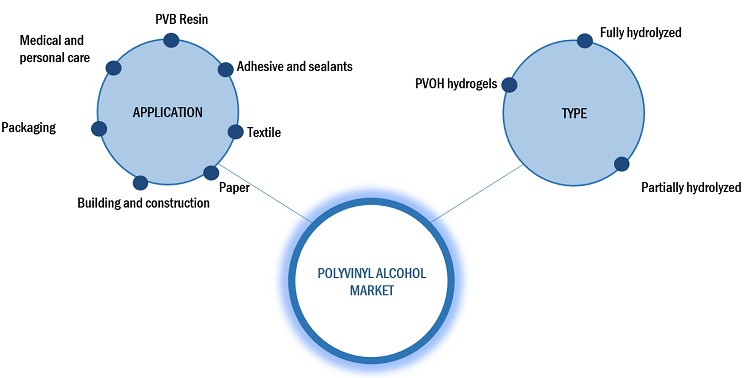

Polyvinyl Alcohol (PVOH) Market by Type (Fully hydrolyzed, partially hydrolyzed, PVOH hydrogels), application(PVB Resin, Adhesives and sealants, Textile, Paper, Builllding & construction, Packaging), and Region - Global Forecast to 2028

Updated on : March 19, 2024

Polyvinyl Alcohol Market

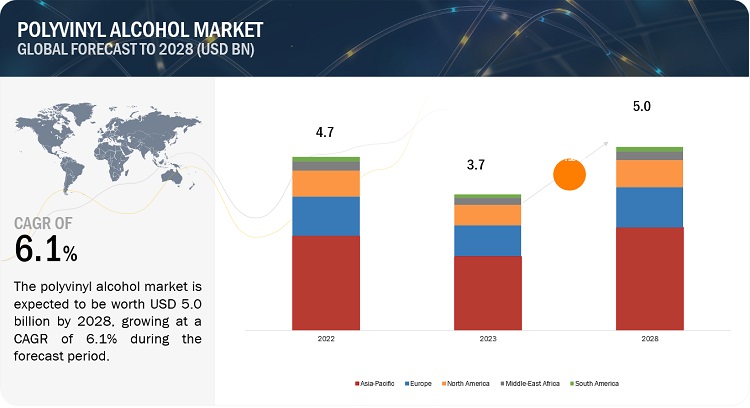

The global Polyvinyl Alcohol (PVOH) market was valued at USD 3.7 billion in 2023 and is projected to reach USD 5.0 billion by 2028, growing at 6.1% cagr from 2023 to 2028. The market is mainly led by the significant usage of polyvinyl alcohol in various end-use industries. The growing demand from the medical and personal care along with the paper, packaging and textile industries, and concerns for reducing the environmental impact are driving the market for polyvinyl alcohol.

Attractive Opportunities in the Polyvinyl Alcohol Market

To know about the assumptions considered for the study, Request for Free Sample Report

Polyvinyl Alcohol Market Dynamics

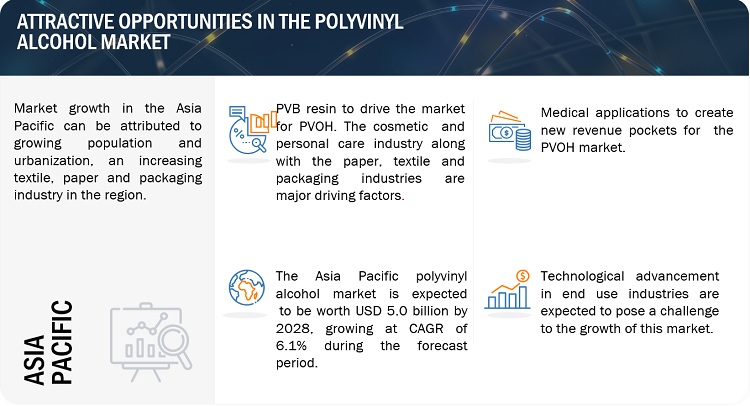

Driver: Polyvinyl Butaryl(PVB) resin to drive the demand for PVOH market.

Due to their excellent adhesion, transparency, and impact resistance, these films are widely utilized in laminated safety glass, such as automotive windshields and architectural glass. As a result, the demand for PVB films and resins is closely linked to the demand for PVOH resins.

The cosmetic and personal care industry drive the demand for PVOH during the forecast period.

The growth of the cosmetics and personal care industry is expected to continue as consumers increasingly seek new and innovative products for their beauty and grooming routines. The cosmetics and personal care industry is driving the demand for PVOH (polyvinyl alcohol) due to its unique properties and versatility in various product applications. PVOH is used as a film-forming agent, thickener, and binder in various cosmetic and personal care products such as face masks, hair styling agents, eye makeup, skin care products and nail polish.

The textile packaging and paper industries to drive the demand of PVOH:

PVOH offers numerous advantages in the textile industry, including its water solubility, film-forming properties, adhesion, and flexibility. Its applications range from yarn sizing and dyeing/printing to fabric finishing and fiber spinning, making it a versatile polymer in textile processing. Polyvinyl alcohol (PVOH) is widely utilized in the packaging industry due to its exceptional film-forming and barrier properties. PVOH films can be manufactured with different thicknesses and characteristics, making them suitable for a wide range of packaging applications. Polyvinyl alcohol (PVOH) offers a range of applications in the paper industry for its unique properties such as paper coatings, surface sizing, fibre reinforcement, paper coatings for packaging, release liners, decorative laminates and moulding applications.

Restraint: Environmental concerns may lead to stringent regulations.

PVOH may face competition from bio-based and biodegradable materials due to factors like sustainability, biodegradability, and regulatory pressures. To remain competitive, PVOH manufacturers must consider developing sustainable and eco-friendly alternatives, focusing on innovation, and highlighting the unique properties and benefits of PVOH in various applications.

Bio based and biodegradable materials are gaining traction in various industries due to their environmental friendly nature and ability to reduce the dependence on petroleum based products.The growing demand for sustainable materials can pose a threat to the PVOH demand in specific applications. PVOH’s water soluble nature can pose concerns when it enters aquatic ecosystems. If PVOH takes longer time to degrade it can accumulate in water bodies, potentially affecting the water quality causing harm to the aquatic life. In addition to that PVOH with higher degree of hydrolysis and molecular weight may degrade slowly potentially persisting in the environment and raising concerns about its environmental impact.

Opportunity: Medical applications to create new revenue pockets for the PVOH market

PVOH has excellent biocompatibility, making it suitable for wound care and medical applications. For example, PVOH can be used to develop hydrogel wound dressings that provide a moist environment for wound healing and absorb wound exudate. Additionally, PVOH can be used in drug delivery systems, such as controlled-release tablets, due to its water solubility and biocompatibility. PVOH is used to develop hydrogel-based wound dressings that promote a moist environment for wound healing, facilitate tissue regeneration, and absorb wound exudate. These dressings are particularly beneficial for treating burns, ulcers, and chronic wounds. It is utilized in drug delivery systems, such as controlled-release tablets or hydrogels, to sustain medications’ release. The biocompatibility and water solubility of PVOH make it an ideal candidate for these applications.

Challenge: technological advancement in end use industries.

In recent years, the adhesive industry has seen the development of hybrid adhesive technologies that combine the benefits of two or more adhesive chemistries. For example, silane-modified polyurethanes (SMPs) or MS polymers are hybrid adhesives that combine the strengths of polyurethane and silicone chemistries. These hybrids offer excellent adhesion, elasticity, and environmental resistance, making them suitable for various applications, such as construction, automotive, and industrial assembly. The increasing adoption of such hybrid adhesives may challenge the demand for PVOH-based adhesives.

Advancements in textile coatings have led to the development of materials that can provide improved performance compared to traditional PVOH-based coatings. For instance, some companies have developed waterborne polyurethane dispersions (PUDs) that can be used as textile coatings for improved water resistance, abrasion resistance, and durability. The growing demand for high-performance textile coatings can present a challenge for PVOH-based coatings in the textile industry.

The growing demand for sustainable packaging solutions has led to the development of bio-based and biodegradable materials that can replace traditional petroleum-based materials like PVOH. For example, polylactic acid (PLA) and polyhydroxyalkanoates (PHAs) are biodegradable polymers derived from renewable resources that can be used in packaging films, coatings, and adhesives. The increased adoption of these sustainable materials in the packaging industry can pose a challenge to the demand for PVOH.

Market Ecosystem

A market ecosystem can be defined as the interlinked network of individuals, organizations, and various factors that influence the dynamics and functioning of a specific market or industry. It encompasses all the stakeholders involved in the production, distribution, and consumption of goods or services within that market.

The market ecosystem consists of several elements that interact and rely on each other, forming a complex web of relationships and dependencies

The key players in this market are Kuraray Co Ltd ( Japan), Anhui Wanwei Group Co Ltd (China), Chang Chun Petrochemicals Co Ltd (Taiwan), Ningxia Dadi Circular Development Corp Ltd (China), Sinopec Sichuan Vinylon Works (China), Sekisui Specialty Chemicals (Japan), Mitsubishi Chemical Corporation (Japan), Japan Vam and Poval Co Ltd (Japan), Merck Kgaa (Germany), Wacker Chemie AG (Germany), Denka Company Ltd (Japan).

Polyvinyl Alcohol Market Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Partially hydrolyzed is the largest type of polyvinyl alcohol in 2023, in terms of value"

Partially hydrolyzed type PVOH accounted for the largest market share in the global polyvinyl alcohol industry, in terms of value, in 2023. The segment is also projected to grow at the highest CAGR in value in 2023. It has many applications in textile , paper,packaging, construction industries among others. Partially hydrolyzed PVOH is employed in construction materials, including cement modifiers and tile adhesives. It enhances workability, adhesion, and water resistance, improving overall performance. Partially hydrolyzed PVOH acts as a binder in adhesive formulations for various applications. It offers excellent adhesion to different substrates, making it suitable for products like labels, tapes, and laminates. PVOH is increasingly utilized in packaging, particularly for water-soluble pouches and films. These pouches have applications in industries such as detergents, agrochemicals, and food processing. They dissolve in water, reducing packaging waste. Partially hydrolyzed PVOH is employed as a surface-sizing agent in paper manufacturing. It enhances the strength, printability, and water resistance of paper products while improving filler and pigment retention. In the textile industry, partially hydrolyzed PVOH acts as a warp-sizing agent, improving adhesion and enhancing the weaving process. It imparts strength, flexibility, and smoothness to fibers.

"PVB resin was the largest appplication for polyvinyl alcohol market in 2023, in terms of value"

Polyvinyl butyral (PVB) resin is an important component of PVB films. To increase the adhesion of the PVB film to other materials, PVA can also be utilized as a binder in PVB resin. The final PVB film's tensile strength and flexibility can both be increased by adding PVA to the PVB resin. In PVB resin which is commonly used in laminated safety glass application.

Polyvinyl alcohol (PVA) is utilized in a range of applications within polyvinyl butyral (PVB) resin, including as a plasticizer to enhance the flexibility and toughness of the end product.

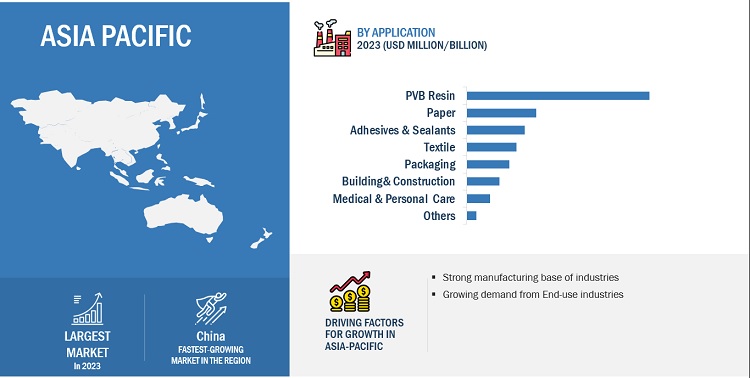

"Asia Pacific was the largest market for polyvinyl alcoholin 2023, in terms of value."

Asia Pacific was the largest market for the global polyvinyl alcohol industry, in terms of value, in 2023. China is the largest market in the Asia Pacific. It is projected to witness the highest growth during the forecast period considering of growth of paper, packaging, textile and construction industries in the region. The major players operating in the Asia Pacific region are Kuraray Co Ltd ( Japan), Anhui Wanwei Group Co Ltd (China), Chang Chun Petrochemicals Co Ltd (Taiwan), Ningxia Dadi Circular Development Corp Ltd (China), Sinopec Sichuan Vinylon Works (China), Sekisui Specialty Chemicals (Japan), Mitsubishi Chemical Corporation (Japan), Japan Vam and Poval Co Ltd (Japan) among others

To know about the assumptions considered for the study, download the pdf brochure

Polyvinyl Alcohol Market Players

The key players in this market are Kuraray Co Ltd ( Japan), Anhui Wanwei Group Co Ltd (China), Chang Chun Petrochemicals Co Ltd (Taiwan), Ningxia Dadi Circular Development Corp Ltd (China), Sinopec Sichuan Vinylon Works (China), Sekisui Specialty Chemicals (Japan), Mitsubishi Chemical Corporation (Japan), Japan Vam and Poval Co Ltd (Japan), Merck Kgaa (Germany), Wacker Chemie AG (Germany), Denka Company Ltd (Japan).

Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of polyvinyl alcohol have opted for new product launches to sustain their market position.

Polyvinyl Alcohol Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 3.7 billion |

|

Revenue Forecast in 2028 |

USD 5.0 billion |

|

CAGR |

6.1% |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023-2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Kuraray Co Ltd (Japan), Anhui Wanwei Group Co Ltd (China), Chang Chun Petrochemicals Co Ltd (Taiwan), Ningxia Dadi Circular Development Corp Ltd (China), Sinopec Sichuan Vinylon Works (China), Sekisui Specialty Chemicals (Japan), Mitsubishi Chemical Corporation (Japan), Japan Vam and Poval Co Ltd (Japan), Merck Kgaa (Germany), Wacker Chemie AG (Germany), Denka Company Ltd (Japan) |

This report categorizes the global polyvinyl alcohol lmarket based on type, application and region.

On the basis of type, the market has been segmented as follows:

- Fully hydrolyzed.

- Partially hydrolyzed.

- PVOH hydrogels.

- Others.

On the basis of application, the market has been segmented as follows:

- PVB Resin.

- Adhesives and sealants.

- Textile.

- Paper.

- Builllding and construction.

- Packaging.

- Medical and personal care.

- Others.

On the basis of region, the market has been segmented as follows:

- Asia Pacific.

- Europe.

- North America.

- Middle East & Africa.

- South America.

Recent Developments

- In February 2023 , Kuraray Poval (polyvinyl alcohol, PVOH), polyvinyl butyral (PVB), polyvinyl butyral film, and SentryGlas, four of the company's products manufactured in Europe, have all undergone a Life Cycle Assessment (LCA) by the product sustainability consultancy Sphera Solutions. This evaluation, which uses a cradle-to-gate approach, seeks to examine the sustainability of Kuraray's goods, and identify potential for development..

- In March 2023 Chang Chun Petrochemical Co. Ltd. announced an expansion project of new copper foil production facility in North America to proactively respond to robust growing consumer demand in electric vehicle market. The plan is to start mass production of copper foil as early as 2026 with capacity of 50,000 tons per annum.

- In February 2023, The Mitsubishi Chemical Corporation announced that it has decided to establish a new facility at the Okayama Plant to enhance the production capacity of GOHSENX and Nichigo G-Polymer, specialty brands of polyvinyl alcohol resin (PVOH resin). The facility is scheduled to start operation in October 2024.

- In May 2022, A deal for renewable energy over five years has been announced by TXU Energy and SEKISUI Specialty Chemical. The company is now running on renewable energy.

- In June 2022, the world's top manufacturer of carbon negative materials, Origin Materials, Inc., and Kuraray Co., Ltd have announced a strategic alliance to market cutting-edge carbon negative materials for a range of polymer applications. Origin Materials, Inc.'s objective is to facilitate the global transition to sustainable materials.

- In march 2021, Anhui Wanwei Group announced plans to invest 1 billion yuan to build a new PVA production line. The new production line is expected to have an annual output of 80,000 tons and will increase the company's PVA production capacity.

- In 2021, Merck Kgaa to serve its fast expanding reference materials business, Merck, a prominent science, and technology corporation, intends to construct a new laboratory facility in Buchs, Switzerland, costing € 18 million.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the polyvinyl alcohol market?

This study's forecast period for the polyvinyl alcoholmarket is 2023-2028. The market is expected to grow at a CAGR of 6.1%, in terms of value, during the forecast period.

Who are the major key players in the polyvinyl alcoholmarket?

The key players in this market are Kuraray Co Ltd ( Japan), Anhui Wanwei Group Co Ltd (China), Chang Chun Petrochemicals Co Ltd (Taiwan), Ningxia Dadi Circular Development Corp Ltd (China), Sinopec Sichuan Vinylon Works (China), Sekisui Specialty Chemicals (Japan), Mitsubishi Chemical Corporation (Japan), Japan Vam and Poval Co Ltd (Japan), Merck Kgaa (Germany), Wacker Chemie AG (Germany), Denka Company Ltd (Japan).

What are the major regulations of the polyvinyl alcoholmarket in various countries?

Environmental protection agencies of different countries have laid down certain regulations for the proper use of polyvinyl alcohol.

What are the drivers and opportunities for the polyvinyl alcoholmarket?

The polyvinyl butaryl(PVB) resin along with end use industries like medical and personal care industry along with the textile, paper and packaging industries are drivers for the polyvinyl alcohol market. The opportunity for the PVOH market being medical and personal care application which is creating new revenuuue pockets for the PVOH industry.

Which are the key technology trends prevailing in the polyvinyl alcohol market?

As environmental concerns increase, there is a growing emphasis on developing sustainable and biodegradable alternatives to traditional materials. PVOH, derived from renewable resources and biodegradable, aligns well with this trend. Researchers are actively exploring methods to modify PVOH's properties to expand its applications. These modifications include cross-linking techniques, blending with other polymers, and incorporating functional additives. The aim is to improve PVOH's mechanical strength, barrier properties, thermal stability, and water resistance, making it suitable for a wider range of applications. The integration of nanotechnology with PVOH is an emerging trend. Nanoparticles like clay, silica, and metallic nanoparticles are incorporated into PVOH matrices to enhance its properties. This includes improvements in mechanical strength, barrier properties, thermal stability, and flame retardancy. PVOH-based nanocomposites are being explored for applications in packaging, electronics, and the biomedical field. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Increasing demand from polyvinyl butyral (PVB) application- Growing demand from textile industry- Growth of packaging industry owing to rapidly growing e-commerce industry- Rising applications in paper industry- Cosmetics & personal care industry to drive demandRESTRAINTS- Moisture sensitivity and limited chemical compatibility- Stringent regulations on use of PVOH in detergents due to environmental concernsOPPORTUNITIES- Emerging applications in medical industry to create new revenue pocketsCHALLENGES- Fluctuating raw material prices affecting profitability of manufacturers- Technological advancement in end-use industries

- 6.1 INTRODUCTION

-

6.2 SUPPLY CHAIN ANALYSISRAW MATERIAL SOURCINGPVOH MANUFACTURINGPACKAGING AND DISTRIBUTIONAPPLICATION IN END-USE INDUSTRIES

-

6.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREATS OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.4 POLYVINYL ALCOHOL MARKET: ECOSYSTEM MAPPING

-

6.5 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGY- Document Type- Publication trends over last 10 yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP PATENT APPLICANTS

- 6.7 PRICING ANALYSIS

-

6.8 KEY FACTORS AFFECTING BUYING DECISIONSQUALITYSERVICE

-

6.9 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

-

6.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESSEMERGING TECHNOLOGIES AND ENVIRONMENTAL CONCERNS FOR POLYVINYL ALCOHOL MANUFACTURERS

-

6.11 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

- 7.1 INTRODUCTION

-

7.2 FULLY HYDROLYZED POLYVINYL ALCOHOLEXCEPTIONAL WATER SOLUBILITY TO ADD TO DEMAND

-

7.3 PARTIALLY HYDROLYZED POLYVINYL ALCOHOLABILITY TO RETAIN SOME OF ITS ACETATE GROUPS TO DRIVE DEMAND

-

7.4 OTHERSPOLYVINYL ALCOHOL HYDROGELSMODIFIED POLYVINYL ALCOHOL- Crosslinked polyvinyl alcohol- Grafted polyvinyl alcohol- Composite polyvinyl alcohol- Blended polyvinyl alcohol- Functionalized polyvinyl alcoholFOAM-GRADE POLYVINYL ALCOHOL- High foam-grade polyvinyl alcohol- Low foam-grade polyvinyl alcohol

- 8.1 INTRODUCTION

-

8.2 PVB RESINEXTENSIVE USE OF PVOH FOR LAMINATED SAFETY GLASS

-

8.3 ADHESIVE & SEALANTSPVOH USED IN ADHESIVES AND SEALANTS DUE TO ITS FILM FORMING AND SUPERIOR ADHESIVE QUALITIES

-

8.4 TEXTILEPVOH WIDELY USED FOR WARP SIZING IN TEXTILE INDUSTRY

-

8.5 PAPERPVOH USED AS DEPENDABLE AND DURABLE SUBSTITUTE FOR STARCH IN PAPER PRODUCTION

-

8.6 BUILDING & CONSTRUCTIONPVOH USED AS SURFACE SEALANT TO PREVENT WATER DAMAGE

-

8.7 PACKAGINGPVOH USEFUL FOR MAKING BIODEGRADABLE PACKAGING

-

8.8 MEDICAL & PERSONAL CAREPVOH WIDELY USED IN PERSONAL CARE PRODUCTS FOR ITS HIGH WATER ABSORPTION AND RETENTION QUALITIES

-

8.9 OTHERSAGRICULTUREINKS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICRECESSION IMPACTCHINA- World leader in capacity, production, and exports of PVOHJAPAN- 40% of total PVOH production utilized by textile industryINDIA- Prominent importer of PVOHSOUTH KOREA- Well-established industrial base boosting PVOH productionREST OF ASIA PACIFIC

-

9.3 EUROPERECESSION IMPACTGERMANY- Strong automotive sector to favor market growthFRANCE- Focus on waste management and sustainabilityITALY- Growing chemical and pharmaceutical industries to drive demandUK- Vast manufacturing sector to support marketSPAIN- Automobile, food & beverage, and textile industries to drive demandREST OF EUROPE

-

9.4 NORTH AMERICARECESSION IMPACTUS- Growing focus on sustainability and eco-friendly solutionsCANADA- High demand from construction industryMEXICO- Growing manufacturing and agricultural industries to drive demand

-

9.5 SOUTH AMERICARECESSION IMPACTBRAZIL- PVOH used in various packaging applicationsCHILE- Growth of mining and manufacturing industries to drive demandREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICARECESSION IMPACTTURKEY- Construction, automobile, and chemical industries to drive marketSOUTH AFRICA- Agriculture sector to drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 OVERVIEW

- 10.2 MARKET SHARE ANALYSIS

- 10.3 MARKET EVALUATION FRAMEWORK

-

10.4 RECENT DEVELOPMENTSDEALS

-

10.5 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

-

10.6 STARTUP/SME EVALUATION QUADRANTPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKS

-

11.1 KEY PLAYERSKURARAY CO., LTD.- Business overview- Production capacity- Products offered- Recent developments- MnM viewSEKISUI SPECIALTY CHEMICALS- Business overview- Production capacity- Products offered- Recent developments- MnM viewSINOPEC SICHUAN VINYLON WORKS- Business overview- Production capacity- Products offered- Recent developments- MnM viewMITSUBISHI CHEMICAL CORPORATION- Business overview- Production capacity- Products offered- Recent developments- MnM viewJAPAN VAM AND POVAL CO., LTD.- Business overview- Production capacity- Products offered- MnM viewCHANG CHUN PETROCHEMICAL CO. LTD.- Business overview- Production capacity- Products offered- Recent developments- MnM viewANHUI WANWEI GROUP CO., LTD.- Business overview- Production capacity- Products offered- Recent developments- MnM viewMERCK KGAA- Business overview- Products offered- Recent developments- MnM viewDENKA COMPANY LTD.- Business overview- Products offered- Recent developments- MnM viewWACKER CHEMIE AG- Business overview- Products offered- Recent developments- MnM viewNINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.- Business overview- Production capacity- Products offered- MnM view

-

11.2 OTHER KEY PLAYERSHEFEI TNJ CHEMICAL INDUSTRY CO., LTD.TOKYO CHEMICAL INDUSTRY CO. LTD (TCI CHEMICALS)ASTRRA CHEMICALSINNER MONGOLIA SHUANGXIN ENVIRONMENT-FRIENDLY MATERIAL CO. LTD.,SYNTHOMER PLCPON PURE CHEMICALS GROUPALFA AESAREASTHONYSNP, INC.SPECTRUM CHEMICAL MANUFACTURING GROUPQUINDAO SANHUAN COLORCHEM CO. LTD.SHANGHAI CHEMEX GROUP LTD.HAREXLIWEI CHEMICAL CO. LTD.TANG ZHI TECHNOLOGY (HEBEI) CO. LTD.

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 2 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 3 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 SOUTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 TOTAL PATENT COUNT IN LAST 10 YEARS

- TABLE 7 IMPORT SCENARIO FOR POLYVINYL ALCOHOL: WHETHER OR NOT CONTAINING UNHYDROLYZED ACETATE GROUP, HS CODE: 390530, BY KEY COUNTRIES, 2022 (USD MILLION)

- TABLE 8 EXPORT SCENARIO FOR POLYVINYL ALCOHOL: WHETHER OR NOT CONTAINING UNHYDROLYZED ACETATE GROUP, HS CODE: 390530, BY KEY COUNTRIES, 2022 (USD MILLION)

- TABLE 9 GDP TRENDS AND FORECASTS, BY KEY COUNTRIES, 2019–2028

- TABLE 10 POLYVINYL ALCOHOL MARKET, BY TYPE, 2020–2022 (USD MILLION)

- TABLE 11 POLYVINYL ALCOHOL MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 12 POLYVINYL ALCOHOL MARKET, BY TYPE, 2020–2022 (TON)

- TABLE 13 POLYVINYL ALCOHOL MARKET, BY TYPE, 2023–2028 (TON)

- TABLE 14 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 15 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 16 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 17 POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 18 POLYVINYL ALCOHOL MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 19 POLYVINYL ALCOHOL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 POLYVINYL ALCOHOL MARKET, BY REGION, 2020–2022 (TON)

- TABLE 21 POLYVINYL ALCOHOL MARKET, BY REGION, 2023–2028 (TON)

- TABLE 22 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 23 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 24 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 25 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 26 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 27 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 29 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 30 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 31 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 32 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 33 CHINA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 34 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 35 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 36 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 37 JAPAN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 38 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 39 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 41 INDIA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 42 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 43 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 45 SOUTH KOREA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 46 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 47 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 49 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 50 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 51 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 53 EUROPE: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 54 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 55 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 57 EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 58 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 59 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 60 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 61 GERMANY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 62 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 63 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 64 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 65 FRANCE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 66 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 67 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 69 ITALY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 70 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 71 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 72 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 73 UK: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 74 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 75 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 77 SPAIN: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 78 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 79 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 81 REST OF EUROPE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 82 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY 2020–2022 (USD MILLION)

- TABLE 83 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY 2023–2028 (USD MILLION)

- TABLE 84 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 85 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 86 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 87 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 89 NORTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 90 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 91 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 93 US: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 94 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 95 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022(TON)

- TABLE 97 CANADA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028(TON)

- TABLE 98 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 99 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 101 MEXICO: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 102 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 103 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 104 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 105 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 106 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 107 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 109 SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 110 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 111 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 113 BRAZIL: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 114 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 115 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 117 CHILE: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 118 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 119 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 121 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 122 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 124 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 125 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY COUNTRY, 2023–2028(TON)

- TABLE 126 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 129 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 130 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 131 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 133 TURKEY: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 134 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 135 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 137 SOUTH AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 138 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION 2020–2022 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 142 STRATEGIES ADOPTED BY KEY MANUFACTURERS OF POLYVINYL ALCOHOL

- TABLE 143 POLYVINYL ALCOHOL MARKET: DEGREE OF COMPETITION

- TABLE 144 MARKET EVALUATION FRAMEWORK, 2020–2023

- TABLE 145 POLYVINYL ALCOHOL MARKET: DEALS, 2020–2023

- TABLE 146 SME TYPE FOOTPRINT

- TABLE 147 SME APPLICATION FOOTPRINT

- TABLE 148 SME REGION FOOTPRINT

- TABLE 149 KEY COMPANY TYPE FOOTPRINT

- TABLE 150 KEY COMPANY APPLICATION FOOTPRINT

- TABLE 151 KEY COMPANY REGION FOOTPRINT

- TABLE 152 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 153 KURARAY CO., LTD.: PRODUCTS OFFERED

- TABLE 154 KURARAY CO., LTD.: DEALS

- TABLE 155 SEKISUI SPECIALTY CHEMICALS: COMPANY OVERVIEW

- TABLE 156 SEKISUI SPECIALTY CHEMICALS: PRODUCTS OFFERED

- TABLE 157 SEKISUI SPECIALTY CHEMICALS: DEALS

- TABLE 158 SINOPEC SICHUAN VINYLON WORKS: COMPANY OVERVIEW

- TABLE 159 SINOPEC SICHUAN VINYLON WORKS: PRODUCTS OFFERED

- TABLE 160 SINOPEC SICHUAN VINYLON WORKS: OTHERS

- TABLE 161 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 162 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS OFFERED

- TABLE 163 MITSUBISHI CHEMICAL CORPORATION: DEALS

- TABLE 164 JAPAN VAM AND POVAL CO., LTD.: COMPANY OVERVIEW

- TABLE 165 JAPAN VAM AND POVAL CO. LTD.: PRODUCTS OFFERED

- TABLE 166 CHANG CHUN PETROCHEMICAL CO. LTD.: COMPANY OVERVIEW

- TABLE 167 CHANG CHUN PETROCHEMICAL CO. LTD.: PRODUCTS OFFERED

- TABLE 168 CHANG CHUN PETROCHEMICAL CO. LTD.: OTHERS

- TABLE 169 ANHUI WANWEI GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 170 ANHUI WANWEI GROUP CO., LTD.: PRODUCTS OFFERED

- TABLE 171 ANHUI WANWEI GROUP CO., LTD.: PRODUCT LAUNCHES

- TABLE 172 ANHUI WANWEI GROUP CO., LTD.: DEALS

- TABLE 173 ANHUI WANWEI GROUP CO., LTD.: OTHERS

- TABLE 174 MERCK KGAA: COMPANY OVERVIEW

- TABLE 175 MERCK KGAA: PRODUCTS OFFERED

- TABLE 176 MERCK KGAA: DEALS

- TABLE 177 MERCK KGAA: OTHERS

- TABLE 178 DENKA COMPANY LTD.: COMPANY OVERVIEW

- TABLE 179 DENKA COMPANY LTD.: PRODUCTS OFFERED

- TABLE 180 DENKA COMPANY LTD.: OTHERS

- TABLE 181 WACKER CHEMIE AG: COMPANY OVERVIEW

- TABLE 182 WACKER CHEMIE AG: PRODUCTS OFFERED

- TABLE 183 WACKER CHEMIE AG: OTHERS

- TABLE 184 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.: COMPANY OVERVIEW

- TABLE 185 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.: PRODUCTS OFFERED

- TABLE 186 NINGXIA DADI CIRCULAR DEVELOPMENT CORP. LTD.: OTHERS

- FIGURE 1 POLYVINYL ALCOHOL MARKET SEGMENTATION

- FIGURE 2 POLYVINYL ALCOHOL MARKET: RESEARCH DESIGN

- FIGURE 3 POLYVINYL ALCOHOL MARKET: DATA TRIANGULATION

- FIGURE 4 PVB RESIN APPLICATION TO LEAD POLYVINYL ALCOHOL MARKET BETWEEN 2023 AND 2028

- FIGURE 5 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL TO DOMINATE POLYVINYL ALCOHOL MARKET BETWEEN 2023 AND 2028

- FIGURE 6 ASIA PACIFIC TO DOMINATE POLYVINYL ALCOHOL MARKET IN 2023

- FIGURE 7 INCREASING DEMAND FROM VARIOUS APPLICATION SEGMENTS TO DRIVE MARKET

- FIGURE 8 PVB RESIN TO BE LARGEST APPLICATION OF POLYVINYL ALCOHOL DURING FORECAST PERIOD

- FIGURE 9 PARTIALLY HYDROLYZED TYPE TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 10 ASIA PACIFIC TO REGISTER HIGHEST CAGR IN POLYVINYL ALCOHOL MARKET DURING FORECAST PERIOD

- FIGURE 11 FULLY HYDROLYZED POLYVINYL ALCOHOL TO BE FASTEST GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 12 MEDICAL & PERSONAL CARE TO BE FASTEST GROWING APPLICATION DURING FORECAST PERIOD

- FIGURE 13 POLYVINYL ALCOHOL MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 14 POLYVINYL ALCOHOL MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 15 POLYVINYL ALCOHOL MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 16 PATENT PUBLICATION OVER LAST 10 YEARS

- FIGURE 17 TOP JURISDICTION–BY DOCUMENT

- FIGURE 18 AVERAGE SELLING PRICE BASED ON REGION (USD/KG)

- FIGURE 19 SUPPLIER SELECTION CRITERION

- FIGURE 20 REVENUE SHIFT FOR POLYVINYL ALCOHOL MANUFACTURERS

- FIGURE 21 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 22 PARTIALLY HYDROLYZED POLYVINYL ALCOHOL TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 23 PVB RESIN TO LEAD POLYVINYL ALCOHOL MARKET DURING FORECAST PERIOD

- FIGURE 24 PVB RESIN TO LEAD POLYVINYL ALCOHOL MARKET DURING FORECAST PERIOD

- FIGURE 25 ASIA PACIFIC: POLYVINYL ALCOHOL MARKET SNAPSHOT

- FIGURE 26 EUROPE: POLYVINYL ALCOHOL MARKET SNAPSHOT

- FIGURE 27 NORTH AMERICA: POLYVINYL ALCOHOL MARKET SNAPSHOT

- FIGURE 28 MARKET RANKING OF TOP 5 PLAYERS, 2022

- FIGURE 29 MARKET SHARE ANALYSIS, 2022

- FIGURE 30 POLYVINYL ALCOHOL MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 31 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022

- FIGURE 32 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 33 SEKISUI SPECIALTY CHEMICALS: COMPANY SNAPSHOT

- FIGURE 34 MITSUBISHI CHEMICAL CORPORATION: COMPANY SNAPSHOT

- FIGURE 35 MERCK KGAA: COMPANY SNAPSHOT

- FIGURE 36 DENKA COMPANY LTD.: COMPANY SNAPSHOT

- FIGURE 37 WACKER CHEMIE AG: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the polyvinyl alcohol market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The polyvinyl alcoholmarket comprises several stakeholders in the value chain, which include raw material suppliers, PVOH manufacturers, packaging and distribution and application of the end users. Various primary sources from the supply and demand sides of the polyvinyl alcoholmarket have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the polyvinyl alcohol industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of polyvinyl alcoholand the future outlook of their business, which will affect the overall market.

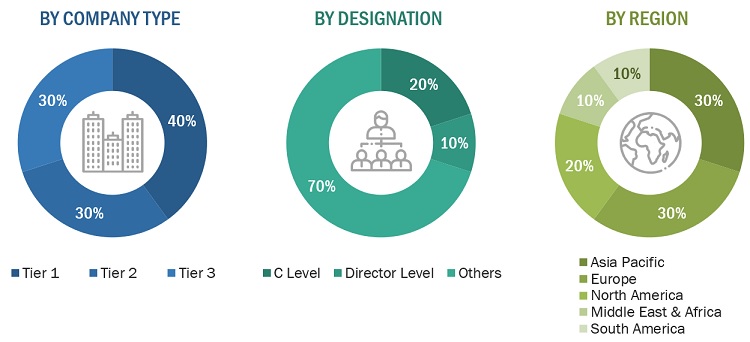

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021 available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

|

Company Name |

Designation |

|

Kuraray Co. Ltd. |

Individual Industry Expert |

|

Anhui Wanwei Group Co Ltd |

Sales Manager |

|

Chang Chun Petrochemicals Co Ltd |

Director |

|

Ningxia Dadi Circular Development Corp Ltd. |

Marketing Manager |

|

Sekisui Specialty Chemicals |

R&D Manager |

Market Size Estimation

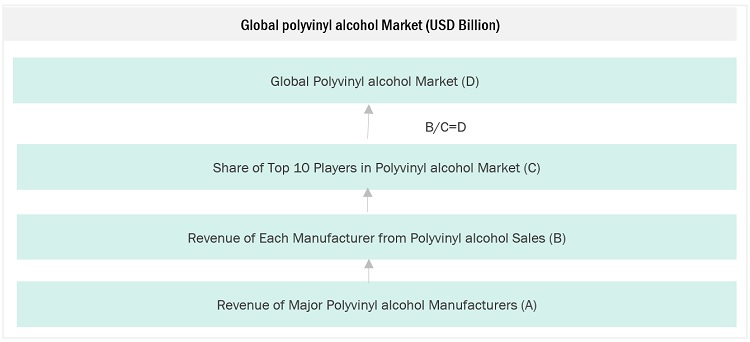

The top-down and bottom-up approaches have been used to estimate and validate the size of the polyvinyl alcohol market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Polyvinyl Alcohol Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarkestsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Polyvinyl Alcohol Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Polyvinyl alcohol (PVOH) is a synthetic polymer derived from vinyl acetate through the process of hydrolysis. It is a water-soluble and biodegradable polymer with a wide range of applications. PVOH is known for its excellent film-forming properties, adhesion, and resistance to oils, solvents, and grease. It is commonly used as a binder in adhesives, a coating or film in packaging materials, a sizing agent in textiles, and as an additive in various industries such as paper, construction, pharmaceuticals, and 3D printing. PVOH is considered environmentally friendly due to its ability to biodegrade in the presence of bacteria, reducing its impact on the environment compared to non-biodegradable plastics.

Key Stakeholders

- Raw material suppliers.

- Polyvinyl alcohol manufacturers.

- Polyvinyl alcohol traders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions..

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the polyvinyl alcohol industry, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Polyvinyl Alcohol (PVOH) Market