Polyvinyl Alcohol Films Market by Grade Type (Fully Hydrolyzed, Partially Hydrolyzed), Application (Detergent Packaging, Medical & Healthcare, Polarizing Plates, Food Packaging, Agrochemical Packaging), & Region - Global Forecast to 2028

Updated on : August 22, 2024

Polyvinyl Alcohol Films Market

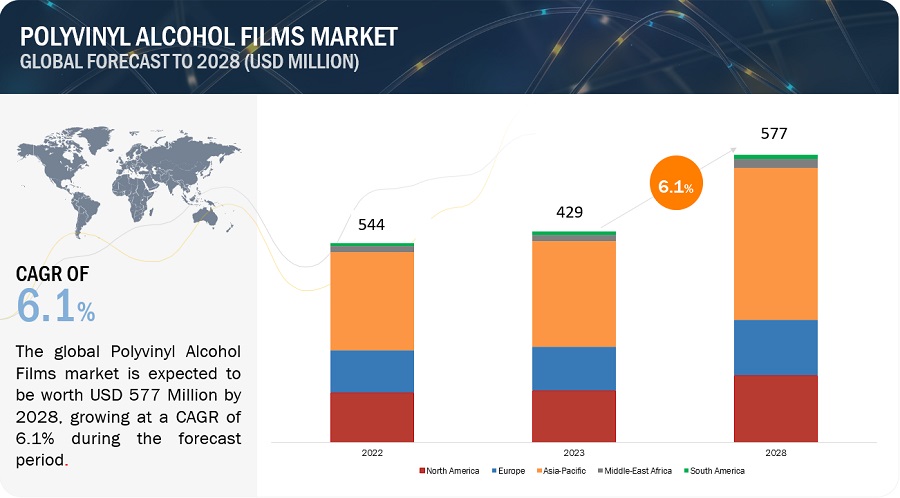

The global polyvinyl alcohol films market was valued at USD 429 million in 2023 and is projected to reach USD 577 million by 2028, growing at 6.1% cagr from 2023 to 2028. Polyvinyl Alcohol (PVA) films are eco-friendly and biodegradable, aligning with growing environmental concerns. Their excellent barrier properties, moisture resistance, and versatility make them ideal for packaging in various industries. Additionally, their application in industries such as food, pharmaceuticals, and agriculture, where sustainability and protection are paramount, has driven their popularity. With an increasing focus on sustainable packaging solutions and a wide range of applications, the PVA films market continues to experience significant growth.

Attractive Opportunities in the Polyvinyl Alcohol Films Market

Note: e-estimated p-projected.

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Polyvinyl Alcohol Films Market Dynamics

Driver: Rising demand from packaging application

The rising demand for polyvinyl alcohol films from the packaging application is a major driver that significantly influences the growth of the PVA films market. The packaging application is witnessing a continuous evolution in response to changing consumer preferences and global market dynamics. PVA films offer unique advantages in terms of their barrier properties, which protect products from moisture, oxygen, and contaminants. They also provide excellent printability and are compatible with various printing techniques, enhancing their appeal for packaging applications. As consumer packaged goods (CPG) companies strive to differentiate their products and enhance shelf appeal, they are increasingly turning to PVA films to create eye-catching, functional, and eco-friendly packaging solutions.

However, e-commerce and online retail have experienced exponential growth, further boosting the demand for packaging materials. The COVID-19 pandemic accelerated the shift toward online shopping, increasing the need for durable and efficient packaging materials to protect products during transit. PVA films, with their versatility and water solubility, are well-suited for this purpose, providing both convenience and environmental sustainability. Moreover, PVA films align with the global trend toward sustainable packaging. Consumers are becoming more conscious of environmental issues, and regulatory bodies are imposing stricter requirements on packaging materials. PVA films, being biodegradable and water-soluble, offer an eco-friendly alternative to traditional plastics, making them a preferred choice for companies aiming to reduce their carbon footprint and meet sustainability goals.

Restraint: Limited heat resistance of polyvinyl alcohol films

Limited heat resistance is a significant restraint in the polyvinyl alcohol films market. PVA films, although prized for their eco-friendliness and water-solubility, have inherent vulnerabilities when exposed to elevated temperatures. This constraint hampers their suitability for applications demanding high-temperature resistance, such as packaging for hot-fill food products, heat-sealing processes, or storage in environments with high thermal stress. The primary challenge arises in the food packaging sector, where PVA films may not withstand the high temperatures involved in hot-fill or pasteurization processes. Traditional plastic films, like polyethylene terephthalate (PET) or polypropylene (PP), are better equipped to handle these extreme conditions, making them preferred choices for such applications. Additionally, industries that rely on heat sealing, such as the pharmaceutical sector, may find PVA films less compatible due to their limited heat resistance. This may hinder their adoption in critical packaging processes.

Furthermore, limited heat resistance may also affect the overall durability of PVA films in storage and transportation. In regions with hot climates or during long-term storage, PVA films may experience heat-related degradation, leading to a potential reduction in their performance and shelf life.

Opportunities: Rising demand from medical and healthcare industry

The rising demand for polyvinyl alcohol films from the medical and healthcare industry presents a significant opportunity in the PVA films market. PVA films are valued in medical applications for their biocompatibility, water solubility, and non-toxic nature. They are used in various critical applications, such as dissolvable surgical drapes, wound care products, drug delivery systems, and diagnostic test strips. The global healthcare sector is continually expanding, driven by factors like an aging population, increasing healthcare awareness, and the ongoing development of innovative medical technologies. As a result, the demand for PVA films in medical and healthcare applications is expected to grow substantially. This not only offers a stable and potentially high-growth market segment for PVA film manufacturers but also aligns with the industry's emphasis on patient safety and product reliability. Companies that focus on meeting the stringent quality standards of the medical sector and develop specialized PVA film products tailored to healthcare needs may capitalize on this growing demand and establish strong footholds in a lucrative market.

Challenges: Rising environmental concerns

Rising environmental concerns poses a significant challenge in the polyvinyl alcohol films market. While PVA films are prized for their biodegradability and eco-friendliness, the processes involved in their production may still raise environmental alarms. Manufacturing PVA films often necessitates chemical inputs and energy-intensive procedures, which may have adverse ecological impacts. Additionally, the proper disposal and recycling infrastructure for PVA films are not universally available, potentially undermining their eco-credentials if they end up in conventional landfills. Moreover, the market faces increasing scrutiny from environmentally conscious consumers and regulatory bodies, demanding higher sustainability standards throughout the product life cycle. As a result, PVA film manufacturers are challenged to implement more sustainable and resource-efficient production methods while ensuring that the films remain competitively priced. Balancing the eco-friendly image of PVA films with the environmental realities of their production processes is a complex task, one that requires continuous innovation and commitment to address these concerns effectively.

Polyvinyl Alcohol Films Market Ecosystem

Prominent companies in this market include well-established, financially stable manufacturers of polyvinyl alcohol films. These companies have been operating in the market for several years and possess a diversified product portfolio and strong global sales and marketing networks. Prominent companies in this market include Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), BASF SE (Germany), and Chang Chun Group (Taiwan).

Based on grade type, partially hydrolyzed grade type is projected to account for the second largest share of the polyvinyl alcohol films market

Partially hydrolyzed grade type holds the second largest share in the polyvinyl alcohol films market's grade type segment due to its unique combination of characteristics. It strikes a balance between water solubility and mechanical strength, making it suitable for various applications, especially in industries like textiles and adhesives. This grade type provides the required flexibility, tensile strength, and adhesion properties, making it a versatile choice. As industries seek adaptable and cost-effective solutions, partially hydrolyzed PVA films emerge as a preferred option, leading to its substantial market share.

Based on application, medical & healthcare application is projected to account for the second largest share of the polyvinyl alcohol films market

The medical & healthcare application sector secures the second largest share in the polyvinyl alcohol (PVA) films market due to its unique combination of properties catering to the stringent requirements of healthcare products. PVA films are highly valued for their exceptional biocompatibility, ensuring that medical devices and implants interact safely with the human body, a paramount criterion in this sector. Additionally, their biodegradability aligns with the industry's growing emphasis on sustainable solutions. PVA films water solubility proves advantageous in various applications, from wound dressings to drug delivery systems. Their mechanical strength, transparency, and heat-sealability are pivotal for creating reliable and sterile medical products. As the healthcare field continues to evolve, PVA films remain a versatile and indispensable material, contributing to their significant presence in the medical application segment of the market.

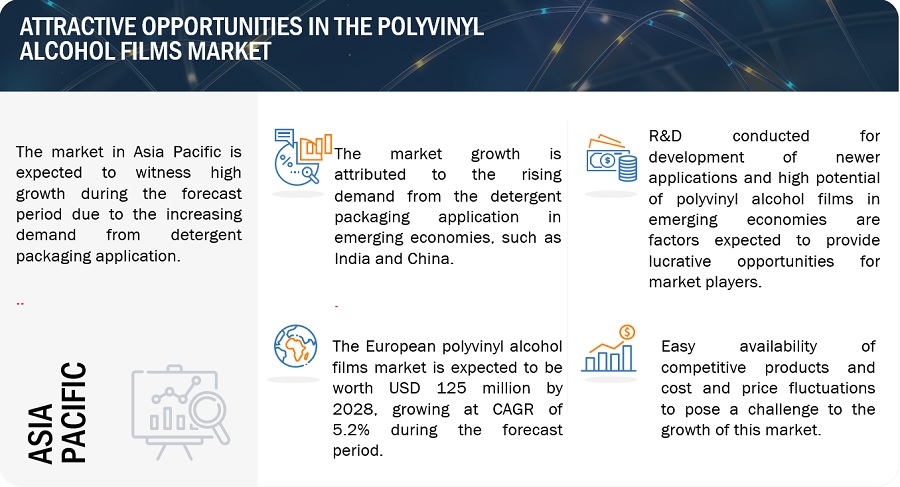

Asia Pacific is expected to be the fastest growing market during the forecast period.

Asia Pacific is poised to be the fastest-growing market for polyvinyl alcohol (PVA) films during the forecast period due to a convergence of factors. The region's burgeoning middle class is driving increased consumer demand for packaged goods, ranging from food to pharmaceuticals, necessitating innovative and sustainable packaging solutions. Furthermore, the regulatory environment is increasingly favouring eco-friendly packaging, and PVA films align well with these requirements as they are biodegradable and eco-conscious. The region's robust manufacturing and industrial base, particularly in countries like China and India, is propelling the adoption of PVA films for diverse applications, including textiles, electronics, and agriculture. This, coupled with a growing awareness of PVA film benefits in reducing plastic waste, positions the Asia Pacific as a hotbed for market expansion in the coming years. Companies investing in this region may tap into the burgeoning demand and capitalize on the sustainability trend.

To know about the assumptions considered for the study, download the pdf brochure

Polyvinyl Alcohol Films Market Players

The polyvinyl alcohol films market is dominated by a few major players that have a wide regional presence. The key players in the polyvinyl alcohol films market are Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), BASF SE (Germany), and Chang Chun Group (Taiwan), Japan VAM & POVAL Co., Ltd. (Japan), Polysciences, Inc. (US), Arrow GreenTech Limited (India), Aicello Corporation (Japan), Ecomavi (Italy). In the last few years, the companies have adopted growth strategies such as Product launches, Investments, Acquisitions, and expansions to capture a larger share of the polyvinyl alcohol films market.

Polyvinyl Alcohol Films Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2020-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion), Volume(Ton) |

|

Segments |

Grade Type, Application, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Mitsubishi Chemical Corporation (Japan), BASF SE (Germany), Chang Chun Group (Taiwan), Japan VAM & POVAL Co., Ltd. (JAPAN), Polysciences, Inc. (US), Arrow GreenTech Limited (India), Aicello Corporation (Japan) Ecomavi (Italy) |

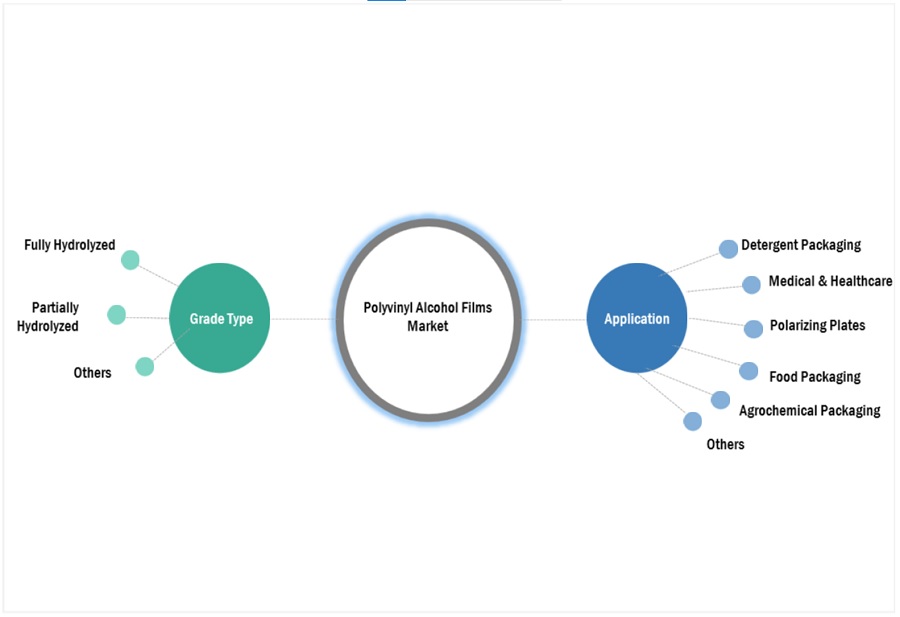

This report categorizes the global polyvinyl alcohol films market based on grade type, application, and region.

On the basis of grade type, the polyvinyl alcohol films market has been segmented as follows:

- Fully Hydrolyzed

- Partially Hydrolyzed

- Others

On the basis of application, the polyvinyl alcohol films market has been segmented as follows:

- Detergent Packaging

- Medical & Healthcare

- Polarizing Plates

- Food Packaging

- Agrochemical Packaging

- Others

On the basis of region, the polyvinyl alcohol films market has been segmented as follows:

- Asia Pacific

- Europe

- North America

- Middle East & Africa

- South America

Recent Developments

- In August 2022, Sekisui Chemical Co., Ltd. has announced to expand the PVOH manufacturing capacity to meet the growing needs of its downstream customers. With this expansion Sekisui Chemical Co., Ltd. remains committed to meeting customers’ needs with high quality products. This expansion will increase Sekisui’s PVOH capacity by as much as 25%.

- In May 2021, Mitsubishi Chemical Corporation has completed the acquisition of major shares of Nakai Industrial Co., Ltd., a film coating manufacturer. This acquisition enables Mitsubishi Chemical Corporation to quickly respond to the sophisticated demands of a wide range of customers for polyester films and polyvinyl alcohol films.

- In February 2020, Mitsubishi Chemical Corporation has completed the acquisition of European Engineering Plastics, a recycling company. This acquisition will allow MCC to establish an integrated business model for engineering plastics, and polyvinyl alcohol films, from manufacturing to sales, machining, collection, and reuse.

- In February 2023, Mitsubishi Chemical Corporation announces that it has decided to establish a new facility at the Okayama Plant to enhance the production capacity of GOHSENX and Nichigo G-Polymer, specialty brands of polyvinyl alcohol resin (PVOH resin). The facility is scheduled to start operation in October 2024.

Frequently Asked Questions (FAQ):

What are the factors influencing the growth of the polyvinyl alcohol films market?

The growth of this market can be attributed to the growing demand for sustainable packaging, versatile applications in various industries, and growing awareness of their biodegradability and protective qualities.

Which are the key applications driving the polyvinyl alcohol films market?

The key applications driving the demand for polyvinyl alcohol films are food packaging, detergent packaging, medical, agrochemical packaging, and others.

Who are the major manufacturers?

Major manufacturers include Kuraray Co. (Japan), Sekisui Chemical Co., Ltd. (Japan), Arrow GreenTech Limited (India), Mitsubishi Chemical Corporation (Japan), Ecomavi (Italy) among others.

What will be the growth prospects of the polyvinyl alcohol films market?

Rise in technological advancements, and rising demand from packaging application are some of the driving factors.

What will be the growth prospects of the polyvinyl alcohol films market in terms of CAGR in next five years?

The CAGR of the market will be in between 5-6% in next five years. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing environmental awareness and regulations regarding plastic waste and pollution- Rising demand from packaging application- Increasing technological advancements- Rising demand from textile industry- Extensive use as water-soluble embroidery backing- Aid in pattern creation and fabric manipulation- Reduced waste and improved efficiencyRESTRAINTS- Low heat resistance of polyvinyl alcohol films- High moisture sensitivity limiting use in various industries- Higher cost may restrain market growthOPPORTUNITIES- Recycling and circular economy initiatives- Adoption of advanced manufacturing techniques- Rising demand from medical and healthcare industryCHALLENGES- Rising environmental concerns- Performance variability poses a significant challenge

- 6.1 INTRODUCTION

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSTRENDS IN POLYVINYL ALCOHOL FILMS MARKET

-

6.3 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND, BY APPLICATIONAVERAGE SELLING PRICE TREND, BY GRADE TYPEAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 APPLICATIONS (USD/TON)

-

6.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND CONSUMERS

-

6.5 ECOSYSTEM/MARKET MAP

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 PATENT ANALYSISMETHODOLOGYPATENTS GRANTED, 2012–2022PATENT PUBLICATION TRENDSINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION-WISE PATENT ANALYSISTOP COMPANIES/APPLICANTSTOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

-

6.8 TRADE ANALYSISIMPORT-EXPORT SCENARIO OF POLYVINYL ALCOHOL FILMS MARKET

- 6.9 KEY CONFERENCES & EVENTS IN 2023–2024

-

6.10 TARIFF AND REGULATORY LANDSCAPETARIFFS AND REGULATIONS RELATED TO POLYVINYL ALCOHOL FILMS MARKETREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS- North America- Europe- Asia Pacific

-

6.11 PORTER'S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.12 KEY STAKEHOLDERS & BUYING CRITERIAKEY STAKEHOLDERSBUYING CRITERIA

-

6.13 MACROECONOMIC FACTORSGLOBAL GDP TRENDS

-

6.14 CASE STUDY ANALYSISHYDROGEL-BASED POLYVINYL ALCOHOL TO PRODUCE 3D SCAFFOLDS COMPOSED OF MACRO AND MICRO-SCALE STRUCTURESPOLYVINYL ALCOHOL HYDROGELS ACHIEVE SITE-SPECIFIC DELIVERY OF SMALL OR LARGE MOLECULAR WEIGHT DRUGS IN DRUG DELIVERY SYSTEMS

- 7.1 INTRODUCTION

-

7.2 FULLY HYDROLYZEDEXCEPTIONAL WATER SOLUBILITY, BIODEGRADABILITY, AND BARRIER PROPERTIES TO DRIVE MARKET

-

7.3 PARTIALLY HYDROLYZEDCONTROLLED SOLUBILITY ENABLING GRADUAL DISINTEGRATION TO DRIVE MARKET

- 7.4 OTHERS

- 8.1 INTRODUCTION

-

8.2 DETERGENT PACKAGINGREDUCTION OF ENVIRONMENTAL IMPACT TO DRIVE MARKET

-

8.3 MEDICAL & HEALTHCAREEASE OF PROCESSING AND FABRICATION OF DIVERSE MEDICAL DEVICES TO DRIVE MARKET

-

8.4 POLARIZING PLATESDEMAND FOR LIQUID CRYSTAL DISPLAYS, OPTICAL FILTERS, AND SUNGLASSES TO DRIVE MARKET

-

8.5 FOOD PACKAGINGEXCELLENT PRESERVATION OF FRESHNESS AND QUALITY TO DRIVE MARKET

-

8.6 AGROCHEMICAL PACKAGINGCONTROLLED-RELEASE FORMULATIONS TO DRIVE MARKET

- 8.7 OTHERS

- 9.1 INTRODUCTION

-

9.2 ASIA PACIFICIMPACT OF RECESSION ON ASIA PACIFICCHINA- Demand from packaging and consumer goods industries to drive marketJAPAN- Research on development of superior polyvinyl alcohol film grades to drive marketINDIA- Vibrant agriculture sector to boost marketSOUTH KOREA- Supportive government policies to drive marketREST OF ASIA PACIFIC

-

9.3 NORTH AMERICAIMPACT OF RECESSION ON NORTH AMERICAUS- Rising demand from agriculture industry to drive marketCANADA- Stringent regulations to drive marketMEXICO- Growing R&D activities to drive market

-

9.4 EUROPEIMPACT OF RECESSION ON EUROPEGERMANY- Emphasis on eco-friendly packaging and sustainable practices to drive marketUK- Growing demand for embroidery application to drive marketFRANCE- Innovation and research to drive marketITALY- Stringent regulations on single-use plastics and emphasis on reducing food waste to drive marketSPAIN- Demand from food packaging, textiles, and pharmaceutical industries to drive marketREST OF EUROPE

-

9.5 SOUTH AMERICAIMPACT OF RECESSION ON SOUTH AMERICABRAZIL- Agricultural sector to drive marketARGENTINA- Packaging industry to drive marketREST OF SOUTH AMERICA

-

9.6 MIDDLE EAST & AFRICAIMPACT OF RECESSION ON MIDDLE EAST & AFRICASAUDI ARABIA- Rising focus on construction quality and durability to drive marketSOUTH AFRICA- Burgeoning textile sector to drive marketREST OF MIDDLE EAST & AFRICA

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

-

10.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS

- 10.4 REVENUE ANALYSIS

-

10.5 COMPANY EVALUATION MATRIX, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT ANALYSIS

-

10.6 STARTUP/SME EVALUATION MATRIX, 2022PROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKINGPOLYVINYL ALCOHOL FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS STARTUPS/SMES

-

10.7 COMPETITIVE SCENARIO AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

11.1 MAJOR PLAYERSKURARAY CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewSEKISUI CHEMICAL CO., LTD.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMITSUBISHI CHEMICAL CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewBASF SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewCHANG CHUN GROUP- Business overview- Products/Services/Solutions offered- MnM viewJAPAN VAM & POVAL CO.,LTD.- Business overview- Products/Services/Solutions offered- MnM viewPOLYSCIENCES, INC.- Business overview- Products/Services/Solutions offered- MnM viewARROW GREENTECH LTD.- Business overview- Products/Services/Solutions offered- MnM viewAICELLO CORPORATION- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewECOMAVI- Business overview- Products/Services/Solutions offered- MnM view

-

11.2 OTHER PLAYERSCORTEC CORPORATIONAMC (UK) LTD.ANHUI WANWEI GROUP CO., LTD.WEIFANG HUAWEI NEW MATERIALS TECHNOLOGY CO., LTD.SPECTRUM CHEMICAL MANUFACTURING CORP.JIANGMEN PROUDLY WATER-SOLUBLE PLASTIC CO., LTD.CHANGZHOU GREENCRADLELAND MACROMOLECULE MATERIALS CO., LTD.NIPPON GOHSEIAMTREX NATURE CARE PVT. LTD.JEVA PACKAGING LIMITEDKK NONWOVENSJOYFORCE CHEMICAL INDUSTRIAL CO. LTD.MONOSOL LLCBARENTZNOBLE INDUSTRIES

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS

- TABLE 1 POLYVINYL ALCOHOL FILMS MARKET: INCLUSIONS & EXCLUSIONS

- TABLE 2 POLYVINYL ALCOHOL FILMS: MARKET SNAPSHOT

- TABLE 3 AVERAGE SELLING PRICE, BY REGION, 2020–2028 (USD/TON)

- TABLE 4 AVERAGE SELLING PRICE, BY APPLICATION, 2020–2028 (USD/TON)

- TABLE 5 AVERAGE SELLING PRICE, BY GRADE TYPE, 2020–2028 (USD/TON)

- TABLE 6 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 APPLICATIONS (USD/TON)

- TABLE 7 POLYVINYL ALCOHOL FILMS MARKET: ECOSYSTEM

- TABLE 8 TOTAL NUMBER OF PATENTS

- TABLE 9 TOP 10 PATENT OWNERS

- TABLE 10 IMPORT TRADE DATA FOR POLYVINYL ALCOHOL FILM PRODUCTS

- TABLE 11 EXPORT TRADE DATA FOR POLYVINYL ALCOHOL FILM PRODUCTS

- TABLE 12 POLYVINYL ALCOHOL FILMS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 13 TARIFFS RELATED TO POLYVINYL ALCOHOL FILMS MARKET

- TABLE 14 GLOBAL: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 POLYVINYL ALCOHOL FILMS MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP 3 APPLICATIONS

- TABLE 20 KEY BUYING CRITERIA FOR FIVE APPLICATIONS

- TABLE 21 PROJECTED REAL GDP GROWTH (ANNUAL PERCENTAGE CHANGE) OF KEY COUNTRIES, 2018–2025

- TABLE 22 POLYVINYL ALCOHOL FILMS MARKET, BY GRADE TYPE, 2020–2022 (USD MILLION)

- TABLE 23 POLYVINYL ALCOHOL FILMS MARKET, BY GRADE TYPE, 2023–2028 (USD MILLION)

- TABLE 24 POLYVINYL ALCOHOL FILMS MARKET, BY GRADE TYPE, 2020–2022 (TON)

- TABLE 25 POLYVINYL ALCOHOL FILMS MARKET, BY GRADE TYPE, 2023–2028 (TON)

- TABLE 26 POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 27 POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 29 POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 30 POLYVINYL ALCOHOL FILMS MARKET, BY REGION, 2020–2022 (USD MILLION)

- TABLE 31 POLYVINYL ALCOHOL FILMS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POLYVINYL ALCOHOL FILMS MARKET, BY REGION, 2020–2022 (TON)

- TABLE 33 POLYVINYL ALCOHOL FILMS MARKET, BY REGION, 2023–2028 (TON)

- TABLE 34 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 35 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 36 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 37 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 38 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 39 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 40 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 41 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 42 CHINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 43 CHINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 44 CHINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 45 CHINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 46 JAPAN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 47 JAPAN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 48 JAPAN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 49 JAPAN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 50 INDIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 51 INDIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 52 INDIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 53 INDIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 54 SOUTH KOREA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 55 SOUTH KOREA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 56 SOUTH KOREA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 57 SOUTH KOREA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 58 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 59 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 60 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 61 REST OF ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 62 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 63 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 64 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 65 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 66 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 67 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 68 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 69 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 70 US: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 71 US: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 72 US: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 73 US: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 74 CANADA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 75 CANADA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 76 CANADA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 77 CANADA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 78 MEXICO: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 79 MEXICO: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 80 MEXICO: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 81 MEXICO: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 82 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 83 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 85 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 86 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 87 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 88 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 89 EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 90 GERMANY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 91 GERMANY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 92 GERMANY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 93 GERMANY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 94 UK: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 95 UK: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 96 UK: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 97 UK: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 98 FRANCE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 99 FRANCE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 FRANCE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 101 FRANCE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 102 ITALY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 103 ITALY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 ITALY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 105 ITALY: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 106 SPAIN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 107 SPAIN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 SPAIN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 109 SPAIN: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 110 REST OF EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 111 REST OF EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 112 REST OF EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 113 REST OF EUROPE: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 114 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 115 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 116 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 117 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 118 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 119 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 121 SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 122 BRAZIL: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 123 BRAZIL: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 BRAZIL: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 125 BRAZIL: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 126 ARGENTINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 127 ARGENTINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 ARGENTINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 129 ARGENTINA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 130 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 131 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 133 REST OF SOUTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 134 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (USD MILLION)

- TABLE 135 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 136 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2020–2022 (TON)

- TABLE 137 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY COUNTRY, 2023–2028 (TON)

- TABLE 138 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 139 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 141 MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 142 SAUDI ARABIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 143 SAUDI ARABIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 SAUDI ARABIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 145 SAUDI ARABIA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 146 SOUTH AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 147 SOUTH AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 148 SOUTH AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 149 SOUTH AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 150 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (USD MILLION)

- TABLE 151 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2020–2022 (TON)

- TABLE 153 REST OF MIDDLE EAST & AFRICA: POLYVINYL ALCOHOL FILMS MARKET, BY APPLICATION, 2023–2028 (TON)

- TABLE 154 OVERVIEW OF STRATEGIES ADOPTED BY KEY POLYVINYL ALCOHOL FILM MANUFACTURERS

- TABLE 155 POLYVINYL ALCOHOL FILMS MARKET: DEGREE OF COMPETITION

- TABLE 156 APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 157 OTHERS APPLICATION FOOTPRINT (10 COMPANIES)

- TABLE 158 GRADE TYPE FOOTPRINT (10 COMPANIES)

- TABLE 159 REGIONAL FOOTPRINT (10 COMPANIES)

- TABLE 160 POLYVINYL ALCOHOL FILMS MARKET: DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 161 APPLICATION BENCHMARKING OF SME PLAYERS (15 COMPANIES)

- TABLE 162 KEY COMPANY APPLICATION BENCHMARKING OF SME PLAYERS (15 COMPANIES)

- TABLE 163 GRADE TYPE BENCHMARKING OF SME PLAYERS (15 COMPANIES)

- TABLE 164 REGION BENCHMARKING OF SME PLAYERS (15 COMPANIES)

- TABLE 165 POLYVINYL ALCOHOL FILMS MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 166 POLYVINYL ALCOHOL FILMS MARKET: DEALS (2020–2023)

- TABLE 167 POLYVINYL ALCOHOL FILMS MARKET: OTHER DEVELOPMENTS (2019–2023)

- TABLE 168 KURARAY CO., LTD.: COMPANY OVERVIEW

- TABLE 169 KURARAY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 170 SEKISUI CHEMICAL CO., LTD.: COMPANY OVERVIEW

- TABLE 171 SEKISUI CHEMICAL CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 172 SEKISUI CHEMICAL CO., LTD.: OTHERS

- TABLE 173 MITSUBISHI CHEMICAL CORPORATION: COMPANY OVERVIEW

- TABLE 174 MITSUBISHI CHEMICAL CORPORATION: PRODUCTS/SERVICES/ SOLUTIONS OFFERED

- TABLE 175 MITSUBISHI CHEMICAL CORPORATION: DEALS

- TABLE 176 MITSUBISHI CHEMICAL CORPORATION: OTHERS

- TABLE 177 BASF SE: COMPANY OVERVIEW

- TABLE 178 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 179 BASF SE: OTHERS

- TABLE 180 CHANG CHUN GROUP: COMPANY OVERVIEW

- TABLE 181 CHANG CHUN GROUP: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 182 JAPAN VAM & POVAL CO.,LTD.: COMPANY OVERVIEW

- TABLE 183 JAPAN VAM & POVAL CO.,LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 184 POLYSCIENCES, INC.: COMPANY OVERVIEW

- TABLE 185 POLYSCIENCES, INC.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 186 ARROW GREENTECH LTD.: COMPANY OVERVIEW

- TABLE 187 ARROW GREENTECH LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 AICELLO CORPORATION: COMPANY OVERVIEW

- TABLE 189 AICELLO CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 AICELLO CORPORATION: OTHERS

- TABLE 191 ECOMAVI: COMPANY OVERVIEW

- TABLE 192 ECOMAVI: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 193 CORTEC CORPORATION: COMPANY OVERVIEW

- TABLE 194 AMC (UK) LTD.: COMPANY OVERVIEW

- TABLE 195 ANHUI WANWEI GROUP CO., LTD.: COMPANY OVERVIEW

- TABLE 196 WEIFANG HUAWEI NEW MATERIALS TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 197 SPECTRUM CHEMICAL MANUFACTURING CORP.: COMPANY OVERVIEW

- TABLE 198 JIANGMEN PROUDLY WATER-SOLUBLE PLASTIC CO., LTD.: COMPANY OVERVIEW

- TABLE 199 CHANGZHOU GREENCRADLELAND MACROMOLECULE MATERIALS CO., LTD.: COMPANY OVERVIEW

- TABLE 200 NIPPON GOHSEI: COMPANY OVERVIEW

- TABLE 201 AMTREX NATURE CARE PVT. LTD.: COMPANY OVERVIEW

- TABLE 202 JEVA PACKAGING LIMITED: COMPANY OVERVIEW

- TABLE 203 KK NONWOVENS: COMPANY OVERVIEW

- TABLE 204 JOYFORCE CHEMICAL INDUSTRIAL CO. LTD.: COMPANY OVERVIEW

- TABLE 205 MONOSOL LLC: COMPANY OVERVIEW

- TABLE 206 BARENTZ: COMPANY OVERVIEW

- TABLE 207 NOBLE INDUSTRIES: COMPANY OVERVIEW

- FIGURE 1 POLYVINYL ALCOHOL FILMS MARKET SEGMENTATION

- FIGURE 2 POLYVINYL ALCOHOL FILMS MARKET: RESEARCH DESIGN

- FIGURE 3 MARKET SIZE ESTIMATION: POLYVINYL ALCOHOL FILMS

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 POLYVINYL ALCOHOL FILMS MARKET: DATA TRIANGULATION

- FIGURE 7 DEMAND-SIDE MARKET FORECAST

- FIGURE 8 ASIA PACIFIC ESTIMATED TO DOMINATE POLYVINYL ALCOHOL FILMS MARKET IN 2023

- FIGURE 9 DETERGENT PACKAGING SEGMENT TO LEAD POLYVINYL ALCOHOL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 10 PARTIALLY HYDROLYZED SEGMENT TO LEAD POLYVINYL ALCOHOL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 11 INCREASING DEMAND FROM PACKAGING AND MEDICAL & HEALTHCARE INDUSTRIES TO DRIVE MARKET DURING FORECAST PERIOD

- FIGURE 12 ASIA PACIFIC MARKET TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 13 INDIA TO BE FASTEST-GROWING POLYVINYL ALCOHOL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 14 PARTIALLY HYDROLYZED SEGMENT TO DOMINATE MARKET BY 2028

- FIGURE 15 DETERGENT PACKAGING SEGMENT TO LEAD MARKET IN 2028

- FIGURE 16 DETERGENT PACKAGING SEGMENT AND CHINA ACCOUNTED FOR SIGNIFICANT SHARES IN 2022

- FIGURE 17 POLYVINYL ALCOHOL FILMS MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 18 AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 19 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 APPLICATIONS

- FIGURE 20 OVERVIEW OF POLYVINYL ALCOHOL FILMS MARKET VALUE CHAIN

- FIGURE 21 POLYVINYL ALCOHOL FILMS MARKET: ECOSYSTEM/MARKET MAP

- FIGURE 22 TOTAL NUMBER OF PATENTS REGISTERED DURING LAST TEN YEARS

- FIGURE 23 LEGAL STATUS OF PATENTS

- FIGURE 24 TOP JURISDICTIONS FOR POLYVINYL ALCOHOL FILM PATENTS

- FIGURE 25 TOP 10 COMPANIES/APPLICANTS WITH HIGHEST NUMBER OF PATENTS

- FIGURE 26 IMPORT TRADE DATA FOR POLYVINYL ALCOHOL FILM PRODUCTS

- FIGURE 27 EXPORT TRADE DATA FOR POLYVINYL ALCOHOL FILM PRODUCTS

- FIGURE 28 PORTER’S FIVE FORCES ANALYSIS: POLYVINYL ALCOHOL FILMS MARKET

- FIGURE 29 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN TOP 3 APPLICATIONS

- FIGURE 30 KEY BUYING CRITERIA FOR TOP FIVE APPLICATIONS

- FIGURE 31 PARTIALLY HYDROLYZED SEGMENT TO LEAD POLYVINYL ALCOHOL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 32 DETERGENT PACKAGING SEGMENT TO LEAD POLYVINYL ALCOHOL FILMS MARKET DURING FORECAST PERIOD

- FIGURE 33 POLYVINYL ALCOHOL FILMS MARKET IN INDIA TO RECORD HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: POLYVINYL ALCOHOL FILMS MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: POLYVINYL ALCOHOL FILMS MARKET SNAPSHOT

- FIGURE 36 EUROPE: POLYVINYL ALCOHOL FILMS MARKET SNAPSHOT

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN POLYVINYL ALCOHOL FILMS MARKET, 2022

- FIGURE 38 POLYVINYL ALCOHOL FILMS MARKET: SHARE OF KEY PLAYERS

- FIGURE 39 REVENUE OF KEY PLAYERS, 2020–2024

- FIGURE 40 POLYVINYL ALCOHOL FILMS MARKET: COMPANY EVALUATION MATRIX, 2022

- FIGURE 41 POLYVINYL ALCOHOL FILMS MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 42 KURARAY CO., LTD.: COMPANY SNAPSHOT

- FIGURE 43 SEKISUI CHEMICAL CO., LTD.: COMPANY SNAPSHOT

- FIGURE 44 BASF SE: COMPANY SNAPSHOT

- FIGURE 45 ARROW GREENTECH LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the polyvinyl alcohol films market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, certified publications, articles from recognized authors, gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key polyvinyl alcohol films, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

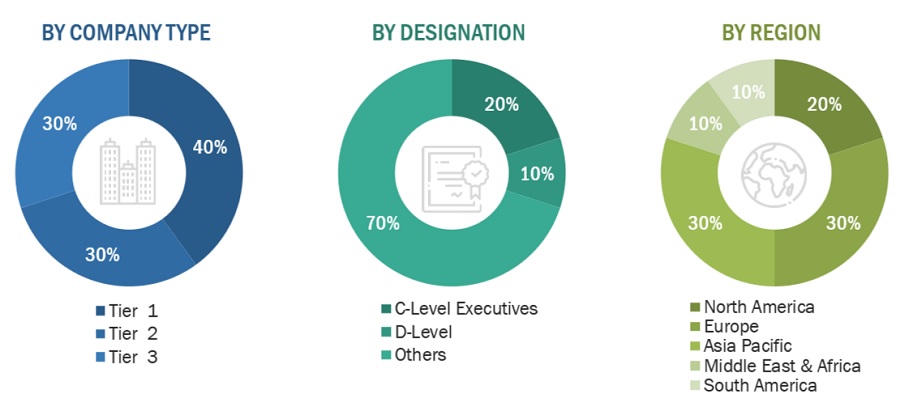

The polyvinyl alcohol films market comprises several stakeholders in the value chain, which include raw material suppliers, manufacturers, and end users. Various primary sources from the supply and demand sides of the polyvinyl alcohol films market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the polyvinyl alcohol films industry.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to chemistry, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of polyvinyl alcohol films and future outlook of their business which will affect the overall market.

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2022 available in the public domain, product portfolios, and geographical presence.

Other designations include sales representatives, production heads, and technicians.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the size of various submarkets for polyvinyl alcohol films for each region. The research methodology used to estimate the market size included the following steps:

- The key players in the industry have been identified through extensive secondary research.

- The supply chain of the industry has been determined through primary and secondary research.

- The global market was then segmented into five major regions and validated by industry experts.

- All percentage shares, splits, and breakdowns based on grade type, application, and country were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data. This data was consolidated and added with detailed inputs and analysis and presented in this report.

Polyvinyl Alcohol Films Market: Bottum-Up Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Polyvinyl Alcohol Films Market: Top-Down Approach

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Data Triangulation

After arriving at the total market size from the estimation process polyvinyl alcohol films above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Polyvinyl alcohol films are a class of versatile polymer-based materials widely used in various industries such as textiles and packaging. These films are derived from the hydrolysis of polyvinyl acetate, resulting in a water-soluble and biodegradable product. PVA films possess remarkable barrier properties against moisture and oxygen, making them ideal for packaging applications in the food, pharmaceutical, and agrochemical industries. They are known for their capacity to create a highly hydrated environment that fosters cell attachment and proliferation, making them invaluable in tissue engineering. Their adaptability to 3D bioprinting and electrospinning technologies further enhances their applicability. PVA films align with the growing global emphasis on sustainability, serving as a preferred eco-friendly choice for product preservation and a broad range of other applications across diverse sectors.

Key Stakeholders

- Polyvinyl alcohol films Manufacturers

- Polyvinyl alcohol films Traders, Distributors, and Suppliers

- Raw Type Suppliers

- Government and Private Research Organizations

- Associations and Industrial Bodies

- R&D Institutions

- Environmental Support Agencies

Report Objectives

- To define, describe, and forecast the size of the polyvinyl alcohol films market, in terms of value and volume.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market.

- To estimate and forecast the market size based on grade type, application, and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Tariff & Regulations

- Regulations and impact on polyvinyl alcohol films market

Growth opportunities and latent adjacency in Polyvinyl Alcohol Films Market