET, BY COMPONENT (2022 VS. 2027)

FIGURE 17 SOLUTIONS SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.3 MARKET, BY ORGANIZATION SIZE (2022 VS. 2027)

FIGURE 18 LARGE ENTERPRISES SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.4 MARKET, BY DEPLOYMENT TYPE (2022 VS. 2027)

FIGURE 19 CLOUD SEGMENT TO HOLD LARGER MARKET SHARE DURING FORECAST PERIOD

4.5 MARKET, BY VERTICAL (2021 VS. 2027)

FIGURE 20 CONSUMER GOODS & RETAIL VERTICAL SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

4.6 MARKET INVESTMENT SCENARIO

FIGURE 21 ASIA PACIFIC TO EMERGE AS BEST MARKET FOR INVESTMENTS IN NEXT FIVE YEARS

5 MARKET OVERVIEW AND INDUSTRY TRENDS (Page No. - 51)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: PRODUCT INFORMATION MANAGEMENT MARKET

5.2.1 DRIVERS

5.2.1.1 Rising demand for PIM solutions from flourishing eCommerce industry

FIGURE 23 GLOBAL RETAIL ECOMMERCE SALES IN TRILLION

5.2.1.2 Increasing need to offer enhanced customer services

5.2.1.3 Focus on attaining seamless omnichannel syndication

5.2.2 RESTRAINTS

5.2.2.1 Misapprehensions related to data security and privacy risks

FIGURE 24 SECURITY ISSUES FACED BY ORGANIZATIONS

5.2.3 OPPORTUNITIES

5.2.3.1 Incorporation of AI and ML capabilities to improve information management and customer experience

FIGURE 25 BENEFITS OFFERED BY ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING-ENABLED PIM SOLUTIONS

5.2.3.2 Rising investments in automation to enable quicker decisions

5.2.4 CHALLENGES

5.2.4.1 Varied data and government regulations across industries and regions

5.2.4.2 Complex data governance and system integration

5.3 CASE STUDY ANALYSIS

5.3.1 CASE STUDY 1: EVA SOLO DEPLOYED PLYTIX PIM SOLUTION TO MANAGE PRODUCT INFORMATION ACROSS ALL CHANNELS

5.3.2 CASE STUDY 2: BACHOFEN AG IMPLEMENTED PERFION PIM FOR CENTRAL ADMINISTRATION AND PRODUCT INFORMATION MANAGEMENT

5.3.3 CASE STUDY 3: GANT USED PIMCORE’S SOLUTION TO REDUCE MANUAL WORK

5.3.4 CASE STUDY 4: TARKETT IMPLEMENTED AKENEO SOLUTION TO STANDARDIZE DATA MODEL

5.3.5 CASE STUDY 5: SHURTECH DEPLOYED SALSIFY’S SOLUTION TO MANAGE PRODUCT INFORMATION ACROSS CHANNELS

5.4 MARKET: COVID-19 IMPACT

5.4.1 DRIVERS AND OPPORTUNITIES

5.4.2 RESTRAINTS AND CHALLENGES

6 PRODUCT INFORMATION MANAGEMENT MARKET, BY COMPONENT (Page No. - 61)

6.1 INTRODUCTION

6.1.1 COMPONENTS: MARKET DRIVERS

6.1.2 COMPONENTS: COVID-19 IMPACT

FIGURE 26 SERVICES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 4 MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 5 MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

6.2 SOLUTIONS

FIGURE 27 MULTI-DOMAIN SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 6 MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 7 MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

6.2.1 MULTI-DOMAIN SOLUTIONS

6.2.1.1 Growing need to achieve unified governance and avoid redundant costs to drive growth of multi-domain PIM solutions

TABLE 8 MULTI-DOMAIN: PRODUCT INFORMATION MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 9 MULTI-DOMAIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.2.2 SINGLE DOMAIN SOLUTIONS

6.2.2.1 Growing demand to meet industry-specific compliance standards to drive growth of single-domain PIM solutions

TABLE 10 SINGLE DOMAIN: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 11 SINGLE DOMAIN: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3 SERVICES

FIGURE 28 TRAINING, SUPPORT & MAINTENANCE SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 12 MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 13 MARKET, BY SERVICE, 022–2027 (USD MILLION)

6.3.1 CONSULTING & IMPLEMENTATION

6.3.1.1 Need to identify right solutions and achieve hassle-free software deployment to drive consulting & implementation services’ growth

TABLE 14 CONSULTING & IMPLEMENTATION: PRODUCT INFORMATION MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 15 CONSULTING & IMPLEMENTATION: MARKET, BY REGION, 2022–2027 (USD MILLION)

6.3.2 TRAINING, SUPPORT & MAINTENANCE

6.3.2.1 Need to reduce resource wastage and resolve critical business issues to boost these services’ demand

TABLE 16 TRAINING, SUPPORT & MAINTENANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 17 TRAINING, SUPPORT & MAINTENANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

7 PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE (Page No. - 71)

7.1 INTRODUCTION

7.1.1 DEPLOYMENT TYPES: MARKET DRIVERS

7.1.2 DEPLOYMENT TYPES: COVID-19 IMPACT

FIGURE 29 CLOUD SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 18 MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 19 MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

7.2 ON-PREMISES

7.2.1 DATA SECURITY AND PRIVACY CONCERNS AMONG ORGANIZATIONS TO BOOST ADOPTION OF ON-PREMISES DEPLOYMENT TYPE

TABLE 20 ON-PREMISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 21 ON-PREMISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

7.3 CLOUD

7.3.1 ORGANIZATIONS WITH FOCUS ON SCALABILITY AND COST-EFFECTIVENESS TO CHOOSE CLOUD DEPLOYMENT TYPE

TABLE 22 CLOUD: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 23 CLOUD: MARKET, BY REGION, 2022–2027 (USD MILLION)

8 PRODUCT INFORMATION MANAGEMENT MARKET, BY ORGANIZATION SIZE (Page No. - 76)

8.1 INTRODUCTION

8.1.1 ORGANIZATION SIZES: MARKET DRIVERS

8.1.2 ORGANIZATION SIZES: COVID-19 IMPACT

FIGURE 30 SMALL AND MEDIUM-SIZED ENTERPRISES SEGMENT TO GROW AT HIGHER CAGR DURING FORECAST PERIOD

TABLE 24 MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 25 MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

8.2 LARGE ENTERPRISES

8.2.1 ECONOMIES OF SCALE AND EXTENSIVE PRODUCT PORTFOLIO TO DRIVE PRODUCT INFORMATION MANAGEMENT SOLUTIONS’ ADOPTION

TABLE 26 LARGE ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 27 LARGE ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

8.3 SMALL AND MEDIUM-SIZED ENTERPRISES

8.3.1 ORGANIZATIONS’ DEMAND FOR FLEXIBLE PRICING MODELS TO BOOST CLOUD-BASED PRODUCT INFORMATION MANAGEMENT SOLUTIONS’ GROWTH

TABLE 28 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 29 SMALL AND MEDIUM-SIZED ENTERPRISES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9 PRODUCT INFORMATION MANAGEMENT MARKET, BY VERTICAL (Page No. - 81)

9.1 INTRODUCTION

9.1.1 VERTICALS: MARKET DRIVERS

9.1.2 VERTICALS: COVID-19 IMPACT

FIGURE 31 CONSUMER GOODS & RETAIL SEGMENT TO GROW AT LARGEST MARKET SIZE DURING FORECAST PERIOD

TABLE 30 MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 31 MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

9.2 BANKING, FINANCIAL SERVICES, & INSURANCE

9.2.1 NEED TO MAINTAIN TRUST AND CONFIDENCE TO DRIVE GROWTH OF PRODUCT INFORMATION MANAGEMENT SOLUTIONS

TABLE 32 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 33 BANKING, FINANCIAL SERVICES, AND INSURANCE: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.3 CONSUMER GOODS & RETAIL

9.3.1 NEED TO ENHANCE CUSTOMER EXPERIENCES AND PRODUCT DATA SYNDICATION TO DRIVE ADOPTION OF PRODUCT INFORMATION MANAGEMENT SOLUTIONS

TABLE 34 CONSUMER GOODS & RETAIL: PRODUCT INFORMATION MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 35 CONSUMER GOODS & RETAIL: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.4 MANUFACTURING

9.4.1 NEED TO ENHANCE COMMUNICATION THROUGH BETTER PRODUCT VISIBILITY TO BOOST MARKET GROWTH

TABLE 36 MANUFACTURING: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 37 MANUFACTURING: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.5 IT & TELECOM

9.5.1 NEED FOR VAST AND COMPLEX PRODUCT PORTFOLIO TO BOOST PRODUCT INFORMATION MANAGEMENT SOLUTIONS’ ADOPTION

TABLE 38 IT & TELECOM: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 39 IT & TELECOM: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.6 MEDIA & ENTERTAINMENT

9.6.1 DIGITAL DATA MANAGEMENT CAPABILITIES OF PRODUCT INFORMATION MANAGEMENT SOLUTIONS TO DRIVE ITS ADOPTION

TABLE 40 MEDIA & ENTERTAINMENT: PRODUCT INFORMATION MANAGEMENT MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 41 MEDIA & ENTERTAINMENT: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.7 HEALTHCARE & LIFE SCIENCES

9.7.1 NEED TO ADHERE TO CHANGING INDUSTRY AND REGIONAL REGULATIONS TO DRIVE PRODUCT INFORMATION MANAGEMENT SOLUTIONS’ DEMAND

TABLE 42 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 43 HEALTHCARE & LIFE SCIENCES: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.8 TRANSPORTATION & LOGISTICS

9.8.1 FOCUS ON AUTOMATING WORKFLOW PROCESSES AND OPTIMIZING SUPPLY CHAIN TO BOOST PRODUCT INFORMATION MANAGEMENT SOLUTIONS’ ADOPTION

TABLE 44 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 45 TRANSPORTATION & LOGISTICS: MARKET, BY REGION, 2022–2027 (USD MILLION)

9.9 OTHER VERTICALS

TABLE 46 OTHER VERTICALS: MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 47 OTHER VERTICALS: MARKET, BY REGION, 2022–2027 (USD MILLION)

10 PRODUCT INFORMATION MANAGEMENT MARKET, BY REGION (Page No. - 93)

10.1 INTRODUCTION

FIGURE 32 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 48 MARKET, BY REGION, 2017–2021 (USD MILLION)

TABLE 49 MARKET, BY REGION, 2022–2027 (USD MILLION)

10.2 NORTH AMERICA

10.2.1 NORTH AMERICA: MARKET DRIVERS

10.2.2 NORTH AMERICA: COVID-19 IMPACT

10.2.3 NORTH AMERICA: REGULATORY LANDSCAPE

FIGURE 33 NORTH AMERICA: MARKET SNAPSHOT

TABLE 50 NORTH AMERICA: PRODUCT INFORMATION MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 51 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 52 NORTH AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 53 NORTH AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 54 NORTH AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 55 NORTH AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 56 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 57 NORTH AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 58 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 59 NORTH AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 61 NORTH AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 62 NORTH AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 63 NORTH AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.2.4 UNITED STATES

10.2.4.1 Need to achieve faster TTM while complying with various regulatory requirements to drive PIM solutions’ adoption

TABLE 64 UNITED STATES: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 65 UNITED STATES: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 66 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 67 UNITED STATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.2.5 CANADA

10.2.5.1 Rising adoption of cloud-based technologies and data compliance practices to boost growth of PIM market in Canada

TABLE 68 CANADA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 69 CANADA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 70 CANADA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 71 CANADA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3 EUROPE

10.3.1 EUROPE: MARKET DRIVERS

10.3.2 EUROPE: COVID-19 IMPACT

10.3.3 EUROPE: REGULATORY LANDSCAPE

TABLE 72 EUROPE: PRODUCT INFORMATION MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 73 EUROPE: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 74 EUROPE: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 75 EUROPE: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 76 EUROPE: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 77 EUROPE: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 78 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 79 EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 80 EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 81 EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 82 EUROPE: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 83 EUROPE: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 84 EUROPE: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 85 EUROPE: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.3.4 UNITED KINGDOM

10.3.4.1 Rising technology adoption and demand for robust solutions to improve customer experience to drive PIM solutions’ adoption

TABLE 86 UNITED KINGDOM: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 87 UNITED KINGDOM: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 88 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 89 UNITED KINGDOM: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.5 GERMANY

10.3.5.1 High adoption of robust solutions across manufacturing industry to manage products to fuel demand for PIM solutions in Germany

TABLE 90 GERMANY: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 91 GERMANY: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 92 GERMANY: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 93 GERMANY: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.6 FRANCE

10.3.6.1 Various favorable investments in AI technologies to lead to enhanced adoption of PIM solutions in France

TABLE 94 FRANCE: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 95 FRANCE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 96 FRANCE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 97 FRANCE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.3.7 REST OF EUROPE

TABLE 98 REST OF EUROPE: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 99 REST OF EUROPE: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 100 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 101 REST OF EUROPE: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4 ASIA PACIFIC

10.4.1 ASIA PACIFIC: MARKET DRIVERS

10.4.2 ASIA PACIFIC: COVID-19 IMPACT

10.4.3 ASIA PACIFIC: REGULATORY LANDSCAPE

FIGURE 34 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 102 ASIA PACIFIC: PRODUCT INFORMATION MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 103 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 104 ASIA PACIFIC: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 105 ASIA PACIFIC: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 106 ASIA PACIFIC: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 107 ASIA PACIFIC: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 108 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 109 ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 110 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 111 ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 112 ASIA PACIFIC: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 113 ASIA PACIFIC: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 114 ASIA PACIFIC: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 115 ASIA PACIFIC: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.4.4 CHINA

10.4.4.1 Imminent need for standardizing product information to boost growth of PIM market

TABLE 116 CHINA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 117 CHINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 118 CHINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 119 CHINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.5 INDIA

10.4.5.1 Increasing number of startups and growing government investments in analytics to drive adoption of PIM

TABLE 120 INDIA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 121 INDIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 122 INDIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 123 INDIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.6 JAPAN

10.4.6.1 High-income economy and rising technology assimilation to boost growth of product information management solutions

TABLE 124 JAPAN: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 125 JAPAN: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 126 JAPAN: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 127 JAPAN: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.4.7 REST OF ASIA PACIFIC

TABLE 128 REST OF ASIA PACIFIC: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 129 REST OF ASIA PACIFIC: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 130 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 131 REST OF ASIA PACIFIC: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5 MIDDLE EAST & AFRICA

10.5.1 MIDDLE EAST & AFRICA: PRODUCT INFORMATION MANAGEMENT MARKET DRIVERS

10.5.2 MIDDLE EAST & AFRICA: COVID-19 IMPACT

TABLE 132 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 133 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 134 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 135 MIDDLE EAST & AFRICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 136 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 137 MIDDLE EAST & AFRICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 138 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 139 MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 140 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 141 MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 142 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 143 MIDDLE EAST & AFRICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 144 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 145 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.5.3 UNITED ARAB EMIRATES

10.5.3.1 Due to increasing trend toward digitalization, marketers operating in UAE to adopt PIM solutions

TABLE 146 UNITED ARAB EMIRATES: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 147 UNITED ARAB EMIRATES: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 148 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 149 UNITED ARAB EMIRATES: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.4 KINGDOM OF SAUDI ARABIA

10.5.4.1 Increasing focus on digital transformation to boost market growth in Kingdom of Saudi Arabia

TABLE 150 KINGDOM OF SAUDI ARABIA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 151 KINGDOM OF SAUDI ARABIA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 152 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 153 KINGDOM OF SAUDI ARABIA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.5 SOUTH AFRICA

10.5.5.1 Increase in purchasing power and influx of cloud services to fuel growth of PIM market in South Africa

TABLE 154 SOUTH AFRICA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 155 SOUTH AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 156 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 157 SOUTH AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.5.6 REST OF MIDDLE EAST & AFRICA

TABLE 158 REST OF MIDDLE EAST & AFRICA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 159 REST OF MIDDLE EAST & AFRICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 160 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 161 REST OF MIDDLE EAST & AFRICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6 LATIN AMERICA

10.6.1 LATIN AMERICA: MARKET DRIVERS

10.6.2 LATIN AMERICA: COVID-19 IMPACT

10.6.3 LATIN AMERICA: REGULATORY LANDSCAPE

TABLE 162 LATIN AMERICA: PRODUCT INFORMATION MANAGEMENT MARKET, BY COMPONENT, 2017–2021 (USD MILLION)

TABLE 163 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 164 LATIN AMERICA: MARKET, BY SOLUTION, 2017–2021 (USD MILLION)

TABLE 165 LATIN AMERICA: MARKET, BY SOLUTION, 2022–2027 (USD MILLION)

TABLE 166 LATIN AMERICA: MARKET, BY SERVICE, 2017–2021 (USD MILLION)

TABLE 167 LATIN AMERICA: MARKET, BY SERVICE, 2022–2027 (USD MILLION)

TABLE 168 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 169 LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 170 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 171 LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 172 LATIN AMERICA: MARKET, BY VERTICAL, 2017–2021 (USD MILLION)

TABLE 173 LATIN AMERICA: MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

TABLE 174 LATIN AMERICA: MARKET, BY COUNTRY, 2017–2021 (USD MILLION)

TABLE 175 LATIN AMERICA: MARKET, BY COUNTRY, 2022–2027 (USD MILLION)

10.6.4 BRAZIL

10.6.4.1 High price consciousness among consumers to compel organizations to adopt PIM solutions

TABLE 176 BRAZIL: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 177 BRAZIL: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 178 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 179 BRAZIL: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.5 MEXICO

10.6.5.1 Demand for reliable and automated PIM solutions from F&B companies to drive PIM solutions’ growth

TABLE 180 MEXICO: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 181 MEXICO: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 182 MEXICO: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 183 MEXICO: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.6 ARGENTINA

10.6.6.1 Increasing technological advancements in Argentina to drive adoption of PIM solutions

TABLE 184 ARGENTINA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 185 ARGENTINA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 186 ARGENTINA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 187 ARGENTINA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

10.6.7 REST OF LATIN AMERICA

TABLE 188 REST OF LATIN AMERICA: PRODUCT INFORMATION MANAGEMENT MARKET, BY DEPLOYMENT TYPE, 2017–2021 (USD MILLION)

TABLE 189 REST OF LATIN AMERICA: MARKET, BY DEPLOYMENT TYPE, 2022–2027 (USD MILLION)

TABLE 190 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2017–2021 (USD MILLION)

TABLE 191 REST OF LATIN AMERICA: MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 145)

11.1 INTRODUCTION

FIGURE 35 MARKET EVALUATION FRAMEWORK

11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PRODUCT INFORMATION MANAGEMENT VENDORS

11.3 HISTORICAL REVENUE ANALYSIS OF TOP VENDORS

FIGURE 36 HISTORICAL REVENUE ANALYSIS

11.4 COMPANY EVALUATION QUADRANT

FIGURE 37 COMPANY EVALUATION MATRIX: CRITERIA WEIGHTAGE

11.4.1 STARS

11.4.2 EMERGING LEADERS

11.4.3 PERVASIVES

11.4.4 PARTICIPANTS

FIGURE 38 PRODUCT INFORMATION MANAGEMENT MARKET (GLOBAL): COMPANY EVALUATION QUADRANT

TABLE 192 COMPANY COMPONENT FOOTPRINT

TABLE 193 COMPANY REGION FOOTPRINT

TABLE 194 COMPANY OVERALL FOOTPRINT

12 COMPANY PROFILES (Page No. - 152)

12.1 INTRODUCTION

(Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, COVID-19 related developments, MnM View)*

12.2 KEY PLAYERS

12.2.1 ORACLE

TABLE 195 ORACLE: BUSINESS OVERVIEW

FIGURE 39 ORACLE: COMPANY SNAPSHOT

TABLE 196 ORACLE: PRODUCT/SOLUTIONS/SERVICES OFFERED

TABLE 197 ORACLE: PRODUCT LAUNCHES

12.2.2 SAP

TABLE 198 SAP: BUSINESS OVERVIEW

FIGURE 40 SAP: COMPANY SNAPSHOT

TABLE 199 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 200 SAP: PRODUCT LAUNCHES

12.2.3 IBM

TABLE 201 IBM: BUSINESS OVERVIEW

FIGURE 41 IBM: COMPANY SNAPSHOT

TABLE 202 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 203 IBM: DEALS

12.2.4 PIMCORE

TABLE 204 PIMCORE: BUSINESS OVERVIEW

TABLE 205 PIMCORE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 206 PIMCORE: PRODUCT LAUNCHES

12.2.5 AKENEO

TABLE 207 AKENEO: BUSINESS OVERVIEW

TABLE 208 AKENEO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 209 AKENEO: PRODUCT LAUNCHES

TABLE 210 AKENEO: DEALS

12.2.6 INRIVER

TABLE 211 INRIVER: BUSINESS OVERVIEW

TABLE 212 INRIVER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 213 INRIVER: PRODUCT LAUNCHES

TABLE 214 INRIVER: DEALS

12.2.7 WINSHUTTLE

TABLE 215 WINSHUTTLE: BUSINESS OVERVIEW

TABLE 216 WINSHUTTLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 217 WINSHUTTLE: DEALS

12.2.8 SYNDIGO

TABLE 218 SYNDIGO: BUSINESS OVERVIEW

TABLE 219 SYNDIGO: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 220 SYNDIGO: PRODUCT LAUNCHES

TABLE 221 SYNDIGO: DEALS

12.2.9 SALSIFY

TABLE 222 SALSIFY: BUSINESS OVERVIEW

TABLE 223 SALSIFY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

TABLE 224 SALSIFY: PRODUCT LAUNCHES

TABLE 225 SALSIFY: DEALS

12.2.10 INFORMATICA

TABLE 226 INFORMATICA: BUSINESS OVERVIEW

TABLE 227 INFORMATICA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

12.2.11 OTHER PLAYERS

12.2.12 APRIMO

12.2.13 STIBO SYSTEMS

12.2.14 CONTENTSERV

12.2.15 MOBIUS

12.2.16 PERFION

12.2.17 PROFISEE

12.2.18 CENSHARE

12.2.19 VINCULUM

12.2.20 PIMWORKS

12.2.21 TRUECOMMERCE

12.2.22 VIAMEDICI

12.2.23 CATSY

12.2.24 SALES LAYER

12.2.25 MAGNITUDE SOFTWARE

12.2.26 PLYTIX

*Details on Business Overview, Solutions, Products & Services, Key Insights, Recent Developments, COVID-19 related developments, MnM View might not be captured in case of unlisted companies.

13 ADJACENT/RELATED MARKET (Page No. - 189)

13.1 INTRODUCTION

13.1.1 RELATED MARKET

13.1.2 LIMITATIONS

13.2 MASTER DATA MANAGEMENT MARKET

TABLE 228 MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2016–2021 (USD MILLION)

TABLE 229 MASTER DATA MANAGEMENT MARKET, BY COMPONENT, 2022–2027 (USD MILLION)

TABLE 230 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2016–2021 (USD MILLION)

TABLE 231 MASTER DATA MANAGEMENT MARKET, BY DEPLOYMENT MODE, 2022–2027 (USD MILLION)

TABLE 232 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2016–2021 (USD MILLION)

TABLE 233 MASTER DATA MANAGEMENT MARKET, BY ORGANIZATION SIZE, 2022–2027 (USD MILLION)

TABLE 234 MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2016–2021 (USD MILLION)

TABLE 235 MASTER DATA MANAGEMENT MARKET, BY VERTICAL, 2022–2027 (USD MILLION)

14 APPENDIX (Page No. - 193)

14.1 DISCUSSION GUIDE

14.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

14.3 AVAILABLE CUSTOMIZATIONS

14.4 RELATED REPORTS

The research study for the PIM involved the use of extensive secondary sources, directories, and databases, such as the websites of PIM vendors, D&B Hoovers, Bloomberg Businessweek, and Factiva, to identify and collect the information for a technical, market-oriented, and commercial study of the PIM market. The primary sources were mainly industry experts from core and related industries, distributors, service providers, technology developers, and technologists from companies and organizations related to all the segments of the industry’s value chain. In-depth interviews were conducted with various primary respondents, including key industry participants, subject matter experts, C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information, as well as assess the market’s prospects. The following diagram shows the research methodology applied in making this report on the global PIM market.

Secondary Research

The market size of companies offering PIM solutions and services was arrived at based on the secondary data available through paid and unpaid sources and by analyzing the product portfolio of the major companies in the ecosystem and rating them according to their performance and quality. In the secondary research process, various sources were referred to for identifying and collecting information for the study. The secondary sources included annual reports, press releases, and investor presentations of companies; white papers, journals, and certified publications; and articles from recognized authors, directories, and databases.

Secondary research was mainly used to obtain key information about the industry’s supply chain, the total pool of key players, and market classification and segmentation according to industry trends to the bottom-most level, regional markets, and key developments from both market and technology-oriented perspectives, all of which were further validated by primary sources.

Primary Research

In the primary research process, various primary sources from both supply and demand sides were interviewed to obtain qualitative and quantitative information on the market. The primary sources from the supply side included various industry experts, such as Chief Experience Officers (CXOs); Vice Presidents (VPs); directors from business development, marketing, and product development/innovation teams; related key executives from PIM solution vendors, SIs, professional service providers, and industry associations; and key opinion leaders.

Primary interviews were conducted to gather insights, such as market statistics, revenue data collected from solutions and services, market breakups, market size estimations, market forecasts, and data triangulation. Primary research also helped understand various trends related to technologies, applications, deployments, and regions. Stakeholders from the demand side, such as Chief Information Officers (CIOs), Chief Technology Officers (CTOs), Chief Strategy Officers (CSOs), and end users using PIM solutions, were interviewed to understand the buyer’s perspective on suppliers, products, service providers, and their current usage of PIM solutions and services, which would impact the overall PIM market.

The following is the breakup of primary profiles:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The PIM market is in an initial stage, with a very limited number of available deployments, and a limited number of vendors. Available secondary data as well as primary information was analyzed to identify use cases, research projects, initiatives, and consortiums specific to the PIM market. An exhaustive list of all vendors offering solutions and services in the PIM was prepared. The revenue contribution of the market vendors was estimated through annual reports, press releases, funding, investor presentations, paid databases, and primary interviews. Each vendor's offerings were evaluated based on the breadth of solutions and services, deployment modes, applications, business functions, channel integration, and verticals. The aggregate of all companies’ revenue was extrapolated to reach the overall market size. Each subsegment was studied and analyzed for its global market size and regional penetration. The markets were triangulated through both primary and secondary research. The primary procedure included extensive interviews for key insights from industry leaders, such as CIOs, CEOs, VPs, directors, and marketing executives. The market numbers were further triangulated with the existing MarketsandMarkets repository for validation.

The list of vendors considered for estimating the market size is not limited to the vendors profiled in the report. However, MarketsandMarkets prepared a laundry list of vendors offering PIM solutions and services and mapped their products related to the PIM to identify major vendors operating in the market.

- The pricing trend is assumed to vary over time.

- All the forecasts are made with the standard assumption that the accepted currency is USD.

- For the conversion of various currencies to USD, average historical exchange rates are used according to the year specified. For all the historical and current exchange rates required for calculations and currency conversions, the US Internal Revenue Service's website is used.

- All the forecasts are made under the standard assumption that the globally accepted currency USD remains constant during the next five years.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both, the demand and supply sides, in the BFSI, government & public sector, healthcare & life sciences, telecommunications, IT & ITeS, manufacturing, energy & utilities, retail & consumer goods, media & entertainment, and other verticals. Others include education, and travel & hospitality.

Report Objectives

- To define, describe, and forecast the PIM market based on components, verticals, organization sizes, deployment types, and regions

- To provide detailed information about major factors (drivers, restraints, opportunities, and challenges) influencing the growth of the PIM market

- To analyze the impact of COVID-19 on the business functions, verticals, components, organization sizes, deployment modes, and regions across the globe

- To analyze the market with respect to individual growth trends, prospects, and contributions to the PIM market

- To forecast the market size of five main regions: North America, Europe, Asia Pacific, Middle East & Africa, and Latin America

- To analyze the opportunities in the market for stakeholders by identifying high-growth segments of the PIM market

- To profile key players in the PIM market and comprehensively analyze their core competencies in each microsegment

- To analyze key players based on pricing models, technology analysis, and their market shares

- To analyze competitive developments, such as new product launches, product enhancements, partnerships, and Mergers and Acquisitions (M&As), in the PIM market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix provides a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakup of the North American digital map market

- Further breakup of the European digital map market

- Further breakup of the Asia Pacific digital map market

- Further breakup of the Latin American digital map market

- Further breakup of the Middle East & Africa digital map market

Company Information

- Detailed analysis and profiling of additional market players up to 5

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Product Information Management (PIM) Market