Precision Feeding Market by Offerings (Hardware, Software, and Services), Farm Type (Dairy, Poultry, Swine, and Other Farm Types), Farm Size (Large, Medium, and Small) and Region - Global Forecast to 2029

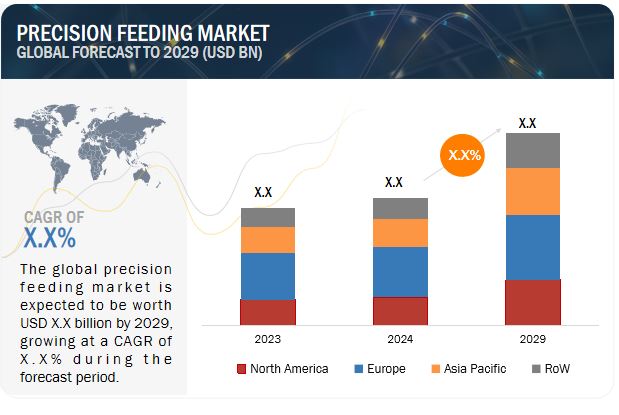

The market for precision feeding is estimated at USD X.X billion in 2024; it is projected to grow at a CAGR of 8.0% to reach USD X.X billion by 2029. Livestock feeding is the first step in milk production and affects the rest of the production chain. Feeding automation reduces workload in livestock farms, reducing the number of labours required for farm management. Advanced feeding systems automatically do most of the work related to feeding animals. Precision feeding systems enable dairy, poultry, and swine farm owners to identify the nutritional needs of animals and provide the optimum feed for their overall development. The major activities performed by automated feeding systems are storing different feed components, mixing total mixed ration (TMR) feed, and distributing feed onto the feeding table. Rail-guided systems, conveyor belt systems, and self-propelled feeding systems are the diverse types of feeding systems.

Companies are launching precision feeding systems to improve efficiency, animal health, and productivity while promoting environmental sustainability. Precision feeding allows for more precise and accurate feeding of animals, leading to cost savings for farmers, reduced risk of diseases, increased productivity, and a lower environmental impact of livestock farming.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Precision Feeding Market Dynamics

Driver: Supporting government policies and incentive programs promoting dairy farm mechanization

Governments across the globe are extensively investing in improving agricultural productivity. Schemes introduced for dairy farmers are expected to provide growth opportunities for market players to develop advanced solutions to improve agricultural yield. For instance, in January 2023, the US Department of Agriculture (USDA) unveiled information regarding aid for dairy producers, which comprises a new program known as the Organic Dairy Marketing Assistance Program (ODMAP) and a second set of payments through the Pandemic Market Volatility Assistance Program (PMVAP). These adjustments to PMVAP and the introduction of ODMAP will empower the USDA to provide enhanced support to small and medium-sized dairy operations that have persevered through the pandemic and are currently confronted with additional difficulties. Similarly, in March 2022, the US Department of Agriculture (USDA) announced an investment of USD 80 million in Dairy Business Innovation (DBI) to promote on-farm improvements and facilitate technical assistance to producers.

Restraint: Lack of technological awareness among livestock farmers

Although the precision feeding marketplace is flooded with various innovative technologies, awareness among dairy farmers remains low, impacting the adoption of digital tools for farm management. Livestock farming products find applications in all functional aspects of modern dairy, poultry, and swine farms, such as animal comfort, calf management, feeding management, heat stress management, ventilation, behaviour monitoring, milk harvesting, and reproduction management. However, farmers are often unable to operate these systems efficiently. In addition, these livestock farming solutions yield vast amounts of data, which is difficult for an unprofessional to process and understand. Furthermore, low awareness of the availability of such technologies among farmers is also a key factor hampering the market's growth. Adoption of technologies in livestock farms has been low due to several factors, including the inflated cost involved in automating farms, lack of technical knowledge among farmers, and reluctance toward adopting modern technology owing to limited skillsets and technology understanding.

Opportunity: Increasing number of dairy, poultry, and swine farms

The number of livestock farms has increased significantly globally over the past few years. These farms provide a supplementary income to farmers. As per the Cattle report released by the National Agricultural Statistics Service (NASS) of the US Department of Agriculture, the number of cattle and calves on farms in the United States was 91.9 million as of January 2022. Furthermore, as per the US Department of Agriculture and FAO, the global population of cows has surpassed one billion in the year 2022. The rising demand for livestock farming products can be primarily attributed to the growing number of dairy cattle addressing the high demand for dairy products worldwide, such as butter, cheese and curd, whey, and yogurt.

Challenge: Technological integration in the existing farms

Integrating advanced technology, such as precision feeding systems, into the existing livestock farm’s infrastructure can be a complex process and requires technical assistance. Furthermore, maintaining and repairing the technological systems requires specialized knowledge and huge cost can be associated with it.

Based on offerings, the service segment is estimated to grow at a significant CAGR during the studied period.

The services segment is expected to showcase a significant growth rate during the forecast period. Rising demand for precision feeding systems has led to the demand for associated services such as integrating the hardware with software to provide a detailed farm analysis. Vendors in the services segments have started offering customized services to dairy, poultry, and swine farms to enable farm owners to achieve optimum production.

The dairy farm in the precision feeding market is forecasted to dominate the market.

Dairy farms include cows and calves under the category of cattle. The use of precision feeding systems has become commonplace in modern-day dairy farms. With the adoption of this technology, dairy farms provide the required amount of feed to farm animals. Precise feed input results in cattle's overall development, affecting milk production. Some of the major players operating in the precision feeding market catering to dairy farms are DELAVAL (Sweden), GEA Group (Germany), Lely (Netherlands), among others.

Furthermore, Government support and initiatives can significantly impact the dairy farming market by providing financial assistance, improving infrastructure, and offering technical guidance to farmers. This assistance can include subsidies, loans, insurance, and grants to invest in modern technologies and high-quality livestock, leading to improved milk production.

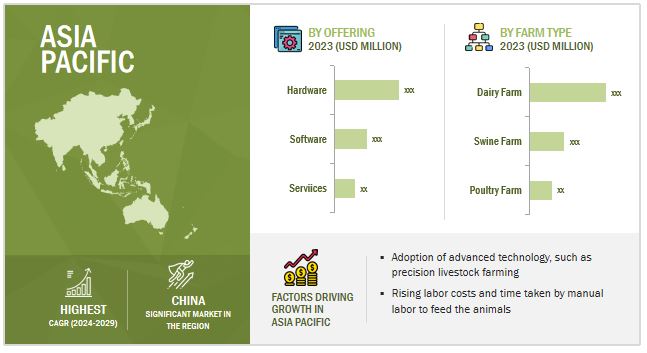

The Asia Pacific region is anticipated to experience the most rapid growth between 2024 and 2029.

The precision feeding market in the Asia Pacific region is witnessing rapid expansion, driven by rapid population growth in the region's developing countries is exerting pressure on the suppliers of livestock products to become more efficient and productive, thus pushing the sales of livestock farming solutions. Furthermore, the rising demand for livestock-related food products and the intensified need to improve yields with limited resources are expected to adopt precision livestock farming practices across the Asia Pacific region.

Key Market Players

Key Market Players include DELAVAL (Sweden), GEA Group (Germany), Lely (Netherlands), Fancom BV (subsidiary of CTB, Inc.) (Netherlands), Trioliet (Netherlands), Big Dutchman (Germany), VDL Group (Netherlands), Dinamica Generale S.p.A (Italy), AKVA GROUP (Norway), Exafan (Spain), SKIOLD A/S (Landmeco) (Denmark), among others.

These players in this market are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in Europe and the North American region. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In March 2023 DeLaval Optimat, DeLaval launched an autonomous feed distribution robot called Opti Wagon. This total feeding solution does everything from weighing, cutting, and mixing feed to delivering it to the feed table. With the Opti Wagon, animals can receive different feed mixes up to twelve times a day. DeLaval DelPro is used to set up and adjust recipes and routes for the Opti Wagon.

- In September 2022, GEA Group has introduced the GEA DairyFeed F4500, an autonomous feeding robot. Designed to reduce dairy farms' carbon footprint and operating costs while increasing flexibility, the new feeding robot boosts efficiency and productivity.

- In December 2022, the iDDEN (Germany), a dairy data service provider, and GEA entered a partnership. In this partnership, GEA's DairyNet software would be used to exchange data between international organizations for collecting and processing animal data.

- In September 2022, Lely International recently introduced the next generation of its automated feed-pushing solution, the Lely Juno. This updated version of the Lely Juno offers improved performance and reliability and new features to help farmers better manage their herd's nutrition and health.

Frequently Asked Questions (FAQ):

What is the current size of the precision feeding market?

The precision feeding market is estimated at USD X.X billion in 2024 and is projected to reach USD X.X billion by 2029, at a CAGR of 8.0% from 2024 to 2029.

Which are the key players in the market, and how intense is the competition?

The key players in this market include DELAVAL (Sweden), GEA Group (Germany), Lely (Netherlands), Fancom BV (subsidiary of CTB, Inc.) (Netherlands), Trioliet (Netherlands), Big Dutchman (Germany), VDL Group (Netherlands), Dinamica Generale S.p.A (Italy), AKVA GROUP (Norway), Exafan (Spain), SKIOLD A/S (Landmeco) (Denmark). The market for precision feeding is expanding rapidly, with more product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the precision feeding market?

The European market is expected to dominate during the forecast period. Germany is one of the key regions in the precision feeding market in Europe in terms of size. Germany held a significant share of the European market in 2023, owing to the high adoption of connected and autonomous livestock farming equipment. The presence of many cattle and other livestock farms and increasing demand for dairy and other livestock-related products are the other factors supporting the growth of the market in Germany. The key market players in the European precision feeding market include DELAVAL (Sweden), GEA Group (Germany), Lely (Netherlands), Fancom BV (subsidiary of CTB, Inc.) (Netherlands), Trioliet (Netherlands), Big Dutchman (Germany), VDL Group (Netherlands) contribute significantly to this dominance through their innovation, expertise, and extensive distribution networks.

What kind of information is provided in the company profile section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the precision feeding market?

Transition from premarket stock farming to decision livestock farming, the surge in labor cost and rising demand for automation in the livestock industry and supporting government policies and incentive programs promoting dairy farm mechanization are some of the key drivers that are expected to impact the market growth. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Precision Feeding Market