Potato Processing Market by Type (Frozen, Chips & Snack Pellets, Dehydrated), Application (Snacks, Ready-to-cook & Prepared Meals), Distribution Channel (Foodservice and Retail), and Region - Global Forecast to 2022

[154 Pages Report] Potato Processing Market report categorizes the global market by Type (Frozen, Chips & Snack Pellets, Dehydrated), Application (Snacks, Ready-to-cook & Prepared Meals), Distribution Channel (Foodservice and Retail), and Region. The global potato processing market was valued at USD 22.74 Billion in 2016 and is projected to reach USD 30.85 Billion by 2022, at a CAGR of 5.3% during the forecast period.

The years considered for the study are as follows:

- Base year: 2016

- Estimated year: 2017

- Projected year: 2022

- Forecast period: 2017–2022

Objectives of the study are as follows:

- To define, segment, and project the global potato processing market size on the basis of type, application, distribution channel, and region

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and challenges)

- To analyze the opportunities in the market for stakeholders and provide the competitive landscape of the market leaders

- To project the size of the market and its submarkets, in terms of value and volume, with respect to the regions (along with the key countries)

- To strategically profile key players and comprehensively analyze their market position and core competencies

- To analyze the competitive developments such as investments, expansions, acquisitions, partnerships, joint ventures, agreements, and new product developments in the potato processing market

Research Methodology

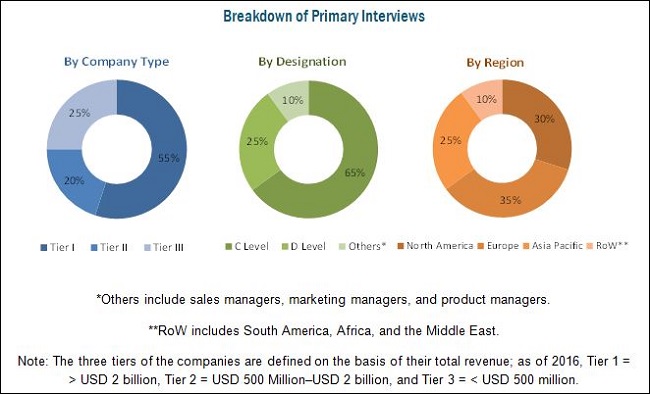

This report includes estimations of market size in terms of value (USD million/billion) and volume (million metric tons). Both, top-down and bottom-up approaches have been used to estimate and validate the size of the potato processing market and of various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research, and their market share in respective regions has been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources The Food and Agriculture Organization (FAO), the National Potato Council (NPC), the Potato Association of America (PAA), the Northern Plains Potato Growers Association (NPPGA), Potatoes Canada, European Potato Processor’s Association (EUPPA), and Potato Processors’ Association (PPA, London)—to identify and collect information useful for this technical, market-oriented, and commercial study of the potato processing market.

To know about the assumptions considered for the study, download the pdf brochure

The market is dominated by key players such as Lamb Weston Holdings, Inc. (U.S.), The Kraft Heinz Company (U.S.), McCain Foods Limited (U.S.), J.R. Simplot Company (U.S.), Agristo NV (Belgium), Farm Frites International B.V. (Netherlands), AGRANA Beteiligungs-AG (Austria), J.R. Short Milling Company (U.S.), Intersnack Group GmbH & Co. KG (Germany), Idahoan Foods, LLC (U.S.), and Aviko B.V. (Netherlands).

Target Audience:

-

Suppliers

- Farmers

- Technology providers

- Potato processing manufacturers/processors

-

Regulatory and research organizations

- Food and agriculture organizations such as the FAO and USDA

- Associations and industry bodies such as the National Potato Council (NPC), the Potato Association of America (PAA), the Northern Plains Potato Growers Association (NPPGA), Potatoes Canada, European Potato Processor’s Association (EUPPA), and Potato Processors’ Association (PPA, London)

- Government agencies and NGOs

- Food safety agencies

- Intermediary suppliers

- Traders

- Wholesalers

- Dealers

- Retailers

Scope of the report

Based on Type, the market has been segmented as follows:

- Frozen

- Chips & snack pellets

- Dehydrated

- Others (canned potato, potato granules, flour, and potato starch)

Based on Distribution Channel, the market has been segmented as follows:

- Foodservice

- Retail

Based on Application, the market has been segmented as follows:

- Snacks

- Ready-to-cook & prepared meals

- Others (food additives in soups, gravies, bakery products, and desserts)

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (South America, the Middle East, and Africa)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Europe potato processing market into the Netherlands, Sweden, Poland, Italy, and Spain

- Further breakdown of the Rest of Asia-Pacific market into Malaysia, South Korea, the Philippines, Sri Lanka, and New Zealand

- Further breakdown of other countries in the RoW market into Brazil, Argentina, Peru, the UAE, and South Africa

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The potato processing market is projected to grow at a CAGR of 5.3% from 2017, to reach a projected value of USD 30.85 Billion by 2022. Easy availability, convenient packaging, rapid urbanization, change in eating habits, and improvement in the standard of living are the major factors that have driven the global market in recent years. Other factors such as the growth in consumer preferences for convenience foods to save time and efforts, coupled with the rise in demand for applications such as snack foods and prepared ready meals, are expected to drive the growth of the this market during the forecast period.

On the basis of type, the market has been segmented into frozen, chips & snack pellets, dehydrated, and others (canned potato, potato granules, flour, and starch). The frozen segment dominated the global potato processing market, and this trend is expected to continue through the forecast period. Frozen potato products are highly consumed owing to the increase in demand for french fries, served in restaurants and fast food chains, worldwide. The expansion of Quick Service Restaurants (QSRs) such as KFC, Pizza Hut, and McDonald’s in countries such as India and China, is expected to fuel the demand for frozen potato products during the forecast period. The chips & snack pellets segment was the second-largest due to the growing popularity of potato chips among young population and ease of availability.

Based on application, the market is segmented into snacks, ready-to-cook & prepared meals, and others (food additives in soups, gravies, bakery, and desserts). The consumption of processed potato products in ready-to-cook & prepared meals application is estimated to account for the largest market share in 2017. Processed potato products used in ready-to-cook & prepared meals is a booming market due to the increase in consumer preference for convenience food products, busy work schedules, and on-the-go consumption habits. Apart from ready-to-cook & prepared meals, processed potato products also find applications in the snacks segment, such as potato-based snacks with low carbs, low salt, air-dried, baked products with a number of flavors, which also drives the demand for potato processing market.

The global market has been segmented on the basis of distribution channel into foodservice and retail. Potato processing have been gaining importance in the foodservice segment due to the growth of food delivery channels and increase in demand for fast food. Apart from the demand from full-service and quick service restaurants, increase in the number of national and international brands in the hotel industry is expected to drive the demand for potato products in the foodservice industry during the forecast period.

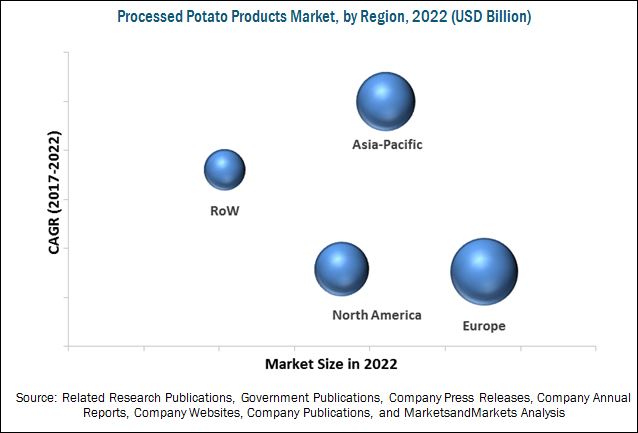

Europe is estimated to occupy the largest share in the global potato processing market, in terms of value and volume, in 2017, owing to the booming food processing industry and presence of major companies in these countries such as the Germany, the U.K., France, the Netherlands, and Belgium. The Asia-Pacific region is projected to be the fastest-growing during the forecast period. Key players in Europe and the U.S. focus on tapping the potato processing market in Asia-Pacific, owing to which Asia-Pacific is expected to witness high growth in the coming years.

The health issues associated with the consumption of processed potato products, high acrylamide content in snack foods, coupled with the high cost incurred for storage and transportation, are the major factors restraining the growth of the potato processing market globally. The major challenge faced by the processed potato product processors/manufacturers is to maintain a continuous or year-round supply of potato varieties at a reasonable price for uninterrupted operations.

The leading players who dominated the potato processing market include Lamb Weston Holdings, Inc. (U.S.), The Kraft Heinz Company (U.S.), McCain Foods Limited (U.S.), J.R. Simplot Company (U.S.), Agristo NV (Belgium), Farm Frites International B.V. (Netherlands), AGRANA Beteiligungs-AG (Austria), J.R. Short Milling Company (U.S.), Intersnack Group GmbH & Co. KG (Germany), Idahoan Foods, LLC (U.S.,) and Aviko B.V. (Netherlands).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 14)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Periodization

1.4 Currency

1.5 Units

1.6 Stakeholders

2 Research Methodology (Page No. - 19)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Size Estimation

2.2.1 Bottom-Up Approach

2.2.2 Top-Down Approach

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 27)

4 Premium Insights (Page No. - 32)

4.1 Potato Processing Market: Overview

4.2 Market: Key Country

4.3 Market, By Type

4.4 Europe: Potato Processing Market, By Type& Country

4.5 Market, By Distribution Channel & Region

5 Market Overview (Page No. - 36)

5.1 Introduction

5.2 Market Insights: Potato Production

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Growth in Demand for Processed Potato Products

5.3.1.2 Increase in the Number of Quick Service Restaurants (QSRS)

5.3.1.3 Expansion of the Retail Landscape

5.3.2 Restraints

5.3.2.1 Health Issues Associated With the Consumption of Processed Potatoes

5.3.2.2 High Acrylamide Content in Snack Foods

5.3.2.3 High Cost Incurred for Storage and Transportation

5.3.3 Opportunities

5.3.3.1 Emerging Markets: New Growth Frontiers

5.3.3.2 Advancement in Technologies and Farming Techniques

5.3.4 Challenges

5.3.4.1 Fluctuations in Raw Material Supply

5.3.4.1.1 Seasonal Fluctuation

5.3.4.1.2 Crop Damage By Pests

5.3.4.2 Trade Barriers

5.3.4.3 Availability of Substitute Products

5.4 Supply Chain Analysis

6 Potato Processing Market, By Type (Page No. - 46)

6.1 Introduction

6.2 Frozen

6.3 Chips & Snack Pellets

6.4 Dehydrated

6.5 Others

7 Potato Processing Market, By Application (Page No. - 55)

7.1 Introduction

7.2 Snacks

7.3 Ready-To-Cook & Prepared Meals

7.4 Others

8 Potato Processing Market, By Distribution Channel (Page No. - 61)

8.1 Introduction

8.2 Foodservice

8.3 Retail

9 Potato Processing Market, By Region (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 Germany

9.3.2 France

9.3.3 U.K.

9.3.4 Russia

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 India

9.4.2 China

9.4.3 Japan

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 RoW

9.5.1 South America

9.5.2 Middle East

9.5.3 Africa

10 Competitive Landscape (Page No. - 102)

10.1 Introduction

10.2 Competitive Leadership Mapping, 2017

10.2.1 Visionary Leaders

10.2.2 Innovators

10.2.3 Dynamic Differentiators

10.2.4 Emerging Companies

10.3 Competitive Benchmarking

10.3.1 Strength of Product Portfolio(25 Players)

10.3.2 Business Strategy Excellence(25 Players)

10.4 Market Standing

11 Company Profiles (Page No. - 107)

(Business Overview, Products Offered, Services Offered, Business Strategy Excellence, Recent Developments)*

11.1 Lamb Weston Holdings, Inc.

11.2 Mccain Foods Limited

11.3 The Kraft Heinz Company

11.4 Aviko B.V.

11.5 J.R. Simplot Company

11.6 Idahoan Foods, LLC

11.7 Farm Frites International B.V.

11.8 Agristo NV

11.9 Intersnack Group GmbH & Co. Kg

11.10 Limagrain Céréales Ingrédients

11.11 The Little Potato Company Ltd.

11.12 J.R. Short Milling Company

11.13 Leng-D'or

11.14 Agrana Beteiligungs-AG

*Details on Business Overview, Products Offered, Services Offered, Business Strategy Excellence, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 147)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (64 Tables)

Table 1 Definitions: Potato & Various Potato Products

Table 2 Glycemic Load for Potatoes Prepared By Different Methods

Table 3 Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 4 Market Size, By Type, 2015–2022 (USD Billion)

Table 5 Frozen Potato Products Market Size, By Region, 2015–2022 (MMT)

Table 6 Frozen Potato Products Market Size, By Region, 2015–2022 (USD Billion)

Table 7 Chips & Snack Pellets Market Size, By Region, 2015–2022 (MMT)

Table 8 Chips & Snack Pellets Market Size, By Region, 2015–2022 (USD Billion)

Table 9 Dehydrated Potato Products Market Size, By Region, 2015–2022 (MMT)

Table 10 Dehydrated Potato Products Market Size, By Region, 2015–2022 (USD Billion)

Table 11 Other Potato Products Market Size, By Region, 2015–2022 (MMT)

Table 12 Other Potato Products Market Size, By Region, 2015–2022 (USD Billion)

Table 13 Potato Processing Market Size, By Application, 2015–2022 (MMT)

Table 14 Potato Processing Market Size, By Application, 2015–2022 (USD Billion)

Table 15 Potato Processing Market Size for Snacks, By Region, 2015–2022 (MMT)

Table 16 Potato Processing Market Size for Ready-To-Cook & Prepared Meals, By Region, 2015–2022 (MMT)

Table 17 Potato Processing Market Size for Other Applications, By Region, 2015–2022 (MMT)

Table 18 Market Size, By Distribution Channel, 2015–2022 (MMT)

Table 19 Market Size, By Distribution Channel, 2015–2022 (USD Billion)

Table 20 Potato Processing Market Size for Foodservice, By Region, 2015–2022 (MMT)

Table 21 Market Size for Retail, By Region, 2015–2022 (MMT)

Table 22 Market Size, By Region, 2015–2022 (MMT)

Table 23 Market Size, By Region, 2015–2022 (USD Billion)

Table 24 North America: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 25 North America: Market Size, By Type, 2015–2022 (USD Billion)

Table 26 North America: Market Size, By Application, 2015–2022 (MMT)

Table 27 North America: Market Size, By Distribution Channel, 2015–2022 (MMT)

Table 28 North America: Market Size, By Country, 2015–2022 (MMT)

Table 29 North America: Market Size, By Country, 2015–2022 (USD Billion)

Table 30 U.S.: Market Size, By Type, 2015–2022 (MMT)

Table 31 Canada: Market Size, By Type, 2015–2022 (MMT)

Table 32 Mexico: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 33 Europe: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 34 Europe: Market Size, By Type, 2015–2022 (USD Billion)

Table 35 Europe: Market Size, By Application, 2015–2022 (MMT)

Table 36 Europe: Market Size, By Distribution Channel, 2015–2022 (MMT)

Table 37 Europe: Market Size, By Country, 2015–2022 (MMT)

Table 38 Europe: Market Size, By Country, 2015–2022 (USD Billion)

Table 39 Germany: Market Size, By Type, 2015–2022 (MMT)

Table 40 France : Market Size, By Type, 2015–2022 (MMT)

Table 41 U.K.: Market Size, By Type, 2015–2022 (MMT)

Table 42 Russia: Market Size, By Type, 2015–2022 (MMT)

Table 43 Rest of Europe: Market Size, By Type, 2015–2022 (MMT)

Table 44 Asia-Pacific: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 45 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Billion)

Table 46 Asia-Pacific: Market Size, By Application, 2015–2022 (MMT)

Table 47 Asia-Pacific: Market Size, By Distribution Channel, 2015–2022 (MMT)

Table 48 Asia-Pacific: Market Size, By Country, 2015–2022 (MMT)

Table 49 Asia-Pacific: Market Size, By Country, 2015–2022 (USD Billion)

Table 50 India: Market Size, By Type, 2015–2022 (MMT)

Table 51 China: Market Size, By Type, 2015–2022 (MMT)

Table 52 Japan: Market Size, By Type, 2015–2022 (MMT)

Table 53 Australia: Market Size, By Type, 2015–2022 (MMT)

Table 54 Rest of Asia-Pacific: Market Size, By Type, 2015–2022 (MMT)

Table 55 RoW: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 56 RoW: Market Size, By Type, 2015–2022 (USD Billion)

Table 57 RoW: Market Size, By Application, 2015–2022 (MMT)

Table 58 RoW: Market Size, By Distribution Channel, 2015–2022 (MMT)

Table 59 RoW: Market Size, By Country, 2015–2022 (MMT)

Table 60 RoW: Market Size, By Country, 2015–2022 (USD Billion)

Table 61 South America: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 62 Middle East: Potato Processing Market Size, By Type, 2015–2022 (MMT)

Table 63 Africa: Market Size, By Type, 2015–2022 (MMT)

Table 64 Top Five Players Led the Global Potato Processing Market, 2017

List of Figures (39 Figures)

Figure 1 Potato Processing Market Segmentation

Figure 2 Potato Processing Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation & Methodology

Figure 6 Potato Processing Market, By Type (2017 vs 2022): Frozen Potato Segment Projected to Be the Largest

Figure 7 Europe Projected to Dominate the Potato Processing Market, 2017–2022

Figure 8 U.S. is Projected to Dominate While India is Projected to Be the Fastest-Growing, 2017-2022

Figure 9 Potato Processing Market, By Application: Snacks Segment Projected to Be the Fastest-Growing During the Forecast Period

Figure 10 Market Snapshot, By Distribution Channel (2017 vs 2022)

Figure 11 Asia-Pacific Projected to Be the Fastest-Growing Region for the Potato Processing Market From 2017 to 2022

Figure 12 Key Players Adopted New Product Developments as the Key Strategy From 2012 to 2017

Figure 13 Opportunities in this Market, 2017–2022

Figure 14 India to Register the Highest CAGR From 2017 to 2022, in Terms of Value

Figure 15 Europe Estimated to Dominate the Potato Processing Market, By Type, in 2017

Figure 16 Frozen Potatoes Estimated to Dominate the European Potato Processing Market in 2017

Figure 17 Europe Estimated to Dominate the Potato Processing Market, By Distribution Channel, in 2017

Figure 18 Potato Production, 2010–2014 (Million Tons)

Figure 19 China Was the Largest Potato Producing Country, 2014

Figure 20 Market Dynamics: Potato Processing Market

Figure 21 Quick Service Restaurant Sales: U.S. vs Canada, 2012–2016

Figure 22 Global Hypermarkets, Supermarkets, and Hard Discounter Sales Value, 2015–2020

Figure 23 U.S. Monthly and Seasonal Average Grower Price for Potatoes, 2015

Figure 24 Potato Products Market: Supply Chain Analysis

Figure 25 Potato Processing Market Size, By Type, 2016

Figure 26 Potato Processing Market Size, By Application, 2017 vs 2022 (USD Billion)

Figure 27 Potato Processing Market Size, By Application, 2017 vs 2022 (MMT)

Figure 28 Market Size, By Distribution Channel, 2017 vs 2022 (MMT)

Figure 29 Geographic Snapshot (2017–2022): China and India are Emerging as New Hot Spots, Value Terms

Figure 30 North America Potato Processing Market Snapshot

Figure 31 Germany: Largest Potato Producer in the EU, 2015

Figure 32 Europe: Potato Processing Market Snapshot

Figure 33 Increase in the Potato Products Consumption

Figure 34 Asia-Pacific: Potato Processing Market Snapshot

Figure 35 Global Market, Competitive Leadership Mapping, 2017

Figure 36 Lamb Weston Holdings, Inc.: Company Snapshot

Figure 37 Kraft Heinz: Company Snapshot

Figure 38 Farm Frites International B.V: Company Snapshot

Figure 39 Agrana Beteiligungs-AG: Company Snapshot

Growth opportunities and latent adjacency in Potato Processing Market