Pressure Control Equipment Market by Type (Wireline Pressure Control Equipment, Coiled Tubing Pressure Control Equipment), Component, Sales Type (New Purchase, Rental, Services, Spares), Application, Pressure and Region - Global Forecast to 2027

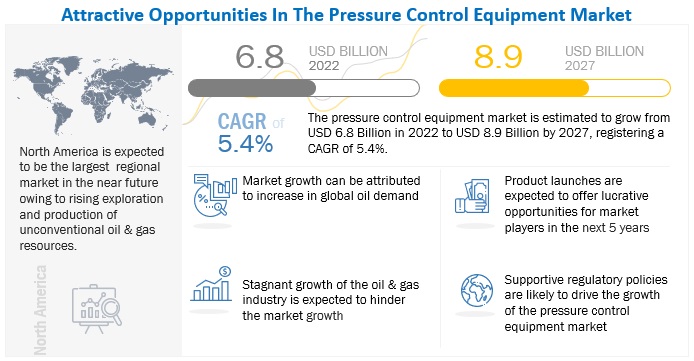

The global pressure control equipment market size was estimated at USD 6.8 billion in 2022 and is projected to reach USD 8.9 billion by 2027, growing at a CAGR of 5.4% from 2022 to 2027. Rising exploration and production of unconventional oil & gas resources, especially in North America region, and increasing global oil demand are the major driving factor for the pressure control equipment market .

To know about the assumptions considered for the study, Request for Free Sample Report

Pressure Control Equipment Market Dynamics

Driver: Rising exploration and production of unconventional oil & gas resources, especially in North America

Since its inception, the oil and gas industry has seen rapid changes in the methods, modes, and materials used for production and delivery.With conventional oil and gas reserves maturing, the demand for substitute resources that can efficiently meet rising energy demand is increasing.The discovery of unconventional oil and gas resources has aided in the development of clean and efficient energy sources. Unconventional oil and gas resources are those that do not occur in traditional formations and necessitate specialised extraction or production techniques.Shale gas, tight gas, coalbed methane (CBM), shale oil, tight oil, and natural gas hydrates are examples of unconventional oil and gas resources.Chemically, these resources are identical to conventional oil and gas resources. The distinction is based on their reservoir rock type, oil and gas origin, occurrence state, underground position, or the unique nature of their reservoirs.

Although the remaining global conventional resources are still abundant and sufficient to meet current needs, unconventional oil and gas resources are gradually becoming valuable and attracting more interest as the oil price rises. Unconventional oil and gas resources are being utilized more and more as decades of oil and natural gas production have resulted in extensive use of conventional resources. As per the World Energy Outlook report by the International Energy Agency (IEA), unconventional oil production is projected to increase from 1.8 mb/d in 2008 to 7.4 mb/d by 2030. By 2035, global unconventional oil production is expected to account for 15.3% of the total oil production. Hence, the increasing production of unconventional oil and gas is expected to lead to extensive exploration and production activities, ultimately fueling the demand for pressure control equipment.

The majority of shale reserves are located in North America, with the United States dominating the regional market, as well as in some parts of Europe and Asia.The International Energy Agency (IEA) predicts that shale production in the United States alone will exceed 100 million barrels per day. According to the US Energy Information Administration (EIA), US oil production from seven major shale formations increased by about 29,000 barrels per day (bpd) in January 2020, bringing total shale oil production to 9.14 million barrels per day. The increasing shale oil and gas production in the North Dakota basin, Montana's Bakken formations, and the Permian basin, as well as rising shale developments, are responsible for the US shale boom, which has propelled the country to the world's largest oil-producing country, ahead of Saudi Arabia and Russia. Furthermore, Argentina's Vaca Meurta shale basin is one of the world's largest shale reservoirs. Argentina has shale gas reserves of 23 trillion cubic metres and shale oil reserves of 27 billion barrels.

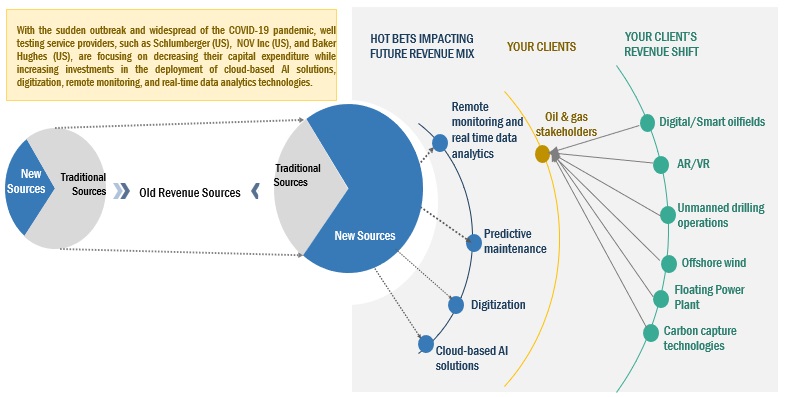

Restraint: Decline in capital expenditure of oilfield operators and service providers

Pressure control equipment demand is tied to exploration, development, and production operations, as well as capital investment by oil and gas corporations. Oil and natural gas price fluctuations have a direct influence on these operations. The fluctuations occur as a result of changes in supply and demand for oil and natural gas, governmental regulations, including policies governing the exploration, production, and development of oil and natural gas reserves, weather, natural disasters, and other factors. Because many large-scale development projects are for a long time, oil and gas companies may reduce or postpone major expenditures based on the perception of long-term low oil and natural gas prices.The prolonged reduction in crude oil prices or expectations of such reduction is expected to hamper the growth of the market.

Furthermore, the growth of the market is directly affected by the decline in capital expenditures by oilfield operators and service providers. It may lead to a decrease in demand for pressure control equipment.

Opportunities: Emerging offshore opportunities

Offshore exploration, drilling, and production operations necessitate distinct environmental and technological issues than onshore oil and gas activities. Despite the challenges posed by harsh offshore environmental conditions, advances in exploration and production technology for application in ice prone regions, such as the Grand Banks, Bohai Sea, Caspian Sea, Cook Inlet, and Sakhalin Island, have developed economically feasible solutions for the production in these regions.

The global slowdown in oil prices has resulted in downturn in the drilling activities in the past few years, thereby putting further pressure on offshore drillers and service providers; however, opportunities for offshore drillers is expected to grow as the industry tends to recover moderately. For instance, in Argentina, the Ministry of Energy launched an auction process for about 6–10 offshore exploration blocks at the end of 2017, whereas the Colombian government reduced offshore gas royalties and lowered windfall profit fees to support offshore developments in the country. Other activities such as commercialization of Liza oil discovery in the Stabroek offshore block by ExxonMobil in Guyana and growing contracts for exploration and production of hydrocarbons in the deepwater offshore in Mexico are expected to develop new opportunities for offshore drilling.

Challenges: Transition toward adoption of renewable energy sources

The aim of global economies to reduce their carbon footprint and emission of greenhouse gases has fueled the adoption of clean and green energy alternatives. This has led the economies to use renewable energy sources such as solar, wind (onshore and offshore), biomass, hydroelectric, and geothermal power for power generation. The growing energy demand due to rapid industrialization and urbanization has further accelerated the transition.

Renewable energy is considered to be the fastest-growing sector globally, with a large number of renewable energy projects receiving more funding than ever before. As the need for clean, sustainable energy increases and renewable technologies become more advanced, more and more projects are expected to be initiated. For instance, the Wudongde Hydropower Station, China, has been under construction since 2015 and began producing power in June 2020. The dam started operational by December 2021. It is expected to offset the use of 12.2 million tons of standard coal and reduce CO2 emissions by 30.5 million tons per year and sulfur dioxide emissions by 104,000 tons per year. The Hornsea Project 2, UK, estimated at the cost of USD 7.8 billion, has been in development since August 2015 and completed by 2022. This project boasts a total installed capacity of 1,386 MW on completion. Countries such as Canada, the US, India, and the UAE are actively investing in renewable energy projects, thus fueling the adoption of renewable energy sources.

The transition toward renewable energy sources, fueled by the increased investments by governments worldwide, is expected to result in a decline in upstream, midstream, and downstream activities and the growth of market players to an extent.

Market Trends

To know about the assumptions considered for the study, download the pdf brochure

Wireline pressure control equipment segment, by type, is expected to be the largest market during the forecast period

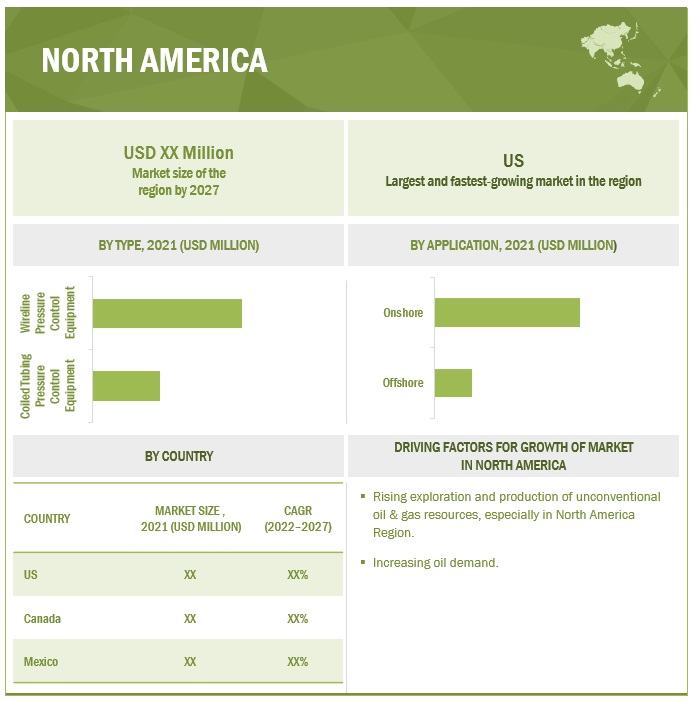

This report segments the pressure control equipment market based on type into two types: wireline pressure control equipment, and coiled tubing pressure control equipment. The wireline pressure control equipment is expected to be the largest market during the forecast period. Increase in drilling activities in key tight and shale basins and inception of several new projects in the federal offshore—Gulf of Mexico—are expected to drive the market for wireline pressure control equipment.

By Component, the control head segment is expected to be the fastest during the forecast period

This report segments the pressure control equipment market based on component into 11 segments: flow control valves, flow control treating iron, flow control adapter & flange, flow control surface crossover, flow control flexible hoses, wellhead equipment, control head, Christmas tree, quick unions, coiled tubing WPCE and others, which includes hydraulic chokes, and crossover adapters. Control head is expected to be the fastest segment during the forecast period. Reduced drilling cost and increases well production is expected to drive the market for control head segment.

“North America”: The largest pressure control equipment market”

North America is expected to dominate the pressure control equipment market between 2022–2027, followed by Europe and Asia Pacific. Rising exploration and production of unconventional oil & gas resources, especially in North America region is driving the gas control equipment market for this region.

Key Market Players

The market is dominated by a few major players that have a wide regional presence. The major players in the pressure control equipment market are SLB (US), Weatherford (US), NOV Inc (US), Baker Hughes Company (US), and The Weir Group PLC (UK). Between 2018 and 2022, Strategies such as product launches, contracts, agreements, partnerships, collaborations, alliances, acquisitions, and expansions are followed by these companies to capture a larger share of the market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Value (USD Billion) |

|

Segments covered |

Pressure control equipment market by type, component, application, sales type, pressure and region. |

|

Geographies covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies covered |

SLB (US), Weatherford (US), NOV Inc (US), Baker Hughes (US), The Weir Group PLC (UK), Hunting (UK), Emerson Electric Co (US), Flowserve Corporation (US), The IKM Group (Norway), Control Flow Inc (US), Brace Tool (Canada), Sunnda Corporation (US), GKD Industries Ltd (Canada), TIS Manufacturing (UK), NXL Technologies (Canada), IOT Group (Norway), Integrated Equipment (US), Allied Valve Inc (US), Omega (UK), and FHE (US) |

This research report categorizes the market by type, component, application, sales type, pressure and region.

On the basis of by type, the pressure control equipment market has been segmented as follows:

- Wireline Pressure Control Equipment

- Coiled Tubing Pressure Control Equipment

On the basis of component, the market has been segmented as follows:

- Flow Control Valves

- Flow Control Treating Iron

- Flow Control Adapter & Flange

- Flow Control Surface Crossover

- Wellhead Equipment

- Control Head

- Christmas Tree

- Quick Unions

- Coiled Tubing WPCE

- Others

On the basis of application, the market has been segmented as follows:

- Onshore

- Offshore

On the basis of sales type, the market has been segmented as follows:

- New Purchase

- Rental

- Services

- Spares

On the basis of pressure, the market has been segmented as follows:

- High Pressure

- Low Pressure

On the basis of region, the market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In October 2022, Weatherford received a five-year contract exceeding $500 million from Petroleum Development Oman (PDO) to deliver Integrated Drilling Services in the Marmul and Grater Saqar fields. As a part of this contract Weatherford will deliver drilling solutions to 700+ wells in the Marmul and Grater Saqar fields in the next years.

- In October 2022, SLB has entered into an agreement to acquire Gyrodata Incorporated, a global company specializing in gyroscopic wellbore positioning and survey technology. This combination will improve wellbore quality and reduce drilling risk to unlock even the most remote and complex reservoirs.

- In May 2022, Baker Hughes has launched a new subsea wellhead technology, the MS-2 Annulus Seal, to save substantial operational rig costs by helping lower overall wellhead installation costs due to reduced rig trips.

- In October 2020, NOV Inc signed a contract for Joint Industry Project (JIP) with Equinor and TotalEnergies for 2 years. This contract focuses on research and developments for deepwater projects.

Frequently Asked Questions (FAQ):

What is the current size of the pressure control equipment market?

The current market size of the pressure control equipment market is USD 6.4 billion in 2021.

What are the major drivers for the pressure control equipment market?

Rising exploration and production of unconventional oil & gas resources, especially in North American region, and increasing global oil demand are the major driving factor for the pressure control equipment market.

Which is the largest region during the forecasted period in the pressure control equipment market?

North America is expected to dominate the pressure control equipment market between 2022–2027, followed by Europe and Asia Pacific. Rising exploration and production of unconventional oil & gas resources, especially in North America region is driving the market for this region.

Which is the largest segment, by type during the forecasted period in the pressure control equipment market?

The wireline pressure control equipment is expected to be the largest market during the forecast period. Increase in drilling activities in key tight and shale basins and inception of several new projects in the federal offshore—Gulf of Mexico—are expected to drive the market for wireline pressure control equipment.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

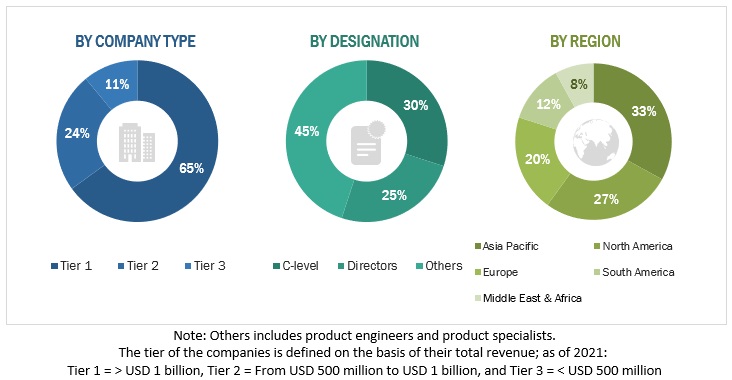

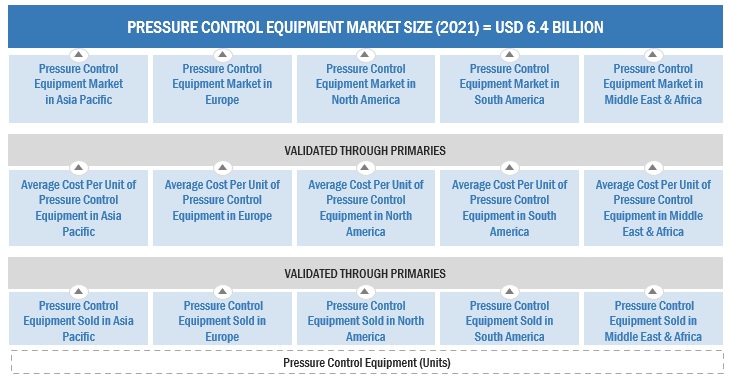

The study involved major activities in estimating the current size of the pressure control equipments market. Exhaustive secondary research was done to collect information on the peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of the segments and subsegments.

Secondary Research

This research study on the pressure control equipments market involved the use of extensive secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, International Energy Agency, and BP Statistical Review of World Energy, to identify and collect information useful for a technical, market-oriented, and commercial study of the pressure control equipments market. The other secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, manufacturer associations, trade directories, and databases.

Primary Research

The pressure control equipment market comprises several stakeholders such as pressure control equipment manufacturers, manufacturing technology providers, and technical support providers in the supply chain. The demand side of this market is characterized by the rising demand for pressure control equipment in, oil & gas, and other end-user industries. The supply side is characterized by rising demand for contracts from the industrial sector, and mergers & acquisitions among big players. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the breakdown of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research, and their market share in the respective regions have been determined through both primary and secondary research.

- The industry’s value chain and market size, in terms of value, have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Pressure control equipment Market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and subsegments, the data triangulation and market breakdown processes have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand- and supply sides. Along with this, the market has been validated using both the top-down and bottom-up approaches.

Objectives of the Study

- To define, describe, segment, and forecast the pressure control equipment market, by type, component, sales type, application, pressure, and region, in terms of value and volume.

- To provide detailed information on the drivers, restraints, opportunities, and industry-specific challenges influencing the growth of the market

- To strategically analyze the market with respect to individual growth trends, future expansions, and contributions of each segment to the market

- To analyze market opportunities for stakeholders and details of the competitive landscape for market leaders

- To forecast the growth of the market with respect to six main regions, namely, North America, Europe, South America, Asia Pacific, Middle East, and Africa

- To profile and rank key players and comprehensively analyze their respective market share

- To analyze competitive developments such as contracts & agreements, investments & expansions, product launches, and mergers & acquisitions in the pressure control equipment market

Available Customizations:

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product Matrix, which provides a detailed comparison of the product portfolio of each company

Company Information

- Detailed analyses and profiling of additional market players

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pressure Control Equipment Market