Porcelain Enamel Coatings Market by Type (Powder, Liquid), End use (Residential, Commercial), Application (Pot, Pan, Baking Dish, Stove, Oven & Cooker, Sanitaryware and Plumbing, Water Heater, Room Heater), and Region - Global Forecast to 2028

Updated on : November 11, 2025

Porcelain Enamel Coatings Market

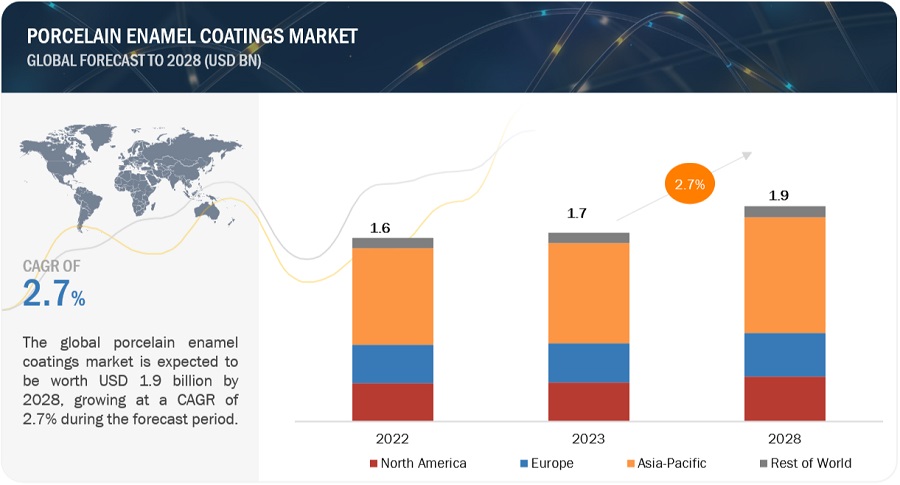

The global porcelain enamel coatings market was valued at USD 1.7 billion in 2023 and is projected to reach USD 1.9 billion by 2028, growing at 2.7% cagr from 2023 to 2028. The room heater, by application segment in Asia Pacific region is expecting a boom in the forecasted period and will lead to an increase in the demand for porcelain enamel coatings.

Porcelain Enamel Coatings Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Porcelain Enamel Coatings Market

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Porcelain Enamel Coatings Market Dynamics

Drivers: Growing population and rapid urbanization, particularly in developing nations

The porcelain enamel coatings market is experiencing a robust push due to the combined impact of a surging global population and rapid urbanization, particularly led by developing countries. As cities expand and modernize, there is an escalating demand for corrosion-resistant, and visually appealing solutions that can withstand the challenges of urban environments. Porcelain enamel coatings, with their exceptional durability and protective properties, have emerged as a vital component in addressing these demands.

Urbanization leads to the construction of new buildings, infrastructure, and public spaces. These structures require durable and visually appealing materials that can withstand the rigors of urban environments. Porcelain enamel coatings provide a protective layer that guards against corrosion, weathering, and wear, making them ideal for architectural components like facades, roofing, and cladding. Also, Rapid urbanization changes the lifestyle and consumer preferences. As people move to urban areas, there is an increased emphasis on convenient and aesthetically pleasing products for modern living. Cookware, kitchen appliances, and home accessories with porcelain enamel coatings align with these preferences, offering durable and visually attractive solutions.

Restraints: Complex application process

The fusion of glass and metal demands precise temperature control and specialized equipment, leading to intricacies in the coating application. This complexity can potentially lead to production challenges, higher costs, and slower manufacturing processes, which could hinder their widespread adoption, particularly in industries where efficiency is paramount.

Additionally, environmental considerations play a role. The firing process required for porcelain enamel coatings involves high temperatures, resulting in energy consumption and emissions. In an era of heightened sustainability awareness, the environmental impact of manufacturing processes can influence purchasing decisions.

Opportunities: Increased penetration in emerging applications

The expanding infrastructure landscape presents a significant opportunity for growth in the porcelain enamel coatings market. As urbanization, commercial development, and construction projects continue to surge, the demand for durable and visually appealing architectural components, such as facades, roofing, and cladding, rises in tandem. Porcelain enamel coatings offer a solution that not only enhances aesthetics but also withstands the challenges posed by urban environments. Their corrosion resistance, weather resilience, and vibrant finishes make them a natural choice for architects, developers, and designers looking to create long-lasting and attractive structures. This growing trend toward infrastructure development creates a favorable environment for the broader adoption of porcelain enamel coatings across various applications within the construction and architectural industries.

Challenges: Stringent regulatory policies

Porcelain enamel coatings market is regulated by various regulatory authorities in Europe and North America. Regulators, such as Environmental Protection Agency (EPA), Food and Drug Administration (FDA), European Chemicals Agency (ECHA), Consumer Product Safety Commission (CPSC), and Health and Safety Executive (HSE) in Europe and North America regulate the production of porcelain enamel coatings. The EPA sets guidelines and regulations related to environmental impact, emissions, and waste disposal associated with manufacturing processes, including those used in producing porcelain enamel coatings. The FDA in the United States enforces regulations for porcelain enamel coatings utilized in cookware and items that have direct contact with food, aiming to prevent the presence of any harmful substances that could potentially migrate into the food.

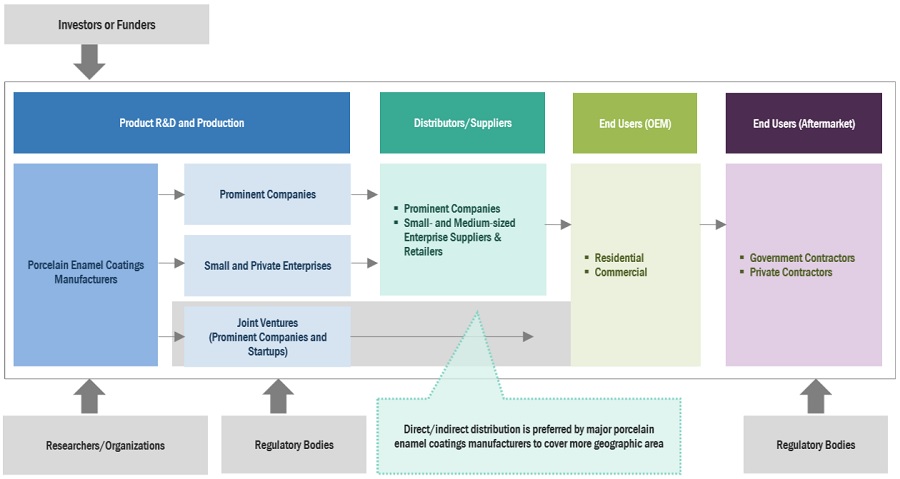

Porcelain Enamel Coatings Market Ecosystem

Prominent companies in this market include well established , financially stable manufactures of porcelain enamel coatings. These companies have been operating in the market for several years and posses a diversified product portfolio and strong global sales and marketing networks. Prominent companies in the market include A.O. Smith Corporation (US), AkCoat (Turkey), Vibrantz technologies (US), Tomatec Co., Ltd.(Japan).

Room heater by application accounted for the highest share of the global porcelain enamel coatings market in terms of value

In terms of value for porcelain enamel coatings market overall, room heater application held the largest share in 2022. One of the primary factors for driving the market is their outstanding heat resistance. Room heaters generate and radiate high temperatures, and porcelain enamel coatings can withstand these extreme heat levels without warping, discoloring, or emitting harmful fumes. This heat resistance ensures the safety and longevity of room heaters, providing peace of mind to consumers. Porcelain enamel coatings can enhance the heat transfer efficiency of heating elements by promoting even heat distribution across the surface. This energy efficiency not only reduces operating costs but also aligns with growing environmental concerns, making porcelain enamel-coated room heaters an attractive choice for eco-conscious consumers.

porcelain enamel coatings offer aesthetic advantages. They come in a variety of colors and finishes, allowing room heater manufacturers to create visually appealing products that can seamlessly integrate into different interior designs. This versatility in design options enhances the marketability of room heaters and attracts consumers looking to balance functionality with aesthetics in their living spaces.

To know about the assumptions considered for the study, download the pdf brochure

India is the fastest-growing porcelain enamel coatings market.

India's rapid urbanization and burgeoning population are driving significant demand for durable and visually appealing coatings for architectural elements, such as building facades, bridges, and commercial structures. Porcelain enamel coatings, with their proven durability, resistance to corrosion, and ability to offer a wide range of customizable aesthetic options, have gained significant traction in these construction projects, propelling the growth of the market. India's burgeoning consumer goods industry contributes to the growth of porcelain enamel coatings. These coatings are favored for their hygienic properties, heat resistance, and ability to maintain a polished appearance over time. The expanding middle-class population, along with changing lifestyles and preferences, has driven the demand for household appliances, cookware, and sanitary ware, all of which frequently use porcelain enamel coatings.

Porcelain Enamel Coatings Market Players

A.O. Smith Corporation (US), AkCoat(Turkey), Tomatec Co., Ltd. (Japan), Vibrantz technologies (US) are the key players in the global porcelain enamel coatings market.

Tomatec Co., Ltd. TOMATEC is a manufacturing company that offers frit, inorganic color pigment, and micronutrient fertilizer. TOMATEC has expertise in supplying & trading of Glass frit, enamel frit, glaze frit etc. the company is developing and supplying advanced materials that meet the demanding requirements of modern industries, including home appliances, construction, automotive, and cookware.

Porcelain Enamel Coatings Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.7 billion |

|

Revenue Forecast in 2028 |

USD 1.9 billion |

|

CAGR |

2.7% |

|

Market size available for years |

2021-2028 |

|

Base year considered |

2022 |

|

Forecast Period |

2023-2028 |

|

Forecast Units |

Value (USD million/billion) |

|

Segments Covered |

By Type, By Application, By End use, By Region |

|

Geographies Covered |

Asia Pacific, Europe, North America, and Rest of World |

|

Companies covered |

A.O. Smith Corporation (US), AkCoat (Turkey), Vibrantz Technologies (US), Tomatec Co., Ltd. (Japan), and Nolifrit (China) |

Based on type, the porcelain enamel coatings market has been segmented as follows:

- Powder

- Liquid

Based on application, the porcelain enamel coatings market has been segmented as follows:

- Pot, Pan, Baking Dish and Other Utensils

- Stove, Oven & Cooker

- Sanitaryware and Plumbing

- Water Heater

- Room Heater

- Others

Based on end-use industry, the porcelain enamel coatings market has been segmented as follows:

- Residential

- Commercial

Based on the region, the porcelain enamel coatings market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Rest of World

Recent Developments

- In April 2022, Prince International Corporation has finished the acquisition of Ferro Corporation, merged it with Chromaflo Technologies, and rebranded the resulting entity as Vibrantz Technologies Inc.

Frequently Asked Questions (FAQ):

What are the growth driving factors of porcelain enamel coatings market?

Growing population and rapid urbanization, particularly in developing nations

What are the major applications for porcelain enamel coatings?

The major applications of porcelain enamel coatings are Pot, Pan, Baking Dish and Other Utensils, Stove, Oven & Cooker, Sanitaryware and Plumbing, Water Heater, Room Heater and Others.

Who are the major manufacturers?

A.O. Smith Corporation (US), AkCoat (Turkey), Tomatec Co., Ltd. (Japan), Vibrantz technologies (US), are some of the leading players operating in the global porcelain enamel coatings market.

What are the reasons behind porcelain enamel coatings gaining market share?

porcelain enamel coatings are gaining market share due to emerging demand from Asia Pacific region.

Which is the largest region in the porcelain enamel coatings market?

Asia Pacific is the largest region in porcelain enamel coatings market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

-

5.1 INTRODUCTIONPROPERTIES OF ENAMEL COATINGS- Thermal- Physical- Chemical- Mechanical

-

5.2 MARKET DYNAMICSDRIVERS- Population growth and rapid urbanization- Rise in food restaurantsRESTRAINTS- Complex application processOPPORTUNITIES- Increased use in emerging applicationsCHALLENGES- Stringent regulatory policies

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSBARGAINING POWER OF SUPPLIERSINTENSITY OF COMPETITIVE RIVALRY

-

5.4 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

5.5 MACROECONOMIC INDICATORSINTRODUCTIONGDP TRENDS AND FORECASTTRENDS AND FORECAST OF GLOBAL CONSTRUCTION INDUSTRY

- 5.6 TECHNOLOGY ANALYSIS

- 5.7 CASE STUDY ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.9 TRADE ANALYSIS

-

5.10 GLOBAL ECONOMIC SCENARIO AFFECTING MARKET GROWTHREDUCED ECONOMIC GROWTH AND HIGH INFLATIONRUSSIA–UKRAINE WAREUROPE RECESSIONENERGY CRISIS IN EUROPEASIA PACIFIC RECESSION

- 5.11 SUPPLY CHAIN ANALYSIS

-

5.12 ECOSYSTEM MAPPING

- 5.13 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

5.14 PATENT ANALYSISMETHODOLOGYPUBLICATION TRENDSTOP JURISDICTIONTOP APPLICANTS

-

5.15 TARIFF AND REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSLEGISLATIVE & REGULATORY POLICY UPDATE- Industrial surface coating regulation update- VOC regulations- HAP regulations

- 5.16 KEY CONFERENCES AND EVENTS, 2023–2024

- 6.1 INTRODUCTION

-

6.2 POWDER COATINGSRESISTANCE TO ACID AND ALKALI TO DRIVE DEMAND FOR ENAMEL POWDERS

-

6.3 LIQUID COATINGSINTRICATE AND UNIFORM COVERAGE ON COMPLEX SURFACES TO FUEL DEMAND FOR LIQUID ENAMELS

- 7.1 INTRODUCTION

-

7.2 STOVE, OVEN, & COOKERDEMAND FOR DURABLE AND APPEALING KITCHEN APPLIANCES TO PROPEL MARKET

-

7.3 SANITARYWARE & PLUMBINGEMPHASIS ON VISUAL APPEAL AND AESTHETICS TO DRIVE MARKET

-

7.4 WATER HEATERRESISTANCE TO CORROSION AND DETERIORATION TO FUEL DEMAND FOR ENAMEL COATINGS

-

7.5 POT, PAN, BAKING DISH, & OTHER UTENSILSNEED FOR INNOVATIVE COOKING SOLUTIONS TO DRIVE MARKET

-

7.6 ROOM HEATERPREFERENCE FOR HEAT-RESISTANT AND NON-COMBUSTIBLE MATERIAL TO BOOST MARKET

- 7.7 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 RESIDENTIALDEMAND FOR DURABLE AND VISUALLY APPEALING SURFACES TO DRIVE MARKET

-

8.3 COMMERCIALNEED FOR CORROSION-RESISTANT AND FINE FINISHES TO FUEL MARKET

-

9.1 INTRODUCTIONGLOBAL RECESSION OVERVIEW

-

9.2 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Rising demand for porcelain kitchenware to drive marketJAPAN- Need for durable material to fuel demand for porcelain enamelSOUTH KOREA- Significant requirement in cookware industry to boost marketINDIA- Demand for porcelain coatings from construction sector to boost marketINDONESIA- Increase in residential projects to propel marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Rise in commercial kitchens and foodservice sector to boost demand for porcelain enamel coatingsCANADA- Sustainable construction practices to propel marketMEXICO- Stringent food safety regulations and guidelines to drive market

-

9.4 EUROPERECESSION IMPACT ON EUROPEGERMANY- Increased investments in construction and transportation sectors to drive marketFRANCE- Architectural trends and renovation projects to fuel marketUK- Stringent food safety standards to drive marketITALY- Rich culinary tradition to boost demand for porcelain enamelSPAIN- Government investments in commercial infrastructure and housing units to boost marketTURKEY- Rapid urbanization and increasing purchasing power to drive marketREST OF EUROPE

-

9.5 REST OF WORLDRECESSION IMPACT ON REST OF WORLDBRAZIL- Increased use of enamel in construction activities and commercial kitchens to drive marketUAE- Access to new markets and low production costs to boost marketREST OF WORLD

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET RANKING ANALYSIS

- 10.4 REVENUE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIXSTARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTSCOMPANY FOOTPRINT

-

10.6 STARTUP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIES

-

10.7 COMPETITIVE SCENARIOMARKET EVALUATION FRAMEWORKSTRATEGIC DEVELOPMENTS

-

11.1 KEY PLAYERSA. O. SMITH CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewCAPRON MANUFACTURING COMPANY- Business overview- Products/Services/Solutions offered- MnM viewVIBRANTZ TECHNOLOGIES- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHUNAN NOLI ENAMEL CO., LTD. (NOLIFRIT)- Business overview- Products/Services/Solutions offered- MnM viewTOMATEC CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewARCHER WIRE INTERNATIONAL CORPORATION- Business overview- Products/Services/Solutions offeredCHEROKEE PORCELAIN ENAMEL CORPORATION- Business overview- Products/Services/Solutions offeredROESCH INC.- Business overview- Products/Services/Solutions offeredAKCOAT- Business overview- Products/Services/Solutions offered- Recent developments

-

11.2 OTHER PLAYERSRIESS KELOMAT GMBH- Products/Services/Solutions offeredCAPRICORN COATINGS AND COLOURS- Products/Services/Solutions offeredPEMCO INTERNATIONAL- Products/Services/Solutions offeredA.J WELLS & SONS- Products/Services/Solutions offered

-

12.1 INTRODUCTIONMARKET LIMITATIONS

- 12.2 MARKET DEFINITION

-

12.3 MARKET OVERVIEWMARKET ANALYSIS, BY MATERIALMARKET ANALYSIS, BY TECHNOLOGYMARKET ANALYSIS, BY PRODUCTMARKET ANALYSIS, BY APPLICATIONMARKET ANALYSIS, BY DISTRIBUTION CHANNELMARKET ANALYSIS, BY REGION

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 INCLUSIONS AND EXCLUSIONS

- TABLE 2 PORCELAIN ENAMEL COATINGS MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 3 EMERGING APPLICATIONS OF PORCELAIN ENAMEL COATINGS

- TABLE 4 PORTER’S FIVE FORCES ANALYSIS

- TABLE 5 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR END-USE INDUSTRIES (%)

- TABLE 6 KEY BUYING CRITERIA FOR PORCELAIN ENAMEL COATINGS

- TABLE 7 GDP PERCENTAGE CHANGE FOR KEY COUNTRIES, 2020–2028

- TABLE 8 COUNTRY-WISE IMPORT DATA, 2021–2022 (USD THOUSAND)

- TABLE 9 COUNTRY-WISE EXPORT DATA, 2021–2022 (USD THOUSAND)

- TABLE 10 PORCELAIN ENAMEL COATINGS MARKET: ECOSYSTEM MAP

- TABLE 11 TOP 15 PATENT OWNERS, 2018–2023

- TABLE 12 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 INTERNATIONALLY RECOGNIZED TEST METHODS

- TABLE 17 PORCELAIN ENAMEL COATINGS MARKET: KEY CONFERENCES AND EVENTS, 2023–2024

- TABLE 18 PORCELAIN ENAMEL COATING MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 19 PORCELAIN ENAMEL COATINGS MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 20 APPLICATION TECHNIQUES FOR STEEL ENAMELING

- TABLE 21 POWDER: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 22 POWDER: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 23 LIQUID: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 24 LIQUID: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 25 PORCELAIN ENAMEL COATINGS MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 26 PORCELAIN ENAMEL COATING MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 27 STOVE, OVEN, & COOKER: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 28 STOVE, OVEN, & COOKER: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 29 SANITARYWARE & PLUMBING: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 30 SANITARYWARE & PLUMBING: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 31 WATER HEATER: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 32 WATER HEATER: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 33 POT, PAN, BAKING DISH, & OTHER UTENSILS: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 34 POT, PAN, BAKING DISH, & OTHER UTENSILS: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 35 ROOM HEATER: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 36 ROOM HEATER: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 37 OTHER APPLICATIONS: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 38 OTHER APPLICATIONS: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 39 PORCELAIN ENAMEL COATINGS MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 40 PORCELAIN ENAMEL COATING MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 41 RESIDENTIAL: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 42 RESIDENTIAL: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 43 COMMERCIAL: PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 44 COMMERCIAL: PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 45 PORCELAIN ENAMEL COATINGS MARKET, BY REGION, 2021–2028 (USD MILLION)

- TABLE 46 PORCELAIN ENAMEL COATING MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 47 ASIA PACIFIC: PORCELAIN ENAMEL COATINGS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 48 ASIA PACIFIC: PORCELAIN ENAMEL COATING MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 49 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 50 ASIA PACIFIC: MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 51 ASIA PACIFIC: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 52 ASIA PACIFIC: MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 53 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 54 ASIA PACIFIC: MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 55 NORTH AMERICA: PORCELAIN ENAMEL COATINGS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 56 NORTH AMERICA: PORCELAIN ENAMEL COATING MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 57 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 58 NORTH AMERICA: MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 59 NORTH AMERICA: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 60 NORTH AMERICA: MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 61 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 63 EUROPE: PORCELAIN ENAMEL COATINGS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 64 EUROPE: PORCELAIN ENAMEL COATING MARKET, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 65 EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 66 EUROPE: MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 67 EUROPE: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 68 EUROPE: MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 69 EUROPE: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 70 EUROPE: MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 71 REST OF WORLD: PORCELAIN ENAMEL COATINGS MARKET, BY COUNTRY, 2021–2028 (USD MILLION)

- TABLE 72 REST OF WORLD: PORCELAIN ENAMEL COATING MARKET SIZE, BY COUNTRY, 2021–2028 (KILOTON)

- TABLE 73 REST OF WORLD: MARKET, BY END-USE INDUSTRY, 2021–2028 (USD MILLION)

- TABLE 74 REST OF WORLD: MARKET, BY END-USE INDUSTRY, 2021–2028 (KILOTON)

- TABLE 75 REST OF WORLD: MARKET, BY TYPE, 2021–2028 (USD MILLION)

- TABLE 76 REST OF WORLD: MARKET, BY TYPE, 2021–2028 (KILOTON)

- TABLE 77 REST OF WORLD: MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 78 REST OF WORLD: MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 79 STRATEGIES ADOPTED BY KEY PORCELAIN ENAMEL COATING PLAYERS (2018–2023)

- TABLE 80 PORCELAIN ENAMEL COATINGS MARKET: DEGREE OF COMPETITION, 2022

- TABLE 81 COMPANY REGION FOOTPRINT

- TABLE 82 COMPANY INDUSTRY FOOTPRINT

- TABLE 83 COMPANY OVERALL FOOTPRINT

- TABLE 84 STRATEGIC DEVELOPMENTS, BY KEY COMPANY

- TABLE 85 HIGHEST ADOPTED STRATEGIES

- TABLE 86 NUMBER OF GROWTH STRATEGIES ADOPTED BY KEY COMPANIES

- TABLE 87 PORCELAIN ENAMEL COATINGS MARKET: DEALS, 2017–2023

- TABLE 88 A. O. SMITH CORPORATION: COMPANY OVERVIEW

- TABLE 89 A. O. SMITH CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 90 CAPRON MANUFACTURING COMPANY: COMPANY OVERVIEW

- TABLE 91 CAPRON MANUFACTURING COMPANY: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 92 VIBRANTZ TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 93 VIBRANTZ TECHNOLOGIES: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 94 VIBRANTZ TECHNOLOGIES: DEALS

- TABLE 95 HUNAN NOLI ENAMEL CO., LTD.: COMPANY OVERVIEW

- TABLE 96 HUNAN NOLI ENAMEL CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 97 TOMATEC CO., LTD.: COMPANY OVERVIEW

- TABLE 98 TOMATEC CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 99 ARCHER WIRE INTERNATIONAL CORPORATION: COMPANY OVERVIEW

- TABLE 100 ARCHER WIRE INTERNATIONAL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 101 CHEROKEE PORCELAIN ENAMEL CORPORATION: COMPANY OVERVIEW

- TABLE 102 CHEROKEE PORCELAIN ENAMEL CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 103 ROESCH INC.: COMPANY OVERVIEW

- TABLE 104 ROESCH INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 105 AKCOAT: COMPANY OVERVIEW

- TABLE 106 AKCOAT: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 107 AKCOAT: DEALS

- TABLE 108 RIESS KELOMAT GMBH: COMPANY OVERVIEW

- TABLE 109 RIESS KELOMAT GMBH: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 110 CAPRICORN COATINGS AND COLOURS: COMPANY OVERVIEW

- TABLE 111 CAPRICORN COATINGS AND COLOURS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 112 PEMCO INTERNATIONAL: COMPANY OVERVIEW

- TABLE 113 PEMCO INTERNATIONAL: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 114 A.J WELLS & SONS: COMPANY OVERVIEW

- TABLE 115 A.J WELLS & SONS: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 116 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (USD MILLION)

- TABLE 117 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY MATERIAL, 2021–2028 (KILOTON)

- TABLE 118 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY TECHNOLOGY, 2021–2028 (USD MILLION)

- TABLE 119 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY TECHNOLOGY, 2021–2028 (KILOTON)

- TABLE 120 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (KILOTON)

- TABLE 121 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY PRODUCT, 2021–2028 (USD MILLION)

- TABLE 122 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (KILOTON)

- TABLE 123 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY APPLICATION, 2021–2028 (USD MILLION)

- TABLE 124 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (USD MILLION)

- TABLE 125 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY DISTRIBUTION CHANNEL, 2021–2028 (KILOTON)

- TABLE 126 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (KILOTON)

- TABLE 127 CERAMIC AND PORCELAIN TABLEWARE MARKET, BY REGION, 2021–2028 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 GEOGRAPHIC SCOPE

- FIGURE 3 PORCELAIN ENAMEL COATINGS MARKET: RESEARCH DESIGN

- FIGURE 4 MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 6 PORCELAIN ENAMEL COATINGS MARKET SIZE ESTIMATION, BY REGION

- FIGURE 7 PORCELAIN ENAMEL COATING MARKET SIZE ESTIMATION, BY TYPE

- FIGURE 8 PORCELAIN ENAMEL COATINGS MARKET SIZE ESTIMATION, BY APPLICATION

- FIGURE 9 PORCELAIN ENAMEL COATING MARKET: SUPPLY-SIDE FORECAST

- FIGURE 10 PORCELAIN ENAMEL COATINGS MARKET: DEMAND-SIDE FORECAST

- FIGURE 11 FACTOR ANALYSIS OF PORCELAIN ENAMEL COATINGS MARKET

- FIGURE 12 PORCELAIN ENAMEL COATING MARKET: DATA TRIANGULATION

- FIGURE 13 POWDER SEGMENT TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 14 ROOM HEATER APPLICATION TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 15 COMMERCIAL END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 16 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 17 INCREASING DEMAND FROM ASIA PACIFIC TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 18 POWDER COATINGS TO RECORD HIGHER CAGR FROM 2023 TO 2028

- FIGURE 19 STOVE, OVEN, & COOKER TO BE LARGEST APPLICATION SEGMENT DURING FORECAST PERIOD

- FIGURE 20 COMMERCIAL SEGMENT TO BE LARGEST END-USE INDUSTRY DURING FORECAST PERIOD

- FIGURE 21 STOVE, OVEN, & COOKER SEGMENT AND CHINA ACCOUNTED FOR LARGEST SHARES IN 2023

- FIGURE 22 MARKET TO WITNESS HIGHER GROWTH IN EMERGING ECONOMIES

- FIGURE 23 INDIA TO EMERGE AS LUCRATIVE MARKET FOR PORCELAIN ENAMEL COATINGS

- FIGURE 24 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PORCELAIN ENAMEL COATINGS MARKET

- FIGURE 25 PORCELAIN ENAMEL COATINGS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS

- FIGURE 27 KEY BUYING CRITERIA FOR PORCELAIN ENAMEL COATINGS

- FIGURE 28 COUNTRY-WISE CONTRIBUTION TO GLOBAL CONSTRUCTION GROWTH, 2020–2030

- FIGURE 29 COUNTRY-WISE GROWTH IN INFRASTRUCTURE, 2020–2030 (%, CAGR)

- FIGURE 30 AVERAGE PRICE COMPETITIVENESS, BY TYPE

- FIGURE 31 AVERAGE PRICE COMPETITIVENESS, BY END-USE INDUSTRY

- FIGURE 32 AVERAGE PRICE COMPETITIVENESS, BY REGION

- FIGURE 33 AVERAGE PRICE COMPETITIVENESS, BY APPLICATION

- FIGURE 34 PORCELAIN ENAMEL COATINGS: SUPPLY CHAIN ANALYSIS

- FIGURE 35 ENAMEL COATING PRODUCTION PROCESS

- FIGURE 36 YC AND YCC SHIFT IN PORCELAIN ENAMEL COATINGS INDUSTRY

- FIGURE 37 NUMBER OF PATENTS PUBLISHED, 2018–2023

- FIGURE 38 JURISDICTION PATENTS, BY COUNTRY, 2018–2023

- FIGURE 39 PATENTS PUBLISHED BY MAJOR PLAYERS, 2018–2023

- FIGURE 40 POWDER COATINGS TO REGISTER HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 41 ROOM HEATER APPLICATION TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 42 COMMERCIAL INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 43 ASIA PACIFIC PROJECTED TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 44 ASIA PACIFIC: PORCELAIN ENAMEL COATINGS MARKET SNAPSHOT

- FIGURE 45 NORTH AMERICA: PORCELAIN ENAMEL COATINGS MARKET SNAPSHOT

- FIGURE 46 EUROPE: PORCELAIN ENAMEL COATINGS MARKET SNAPSHOT

- FIGURE 47 REST OF WORLD: PORCELAIN ENAMEL COATINGS MARKET SNAPSHOT

- FIGURE 48 MARKET SHARE OF KEY PLAYERS, 2022

- FIGURE 49 RANKING OF LEADING PLAYERS IN PORCELAIN ENAMEL COATINGS MARKET, 2022

- FIGURE 50 REVENUE ANALYSIS OF TOP PLAYERS, 2018–2022

- FIGURE 51 PORCELAIN ENAMEL COATINGS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 52 A. O. SMITH CORPORATION: COMPANY SNAPSHOT

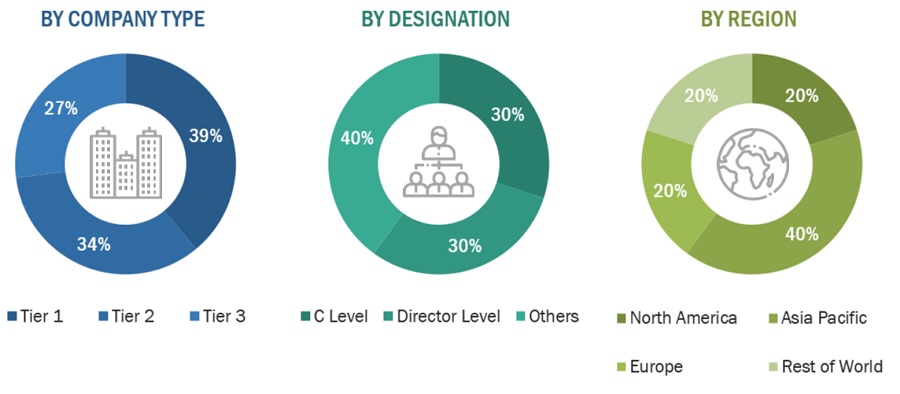

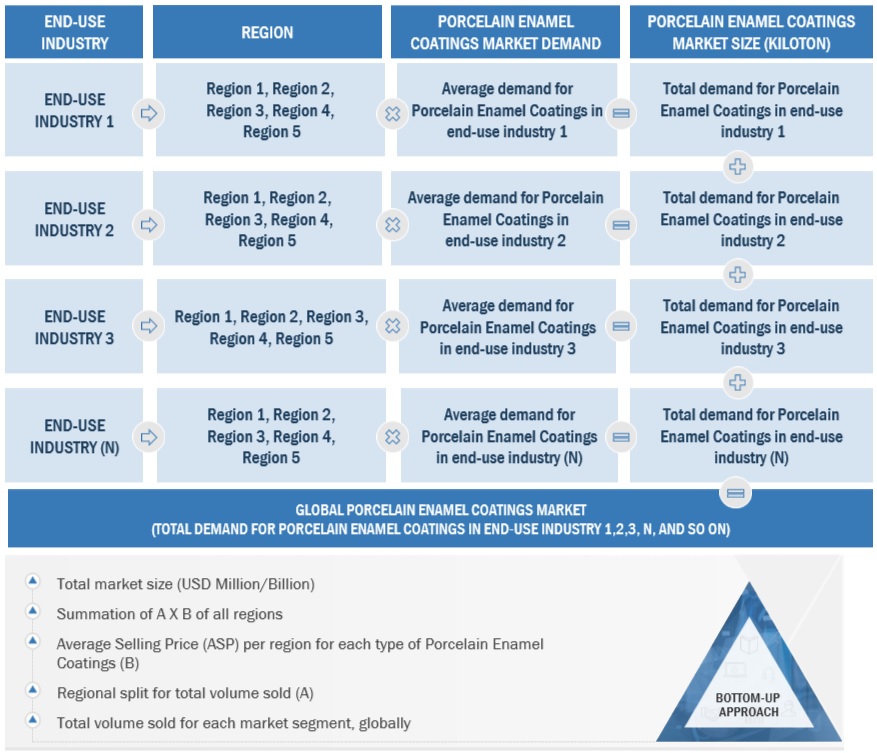

The study involved four major activities in order to estimating the current size of the porcelain enamel coatings market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva; and publications and databases from associations, including Powder Coatings Institute British Coatings Federation, The European Chemical Industry Council (CEFIC), National Paints & Coatings Associations (NPCA), China National Coatings Industry Association (CNCIA), and Environmental Protection Agency.

Primary Research

Extensive primary research was carried out after gathering information about porcelain enamel coatings market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the porcelain enamel coatings market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, applications, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

|

CoMPANY NAME |

DESIGNATION |

|

A.O. Smith Corporation |

Sales Manager |

|

Vibrantz technologies |

Project Manager |

|

AkCoat |

Individual Industry Expert |

|

Nolifrit |

Manager |

Market Size Estimation

The following information is part of the research methodology used to estimate the size of the porcelain enamel coatings market. The market sizing of the porcelain enamel coatings market was undertaken from the demand side. The market size was estimated based on market size for porcelain enamel coatings in various end-use industries.

Global Porcelain Enamel Coatings Market Size: Bottom Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Global Porcelain Enamel Coatings Market Size: Top-Down Approach

Data Triangulation

After arriving at the overall market size, the market has been split into several segments.To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

Porcelain enamel is a glass-like material fused to metal substrates through a high-temperature firing process. These coatings offer a durable, glossy, and smooth finish to surfaces, enhancing their aesthetic appeal while protecting against corrosion, heat, and chemicals. The market encompasses various sectors such as appliances, cookware, sanitaryware, architectural elements, and industrial equipment, where porcelain enamel coatings are used to improve the functional and visual qualities of the products.

Key Stakeholders

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives

- To define, describe, segment, and forecast the size of the porcelain enamel coatings market based on type, application, end use and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, and Rest of world along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the porcelain enamel coatings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the porcelain enamel coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which provides a detailed comparison of the product portfolio of each company in the porcelain enamel coatings Market

Growth opportunities and latent adjacency in Porcelain Enamel Coatings Market