Polyurethane Composites Market by Type (Glass, Carbon), Manufacturing Process (Lay-Up, Pultrusion, Resin Transfer Molding), End-Use Industry (Transportation, Building & Construction, Electrical & Electronics), Region - Global Forecast to 2026

[173 Pages Report] The global polyurethane composites market is anticipated to grow from USD 515.0 Million in 2016 to USD 909.8 Million by 2026, at a CAGR of 5.9% from 2016 to 2026.

The objectives of this study are:

- To define, describe, and forecast the polyurethane composites market based on fiber type, manufacturing process, end-use industry, and region

- To estimate and forecast the polyurethane composites market size, in terms of value (USD million) and volume (kilotons)

- To estimate and forecast the polyurethane composites market based on fiber type, manufacturing process, end–use industry in North America, Europe, Asia- Pacific, Middle East & Africa, and South America

- To identify and analyze the key growth drivers, restraints, threats, and opportunities that are influencing the polyurethane composites market

- To strategically identify and profile key market players and analyze their core competencies in each application of the markets

- To track and analyze recent market developments and competitive strategies, such as partnerships, agreements, collaborations, mergers & acquisitions, new product developments, and expansions in the polyurethane composites market

- Market share analysis of the leading market players that are operating in polyurethane composites market

The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2026

- Forecast Period – 2016 to 2026

- For company profiles in the report, 2015 has been considered as the base year. In certain cases, wherein information is unavailable for the base year, the years prior to it have been considered.

Research Methodology

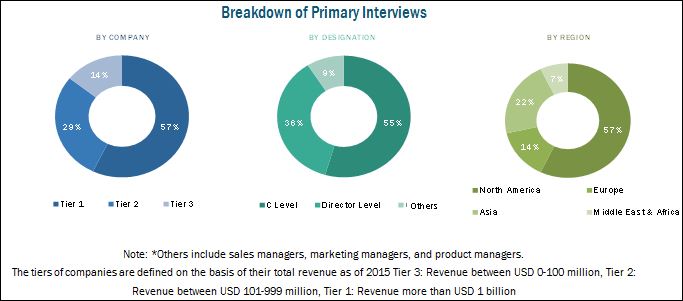

This study aims to estimate the polyurethane composites market size for 2016 and projects its demand till 2026. It also provides a detailed qualitative and quantitative analysis of the polyurethane composites. Various secondary sources that include directories, industry journals, various associations (such as ACMA, EuCIA, Composite Panel Association, American Society for Composites, BCS) and databases have been used to identify and collect information useful for this extensive commercial study of the polyurethane composites market. Primary sources, such as experts from related industries and suppliers have been interviewed to obtain and verify critical information as well as to assess future prospects of the polyurethane composites market. Breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Companies operating in the global polyurethane composites market include BASF SE (Germany), Bayer AG (Germany), Hexcel Corporation (U.S.), Huntsman Corporation (U.S.), SGL Group (Germany), Toray Industries, Inc. (Japan), The Dow Chemical Company (U.S.), Wanhua Chemical Group Co., Ltd. (China), Sekisui Chemical Co., Ltd. (Japan), Owens Corning (U.S.), and SGL Group (Germany) among others.

Key Target Audience

- Manufacturers of Polyurethane Composites

- Traders, Distributors, and Suppliers of Polyurethane Composites

- End-Use Industries Operating in Polyurethane Composites Supply Chain

- Government and Research Organizations

- Investment Banks and Private Equity Firms

Scope of the Report: This research report categorizes the global polyurethane composites market on the basis of fiber type, manufacturing process, end-use industry, and region, forecasting revenues as well as analyzing trends in each of the sub-markets.

On the basis of Fiber Type:

- Glass Fiber Polyurethane Composites

- Carbon Fiber Polyurethane Composites

- Others

On the basis of Manufacturing Process:

- Lay-up

- Pultrusion

- Resin Transfer Molding

- Injection Molding

- Filament Winding

- Compression Molding

- Others

On the basis of End-Use Industry:

- Transportation

- Building & Construction

- Electrical & Electronics

- Wind Power Energy

- Petrochemical

- Sports & Leisure

- Aerospace & Defense

- Others

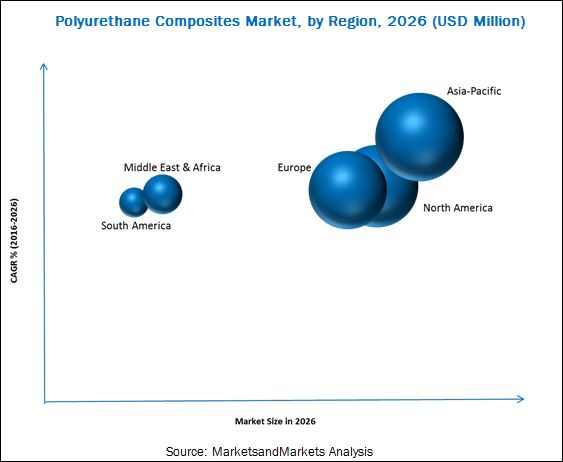

On the basis of Region:

- Asia-Pacific

- Europe

- North America

- Middle East & Africa

- South America

Available Customizations

End-Use Industry Analysis

- Further breakdown of the end-use industry into sub segments, wherein polyurethane composites are used

Country Analysis

- Value and volume analysis of polyurethane composites consumption in terms of manufacturing process and fiber type

The polyurethane composites market is estimated at USD 515.0 Million in 2016, and is projected to reach USD 909.8 Million by 2026, at a CAGR of 5.9% from 2016 to 2021. The rising adoption of polyurethane composites across various end-use industries such as transportation, building & construction, electrical & electronics, and wind power energy is expected to fuel the growth of the polyurethane composites market.

The transportation segment of the polyurethane composites market is estimated to lead the polyurethane composites market in 2016, and is also projected to grow at the highest CAGR from 2016 to 2021, in terms of value. The increasing adoption of polyurethane composites in the development of lightweight automotive components that have superior mechanical and physical properties to that of competing materials is anticipated to drive the demand for polyurethane composites in the transportation industry.

The glass fiber segment is estimated to account for a largest share of the polyurethane composites market in 2016. The growth of the segment can be attributed to superior properties, such as strength, flexibility, durability, stability, light weight as well as resistance to heat, temperature, and moisture of glass fiber polyurethane composites. These lead to the increasing use of glass fiber polyurethane composites in the manufacturing of various products across industries.

The lay-up manufacturing segment is estimated to account for a largest share of the polyurethane composites market in 2016. Low cost and ease of processing are the major reasons which make lay-up one of the preferred manufacturing process for polyurethane composites.

Asia-Pacific is anticipated to be the largest market for polyurethane composites. The growth is attributed by high economic growth rate, followed by heavy investments across various industries, such as automotive, building & construction, electrical & electronics, and wind power energy. Additionally, initiatives taken by various governments for the inflow of foreign investments to support the domestic demand also anticipate to drive the polyurethane composites demand within this region.

The factors inhibiting the growth of the polyurethane composites market are, slow economic recovery of the European countries and North America, and recyclability issues. Key market players operating in the global polyurethane composites market, such as BASF SE (Germany), Bayer AG (Germany), Hexcel Corporation (U.S.), Huntsman Corporation (U.S.), SGL Group (Germany), Toray Industries, Inc. (Japan), The Dow Chemical Company (U.S.), Wanhua Chemical Group Co., Ltd. (China), Sekisui Chemical Co., Ltd. (Japan), Owens Corning (U.S.), and SGL Group (Germany) among others, have adopted various strategies to increase their market shares. Expansions, merger & acquisitions, new product launches, agreements, and research & development are some of the key strategies adopted by market players to achieve growth in the global polyurethane composites market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 16)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Stakeholders

1.6 Limitations

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.2 Secondary Data

2.2.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.3 Break Down of Primaries

2.3 Market Size Estimation

2.4 Market Breakdown and Data Triangulation

2.5 Assumptions

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 33)

4.1 Attractive Market Opportunities in the Polyurethane Composites Market

4.2 Polyurethane Composites Market, By Fiber Type

4.3 Polyurethane Composites Market

4.4 Polyurethane Composites Market Growth

4.5 Polyurethane Composites Market, By End-Use Industry

4.6 Polyurethane Composites Market: Emerging vs Developed Nations

5 Market Overview (Page No. - 37)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Adoption of Polyurethane Composites in the Manufacturing of Fuel Efficient Vehicles

5.3.1.2 Increasing Usage of Polyurethane Composite-Based Products in the Wind Power Energy Industry

5.3.2 Restraints

5.3.2.1 High Processing and Manufacturing Cost of Polyurethane Composites

5.3.3 Opportunities

5.3.3.1 Increasing Demand for Polyurethane Composites From Emerging Economies

5.3.3.2 Growing Adoption of Bio-Based Composites

5.3.4 Challenges

5.3.4.1 Issues Related to Recycling Polyurethane Composites

5.4 Cost Structure Analysis

6 Industry Trends (Page No. - 46)

6.1 Introduction

6.2 Revenue Pocket Matrix

6.3 Economic Indicators

6.3.1 Industry Outlook

6.3.1.1 Automotive

6.3.1.2 Construction

6.3.1.3 Wind Energy

6.3.1.4 Aerospace Industry Trend

7 Polyurethane Composites Market, By Fiber Type (Page No. - 52)

7.1 Introduction

7.2 Glass Fiber Polyurethane Composites

7.3 Carbon Fiber Polyurethane Composites

7.4 Others

8 Polyurethane Composites Market, By Manufacturing Process (Page No. - 60)

8.1 Introduction

8.2 Lay-Up

8.3 Pultrusion

8.4 Resin Transfer Molding

8.5 Injection Molding

8.6 Filament Winding

8.7 Compression Molding

8.8 Others

9 Polyurethane Composites Market, By End-Use Industry (Page No. - 70)

9.1 Introduction

9.2 Transportation

9.2.1 Interiors

9.2.2 Exteriors

9.3 Building & Construction

9.3.1 Indoor Application

9.3.2 Outdoor Application

9.4 Electrical & Electronics

9.4.1 Electronics Components

9.5 Wind Power Energy

9.5.1 Blades

9.5.2 Others

9.6 Petrochemical

9.6.1 Pipes

9.6.2 Tanks

9.7 Sports & Leisure

9.7.1 Sports

9.7.2 Leisure

9.8 Aerospace & Defense

9.8.1 Commercial

9.8.2 Military

9.9 Others

9.9.1 Marine

9.9.2 Consumer Durables

10 Regional Analysis (Page No. - 87)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 Italy

10.3.3 U.K.

10.3.4 Russia

10.3.5 France

10.3.6 Spain

10.3.7 Turkey

10.3.8 Rest of Europe

10.4 Asia-Pacific

10.4.1 China

10.4.2 Japan

10.4.3 India

10.4.4 South Korea

10.4.5 Australia & New Zealand

10.4.6 Indonesia

10.4.7 Rest of Asia-Pacific

10.5 South America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of South America

10.6 Middle East & Africa (MEA)

10.6.1 Saudi Arabia

10.6.2 South Africa

10.6.3 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 129)

11.1 Overview

11.2 Polyurethane Composites Market: Company Share Analysis

11.3 Expansions

11.4 Maximum Developments in 2012

11.5 Competitive Situation & Trends

11.5.1 Expansions

11.5.2 Mergers & Acquisitions

11.5.3 Partnerships, Agreements, and Joint Ventures

11.5.4 New Product Launches

12 Company Profiles (Page No. - 136)

(Overview, Products & Services, Strategies & Insights, Developments and MnM View)*

12.1 BASF SE

12.2 Bayer AG

12.3 Huntsman Corporation

12.4 The DOW Chemical Company

12.5 Wanhua Chemical Group Co., Ltd.

12.6 Toray Industries, Inc.

12.7 Hexcel Corporation

12.8 Sekisui Chemical Co., Ltd.

12.9 SGL Group

12.10 Owens Corning

12.11 Other Leading Players

*Details on Overview, Products & Services, Strategies & Insights, Developments and MnM View Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 166)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

13.7 Author Details

List of Tables (121 Tables)

Table 1 Global Polyurethane Composites Market Snapshot

Table 2 Polyurethane Composites Market, By End-Use Industry

Table 3 Polyurethane Composites Market, By Manufacturing Process

Table 4 Polyurethane Composites Market, By Fiber Type

Table 5 Polyurethane Composites Market, By Region

Table 6 European Union: Co2 Emissions Standards for New Passenger Cars, (Gram/Kilometer)

Table 7 Regional Cumulative Wind Energy Market Forecast, 2015-2020 (Megawatts)

Table 8 Polyurethane Composites: Cost Structure Analysis

Table 9 International Car Sales Outlook, 1990-2016 (F)

Table 10 Contribution of Construction Industry to GDP, 2014–2021 (USD Billion)

Table 11 Countrywide Installed Wind Power Capacity, Mw (2014 & 2015)

Table 12 Regional Installed Wind Power Capacity, Mw (2014 & 2015)

Table 13 New Aircraft Delivered, 2015

Table 14 Polyurethane Composites Market, By Fiber Type, 2014-2021 (Kilotons)

Table 15 Polyurethane Composites Market, By Fiber Type, 2014-2021 (USD Million)

Table 16 Glass Fiber Polyurethane Composites Segment, By Region, 2014-2021 (Kilotons)

Table 17 Glass Fiber Polyurethane Composites Segment, By Region, 2014-2021 (USD Million)

Table 18 Carbon Fiber Polyurethane Composites Segment, By Region, 2014-2021 (Kilotons)

Table 19 Carbon Fiber Polyurethane Composites Segment, By Region, 2014-2021 (USD Million)

Table 20 Other Segment, By Region, 2014-2021 (Kilotons)

Table 21 Others Segment, By Region, 2014-2021 (USD Million)

Table 22 Polyurethane Composites Market, By Manufacturing Process, 2014-2021 (Kilotons)

Table 23 Polyurethane Composites Market, By Manufacturing Process, 2014-2021 (USD Million)

Table 24 Lay-Up Segment, By Region, 2014-2021 (Kilotons)

Table 25 Lay-Up Segment, By Region, 2014-2021 (USD Million)

Table 26 Pultrusion Segment, By Region, 2014-2021 (Kilotons)

Table 27 Pultrusion Segment, By Region, 2014-2021 (USD Million)

Table 28 Resin Transfer Molding Segment, By Region, 2014-2021 (Kilotons)

Table 29 Resin Transfer Molding Segment, By Region, 2014-2021 (USD Million)

Table 30 Injection Molding Segment, By Region, 2014-2021 (Kilotons)

Table 31 Injection Molding Segment, By Region, 2014-2021 (USD Million)

Table 32 Filament Winding Segment, By Region, 2014-2021 (Kilotons)

Table 33 Filament Winding Segment, By Region, 2014-2021 (USD Million)

Table 34 Compression Molding Segment, By Region, 2014-2021 (Kilotons)

Table 35 Compression Molding Segment, By Region, 2014-2021 (USD Million)

Table 36 Others Segment, By Region, 2014-2021 (Kilotons)

Table 37 Others Segment, By Region, 2014-2021 (USD Million)

Table 38 Polyurethane Composites Market, By End-Use Industry, 2014-2021 (Kilotons)

Table 39 Polyurethane Composites Market, By End-Use Industry, 2014-2021 (USD Million)

Table 40 Transportation Segment, By Region, 2014-2026 (Kilotons)

Table 41 Transportation Segment, By Region, 2014-2026 (USD Million)

Table 42 Building & Construction Segment, By Region, 2014-2026 (Kilotons)

Table 43 Building & Construction Segment, By Region, 2014-2026 (USD Million)

Table 44 Electrical & Electronics Segment, By Region, 2014-2026 (Kilotons)

Table 45 Electrical & Electronics Segment, By Region, 2014-2026 (USD Million)

Table 46 Wind Power Energy Segment, By Region, 2014-2021 (Kilotons)

Table 47 Wind Power Energy Segment, By Region, 2014-2026 (USD Million)

Table 48 Petrochemical Segment, By Region, 2014-2026 (Kilotons)

Table 49 Petrochemical Segment, By Region, 2014-2026 (USD Million)

Table 50 Sports & Leisure Segment, By Region, 2014-2026 (Kilotons)

Table 51 Sports & Leisure Segment, By Region, 2014-2026 (USD Million)

Table 52 Aerospace & Defense Segment, By Region, 2014-2026 (Kilotons)

Table 53 Aerospace & Defense Segment, By Region, 2014-2026 (USD Million)

Table 54 Others Segment, 2014-2026 (Kilotons)

Table 55 Others Segment, By Region, 2014-2026 (USD Million)

Table 56 Polyurethane Composites Market, By Region, 2014-2026 (Kilotons)

Table 57 Polyurethane Composites Market, By Region, 2014-2026 (USD Million)

Table 58 North America: By Market, By Country, 2014-2026 (Kilo Tons)

Table 59 North America: By Market, By Country, 2014-2026 (USD Million)

Table 60 North America: By Market, By Fiber Type, 2014-2026 (Kilotons)

Table 61 North America: By Market, By Fiber Type, 2014-2026 (USD Million)

Table 62 North America: By Market, By Manufacturing Process, 2014-2026 (Kilotons)

Table 63 North America: By Market, By Manufacturing Process, 2014-2026 (USD Million)

Table 64 North America: By Market, By End-Use Industry, 2014-2026 (Kilotons)

Table 65 North America: By Market, By End-Use Industry, 2014-2026 (USD Million)

Table 66 Europe: By Market, By Country, 2014-2026 (Kilotons)

Table 67 Europe: By Market, By Country, 2014-2026 (USD Million)

Table 68 Europe: By Market, By Fiber Type, 2014-2026 (Kilotons)

Table 69 Europe: By Market, By Fiber Type, 2014-2026 (USD Million)

Table 70 Europe: By Market, By Manufacturing Process, 2014-2026 (Kilotons)

Table 71 Europe: By Market, By Manufacturing Process, 2014-2021 (USD Million)

Table 72 Europe: By Market, By End-Use Industry, 2014-2026 (Kilotons)

Table 73 Europe: By Market, By End-Use Industry, 2014-2026 (USD Million)

Table 74 Asia-Pacific: By Market, By Country, 2014-2026 (Kilotons)

Table 75 Asia-Pacific: By Market, By Country, 2014-2026 (USD Million)

Table 76 Asia-Pacific: By Market, By Fiber Type, 2014-2026 (Kilotons)

Table 77 Asia-Pacific: By Market, By Fiber Type, 2014-2026 (USD Million)

Table 78 Asia-Pacific: By Market, By Manufacturing Process, 2014-2026 (Kilotons)

Table 79 Asia-Pacific: By Market, By Manufacturing Process, 2014-2021 (USD Million)

Table 80 Asia-Pacific: By Market, By End-Use Industry, 2014-2026 (Kilotons)

Table 81 Asia-Pacific: By Market, By End-Use Industry, 2014-2026 (USD Million)

Table 82 South America: By Market, By Country, 2014-2026 (Kilotons)

Table 83 South America: By Market, By Country, 2014-2026 (USD Million)

Table 84 South America: By Market, By Fiber Type, 2014-2026 (Kilotons)

Table 85 South America: By Market, By Fiber Type, 2014-2026 (USD Million)

Table 86 South America: By Market, By Manufacturing Process, 2014-2026 (Kilotons)

Table 87 South America: By Market, By Manufacturing Process, 2014-2021 (USD Million)

Table 88 South America: By Market, By End-Use Industry, 2014-2026 (Kilotons)

Table 89 South America: By Market, By End-Use Industry, 2014-2026 (USD Million)

Table 90 Middle East & Africa: By Market, By Country, 2014-2026 (Kilotons)

Table 91 Middle East & Africa: By Market, By Country, 2014-2026 (USD Million)

Table 92 Middle East & Africa: By Market, By Fiber Type, 2014-2026 (Kilotons)

Table 93 Middle East & Africa: By Market, By Fiber Type, 2014-2026 (USD Million)

Table 94 Middle East & Africa: By Market, By Manufacturing Process, 2014-2026 (Kilotons)

Table 95 Middle East & Africa: By Market, By Manufacturing Process, 2014-2021 (USD Million)

Table 96 Middle East & Africa: By Market, By End-Use Industry, 2014-2026 (Kilotons)

Table 97 Middle East & Africa: By Market, By End-Use Industry, 2014-2026 (USD Million)

Table 98 Expansions

Table 99 Mergers & Acquisitions

Table 100 Partnerships, Agreements, and Joint Ventures

Table 101 New Product Launches

Table 102 BASF SE: Products & Services Offered

Table 103 BASF SE: Recent Developments

Table 104 Bayer AG: Products & Services Offered

Table 105 Bayer AG: Recent Developments

Table 106 Huntsman Corporation: Products & Services Offered

Table 107 Huntsman Corporation: Recent Developments

Table 108 The DOW Chemical Company: Products & Services Offered

Table 109 The DOW Chemical Company: Recent Developments

Table 110 Wanhua Chemical Group Co., Ltd.: Products & Services Offered

Table 111 Wanhua Chemical Group Co., Ltd.: Recent Developments

Table 112 Toray Industries, Inc.: Products & Services Offered

Table 113 Toray Industries, Inc.: Recent Developments

Table 114 Hexcel Corporation: Products & Services Offered

Table 115 Hexel Corporation: Recent Developments

Table 116 Sekisui Chemical Co., Ltd.: Products & Services Offered

Table 117 Sekisui Chemical Co., Ltd.: Recent Developments

Table 118 SGL Group: Products and Services Offered

Table 119 SGL Group: Recent Developments

Table 120 Owens Corning: Products Offered

Table 121 Owens Corning: Recent Developments

List of Figures (83 Figures)

Figure 1 Polyurethane Composites Market: Research Design

Figure 2 Breakdown of Primary Interviews: By Company, Designation, and Region

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 The Transportation End-Use Industry Segment is Projected to Dominate the Polyurethane Composites Market During the Forecast Period

Figure 6 Asia-Pacific is Estimated to Be the Largest Market for Polyurethane Composites Across A Majority of End-Use Industries in 2016

Figure 7 Polyurethane Composites Market Share, By Region, 2016

Figure 8 Asia-Pacific is Projected to Be the Fastest-Growing Polyurethane Composites Market, 2016-2021

Figure 9 The Polyurethane Composites Market is Projected to Witness Substantial Growth During the Forecast Period, 33

Figure 10 The Glass Fiber Polyurethane Composites Segment is Projected to Grow at the Highest CAGR During the Forecast Period

Figure 11 The Transportation End-Use Industry Segment is Estimated to Account for the Largest Share of the Polyurethane Composites Market in 2016

Figure 12 Asia-Pacific is Projected to Be the Fastest-Growing Market for Polyurethane Composites During the Forecast Period

Figure 13 The Transportation End-Use Industry is Projected to Be the Largest Segment of the Polyurethane Composites Market By 2021

Figure 14 China is Projected to Be the Largest Market for Polyurethane Composites By 2021

Figure 15 Increasing Demand From Various End-Use Industries is Projected to Drive the Growth of the Polyurethane Composites Market

Figure 16 Polyurethane Composites: Cost Structure Analysis

Figure 17 Revenue Pocket Matrix: Polyurethane Composites Market, By End-Use Industry, 2016

Figure 18 Revenue Pocket Matrix: Polyurethane Composites Market, By Fiber Type, 2016

Figure 19 Glass Fiber Polyurethane Composites Segment Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 20 Glass Fiber Polyurethane Composites of Polyurethane Composites Market in Asia-Pacific is Projected to Be the Largest Segment By 2021

Figure 21 Carbon Fiber Polyurethane Composites is Projected to Grow at the Highest CAGR in Asia-Pacific From 2016 -2021

Figure 22 Polyurethane Composites Market in Asia-Pacific is Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 23 Lay-Up Projected to Be the Largest Manufacturing Process Segment in the Polyurethane Composites Market By 2021

Figure 24 Transportation in the Asia-Pacific Polyurethane Composites Market is Projected to Be the Largest Segment By 2021

Figure 25 Building & Construction Segment in the Asia Pacific Polyurethane Market Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 26 Electric & Electronics in the Asia-Pacific Polyurethane Composites Market Projected to Be the Largest Segment By 2021

Figure 27 Wind Power Energy Segment of the Asia-Pacific Polyurethane Composites Market is Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 28 Petrochemical Segment in the Asia-Pacific Polyurethane Composites Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 29 Sports & Leisure in the Asia-Pacific Polyurethane Composites Market Projected to Be the Largest Segment By 2021

Figure 30 Aerospace & Defense Segment in the Asia-Pacific Polyurethane Composites Market Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 31 Other End-Use Industries in the Middle East & Africa is Projected to Grow at the Highest CAGR From 2016 to 2021

Figure 32 Emerging Economies are Projected to Grow at A High Growth Rate

Figure 33 North America Polyurethane Composites Market Snapshot

Figure 34 U.S. Polyurethane Composites Market, 2016 - 2021

Figure 35 Canada Polyurethane Composites Market, 2016-2021

Figure 36 Mexico Polyurethane Composites Market, 2016-2021

Figure 37 Europe Polyurethane Composites Market Snapshot

Figure 38 Germany Polyurethane Composites Market, 2016-2021

Figure 39 Italy Polyurethane Composites Market, 2016-2021

Figure 40 U.K. Polyurethane Composites Market, 2016-2021

Figure 41 Russia Polyurethane Composites Market, 2016-2021

Figure 42 France Polyurethane Composites Market, 2016-2021

Figure 43 Spain Polyurethane Composites Market, 2016-2021

Figure 44 Turkey Polyurethane Composites Market, 2016-2021

Figure 45 Rest of Europe Polyurethane Composites Market, 2016-2021

Figure 46 Asia-Pacific Polyurethane Composites Market Snapshot

Figure 47 China Polyurethane Composites Market, 2016-2021

Figure 48 Japan Polyurethane Composites Market, 2016-2021

Figure 49 India Polyurethane Composites Market, 2016-2021

Figure 50 South Korea Polyurethane Composites Market, 2016-2021

Figure 51 Australia & New Zealand: Polyurethane Composites Market, 2016-2021

Figure 52 Indonesia Polyurethane Composites Market, 2016-2021

Figure 53 Rest of Asia-Pacific Polyurethane Composites Market, 2016-2021

Figure 54 South America Polyurethane Composites Market Snapshot

Figure 55 Brazil Polyurethane Composites Market, 2016-2021

Figure 56 Argentina Polyurethane Composites Market, 2016-2021

Figure 57 Rest of South America Polyurethane Composites Market, 2016-2021

Figure 58 Middle East & Africa Polyurethane Composites Snapshot

Figure 59 Saudi Arabia Polyurethane Composites Market, 2016-2021

Figure 60 South Africa Polyurethane Composites Market, 2016-2021

Figure 61 Rest of Middle East & Africa Polyurethane Composites Market, 2016-2021

Figure 62 Companies Have Mostly Adopted Organic Growth Strategies, 2011-2016 (Till August)

Figure 63 Polyurethane Composites Market: Company Share Analysis, 2015 (%)

Figure 64 Expansions is the Most Adopted Key Strategies in the Global Polyurethane Composites Market, 2011-2016

Figure 65 Polyurethane Composites Market: Year-Wise Share of the Total Developments in the Market, 2011–2016 (Till August)

Figure 66 BASF SE: Company Snapshot

Figure 67 BASF SE: SWOT Analysis

Figure 68 Bayer AG: Company Snapshot

Figure 69 Bayer AG: SWOT Analysis

Figure 70 Huntsman Corporation: Company Snapshot

Figure 71 Huntsman Corporation: SWOT Analysis

Figure 72 The DOW Chemical Company: Company Snapshot

Figure 73 The DOW Chemical Company: SWOT Analysis

Figure 74 Wanhua Chemical Group Co., Ltd. : Company Snapshot

Figure 75 Toray Industries, Inc.: Business Overview

Figure 76 Toray Industries, Inc.: SWOT Analysis

Figure 77 Hexcel Corporation: Business Overview

Figure 78 Hexcel Corporation: SWOT Analysis

Figure 79 Sekisui Chemical Co., Ltd.: Company Snapshot

Figure 80 SGL Group: Company Snapshot

Figure 81 SGL Group: SWOT Analysis

Figure 82 Owens Corning: Company Snapshot

Figure 83 Owens Corning: SWOT Analysis

Growth opportunities and latent adjacency in Polyurethane Composites Market