Polyurethane Catalyst Market by Type, Functionality (Blowing Catalyst, Curing Catalyst, Foam Stabilizing Catalyst, Cross Linking Catalyst, Gelling Catalyst), Application (Foam, Sealant & Adhesive, Coating, Elastomer), Region - Global Forecast to 2028

Updated on : August 04, 2025

Polyurethane Catalyst Market

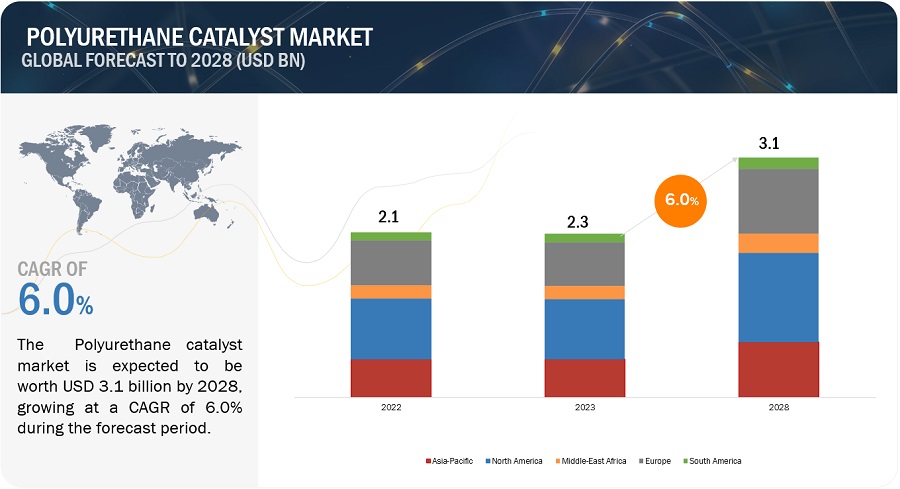

The global polyurethane catalyst market was valued at USD 2.3 billion in 2023 and is projected to reach USD 3.1 billion by 2028, growing at 6.0% cagr from 2023 to 2028. The market is mainly led by the significant usage of polyurethane catalysts in various end-use industries. The growing demand from the automotive, construction, rising demand for industrial sector, driving the market for near infrared absorbing market.

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in the Polyurethane Catalyst Market

Polyurethane Catalyst Market Dynamics

Driver: Increasing demand for energy efficient manufacturing processes.

The global emphasis on energy efficiency is a prominent driving factor in the polyurethane catalyst market. As concerns about climate change and environmental sustainability escalate, there is a growing need to reduce energy consumption and minimize greenhouse gas emissions. Polyurethane materials, particularly in the form of foams, offer exceptional thermal insulation properties that contribute to energy conservation in various applications.

Catalysts play a crucial role in the production of polyurethane foams used for insulation purposes. These foams, commonly employed in buildings, appliances, and industrial equipment, effectively reduce heat transfer, maintaining indoor temperatures and reducing the need for excessive heating or cooling. As a result, energy consumption is lowered, leading to cost savings for consumers and businesses alike.

The rising demand for energy-efficient solutions is also fueled by consumer awareness and preferences. Individuals and businesses increasingly seek products that contribute to lower energy bills, reduced environmental impact, and improved comfort. As a result, there's a higher market demand for polyurethane foam insulation, and consequently, for the catalysts that enable its efficient production.

Restraint: Environmental challenges and regulatory concerns

The polyurethane catalyst market faces challenges stemming from increasing environmental awareness and stringent regulations. Some catalysts used in the production of polyurethane materials may release volatile organic compounds (VOCs) or other harmful byproducts during the curing process. These emissions can contribute to air pollution and have adverse effects on air quality, human health, and the environment.

Regulatory agencies in various regions have established standards for emissions and the use of certain chemicals, including those found in catalysts. These regulations ns aim to mitigate the negative impact of chemical emissions on air and water quality, worker safety, and public health. As a result, manufacturers are required to closely monitor and limit the use of catalysts that may contain harmful components.

Opportunity: Utilization of green catalyst and low emission formulations

The opportunity presented by the development and utilization of green catalysts and low emission formulations holds immense significance in the polyurethane catalyst market. This opportunity aligns perfectly with the escalating emphasis on environmental sustainability, regulatory compliance, and the creation of healthier indoor environments. As industries across sectors strive to reduce their environmental impact and adhere to stricter emission regulations, the demand for catalysts that facilitate the production of polyurethane materials with minimal volatile organic compound (VOC) and harmful emissions intensifies. Green catalysts offer the advantage of significantly decreasing the release of VOCs during the polyurethane production process, directly contributing to reduced environmental footprints. Moreover, the creation of low emission formulations, enabled by these catalysts, directly addresses the pressing need for improved indoor air quality in applications such as insulation materials. Not only does this opportunity align with regulatory mandates related to air quality, but it also resonates with health-conscious consumers seeking products free from harmful chemicals. Companies embracing this opportunity can achieve regulatory compliance, attract environmentally conscious customers, and even position themselves as industry leaders committed to sustainability. By leveraging green catalysts and low emission formulations, businesses not only tap into a growing market niche but also contribute significantly to the overarching goals of environmental protection and healthier living spaces. This opportunity represents a powerful way to drive market growth while advocating for a more sustainable future.

Challenge: stringent regulatory framework.

The regulatory framework governing chemical substances and their applications is far from static; it evolves continuously as governments and international bodies respond to scientific advancements, environmental concerns, and health considerations. Different regions, countries, and even municipalities wield varying regulations, each tailored to their unique circumstances and priorities. This heterogeneity necessitates an in-depth understanding of local and international standards, as well as an unwavering commitment to staying abreast of ongoing changes.

Evolving standards pose a multifaceted challenge for stakeholders across the polyurethane catalyst market. Manufacturers, distributors, and end-users alike must meticulously assess their products and processes against the latest regulatory benchmarks to ensure compliance. Non-compliance can incur steep penalties, erode public trust, and impede market access.

Additionally, chemical restrictions implemented due to environmental or health concerns can significantly impact the selection of catalysts and the formulation of polyurethane materials. These restrictions underscore the need for catalyst manufacturers and the entire supply chain to continuously innovate and develop solutions that fulfill both regulatory requirements and the performance demands of a diverse range of industries. Furthermore, as emissions and environmental impact regulations become progressively stringent, selecting and formulating catalysts to minimize emissions, particularly volatile organic compounds (VOCs), becomes imperative. Achieving compliance with air quality standards while maintaining product quality requires meticulous testing, documentation, and collaboration among stakeholders.

Polyurethane Catalyst Market Ecosystem

The market ecosystem for polyurethane catalyst is composed of a diverse array of entities and stakeholders that collectively contribute to the development, implementation, and advancement of near infrared absorbing materials. At the core of this ecosystem are material providers who focus on research, development, and manufacturing of polyurethane catalysts and systems. They continuously innovate and produce novel materials and their applications to meet the evolving demands of the market.

BASF SE Germany), Evonik Industries AG (Germany), Huntsman International LLC (US), Momentive (Niskayuna), Tokyo Chemical Industry Co., Ltd. (Japan), DOW (US), Tosoh Corporation (Japan), Carpenter Co. (US), Mofan Polyurethane CO., LTD. (China), UMICORE (Brussels).

Polyurethane Catalyst: Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Amine catalyst is the largest type polyurethane catalyst market in 2023, in terms of value."

Amine catalysts play a pivotal role in the efficient production of polyurethanes by facilitating the reaction between isocyanates and polyols, leading to rapid urethane formation. This catalytic activity is a critical factor in achieving high reaction rates and shorter curing times, both of which significantly contribute to efficient production processes in the polyurethane industry.

Moreover, the catalytic activity of amines not only accelerates the reaction rate but also influences the overall curing process. The faster reaction kinetics achieved through amine catalysis lead to shorter curing times, which is of paramount importance in industries where rapid production turnover is essential. This reduction in curing time directly translates to increased productivity and cost-effectiveness, as manufacturers can produce more products within a given timeframe.

“Gelling catalyst accounted for the largest material share of the polyurethane catalyst market in 2023” in terms of value.

Different gelling catalysts are designed to produce foams with varying degrees of expansion and cell size. Manufacturers can control the expansion rate and foam density by selecting the appropriate gelling catalyst, allowing them to tailor the foam's characteristics to specific applications. Polyurethane foams underscore their shared prominence across industries, showcasing the integral role of chemistry in crafting materials that enhance everyday lives.

“Elastomers accounted for the largest share of the polyurethane catalyst market in 2023” in terms of value.

These elastomers exhibit a level of flexibility and elasticity akin to that of rubber, enabling them to undergo substantial deformation without enduring permanent changes. This inherent resilience allows them to effortlessly revert to their original shape after being stretched or compressed, a trait particularly advantageous in scenarios where materials are subjected to dynamic forces. Beyond their flexibility, polyurethane elastomers possess inherent durability and resistance to wear, rendering them exceptionally well-suited for applications marked by constant stress, friction, and exposure to abrasive surfaces. This unique combination of attributes places them at the forefront of industries requiring enduring and robust solutions, finding their way into diverse applications such as wheels, seals, gaskets, and other components.

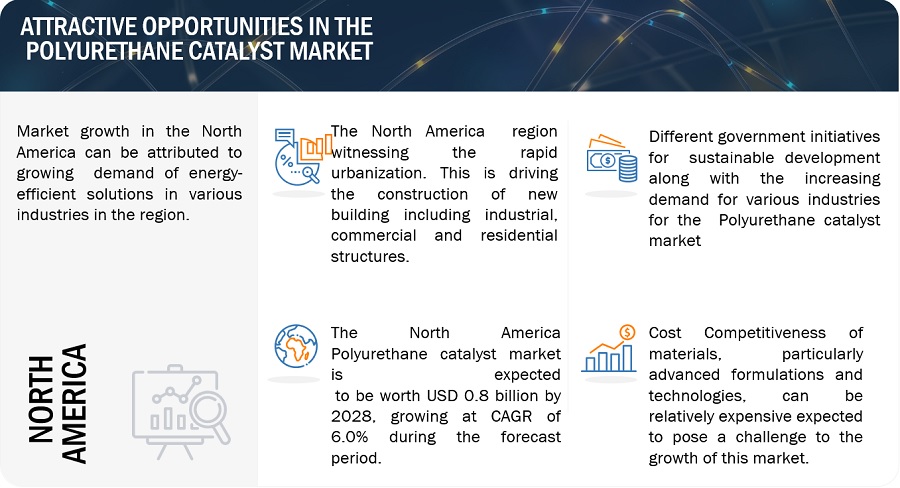

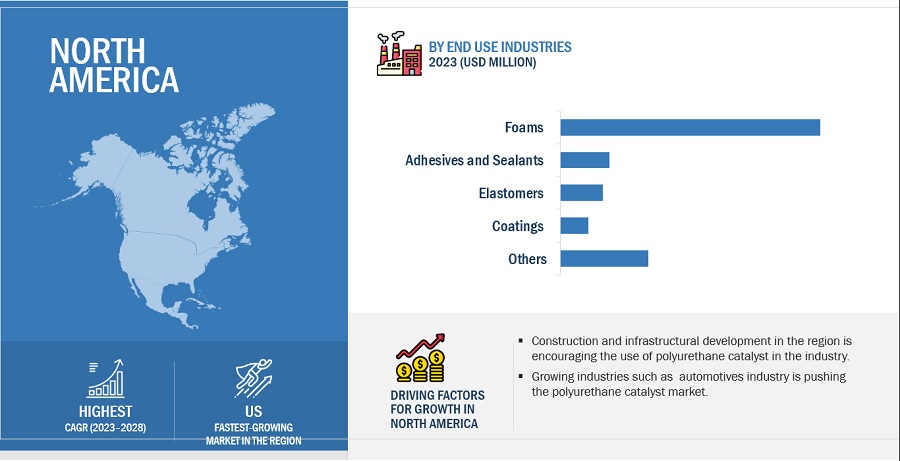

"North America was the largest market for polyurethane catalyst Market in 2023, in terms of value."

The growth of the polyurethane catalyst market in North America is propelled by the region's reputation as a hub of industrial expansion and innovation, with several key industries experiencing remarkable growth. The construction, automotive, furniture, and electronics sectors, all heavy users of polyurethane products, have been on an upward trajectory, leading to heightened demand for these versatile materials. This surge in demand creates a direct need for specialized polyurethane catalysts, essential for supporting efficient production processes, fine-tuning material properties, and meeting the stringent requirements of these burgeoning industries.

To know about the assumptions considered for the study, download the pdf brochure

Polyurethane Catalyst Market Players

The key players in this market BASF SE Germany), Evonik Industries AG (Germany), Huntsman International LLC (US), Momentive (Niskayuna), Tokyo Chemical Industry Co., Ltd. (Japan), Dow Chemical Company (Michigan), PATCHAM (FZC) (UAE), Carpenter Co. (US), Mofan Polyurethane CO., LTD. (China), UMICORE (Brussels). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of polyurethane catalyst have opted for new product launches to sustain their market position.

Polyurethane Catalyst Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 2.3 billion |

|

Revenue Forecast in 2028 |

USD 3.1 billion |

|

CAGR |

6.0% |

|

Years considered for the study |

2023-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

type, functionality, application and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

BASF SE Germany), Evonik Industries AG (Germany), Huntsman International LLC (US), Momentive (Niskayuna), Tokyo Chemical Industry Co., Ltd. (Japan), DOW (US), Tosoh Corporation (Japan), Carpenter Co. (US), Mofan Polyurethane CO., LTD. (China), UMICORE (Brussels). |

Segmentation

This report categorizes the global polyurethane catalyst market based on IR Range, Material type, functions, end use industry and region.

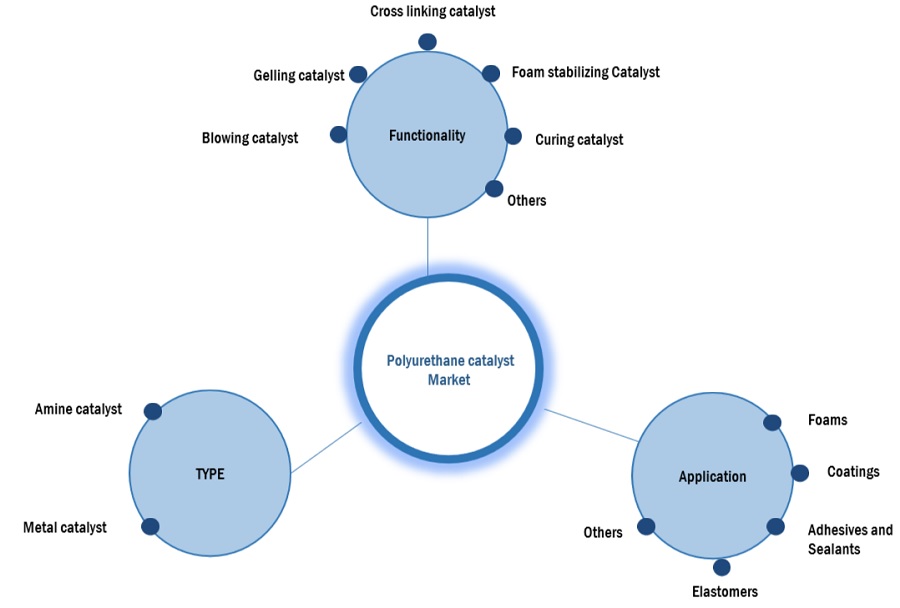

On the basis of type, the polyurethane catalyst market has been segmented as follows:

- Amine Catalyst

- Metal Catalyst

On the basis of functionality, the polyurethane catalyst market has been segmented as follows:

- Gelling catalyst

- Blowing Catalyst

- Curing Catalyst

- Foam Stabilizing Catalyst

- Cross linking Catalyst

- Others

On the basis of application, the polyurethane catalyst market has been segmented as follows:

- Foams

- Elastomer

- Sealant and adhesive

- Coating

- Others.

On the basis of region, the polyurethane catalyst market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- In 2022 Evonik completed the acquisition of the Porocel Group, Houston (USA), for US$ 210 million, as planned. The intensive planning work that has been done for the integration into the business line Catalysts over the past few months will be put into action straight away. Porocel's customers will continue to receive the same high-quality products and services they have come to expect via the established sales channels.

- In 2023, Dow and Avery Dennison have co-developed an innovative and sustainable new hotmelt label adhesive solution.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the polyurethane catalyst market?

This study's forecast period for the polyurethane catalyst market is 2023-2028. The market is expected to grow at a CAGR of 6.0% in terms of value, during the forecast period.

Who are the major key players in the polyurethane catalyst market?

BASF SE Germany), Evonik Industries AG (Germany), Huntsman International LLC (US), Momentive (Niskayuna), Tokyo Chemical Industry Co., Ltd. (Japan), Dow Chemical Company (Michigan), PATCHAM (FZC) (UAE), Carpenter Co. (US), Mofan Polyurethane CO., LTD. (China), UMICORE (Brussels) are the leading manufacturers and service provider of polyurethane catalyst market.

What are the emerging trends in Polyurethane catalyst market?

Increasing environmental concerns have driven the demand for greener and more sustainable solutions across industries. In the polyurethane catalyst market, there has been a growing interest in eco-friendly catalysts that minimize the environmental impact of polyurethane production. These catalysts might focus on reducing emissions, promoting recycling, and using renewable feedstocks.

What are the drivers and opportunities for the polyurethane catalyst market?

The Increasing demand for advanced technologies in the polyurethane catalyst drive the polyurethane catalyst market. The growing energy efficiency sector presents significant opportunities for the utilization and advancement of polyurethane catalyst.

What are the restraining factors in the polyurethane catalyst market?

Strict regulatory framework serve as restraints to the widespread adoption and implementation of polyurethane catalysts. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Use of polyurethane products in construction and automotive sectors- Environmental regulations and sustainability practices- Increasing demand for sustainable materialsRESTRAINTS- Fluctuating raw material prices- Limited shelf-life of polyurethane catalysts- Use of thermoplastics as substitutesOPPORTUNITIES- Increasing demand for bio-based catalysts- Advancements in catalyst technology- Use of low-emission VOCsCHALLENGES- High regulatory pressure on use of eco-friendly products- Intense competition and market consolidation

-

5.3 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

- 6.1 COVID-19 IMPACT

-

6.2 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND USERS

-

6.3 MACROECONOMIC INDICATORSGDP TRENDS AND FORECAST

-

6.4 REGULATORY LANDSCAPEREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

6.5 TRADE ANALYSISEXPORT SCENARIOIMPORT SCENARIO

-

6.6 PATENT ANALYSISINTRODUCTIONMETHODOLOGYDOCUMENT TYPESINSIGHTSLEGAL STATUSJURISDICTION ANALYSISTOP APPLICANTS

- 6.7 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

-

6.8 ECOSYSTEM MAPPING

-

6.9 TECHNOLOGY ANALYSISGAS-BASED FLOW CHEMISTRYCOMPUTATIONAL MODELLING

-

6.10 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.11 CASE STUDY ANALYSISASSESSING RECYCLING POTENTIAL OF GLYCOLYSIS TREATMENT FOR RIGID POLYURETHANE FOAM WASTEUSE OF NOVEL NON-TOXIC BISMUTH CATALYST FOR PREPARING FLEXIBLE POLYURETHANE FOAM

- 7.1 INTRODUCTION

-

7.2 AMINE CATALYSTSVERSATILITY AND MULTIFUNCTIONALITY TO DRIVE MARKET

-

7.3 METAL CATALYSTSTHERMAL RESILIENCE AND CRAFTING EFFICIENCY TO FUEL MARKET

- 7.4 OTHER TYPES

- 8.1 INTRODUCTION

-

8.2 GELLING CATALYSTSGELATION AND SOLIDIFICATION PROPERTIES

-

8.3 BLOWING CATALYSTSFACILITATING EXPANSION OF GASES IN CELLULAR FOAM STRUCTURE

-

8.4 CURING CATALYSTSAPPLICATION IN POLYMERIZATION REACTIONS OF POLYOLS AND ISOCYANATES

-

8.5 CROSSLINKING CATALYSTSSTRONG CHEMICAL BONDING AND DURABILITY

-

8.6 FOAM-STABILIZING CATALYSTSWELL-DEFINED CELLULAR CONFIGURATIONS

- 8.7 OTHER FUNCTIONALITIES

- 9.1 INTRODUCTION

-

9.2 FOAMSVERSATILITY AND ADAPTABILITY OF POLYURETHANE FOAMS TO DRIVE MARKET

-

9.3 ADHESIVES & SEALANTSRISING DEMAND FOR EFFECTIVE TAILORED SEALANTS TO FUEL MARKET

-

9.4 ELASTOMERSDURABILITY AND PLIABILITY OF POLYURETHANE ELASTOMERS TO DRIVE MARKET

-

9.5 COATINGSRESISTANCE TO ABRASION AND WEATHERING TO BOOST MARKET

- 9.6 OTHER APPLICATIONS

- 10.1 INTRODUCTION

-

10.2 NORTH AMERICARECESSION IMPACT ON NORTH AMERICAUS- Rising environmental concerns to drive demand for eco-friendly polyurethane productsCANADA- Technological advancements to drive demand for polyurethane catalystsMEXICO- Demand for comfortable and aesthetically appealing furniture and bedding products to drive market

-

10.3 EUROPERECESSION IMPACT ON EUROPEGERMANY- Growth of automotive and construction sector to drive marketITALY- Strong manufacturing base to drive marketFRANCE- Growth of packaging and foam industries to drive marketUK- Demand for electric vehicles to drive marketRUSSIA- Need for energy-efficient foams in automotives to fuel demand for polyurethane catalystsSPAIN- Growth of automotive sector to fuel demand for foam catalystsREST OF EUROPE

-

10.4 ASIA PACIFICRECESSION IMPACT ON ASIA PACIFICCHINA- Rise in foreign investments to drive marketJAPAN- Sustainability practices to promote demand for energy-efficient catalystsSOUTH KOREA- Well-developed and organized financial sector to boost marketINDIA- Foreign investments in industrial sector to drive marketREST OF ASIA PACIFIC

-

10.5 MIDDLE EAST & AFRICARECESSION IMPACT ON MIDDLE EAST & AFRICASAUDI ARABIA- Infrastructural development to drive demand for polyurethane catalystsSOUTH AFRICA- Government initiatives toward sustainability to drive marketREST OF MIDDLE EAST & AFRICA

-

10.6 SOUTH AMERICARECESSION IMPACT ON SOUTH AMERICABRAZIL- Prominent industrial hub and high purchasing power to drive marketARGENTINA- Demand for catalysts from automotive and construction sector to fuel marketREST OF SOUTH AMERICA

- 11.1 INTRODUCTION

-

11.2 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERSMARKET SHARE OF KEY PLAYERS- BASF SE- Umicore- Evonik Industries AG- DOW- Huntsman International LLC

- 11.3 COMPANY PRODUCT FOOTPRINT ANALYSIS

-

11.4 COMPANY EVALUATION MATRIXSTARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTS

- 11.5 COMPETITIVE BENCHMARKING

-

11.6 STARTUP/SME EVALUATION MATRIXRESPONSIVE COMPANIESSTARTING BLOCKSPROGRESSIVE COMPANIESDYNAMIC COMPANIES

-

11.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

12.1 KEY PLAYERSBASF SE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewEVONIK INDUSTRIES AG- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewHUNTSMAN INTERNATIONAL LLC- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMOMENTIVE- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTOKYO CHEMICAL INDUSTRY CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewDOW- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewMOFAN POLYURETHANE CO., LTD.- Business overview- Products/Services/Solutions offered- MnM viewCARPENTER CO.- Business overview- Products/Services/Solutions offered- Recent developments- MnM viewTOSOH CORPORATION- Business overview- Products/Services/Solutions offered- MnM viewUMICORE- Business overview- Products/Services/Solutions offered- Recent developments- MnM view

-

12.2 OTHER PLAYERSSOLVAYMILLIKENCHINA PETROLEUM & CHEMICAL CORPORATIONBCL HOLDING SAMITSUI CHEMICALS, INC.DIC CORPORATIONLANXESSWANHUA CHEMICAL GROUP CO., LTD.TRIISO LLCIMEN POLYMER CHEMIE CO.COVESTRO AGBYKCLARIANT AGGULBRANDSENAIR PRODUCTS AND CHEMICALS, INC.

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS

- TABLE 1 POLYURETHANE CATALYST MARKET: PORTER’S FIVE FORCES ANALYSIS

- TABLE 2 GDP TRENDS AND FORECAST, BY KEY COUNTRY, 2019–2027 (USD MILLION)

- TABLE 3 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 4 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 5 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 GRANTED PATENTS IN LAST 10 YEARS

- TABLE 7 GDP TRENDS AND FORECAST, BY KEY COUNTRY (2019–2027)

- TABLE 8 ADVANTAGES OF CATALYST DEVELOPMENT FOR POLYURETHANE CATALYSTS

- TABLE 9 ADVANTAGES OF FLOW CHEMISTRY

- TABLE 10 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FIVE APPLICATIONS

- TABLE 11 KEY BUYING CRITERIA

- TABLE 12 POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 13 POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 14 POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 15 POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 16 POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 17 POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 18 POLYURETHANE CATALYST MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 19 POLYURETHANE CATALYST MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 21 POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 22 POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 23 POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 24 POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 25 POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 26 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 27 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 28 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 29 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 30 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 31 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 32 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 33 NORTH AMERICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 34 US: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 35 US: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 36 US: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 37 US: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 38 CANADA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 39 CANADA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 40 CANADA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 41 CANADA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 42 MEXICO: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 43 MEXICO: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 44 MEXICO: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 45 MEXICO: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 46 EUROPE: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 47 EUROPE: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 48 EUROPE: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 49 EUROPE: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 50 EUROPE: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 51 EUROPE: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 52 EUROPE: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 53 EUROPE: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 54 GERMANY: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 55 GERMANY: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 56 GERMANY: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 57 GERMANY: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 58 ITALY: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 59 ITALY: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 60 ITALY: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 61 ITALY: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 62 FRANCE: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 63 FRANCE: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 64 FRANCE: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 65 FRANCE: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 66 UK: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 67 UK: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 UK: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 69 UK: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 70 RUSSIA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 71 RUSSIA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 72 RUSSIA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 73 RUSSIA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 74 SPAIN: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 75 SPAIN: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 76 SPAIN: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 77 SPAIN: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 78 REST OF EUROPE: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 79 REST OF EUROPE: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 80 REST OF EUROPE: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 81 REST OF EUROPE: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 82 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 83 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 84 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 85 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 86 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 87 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 88 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 89 ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 90 CHINA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 91 CHINA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 92 CHINA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 93 CHINA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 94 JAPAN: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 95 JAPAN: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 96 JAPAN: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 97 JAPAN: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 98 SOUTH KOREA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 99 SOUTH KOREA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 100 SOUTH KOREA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 101 SOUTH KOREA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 102 INDIA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 103 INDIA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 104 INDIA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 105 INDIA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 106 REST OF ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 107 REST OF ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 108 REST OF ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 109 REST OF ASIA PACIFIC: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 110 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 111 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 112 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 113 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 114 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 115 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 116 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 117 MIDDLE EAST AND AFRICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 118 SAUDI ARABIA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 119 SAUDI ARABIA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 120 SAUDI ARABIA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 121 SAUDI ARABIA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 122 SOUTH AFRICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 123 SOUTH AFRICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 124 SOUTH AFRICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 125 SOUTH AFRICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 126 REST OF MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 127 REST OF MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 128 REST OF MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 129 REST OF MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 130 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 131 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 132 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 133 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 134 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2019–2022 (USD MILLION)

- TABLE 135 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023–2028 (USD MILLION)

- TABLE 136 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 137 SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 138 BRAZIL: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 139 BRAZIL: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 140 BRAZIL: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 141 BRAZIL: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 142 ARGENTINA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 143 ARGENTINA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 144 ARGENTINA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 145 ARGENTINA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 146 REST OF SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 147 REST OF SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 148 REST OF SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 149 REST OF SOUTH AMERICA: POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 150 STRATEGIES ADOPTED BY KEY MARKET PLAYERS

- TABLE 151 POLYURETHANE CATALYST MARKET: DEGREE OF COMPETITION

- TABLE 152 POLYURETHANE CATALYST MARKET: KEY COMPANY APPLICATION FOOTPRINT

- TABLE 153 POLYURETHANE CATALYST MARKET: KEY COMPANY TYPE FOOTPRINT

- TABLE 154 POLYURETHANE CATALYST MARKET: KEY COMPANY REGION FOOTPRINT

- TABLE 155 POLYURETHANE CATALYST MARKET: KEY STARTUPS/SMES

- TABLE 156 POLYURETHANE CATALYST MARKET: SME APPLICATION FOOTPRINT

- TABLE 157 POLYURETHANE CATALYST MARKET: SME TYPE FOOTPRINT

- TABLE 158 POLYURETHANE CATALYST MARKET: SME REGION FOOTPRINT

- TABLE 159 POLYURETHANE CATALYST MARKET: PRODUCT LAUNCHES (2020–2023)

- TABLE 160 POLYURETHANE CATALYST MARKET: DEALS (2020–2023)

- TABLE 161 POLYURETHANE CATALYST MARKET: OTHER DEVELOPMENTS (2020–2023)

- TABLE 162 BASF SE: COMPANY OVERVIEW

- TABLE 163 BASF SE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 164 BASF SE: OTHER DEVELOPMENTS

- TABLE 165 EVONIK INDUSTRIES AG: COMPANY OVERVIEW

- TABLE 166 EVONIK INDUSTRIES AG: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 167 EVONIK INDUSTRIES AG: DEALS

- TABLE 168 EVONIK INDUSTRIES AG: OTHER DEVELOPMENTS

- TABLE 169 HUNTSMAN INTERNATIONAL LLC: COMPANY OVERVIEW

- TABLE 170 HUNTSMAN INTERNATIONAL LLC: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 171 HUNTSMAN INTERNATIONAL LLC: OTHER DEVELOPMENTS

- TABLE 172 HUNTSMAN INTERNATIONAL LLC: DEALS

- TABLE 173 MOMENTIVE: COMPANY OVERVIEW

- TABLE 174 MOMENTIVE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 175 MOMENTIVE: OTHER DEVELOPMENTS

- TABLE 176 TOKYO CHEMICAL INDUSTRY CO., LTD.: COMPANY OVERVIEW

- TABLE 177 TOKYO CHEMICAL INDUSTRY CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 178 DOW: COMPANY OVERVIEW

- TABLE 179 DOW: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 180 DOW: OTHER DEVELOPMENTS

- TABLE 181 MOFAN POLYURETHANE CO., LTD.: COMPANY OVERVIEW

- TABLE 182 MOFAN POLYURETHANE CO., LTD.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 183 CARPENTER CO.: COMPANY OVERVIEW

- TABLE 184 CARPENTER CO.: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 185 CARPENTER CO.: DEALS

- TABLE 186 TOSOH CORPORATION: COMPANY OVERVIEW

- TABLE 187 TOSOH CORPORATION: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 188 UMICORE: COMPANY OVERVIEW

- TABLE 189 UMICORE: PRODUCTS/SERVICES/SOLUTIONS OFFERED

- TABLE 190 UMICORE: OTHER DEVELOPMENTS

- TABLE 191 UMICORE: PRODUCT LAUNCHES

- FIGURE 1 POLYURETHANE CATALYST MARKET SEGMENTATION

- FIGURE 2 POLYURETHANE CATALYST MARKET: RESEARCH DESIGN

- FIGURE 3 POLYURETHANE CATALYST MARKET: DATA TRIANGULATION

- FIGURE 4 AMINE CATALYSTS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 5 FOAMS APPLICATION TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 6 GELLING CATALYSTS TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD

- FIGURE 7 ASIA PACIFIC TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 8 INCREASING AWARENESS REGARDING SUSTAINABLE DEVELOPMENT TO BOOST MARKET DURING FORECAST PERIOD

- FIGURE 9 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 10 AMINE CATALYST SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 11 FOAMS SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 12 GELLING CATALYST SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2028

- FIGURE 13 INDIA TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CHINA AND FOAMS SEGMENT ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 16 PORTER’S FIVE FORCES ANALYSIS: POLYURETHANE CATALYST MARKET

- FIGURE 17 VALUE CHAIN FOR POLYURETHANE CATALYST MARKET

- FIGURE 18 EXPORT SCENARIO FOR HS CODE 390950, BY KEY COUNTRY (2019–2022)

- FIGURE 19 EXPORT SCENARIO FOR HS CODE 38159000, BY KEY COUNTRY (2019–2022)

- FIGURE 20 IMPORT SCENARIO FOR HS CODE 390950, BY KEY COUNTRY (2019–2022)

- FIGURE 21 IMPORT SCENARIO FOR HS CODE 38159000, BY KEY COUNTRY (2019–2022)

- FIGURE 22 PUBLICATION TRENDS OVER LAST 10 YEARS

- FIGURE 23 TOP JURISDICTION, BY DOCUMENT

- FIGURE 24 REVENUE SHIFT & NEW REVENUE POCKETS OF POLYURETHANE CATALYST PROVIDERS

- FIGURE 25 POLYURETHANE CATALYST MARKET: ECOSYSTEM MAP

- FIGURE 26 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FIVE APPLICATIONS

- FIGURE 27 KEY BUYING CRITERIA FOR END USERS

- FIGURE 28 POLYURETHANE CATALYST MARKET, BY TYPE, 2023 & 2028

- FIGURE 29 POLYURETHANE CATALYST MARKET, BY FUNCTIONALITY, 2023 & 2028

- FIGURE 30 POLYURETHANE CATALYST MARKET, BY APPLICATION, 2023 & 2028

- FIGURE 31 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 32 NORTH AMERICA: POLYURETHANE CATALYST MARKET SNAPSHOT

- FIGURE 33 EUROPE: POLYURETHANE CATALYST MARKET SNAPSHOT

- FIGURE 34 ASIA PACIFIC: POLYURETHANE CATALYST MARKET SNAPSHOT

- FIGURE 35 MIDDLE EAST & AFRICA: POLYURETHANE CATALYST MARKET SNAPSHOT

- FIGURE 36 SOUTH AMERICA: POLYURETHANE CATALYST MARKET SNAPSHOT

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN POLYURETHANE CATALYST MARKET, 2022

- FIGURE 38 POLYURETHANE CATALYST MARKET SHARE ANALYSIS, 2022

- FIGURE 39 POLYURETHANE CATALYST MARKET: COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- FIGURE 40 POLYURETHANE CATALYST MARKET: STARTUP/SME EVALUATION MATRIX, 2022

- FIGURE 41 BASF SE: COMPANY SNAPSHOT

- FIGURE 42 EVONIK INDUSTRIES AG: COMPANY SNAPSHOT

- FIGURE 43 HUNTSMAN INTERNATIONAL LLC: COMPANY SNAPSHOT

- FIGURE 44 DOW: COMPANY SNAPSHOT

- FIGURE 45 UMICORE: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Polyurethane Catalystmarket. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Polyurethane Catalystmarket comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the Polyurethane Catalystmarket have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Polyurethane Catalystindustry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Polyurethane Catalystand the outlook of their business, which will affect the overall market.

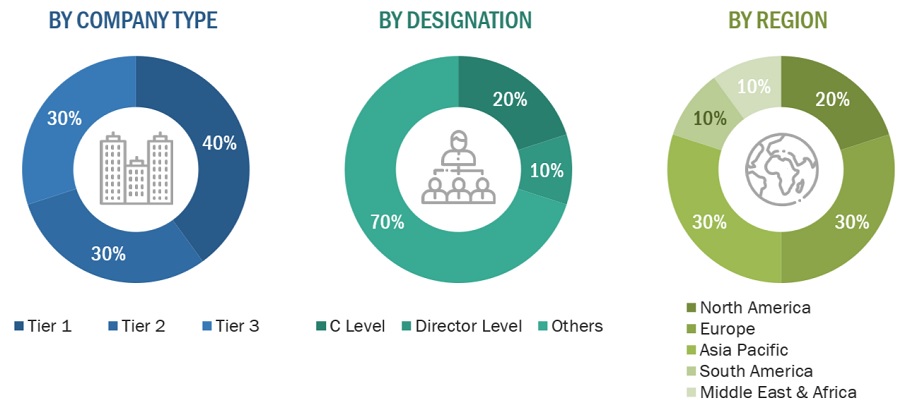

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

BASF SE |

Individual Industry Expert |

|

Evonik Industries AG |

Sales Manager |

|

UMICORE |

Manager |

|

Momentive |

Marketing Manager |

|

Huntsman International LLC |

Senior Scientist |

Market Size Estimation

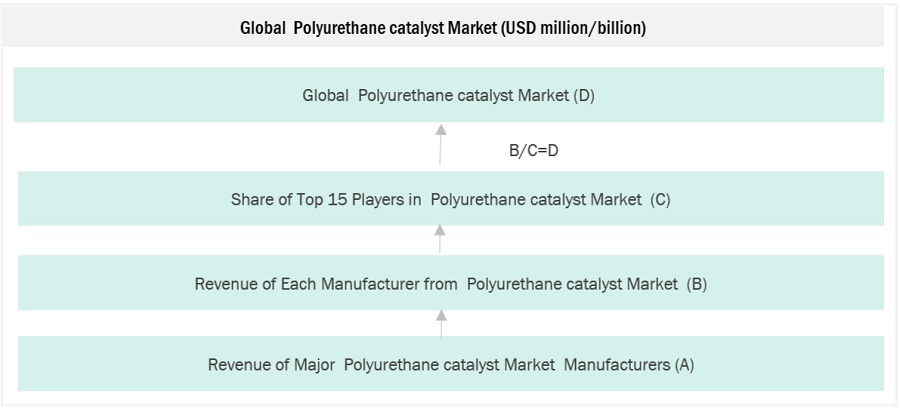

The top-down and bottom-up approaches have been used to estimate and validate the size of the Polyurethane Catalystmarket.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Polyurethane Catalystmarket: Bottum-Up Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

Polyurethane Catalystmarket: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

Near-infrared (NIR) absorbing materials, also known as NIR absorbers, refer to substances or compounds that have the ability to absorb electromagnetic radiation in the near-infrared region of the electromagnetic spectrum. This region typically spans wavelengths ranging from approximately 700 nanometers (nm) to 2500 nm. NIR absorbing materials are designed to selectively absorb light within this wavelength range while allowing other wavelengths, such as visible light or longer infrared radiation, to pass through or remain unaffected. These materials find diverse applications in various industries such as electronics & telecommunications, industrial, photovoltaics etc.

Key Stakeholders

- Raw material suppliers.

- Polyurethane Catalystmanufacturers.

- Polyurethane Catalysttraders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the Polyurethane Catalystmarket, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

Further breakdown of a region with respect to a particular country or additional application

Company Information

Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Polyurethane Catalyst Market