Powder Coating Equipment Market by Component Type (Kneader, Extruders, Cooling Equipment, Grinders), Resin Type (Polyester, Hybrid, Epoxy, Polyurethane, Acrylic), End-Use Industry & Region- Global Forecast to 2030

Updated on : September 17, 2025

Powder Coating Equipment Market

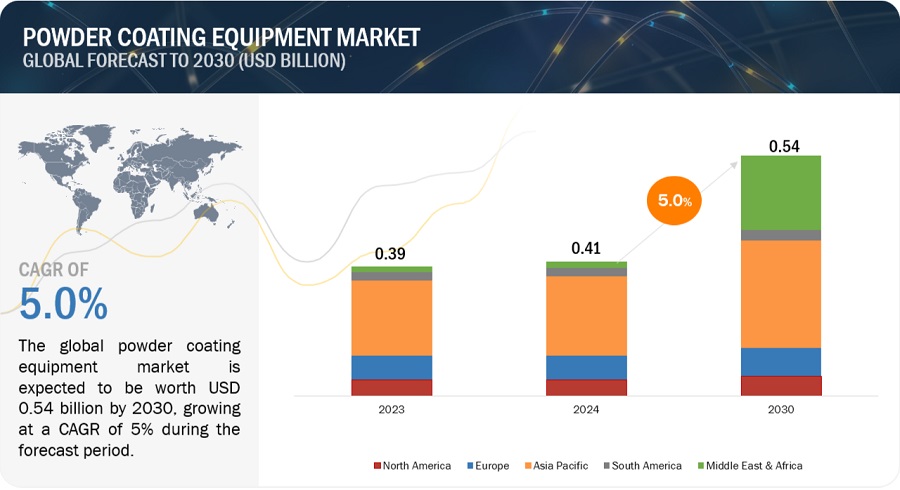

The global powder coating equipment market size was valued at USD 0.41 billion in 2024 and is projected to reach USD 0.54 billion by 2030, growing at 5.0% cagr from 2024 to 2030. The growing urbanization, rising infrastructure development, and expanding automotive sector are increasing the demand for powder coating equipment and driving market growth.

Powder coating equipment refers to the machinery or system used to produce and apply powder coatings. Powder coatings are dry, powdered substances used to create a protective and decorative layer on metal and other substrates. According to the Indian Paint and Coating Association (IPCA), powder coating is applied as a free-flowing dry powder without the need for solvents to maintain the binder and filler components in a liquid suspension. The coating is usually applied electrostatically and cured under heat to flow and form a layer. The powder used in this process can be either a thermoplastic or thermoset polymer, resulting in a finish that is generally harder and more durable than conventional paint. Powder coating is mainly used on metal surfaces of household appliances, aluminum extrusions, drum hardware, and parts for automobiles and bicycles.

Powder Coating Equipment Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Powder Coating Equipment Market

Powder Coating Equipment Market Dynamics

Driver: Rising demand for automobile parts and components

China, India, and other Southeast Asian countries are witnessing steady population growth, leading to increased demand for public transport and private vehicles. Powder coating is ideal for coating metal components and parts used in these vehicles. The expansion of the electric vehicle (EV) and hybrid vehicle markets are significant drivers for the growth of the powder coating equipment market. Powder coatings offer a compelling solution to the unique challenges associated with electric vehicle manufacturing. Their durability and corrosion resistance make them well-suited for protecting critical components such as battery enclosures, chassis, and electronic systems from environmental hazards and wear and tear. In addition, their ability to withstand high temperatures is advantageous in EV applications, where heat dissipation and thermal management are essential for optimizing performance and extending battery life.

Restraint: Growing environmental concerns and high energy consumption

With growing environmental concerns, industries face stringent emissions and waste management regulations. Powder coating is generally more environmentally friendly than traditional liquid painting, producing minimal volatile organic compounds (VOCs) and waste. However, the equipment used in powder coating must comply with stringent environmental standards. Suppose powder coating equipment providers fail to comply with environmental regulations. In that case, they may be penalized or forced to invest in compliance measures, affecting their market viability and increasing operational costs. Besides, the powder coating material production process consumes high power and energy as many processes are involved. All these factors are expected to hamper the demand for powder coating equipment and restrain the market growth during the forecast period.

Opportunity: Rising use of powder coatings on wood and plastics

Powder coating, traditionally applied to metals, is increasingly used to coat non-metal substrates such as wood and plastics. Its widening application scope creates growth opportunities for powder coating equipment providers, as specialized machinery is required to coat non-metal substrates. The development of low-bake powder coatings has made it feasible to coat heat-sensitive substrates such as medium-density fiberboard (MDF) and plastics, which were previously difficult to powder coat due to their thermal limitations.

Powder coatings are also preferred for their environmental advantages over liquid paints. As industries move toward more sustainable practices, the demand for eco-friendly materials is expected to increase. This trend benefits the environment and aligns with regulatory trends that favor low-emission products, driving the adoption of powder coatings in various industries, including furniture and architecture.

Challenge: High maintenance and operational costs

Powder coating equipment require significant maintenance and operational costs, which can be a challenge for adoption in some industries. The curing process of powder coatings requires high-temperature ovens, often gas-fired, and maintaining oven seals, burners, and temperature controls is critical. Downtime for oven repairs or cleaning can significantly impact production, and upgrades to improve energy efficiency can be costly.

Additionally, equipment such as twin-screw extruders and kneaders, which include expensive parts such as gearboxes and torque screws, require proper maintenance. These costs must be covered by powder coating equipment manufacturers when maintenance is needed, which can be challenging for small and medium-sized enterprises.

Powder Coating Equipment Market Ecosystem

Based on end-use industry, appliance segment to register for highest CAGR in powder coating equipment market during forecast period

Powder coating is an eco-friendly alternative to traditional liquid coatings, generating less VOCs and lowering environmental impact. This aligns with the growing consumer and regulatory focus on sustainability. Powder coatings also offer various colors and finishes, allowing manufacturers to cater to changing consumer preferences and design trends in home appliances. The increasing demand for durable and aesthetically appealing home appliances and consumer goods, along with rising consumer expectations for quality and sustainability, is driving the adoption of powder coatings and powder coating equipment. As the appliance industry continues to expand and evolve, manufacturers are increasingly adopting powder coatings to meet these demands.

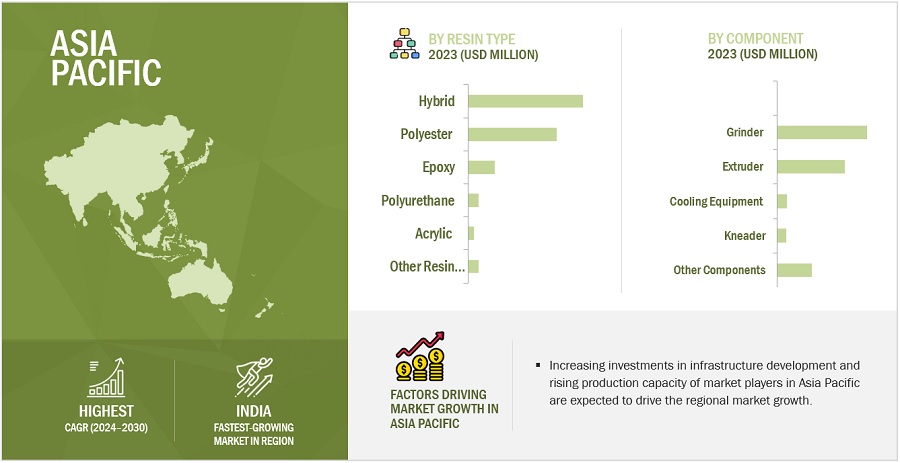

Based on resin type, polyester segment to register highest CAGR in powder coating equipment market during forecast period

Polyester resin offers exceptional durability, including resistance to UV rays, chemical exposure, and weathering, making it ideal for outdoor applications such as architectural coatings, outdoor furniture, and automobile finishes. Polyester-based powder coatings are also more environmentally friendly than traditional liquid coatings, containing less to no VOCs. This characteristic aligns with growing regulatory guidelines and consumer preferences for sustainable and eco-friendly products.

Based on component, extruder segment to register highest CAGR in powder coating equipment market during forecast period

The extruder, particularly the twin-screw extruder, is an essential machine in the powder coating production line, as it ensures the production of highly consistent and efficient powder coatings. The co-rotating twin-screw extruder is known for its excellent distributive and dispersive mixing properties, which are crucial for achieving uniform distribution of pigments and additives throughout the resin. As manufacturers expand their production capabilities to meet the growing demand for powder coatings, the need for advanced extruder machines is expected to rise significantly, driving the segment’s growth.

Asia Pacific to hold largest market share during forecast period

Asia Pacific is expected to be the major market for powder coating equipment, followed by North America and Europe. The rapid urbanization and industrialization, along with significant investments in the building & construction industry, are the primary drivers for the regional market growth. The region is also experiencing high demand for consumer goods and household appliances, which is driving the powder coating market and, in turn, boosting the demand for powder coating equipment.

To know about the assumptions considered for the study, download the pdf brochure

Powder Coating Equipment Market Players

Key players in this market include Hillenbrand, Inc. (Coperion GmbH), BUSS AG, Hosokawa Micron Corporation, Moriyama Corporation, CPM Extrusion Group, BBA Innova AG, IPCO AB, Chongqing DEGOLD Machine Co., Ltd., and Xtrutech Ltd. These companies are strengthening their market position by adopting various inorganic and organic strategies. This study includes a thorough competitive analysis of these key market participants, providing insights into company profiles, recent developments, and key market strategies.

Powder Coating Equipment Market Report Scope

|

Report Metric |

Details |

|

Market Size Available for Years |

2022–2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024–2030 |

|

Currency Considered |

USD Million |

|

Segments Covered |

By Resin Type, Component, End-use Industry, and Region |

|

Geographies Covered |

Europe, North America, Asia Pacific, Latin America, and the Middle East & Africa |

|

Companies Covered |

Hillenbrand, Inc. (Coperion GmbH) (Germany), BUSS AG (Switzerland), Hosokawa Micron Group (Japan), Yantai Wutai Chemical Equipment Co., Ltd. (China), Xtrutech Ltd. (UK), Chongqing Degold Machine Co., Ltd. (China), VORTEX Mixing Technology (China), Moriyama Corporation (Japan), BBA Innova AG (Switzerland), Yantai Donghui Powder Processing Equipment Co., Ltd. (China), CPM Extrusion Group (US), Polimer Teknik. (Türkiye), IPCO AB (Sweden), and Tiermax Inc. (Canada) |

The study categorizes the powder coating equipment market based on Resin Type, Component, End-use industry, and Region.

Powder Coating Equipment Market by Resin Type:

- Polyester

- Hybrid

- Epoxy

- Polyurethane

- Acrylic

- Others (Polyamide, Polyethylene, and PVC)

Powder Coating Equipment Market by Component:

- Kneader

- Extruder

- Cooling Equipment

- Grinder

- Other Components (Feeder, Sieving System, Filter & Blending)

Powder Coating Equipment Market by End-use industry:

- Appliances

- Automotive

- General Industrial

- Architectural

- Furniture

- Other end-use industries

Powder Coating Equipment Market by Region:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

Recent Developments

- In January 2018, Hillenbrand Inc. (Coperion GmbH) announced the launch of the ZSK 43 MV PLUS twin screw extruder with enhanced properties and production quality.

- In May 2023, Hillenbrand Inc. (Coperion GmbH) acquired Schenck Process FPM. This move is expected to help the company integrate various technologies into its equipment and expand its product portfolio in the powder coating equipment market.

- In March 2022, Hosokawa Alpine AG launched the new ACM 5 NEX, a classifier mill of the ACM series, which is a reliable system for ultra-fine grinding with integrated classifying of powder coatings.

- In June 2024, Xtrutech Ltd launched XTDC2, a drum cooler with interchangeable configurations. The XTDC2 can be paired with Xtrutech’s XTS24 twin screw extruder to create a seamlessly integrated extruder line.

Frequently Asked Questions (FAQ):

Which are the major companies in the powder coating equipment market? What are their major strategies to strengthen their market presence?

Key players in the powder coating equipment market include Hillenbrand, Inc. (Coperion GmbH) (Germany), BUSS AG (Switzerland), Hosokawa Micron Group (Japan), Yantai Wutai Chemical Equipment Co., Ltd. (China), Xtrutech Ltd. (UK), Chongqing Degold Machine Co., Ltd. (China), VORTEX Mixing Technology (China), Moriyama Corporation (Japan), BBA Innova AG (Switzerland), Yantai Donghui Powder Processing Equipment Co., Ltd. (China), CPM Extrusion Group (US), Polimer Teknik. (Türkiye), IPCO AB (Sweden), and Tiermax Inc. (Canada). Contracts and deals are the key strategies adopted by companies to strengthen their position in the powder coating equipment market.

What are the drivers and opportunities for the powder coating equipment market?

Increasing demand for automobile parts and components is expected to drive market growth, whereas the rising use of powder coatings on non-metal substrates is projected to create growth opportunities for the market players during the forecast period.

Which region is expected to hold the largest market share?

Asia Pacific is projected to grow significantly in the global powder coating equipment market. This growth can be attributed to increased investments in infrastructure development, which is fueling the demand for powder coatings and related equipment.

What is the expected total CAGR to be recorded for the powder coating equipment market from 2024 to 2030?

The CAGR is expected to be 5% between 2024 and 2030.

How is the powder coating equipment market aligned?

The market is growing at a considerable pace and competitive. Many manufacturers are adopting different business strategies to expand their existing production capacities. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Low carbon footprint and excellent properties- Rising demand for automobile parts and components- Growing preference for long-lasting and sustainable coatingsRESTRAINTS- High capital investment and set-up costs- Environmental and energy consumption concerns associated with powder coating equipmentOPPORTUNITIES- Rising use of powder coatings on wood and plastics- Increasing applications in shipbuilding and pipeline industries- Technological advancements and innovations in powder coating equipmentCHALLENGES- Limited substrate compatibility- High maintenance and operational costs

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMICS INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS IN GLOBAL CONSTRUCTION INDUSTRYTRENDS IN GLOBAL AUTOMOTIVE INDUSTRYTRENDS IN GLOBAL APPLIANCE INDUSTRY

-

5.6 SUPPLY CHAIN ANALYSISRAW MATERIAL ANALYSISMANUFACTURING EQUIPMENT ANALYSISFINAL PRODUCT ANALYSIS

- 5.7 VALUE CHAIN ANALYSIS

-

5.8 ECOSYSTEM ANALYSIS

-

5.9 PRICING ANALYSISPRICING ANALYSIS OF COMPONENTS, BY KEY PLAYERPRICING ANALYSIS OF COMPONENTS, BY SIZE

-

5.10 TRADE ANALYSISIMPORT SCENARIO (HS CODE 8474)EXPORT SCENARIO (HS CODE 8474)

-

5.11 TECHNOLOGY ANALYSISKEY TECHNOLOGIES- Low cure technology- Nano technologyCOMPLEMENTARY TECHNOLOGIES- Waterborne powder coating technologyADJACENT TECHNOLOGIES- Precision application method

-

5.12 IMPACT OF AI/GEN AI ON POWDER COATING EQUIPMENT MARKETTOP USE CASES AND MARKET POTENTIALBEST PRACTICES IN POWDER COATING EQUIPMENT MARKETCASE STUDIES OF AI IMPLEMENTATION IN POWDER COATING EQUIPMENT MARKETINTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERSCLIENTS’ READINESS TO ADOPT GENERATIVE AI IN POWDER COATING EQUIPMENT MARKET

-

5.13 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPEINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP APPLICANTSLIST OF PATENTS BY AGC INC.LIST OF PATENTS BY BLH TECH INC.LIST OF PATENTS BY GEMA SWITZERLAND GMBH

-

5.14 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2024–2025

-

5.16 CASE STUDY ANALYSISHILLENBRAND, INC. (COPERION GMBH) INTRODUCED ZSK 43 MV PLUS TWIN SCREW EXTRUDERXTRUTECH LTD. AND INTELLIGENT PROJECT SOLUTIONS PARTNERED TO EXPAND BUSINESS IN INDIAAKZONOBEL AND COATMASTER PARTNERED WITH COATINGAI AG

- 5.17 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 6.1 INTRODUCTION

-

6.2 POLYESTERADVANCEMENTS IN COMPOUNDING TECHNOLOGIES TO DRIVE MARKET

-

6.3 HYBRID (EPOXY POLYESTER)HIGH-END PROPERTIES OF HYBRID RESIN POWDER COATINGS TO BOOST DEMAND

-

6.4 EPOXYHIGH RESISTANCE TO HARSH CHEMICALS AND CORROSION TO FUEL DEMAND

-

6.5 ACRYLICRISING USE OF ACRYLIC RESIN POWDER COATING EQUIPMENT IN CONSUMER GOODS, ARCHITECTURE, AND AUTOMOTIVE INDUSTRIES TO DRIVE MARKET

-

6.6 POLYURETHANEABRASION RESISTANCE AND DURABILITY FEATURES OF POLYURETHANE TO DRIVE MARKET

- 6.7 OTHER RESIN TYPES

- 7.1 INTRODUCTION

-

7.2 KNEADERSUNIFORM SHEARING, HIGH FILLING, HIGH DISPERSION, AND STRETCHING MELT CHARACTERISTICS TO DRIVE DEMAND

-

7.3 EXTRUDERSHIGH SHEAR MIXING PROPERTIES TO DRIVE DEMAND

-

7.4 COOLING EQUIPMENTFOCUS ON REDUCING CARBON FOOTPRINT AND ADHERING TO STRICTER ENVIRONMENTAL REGULATIONS TO DRIVE DEMAND

-

7.5 GRINDERSDEPLOYMENT OF AUTOMATION AND ADVANCED TECHNOLOGIES IN PRODUCTION LINES TO FUEL DEMAND

- 7.6 OTHER COMPONENTS

- 8.1 INTRODUCTION

-

8.2 APPLIANCEREQUIREMENT FOR COATINGS WITH HIGH DURABILITY, HEAT RESISTANCE, AND CHEMICAL RESISTANCE PROPERTIES TO DRIVE MARKET

-

8.3 AUTOMOTIVERISING DEMAND FOR HIGH-PERFORMANCE COATINGS IN AUTOMOTIVE INDUSTRY TO BOOST MARKET GROWTH

-

8.4 GENERAL INDUSTRIALADOPTION OF SUSTAINABLE POWDER COATING MANUFACTURING PRACTICES TO DRIVE MARKET

-

8.5 ARCHITECTUREGROWING NEED FOR HIGH-PERFORMANCE, AESTHETICALLY ATTRACTIVE COATINGS TO BOOST MARKET GROWTH

-

8.6 FURNITURECHANGING LIFESTYLES AND RISING DEMAND FOR COATING EQUIPMENT THAT CAN DELIVER CONSISTENT, HIGH-QUALITY RESULTS TO DRIVE MARKET

- 8.7 OTHER END-USE INDUSTRIES

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICCHINA- Industrial growth and urbanization to drive marketINDIA- Rapid growth of automotive industry to drive marketJAPAN- Increasing demand for advanced coating solutions to drive marketTHAILAND- Increasing investments in public infrastructure development to drive marketSOUTH KOREA- Government-led initiatives for promoting adoption of new technologies to drive marketINDONESIA- Increasing investments in construction industry to drive marketMALAYSIA- Growing demand for protective and aesthetically appealing finishes in automotive sector to drive marketREST OF ASIA PACIFIC

-

9.3 EUROPEGERMANY- Rising demand for EVs to drive marketITALY- Surging industrial robot installations to drive demandFRANCE- Economic growth and rising infrastructure development to drive marketUK- Increasing demand for SUVs and zero-emission vehicles to drive marketSPAIN- Increasing demand for various machinery and equipment to drive marketNETHERLANDS- Supportive regulatory environment and incentives for eco-friendly practices to drive marketTURKEY- Developing industrial base and growing emphasis on innovative coating technologies to drive marketREST OF EUROPE

-

9.4 NORTH AMERICAUS- Presence of major powder coating and related equipment manufacturers to drive marketCANADA- Rapid infrastructure development to drive market

-

9.5 LATIN AMERICAMEXICO- Expanding automotive sector to drive marketBRAZIL- Increasing demand for modern, attractive, and sustainable building materials to drive marketARGENTINA- Growing population and improved economic conditions to drive marketREST OF LATIN AMERICA

-

9.6 MIDDLE EAST & AFRICAGCC COUNTRIES- UAE- Saudi Arabia- Rest of GCC countriesSOUTH AFRICA- Government-led investments in different industries to drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

-

10.4 MARKET SHARE ANALYSISRANKING ANALYSIS

-

10.5 BRAND/PRODUCT COMPARISONZSK MV PLUSPCSWONDER KNEADERCX/CXE

-

10.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT: KEY PLAYERS, 2023- Company footprint- Component footprint- Resin type footprint- End-use industry footprint- Region footprint

-

10.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2023PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING: STARTUPS/SMES, 2023- Detailed list of key startups/SMEs- Competitive benchmarking of key startups/SMEs

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

-

10.9 COMPETITIVE SCENARIOSPRODUCT LAUNCHESDEALSEXPANSIONS

-

11.1 KEY PLAYERSHILLENBRAND, INC. (COPERION GMBH)- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBUSS AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewHOSOKAWA MICRON GROUP- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYANTAI WUTAI CHEMICAL EQUIPMENT CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewXTRUTECH LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHONGQING DEGOLD MACHINE CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewVORTEX MIXING TECHNOLOGY- Business overview- Products/Solutions/Services offered- MnM viewMORIYAMA CORPORATION- Business overview- Products/Solutions/Services offered- MnM viewBBA INNOVA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewYANTAI DONGHUI POWDER PROCESSING EQUIPMENT CO., LTD.- Business overview- Products/Solutions/Services offered- MnM viewCPM EXTRUSION GROUP- Business overview- Products/Solutions/Services offered- MnM viewPOLIMER TEKNIK- Business overview- Products/Solutions/Services offered- MnM viewIPCO AB- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTIERMAX INC- Business overview- Products/Solutions/Services offered- MnM view

-

11.2 OTHER PLAYERSDONGSUN POWDER PROCESSING EQUIPMENT CO., LTD.YANTAI YUANLI MACHINERY MANUFACTURING CO., LTD.LEISTRITZ EXTRUSIONSTECHNIK GMBHSHANDONG SHENGSHIDA TECHNOLOGY CO., LTD.YANTAI LINGYU POWDER MACHINERY CO., LTD.MICRO POWDER TECHSBS STEEL BELT SYSTMES S.R.L.STEER WORLDSK TOOLS

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 GLOBAL ELECTRIC VEHICLE STOCK, BY KEY COUNTRY, 2020–2023 (MILLION)

- TABLE 2 POWDER COATING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- TABLE 4 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- TABLE 5 GDP PERCENTAGE CHANGE, BY KEY COUNTRY, 2021–2029

- TABLE 6 TRENDS OF GLOBAL AUTOMOTIVE INDUSTRY, 2022–2023

- TABLE 7 ROLES OF COMPANIES IN POWDER COATING EQUIPMENT ECOSYSTEM

- TABLE 8 PRICING ANALYSIS OF COMPONENTS RELATED TO POWDER COATING EQUIPMENT, BY SIZE, 2023 (USD/UNIT)

- TABLE 9 LEADING IMPORTERS OF HS CODE 8474-COMPLIANT PRODUCTS IN 2023 (USD MILLION)

- TABLE 10 LEADING EXPORTERS OF HS CODE 8474-COMPLIANT PRODUCTS IN 2023 (USD MILLION)

- TABLE 11 TOP USE CASES AND MARKET POTENTIAL

- TABLE 12 BEST PRACTICES: COMPANIES IMPLEMENTING USE CASES

- TABLE 13 POWDER COATING EQUIPMENT MARKET: CASE STUDIES RELATED TO GEN AI IMPLEMENTATION

- TABLE 14 INTERCONNECTED ADJACENT ECOSYSTEM AND IMPACT ON MARKET PLAYERS

- TABLE 15 POWDER COATING EQUIPMENT MARKET: TOTAL NUMBER OF PATENTS, JANUARY 2014–JULY 2024

- TABLE 16 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 19 ROW: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 20 POWDER COATING EQUIPMENT MARKET: LIST OF KEY CONFERENCES AND EVENTS, 2024–2025

- TABLE 21 APPLICATIONS AND PROPERTIES OF POWDER COATING RESINS

- TABLE 22 POWDER COATING EQUIPMENT MARKET, BY RESIN TYPE, 2022–2030 (USD MILLION)

- TABLE 23 POLYESTER: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 24 HYBRID: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 25 EPOXY: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 26 ACRYLIC: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 27 POLYURETHANE: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 28 OTHER RESIN TYPES: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 29 POWDER COATING EQUIPMENT MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 30 KNEADERS: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 31 EXTRUDERS: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 32 COOLING EQUIPMENT: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 33 GRINDERS: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 34 OTHER COMPONENTS: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 35 POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 36 APPLIANCE: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 37 AUTOMOTIVE: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 38 GENERAL INDUSTRIAL: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 39 ARCHITECTURE: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 40 FURNITURE: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 41 OTHER END-USE INDUSTRIES: POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 42 POWDER COATING EQUIPMENT MARKET, BY REGION, 2022–2030 (USD MILLION)

- TABLE 43 ASIA PACIFIC: POWDER COATING EQUIPMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 44 ASIA PACIFIC: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 45 ASIA PACIFIC: MARKET, BY RESIN TYPE, 2022–2030 (USD MILLION)

- TABLE 46 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 47 CHINA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 48 INDIA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 49 JAPAN: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 50 THAILAND: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 51 SOUTH KOREA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 52 INDONESIA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 53 MALAYSIA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 54 REST OF ASIA PACIFIC: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 55 EUROPE: POWDER COATING EQUIPMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 56 EUROPE: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 57 EUROPE: MARKET, BY RESIN TYPE, 2022–2030 (USD MILLION)

- TABLE 58 EUROPE: MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 59 GERMANY: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 60 ITALY: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 61 FRANCE: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 62 UK: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 63 SPAIN: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 64 NETHERLANDS: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 65 TURKEY: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 66 REST OF EUROPE: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 67 NORTH AMERICA: POWDER COATING EQUIPMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 68 NORTH AMERICA: MARKET, BY RESIN TYPE, 2022–2030 (USD MILLION)

- TABLE 69 NORTH AMERICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 70 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 71 US: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 72 CANADA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 73 LATIN AMERICA: POWDER COATING EQUIPMENT MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 74 LATIN AMERICA: MARKET, BY RESIN TYPE, 2022–2030 (USD MILLION)

- TABLE 75 LATIN AMERICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 76 LATIN AMERICA: MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 77 MEXICO: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 78 BRAZIL: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 79 ARGENTINA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 80 REST OF LATIN AMERICA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 81 MIDDLE EAST & AFRICA: POWDER COATING EQUIPMENT MARKET, BY RESIN TYPE, 2022–2030 (USD MILLION)

- TABLE 82 MIDDLE EAST & AFRICA: MARKET, BY COMPONENT, 2022–2030 (USD MILLION)

- TABLE 83 MIDDLE EAST & AFRICA: MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 84 MIDDLE EAST & AFRICA: MARKET, BY COUNTRY, 2022–2030 (USD MILLION)

- TABLE 85 UAE: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 86 SAUDI ARABIA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 87 REST OF GCC COUNTRIES: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 88 SOUTH AFRICA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 89 REST OF MIDDLE EAST & AFRICA: POWDER COATING EQUIPMENT MARKET, BY END-USE INDUSTRY, 2022–2030 (USD MILLION)

- TABLE 90 POWDER COATING EQUIPMENT MARKET: KEY STRATEGIES ADOPTED BY MAJOR POWDER COATING EQUIPMENT MANUFACTURERS

- TABLE 91 POWDER COATING EQUIPMENT MARKET: DEGREE OF COMPETITION, 2023

- TABLE 92 POWDER COATING EQUIPMENT MARKET: COMPONENT FOOTPRINT

- TABLE 93 POWDER COATING EQUIPMENT MARKET: RESIN TYPE FOOTPRINT

- TABLE 94 POWDER COATING EQUIPMENT MARKET: END-USE INDUSTRY FOOTPRINT

- TABLE 95 POWDER COATING EQUIPMENT MARKET: REGION FOOTPRINT

- TABLE 96 POWDER COATING EQUIPMENT MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 97 POWDER COATING EQUIPMENT MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 98 POWDER COATING EQUIPMENT MARKET: PRODUCT LAUNCHES, JANUARY 2018–JANUARY 2024

- TABLE 99 POWDER COATING EQUIPMENT MARKET: DEALS, JANUARY 2018–JANUARY 2024

- TABLE 100 POWDER COATING EQUIPMENT MARKET: EXPANSIONS, JANUARY 2018–JANUARY 2024

- TABLE 101 HILLENBRAND, INC. (COPERION GMBH): COMPANY OVERVIEW

- TABLE 102 HILLENBRAND, INC. (COPERION GMBH): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 103 HILLENBRAND, INC. (COPERION GMBH): PRODUCT LAUNCHES

- TABLE 104 HILLENBRAND, INC. (COPERION GMBH): DEALS

- TABLE 105 BUSS AG: COMPANY OVERVIEW

- TABLE 106 BUSS AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 107 BUSS AG: EXPANSIONS

- TABLE 108 HOSOKAWA MICRON GROUP: COMPANY OVERVIEW

- TABLE 109 HOSOKAWA MICRON GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 110 HOSOKAWA MICRON GROUP: PRODUCT LAUNCHES

- TABLE 111 HOSOKAWA MICRON GROUP: EXPANSIONS

- TABLE 112 YANTAI WUTAI CHEMICAL EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 113 YANTAI WUTAI CHEMICAL EQUIPMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 114 XTRUTECH LTD.: COMPANY OVERVIEW

- TABLE 115 XTRUTECH LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 116 XTRUTECH LTD.: PRODUCT LAUNCHES

- TABLE 117 XTRUTECH LTD.: DEALS

- TABLE 118 CHONGQING DEGOLD MACHINE CO., LTD.: COMPANY OVERVIEW

- TABLE 119 CHONGQING DEGOLD MACHINE CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 120 VORTEX MIXING TECHNOLOGY: COMPANY OVERVIEW

- TABLE 121 VORTEX MIXING TECHNOLOGY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 122 MORIYAMA CORPORATION: COMPANY OVERVIEW

- TABLE 123 MORIYAMA CORPORATION: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 124 BBA INNOVA AG: COMPANY OVERVIEW

- TABLE 125 BBA INNOVA AG: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 126 BBA INNOVA AG: PRODUCT LAUNCHES

- TABLE 127 YANTAI DONGHUI POWDER PROCESSING EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 128 YANTAI DONGHUI POWDER PROCESSING EQUIPMENT CO., LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 129 CPM EXTRUSION GROUP: COMPANY OVERVIEW

- TABLE 130 CPM EXTRUSION GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 131 POLIMER TEKNIK: COMPANY OVERVIEW

- TABLE 132 POLIMER TEKNIK: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 133 IPCO AB: COMPANY OVERVIEW

- TABLE 134 IPCO AB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 135 IPCO AB: DEALS

- TABLE 136 TIERMAX INC: COMPANY OVERVIEW

- TABLE 137 TIERMAX INC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 138 DONGSUN POWDER PROCESSING EQUIPMENT CO., LTD.: COMPANY OVERVIEW

- TABLE 139 YANTAI YUANLI MACHINERY MANUFACTURING CO., LTD.: COMPANY OVERVIEW

- TABLE 140 LEISTRITZ EXTRUSIONSTECHNIK GMBH: COMPANY OVERVIEW

- TABLE 141 SHANDONG SHENGSHIDA TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 142 YANTAI LINGYU POWDER MACHINERY CO., LTD.: COMPANY OVERVIEW

- TABLE 143 MICRO POWDER TECH: COMPANY OVERVIEW

- TABLE 144 SBS STEEL BELT SYSTEMS S.R.L.: COMPANY OVERVIEW

- TABLE 145 STEER WORLD: COMPANY OVERVIEW

- TABLE 146 SK TOOLS: COMPANY OVERVIEW

- FIGURE 1 POWDER COATING EQUIPMENT MARKET SEGMENTATION

- FIGURE 2 POWDER COATING EQUIPMENT MARKET: RESEARCH DESIGN

- FIGURE 3 POWDER COATING EQUIPMENT MARKET: BOTTOM-UP APPROACH

- FIGURE 4 POWDER COATING EQUIPMENT MARKET: TOP-DOWN APPROACH

- FIGURE 5 DATA TRIANGULATION

- FIGURE 6 EXTRUDERS SEGMENT TO RECORD FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 7 HYBRID SEGMENT TO HOLD LARGEST MARKET SHARE IN 2030

- FIGURE 8 APPLIANCE SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO DOMINATE POWDER COATING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 10 SURGING DEMAND FOR POWDER COATING EQUIPMENT IN EMERGING ECONOMIES TO OFFER LUCRATIVE OPPORTUNITIES FOR MARKET PLAYERS

- FIGURE 11 APPLIANCE SEGMENT AND ASIA PACIFIC ACCOUNTED FOR LARGEST SHARES OF POWDER COATING EQUIPMENT MARKET IN 2023

- FIGURE 12 POLYESTER SEGMENT TO REGISTER HIGHEST CAGR IN POWDER COATING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 13 EXTRUDERS SEGMENT TO EXHIBIT HIGHEST CAGR IN POWDER COATING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 14 INDIA TO REGISTER HIGHEST CAGR IN POWDER COATING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES RELATED TO POWDER COATING EQUIPMENT MARKET

- FIGURE 16 POWDER COATING EQUIPMENT MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY END-USE INDUSTRY

- FIGURE 18 KEY BUYING CRITERIA, BY END-USE INDUSTRY

- FIGURE 19 POWDER COATING EQUIPMENT MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 20 POWDER COATING EQUIPMENT MARKET: VALUE CHAIN ANALYSIS

- FIGURE 21 POWDER COATING EQUIPMENT ECOSYSTEM ANALYSIS

- FIGURE 22 PARTICIPANTS IN POWDER COATING EQUIPMENT ECOSYSTEM

- FIGURE 23 PRICING ANALYSIS OF COMPONENTS RELATED TO POWDER COATING EQUIPMENT OFFERED BY KEY PLAYERS, 2023 (USD/UNIT)

- FIGURE 24 IMPORT DATA RELATED TO HS CODE 8474-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 25 EXPORT DATA RELATED TO HS CODE 8474-COMPLIANT PRODUCTS, BY KEY COUNTRY, 2019–2023 (USD MILLION)

- FIGURE 26 PATENT ANALYSIS, BY DOCUMENT TYPE, JANUARY 2014–JULY 2024

- FIGURE 27 PATENT PUBLICATION TREND, 2014−2024

- FIGURE 28 POWDER COATING EQUIPMENT MARKET: LEGAL STATUS OF PATENTS, JANUARY 2014–JULY 2024

- FIGURE 29 JURISDICTION OF CHINA REGISTERED HIGHEST NUMBER OF PATENTS BETWEEN JANUARY 2014 AND JULY 2024

- FIGURE 30 TOP PATENT APPLICANTS, JANUARY 2014–JULY 2024

- FIGURE 31 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 32 POWDER COATING EQUIPMENT MARKET: INVESTMENT AND FUNDING SCENARIO OF MAJOR PLAYERS, 2024 (USD BILLION)

- FIGURE 33 HYBRID RESIN SEGMENT TO HOLD LARGEST SHARE OF POWDER COATING EQUIPMENT MARKET IN 2024

- FIGURE 34 CHARACTERISTICS OF THERMOSET POWDER COATINGS

- FIGURE 35 ASIA PACIFIC TO DOMINATE POWDER COATING EQUIPMENT MARKET FOR POLYESTERS DURING FORECAST PERIOD

- FIGURE 36 EXTRUDER SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 ASIA PACIFIC TO DOMINATE POWDER COATING EQUIPMENT MARKET FOR KNEADERS DURING FORECAST PERIOD

- FIGURE 38 APPLIANCE SEGMENT TO DOMINATE POWDER COATING EQUIPMENT MARKET DURING FORECAST PERIOD

- FIGURE 39 ASIA PACIFIC TO DOMINATE POWDER COATING EQUIPMENT MARKET FOR APPLIANCE SEGMENT DURING FORECAST PERIOD

- FIGURE 40 ASIA PACIFIC: POWDER COATING EQUIPMENT MARKET SNAPSHOT

- FIGURE 41 EUROPE: POWDER COATING EQUIPMENT MARKET SNAPSHOT

- FIGURE 42 NORTH AMERICA: POWDER COATING EQUIPMENT MARKET SNAPSHOT

- FIGURE 43 POWDER COATING EQUIPMENT MARKET: REVENUE ANALYSIS OF FIVE KEY PLAYERS, 2019–2023 (USD MILLION)

- FIGURE 44 POWDER COATING EQUIPMENT MARKET SHARE ANALYSIS, 2023

- FIGURE 45 POWDER COATING EQUIPMENT MARKET: RANKING OF TOP FIVE PLAYERS

- FIGURE 46 POWDER COATING EQUIPMENT MARKET: BRAND/PRODUCT COMPARATIVE ANALYSIS

- FIGURE 47 POWDER COATING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 48 POWDER COATING EQUIPMENT MARKET: COMPANY FOOTPRINT (14 COMPANIES)

- FIGURE 49 POWDER COATING EQUIPMENT MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2023

- FIGURE 50 POWDER COATING EQUIPMENT MARKET: EV/EBITDA OF KEY MANUFACTURERS

- FIGURE 51 POWDER COATING EQUIPMENT MARKET: YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY MARKET PLAYERS

- FIGURE 52 HILLENBRAND, INC. (COPERION GMBH): COMPANY SNAPSHOT

- FIGURE 53 HOSOKAWA MICRON GROUP: COMPANY SNAPSHOT

The study involves two major activities in estimating the current market size for the powder coating equipment market. Exhaustive secondary research was done to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this research study include financial statements of companies offering powder coating equipment and information from various trade, business, and professional associations. Secondary research has been used to obtain critical information about the industry’s value chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. The secondary data was collected and analyzed to arrive at the overall size of the powder coating equipment market, which was validated by primary respondents.

Primary Research

Extensive primary research was conducted after obtaining information regarding the powder coating equipment market scenario through secondary research. Several primary interviews were conducted with market experts from both the demand and supply sides across major countries of North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America. Primary data was collected through questionnaires, emails, and telephonic interviews. The primary sources from the supply side included various industry experts, such as Chief X Officers (CXOs), Vice Presidents (VPs), Directors from business development, marketing, product development/innovation teams, and related key executives from powder coating equipment industry vendors; system integrators; component providers; distributors; and key opinion leaders. Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, CSOs, and installation teams of the customer/end users who are using steel fiber products were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of powder coating equipment and outlook of their business which will affect the overall market.

The Breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The research methodology used to estimate the size of the powder coating equipment market includes the following details. The market sizing of the market was undertaken from the demand side. The market was upsized based on procurements and modernizations in powder coating equipment in different applications at a regional level. Such procurements provide information on the demand aspects of the powder coating equipment industry for each application. For each application, all possible segments of the powder coating equipment market were integrated and mapped.

Powder Coating equipment market Size: Bottom-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Powder Coating equipment market Size: Top-Down Approach

Data Triangulation

After arriving at the overall size from the market size estimation process explained above, the total market was split into several segments and subsegments. The data triangulation and market breakdown procedures explained below were implemented, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for various market segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Powder coating equipment refers to the machinery and systems used to manufacture and process powder coatings. This equipment is integral to the production of powder coatings, which are dry, powdered substances used to create a decorative finish on metal and other substrates. According to IPCA (Indian Paint and Coating Association), Powder coating is applied as a free-flowing dry powder. It does not require any solvent to keep the binder and filler parts in a liquid suspension form. The coating is usually applied electrostatically and cured under heat to flow and form a layer. The powder is either a thermoset or a thermoplastic polymer. It is usually used to create a hard finish that is tougher than conventional paint. Powder coating is mainly used to coat metals on household appliances, aluminum extrusions, drum hardware, automobile, automotive parts, and bicycle parts. The application of powder coating is growing as technology is evolving and research is undergoing to make powder coating compatible with more substrates apart from metals, hence it is being widely adopted for coating on wood and plastic.

Key Stakeholders

- Powder coating equipment manufacturers

- Powder coating manufacturers

- Raw Materials Suppliers

- Distributors and Suppliers

- End-use Industries

- Industry Associations

- R&D Institutions

- Environment Support Agencies

Report Objectives

- To define, describe, and forecast the powder coating equipment market size in terms of value.

- To provide detailed information regarding the key factors, such as drivers, restraints, opportunities, and challenges influencing market growth

- To analyze and project the global powder coating equipment market by component, resin type, end-use industry, and region.

- To forecast the market size concerning five main regions (along with country-level data), namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, and analyze the significant region-specific trends.

- To strategically analyze micro markets with respect to individual growth trends, prospects, and contributions of the submarkets to the overall market

- To analyze the market opportunities and the competitive landscape for stakeholders and market leaders

- To assess recent market developments and competitive strategies, such as agreements, contracts, acquisitions, and new product developments/new product launches, to draw the competitive landscape.

- To strategically profile the key market players and comprehensively analyze their core competencies.

Available Customizations

MarketsandMarkets offers following customizations for this market report:

- Additional country-level analysis of the powder coating equipment market

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company's market.

Growth opportunities and latent adjacency in Powder Coating Equipment Market