Poultry Diagnostics Market by Test (ELISA, PCR) Disease (Avian Salmonellosis, Avian Influenza, Newcastle Disease, Avian Pasteurellosis, Encephalomyelitis, Infectious Bronchitis), Service (Virology, Bacteriology, Parasitology) - Global Forecast to 2022

[155 Pages Report] The global poultry diagnostics market is estimated to reach USD 495.3 Million by 2022 from USD 300.6 Million in 2017, at a CAGR of 10.5%. The majority of the demand for testing kits such as ELISA and PCR tests is driven by the increase in disease outbreaks in poultry, rising prevalence of zoonotic diseases, and growing demand for poultry-derived food products. In addition, the diagnostic monitoring of bacterial avian disease on a regular basis in regions like Europe is further driving the overall growth of the market. Emerging regions such as Asia-Pacific offer an added potential due to the large livestock population in this region, growing demand of poultry-derived food products, and increasing awareness about animal health.

Years considered for this report

- 2016 – Base Year

- 2017 – Estimated Year

- 2022 – Projected Year

Research Methodology

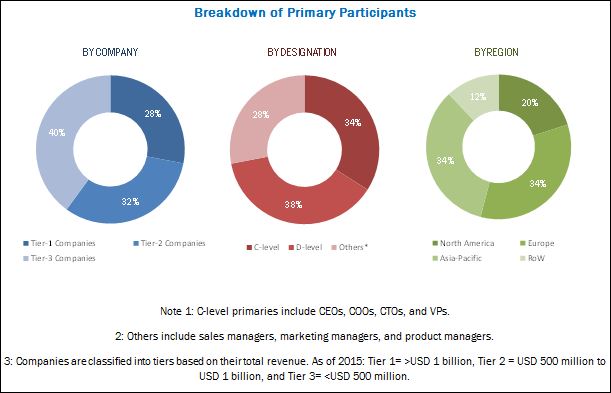

This study estimates the poultry diagnostics market size for 2017 and projects its demand till 2022. It also provides a detailed qualitative and quantitative analysis of the market. Various secondary sources such as directories, industry journals, and databases have been used to identify and collect information useful for this extensive commercial study of the global market for poultry diagnostics. Primary sources such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess prospects of the market. All possible factors that affect the market included in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data. This data was combined and added with detailed inputs and analysis from MarketsandMarkets and presented in this report. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

The major players in the market are IDEXX Laboratories, Inc. (U.S.), QIAGEN N.V. (Netherlands), Thermo Fisher Scientific Inc. (U.S.), Zoetis, Inc. (U.S.), GD Animal Health (Netherlands), IDvet (France), AffiniTech, LTD. (U.S.), AgroBioTek Internacional (Honduras), BioNote, Inc. (South Korea), BioChek (Netherlands), Boehringer Ingelheim (Germany), MEGACOR Diagnostik GmbH (Germany), and BioinGentech Biotechnologies, Inc. (Chile).

Target Audience:

- Veterinary diagnostics manufacturers

- Veterinary diagnostics distributors

- Animal health research and development (R&D;) companies

- Veterinary reference laboratories

- Government associations

- Market research and consulting firms

- Venture capitalists and investors

“The study answers several questions for the stakeholders, primarily which market segments to focus on in the next five years for prioritizing efforts and investments and the competitive landscape of the market.”

Scope of the Report:

The research report categorizes the global market into the following segments and subsegments:

Global Poultry Diagnostics Market, by Product

-

By Test Type

- ELISA Test

- PCR Test

- Other Diagnostic Tests

-

By Disease Type

- Avian Salmonellosis

- Avian Influenza

- Newcastle Disease

- Avian Mycoplasmosis

- Avian Pasteurellosis

- Infectious Bronchitis

- Infectious Bursal Disease

- Avian Encephalomyelitis

- Avian Reovirus

- Chicken Anemia

Global Poultry Diagnostics Market, By Service

- Bacteriology

- Virology

- Parasitology

Global Poultry Diagnostics Market, by Region

- North America

- Europe

- Asia-Pacific

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix which gives a detailed comparison of the product portfolios of each company

Geographic Analysis

- Further breakdown of the poultry diagnostics market at the country-level

Company Information

- Detailed analysis and profiling of additional market players (Up to 5)

The global poultry diagnostics market is projected to reach USD 495.3 Million by 2022 from USD 300.6 Million in 2017, growing at a CAGR of 10.5%. Significant increase in the avian diseases outbreak and rising incidence of zoonotic diseases, rising consumer focus on food safety along with the increasing animal health awareness, and increasing trade in terms of export within the poultry industry are the major drivers for the growth of the global market for poultry diagnostics. Other factors such as rising demand for poultry-derived food products across geographies and the increasing animal healthcare expenditure in emerging countries are also contributing to the growth of the market. Emerging markets such as China, India, and Brazil offer significant opportunities for the growth of market. However, lack of awareness regarding animal health in these regions may negatively impact the market growth. The high cost of production, increasing feed costs, and trade disputes in the poultry industry may hinder the growth of this market to a certain extent during the forecast period.

In this report, the poultry diagnostics market is segmented on the basis of product, service, and region. On the basis of product, the market has been further segmented by test type and disease type. The test type segment accounted for the largest share of the market in 2016. It is also expected to grow at the highest CAGR during the forecast period. This can be attributed to the wide use of ELISA tests for preliminary screening of all avian diseases coupled with their high sensitivity, specificity, and cost-effective nature. These tests are the most preferred for fast and accurate results. The disease type is also expected to register the fastest growth in the market during the forecast period. This is due to the recent surge in avian influenza outbreaks in countries like the U.S., Canada, and China. This has led to the adoption of various test kits to detect and combat its spread.

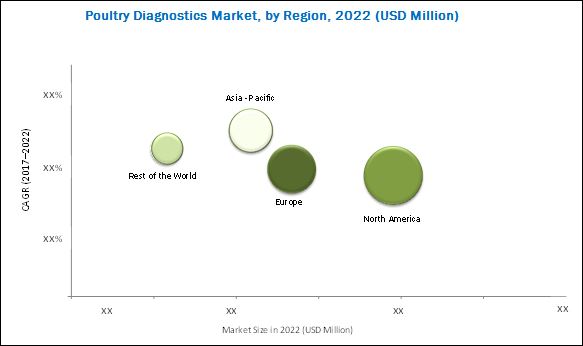

Geographically, the global market is segmented into North America, Europe, Asia-Pacific, and Rest of the World. In 2016, North America commanded a major share of the poultry diagnostics market. The large share can be attributed to increasing adoption of diagnostic modalities owing to the increasing number of avian disease outbreaks in the region, the rising veterinary healthcare expenditure in the region, and the growing government focus on improving food-producing animal health. However, Asia-Pacific is expected to witness the highest growth during the forecast period. Growth in the Asia-Pacific market can be mainly due to the large livestock population in this region, growing demand of poultry-derived food products, increasing awareness about animal health, and growing per capita animal health expenditure, especially in India and China. Moreover, the increasing outbreak of avian influenza and Newcastle disease in this region is aiding the market growth.

The market is characterized by a large number of players. It is consolidated in nature and is dominated by IDEXX Laboratories, Inc. (U.S.), QIAGEN N.V. (Netherlands), Thermo Fisher Scientific Inc. (U.S.), Zoetis, Inc. (U.S.), GD Animal Health (Netherlands), IDvet (France), AffiniTech, LTD. (U.S.), AgroBioTek Internacional (Honduras), BioNote, Inc. (South Korea), BioChek (Netherlands), Boehringer Ingelheim (Germany), MEGACOR Diagnostik GmbH (Germany), and BioinGentech Biotechnologies, Inc. (Chile). Key players in the market are pursuing several organic and inorganic growth strategies such as product launches, expansions, collaborations, and acquisitions to garner larger shares in the market. During 2012 to 2017, companies adopted product launches as their major growth strategy followed by expansions.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 18)

2.1 Research Approach

2.1.1 Secondary Research

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Research

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumption for the Study

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Poultry Diagnostics Market: Overview

4.2 Global Market: By Test Type and Service (2016)

4.3 Global Market: Geographic Growth Opportunities

4.4 Global Market: Regional Mix

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Key Market Drivers

5.2.1.1 Increasing Disease Outbreaks in Poultry

5.2.1.2 Rising Demand for Poultry-Derived Food Products

5.2.2 Key Market Restraint

5.2.2.1 High Poultry Production Costs

5.2.3 Key Market Opportunity

5.2.3.1 Untapped Emerging Markets

5.2.4 Key Challenge

5.2.4.1 Lack of Animal Health Awareness in Emerging Markets

5.3 Industry Trends

5.3.1 Outsourcing Diagnostic Testing Services to Reference Labs

5.3.2 Rising Number of Research Collaborations

6 Poultry Diagnostics Market, By Test Type (Page No. - 44)

6.1 Introduction

6.2 Enzyme-Linked Immunosorbent Assay (Elisa) Tests

6.3 Polymerase Chain Reaction (PCR) Tests

6.4 Other Diagnostic Tests

7 Poultry Diagnostics Market, By Disease Type (Page No. - 53)

7.1 Introduction

7.2 Avian Salmonellosis

7.3 Avian Influenza

7.4 Newcastle Disease

7.5 Avian Mycoplasmosis

7.6 Infectious Bronchitis

7.7 Infectious Bursal Disease

7.8 Avian Pasteurellosis

7.9 Avian Encephalomyelitis

7.10 Avian Reovirus

7.11 Chicken Anemia

8 Poultry Diagnostics Market, By Services (Page No. - 70)

8.1 Introduction

8.2 Virology

8.3 Bacteriology

8.4 Parasitology

9 Poultry Diagnostics Market, By Region (Page No. - 77)

9.1 Introduction

9.2 North America

9.3 Europe

9.4 Asia-Pacific

9.5 Rest of the World

10 Poultry Diagnostics Market, Competitive Landscape (Page No. - 100)

10.1 Overview

10.2 Vendor Dive Overview

10.2.1 Vanguards

10.2.2 Innovators

10.2.3 Dynamic

10.2.4 Emerging

10.3 Analysis of the Product Portfolio of Major Players in the Market

10.4 Business Strategies Adopted By Players in the Market

*Top 25 Companies Analyzed for This Studies are - Idexx Laboratories, Inc. (U.S.), Qiagen N.V. (Netherlands), Zoetis, Inc. (U.S.), Thermo Fisher Scientific Inc. (U.S.), GD Animal Health (Netherlands), IDVet (France), Biochek (Netherlands), Affinitech, Ltd. (U.S.), Agrobiotek Internacional (Honduras), Bionote, Inc. (South Korea), Boehringer Ingelheim GmbH (Germany), Bioingentech Biotechnologies, Inc. (Chile), Clementia Biotech (India), Bioneer Corporation (South Korea), DRG Instruments GmbH (Germany), Aquila Diagnostic Systems, Inc. (Canada), Biogal-Galed Laboratories (Israel), Megacor Diagnostik GmbH (Germany), Life Bioscience (Australia), Ubio Biotechnology Systems Pvt. Ltd. (India), Nisseinken Co., Ltd. (Japan).

11 Company Profiles (Page No. - 104)

(Introduction, Products & Services, Strategy, & Analyst Insights, Developments, MnM View)*

11.1 Idexx Laboratories, Inc.

11.2 Zoetis, Inc.

11.3 Thermo Fisher Scientific Inc.

11.4 Qiagen N.V.

11.5 GD Animal Health

11.6 IDVet

11.7 Affinitech, Ltd.

11.8 Agrobiotek Internacional

11.9 Biochek

11.10 Bionote, Inc.

11.11 Boehringer Ingelheim GmbH

11.12 Bioingentech Biotechnologies, Inc.

11.13 Megacor Diagnostik GmbH.

*Details on Marketsandmarkets View, Introduction, Product & Services, Strategy, & Analyst Insights, New Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 146)

12.1 Insights of Industry Experts

12.2 Discussion Guide

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

12.7 Author Details

List of Tables (72 Tables)

Table 1 Past and Projected Trends in Poultry Meat Consumption

Table 2 Key Market Drivers: Impact Analysis

Table 3 Key Market Restraints: Impact Analysis

Table 4 Key Market Opportunities: Impact Analysis

Table 5 Key Market Challenges: Impact Analysis

Table 6 Global Poultry Diagnostics Tests Market Size, By Test Type, 2015-2022 (USD Million)

Table 7 Global Poultry Diagnostic Tests Market Size, By Test Type, 2015-2022 (Hundred Units)

Table 8 Global Poultry Diagnostics Tests Market Size, By Region, 2015-2022 (USD Million)

Table 9 Poultry Diseases Detected By Elisa Tests

Table 10 Global Poultry Elisa Tests Market Size, By Region, 2015-2022 (USD Million)

Table 11 Global Poultry Elisa Tests Market Size, By Region, 2015-2022 (Hundred Units)

Table 12 Poultry Diseases Detected By PCR

Table 13 Global Poultry PCR Tests Market Size, By Region, 2015-2022 (USD Million)

Table 14 Global Poultry PCR Tests Market Size, By Region, 2015-2022 (Hundred Units)

Table 15 Global Other Poultry Diagnostic Tests Market Size, By Region, 2015-2022 (USD Million)

Table 16 Global Other Poultry Diagnostic Tests Market Size, By Region, 2015-2022 (Hundred Units)

Table 17 Global Poultry Diagnostics Market Size, By Disease Type, 2015-2022 (USD Million)

Table 18 Global Market for Poultry Diagnostics: Size, By Disease Type, 2015-2022 (Hundred Units)

Table 19 Global Market Size for Avian Salmonellosis, By Region, 2015-2022 (USD Million)

Table 20 Global Market Size for Avian Salmonellosis, By Region, 2015-2022 (Hundred Units)

Table 21 Global Market Size for Avian Influenza, By Region, 2015-2022 (USD Million)

Table 22 Global Market Size for Avian Influenza, By Region, 2015-2022 (Hundred Units)

Table 23 Global Market for Poultry Diagnostics: Size for Newcastle Disease, By Region, 2015-2022 (USD Million)

Table 24 Global Market Size for Newcastle Disease, By Region, 2015-2022 (Hundred Units)

Table 25 Global Market Size for Avian Mycoplasmosis, By Region, 2015-2022 (USD Million)

Table 26 Global Market Size for Avian Mycoplasmosis, By Region, 2015-2022 (Hundred Units)

Table 27 Global Market Size for Infectious Bronchitis, By Region, 2015-2022 (USD Million)

Table 28 Global Poultry Diagnostics Market Size for Infectious Bronchitis, By Region, 2015-2022 (Hundred Units)

Table 29 Global Market for Poultry Diagnostics: Size for Infectious Bursal Disease, By Region, 2015-2022 (USD Million)

Table 30 Global Market Size for Infectious Bursal Disease, By Region, 2015-2022 (Hundred Units)

Table 31 Global Market Size for Avian Pasteurellosis, By Region, 2015-2022 (USD Million)

Table 32 Global Market Size for Avian Pasteurellosis, By Region, 2015-2022 (Hundred Units)

Table 33 Global Market Size for Avian Encephalomyelitis, By Region, 2015-2022 (USD Million)

Table 34 Global Market for Poultry Diagnostics: Size for Avian Encephalomyelitis, By Region, 2015-2022 (Hundred Units)

Table 35 Global Market Size for Avian Reovirus, By Region, 2015-2022 (USD Million)

Table 36 Global Market Size for Avian Reovirus, By Region, 2015-2022 (Hundred Units)

Table 37 Global Market Size for Chicken Anemia, By Region, 2015-2022 (USD Million)

Table 38 Global Poultry Diagnostics Market Size for Chicken Anemia, By Region, 2015-2022 (Hundred Units)

Table 39 Global Poultry Diagnostic Services Market Size, By Type, 2015-2022 (USD Million)

Table 40 Viral Diseases in Poultry and Their Causative Agents

Table 41 Global Poultry Diagnostic Services Market Size for Virology, By Region, 2015-2022 (USD Million)

Table 42 Bacterial Diseases in Poultry and Their Causative Agents

Table 43 Global Poultry Diagnostic Services Market Size for Bacteriology, By Region, 2015-2022 (USD Million)

Table 44 Global Poultry Diagnostic Services Market Size for Parasitology, By Region, 2015-2022 (USD Million)

Table 45 Global Market Size, By Region, 2015–2022 (USD Million)

Table 46 North America: Chicken Population (Million)

Table 47 North America: Poultry Diagnostics Market Size, By Product and Service, 2015–2022 (USD Million)

Table 48 North America: Market Size, By Test Type, 2015–2022 (USD Million)

Table 49 North America: Market Size, By Test Type, 2015-2022 (Hundred Units)

Table 50 North America: Market Size, By Disease Type, 2015–2022 (USD Million)

Table 51 North America: Market Size, By Disease Type, 2015–2022 (Hundred Units)

Table 52 North America: Market for Poultry Diagnostics: Size, By Service, 2015–2022 (USD Million)

Table 53 Europe: Chicken Population (Million)

Table 54 Europe: Poultry Diagnostics Market Size, By Product & Service, 2015–2022 (USD Million)

Table 55 Europe: Market Size, By Test Type, 2015–2022 (USD Million)

Table 56 Europe: Market Size, By Test Type, 2015–2022 (Hundred Units)

Table 57 Europe: Market Size, By Disease Type, 2015–2022 (USD Million)

Table 58 Europe: Market Size, By Disease Type, 2015–2022 (Hundred Units)

Table 59 Europe: Market for Poultry Diagnostics: Size, By Service, 2015–2022 (USD Million)

Table 60 Asia-Pacific: Chicken Population (Million)

Table 61 Asia-Pacific: Poultry Diagnostics Market Size, By Product & Service, 2015–2022 (USD Million)

Table 62 Asia-Pacific: Market Size, By Test Type, 2015–2022 (USD Million)

Table 63 Asia-Pacific: Market Size, By Test Type, 2015–2022 (Hundred Units)

Table 64 Asia-Pacific: Market Size, By Disease Type, 2015–2022 (USD Million)

Table 65 Asia-Pacific: Market Size, By Disease Type, 2015–2022 (Hundred Units)

Table 66 Asia-Pacific: Market for Poultry Diagnostics: Size, By Service, 2015–2022 (USD Million)

Table 67 RoW: Poultry Diagnostics Market Size, By Product & Service, 2015–2022 (USD Million)

Table 68 RoW: Market Size, By Test Type, 2015–2022 (USD Million)

Table 69 RoW: Market Size, By Test Type, 2015–2022 (Hundred Units)

Table 70 RoW: Market Size, By Disease Type, 2015–2022 (USD Million)

Table 71 RoW: Market Size, By Disease Type, 2015–2022 (Hundred Units)

Table 72 RoW: Poultry Diagnostics Market Size, By Service, 2015–2022 (USD Million)

List of Figures (59 Figures)

Figure 1 Global Poultry Diagnostics Market Segmentation

Figure 2 Research Design

Figure 3 Secondary Research Approach

Figure 4 Primary Research Approach

Figure 5 Market Sizing Approach

Figure 6 Bottom-Up Approach

Figure 7 Top-Down Approach

Figure 8 Data Triangulation Methodology

Figure 9 Global Market Size, By Products & Services, 2017 vs 2022 (USD Million)

Figure 10 Market for Poultry Diagnostics: Size, By Test Type, 2017 vs 2022 (USD Million)

Figure 11 Market Size, By Disease Type, 2017 vs 2022 (USD Million)

Figure 12 Poultry Diagnostics Market Size, By Service, 2017 vs 2022 (USD Million)

Figure 13 Geographic Analysis: Global Market

Figure 14 Rise in Disease Outbreaks in Poultry Animals is the Major Factor Driving the Growth of the Poultry Diagnostics Market

Figure 15 Elisa Tests Accounted for A Major Share of the Market in 2016

Figure 16 North America Dominated the Global Poultry Diagnostics Market in 2016

Figure 17 North America Will Continue to Dominate the global Market in 2022

Figure 18 Global Market: Drivers, Restraints, Opportunities, and Challenges

Figure 19 Rise in Outsourcing of Diagnostic Testing Services to Reference Labs is A Leading Industry Trend

Figure 20 The Elisa Tests Dominated the Market in 2017

Figure 21 Avian Influenza Diagnostics Segment to Grow at the Highest CAGR During the Forecast Period

Figure 22 Virology Segment to Dominate the Poultry Diagnostics Market During the Forecast Period

Figure 23 Global Market: Geographic Snapshot

Figure 24 North America: Market Snapshot

Figure 25 Europe: Market Snapshot

Figure 26 Asia-Pacific: Market Snapshot

Figure 27 RoW: Market Snapshot

Figure 28 MnM Dive-Vendor Comparison Matrix: Poultry Diagnostics Market

Figure 29 Idexx Laboratories, Inc.: Company Snapshot (2016)

Figure 30 Idexx Laboratories, Inc.: Product Offering Scorecard

Figure 31 Idexx Laboratories, Inc.: Business Strategy Scorecard

Figure 32 Zoetis, Inc.: Company Snapshot (2016)

Figure 33 Zoetis, Inc.: Product Offering Scorecard

Figure 34 Zoetis, Inc.: Business Strategy Scorecard

Figure 35 Thermo Fisher Scientific Inc.: Company Snapshot (2016)

Figure 36 Thermo Fisher Scientific Inc.: Product Offering Scorecard

Figure 37 Thermo Fisher Scientific Inc.: Business Strategy Scorecard

Figure 38 Qiagen N.V.: Company Snapshot (2016)

Figure 39 Qiagen N.V.: Product Offering Scorecard

Figure 40 Qiagen N.V.: Business Strategy Scorecard

Figure 41 GD Animal Health: Product Offering Scorecard

Figure 42 GD Animal Health: Business Strategy Scorecard

Figure 43 IDVet: Product Offering Scorecard

Figure 44 IDVet: Business Strategy Scorecard

Figure 45 Affinitech, Ltd.: Product Offering Scorecard

Figure 46 Affinitech, Ltd.: Business Strategy Scorecard

Figure 47 Agrobiotek Internacional: Product Offering Scorecard

Figure 48 Agrobiotek Internacional: Business Strategy Scorecard

Figure 49 Biochek: Product Offering Scorecard

Figure 50 Biochek: Business Strategy Scorecard

Figure 51 Bionote, Inc.: Product Offering Scorecard

Figure 52 Bionote, Inc.: Business Strategy Scorecard

Figure 53 Boehringer Ingelheim GmbH: Company Snapshot (2016)

Figure 54 Boehringer Ingelheim GmbH: Product Offering Scorecard

Figure 55 Boehringer Ingelheim GmbH: Business Strategy Scorecard

Figure 56 Bioingentech Biotechnologies, Inc.: Product Offering Scorecard

Figure 57 Bioingentech Biotechnologies, Inc.: Business Strategy Scorecard

Figure 58 Megacor Diagnostik GmbH: Product Offering Scorecard

Figure 59 Megacor Diagnostik GmbH: Business Strategy Scorecard

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Poultry Diagnostics Market