Primary Cells Market by Type (Hematopoietic, Dermatocytes, Hepatocytes, Gastrointestinal, Lung, Renal, Heart, Musculoskeletal), Origin (Human Primary Cells, Animal Primary Cells), End User (Pharma Biotech, CROs, Academia), Region - Global Forecast to 2028

Market Growth Outlook Summary

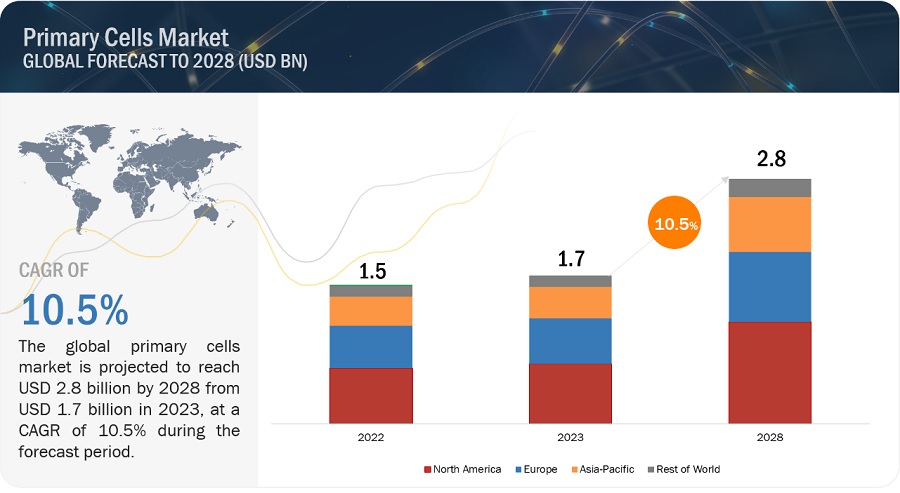

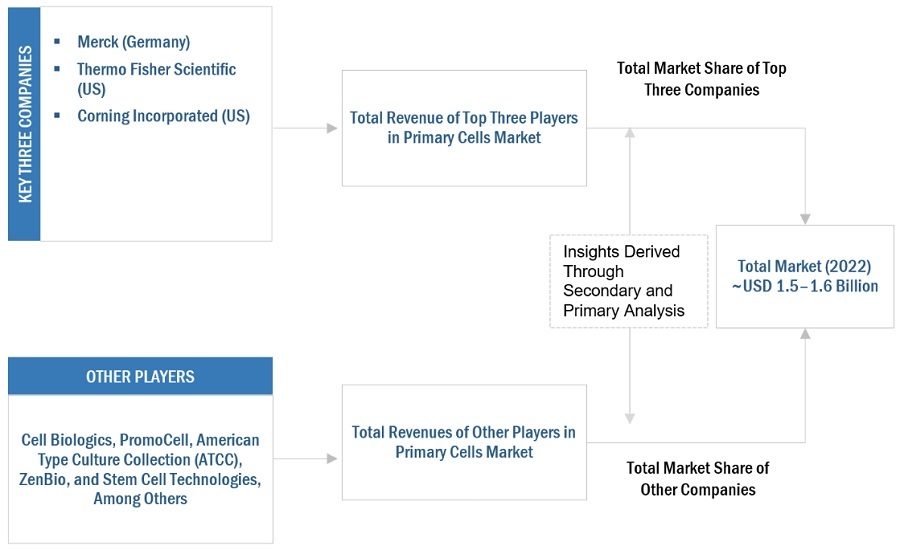

The global primary cells market, valued at US$1.5 billion in 2022, stood at US$1.7 billion in 2023 and is projected to advance at a resilient CAGR of 10.5% from 2023 to 2028, culminating in a forecasted valuation of US$2.8 billion by the end of the period. The growth of this market can be attributed to factors such as the is the growing advantages of primary human cells over cell lines, rising growth in pharmaceutical & biotechnology industries, increasing demand for monoclonal antibodies, Government investments for cell-based research, and increasing cancer research.

Primary Cells Market Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Primary Cells Market Dynamics

DRIVER: Advantages of primary human cells over cell lines

Primary human cells have a wide range of advantages over in vitro cell lines; they provide reliable tissue-specific responses in a biologically relevant microenvironment. Drug responses in cell lines may not provide false responses in a cellular context. Moreover, primary human cells are cost-effective and help in reducing the expenditure on animal models required for in vivo studies. Pre-screened primary cells help in representing signaling in vivo very closely. Owing to this, pharmaceutical and biotechnology companies, as well as CROs, are increasingly shifting to primary human cells for their lead identification and optimization processes in drug discovery. Some of the key advantages of primary human cells include physiological relevance, genetic diversity, and tumor microenvironment representation, among others.

The conventional methods of toxicity and drug safety assessment involve animal testing, which is expensive, time-consuming, and low throughput. Thus, primary human cells present a preferable alternative for biochemical assays and animals because of their physiological relevance; inherent virtues; and ability to provide efficient, cost-effective, and accelerated drug discovery solutions. The use of primary cultures also tackles many ethical objections raised against animal experiments and allows for experimentation on human tissues, which is otherwise limited to in vitro studies. These advantages of human and animal primary cells are driving their adoption among end users and thereby fueling market growth.

RESTRAINT: Concerns regarding primary cell culture contamination

Contamination is a significant concern in primary cell cultures, as it can negatively impact experimental results, introduce variability, and compromise the reliability of research findings. Some of the main concerns regarding primary cell culture contamination include bacterial and fungal contamination, viral contamination, cross-contamination, and mycoplasma contamination. To minimize the risk of contamination, it is essential to follow good aseptic techniques and implement appropriate quality control measures. Implementing strict aseptic practices, performing regular monitoring, and testing, and using authenticated cells can minimize the risk of contamination in primary cell cultures, ensuring more reliable and reproducible experimental outcomes.

OPPORTUNITY: Advancing biomedical research using primary cells in 3D cultures

The use of primary cells in 3D cultures has advanced biomedical research by providing a more physiologically relevant model that better mimics the complexity and architecture of human tissues. Primary cells in 3D cultures have significantly advanced biomedical research by providing more physiologically relevant models for studying diseases, drug discovery, toxicity assessment, and personalized medicine. These models have the potential to bridge the gap between traditional cell culture and in vivo studies, leading to more accurate predictions and improved translation of research findings to clinical applications. Hence, the increasing use of primary cells with 3D cultures in various R&D activities is expected to influence the demand for primary cells in the coming years. This is expected to provide a wide range of growth opportunities for players in the market.

CHALLENGE: Sourcing and availability of primary cells

Obtaining high-quality primary cells can be a challenge due to the limited availability of specific tissue types and donor variability. Sourcing primary cells from diverse patient populations and obtaining consent for tissue donation can be logistically challenging. Additionally, the availability of certain primary cell types may be limited, making it difficult to meet the demand for specific research needs. Sourcing and availability of primary cells can be a challenge due to several factors, such as tissue acquisition, donor variability, tissue preservation, and transport, and the limited availability of specific cell types. Addressing these challenges requires collaborations between researchers, tissue banks, and regulatory bodies to ensure a streamlined process for tissue acquisition, storage, and distribution. Efforts to expand tissue repositories, establish partnerships with healthcare institutions, and promote tissue donation can help enhance the availability of primary cells. Additionally, advances in techniques for cryopreservation, tissue storage, and transport can improve the accessibility and quality of primary cells, overcoming some of the challenges associated with sourcing and availability.

In 2022, by origin, human primary cells segment dominated the primary cells industry.

On the basis of origin, the primary cells market is divided into animal and human primary cells. In 2022, the human primary cells segment accounted for the largest share of the market. Factors responsible for the growth of the segment include the extensive use of human primary cells for studying human cancerous cell models, as well as in toxicology studies. The driving factors for the human market also include the demand for accurate disease models, advancements in research and drug discovery, the rise of regenerative medicine, safety testing requirements, the increasing burden of chronic diseases, technological innovations, ethical considerations, and collaborative initiatives within the scientific community.

Hematopoietic cells segment accounted for the largest share in the primary cells industry, by type in 2022.

On the basis of type, the primary cells market is divided into hematopoietic cells, dermatocytes, gastrointestinal cells, hepatocytes, lung cells, renal cells, heart cells, musculoskeletal cells, and other primary cells. In 2022, the hematopoietic cells segment accounted for the largest market share. Factors such as use of Hematopoietic cell transplants and to develop novel cancer therapies to treat blood cancers and other disorders of the immune system are responsible for the segment growth. Hepatocytes, due to their increasing demand in toxicological and pharmacological studies, are expected to witness the highest growth in the market.

In 2022, the pharmaceutical & biotechnology companies, and CROs segment accounted for the largest share of the global primary cells industry, by end user.

On the basis of end users, the primary cells market is segmented into pharmaceutical & biotechnology companies, and CROs, academic & research institutes, and other end users. In 2022, pharmaceutical & biotechnology companies and CROs accounted for the largest share of the market, mainly due to the high adoption of primary cells in cell-based experiments and cancer research in pharmaceutical & biotechnology companies and CROs, as well as the increasing number of R&D facilities globally.

In 2022, North America is the largest region for primary cells industry.

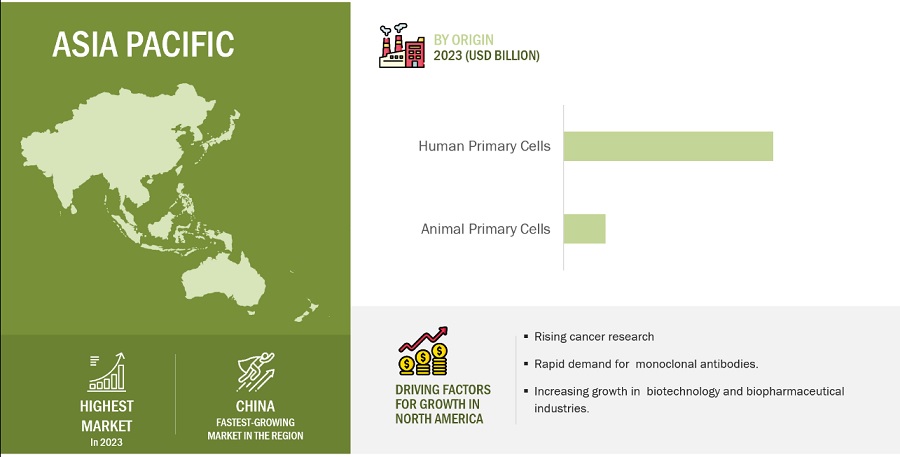

The global primary cells market is divided in four major regions, namely, North America, Europe, Asia Pacific, and the Rest of the World. In 2022, North America accounted for the largest share of the market, followed by Europe. Due to established clusters in North America and Europe, these regions are the preferred locations for drug discovery. Asia Pacific is expected to register the highest growth during the forecast period due to an increase in populations and a rise in the burden of diseases.

To know about the assumptions considered for the study, download the pdf brochure

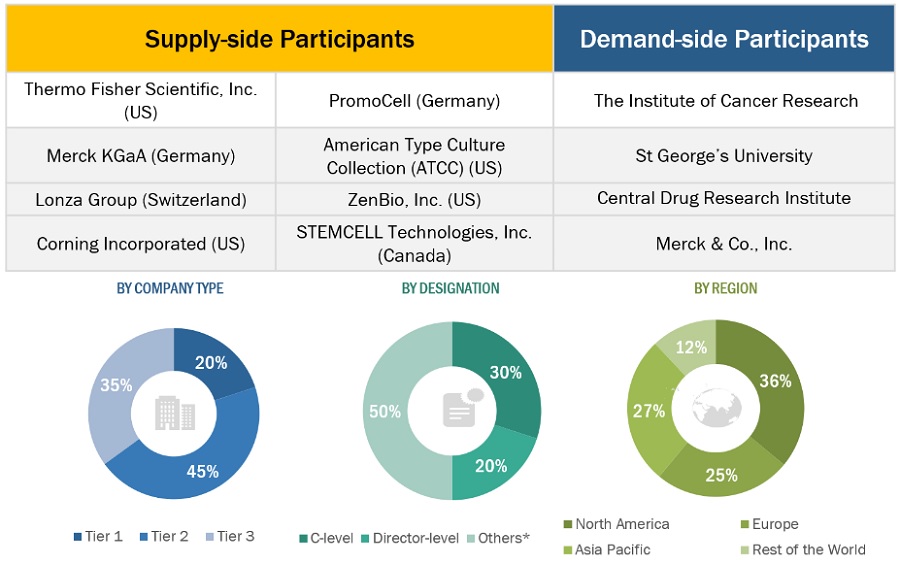

Key players in the primary cells market are Thermo Fisher Scientific, Inc. (US), Merck KGaA (Germany), Lonza (Switzerland), and Corning Incorporated (US).

Scope of the Primary Cells Industry

|

Report Metric |

Details |

|

Market Revenue Size in 2023 |

$1.7 billion |

|

Projected Revenue Size by 2028 |

$2.8 billion |

|

Industry Growth Rate |

Poised to Grow at a CAGR of 10.5% |

|

Market Driver |

Advantages of primary human cells over cell lines |

|

Market Opportunity |

Advancing biomedical research using primary cells in 3D cultures |

This report categorizes the primary cells market to forecast revenue and analyze trends in each of the following submarkets:

By Origin

- Human Primary Cells

- Animal Primary Cells

By Type

- Hematopoietic Cells

- Dermatocytes

- Gastrointestinal Cells

-

Hepatocytes

- Cryopreserved Hepatocytes

- Fresh Hepatocytes

- Lung Cells

- Renal Cells

- Heart Cells

- Musculoskeletal Cells

- Other Primary Cells

By End User

- Pharmaceutical & Biotechnology Companies and CROs

- Academic & Research Institutes

- Other End Users

By Region

-

North America

- US

- Canada

-

Europe

- UK

- Germany

- France

- Italy

- Rest of Europe

-

Asia Pacific

- China

- Japan

- Rest of Asia Pacific

- Rest of the World

Recent Developments of Primary Cells Industry

- In June 2023, iXCells Biotechnologies entered into an agreement with Tebubio to enhance the distribution of the company’s products throughout Europe.

- In March 2022, Lonza launched human stem cell offerings to provide human cord blood CD34+ hematopoietic stem cells (CB-CD34+ HSCs) in large batch sizes, expanding

Frequently Asked Questions (FAQ):

What is the projected growth rate of the global primary cells market between 2023 and 2028?

The global primary cells market is projected to grow from USD 1.7 billion in 2023 to USD 2.8 billion by 2028, demonstrating a robust CAGR of 10.5%.

What are the key factors driving the primary cells market?

Key drivers of the primary cells market include the growing use of primary human cells in drug discovery, increasing demand for monoclonal antibodies, rising cancer research, and government investments in cell-based research.

What are the main challenges facing the primary cells market?

The primary cells market faces challenges such as contamination issues in primary cell cultures, limited availability of specific tissue types, donor variability, and logistical challenges in sourcing high-quality cells.

What are the advantages of primary human cells over cell lines?

Primary human cells offer several advantages over cell lines, including greater physiological relevance, genetic diversity, and the ability to provide reliable tissue-specific responses. These attributes make them ideal for drug discovery and toxicity studies.

What opportunities exist in the primary cells market?

Significant opportunities in the primary cells market lie in advancing biomedical research, especially through the use of 3D cultures. These cultures better mimic human tissue architecture, allowing for more accurate disease modeling, drug discovery, and personalized medicine.

Which primary cell type accounted for the largest share of the market in 2022?

In 2022, hematopoietic cells accounted for the largest share of the primary cells market. These cells are crucial for cancer therapies, such as hematopoietic cell transplants, and are widely used in immunology and blood cancer research.

Which end user segment leads the primary cells market?

Pharmaceutical and biotechnology companies, along with Contract Research Organizations (CROs), dominate the primary cells market. Their extensive use of primary cells for drug development, cancer research, and cell-based assays drives market growth.

Which region is expected to grow the fastest in the primary cells market?

Asia Pacific is expected to register the highest growth in the primary cells market due to its expanding population, rising disease burden, and growing investments in research and healthcare infrastructure.

What are the key factors driving the demand for human primary cells?

The demand for human primary cells is driven by their use in cancer research, toxicology studies, and drug discovery. Their physiological relevance and ability to closely mimic human in vivo environments make them essential for accurate disease modeling.

What recent developments have influenced the primary cells market?

Recent developments include the launch of advanced stem cell offerings, such as Lonza's human cord blood CD34+ hematopoietic stem cells, which expand the availability of primary cells for research in regenerative medicine and immunotherapy.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing cancer research- Advantages of primary human cells over cell lines- Increasing demand for monoclonal antibodies- Rapid growth in biotechnology and biopharmaceutical industries- Growing focus on personalized medicine- Government investments for cell-based researchRESTRAINTS- Concerns regarding primary cell culture contamination- Ethical concerns regarding research in cell biologyOPPORTUNITIES- Advancing biomedical research using primary cells in 3D culturesCHALLENGES- Sourcing and availability of primary cells

-

5.3 REGULATORY ANALYSISREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4 PRICING ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

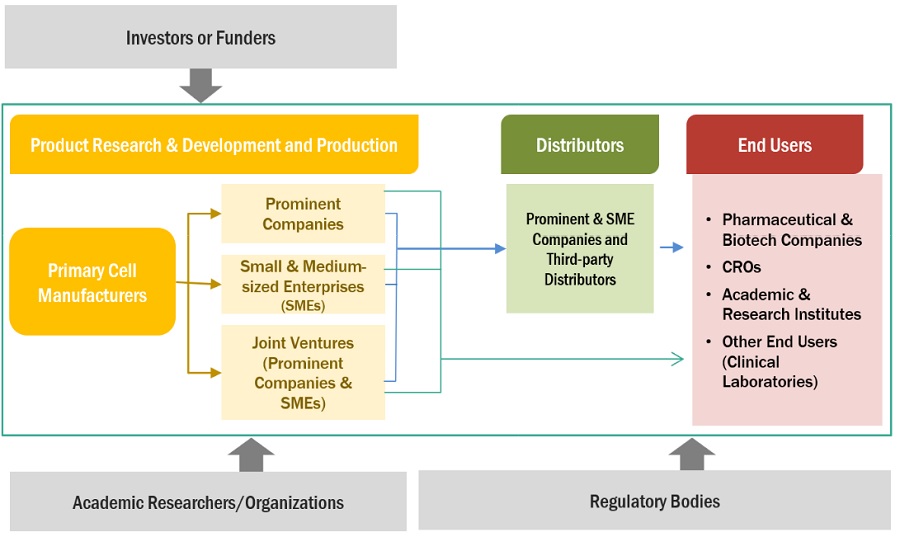

- 5.6 SUPPLY CHAIN ANALYSIS

-

5.7 ECOSYSTEM ANALYSIS

- 5.8 KEY CONFERENCES & EVENTS, 2023–2024

- 5.9 TECHNOLOGY ANALYSIS

-

5.10 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.11 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA FOR PRIMARY CELLS

- 6.1 INTRODUCTION

-

6.2 HEMATOPOIETIC CELLSINCREASING CANCER RESEARCH & FUNDING TO PROPEL MARKET GROWTH

-

6.3 DERMATOCYTESRISING PREVALENCE OF MELANOMA TO BOOST DEMAND

-

6.4 GASTROINTESTINAL CELLSGROWING INCIDENCE OF STOMACH CANCER TO BOLSTER GROWTH

-

6.5 HEPATOCYTESCRYOPRESERVED HEPATOCYTES- Longer lifespan of cryopreserved hepatocytes than fresh hepatocytes to drive market growthFRESH HEPATOCYTES- Stringent regulations and limited availability of fresh hepatocytes to limit market growth

-

6.6 LUNG CELLSINCREASING RATE OF LUNG CANCER & COPD TO DRIVE DEMAND FOR LUNG CELLS

-

6.7 RENAL CELLSLACK OF AVAILABILITY OF EFFECTIVE RENAL THERAPIES TO PROPEL MARKET GROWTH

-

6.8 HEART CELLSHIGH INCIDENCE OF CARDIOVASCULAR DISEASES TO SUPPORT GROWTH

-

6.9 MUSCULOSKELETAL CELLSRISING INCIDENCE OF MUSCULOSKELETAL DISORDERS TO PROPEL MARKET GROWTH

- 6.10 OTHER PRIMARY CELLS

- 7.1 INTRODUCTION

-

7.2 HUMAN PRIMARY CELLSINCREASING PREVALENCE OF CANCER TO SUPPORT MARKET GROWTH

-

7.3 ANIMAL PRIMARY CELLSRISING INVESTMENTS IN ANIMAL CELL RESEARCH TO PROPEL MARKET GROWTH

- 8.1 INTRODUCTION

-

8.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROSINCREASING INVESTMENTS IN CELL-BASED RESEARCH TO DRIVE MARKET GROWTH

-

8.3 ACADEMIC & RESEARCH INSTITUTESINCREASING GOVERNMENT FUNDING FOR RESEARCH AND HIGH PREVALENCE OF CANCER TO FAVOR MARKET GROWTH

- 8.4 OTHER END USERS

- 9.1 INTRODUCTION

-

9.2 NORTH AMERICAUS- High R&D spending and growing support for stem cell research to drive market growthCANADA- Presence of advanced R&D infrastructure to boost marketNORTH AMERICA: IMPACT OF RECESSION

-

9.3 EUROPEUK- Growth in life science industry to fuel market growthGERMANY- Increasing life science research activities to support market growthFRANCE- Robust biotechnology infrastructure to support growthITALY- Increasing number of cell biology seminars and conferences to fuel adoption of primary cellsREST OF EUROPEEUROPE: IMPACT OF RECESSION

-

9.4 ASIA PACIFICCHINA- Growing focus on cancer therapeutics-related research to bolster growthJAPAN- Government initiatives to propel market growth in JapanREST OF ASIA PACIFICASIA PACIFIC: IMPACT OF RECESSION

-

9.5 REST OF THE WORLDREST OF THE WORLD: IMPACT OF RECESSION

- 10.1 INTRODUCTION

- 10.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE SHARE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

-

10.5 COMPANY EVALUATION QUADRANTSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 COMPETITIVE BENCHMARKING OF TOP 25 PLAYERSPRODUCT FOOTPRINT OF COMPANIES (25 COMPANIES)REGIONAL FOOTPRINT OF COMPANIES (25 COMPANIES)

-

10.7 COMPANY EVALUATION QUADRANT: START-UPS/SMESPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

- 10.8 COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

-

10.9 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSTHERMO FISHER SCIENTIFIC, INC.- Business overview- Products offered- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewCORNING INCORPORATED- Business overview- Products offered- MnM viewLONZA GROUP- Business overview- Products offered- Recent developmentsCHARLES RIVER LABORATORIES, INC.- Business overview- Products offered- Recent developmentsPROMOCELL GMBH- Business overview- Products offered- Recent developmentsAMERICAN TYPE CULTURE COLLECTION (ATCC)- Business overview- Products offeredCELL BIOLOGICS, INC.- Business overview- Products offeredZENBIO, INC.- Business overview- Products offeredSTEMCELL TECHNOLOGIES, INC.- Business overview- Products offeredALLCELLS- Business overview- Products offeredIXCELLS BIOTECHNOLOGIES- Business overview- Products offered- Recent developmentsNEUROMICS- Business overview- Products offered

-

11.2 OTHER COMPANIESAXOL BIOSCIENCE LTD.STEMEXPRESSBIOIVTSCIENCELL RESEARCH LABORATORIES, INC.AMSBIOPROMAB BIOTECHNOLOGIES, INC.CREATIVE BIOARRAYBPS BIOSCIENCE, INC.EPITHELIXREACHBIO RESEARCH LABSACCEGENKOSHEEKA

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL INFLATION RATE PROJECTIONS, 2024–2028 (% GROWTH)

- TABLE 2 US HEALTH EXPENDITURE, 2019–2022 (USD MILLION)

- TABLE 3 US HEALTH EXPENDITURE, 2023–2027 (USD MILLION)

- TABLE 4 PRIMARY CELLS MARKET: IMPACT ANALYSIS

- TABLE 5 PROJECTED INCREASE IN NUMBER OF CANCER PATIENTS, 2015 VS. 2018 VS. 2020 VS. 2035

- TABLE 6 ESTIMATED NUMBER OF NEW CASES OF ALL CANCERS (EXCLUDING NON-MELANOMA SKIN CANCER) FOR BOTH SEXES, 2020 VS. 2040

- TABLE 7 GROWTH IN NUMBER OF PERSONALIZED MEDICATIONS, 2015–2022

- TABLE 8 AVERAGE PRICE OF PRIMARY CELL PRODUCTS, BY KEY PLAYER (USD)

- TABLE 9 PRIMARY CELLS MARKET ECOSYSTEM

- TABLE 10 PRIMARY CELLS MARKET: LIST OF CONFERENCES & EVENTS

- TABLE 11 PRIMARY CELLS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 12 PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 13 TYPES OF HEMATOPOIETIC CELLS

- TABLE 14 HEMATOPOIETIC CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 15 NORTH AMERICA: HEMATOPOIETIC CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 16 EUROPE: HEMATOPOIETIC CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 17 ASIA PACIFIC: HEMATOPOIETIC CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 18 DERMATOCYTES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 19 NORTH AMERICA: DERMATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 20 EUROPE: DERMATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 21 ASIA PACIFIC: DERMATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 22 GASTROINTESTINAL CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 23 NORTH AMERICA: GASTROINTESTINAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 24 EUROPE: GASTROINTESTINAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 25 ASIA PACIFIC: GASTROINTESTINAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 26 GLOBAL LIVER DISORDER INCIDENCE

- TABLE 27 HEPATOCYTES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 29 EUROPE: HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 31 HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 32 CRYOPRESERVED HEPATOCYTES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 33 NORTH AMERICA: CRYOPRESERVED HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 34 EUROPE: CRYOPRESERVED HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 35 ASIA PACIFIC CRYOPRESERVED HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 36 FRESH HEPATOCYTES MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 37 NORTH AMERICA: FRESH HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 38 EUROPE: FRESH HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 39 ASIA PACIFIC: FRESH HEPATOCYTES MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 40 LUNG CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 41 NORTH AMERICA: LUNG CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 42 EUROPE: LUNG CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 43 ASIA PACIFIC: LUNG CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 44 RENAL CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 45 NORTH AMERICA: RENAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 46 EUROPE: RENAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 47 ASIA PACIFIC: RENAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 HEART CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 49 NORTH AMERICA: HEART CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 50 EUROPE: HEART CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: HEART CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 52 MUSCULOSKELETAL CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 53 NORTH AMERICA: MUSCULOSKELETAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 54 EUROPE: MUSCULOSKELETAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: MUSCULOSKELETAL CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 OTHER PRIMARY CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 57 NORTH AMERICA: OTHER PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 58 EUROPE: OTHER PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: OTHER PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 60 PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 61 HUMAN PRIMARY CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: HUMAN PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 63 EUROPE: HUMAN PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 ASIA PACIFIC: HUMAN PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 65 ANIMAL PRIMARY CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: ANIMAL PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 67 EUROPE: ANIMAL PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 68 ASIA PACIFIC: ANIMAL PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 69 PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 70 PRIMARY CELLS MARKET FOR PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 71 NORTH AMERICA: PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 EUROPE: PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 73 ASIA PACIFIC: PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 74 PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY REGION, 2021–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 76 EUROPE: PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 77 ASIA PACIFIC: PRIMARY CELLS MARKET FOR ACADEMIC & RESEARCH INSTITUTES, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 78 PRIMARY CELLS MARKET FOR OTHER END USERS, BY REGION, 2021–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: PRIMARY CELLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 80 EUROPE: PRIMARY CELLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 81 ASIA PACIFIC: PRIMARY CELLS MARKET FOR OTHER END USERS, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 82 PRIMARY CELLS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 86 NORTH AMERICA: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 88 US: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 89 US: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 90 US: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 91 US: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 92 CANADA: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 93 CANADA: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 94 CANADA: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 95 CANADA: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 96 EUROPE: PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 97 EUROPE: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 98 EUROPE: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 99 EUROPE: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 100 EUROPE: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 101 UK: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 102 UK: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 103 UK: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 104 UK: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 105 GERMANY: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 106 GERMANY: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 107 GERMANY: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 108 GERMANY: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 109 FRANCE: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 110 FRANCE: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 111 FRANCE: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 112 FRANCE: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 113 ITALY: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 114 ITALY: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 115 ITALY: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 116 ITALY: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 117 REST OF EUROPE: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 120 REST OF EUROPE: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 121 ASIA PACIFIC: PRIMARY CELLS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 122 ASIA PACIFIC: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 123 ASIA PACIFIC: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 124 ASIA PACIFIC: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 125 ASIA PACIFIC: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 126 CHINA: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 127 CHINA: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 128 CHINA: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 129 CHINA: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 130 JAPAN: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 131 JAPAN: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 132 JAPAN: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 133 JAPAN: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 134 REST OF ASIA PACIFIC: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 135 REST OF ASIA PACIFIC: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 136 REST OF ASIA PACIFIC: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 137 REST OF ASIA PACIFIC: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 138 REST OF THE WORLD: PRIMARY CELLS MARKET, BY ORIGIN, 2021–2028 (USD MILLION)

- TABLE 139 REST OF THE WORLD: PRIMARY CELLS MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 140 REST OF THE WORLD: HEPATOCYTES MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 141 REST OF THE WORLD: PRIMARY CELLS MARKET, BY END USER, 2021–2028 (USD MILLION)

- TABLE 142 PRIMARY CELLS MARKET: DEGREE OF COMPETITION

- TABLE 143 PRIMARY CELLS MARKET: PRODUCT FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 144 PRIMARY CELLS MARKET: REGIONAL FOOTPRINT ANALYSIS OF KEY PLAYERS

- TABLE 145 PRIMARY CELLS MARKET: DETAILED LIST OF KEY START-UP/SME PLAYERS

- TABLE 146 PRIMARY CELLS MARKET: COMPETITIVE BENCHMARKING OF START-UP/SME PLAYERS

- TABLE 147 PRIMARY CELLS MARKET: PRODUCT LAUNCHES, JANUARY 2020–JUNE 2023

- TABLE 148 PRIMARY CELLS MARKET: DEALS, JANUARY 2020–JUNE 2023

- TABLE 149 PRIMARY CELLS MARKET: OTHER DEVELOPMENTS, JANUARY 2020–JUNE 2023

- TABLE 150 THERMO FISHER SCIENTIFIC, INC.: BUSINESS OVERVIEW

- TABLE 151 MERCK KGAA: COMPANY OVERVIEW

- TABLE 152 OTHER DEVELOPMENTS

- TABLE 153 CORNING INCORPORATED: BUSINESS OVERVIEW

- TABLE 154 LONZA GROUP: BUSINESS OVERVIEW

- TABLE 155 PRODUCT LAUNCHES

- TABLE 156 CHARLES RIVER LABORATORIES, INC.: BUSINESS OVERVIEW

- TABLE 157 ACQUISITIONS

- TABLE 158 PROMOCELL GMBH: BUSINESS OVERVIEW

- TABLE 159 PRODUCT LAUNCHES

- TABLE 160 AMERICAN TYPE CULTURE COLLECTION (ATCC): BUSINESS OVERVIEW

- TABLE 161 CELL BIOLOGICS, INC.: BUSINESS OVERVIEW

- TABLE 162 ZENBIO, INC.: BUSINESS OVERVIEW

- TABLE 163 STEMCELL TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 164 ALLCELLS: BUSINESS OVERVIEW

- TABLE 165 IXCELLS BIOTECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 166 AGREEMENTS

- TABLE 167 NEUROMICS: BUSINESS OVERVIEW

- TABLE 168 AXOL BIOSCIENCE LTD.: COMPANY OVERVIEW

- TABLE 169 STEMEXPRESS: COMPANY OVERVIEW

- TABLE 170 BIOIVT: COMPANY OVERVIEW

- TABLE 171 SCIENCELL RESEARCH LABORATORIES, INC.: COMPANY OVERVIEW

- TABLE 172 AMSBIO: COMPANY OVERVIEW

- TABLE 173 PROMAB BIOTECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 174 CREATIVE BIOARRAY: COMPANY OVERVIEW

- TABLE 175 BPS BIOSCIENCE, INC.: COMPANY OVERVIEW

- TABLE 176 EPITHELIX: COMPANY OVERVIEW

- TABLE 177 REACHBIO RESEARCH LABS: COMPANY OVERVIEW

- TABLE 178 ACCEGEN: COMPANY OVERVIEW

- TABLE 179 KOSHEEKA: COMPANY OVERVIEW

- FIGURE 1 PRIMARY CELLS MARKET: RESEARCH DESIGN

- FIGURE 2 PRIMARY CELLS MARKET: BREAKDOWN OF PRIMARIES

- FIGURE 3 PRIMARY CELLS MARKET SIZE ESTIMATION (SUPPLY-SIDE ANALYSIS), 2022

- FIGURE 4 MARKET SIZE ESTIMATION: APPROACH 1 – REVENUE SHARE ANALYSIS (2022)

- FIGURE 5 ILLUSTRATIVE EXAMPLE OF MERCK KGAA: REVENUE SHARE ANALYSIS (2022)

- FIGURE 6 KEY INDUSTRY INSIGHTS

- FIGURE 7 PRIMARY CELLS MARKET: CAGR PROJECTIONS, 2023–2028

- FIGURE 8 PRIMARY CELLS MARKET: GROWTH ANALYSIS OF DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 9 DATA TRIANGULATION METHODOLOGY

- FIGURE 10 PRIMARY CELLS MARKET, BY TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 11 PRIMARY CELLS MARKET, BY ORIGIN, 2023 VS. 2028 (USD MILLION)

- FIGURE 12 PRIMARY CELLS MARKET, BY END USER, 2023 VS. 2028 (USD MILLION)

- FIGURE 13 GEOGRAPHICAL SNAPSHOT OF PRIMARY CELLS MARKET

- FIGURE 14 GROWING GLOBAL INCIDENCE OF CANCER TO DRIVE MARKET GROWTH

- FIGURE 15 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES AND CROS DOMINATED NORTH AMERICAN PRIMARY CELLS MARKET IN 2022

- FIGURE 16 HEMATOPOIETIC CELLS SEGMENT TO DOMINATE MARKET IN 2028

- FIGURE 17 HUMAN PRIMARY CELLS SEGMENT DOMINATED MARKET IN 2022

- FIGURE 18 ASIA PACIFIC COUNTRIES TO REGISTER HIGH GROWTH RATES FROM 2023 TO 2028

- FIGURE 19 PRIMARY CELLS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 20 GLOBAL PHARMACEUTICAL R&D SPENDING, 2014–2028

- FIGURE 21 MAJOR VALUE ADDED DURING MANUFACTURING & ASSEMBLY PHASE

- FIGURE 22 DISTRIBUTION—A STRATEGY PREFERRED BY PROMINENT COMPANIES

- FIGURE 23 ECOSYSTEM ANALYSIS OF PRIMARY CELLS MARKET

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS OF PRIMARY CELL PRODUCTS

- FIGURE 25 KEY BUYING CRITERIA FOR END USERS

- FIGURE 26 NORTH AMERICA: PRIMARY CELLS MARKET SNAPSHOT

- FIGURE 27 ASIA PACIFIC: PRIMARY CELLS MARKET SNAPSHOT

- FIGURE 28 PRIMARY CELLS MARKET: STRATEGIES ADOPTED

- FIGURE 29 REVENUE ANALYSIS OF KEY PLAYERS (2019–2022)

- FIGURE 30 MARKET SHARE ANALYSIS OF KEY PLAYERS (2022)

- FIGURE 31 PRIMARY CELLS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 32 PRIMARY CELLS MARKET: COMPANY EVALUATION MATRIX FOR START-UPS/SMES, 2022

- FIGURE 33 THERMO FISHER SCIENTIFIC, INC.: COMPANY SNAPSHOT (2022)

- FIGURE 34 MERCK KGAA: COMPANY SNAPSHOT (2022)

- FIGURE 35 CORNING INCORPORATED: COMPANY SNAPSHOT (2022)

- FIGURE 36 LONZA GROUP: COMPANY SNAPSHOT (2022)

- FIGURE 37 CHARLES RIVER LABORATORIES, INC.: COMPANY SNAPSHOT (2022)

This research study involved the extensive use of secondary sources, directories, and databases to identify and collect valuable information for the analysis of the global primary cells market. In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, to obtain and verify critical qualitative and quantitative information and assess the growth prospects of the market. The global market size estimated through secondary research was then triangulated with inputs from primary research to arrive at the final market size.

Secondary Research

The secondary sources referred to for this research study include publications from government sources, such as the Department of Health and Social Care (DHSC), the International Cell Line Authentication Committee (ICLAC), National Cancer Institute (NCI), Cancer Research UK, Israel Cancer Research Fund (ICRF), Breast Cancer Research Foundation (BCRF), Centre for Cellular & Molecular Biology (CCMB), European Collection of Authenticated Cell Cultures (ECACC), Chinese Academy of Medical Sciences (CAMS), National Centre for Cell Science (NCCS), GLOBOCAN, World Health Organization (WHO), National Center for Biotechnology Information (NCBI), US Food and Drug Administration (FDA). Secondary sources also include corporate & regulatory filings, such as annual reports, SEC filings, investor presentations, and financial statements; business magazines & research journals; press releases; and trade, business, and professional associations. Secondary data was collected and analyzed to arrive at the overall size of the global primary cells market, which was validated through primary research.

Primary Research

Primary research was conducted to validate the market segmentation, identify key players, and gather insights into key industry trends and market dynamics.

Extensive primary research was conducted after acquiring basic knowledge about the global primary cells market scenario through secondary research. Several primary interviews were conducted with market experts from the demand side, such as personnel from pharmaceutical & biopharmaceutical industries, academic & research institutes, and experts from the supply side, such as C-level & D-level executives, product managers, marketing & sales managers of key manufacturers, distributors, and channel partners. These interviews were conducted across four major regions: North America, Europe, Asia Pacific, and the Rest of the World. Approximately 70% and 30% of the primary interviews were conducted with supply-side and demand-side participants, respectively. This primary data was collected through questionnaires, e-mails, online surveys, personal interviews, and telephonic interviews.

The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The report presents a detailed assessment of the primary cells market and qualitative inputs and insights from MarketsandMarkets. The global size of the primary cells market was estimated through multiple approaches. A detailed market estimation approach was followed to estimate and validate the value of the primary cells and other dependent submarkets. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive primary and secondary research.

- The revenues generated from the primary cells business of leading players have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

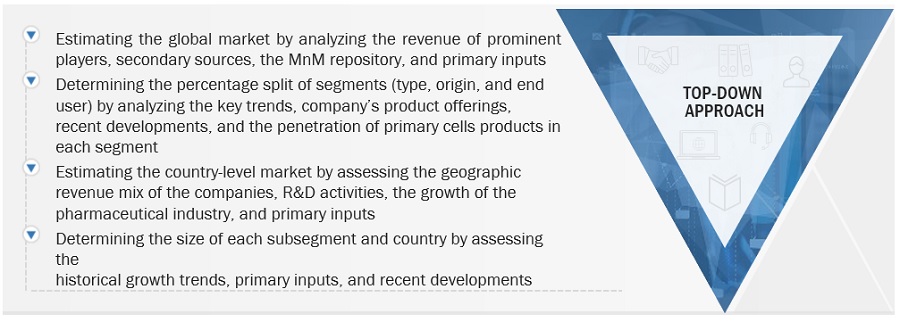

Top- Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Bottom-up Approach

Approach: MnM Repository Analysis

For this report, the previous version of the primary cells market were considered. The global and regional market values of the primary cells market and dependent submarkets were extracted from the MnM repository and validated through secondary and primary research. The final global market size was triangulated through the average of all approaches and validated through primary interviews with industry experts.

Data Triangulation

After arriving at the market size from the market size estimation process explained above, the total market was divided into several segments and subsegments. Data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments.

Market Definition:

Primary cells are the most physiologically and biologically relevant in vitro tools for biotechnology-based research. These cells are directly isolated from primary cell cultures of human or animal living tissue through enzymatic or mechanical methods. The integration of primary cells into cell-based research programs has helped to deliver biologically accurate and relevant data because they efficiently maintain their fundamental cellular functions.

Key Stakeholders

- Research institutes

- Manufacturers & distributors of primary cells

- Clinical research organizations (CROs)

- Academic research institutes

- Biopharmaceutical & biotechnology companies

- Cell banks

- Venture capitalists and investors

- Government associations dedicated to primary cells and cell culture preservation

Report Objectives

- To define, describe, segment, and forecast the global primary cells market by origin, type, end user, and region

- To provide detailed information regarding the major factors influencing market growth (drivers, restraints, opportunities, and challenges)

- To analyze micromarkets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of the market segments with respect to four regions, namely, North America, Europe, Asia Pacific, and the Rest of the World

- To profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze company developments such as product launches, expansions, and acquisitions in the primary cells market.

- To benchmark players within the market using the proprietary "Competitive Leadership Mapping" framework, which analyzes market players on various parameters within the broad categories of business and product strategy

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Geographical Analysis

- Further breakdown of the RoE primary cells market, by country

- Further breakdown of the RoAPAC primary cells market, by country

- Further breakdown of the RoW primary cells markets, by country

Company Information

- Detailed analysis and profiling of additional market players (Up to five)

Segment Analysis

- Further breakdown of the therapeutic area segment as per the product portfolio of prominent players operating in the market.

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Primary Cells Market