Asia-Pacific Seed Treatment Market By Type (Chemical & Non-Chemical), By Application (Fungicide, Insecticide, Bio-Control And Others) And By Crop (Cereals, Oilseeds And Others): Trends, Forecasts And Technical Insights Up To 2018

The seed treatment market consists of crop protection chemicals or agrochemicals, specifically for seeds, and genetically modified (GM) crop-seeds. Crop protection chemicals are the most dominating segment of this market in terms of market share as well as product innovations. Seed treatment market is further classified as insecticides (chemical), fungicides (chemical), bio-control seed treatments, and other seed treatment chemicals.

On the basis of types, seed treatment market is further segmented as chemical and non-chemical. Bio-based seed treatments, a part of non-chemical seed treatment, are made up of renewable resources and contain natural active ingredients. These seed treatments have much of a no negative impact on the environment, workforce and consumers safety when compared to chemical seed treatments. Bio-based seed treatment is expected to be one of the fastest growing seed treatment segments in the near future.

Chemical seed treatments, which are typically manufactured from petrochemical or inorganic raw materials, are further segmented as insecticides, fungicides, and other chemical seed treatments. The market is dominated by chemical insecticides, accounting for over 52.2% of the total seed treatment demand in 2012. The fungicide seed treatments market is growing at a CAGR of 10.6% and is expected to reach $102.7 million by 2018. The insecticides seed treatment market is projected to reach $163.9 million by 2018, growing at a CAGR of 11.7%

Rising GM seed prices and cost effectiveness of seed treatments over other crop protection methods are expected to drive the demand for the seed treatment market in the near future. However, an absence of centralized government regulations for treated seed and seed treatment active ingredient registration are expected to hamper the growth and demand for seed treatments in the next five years.

One of the critical success factors (CSFs) in the market is the ability of a market participant to innovate a complete protection solution against various biotic and abiotic stresses in a single product. This battle of most of the grower-friendly, crop-friendly and environment-friendly product innovations are going to be one of the key strategy market players following the seed treatment industry in the next five years.

This report estimates the Asia-Pacific seed treatment market in terms of revenue. The market has been further segmented on the basis of crop types such as cereals and grains, oilseeds, and other crops, as well as by the sub-segmentation of insecticides, fungicides, and other chemical seed treatments such as plant growth regulators, and micronutrients. This segmentation is given for major regions and key countries in those regions. Market drivers, restraints and challenges, and crop trends are discussed in detail. Market share by participants for the overall market is discussed in detail in the report. We have also profiled leading players of this industry including Nufarm (Australia), Sumitomo Chemical Company Ltd. (Japan), and Monsanto (U.S.).

Customer Interested in this report also can view

-

Seed Treatment Market by Type (Chemical & Non-Chemical), by Application (Fungicide, Insecticide, Bio-Control And Others) And by Crop (Cereals, Oilseeds And Others): Global Trends, Forecasts And Technical Insights Up To 2018

-

Europe Seed Treatment Market (By Type (Chemical & Non-Chemical), By Application (Fungicide, Insecticide, Bio-Control And Others) And By Crop (Cereals, Oilseeds And Others): Trends, Forecasts And Technical Insights Up To 2018

-

North America Seed Treatment Market by Type (Chemical & Non-chemical), by Application (fungicide, insecticide, bio-control and others) and by Crop (cereals, oilseeds and others): Trends, Forecasts and Technical Insights up to 2018

The seed treatment market, which is a wider crop protection market primarily includes;

- Chemical seed treatments

- Non-chemical seed treatments

Chemical seed treatment consists of seed treatment insecticides, seed treatment fungicides, and other chemical seed treatment products such as plant growth regulators, micronutrients, safeners, etc. Chemical seed treatments held 97.6% of the seed treatment market in 2012, with seed treatment insecticides as the largest revenue generating segment. However, micro-nutrients, by definition and plant growth regulators, safeners by application, are used in very minute quantities and hence constitute a minor share in the market.

This report provides a comprehensive outlook on the Asia-Pacific seed treatment market with respect to various countries, product types as well as applications. In terms of revenue, the market was estimated to be worth $161.4 million in 2012 and is expected to reach $306.8 million by 2018, growing at a CAGR of 11.3%. Growth in revenue is expected to be higher than volume, primarily because of increasing cost of agrochemicals. Development and registration of a pesticide active ingredient is one of the biggest components of cost for seed treatment manufacturers. Currently, the cost of innovation and registration of an active ingredient is about $200 million, which is a 25% increase from 2000.

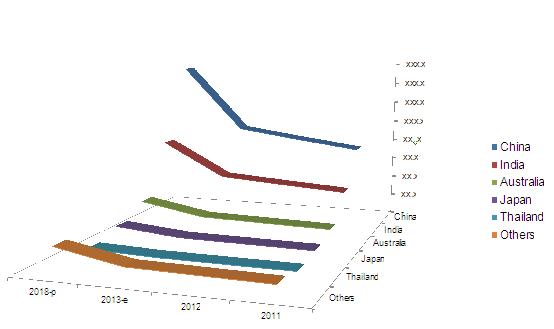

SEED TREATMENT MARKET, BY COUNTRY, 2011 2018 ($MILLION)

Source: MarketsandMarkets Analysis

China and India were the leading consumers of seed treatments, together accounting for over 76.0% of the market in 2012. A constant regulatory push towards restricting the use of agrochemicals and increasing consumer awareness regarding the consequences of agrochemical residues in food, has resulted in a significant increase in demand for seed treatments in other regions as well.

Asia-Pacific, which has witnessed a steady demand for these seed treatments in recent years, is now one of the growing markets for the seed treatment industry. Increasing modernization of agriculture in India and China is expected to drive the Asia-Pacific market in the near future.

Among all seed treatment products, seed treatment insecticides (chemical) form the largest segment and accounted for almost 52.2% share of the seed treatment market in 2012. Seed treatment fungicide (chemical) forms the second largest segment of the global seed treatment market with 34.8% of the market share in 2012.

In terms of competition, the market is dominated by innovators, which are essentially companies having patented products in the market. Key innovators include Monsanto (U.S.), Sumitomo (Japan) and Nufarm (Australia.). Also, there are companies that focus on bio-control seed treatment products; i.e. products that have a natural active ingredient. Key participants in the Bio-control segment include Plant Health Care (U.S.) and Becker Underwood (U.S.). APAC leaders are now taking a leaf out of the book and venturing into further research for bio-control agents in the seed treatment market.

Table Of Contents

1 Introduction (Page No. - 22)

1.1 Key Take-Aways

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Research Methodology

1.5.1 Market Size

1.5.2 Key Data Points Taken From Secondary Sources

1.5.3 Key Data Points Taken From Primary Sources

1.5.4 Assumptions Made For This Report

2 Executive Summary (Page No. - 29)

3 Market Overview (Page No. - 31)

3.1 Introduction

3.1.1 Agro-Market Retailers Help Rapid Growth In Seed Treatment Market

3.2 Seed Treatment Market

3.2.1 Commercial Seed Treatments

3.2.2 Downstream Seed Treatments

3.2.3 Grower Applied Seed Treatments

3.3 Global Seed Market: An Overview

3.3.1 Types Of Seed

3.3.1.1 Seed Sources

3.3.1.1.1 Farm-Saved Seed

3.3.1.1.2 Seed Supplied Commercially

3.3.1.2 Seed Types

3.3.1.2.1 Conventional Seed

3.3.1.2.2 GM Seed

3.3.2 Stages In Commercial Seed Production

3.3.2.1 Foundation Or Basic Seed

3.3.2.2 Certified Seed

3.3.3 Global Seed Market Share Analysis

3.4 Evolution Of Seed Treatment Market

3.5 Winning Imperative

3.5.1 Seed Treatment As A Complete Solution To Safegaurd Seed Investments

3.6 Burning Issues

3.6.1 Issues Impacting International Seed Movements

3.6.2 Lack Of Cohesive Regulatory Body For Seed Treatment Approvals

3.7 Drivers

3.7.1 Seed Treatment As A Low Cost Crop Protection Solution

3.7.2 Rising Prices Of The GM Crops Creating A Need For Crop Protection

3.7.3 Rising World Population & Food Requirements - 4 Fs(Food-Fuel-Feed-Fiber)

3.7.4 Acreage & Advanced Technologies Warrant The Need For Treated Seeds

3.7.5 Soil Nutrition Deficiencies Created By Shortened Crop Rotation Practices Create Need For Seed Treatment

3.8 Restraints

3.8.1 Discouraging Government Regulations

3.8.2 Low Permitted Shelf Life & Difficulty In Disposal Of Treated Seed

3.9 Opportunities

3.9.1 Rapid Growth In Bio-Control Seed Treatment Solutions

3.9.2 Strong Progress In New & Emerging Markets - Latin America & APAC

3.10 Seed Treatment Equipments: An Overview

3.10.1 Key Factors

3.10.1.1 Uniform Coverage

3.10.1.2 Application Volumes & Rates

3.10.2 Continuous System

3.10.3 Batch System

3.10.4 Dust/Powder Treater

3.10.5 Slurry Treater

3.10.6 On-Farm/Direct Treater

3.11 Market Share Analysis

3.11.1 Global Market Share (Revenue)

3.11.1.1 BASF, Bayer And Syngenta Global Leaders

3.11.1.2 Agreements Between Market Leaders A Key Trend

3.12 Patent Analysis

3.12.1 By Company

4 APAC Seed Treatment Market, By Types (Page No. - 70)

4.1 Introduction

4.1.1 Drivers

4.1.1.1 Extensive Product Portfolios By Market Leaders To Hold 85% Of The Global Share

4.1.1.2 Chemical Seed Treatments Continue To Dominate

4.1.1.3 Insecticides Hold Major Share; Bio-Control Drive Future Growth

4.1.1.4 Global Climatic Changes Translate Into Growing Demands For Fungicidal Seed Treatment

4.1.1.5 Strong Demand Growth From Organic Farming And Integrated Pest Management (IPM)

4.1.1.6 Integrating Bio-Control Products With Conventional Chemicals

4.1.1.7 Less Regulatory Pressure & Worker/ Environment Safety

4.1.1.8 New Acquisitions And Partnerships

4.1.2 Restraints

4.1.2.1 Variable Efficiency And Low Shelf Life

4.1.3 Opportunities

4.1.3.1 Plant Extracts And Oil-Based Seed Treatments For Organic Farming

4.1.3.2 Seed Treatment For Abiotic Stress

4.1.3.3 Abiotic Stress Limiting Plant Growth

4.1.3.4 Thermo-Seeds

4.2 Chemical Seed Treatment

4.2.1 Drivers

4.2.1.1 Insecticide Dominate Value Market; Fungicides Lead In Volumes

4.2.2 Insecticides

4.2.2.1 Global Productivity And Use Of Combination Chemicals Drives Insecticide Demands

4.2.2.2 Carbamates And Pyrethroids Dominate Global Insecticide Market

4.2.2.2.1 Carbamates And Organophosphates

4.2.2.2.2 Pyrethroids

4.2.2.2.3 Other Seed Treatment Insecticides

4.2.3 Fungicides

4.2.3.1 High Economic Impact Has Led To Use Of Broad Spectrum Fungicides

4.2.3.2 Rhizoctonia And Fusarium Key Target Fungi Amongst Other Seed, Soil And Air Borne Species

4.2.3.3 Triazoles And Diazoles Dominate Fungicidal Seed Treatment Market

4.2.3.3.1 Benzimidazoles

4.2.3.3.2 Triazoles And Diazoles

4.2.3.3.3 Dithiocarbamates

4.2.3.3.4 Others Seed Treatment Fungicides

4.2.3.3.5 Carboxin

4.2.4 Others

4.2.4.1 Micronutrients

4.2.4.2 Colorants

4.2.4.3 Polymers

4.2.4.4 Phytohormones

4.2.4.5 Safeners

4.3 NonChemical Seed Treatment

4.3.1 Drivers

4.3.1.1 Revolution In Regulatory Requirements Revives Non-Chemical Seed Treatment Practices

4.3.2 Traditional Seed Treatment

4.3.2.1 Oldest And Still The Most Trusted And Cost-Effective Methods Of Seed Treatment

4.3.2.1.1 Priming And Pelleting

4.3.2.1.2 Hot Water Treatments

4.3.3 Bio-Control

4.3.3.1 Soybean And Canola Drive U.S. Dominance In Bio-Control Market

4.3.3.2 China Dominates; Lack Of Governmental Initiatives Holds Back Growth In APAC

4.4 Rest Of Chemicals

4.4.1 Nematicides

4.4.1.1 Harpin

4.4.1.1.1 Key Feature: Multiple Functionalities

4.4.1.1.2 Pros And Cons

4.4.1.2 Abamectin

4.4.1.2.1 Key Feature: Low Toxicity To Humans And Animals

4.4.1.3 Spinosad

4.4.1.3.1 Key Feature: Low Cost And Lasting Effect

4.4.2 Inoculants

4.4.2.1 Rhizobium Inoculants

4.4.2.1.1 Global Demands Synchronous With Soybean Market Trends

4.4.2.2 Azospirillum Inoculants

4.4.2.2.1 Research On Root Interaction Can Help Boost Efficiency And Market Demand

4.4.2.3 Other Inoculants

4.4.2.3.1 Azotobacter

4.4.2.3.2 Acetobacter

4.4.2.4 Advantages Of Inoculation

4.4.2.5 Regulations For Commercial Inoculants

4.4.2.5.1 Commercial Microbial Inoculants Enter Market

4.5 Seed Treatment Application Techniques

4.5.1 Seed Encrusting

4.5.2 Seed Pelleting

5 Seed Treatment Market, By Target Protection (Page No. - 118)

5.1 Introduction

5.1.1 Key Features

5.1.1.1 Key Motive: Improved Crop Stand, Yields And Profitability

5.1.1.2 Fungicides Most Commonly Used; Used In Combination With Insecticides For Efficiency

5.1.1.3 Changing Norms And Target Pathogen Physiologies Warrant Constant Modifications

5.2 Fungicides

5.2.1 Key Features

5.2.1.1 Aids Seedling Emergence In Addition To Protection

5.2.1.2 Non-Volatile Fungicides: The Way Ahead

5.2.2 Maize/Corn

5.2.2.1 Soil And Seed Borne Pathogens: Key Targets For Seed Treatment

5.2.2.2 Faulty Crop Planting And Rotation Practices Make Crop Vulnerable

5.2.3 Soybean

5.2.3.1 Economic Impact Of Seedling Disease: Focus Of Seed Treatment

5.2.4 Cotton

5.2.4.1 Global Acceptance Of Bt Cotton And The Resultant Rising Prices Drive The Cotton Market

5.2.4.2 On-Going Research; Seed Treatment Demand Not Growing At The Rate Of Demand For Crop

5.2.5 Wheat

5.2.5.1 Seed-Borne Fungal And Root-Rots Remain The Key Target For Seed Treatment

5.2.6 Potato

5.2.6.1 Low Commodity Price Has Restricted Market Growth; Not Any More

5.2.7 Canola

5.2.7.1 Economic Losses Due To Blackleg And High Value Of Canola Influence Seed Treatment Practices

5.2.8 Rice

5.2.8.1 Low Cost Production Along With Protection From Fungal Diseases

5.2.8.2 Field Practices, Temperature And Rice Variant Greatly Influence Need For Treatment

5.2.9 Vegetables

5.2.9.1 Modernization Of Sector Revives Seed Treatment Practices, Especially For Exotic Variants

5.3 Insecticides

5.3.1 Drivers

5.3.1.1 R&D Influential In Driving The Insecticide Seed Treatment Segment

5.3.1.2 Used In Combination With Other Pesticides Due To Low Dosage Level Requirement

5.4 Nematicides

5.4.1 Key Features

5.4.1.1 Target Specific Product Developments Lead To Demand For Nematicides

5.4.1.2 Developments Of Nematicides Help Boost Adoption Of Seed Treatment Practices

6 APAC Seed Treatment Market, By Target Crops (Page No. - 146)

6.1 Introduction

6.1.1 Drivers

6.1.1.1 Seed Value And Vulnerability Influences Demand Dynamics

6.1.1.2 Maize Consumption For Biofuels Boosts Production And Seed Treatment Requirements

6.1.1.3 Asia And Europe Drive Wheat Seed Treatment Market With Increasing Area Under Cultivation

6.2 Cereals & Grains

6.2.1 Driver

6.2.1.1 Technology Premiums And Conventional Seeds Drive The Growth In Demand

6.2.2 Maize

6.2.2.1 Leading Market Players Focus On Maize For Product Development

6.2.2.2 Vulnerability To Soil-Borne Pathogens Drives The Need For Seed Treatment

6.2.2.3 High Evidence Of Seedling Disease In Maize Creates Opportunities For Market

6.2.3 Rice

6.2.3.1 R&D And Development Of Bt Rice Boost Need For Seed Treatment Practices

6.2.3.2 Hybrid Seeds, Privatization Of Market: Key Drivers For Increasing Demand For Seed Treatment

6.2.4 Wheat

6.2.4.1 Wheat Fungal Vulnerability Drives Need For Seed Treatment Solutions

6.2.5 Sorghum

6.2.5.1 Heavy Economic Losses Due To Smut Translates Into Seed Treatment Need

6.3 Oilseeds

6.3.1 Driver

6.3.1.1 New Application Fields Drive Need For Enhanced Production And Seed Treatment Practices

6.3.2 Soybean

6.3.2.1 Increasing Global Oil Prices And Bio Fuel Demand Propelling Market Demand

6.3.2.2 Global Acceptance Of GM Seeds And Seed Treatment, Due To Rising Requirements

6.3.2.3 Combined Growth Of Biotech Trait And Seed Market: Key Influencer On Seed Treatment Demands

6.3.3 Sunflower

6.3.3.1 Rising Prices And High Demand For Production Of Sunflower Oil Globally

6.3.3.2 Biotech Trait Seed Market Has More Than Doubled; Driving The Seed Treatment Needs

6.3.4 Cotton

6.3.4.1 Changing Dynamics In China And India Influencing Global Price Trends

6.3.4.2 Increased Prices Revitalised Cotton Seed And Seed Treatment Markets

6.3.4.3 High Market Share Of Trait Premium Seeds Drives Demand For Seed Treatment

6.3.5 Canola

6.3.5.1 Biofuel Preference For Canola Drives Demand For Higher Production Volumes

6.3.5.2 High Economic Impact Of Fungal Diseases Boost Demand For Seed Treatment

6.3.5.3 Leading Trait Premium Seed Manufacturers Also Push The Seed Treatment Market

6.4 Others

6.4.1 Sugar Beets

6.4.1.1 Subsidy Support For Ethanol Production Revives Sugar Beets Market

6.4.1.2 Regulatory Challenges Cast Uncertainty On Future Demands

6.4.2 Vegetables

6.4.2.1 Increasing Volume Of Small Seeded Vegetables Drives Seed Treatment Requirements

7 Seed Treatment Technologies: The Future Prospective (Page No. - 186)

7.1 Introduction

7.1.1 Evolution Of Crop Protection

7.1.2 Imperative Novel Seed Treatment Methods

7.2 Genetic Engineering: Key To Modern Agriculture

7.2.1 Problems Associated With Promoting Genetically Modified Foods

7.2.1.1 Legislative & Regulatory Hurdles:

7.2.1.2 Ambiguous European Laws Governing GM Foods

7.2.1.3 GM Labeling

7.2.1.4 Consumer Antagonism: Major Deterrent

7.3 Non-Transgenic; Non-GMO Biotechnology Crops

7.3.1 Technology To Replace The Impact Of Resources

7.3.1.1 Crops Evolving Into Bio-Factories

7.4 Cibius Global

7.4.1 Technical Process

7.4.2 Advantages

7.5 Pioneer (Dupont)

7.5.1 Accelerated Yield Technology (AYT System)

7.5.2 Advantages:

7.6 Okanagen Speciality Fruits Inc.

7.6.1 Technical Process

7.6.2 Key Benefit

7.6.3 Market Prospects

7.7 Morflora

7.7.1 Traitup Platform: A New Paradigm

7.7.1.1 An Innovative Non Transgenic Technology

7.7.2 Platform For Trait Introduction In Seeds

7.7.2.1 Fastest Method To Introduce New Trait

7.7.2.2 Cost Effective

7.7.2.3 A Complete Crop Protection Solution

7.7.3 Intellectual Property

7.7.4 Technical Process

7.7.5 Advantages

7.7.6 Summary

8 APAC Seed Treatment Market, By Country (Page No. - 207)

8.1 Introduction

8.1.1 Drivers

8.1.1.1 Regulatory Requirements Beneficial For Seed Treatment Market

8.1.1.2 GM Seed Trends In America Translate Into Demands For Seed Treatment

8.2 Asia-Pacific

8.2.1 Drivers

8.2.1.1 Increasing Food Demands And Decreasing Arable Land

8.2.1.2 China, India And Australia Drive APAC Market Trends

8.2.1.3 Vague Regulatory Practices Aid Manufacturers In Expanding Presence In Market

8.2.2 Japan

8.2.2.1 Driving Force: Transformation In Regulations

8.2.2.2 Tomato And Sugar Beets Drive Japanese Seed Treatment Demands

8.2.3 Thailand

8.2.3.1 Seed-Borne Pathogens Targeting Cotton, Rice And Maize Drive Market Demands

8.2.4 Australia

8.2.4.1 Government And Federal Support Drives Domestic Market Growth And Efficiency

8.2.5 China

8.2.5.1 Subsidies Offered By Chinese Government Supports Market Growth

8.2.5.2 Restructuring Of Regulatory Norms Has Positive Implications On Seed Treatment Market

8.2.6 India

8.2.6.1 Inappropriate Deep Rooted Distribution Set-Up Hampers Growth

8.2.6.2 Lucrative Destination Due To Absence Of Market Leader

8.2.6.3 Advancement Of Biotech Seed Treatment Practices

9 Competitive Landscape (Page No. - 226)

9.1 Introduction

9.1.1 Merges And Acquisitions - Most Preferred Strategic Approach

9.2 Mergers & Acquisitions

9.3 Agreements, Collaborations And Partnerships

9.4 Expansions, Investments & Other Developments

9.5 New Products And Technology Launches

10 Company Profiles (Overview, Financials, Products & Services, Strategy, And Developments)* (Page No. - 226)

10.1 Cibus Global

10.2 Morflora

10.3 Monsanto Company

10.4 Nufarm Limited

10.5 Sumitomo Chemical Company Limited

*Details On Overview, Financials, Product & Services, Strategy, And Developments Might Not Be Captured In Case Of Unlisted Companies.

Appendix (Page No. - 257)

Japan Patents

List Of Tables (101 Tables)

Table 1 Asia-Pacific: Seed Treatment Market Revenue, By Countries,2011 2018 ($Million)

Table 2 Seed Treatment Market Types & Benefits

Table 3 Physiological Effect Of Seed Treatment On Its Quality

Table 4 Global Seed Market Revenue, 2001 2010 ($Billion)

Table 5 Seed Market Revenue, By Types, 2001 2010 ($Billion)

Table 6 Seed Treatment: Upcoming Product Innovations & Proposed Products Launch

Table 7 Seed Treatment As Cost Effective Solution

Table 8 World Population & Per Capita Land Available

Table 9 Seed Treatment Fungicides

Table 10 Seed Treatment Insecticides

Table 11 Gustafson (Bayer Cropscience): Seed Treatment Equipment

Table 12 APAC Seed Treatment Market Revenue, By Types,2011 2018 ($Million)

Table 13 APAC Seed Treatment Market Revenue, By Applications,2013 2018($Million)

Table 14 Chemistry & Bio-Control Combinations

Table 15 Minimum Inhibitory Concentration (MIC) Of Essential Oils For Seed Treatment (PPM)

Table 16 Effect Of Thermal Seed Treatment, By Crops, By Pathogens

Table 17 APAC: Chemical Seed Treatment Market, By Countries,2011 2018 ($Million)

Table 18 APAC: Insecticide Seed Treatment Market, By Countries,2011 2018 ($Million)

Table 19 Commercial Active Ingredients-Carbamate Seed Treatments

Table 20 Commercially Available Seed Treatment Products,By Active Ingredient, By Crops

Table 21 APAC: Fungicide Seed Treatment Market, By Countries,2011 2018 ($Million)

Table 22 Common Seed Treatment Fungicides

Table 23 Seed Treatment Fungicides Consumption Market Volume,By Chemical Class, 2009 (Kilo Tonnes)

Table 24 Commercial Active Ingredients Benzimidazoles

Table 25 Commercially Available Triazole Seed Treatment Products, By Active Ingredients

Table 26 Commercially Available Seed Treatment Products,By Active Ingredients

Table 27 Micronutrients Benefits

Table 28 Relative Responsiveness Of Selected Crops To Micronutrients

Table 29 Hot Water Seed Treatment, By Crops

Table 30 APAC: Bio-Control Seed Treatment Market, By Countries,2011 2018 ($Million)

Table 31 Commercial Bio-Control Seed Treatments,By Active Ingredients

Table 32 Commercial Nematicides, By Active Ingredients, By Crops

Table 33 Commercially Available Inoculants, By Crops, By Dosages

Table 34 Rhizobium Inoculants, By Crops

Table 35 Nitrogen Fixing Capacity Of Azospirillumn, By Crops

Table 36 Area Under Legume Crops, By Geography, 2008 2009 (Ha)

Table 37 Saving Chemical Nutrients By Use Of Inoculants

Table 38 Organic Material Review Institute (OMRI) Approved Inoculants

Table 39 APAC: Rest Of Chemical Seed Treatment Market, By Countries, 2011 2018 ($Million)

Table 40 Seed Treatment Application Techniques, By Crops

Table 41 Important Pathogens As Seed Treatment Targets

Table 42 Maize/Corn: Economically Important Pathogens, Diseases & Treatments

Table 43 Soybean: Economically Important Pathogens, Diseases & Treatments

Table 44 Cotton: Economically Important Pathogens, Diseases & Treatments

Table 45 Wheat: Economically Important Pathogens, Diseases & Treatments

Table 46 Potato: Economically Important Pathogens, Diseases & Treatments

Table 47 Canola: Economically Important Pathogens, Diseases & Treatments

Table 48 Rice: Economically Important Pathogens, Diseases & Treatments

Table 49 Vegetables: Economically Important Pathogens, Diseases & Treatments

Table 50 Insecticide Family, Active Ingredients & Target Pests

Table 51 Nematicide Compounds & Target Pests

Table 52 Asia-Pacific Seed Treatment Market Revenue, By Crop Types, 2011 2018 ($Million)

Table 53 Asia-Pacific Seed Treatment Market For Cereals & Grains,By Crop, 2011 2018($Million)

Table 54 APAC Maize Market Area Harvested (Hectare) & Production (Tonnes), 2010 2011

Table 55 Global Maize Seed Market Revenue, By Types,2007 2010 ($Billion)

Table 56 APAC Rice Market Area Harvested (Hectare) & Production (Tonnes), 2010 2011

Table 57 Global Rice Seed Market Revenue, By Types,2007 2010 ($Billion)

Table 58 APAC Wheat Market Area Harvested (Hectare) & Production (Tonnes), 2010 2011

Table 59 Global Wheat Seed Market Revenue, By Types,2007 2010 ($Billion)

Table 60 APAC Sorghum Market Area Harvested (Hectare) & Production (Tonnes), 2010 2011

Table 61 Global Oilseeds Seed Market Revenue, By Types,2008 2010 ($Million)

Table 62 APAC Oilseeds Seed Treatment Market Revenue, By Crop,2011 2018 ($Million)

Table 63 APAC Soybean Market Area Harvested (Hectare) & Production (Tonnes), 2010 2011

Table 64 Global Soybean Seed Market Revenue, By Types,2007 2010 ($Billion)

Table 65 APAC Sunflower Market Area Harvested (Hectare) & Production (Tonnes), 2010 2011

Table 66 Global Sulflower Seed Market Revenue, By Types,2007 2010 ($Million)

Table 67 APAC Cotton Market, Production (Tonnes), 2010 2011

Table 68 Global Cotton Seed Market Revenue, By Types,2007 2010 ($Billion)

Table 69 APAC Canola Market Area Harvested (Hectare) & Production (Tons), 2010 2011

Table 70 Global Canola Seed Market Revenue, By Types,2007 2010 ($Million)

Table 71 APAC Other Crops Seed Treatment Market, Revenues,By Crop, 2011 2018 ($Million)

Table 72 APAC Sugar Beets Market Area Harvested (Hectare) & Production (Tons), 2010 2011

Table 73 Global Sugar Beet Seed Market Revenue, By Types,2007 2010 ($Million)

Table 74 APAC Vegetables Market Area Harvested (Hectare) & Production (Tons), 2010 2011

Table 75 Global Vegetables Seed Market, By Crop Types,2008 2010 ($Million)

Table 76 Trait-Up Comparitive Analysis

Table 77 Asia-Pacific: Seed Treatment Market Revenue, By Types,2011 2018 ($Million)

Table 78 Asia-Pacific: Seed Treatment Market Revenue,By Applications, 2011 2018 ($Million)

Table 79 Asia-Pacific: Seed Treatment Market Revenue, By Countries, 2011 2018 ($Million)

Table 80 Japan: Seed Treatment Market Revenue, By Applications,2009 2016 ($Million)

Table 81 Japan: Seed Treatment Market, By Types, 2011 2018 ($Million)

Table 82 Thailand: Seed Treatment Market Revenue, By Applications, 2009 2016 ($Million)

Table 83 Rest Of APAC: Seed Treatment Market, By Types,2011 2018 ($Million)

Table 84 Australia: Seed Treatment Market Revenue, By Applications, 2012 2018 ($Million)

Table 85 China: Seed Treatment Market Revenue, By Applications,2011 2018 ($Million)

Table 86 China: Seed Treatment Market, By Types, 2011 2018 ($Million)

Table 87 India: Seed Treatment Market Revenue, By Applications,2011 2018 ($Million)

Table 88 India: Seed Treatment Market, By Types, 2011 2018 ($Million)

Table 89 Mergers & Acquisitions, 2010 March 2013

Table 90 Partnerships,Collaborations & Agreements,January 2010 March 2013

Table 91 Expansions, Investments And Other Developments,2010 2013

Table 92 New Products Launch & Research, 2008 2011

Table 93 Monsanto: Annual Revenue, By Segments,2011 2012 ($Million)

Table 94 Monsanto: Annual Revenue, By Geography,2011 2012 ($Million)

Table 95 Monsanto: Seed Treatment Product Portfolio For Soybean

Table 96 Monsanto: Products For Cotton & Its Applications

Table 97 Monsanto: Seed Treatment Product Portfolio For Corn

Table 98 Nufarm: Annual Revenue, By Segments, 2012 ($Million)

Table 99 Nufarm: Annual Revenue, By Geography, ($Million)

Table 100 Nufarm: Product Portfolio, Active Ingredient And Applications

Table 101 Sumitomo: Product, Brands & Its Applications

List Of Figures (35 Figures)

Figure 1 APAC Seed Treatment Market

Figure 2 APAC Seed Treatment Market Segmentation

Figure 3 Seed Treatment Market, By Applicator

Figure 4 Elements Of Commercial Seed Price, 2012

Figure 5 Global Seed Market Revenue, By Types, 2001 2010 ($Billion)

Figure 6 Global Seed Market Share, By Company, 2011

Figure 7 Evolution Of The Seed Treatment Market

Figure 8 Seed Treatment Solutions Evolution

Figure 9 Impact Of Major Drivers On Global Seed Treatment Market,2011 2018

Figure 10 Price Trends Maize/Corn & Soybean Seeds, 2010

Figure 11 Impact Of Major Restraints On The Global Seed Treatment Market, 2011 2018

Figure 12 Global Seed Treatment Market Share, By Company, 2012

Figure 13 Patent Analysis, By Company, January 2010 January 2013

Figure 14 Global Organic Food Market Revenue, 2006 2010 ($Million)

Figure 15 Stress Effect On Maize Production, 2010

Figure 16 APAC Chemical Seed Treatment Market Share,By Applications, 2012

Figure 17 Biocontrol Seed Treatment Market Share, By Geography, 2012

Figure 18 Transmission Pathways For Diseases & Methods Of Protection

Figure 19 APAC Seed Treatment Market Share, By Crops, 2012

Figure 20 Global Maize Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 21 APAC Rice Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 22 APAC Wheat Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 23 APAC Sorghum Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 24 APAC Soybean Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 25 APAC Sunflower Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 26 APAC Cotton Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 27 APAC Canola Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 28 APAC Sugar Beet Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 29 APAC Vegetables Seed Treatment Market Revenue,2011 2018 ($Million)

Figure 30 The Evulation Of Plant Breeding

Figure 31 RTDS The Process

Figure 32 Trait-Up Procedure

Figure 33 Seed Treatment Market Share, By Geography, 2012

Figure 34 Asia-Pacific: Seed Treatment Market Share,By Countries, 2010

Figure 35 APAC Seed Market Growth Strategies,January 2010 March 2013

Growth opportunities and latent adjacency in Asia-Pacific Seed Treatment Market