Polypropylene Recycling Market by source (Bottles, Films, Bags), End-use Industry (Packaging, Automotive, Building & Construction, Textiles), Process (Mechanical, Chemical) & Region - Global Forecast to 2030

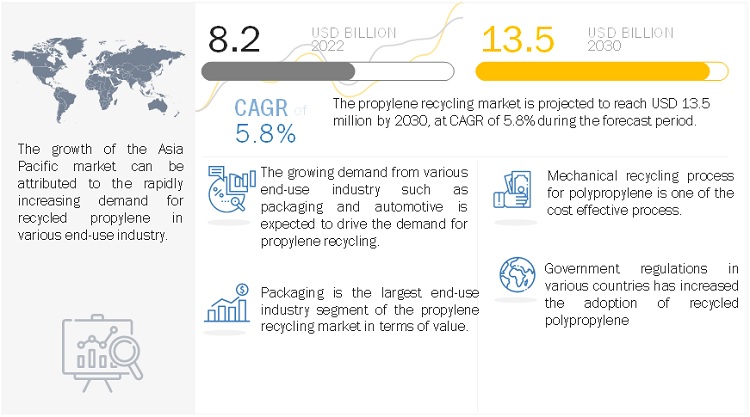

The global polypropylene recycling market is projected to grow from USD 8.2 billion in 2022 to USD 13.5 billion by 2030, at a CAGR of 5.8% from 2022 to 2030. The polypropylene recycling market has grown considerably in recent years and is expected to grow at a higher rate in the coming years. Primary reasons for increasing demand of polypropylene recycling are increasing adoption by various growing end-use industry.

Attractive Opportunities in the Polypropylene Recycling Market

To know about the assumptions considered for the study, Request for Free Sample Report

Polypropylene Recycling Market Dynamics

Driver: Increasing use in packaging and automotive industries

The usage of recycled polypropylene has increased manifold in the packaging industry. the growing consumption of recycled polypropylene by the major stakeholders in the packaging and automotive industries will directly contribute to the increasing demand for these plastics.

Restraint: Stringent competition from virgin plastics

Recycled polypropylene faces huge competition from virgin plastics. Recycled polypropylene is still not used many manufacturers in food industry. For high-end products, where the chemical composition of the plastic must be specific, only virgin materials can be used for food packaging.

Opportunity: Favorable initiatives to promote the use of recycled polypropylene in developed countries

In developing countries various initiatives are taken by government to promote the use of recycled polypropylene for various applications. Recycled polypropylene ideal option and can replace virgin plastic in many applications such as packaging.

Challenges: Difficulty in collection of raw materials

Polypropylene recycling depends on the various raw material sources such as bottles, bags, foams, and others. Raw materials are mostly in contaminated form, thus the many PP plastics provide very little scope for separation, are too small for collection, or has very low economic value.

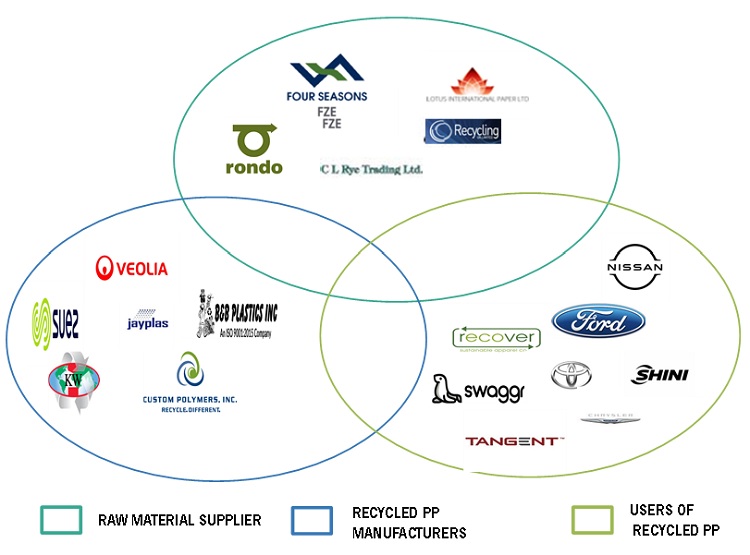

Polypropylene Recycling Market: Ecosystem

Based on source, the bottles segment is projected to grow at a significant CAGR during the forecast period.

The bottles segment, by source is projected to grow at significant CAGR due its easily availability. These Types of polypropylene source is mostly likely to be less contaminated and can easily be recycled for various end-use applications.

Based on process, the mechanical segment is expected to grow significantly during the forecast period

Mechanical segment, by process is expected to grow significantly as it is the most cost-effective process of recycling. This process helps to retore the quality of plastic comparative to other recycling process. Thus, making it ideal process for polypropylene recycling.

Based on end-use industry, the packaging segment is projected to grow at a significant CAGR during the forecast period

Now-a-days many customers prefer ready to make, packaged foods, which has increased the demand of packaging. Recycled polypropylene can be used for various packaging applications and can reduce the use of virgin plastics.

Asia Pacific region is projected to grow at a significant CAGR during the forecast period

By region, Asia Pacific is one of the fastest-growing markets of polypropylene recycling. There are various factors that has driven the market such as growing manufacturing industries which has increased the use of recycled polypropylene in their processes.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Veolia (France), Suez (France), KW Plastics (US), Jayplas (UK), B&B Plastics (US), Custom Polymers (US), Joe's Plastics Inc (US), MBA Polymers (US), Ultra Poly Corporation (US), PLASgran Ltd (UK), Remondis Recycling (Germany), Imerys (France), Envision Plastics (US), and Luxus Ltd (UK) are among the key players leading the market through their innovative offerings, enhanced production capacities, and efficient distribution channels.

Scope of the report

|

Report Metric |

Details |

|

Market Size Available for Years |

2019,2020,2021,2022,2023,2024,2025,2026, 2027, 2028, 2029 and 2030 |

|

Base Year Considered |

2021 |

|

Forecast Period |

2022–2030 |

|

Forecast Units |

Value (USD Million) |

|

Segments Covered |

By Source, by Process, by end-use industry and Region. |

|

Geographies Covered |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies Covered |

The major market players include Veolia (France), Suez (France), KW Plastics (US), Jayplas (UK), B&B Plastics (US), Custom Polymers (US), Joe's Plastics Inc (US), MBA Polymers (US), Ultra Poly Corporation (US), PLASgran Ltd (UK), Remondis Recycling (Germany), Imerys (France), Envision Plastics (US), and Luxus Ltd (UK) |

This research report categorizes the microcapsule market based on source, process, end-use industry and region.

Based on source, the polypropylene recycling market has been segmented as follows:

- Bottles

- Films

- Bags

- Foams

- Others

Based on process, the polypropylene recycling market has been segmented as follows:

- Mechanical

- Chemical

Based on end-use industry, the polypropylene recycling market has been segmented as follows:

- Packaging

- Building & Construction

- Automotive

- Textile

- Electrical & Electronic

- Others

Based on regions, the polypropylene recycling market has been segmented as follows:

- Asia Pacific

- North America

- Europe

- Middle East & Africa

- South America

Recent Developments

- In December 2021, Veolia and L’Oreal joined forces to reduce the carbon footprint of cosmetic packaging in a circular economy approach.

- In July 2021, Jayplas has teamed up with the Co-op supermarket chain to run Europe's most comprehensive in-store recycling program for plastic bags and product packaging.

Frequently Asked Questions (FAQ):

Which are the key companies operating in the polypropylene recycling market?

Veolia Water Technologies (France), Sumitomo Heavy Industries, Ltd. (Japan), SPX Flow Inc. (US), JEOL Ltd. (Japan), SUEZ Water Technologies & Solutions (France), GEA Group AG (Germany), De Dietrich Process Systems (France), Coilmaster Corporation (US), Colmac Coil Manufacturing, Inc. (US), Saltworks Technologies Inc. (Canada), Belmar Technologies Ltd. (England), Sasakura Engineering Co., Ltd. (Japan), Praj Industries Ltd. (India), SMI Evaporative Solutions (US), Alfa Laval (Sweden), are some of the companies operating in the polypropylene recycling market.

What are the key strategies adopted by the market players?

The companies involved in the polypropylene recycling market have focused on agreement, acquisitions, contracts, and partnership as their key strategies to increase their geographical reach and business revenue.

How polypropylene recycling market is classified?

Polypropylene recycling market is classified based on source, process, and end-use industry.

What are the major drivers of polypropylene recycling market?

Increasing use in packaging and automotive industries is one of the drivers of polypropylene recycling market

What is the major process of polypropylene recycling?

Generally polypropylene is recycled by mechanical process. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSIONS & EXCLUSIONS

1.4 SCOPE OF THE STUDY

1.4.1 MARKETS COVERED

1.4.2 YEARS CONSIDERED FOR THE STUDY

1.5 CURRENCY

1.6 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 INTRODUCTION

2.2 RESEARCH DATA

2.2.1 SECONDARY DATA

2.2.1.1 Key data from secondary sources

2.2.2 PRIMARY DATA

2.2.2.1 Key data from primary sources

2.2.2.2 Key industry insights

2.2.2.3 Breakdown of primary interviews

2.3 MARKET SIZE ESTIMATION

2.3.1 BOTTOM-UP APPROACH

2.3.2 TOP-DOWN APPROACH

2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

2.5 RESEARCH ASSUMPTIONS AND LIMITATIONS

2.5.1 ASSUMPTIONS

2.5.2 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

4.1 ATTRACTIVE MARKET OPPORTUNITIES

4.2 POLYPROPYLENE RECYCLING MARKET, BY REGION

4.3 ASIA PACIFIC POLYPROPYLENE RECYCLING MARKET, BY APPLICATION AND COUNTRY

4.4 POLYPROPYLENE RECYCLING MARKET, BY MAJOR COUNTRIES

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 OVERVIEW OF POLYPROPYLENE RECYCLING MARKET

5.3 MARKET DYNAMICS

5.3.1 DRIVERS

5.3.2 RESTRAINTS

5.3.3 OPPORTUNITIES

5.3.4 CHALLENGES

5.4 PORTER’S FIVE FORCES ANALYSIS

5.4.1 THREAT OF NEW ENTRANTS

5.4.2 THREAT OF SUBSTITUTES

5.4.3 BARGAINING POWER OF SUPPLIERS

5.4.4 BARGAINING POWER OF BUYERS

5.4.5 INTENSITY OF COMPETITIVE RIVALRY

5.5 SUPPLY CHAIN ANALYSIS

5.6 TECHNOLOGY ANALYSIS

5.7 ECOSYSTEM/MARKET MAP OF POLYPROPYLENE RECYCLING MARKET

5.8 PRODUCTION CAPACITY OF KEY COMPANIES

5.9 AVERAGE SELLING PRICE TREND

5.10 TARIFF AND REGULATORY LANDSCAPE

5.11 TRENDS/ DISRUPTIONS IMPACTING CUSTOMER’S BUSINESS

5.12 TRADE DATA STATISTICS

5.13 CASE STUDY ANALYSIS

5.14 PATENT ANALYSIS

5.15 KEY CONFERENCES & EVENTS IN 2022–2023

6 POLYPROPYLENE RECYCLING MARKET, BY SOURCE

6.1 INTRODUCTION

6.2 BOTTLES

6.3 FILMS

6.4 BAGS

6.5 FOAMS

6.4 OTHERS

7 POLYPROPYLENE RECYCLING MARKET, BY PROCESS

7.1 INTRODUCTION

7.2 MECHANICAL

7.3 CHEMICAL

8 POLYPROPYLENE RECYCLING MARKET, BY END-USE INDUSTRY

8.1 INTRODUCTION

8.2 PACKAGING

8.3 BUILDING & CONSTRUCTION

8.4 AUTOMOTIVE

8.5 TEXTILE

8.6 ELECTRICAL & ELECTRONIC

8.7 OTHERS

9 REGIONAL ANALYSIS

9.1 INTRODUCTION

9.2 NORTH AMERICA

9.2.1 US

9.2.2 CANADA

9.2.3 MEXICO

9.3 EUROPE

9.3.1 GERMANY

9.3.2 ITALY

9.3.3 SPAIN

9.3.4 FRANCE

9.3.5 RUSSIA

9.3.6 UK

9.3.7 REST OF EUROPE

9.4 ASIA PACIFIC

9.4.1 CHINA

9.4.2 INDIA

9.4.3 JAPAN

9.4.4 SOUTH KOREA

9.4.5 AUSTRALIA

9.4.6 INDONESIA

9.4.7 REST OF ASIA PACIFIC

9.5 SOUTH AMERICA

9.5.1 BRAZIL

9.5.2 ARGENTINA

9.5.3 REST OF SOUTH AMERICA

9.6 MIDDLE EAST & AFRICA

9.6.1 TURKEY

9.6.2 SOUTH AFRICA

9.6.3 UAE

9.6.4 ISRAEL

9.6.5 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

10.1 OVERVIEW

10.2 MARKET SHARE/RANKING

10.3 COMPETITIVE SCENARIO

10.3.1 NEW PRODUCT LAUNCHES

10.3.2 EXPANSIONS

10.3.3 PARTNERSHIPS

10.3.4 ACQUISITIONS

10.3.5 CONTRACTS

10.3.6 JOINT VENTURES

10.3.7 DIVESTMENTS

10.4 COMPANY EVALUATION QUADRANT MATRIX DEFINITIONS AND METHODOLOGY

10.4.1 STAR

10.4.4 EMERGING LEADER

10.4.3 PERVASIVE

10.4.4 PARTICIPANT

10.5 COMPANY EVALUATION QUADRANT MATRIX, 2020

10.6 COMPETITIVE BENCHMAKING

10.7 SME MATRIX

11 COMPANY PROFILES

(OVERVIEW, FINANCIAL*, SWOT, PRODUCTS & SERVICES, STRATEGY, AND DEVELOPMENTS)

11.1 KEY PLAYERS

11.1.1 VEOLIA

11.1.2 SUEZ

11.1.3 KW PLASTICS

11.1.4 JAYPLAS

11.1.5 B&B PLASTICS

11.1.6 CUSTOM POLYMERS

11.1.7 JOE’S PLASTICS, INC

11.1.8 MBA POLYMERS

11.1.10 ULTRA POLY CORPORATION

11.1.11 PLASGRAN LTD.

11.1.12 LYONDELLBASELL INDUSTRIES HOLDINGS B.V

11.1.13 REMONDIS RECYCLING

11.1.14 IMERYS

11.1.15 ENVISION PLASTICS

11.1.16 LUXUS LTD

11.1.17 RECYLEX GROUP

11.1.18 SKYTECH

11.1.19 PURECYCLE TECHNOLOGIES

11.1.20 OOTONE PLASTIC

11.1.21 RIPRO CORPORATION

11.1.22 DA FON ENVIRONMENTAL TECHOLOGY

11.1.23 CABKA

11.1.24 MOHAWK INDUSTRIES INCORPORATED

11.1.25 INEOS

11.1.26 BRASCHEM

*DETAILS MIGHT NOT BE CAPTURED IN CASE OF UNLISTED COMPANIES

*THE ABOVE LIST OF COMPANIES IS NON-EXHAUSTIVE AND WILL BE UPDATED OVER THE COURSE OF STUDY

12 APPENDIX

12.1 DISCUSSION GUIDES

12.2 KNOWLEDGE STORE: MARKETSANDMARKETS SUBSCRIPTION PORTAL

12.3 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

12.4 AVAILABLE CUSTOMIZATIONS

12.5 RELATED REPORTS

12.6 AUTHOR DETAILS

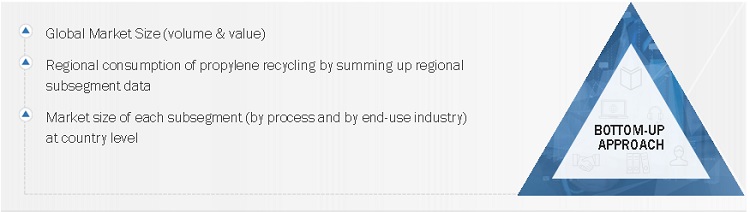

The study involved four major activities in estimating the current size of the polypropylene recycling market. Exhaustive secondary research was done to collect information on the market, peer markets, and parent market. The next step was to validate these findings, assumptions, and sizing with the industry experts across the polypropylene recycling value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

Secondary sources referred to for this study include Hoovers, Bloomberg, BusinessWeek, and Dun & Bradstreet, were referred for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, and articles by recognized authors, authenticated directories, and databases. Secondary data has been collected and analyzed to arrive at the overall market size, which is further validated by primary research.

Primary Research

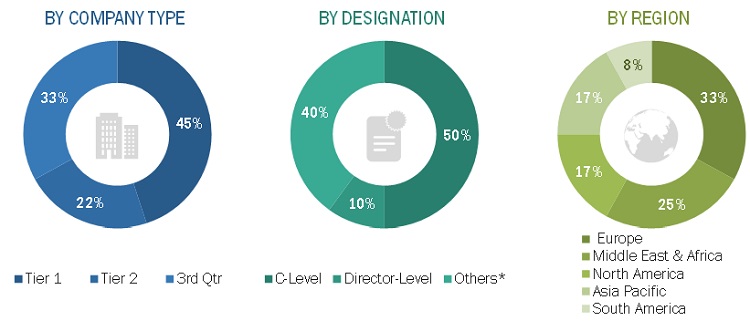

The polypropylene recycling market comprises several stakeholders, such as raw material suppliers, manufacturers, raw material manufacturers, end-use industries, distributors, traders, suppliers, institutions, contract manufacturing organizations, and regulatory organizations in the supply chain.

As part of the primary research process, various primary sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report on the polypropylene recycling market. Primary sources from the supply side included industry experts such as Chief Executive Officers (CEOs), vice presidents, marketing directors, and related key executives from various key companies and organizations operating in the polypropylene recycling market. Primary sources from the demand side included directors, marketing heads, and purchase managers from various end-use industries.

Breakdown of the Primary Interviews

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the polypropylene recycling market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size included the following:

- The key players were identified through extensive primary and secondary research.

- The value chain and market size of the polypropylene recycling market, in terms of value, were determined through primary and secondary research.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research included the study of reports, reviews, and newsletters of top market players, along with extensive interviews for opinions from key leaders, such as CEOs, directors, and marketing executives.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size—using the market size estimation processes as explained above—the market was split into several segments and subsegments. In order to complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides. In addition to this, the market size was validated using both top-down and bottom-up approaches.

Report Objectives

- To define, describe, and forecast the global market size of polypropylene recycling in terms of value

- To define, describe, and forecast the global market size of polypropylene recycling based on construction source, process, end-use industry, and region

- To provide detailed information about significant drivers, restraints, opportunities, and challenges influencing market growth

- To forecast the size of the various segments of the global polypropylene recycling market based on five regions—North America, Asia Pacific, Europe, South America, and the Middle East & Africa—along with key countries in each of these regions

- To analyze region-specific trends in North America, Europe, Asia Pacific, Middle East & Africa, and South America

- To analyze recent developments, such as agreements, contracts, partnerships, and acquisitions in the global polypropylene recycling market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations

MarketsandMarkets offers the following customizations for this market report:

- A further breakdown of product portfolio of each company in the polypropylene recycling market

- A further breakdown of a region of the polypropylene recycling market with respect to a particular country

- Details and profiling of additional market players (up to five)

Growth opportunities and latent adjacency in Polypropylene Recycling Market