Printing Ink Market by Type (Nitrocellulose, Polyurethane, Water based, Acrylic, UV Curable), Process (Gravure, Flexographic, Lithographic, Digital), Application (Cardboards, Flexible Packaging, Tags & Labels, Cartons), & Region - Global Forecasts to 2028

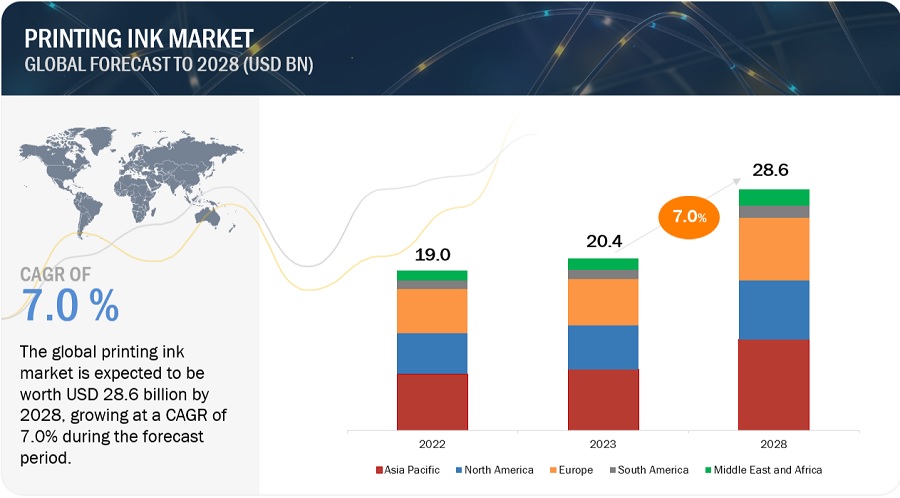

The substantial increasing demand for printing ink is supported by the rapid expansion of e-commerce sector and the significant increasing demand from the global packaging industry . The need for effective marketing and advertising materials is stimulating the demand of high-performance inks in both traditional and digital formats. The market size of printing ink was USD 20.4 billion in 2023 and is projected to reach USD 28.6 billion by 2028, registering a CAGR of 7.0% between 2023 and 2038.

Attractive Opportunities in Printing Ink Market

To know about the assumptions considered for the study, Request for Free Sample Report

Printing Ink Market Dynamics

Driver: Growth of the digital textile and ceramic tiles printing industry

Due to the increased demand for customized and high-quality products, digital textile and ceramic tile industries are rapidly expanding. Custom clothing, accessories, custom wall coverings, curtains, other home and decorative textiles, promotional banners, flags, and other marketing materials are all commonly printed using digital textile printing. Digital ceramic tile printing with digital printing inks is also gaining popularity for a variety of applications, including home furnishings, commercial flooring, and signage. Digital textile printing allows on-demand and customized fabric designs, catering to individual preferences and small production runs. This trend has driven the demand for specialized textile inks that offer vibrant colors, durability, and wash-fastness. Compared to traditional methods, digital textile printing generates less waste by eliminating the need for screens and reducing setup times. This efficiency has led to cost savings and environmental benefits.

Restraint: Stringent regulatory compliance

Printing ink formulations often need to be altered to comply with regulations regulating food safety, health, and safety standards that restrict the use of certain chemicals or compounds. This lead to challenges in maintaining the same level of performance and quality while meeting the new regulatory requirements. Furthermore, stringent regulations also hinder a company's ability to cater to specific customer needs or to develop innovative products. Meeting the compliance regulations of different industries of various countries is challenging for ink manufacturers, potentially limiting the range of ink options available for certain industries and applications.

Opportunity: Rising demand for bio-based printing inks

The anticipated surge in the adoption of bio-based printing inks represents a promising opportunity in the printing ink market. As sustainability and eco-consciousness gain prominence, industries are increasingly seeking environmentally friendly alternatives. Bio-based inks, derived from renewable sources and characterized by lower environmental impact and reduced volatile organic compound emissions, align well with these priorities. Bio-based printing inks are made from renewable materials, such as vegetable oils, starches, and sugar, and are a more sustainable alternative to traditional printing inks. This growing preference for greener solutions is poised to drive demand for bio-based printing inks, thereby opening doors for market expansion and innovation in the quest for more sustainable printing practices.

Challenge: Environmental concerns

While there is a demand for eco-friendly inks, the formulation and production of such inks must strike a balance between sustainability and performance. Some printing inks contain hazardous chemicals such as heavy metals, solvents, and other toxic substances. These chemicals can pose risks to workers, consumers, and the environment during production, use, and disposal. Many traditional printing inks contain VOCs, which are volatile chemicals that can evaporate into the air and contribute to air pollution. VOCs can have adverse effects on air quality, human health, and contribute to the formation of smog. Developing inks with low VOC emissions and eco-friendly components without compromising on color vibrancy, adhesion, and durability remains a technical challenge for manufacturers.

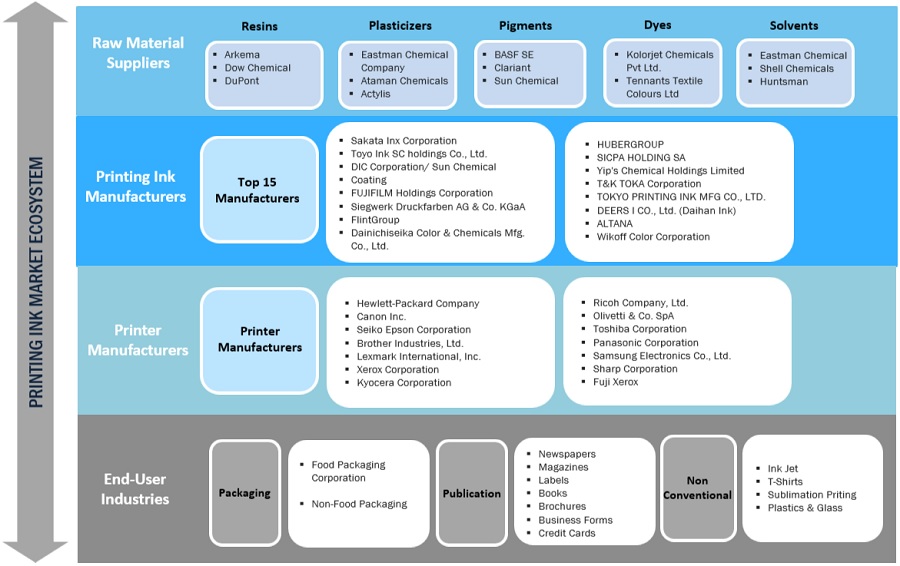

Ecosystem: Printing Ink Market

Based on type, the UV curable segment is anticipated to register the highest CAGR

Based on type, the market is segmented into nitrocellulose, polyurethane, water-based, UV curable and acrylic. UV curable printing inks are gaining prominence due to their instantaneous curing when exposed to UV light, enabling faster production and reduced drying times. Offering environmental friendliness with low VOC emissions, they deliver superior print quality, vibrant colors, and adhesion to diverse substrates like paper, plastics, metals, and glass. Their durability, resistance to abrasion and chemicals, and customization capabilities make them suitable for applications ranging from packaging to wide format printing.

Based on the application, the tags and labels segment is estimated to account for the largest market share during the forecast period

In the printing ink market, the application of printing inks in tags and labels is projected to hold the highest share due to its wide-ranging significance across industries. Tags and labels serve as crucial elements for product identification, branding, information dissemination, and regulatory compliance. Whether on consumer goods, pharmaceuticals, food and beverages, textiles, or industrial products, printing inks play a pivotal role in creating visually appealing and informative tags and labels. These inks are required to exhibit exceptional adhesion to various substrates, resistance to external factors like moisture and friction, and compliance with health and safety standards. As industries continue to innovate in packaging design, sustainability, and brand differentiation, the demand for versatile and reliable printing inks in the tags and labels application is expected to maintain its leading position in the market.

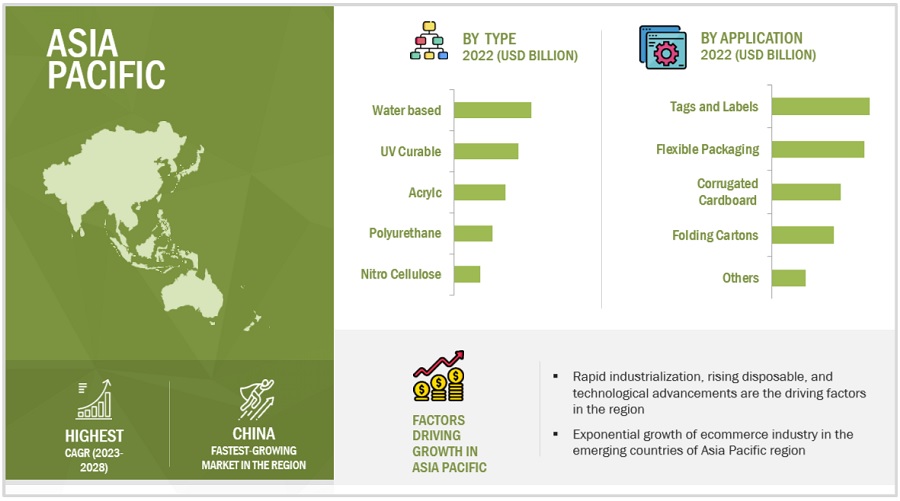

Asia Pacific to hold the largest market share during the forecast period

Printing ink market in the Asia pacific region is driven by the region's economic growth, industrial expansion, and consumer demands. With the presence of several emerging economies and a significant manufacturing base, Asia Pacific is witnessing increased production activities across diverse industries such as packaging, textiles, electronics, and automotive. This growth fuels the demand for printing inks used in packaging, labels, promotional materials, and industrial applications. Moreover, the region's rapid urbanization, rising disposable incomes, and changing lifestyles contribute to greater consumer demand for products, enhancing the need for effective branding, labeling, and packaging – all of which rely heavily on printing inks.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players in the global printing ink market are DIC Corporation (Japan), Toyo Ink SC Holdings Co., Ltd. (Japan), T&K TOKA CORPORATION (Japan), Tokyo Printing Ink Mfg. Co., Ltd. (Japan), FUJIFILM Holdings Corporation (Japan), Yip’s Chemical Holdings Limited (Hong Kong), Sakata Inx Corporation (Japan), Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan), Siegwerk Druckfarben AG & Co. KGaA (Germany), Hubergroup (Germany), Flint Group (Luxembourg), SICPA Holding SA (Switzerland), Wikoff Color Corporation (US), ALTANA (Germany), and DEERS i Co., LTD. (South Korea).

These companies are involved in adopting various inorganic and organic strategies to increase their foothold in the printing ink industry. The study includes an in-depth competitive analysis of these key players in the printing ink market, with their company profiles, recent developments, and key market strategies.

Printing Ink Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2022 |

USD 19.0 billion |

|

Revenue Forecast in 2028 |

USD 28.6 billion |

|

CAGR |

7.0% |

|

Market size available for years |

2022–2028 |

|

Base year considered |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion), Volume (Million Tons) |

|

Segments Covered |

By Type, By Proess, By Application, Region |

|

Geographies covered |

North America, Europe, Asia Pacific, South America and Middle East and Africa |

|

Companies covered |

DIC Corporation, Toyo Ink SC Holdings Co., Ltd., T&K TOKA CORPORATION, Tokyo Printing Ink Mfg. Co., Ltd., FUJIFILM Holdings Corporation, Yip’s Chemical Holdings Limited, Sakata Inx Corporation, Dainichiseika Color & Chemicals Mfg. Co., Ltd., Siegwerk Druckfarben AG & Co. KGaA, Hubergroup, Flint Group, SICPA Holding SA, Wikoff Color Corporation, ALTANA, and DEERS i Co., LTD. |

The study categorizes the printing ink market based on Type, Process, Application, and Region.

By Type:

- Nitrocellulose

- Polyurethane

- Water based

- Acrylic

- UV Curable

By Process:

- Gravure

- Flexographic

- Lithographic

- Digital

- Others

By Application:

- Corrugated Cardboards

- Flexible Packaging

- Tags & Labels

- Folding Cartons

- Others

By Region:

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Recent Developments

- In March 2023, Toyo Ink SC Holdings Co., Ltd., the Japan-based parent company of the specialty chemicals company Toyo Ink Group, announced a share purchase agreement to wholly acquire Thai Eurocoat Ltd., the top manufacturer of external coatings for non-printed cans in the Thai canned food market.

- In December 2022, the specialty chemicals group ALTANA has acquired a stake in the tech startup SARALON. The young company specializes in the development of inks for printing electronics.

- In September 2022, UbiQD, Inc., a New Mexico-based nanotechnology company, and SICPA SA, a Swiss technology company expanded their partnership in the development of anti-counterfeit security inks based on UbiQD’s quantum dot technology.

- In January 2022, Siegwerk commissioned a new solvent-based Blending Center at Bhiwadi facility in India. The new Blending Center, spread across 3400 Sq.M, is an addition to an existing 100% toluene-free manufacturing plant which will support its industry-leading growth.

- In March 2021, FUJIFILM Imaging Colorants, Inc., a US subsidiary of FUJIFILM Corporation, constructed a new production plant for pigment dispersions, which is a colorant for water-based pigment inkjet inks in order to accelerate the growth of the global inkjet business.

Frequently Asked Questions (FAQ):

Which are the major companies in the printing ink market? What are their major strategies to strengthen their market presence?

Some of the major players are DIC Corporation (Japan), Toyo Ink SC Holdings Co., Ltd. (Japan), T&K TOKA CORPORATION (Japan), Tokyo Printing Ink Mfg. Co., Ltd. (Japan), FUJIFILM Holdings Corporation (Japan), Yip’s Chemical Holdings Limited (Hong Kong), Sakata Inx Corporation (Japan), Dainichiseika Color & Chemicals Mfg. Co., Ltd. (Japan), Siegwerk Druckfarben AG & Co. KGaA (Germany), Hubergroup (Germany), Flint Group (Luxembourg), SICPA Holding SA (Switzerland), Wikoff Color Corporation (US), ALTANA (Germany), and DEERS I Co., LTD. (South Korea) among others, are the key manufacturers that secured contracts, deals in the last few years. Contracts and deals were the key strategies adopted by these companies to strengthen their position in the printing ink market.

What are the drivers and opportunities for the printing ink market?

The need for printing ink has increased significantly around the world, particularly in Asia Pacific, Europe, followed by North America, where the major printing ink manufacturers are present. Rising R&D efforts and growing technological advancement in manufacturing are anticipated to accelerate market expansion globally.

What are the factors influencing the growth of the printing ink market?

Economic growth, urbanization, rising disposable income, and rapid growth of ecommerce industry across various countries is driving the growth of the market.

Which is the highest growing country-level market for printing ink market?

China is the highest growing country in the printing ink market due to high demand for packaging materials from retail and consumer goods industry.

What are the challenges in the printing ink market?

Stringent regulations from various end-use industries such as food and beverages, and medical industry and environmental concerns are the major challenge in the printing ink market.

Which type of printing ink is expected to witness highest growth?

UV curable printing ink is expected to register the highest growth in terms of value and volume, in the printing ink market.

How is the printing ink market aligned?

The market is growing at a significant pace. The market is a potential market, and many manufacturers are planning business strategies to expand their existing business. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 EVOLUTION

-

5.3 MARKET DYNAMICSDRIVERS- Growth of digital textile and ceramic tile printing industry- Development of new ink resin technologies- Increasing demand for printing inks from packaging industryRESTRAINTS- Decline of conventional commercial printing industry- Shift from print to digital mediaOPPORTUNITIES- Innovations in business printing and publishing- Rising demand for bio-based printing inksCHALLENGES- Stringent regulations regarding disposal of printing inks- Volatile raw material prices

-

5.4 PORTER’S FIVE FORCES ANALYSISBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESINTENSITY OF COMPETITIVE RIVALRY

- 5.5 SUPPLY CHAIN ANALYSIS

-

5.6 PRICING ANALYSISAVERAGE SELLING PRICE, BY PROCESS (KEY PLAYERS)AVERAGE SELLING PRICE, BY TYPE (KEY PLAYERS)AVERAGE SELLING PRICE, BY PROCESS (KEY PLAYERS)AVERAGE SELLING PRICE, BY APPLICATION (KEY PLAYERS)

- 5.7 AVERAGE SELLING PRICE TREND

-

5.8 TRADE DATA ANALYSISEXPORT SCENARIO OF PRINTING INKSIMPORT SCENARIO OF PRINTING INKS

-

5.9 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

- 5.10 TECHNOLOGY ANALYSIS

-

5.11 ECOSYSTEM: PRINTING INK MARKET

- 5.12 VALUE CHAIN ANALYSIS

- 5.13 CASE STUDY ANALYSIS

- 5.14 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.15 TARIFFS AND REGULATIONSREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16 STANDARDS FOR PRINTING INK MARKET

-

5.17 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANT ANALYSISPATENTS BY SEIKO EPSON CORPORATIONPATENTS BY CANON INC.PATENTS BY XEROX CORPORATIONTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- 5.18 KEY CONFERENCES & EVENTS

- 6.1 INTRODUCTION

-

6.2 CORRUGATED CARDBOARDSPACKAGING, BRANDING, AND INFORMATIONAL APPLICATIONS TO DRIVE MARKETPRINTING INK MARKET IN CORRUGATED CARDBOARDS, BY REGION

-

6.3 FOLDING CARTONSWORLDWIDE FOOD PACKAGING INDUSTRY DRIVING DEMANDPRINTING INK MARKET IN FOLDING CARTONS, BY REGION

-

6.4 FLEXIBLE PACKAGINGLIGHTWEIGHT, COST-EFFECTIVE, AND PROTECTION OF PRODUCTS TO DRIVE MARKETPRINTING INK MARKET IN FLEXIBLE PACKAGING, BY REGION

-

6.5 TAGS & LABELSDEMAND FOR IDENTIFYING, TRACKING, AND DECORATING PRODUCTS TO DRIVE MARKETPRINTING INK MARKET IN TAGS & LABELS, BY REGION

-

6.6 OTHERSPRINTING INK MARKET IN OTHER APPLICATIONS, BY REGION

- 7.1 INTRODUCTION

-

7.2 LITHOGRAPHICDOMINANT PROCESS TO DRIVE MARKETPRINTING INK MARKET IN LITHOGRAPHIC PRINTING PROCESS, BY REGION

-

7.3 GRAVURECOMPETITIVE PROCESS TO DRIVE MARKETPRINTING INK MARKET IN GRAVURE PRINTING PROCESS, BY REGION

-

7.4 FLEXOGRAPHICPACKAGING AND PUBLISHING APPLICATIONS TO DRIVE MARKETPRINTING INK MARKET IN FLEXOGRAPHIC PRINTING PROCESS, BY REGION

-

7.5 DIGITALLOW COST AND SHORTER TURNAROUND, AMONG SEVERAL BENEFITS, TO DRIVE MARKETPRINTING INK MARKET IN DIGITAL, BY REGION

-

7.6 OTHERSPRINTING INK MARKET IN OTHER PRINTING PROCESSES, BY REGION

- 8.1 INTRODUCTION

-

8.2 NITROCELLULOSESUPERIOR CHARACTERISTICS OF NIRTROCELLULOSE TO BOOST MARKET

-

8.3 POLYURETHANELONG-LASTING PERFORMANCE IN HARSH ENVIRONMENTS TO DRIVE MARKET

-

8.4 WATER-BASEDDEMAND FOR SUSTAINABLE INKS TO DRIVE MARKETWATER-BASED PRINTING INK MARKET, BY REGION

-

8.5 ACRYLICWIDER ADAPTABILITY TO DRIVE MARKETACRYLIC PRINTING INK MARKET, BY REGION

-

8.6 UV CURABLEINSTANT DRYING, SWIFT PRODUCTION, AND REDUCED LEAD TIME TO DRIVE MARKETUV CURABLE PRINTING INK MARKET, BY REGION

-

9.1 INTRODUCTIONPRINTING INK MARKET, BY REGION

-

9.2 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICANORTH AMERICA: PRINTING INK MARKET, BY TYPENORTH AMERICA: PRINTING INK MARKET, BY PROCESSNORTH AMERICA: PRINTING INK MARKET, BY APPLICATIONNORTH AMERICA: PRINTING INK MARKET, BY COUNTRYUS- Tags & labels segment and sustainable printing inks to drive market- US: Printing ink market, by applicationCANADA- Digital printing to drive market- Canada: Printing ink market, by applicationMEXICO- Printing, circulation, and reprinting of banknotes to drive market- Mexico: Printing ink market, by application

-

9.3 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICASIA PACIFIC: PRINTING INK MARKET, BY TYPEASIA PACIFIC: PRINTING INK MARKET, BY PROCESSASIA PACIFIC: PRINTING INK MARKET, BY APPLICATIONASIA PACIFIC: PRINTING INK MARKET, BY COUNTRYCHINA- Large printing, packaging, and labeling industries to propel market- China: Printing ink market, by applicationJAPAN- Innovations in printing technology to boost market- Japan: Printing ink market, by applicationSOUTH KOREA- Presence of major electronics companies to propel demand- South Korea: Printing ink market, by applicationINDIA- Rapid urbanization, increasing literacy, and growth of FMCG sector to boost market- India: Printing ink market, by applicationREST OF ASIA PACIFIC- Rest of Asia Pacific: Printing ink market, by application

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEEUROPE: PRINTING INK MARKET, BY TYPEEUROPE: PRINTING INK MARKET, BY PROCESSEUROPE: PRINTING INK MARKET, BY APPLICATIONEUROPE: PRINTING INK MARKET, BY COUNTRYGERMANY- Increasing use of digital printing technology to drive market- Germany: Printing ink market, by applicationFRANCE- Demand for secure and tamper-proof products to drive market- France: Printing ink market, by applicationUK- Production of wide range of printing inks to drive market- UK: Printing ink market, by applicationITALY- Demand for high-security inks for various applications to drive market- Italy: Printing ink market, by applicationSPAIN- Growth of e-commerce and demand for innovative and sustainable packaging solutions to drive market- Spain: Printing ink market, by applicationREST OF EUROPE- Rest of Europe: Printing ink market, by application

-

9.5 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICAMIDDLE EAST & AFRICA: PRINTING INK MARKET, BY TYPEMIDDLE EAST & AFRICA: PRINTING INK MARKET, BY PROCESSMIDDLE EAST & AFRICA: PRINTING INK MARKET, BY APPLICATIONMIDDLE EAST & AFRICA: PRINTING INK MARKET, BY COUNTRYSAUDI ARABIA- Growing automotive industry to drive market- Saudi Arabia: Printing ink market, by applicationUAE- Diverse range of packaging alternatives for various industrial sectors to drive market- UAE: Printing ink market, by applicationSOUTH AFRICA- Increasing cases of fraud and counterfeiting to augment demand- South Africa: Printing ink market, by applicationREST OF MIDDLE EAST & AFRICA- Rest of Middle East & Africa: Printing ink market, by application

-

9.6 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICASOUTH AMERICA: PRINTING INK MARKET, BY TYPESOUTH AMERICA: PRINTING INK MARKET, BY PROCESSSOUTH AMERICA: PRINTING INK MARKET, BY APPLICATIONSOUTH AMERICA: PRINTING INK MARKET, BY COUNTRYBRAZIL- Tourism sector to drive market- Brazil: Printing ink market, by applicationARGENTINA- Increased spending on food and pharmaceutical commodities to drive market- Argentina: Printing ink market, by applicationREST OF SOUTH AMERICA- Rest of South America: Printing ink market, by application

- 10.1 INTRODUCTION

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET RANKING

- 10.4 REVENUE ANALYSIS OF TOP MARKET PLAYERS

-

10.5 COMPANY EVALUATION MATRIX

-

10.6 COMPETITIVE LANDSCAPE MAPPINGSTARSPERVASIVE PLAYERSPARTICIPANTSEMERGING LEADERS

- 10.7 MARKET EVALUATION FRAMEWORK

- 10.8 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

10.9 SMALL AND MEDIUM-SIZED ENTERPRISES (SME) EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.1 KEY COMPANIESDIC CORPORATION- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewTOYO INK SC HOLDINGS CO., LTD.- Business overview- Products/Solutions/Services offered- Product/Technology development- Deals- Other developments- MnM viewT&K TOKA CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewTOKYO PRINTING INK MFG CO., LTD.- Business overview- Products/Solutions/Services/ offered- Deals- MnM viewFUJIFILM HOLDINGS CORPORATION- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewYIP'S CHEMICAL HOLDINGS LIMITED- Business overview- Products/Solutions/Services offered- MnM viewSAKATA INX CORPORATION- Business overview- Products/Solutions/Services offered- Deals- MnM viewDAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewSIEGWERK DRUCKFARBEN AG & CO. KGAA- Business overview- Products/Solutions/Services offered- Product/Technology development- Deals- Other developments- MnM viewHUBERGROUP- Business overview- Products/Solutions/Services offered- Product/Technology development- Deals- Other developments- MnM viewFLINT GROUP- Business overview- Products/Solutions/Services offered- Deals- Other developments- MnM viewSICPA HOLDING SA- Business overview- Products/Solutions/Services offered- Deals- MnM viewWIKOFF COLOR CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewALTANA- Business overview- Products/Solutions/Services offered- Deals- MnM viewDEERS I CO., LTD. (DAIHAN INK)- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSEPPLE DRUCKFARBEN AGZELLER+GMELIN CORPORATIONSANCHEZ SA DE CVVAN SON INK CORPORATIONALDEN AND OTT PRINTING INKS CO.GARDINER COLOURS LIMITEDKOHINOOR PRINTING INK CO.MALLARD INK CO. AND OFFSET BLANKET CO., INCAVREON CHEMICALS INDIA PRIVATE LIMITEDINKNOVATORS

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 PRINTING INK MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 PRINTING INK MARKET: COMPANIES AND THEIR ROLE IN ECOSYSTEM

- TABLE 3 PRINTING INKS: AVERAGE SELLING PRICE TREND IN PRINTING INK MARKET, BY REGION

- TABLE 4 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- TABLE 5 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- TABLE 6 PRINTING INK MANUFACTURING PROCESS

- TABLE 7 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 CURRENT STANDARD CODES FOR PRINTING INK MARKET

- TABLE 11 PRINTING INK MARKET: GLOBAL PATENTS

- TABLE 12 DETAILED LIST OF CONFERENCES & EVENTS RELATED TO PRINTING INK AND RELATED MARKETS, 2023–2024

- TABLE 13 PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 14 PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 15 PRINTING INK MARKET IN CORRUGATED CARDBOARDS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 16 PRINTING INK MARKET IN CORRUGATED CARDBOARDS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 17 PRINTING INK MARKET IN FOLDING CARTONS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 18 PRINTING INK MARKET IN FOLDING CARTONS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 19 PRINTING INK MARKET IN FLEXIBLE PACKAGING, BY REGION, 2021–2028 (USD BILLION)

- TABLE 20 PRINTING INK MARKET IN FLEXIBLE PACKAGING, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 21 PRINTING INK MARKET IN TAGS & LABELS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 22 PRINTING INK MARKET IN TAGS & LABELS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 23 PRINTING INK MARKET IN OTHER APPLICATIONS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 24 PRINTING INK MARKET IN OTHER APPLICATIONS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 25 PRINTING INK MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 26 PRINTING INK MARKET, BY PROCESS, 2021–2028 (MILLION TONS)

- TABLE 27 PRINTING INK MARKET IN LITHOGRAPHIC PRINTING PROCESS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 28 PRINTING INK MARKET IN LITHOGRAPHIC PRINTING PROCESS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 29 PRINTING INK MARKET IN GRAVURE PRINTING PROCESS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 30 PRINTING INK MARKET IN GRAVURE PRINTING PROCESS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 31 PRINTING INK MARKET IN FLEXOGRAPHIC PRINTING PROCESS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 32 PRINTING INK MARKET IN FLEXOGRAPHIC PRINTING PROCESS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 33 PRINTING INK MARKET IN DIGITAL PRINTING PROCESS, BY REGION, 2021–2028 (USD BILLION)

- TABLE 34 PRINTING INK MARKET IN DIGITAL PRINTING PROCESS, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 35 PRINTING INK MARKET IN OTHER PRINTING PROCESSES, BY REGION, 2021–2028 (USD BILLION)

- TABLE 36 PRINTING INK MARKET IN OTHER PRINTING PROCESSES, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 37 PRINTING INK MARKET, BY TYPE, 2021–2028 (USD BILLION)

- TABLE 38 PRINTING INK MARKET, BY TYPE, 2021–2028 (MILLION TONS)

- TABLE 39 NITROCELLULOSE PRINTING INK MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 40 NITROCELLULOSE PRINTING INK MARKET, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 41 POLYURETHANE PRINTING INK MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 42 POLYURETHANE PRINTING INK MARKET, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 43 WATER-BASED PRINTING INK MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 44 WATER-BASED PRINTING INK MARKET, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 45 ACRYLIC PRINTING INK MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 46 ACRYLIC PRINTING INK MARKET, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 47 UV CURABLE PRINTING INK MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 48 UV CURABLE PRINTING INK MARKET, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 49 PRINTING INK MARKET, BY REGION, 2021–2028 (USD BILLION)

- TABLE 50 PRINTING INK MARKET, BY REGION, 2021–2028 (MILLION TONS)

- TABLE 51 NORTH AMERICA: PRINTING INK MARKET, BY TYPE, 2021–2028 (USD BILLION)

- TABLE 52 NORTH AMERICA: PRINTING INK MARKET, BY TYPE, 2021–2028 (MILLION TONS)

- TABLE 53 NORTH AMERICA: PRINTING INK MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 54 NORTH AMERICA: PRINTING INK MARKET, BY PROCESS, 2021–2028 (MILLION TONS)

- TABLE 55 NORTH AMERICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 56 NORTH AMERICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 57 NORTH AMERICA: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 58 NORTH AMERICA: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (MILLION TONS)

- TABLE 59 US: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 60 US: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 61 CANADA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 62 CANADA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 63 MEXICO: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 64 MEXICO: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 65 ASIA PACIFIC: PRINTING INK MARKET, BY TYPE, 2021–2028 (USD BILLION)

- TABLE 66 ASIA PACIFIC: PRINTING INK MARKET, BY TYPE, 2021–2028 (MILLION TONS)

- TABLE 67 ASIA PACIFIC: PRINTING INK MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 68 ASIA PACIFIC: PRINTING INK MARKET, BY PROCESS, 2021–2028 (MILLION TONS)

- TABLE 69 ASIA PACIFIC: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 70 ASIA PACIFIC: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 71 ASIA PACIFIC: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 72 ASIA PACIFIC: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (MILLION TONS)

- TABLE 73 CHINA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 74 CHINA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 75 JAPAN: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 76 JAPAN: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 77 SOUTH KOREA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 78 SOUTH KOREA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 79 INDIA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 80 INDIA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 81 REST OF ASIA PACIFIC: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 82 REST OF ASIA PACIFIC: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 83 EUROPE: PRINTING INK MARKET, BY TYPE, 2021–2028 (USD BILLION)

- TABLE 84 EUROPE: PRINTING INK MARKET, BY TYPE, 2021–2028 (MILLION TONS)

- TABLE 85 EUROPE: PRINTING INK MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 86 EUROPE: PRINTING INK MARKET, BY PROCESS, 2021–2028 (MILLION TONS)

- TABLE 87 EUROPE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 88 EUROPE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 89 EUROPE: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 90 EUROPE: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (MILLION TONS)

- TABLE 91 GERMANY: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 92 GERMANY: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 93 FRANCE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 94 FRANCE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 95 UK: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 96 UK: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 97 ITALY: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 98 ITALY: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 99 SPAIN: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 100 SPAIN: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 101 REST OF EUROPE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 102 REST OF EUROPE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 103 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY TYPE, 2021–2028 (USD BILLION)

- TABLE 104 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY TYPE, 2021–2028 (MILLION TONS)

- TABLE 105 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 106 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY PROCESS, 2021–2028 (MILLION TONS)

- TABLE 107 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 108 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 109 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 110 MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (MILLION TONS)

- TABLE 111 SAUDI ARABIA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 112 SAUDI ARABIA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 113 UAE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 114 UAE: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 115 SOUTH AFRICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 116 SOUTH AFRICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 117 REST OF MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 118 REST OF MIDDLE EAST & AFRICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 119 SOUTH AMERICA: PRINTING INK MARKET, BY TYPE, 2021–2028 (USD BILLION)

- TABLE 120 SOUTH AMERICA: PRINTING INK MARKET, BY TYPE, 2021–2028 (MILLION TONS)

- TABLE 121 SOUTH AMERICA: PRINTING INK MARKET SIZE, BY PROCESS, 2021–2028 (USD BILLION)

- TABLE 122 SOUTH AMERICA: PRINTING INK MARKET, BY PROCESS, 2021–2028 (MILLION TONS)

- TABLE 123 SOUTH AMERICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 124 SOUTH AMERICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 125 SOUTH AMERICA: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (USD BILLION)

- TABLE 126 SOUTH AMERICA: PRINTING INK MARKET, BY COUNTRY, 2021–2028 (MILLION TONS)

- TABLE 127 BRAZIL: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 128 BRAZIL: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 129 ARGENTINA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 130 ARGENTINA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 131 REST OF SOUTH AMERICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (USD BILLION)

- TABLE 132 REST OF SOUTH AMERICA: PRINTING INK MARKET, BY APPLICATION, 2021–2028 (MILLION TONS)

- TABLE 133 DEGREE OF COMPETITION: PRINTING INK MARKET

- TABLE 134 COMPANY PRODUCT FOOTPRINT

- TABLE 135 COMPANY TYPE FOOTPRINT

- TABLE 136 COMPANY APPLICATION FOOTPRINT

- TABLE 137 COMPANY REGION FOOTPRINT

- TABLE 138 DEALS, 2018–2023

- TABLE 139 OTHER DEVELOPMENTS, 2018–2023

- TABLE 140 PRODUCT/TECHNOLOGY DEVELOPMENT, 2018–2023

- TABLE 141 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 142 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 143 DIC CORPORATION: COMPANY OVERVIEW

- TABLE 144 TOYO INK SC HOLDINGS CO., LTD.: COMPANY OVERVIEW

- TABLE 145 T&K TOKA CO., LTD.: COMPANY OVERVIEW

- TABLE 146 TOKYO PRINTING INK MFG CO., LTD.: COMPANY OVERVIEW

- TABLE 147 FUJIFILM HOLDINGS CORPORATION: COMPANY OVERVIEW

- TABLE 148 YIP’S CHEMICAL HOLDINGS LIMITED: COMPANY OVERVIEW

- TABLE 149 SAKATA INX CORPORATION: COMPANY OVERVIEW

- TABLE 150 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.: COMPANY OVERVIEW

- TABLE 151 SIEGWERK DRUCKFARBEN AG & CO. KGAA: COMPANY OVERVIEW

- TABLE 152 HUBERGROUP: COMPANY OVERVIEW

- TABLE 153 FLINT GROUP: COMPANY OVERVIEW

- TABLE 154 SICPA HOLDING SA: COMPANY OVERVIEW

- TABLE 155 WIKOFF COLOR CORPORATION: COMPANY OVERVIEW

- TABLE 156 ALTANA: COMPANY OVERVIEW

- TABLE 157 DEERS I CO., LTD. (DAIHAN INK): COMPANY OVERVIEW

- TABLE 158 EPPLE DRUCKFARBEN AG: COMPANY OVERVIEW

- TABLE 159 ZELLER+GMELIN CORPORATION: COMPANY OVERVIEW

- TABLE 160 SANCHEZ SA DE CV: COMPANY OVERVIEW

- TABLE 161 VAN SON INK CORPORATION: COMPANY OVERVIEW

- TABLE 162 ALDEN & OTT PRINTING INKS CO.: COMPANY OVERVIEW

- TABLE 163 GARDINER COLOURS LIMITED: COMPANY OVERVIEW

- TABLE 164 KOHINOOR PRINTING INK CO.: COMPANY OVERVIEW

- TABLE 165 MALLARD INK CO AND OFFSET BLANKET CO, INC: COMPANY OVERVIEW

- TABLE 166 AVREON CHEMICALS INDIA PRIVATE LIMITED: COMPANY OVERVIEW

- TABLE 167 INKNOVATORS: COMPANY OVERVIEW

- FIGURE 1 PRINTING INK MARKET SEGMENTATION

- FIGURE 2 PRINTING INK MARKET: RESEARCH DESIGN

- FIGURE 3 MAJOR FACTORS ATTRIBUTED TO GLOBAL RECESSION AND THEIR IMPACT ON PRINTING INK MARKET

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 PRINTING INK MARKET: DATA TRIANGULATION

- FIGURE 7 UV CURABLE TO BE FASTEST-GROWING PRINTING INK SEGMENT DURING FORECAST PERIOD

- FIGURE 8 LITHOGRAPHIC PROCESS TO LEAD PRINTING INK MARKET

- FIGURE 9 FLEXIBLE PACKAGING TO BE FASTEST-GROWING APPLICATION OF PRINTING INK MARKET

- FIGURE 10 US TO BE LARGEST PRINTING INK MARKET

- FIGURE 11 ASIA PACIFIC DOMINATED PRINTING INK MARKET IN 2022

- FIGURE 12 DEMAND FROM FLEXIBLE PACKAGING APPLICATION TO DRIVE MARKET

- FIGURE 13 WATER-BASED PRINTING INK SEGMENT DOMINATED OVERALL MARKET IN 2022

- FIGURE 14 LITHOGRAPHIC SEGMENT AND ASIA PACIFIC LARGEST PRINTING INK MARKETS IN 2022

- FIGURE 15 FLEXIBLE PACKAGING SEGMENT TO LEAD PRINTING INK MARKET

- FIGURE 16 MARKET IN INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 17 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PRINTING INK MARKET

- FIGURE 18 PRINTING INK MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 19 AVERAGE SELLING PRICES FOR PROCESSES, BY KEY PLAYERS (USD/KG)

- FIGURE 20 AVERAGE SELLING PRICE FOR TYPE (USD/KG)

- FIGURE 21 AVERAGE SELLING PRICE BASED ON PROCESS (USD/KG)

- FIGURE 22 AVERAGE SELLING PRICE BASED ON APPLICATION (USD/KG)

- FIGURE 23 EXPORT OF PRINTING INKS, BY KEY COUNTRIES, 2018–2022 (USD MILLION)

- FIGURE 24 IMPORT OF PRINTING INKS, BY KEY COUNTRIES, 2018–2022 (USD MILLION)

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE APPLICATIONS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE APPLICATIONS

- FIGURE 27 VALUE CHAIN ANALYSIS: PRINTING INK MARKET

- FIGURE 28 GLOBAL PATENT ANALYSIS, BY DOCUMENT TYPE

- FIGURE 29 GLOBAL PATENT PUBLICATION TREND: 2013–2023

- FIGURE 30 PRINTING INK MARKET: LEGAL STATUS OF PATENTS

- FIGURE 31 GLOBAL JURISDICTION ANALYSIS

- FIGURE 32 SEIKO EPSON CORPORATION REGISTERED HIGHEST NUMBER OF PATENTS

- FIGURE 33 FLEXIBLE PACKAGING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC TO BE LARGEST MARKET FOR CORRUGATED CARDBOARDS

- FIGURE 35 ASIA PACIFIC TO BE LARGEST MARKET FOR FOLDING CARTONS APPLICATION

- FIGURE 36 EUROPE TO BE SECOND-LARGEST PRINTING INK MARKET FOR FLEXIBLE PACKAGING APPLICATION

- FIGURE 37 EUROPE TO BE LARGEST PRINTING INK MARKET FOR TAGS & LABELS

- FIGURE 38 DIGITAL PRINTING SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO BE LARGEST MARKET FOR LITHOGRAPHIC PRINTING INKS

- FIGURE 40 ASIA PACIFIC TO BE LARGEST GRAVURE PRINTING PROCESS MARKET

- FIGURE 41 EUROPE TO BE SECOND-LARGEST MARKET FOR FLEXOGRAPHIC PRINTING INKS

- FIGURE 42 ASIA PACIFIC TO BE LARGEST MARKET FOR DIGITAL PRINTING INKS

- FIGURE 43 WATER-BASED SEGMENT TO LEAD PRINTING INK MARKET DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC TO BE LARGEST NITROCELLULOSE PRINTING INK MARKET

- FIGURE 45 ASIA PACIFIC TO BE LARGEST POLYURETHANE PRINTING INK MARKET

- FIGURE 46 EUROPE TO ACCOUNT FOR SECOND-LARGEST SHARE OF WATER-BASED PRINTING INK MARKET

- FIGURE 47 NORTH AMERICA TO BE SECOND-LARGEST ACRYLIC PRINTING INK MARKET

- FIGURE 48 EUROPE TO BE SECOND-LARGEST UV CURABLE PRINTING INK MARKET

- FIGURE 49 INDIA TO BE FASTEST-GROWING PRINTING INK MARKET DURING FORECAST PERIOD

- FIGURE 50 NORTH AMERICA: PRINTING INK MARKET SNAPSHOT

- FIGURE 51 ASIA PACIFIC: PRINTING INK MARKET SNAPSHOT

- FIGURE 52 EUROPE: PRINTING INK MARKET SNAPSHOT

- FIGURE 53 SHARE OF TOP COMPANIES IN PRINTING INK MARKET

- FIGURE 54 RANKING OF TOP FIVE PLAYERS IN PRINTING INK MARKET

- FIGURE 55 REVENUE ANALYSIS

- FIGURE 56 PRINTING INK MARKET (GLOBAL): COMPANY EVALUATION MATRIX, 2022

- FIGURE 57 SMALL AND MEDIUM-SIZED ENTERPRISES MAPPING, 2022

- FIGURE 58 DIC CORPORATION: COMPANY SNAPSHOT

- FIGURE 59 TOYO INK SC HOLDINGS CO., LTD.: COMPANY SNAPSHOT

- FIGURE 60 T&K TOKA CO., LTD.: COMPANY SNAPSHOT

- FIGURE 61 TOKYO PRINTING INK MFG CO., LTD.: COMPANY SNAPSHOT

- FIGURE 62 FUJIFILM HOLDINGS CORPORATION: COMPANY SNAPSHOT

- FIGURE 63 YIP’S CHEMICAL HOLDINGS LIMITED: COMPANY SNAPSHOT

- FIGURE 64 SAKATA INX CORPORATION: COMPANY SNAPSHOT

- FIGURE 65 DAINICHISEIKA COLOR & CHEMICALS MFG. CO., LTD.: COMPANY SNAPSHOT

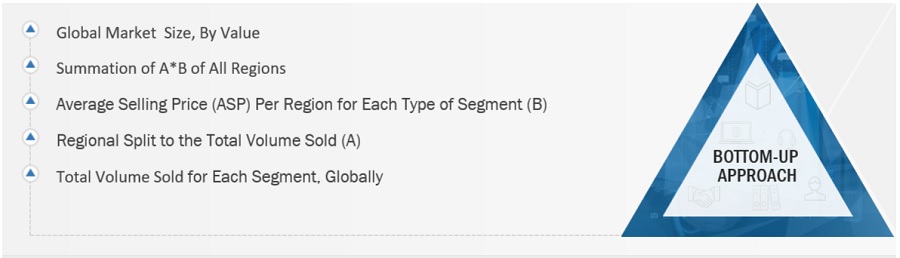

The study involves two major activities in estimating the current market size for the printing ink market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. This research involves the extensive use of secondary sources and databases, press releases of companies, Bloomberg, and Factiva to identify and collect information useful for a technical and market-oriented study of the printing ink market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. The primary sources are mainly industry experts from related industries and preferred suppliers, manufacturers, distributors, technologists, standards & certification organizations, and organizations related to all segments of the value chain of the printing ink industry. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering printing ink and information from various trade, business, and professional associations. The secondary data was collected and analyzed to arrive at the overall size of the printing ink market, which was validated by primary respondents.

Secondary research has been used to obtain key information about the supply chain of the printing ink industry, the market's monetary chain, the total pool of key players, market classification & segmentation according to industry trends to the bottom-most level, and regional markets. It has also been used to obtain information about the key developments that have taken place from a market-oriented perspective

Primary Research

Extensive primary research was conducted after obtaining information regarding the printing ink market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and South America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from printing ink industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, application, vertical, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using the printing ink industry, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of printing ink and future outlook of their business which will affect the overall market.

The Breakup of Primary Research :

To know about the assumptions considered for the study, download the pdf brochure

|

COMPANY NAME |

DESIGNATION |

|

SICPA Holding SA |

Sales Head |

|

AT Inks |

CEO & Founder |

|

Sakata Inx Corporation |

Printing ink Consultant |

|

Boston Industrial Solutions, Inc. |

Sales Head |

Market Size Estimation

The research methodology used to estimate the size of the printing ink market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in printing ink in different applications of the printing ink industry at a regional level. Such procurements provide information on the demand aspects of the printing ink industry for each application. For each application, all possible segments of the printing ink market were integrated and mapped.

Printing Ink Market Size: Botton Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Printing Ink Market Size: Top Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Printing inks are complex chemical compound mixtures. The composition of printing inks differs depending upon the printing process, whether it is sheet-fed or web-fed, and the target substrate. The composition varies depending upon whether the solvent is oil or water. It varies depending upon the drying mechanism and whether the drying is primarily chemical, such as oxidation polymerization, ultraviolet cure, or physical, such as evaporation or absorption. Inks are classified as liquid or paste. Liquid inks (or toners) are used in gravure, flexo, inkjet, electrographic, and some electrophotographic processes. Paste inks include lithographic, screen, and letterpress.

Printing inks are extremely versatile and can be applied to almost any surface, regardless of texture, size, or shape. They are suitable for coloring paper, plastics, metal, glass, and textiles. Unlike paints and varnish coatings, printing inks are applied to surfaces in the forms of very thin layers, which can range in thickness from 2 to 30 micron depending upon the printing process. The visual characteristics of the ink are determined by three major factors: its color, transparency, and gloss. Several interconnected features also influence the color of the ink.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Report Objectives

- To define, describe, segment, and forecast the size of the printing ink market based on type, process, application, and region

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, Middle East and Africa and South America, along with major countries in each region

- To provide detailed information about key factors (drivers, restraints, opportunities, and challenges) influencing market growth

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the printing ink market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market

Growth opportunities and latent adjacency in Printing Ink Market