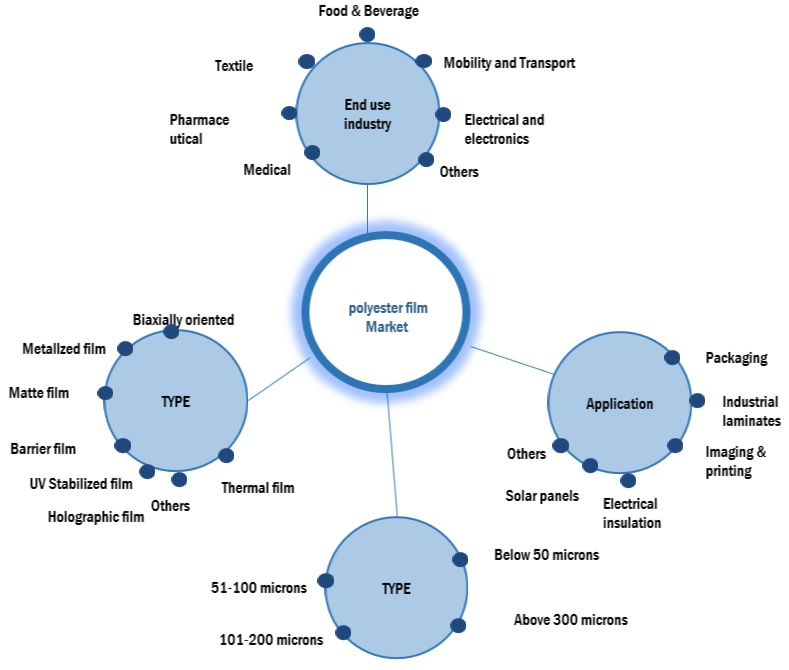

Polyester Film Market by Type (Biaxially oriented, thermal film, metalized film, holographic film, UV stabilized, matte film, barrier film), Application (packaging, electrical insulation, imaging), End Use Industry, and Region - Global forecast to 2028

Updated on : September 09, 2025

Polyester Film Market

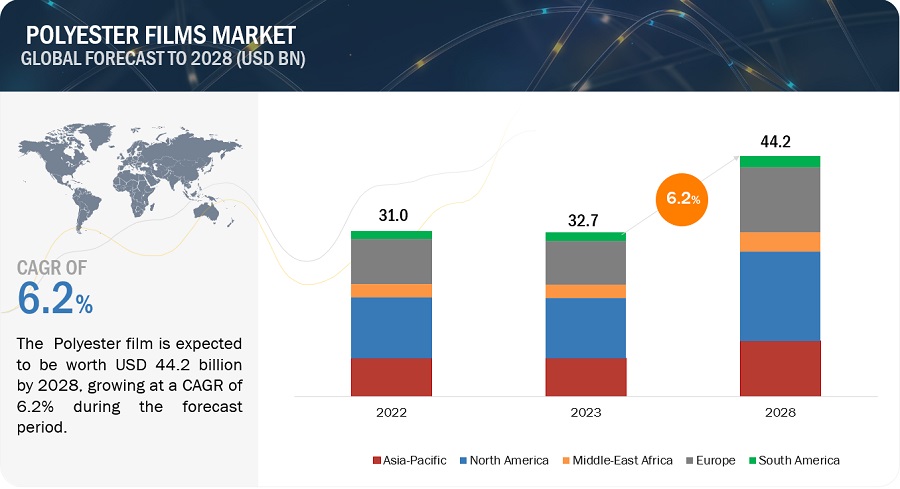

The global polyester film market was valued at USD 32.7 billion in 2023 and is projected to reach USD 44.2 billion by 2028, growing at 6.2% cagr from 2023 to 2028. The market is mainly led by the significant usage of polyester film in various end-use industries. The growing demand from the food & beverage, pharmaceuticals, textile, and electronics rising demand for industrial sector, is driving the polyester film market for market.

Polyester Film Market Forecast & Trends

To know about the assumptions considered for the study, Request for Free Sample Report

Attractive Opportunities in Polyester Film Market

Polyester Film Market Dynamics

Driver: Increasing demand for durable materials in the electronics industry for technological advancements.

The electronics industry's reliance on polyester films has been significantly fueled by ongoing technological advancements. These films play a crucial role in providing electrical insulation for electronic components and flexible printed circuits, facilitating the creation of smaller, lighter, and more durable electronic devices. With the rapid miniaturization of electronic components and the ever-increasing demand for portable and high-performance gadgets, polyester films have become an indispensable part of the industry's drive toward innovation. Their electrical insulating properties not only ensure the reliability and safety of electronic devices but also contribute to their longevity, meeting the market's demands for high-quality, long-lasting electronics. As a result, polyester films are at the forefront of enabling the electronics industry to meet the evolving needs of consumers for more compact and resilient technological products.

Restraint: the presence of competitive materials in the market is restraining the market for polyester films globally

Polyester films, while versatile and widely used, contend with formidable competition from various alternative materials, including polypropylene, polyethylene, and paper-based packaging options. In specific applications and market segments, these competing materials can limit the market share and growth potential of polyester films. Polypropylene, for instance, is known for its cost-effectiveness and durability, making it a preferred choice in certain flexible packaging applications. Polyethylene, with its diverse range of forms such as low-density and high-density polyethylene, competes directly with polyester films in sectors like food packaging, where both materials offer moisture resistance. Additionally, paper-based packaging solutions are gaining prominence as eco-friendly alternatives, appealing to environmentally conscious consumers and industries. As sustainability and cost-efficiency continue to influence material choices, polyester films must contend with these alternatives, adapting and innovating to maintain their market position. It is in this dynamic landscape that polyester films encounter challenges and strive to identify niche markets and applications where their unique properties, such as exceptional barrier capabilities and versatility, can maintain a competitive edge.

Opportunity: Utilization of sustainable packaging materials

The polyester film market presents numerous opportunities for growth and innovation. One of the primary opportunities lies in the ever-expanding demand for sustainable packaging solutions. As global environmental concerns mount, polyester films, known for their recyclability, lightweight nature, and durability, are poised to meet the evolving requirements of eco-conscious consumers and industries. This shift towards sustainability not only positions polyester films as a more environmentally responsible choice but also opens doors to collaboration and research for even more sustainable alternatives, like biodegradable polyester films. Moreover, technological advancements offer a significant growth avenue for the polyester film market. As industries continually seek ways to improve product performance and efficiency, polyester films can be tailored to meet the stringent requirements of these advancements. In particular, the electronics sector, which relies on polyester films for insulation, flexible printed circuits, and electronic components, benefits from ongoing technological innovations that demand ever-thinner, lighter, and more robust materials. Polyester films are thus well-positioned to continue playing a pivotal role in advancing electronics and other high-tech applications.

Challenge: Continous development in regulatory landscape and regulatory standards for packaging material.

Evolving regulatory standards and compliance requirements represent another hurdle for the polyester film industry. Regulations related to packaging materials, such as restrictions on certain additives or environmental labeling, may necessitate adjustments in manufacturing processes and potentially lead to increased costs. Furthermore, economic uncertainties or downturns can have a direct impact on the polyester film market. Reduced consumer spending and industrial activities during economic crises can lead to decreased demand for packaging and industrial applications, affecting the overall growth prospects of the market. The constant need to innovate and adapt to changing consumer preferences and industry demands is also a challenge. As the market increasingly focuses on sustainability, manufacturers need to invest in research and development to create more environmentally friendly polyester film alternatives or enhance existing products. Moreover, polyester film producers need to identify niche markets and applications where their specific properties, such as exceptional barrier capabilities and versatility, can continue to shine.

Polyester Film Market Ecosystem

The market ecosystem for polyester film is composed of a diverse array of entities and stakeholders that collectively contribute to the development, implementation, and advancement of polyester film materials. At the core of this ecosystem are material providers who focus on research, development, and manufacturing of polyester film. They continuously innovate and produce novel materials and their applications to meet the evolving demands of the market.

DuPont Teijin Films (US), TORAY INDUSTRIES, INC. (Japan), Mitsubishi Polyester Film GmbH (Germany), Kolon Industries, Inc. (South Korea), ESTER INDUSTRIES LIMITED (India), Jindal Films Limited (India), Terphane LLC (US), TOYOBO CO. LTD.,(Japan), Polyplex Corporation Limited (India).

Polyester Film: Ecosystem

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

"Below 50 microns is the largest sub-segments amongst the thickness segment in the polyester film market in 2023, in terms of value."

Polyester films with thicknesses below 50 microns dominate the market for a multitude of compelling reasons. These films find extensive use in flexible packaging, where their unique blend of strength and flexibility proves invaluable for packaging a diverse array of products, including food, beverages, and personal care items. Notably, their cost-effectiveness, when compared to thicker alternatives, makes them a preferred choice for manufacturers and converters, especially in high-volume packaging operations. Their lightweight nature not only simplifies packaging but also contributes to reduced transportation costs and a smaller environmental footprint, aligning with sustainability goals.

“Packaging accounted for the largest application share of the polyester film market in 2023” in terms of value.

Packaging stands as the largest application for polyester film due to its remarkable versatility and adaptability to a wide spectrum of packaging requirements. Polyester film can be customized to meet specific needs, available in various thicknesses, finishes, and with diverse barrier properties. This adaptability ensures that it can effectively package an extensive range of products, from food and beverages to electronics and consumer goods. Furthermore, polyester film's recyclability aligns with the growing demand for sustainable packaging options, making it an environmentally responsible choice. Its cost-effectiveness, lightweight nature, and reduced environmental impact in transportation further underscore its prominence in the packaging industry. Altogether, these qualities position polyester film as the top choice for packaging, catering to the diverse needs of a dynamic and evolving consumer market.

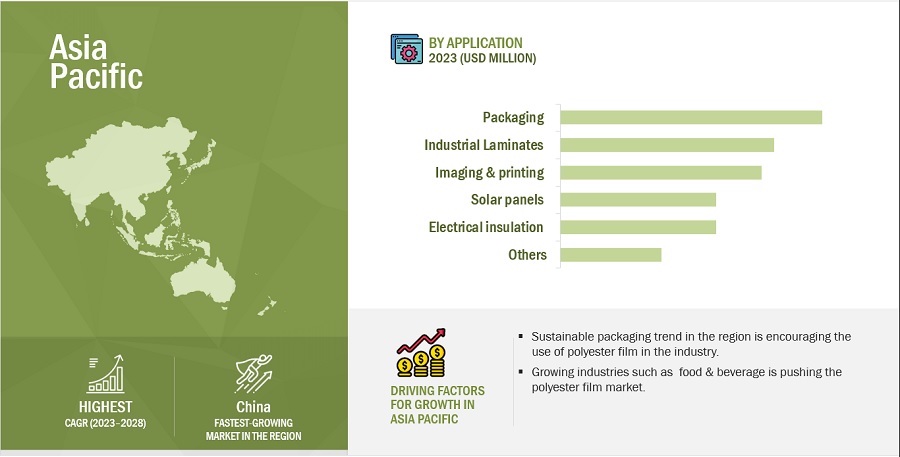

"Asia pacific is the largest market for polyester film Market in 2023, in terms of value."

Asia Pacific's status as the largest market for polyester film can be attributed to a convergence of crucial factors. Foremost, the region has witnessed rapid economic growth, fostering increased consumerism, rising disposable incomes, and the expansion of a burgeoning middle class. As a result, the demand for products necessitating polyester film for packaging, labeling, and other applications has surged. In parallel, ongoing infrastructure development and urbanization across the region necessitate construction materials and automotive components, both of which extensively incorporate polyester films. Additionally, the cost-effectiveness of manufacturing in Asia Pacific has established it as a hub for efficient polyester film production, further cementing its status as the preeminent market for this versatile material. Collectively, these factors underscore Asia Pacific's leadership in the global polyester film industry.

To know about the assumptions considered for the study, download the pdf brochure

Polyester Film Market Players

The key players in this DuPont Teijin Films (US), TORAY INDUSTRIES, INC. (Japan), Mitsubishi Polyester Film GmbH (Germany), Kolon Industries, Inc. (South Korea), ESTER INDUSTRIES LIMITED (India), Jindal Films Limited (India), Terphane LLC (US), TOYOBO CO. LTD.,(Japan), Polyplex Corporation Limited (India). Continuous developments in the market—including new product launches, mergers & acquisitions, agreements, and expansions—are expected to help the market grow. Leading manufacturers of polyester film have opted for new product launches to sustain their market position.

Read More: Polyester Film Companies

Polyester Film Market Report Scope

|

Report Metric |

Details |

|

Years considered for the study |

2023-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Billion/Million) |

|

Segments |

type, application, end use industry and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

DuPont Teijin Films (US), TORAY INDUSTRIES, INC. (Japan), Mitsubishi Polyester Film GmbH (Germany), Kolon Industries, Inc. (South Korea), ESTER INDUSTRIES LIMITED (India), Jindal Films Limited (India), Terphane LLC (US), TOYOBO CO. LTD.,(Japan), Polyplex Corporation Limited (India). |

Segmentation

This report categorizes the global Polyester Film market based on IR Range, Material type, functions, end use industry and region.

On the basis of type the market has been segmented as follows:

- Biaxially oriented

- Thermal film

- Metallized film

- Holographic film

- UV stabilized

- Matte film

- Barrier film

- Others

On the basis of application, the market has been segmented as follows:

- Packaging

- Electrical insulation

- Imaging

- Industrial laminates

- Others

On the basis of end use industry, the market has been segmented as follows:

- Food & beverage Packaging

- Electronics

- Construction

- Pharmaceuticals

- Textiles

- Medical

- Mobility transportation

- Others

On the basis of region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- Middle East & Africa

- South America

Recent Developments

- Ester Industries Limited acquired the engineering plastics business of RadiciGroup of Italy in a deal worth €35 million ($37 million) in 2023. The acquisition was made through Ester Industries' subsidiary, Ester Engineering Plastics Limited. The acquisition of RadiciGroup's engineering plastics business gives Ester Industries a strong foothold in the Indian engineering plastics market.

- Also in 2021, DuPont Teijin Films announced the expansion of its manufacturing plant in Florence, Kentucky, to increase production of its Mylar® polyester film. The expansion is expected to be completed in 2023 and will create 50 new jobs.

- Ester Industries Limited, a leading manufacturer of polyester films in India, and Covestro AG, a leading global supplier of polymer materials, have partnered to develop and commercialize sustainable polyester films. The partnership will focus on developing polyester films that are made from recycled materials or renewable resources, and that have a lower environmental impact than traditional polyester films. The two companies will also work together to develop new applications for sustainable polyester films.

Frequently Asked Questions (FAQ):

What is the expected growth rate of the polyester film market?

This study's forecast period for the polyester film market is 2023-2028. The market is expected to grow at a CAGR of 6.2% in terms of value, during the forecast period.

Who are the major key players in the polyester film market?

DuPont Teijin Films (US), TORAY INDUSTRIES, INC. (Japan), Mitsubishi Polyester Film GmbH (Germany), Kolon Industries, Inc. (South Korea), ESTER INDUSTRIES LIMITED (India), Jindal Films Limited (India), Terphane LLC (US), TOYOBO CO. LTD.,(Japan), Polyplex Corporation Limited (India) are the leading manufacturers and service providers of polyester film market.

What are the emerging trends in the polyester film market?

Increasing environmental concerns have driven the demand for greener and more sustainable solutions across industries. In the polyester film market, there has been a growing interest in eco-friendly materials that minimize the environmental impact of polyester film.

What are the drivers and opportunities for the polyester film market?

The increasing demand for advanced technologies in polyester film drives the polyester film market. The growing packaging sector presents significant opportunities for the utilization and advancement of polyester film.

What are the restraining factors in the polyester film market?

The introduction of competitive products serves as a restraint to the widespread adoption and implementation of polyester film.

What are the latest market trends influencing polyester film demand in Europe across packaging, electronics, and industrial sectors?

Overview of sector-specific drivers for polyester film demand, focusing on industry trends shaping growth in Europe.

How are European regulations impacting the development and adoption of sustainable polyester film products?

Discussion of EU regulations affecting production, recycling, and innovation within the polyester film industry, with a focus on sustainability initiatives.

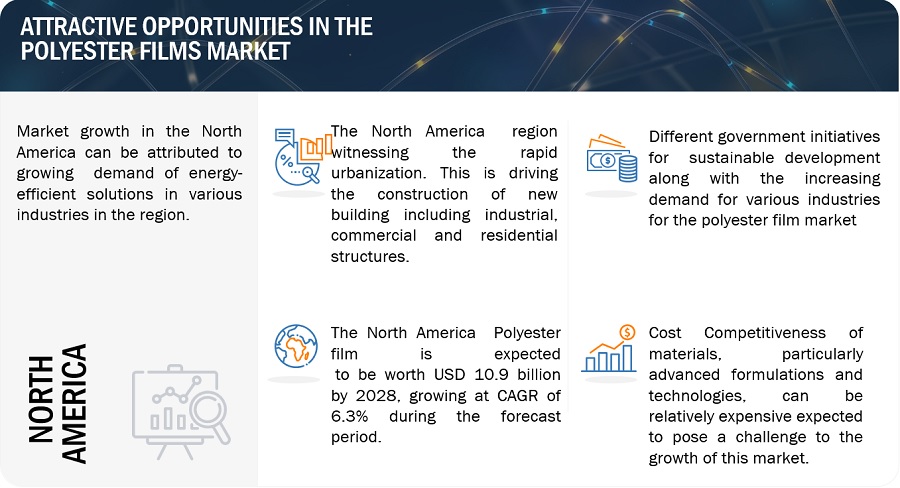

What are the key challenges North American companies face in the polyester film supply chain, and how are they adapting?

Insights into supply chain disruptions, raw material costs, and the strategies being employed to mitigate these issues in North America.

How are North American manufacturers incorporating technological advancements to improve the durability and functionality of polyester films?

Overview of innovations in North America, including improved strength, environmental resistance, and functional coatings in polyester films.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MARKET DYNAMICSDRIVERS- Growing packaging industry- E-commerce boom in recent years- Expanding landscape of pharmaceutical and healthcare industriesRESTRAINTS- Growing environmental concerns about plastic waste- Availability of alternativesOPPORTUNITIES- Recycling and circular economy- Sustainable packagingCHALLENGES- Overcoming recycling-related issues

- 6.1 INTRODUCTION

-

6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER’S BUSINESSREVENUE SHIFT AND NEW REVENUE POCKETS FOR POLYESTER FILM MANUFACTURERS

-

6.3 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSPOLYESTER RESIN MANUFACTURINGPOLYESTER FILM MANUFACTURINGDISTRIBUTIONEND-USE INDUSTRIES

-

6.4 PRICING ANALYSISAVERAGE SELLING PRICE TREND, BY REGIONAVERAGE SELLING PRICE TREND, BY TYPEAVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 TYPES

-

6.5 ECOSYSTEM MAPPING

- 6.6 TECHNOLOGY ANALYSIS

-

6.7 PATENT ANALYSISMETHODOLOGYPATENTS GRANTED WORLDWIDE, 2014–2023- Publication trends over last ten yearsINSIGHTSLEGAL STATUS OF PATENTSJURISDICTION ANALYSISTOP COMPANIES/APPLICANTSLIST OF MAJOR PATENTS

-

6.8 TRADE ANALYSISIMPORT SCENARIOEXPORT SCENARIO

- 6.9 KEY CONFERENCES & EVENTS, 2023–2024

-

6.10 TARIFF & REGULATORY LANDSCAPETARIFF AND REGULATIONS RELATED TO POLYESTER FILMREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONSREGULATIONS RELATED TO POLYESTER FILM MARKET

-

6.11 PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.12 KEY STAKEHOLDERS AND BUYING CRITERIAKEY STAKEHOLDERS IN BUYING PROCESSBUYING CRITERIA

-

6.13 MACROECONOMIC INDICATORSGDP TRENDS AND FORECASTS OF MAJOR ECONOMIES

-

6.14 CASE STUDYUSE OF RECYCLED POLYESTER IN DIFFERENT APPLICATIONSDETERMINING PURITY OF POLYESTER FILMS FOR USE IN ENCAPSULATION OF COLLECTION MATERIALSEVALUATION OF INDIGENOUSLY MANUFACTURED GARFILM-EM-250 ΜM THICK POLYESTER FILM AS DOSIMETER FOR HIGH DOSE APPLICATIONS

- 7.1 INTRODUCTION

-

7.2 BIAXIALLY-ORIENTED FILMSSUPERIOR DIMENSIONAL STABILITY, TENSILE STRENGTH, AND OPTICAL CLARITY

-

7.3 THERMAL FILMSENGINEERED TO WITHSTAND HIGH TEMPERATURES

-

7.4 METALIZED FILMSVERSATILE FILMS WITH REFLECTIVE, BARRIER, AND INSULATING PROPERTIES

-

7.5 HOLOGRAPHIC FILMSENGINEERED TO PRODUCE DYNAMIC AND THREE-DIMENSIONAL VISUAL EFFECTS WHEN EXPOSED TO LIGHT

-

7.6 UV STABILIZED FILMSENGINEERED TO PROVIDE EXCEPTIONAL PROTECTION AGAINST UV RADIATION

-

7.7 MATTE FILMSDESIGNED TO REDUCE GLARE, MINIMIZE REFLECTION, AND PROVIDE SOFT DIFFUSED APPEARANCE

-

7.8 BARRIER FILMSSUPERIOR PROTECTION AGAINST PENETRATION OF GASES, MOISTURE, AND OTHER ENVIRONMENTAL FACTORS

-

7.9 OTHER FILMSCONDUCTIVE FILMS- Engineered to provide electrical conductivity while retaining flexibility and durabilityRELEASE FILMS- Prevent adhesion between adhesive materials and various surfaces during manufacturing processANTI-STATIC FILMS- Engineered to control and dissipate static electricity

- 8.1 INTRODUCTION

-

8.2 PACKAGINGENHANCED BARRIER PROPERTIES, COUPLED WITH TRANSPARENCY, DURABILITY, AND RECYCLABILITY

-

8.3 INDUSTRIAL LAMINATESABILITY TO COMBINE WITH OTHER MATERIALS FOR SPECIFIC PERFORMANCE CHARACTERISTICS

-

8.4 IMAGING & PRINTINGENHANCED OPTICAL CLARITY, DIMENSIONAL STABILITY, AND PRINTABILITY

-

8.5 ELECTRICAL INSULATIONEXCEPTIONAL DIELECTRIC PROPERTIES, THERMAL RESISTANCE, AND DURABILITY

-

8.6 SOLAR PANELSUV RESISTANCE, MOISTURE RESISTANCE, AND THERMAL STABILITY

-

8.7 OTHER APPLICATIONSAGRICULTURE & HORTICULTURE- Enhancing crop protection, optimizing growth conditions, and managing environmental influencesAUTOMATED CUTTING & ENGRAVING- Enhanced accuracy, efficiency, and customization allow precise replication of designs on various surfaces

- 9.1 INTRODUCTION

-

9.2 <50 MICRONSTHINNESS, FLEXIBILITY, AND VERSATILITY FOR VARIOUS INNOVATIVE APPLICATIONS

-

9.3 51–100 MICRONSBALANCE BETWEEN FLEXIBILITY, STRENGTH, AND DURABILITY

-

9.4 101–200 MICRONSVERSATILITY AND ROBUSTNESS MAKE THEM PREFERABLE CHOICE

-

9.5 201–300 MICRONSENHANCED COMBINATION OF STRENGTH, RIGIDITY, AND LONGEVITY

-

9.6 >300 MICRONSSUPERIOR STRENGTH, DURABILITY, AND RIGIDITY

- 10.1 INTRODUCTION

-

10.2 FOOD & BEVERAGEVERSATILITY, PRINTABILITY, AND BARRIER PROPERTIES TO DRIVE DEMAND

-

10.3 ELECTRICAL & ELECTRONICSVERSATILE MATERIAL FOR WIDE RANGE OF APPLICATIONS

-

10.4 PHARMACEUTICALSUITABLE FOR STERILE AND MOISTURE-SENSITIVE APPLICATIONS

-

10.5 TEXTILECREATION OF FUNCTIONAL, DECORATIVE, AND HIGH-PERFORMANCE TEXTILES

-

10.6 MEDICALBIOCOMPATIBILITY, RESISTANCE TO STERILIZATION PROCESSES, AND CLARITY

-

10.7 MOBILITY & TRANSPORTATIONENHANCEMENT OF SAFETY, COMFORT, AND AESTHETICS OF VEHICLES AND TRANSPORTATION INFRASTRUCTURE

-

10.8 OTHER END-USE INDUSTRIESBUILDING & CONSTRUCTION- Improved safety, security, aesthetics, and energy efficiency of buildingsSPORTS & RECREATION- Strength, durability, and resistance to environmental factors

- 11.1 INTRODUCTION

-

11.2 ASIA PACIFICRECESSION IMPACTCHINA- Heavy capital investment in packaging material to drive marketJAPAN- Largest market for polyester film productsSOUTH KOREA- Dynamic private sector and investment by public companies to drive industrial growthINDIA- Investment by major players to drive growthREST OF ASIA PACIFIC

-

11.3 NORTH AMERICARECESSION IMPACT- USCANADA- Plastic and packaging industry to drive demandMEXICO- Evolving food & beverage industry to drive demand

-

11.4 EUROPERECESSION IMPACTGERMANY- Largest potential market for big industries such as automotive and constructionITALY- Largest economy in Europe with well-developed petrochemical industryFRANCE- Presence of many established players to drive marketUK- Rapid growth in construction sector to drive marketRUSSIA- High versatility of polyester films to drive demandSPAIN- Increased demand for safe vehicles to drive marketREST OF EUROPE

-

11.5 MIDDLE EAST & AFRICARECESSION IMPACTSAUDI ARABIA- Industrial growth to drive polyester film marketSOUTH AFRICA- Rapid growth in manufacturing industry to drive demandREST OF MIDDLE EAST & AFRICA

-

11.6 SOUTH AMERICARECESSION IMPACTBRAZIL- Largest share in GDP of South AmericaARGENTINA- Industrial sector of Argentina to drive demandREST OF SOUTH AMERICA

- 12.1 INTRODUCTION

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS

-

12.3 MARKET SHARE ANALYSISRANKING OF KEY MARKET PLAYERS, 2022MARKET SHARE OF KEY PLAYERS- Toyobo Co., Ltd.- Polyplex Corporation Ltd.- Kolon Industries Inc.- Toray Industries Inc.- Polifilm Extrusion GmbH

- 12.4 REVENUE ANALYSIS

-

12.5 COMPANY EVALUATION MATRIX (TIER 1)STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSCOMPANY FOOTPRINT

-

12.6 START-UP/SME EVALUATION MATRIXPROGRESSIVE COMPANIESRESPONSIVE COMPANIESDYNAMIC COMPANIESSTARTING BLOCKSCOMPETITIVE BENCHMARKING

-

12.7 COMPETITIVE SCENARIOS AND TRENDSPRODUCT LAUNCHESDEALSOTHER DEVELOPMENTS

-

13.1 KEY PLAYERSTORAY INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewKOLON INDUSTRIES, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTOYOBO CO., LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPOLYPLEX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewESTER INDUSTRIES LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDUPONT TEIJIN FILMS- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewMITSUBISHI POLYESTER FILM GMBH- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPOLIFILM EXTRUSION GMBH.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewTERPHANE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewJINDAL POLY FILMS LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERSSEALED AIR CORPORATIONOBEN HOLDING GROUPRADICI PARTECIPAZIONI SPAAEP INDUSTRIESUFLEX LIMITEDAMCOR PLCBERRY GLOBAL GROUP, INC.DOWEASTMAN CHEMICAL COMPANYIMPAK FILMS US LLCPOLINASFUTAMURA CHEMICAL CO. LTD.SUMILON POLYESTER LTD.AMERPLASTZHEJIANG WUZHOU POLYESTER FILM CO., LTD.

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS

- TABLE 1 AVERAGE SELLING PRICE, BY REGION, 2019–2028 (USD/TON)

- TABLE 2 AVERAGE SELLING PRICE, BY TYPE, 2019–2028 (USD/TON)

- TABLE 3 AVERAGE SELLING PRICE, BY TOP 3 TYPES, 2019–2028 (USD/TON)

- TABLE 4 POLYESTER FILM MARKET: ECOSYSTEM

- TABLE 5 KEY TECHNOLOGIES OFFERED IN POLYESTER FILM MARKET

- TABLE 6 COMPLEMENTARY TECHNOLOGIES OFFERED IN POLYESTER FILM MARKET

- TABLE 7 ADJACENT TECHNOLOGIES OFFERED FOR POLYESTER FILM

- TABLE 8 TOTAL NUMBER OF PATENTS

- TABLE 9 LIST OF MAJOR PATENT OWNERS FOR POLYESTER FILM

- TABLE 10 MAJOR PATENTS FOR POLYESTER FILM

- TABLE 11 POLYESTER FILM MARKET: DETAILED LIST OF CONFERENCES AND EVENTS

- TABLE 12 TARIFFS RELATED TO POLYESTER FILM MARKET

- TABLE 13 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 16 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 17 SOUTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 18 NORTH AMERICA: LIST OF REGULATIONS FOR POLYESTER FILM MARKET

- TABLE 19 EUROPE: LIST OF REGULATIONS FOR POLYESTER FILM MARKET

- TABLE 20 ASIA PACIFIC: LIST OF REGULATIONS FOR POLYESTER FILM MARKET

- TABLE 21 IMPACT OF PORTER’S FIVE FORCES ON POLYESTER FILM MARKET

- TABLE 22 INFLUENCE OF INSTITUTIONAL BUYERS ON BUYING PROCESS FOR TOP FIVE APPLICATIONS

- TABLE 23 KEY BUYING CRITERIA FOR APPLICATIONS

- TABLE 24 GDP TRENDS AND FORECASTS, BY KEY COUNTRY, 2019–2028 (USD MILLION)

- TABLE 25 POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 26 POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 27 POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 28 POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 29 POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 30 POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 31 POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 32 POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 33 POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 34 POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 35 POLYESTER FILM MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 36 POLYESTER FILM MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 37 POLYESTER FILM MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 38 POLYESTER FILM MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 39 POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 40 POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 41 POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 42 POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 43 POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 44 POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 45 POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 46 POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 47 POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 48 POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 49 ASIA PACIFIC: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 50 ASIA PACIFIC: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 51 ASIA PACIFIC: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 52 ASIA PACIFIC: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 53 ASIA PACIFIC: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 54 ASIA PACIFIC: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 55 ASIA PACIFIC: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 56 ASIA PACIFIC: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 57 ASIA PACIFIC: POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 58 ASIA PACIFIC: POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 59 ASIA PACIFIC: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 60 ASIA PACIFIC: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 61 ASIA PACIFIC: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 62 ASIA PACIFIC: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 63 CHINA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 64 CHINA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 65 JAPAN: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 66 JAPAN: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 67 SOUTH KOREA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 68 SOUTH KOREA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 69 INDIA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 70 INDIA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 71 REST OF ASIA PACIFIC: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 72 REST OF ASIA PACIFIC: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 73 NORTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 74 NORTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 75 NORTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 76 NORTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 77 NORTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 78 NORTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 NORTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 80 NORTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 81 NORTH AMERICA: POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 82 NORTH AMERICA: POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 87 US: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 88 US: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 89 CANADA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 90 CANADA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 MEXICO: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 92 MEXICO: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 93 EUROPE: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 94 EUROPE: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 95 EUROPE: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 96 EUROPE: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 97 EUROPE: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 98 EUROPE: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 99 EUROPE: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 100 EUROPE: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 101 EUROPE: POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 102 EUROPE: POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 103 EUROPE: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 104 EUROPE: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 105 EUROPE: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 106 EUROPE: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 107 GERMANY: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 108 GERMANY: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 109 ITALY: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 110 ITALY: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 111 FRANCE: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 112 FRANCE: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 113 UK: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 114 UK: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 115 RUSSIA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 116 RUSSIA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 117 SPAIN: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 118 SPAIN: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 119 REST OF EUROPE: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 120 REST OF EUROPE: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 123 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 125 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 127 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 129 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 131 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 132 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 133 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 134 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 135 SAUDI ARABIA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 136 SAUDI ARABIA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 137 SOUTH AFRICA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 138 SOUTH AFRICA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 139 REST OF MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 141 SOUTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 142 SOUTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 143 SOUTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 144 SOUTH AMERICA: POLYESTER FILM MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 145 SOUTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 146 SOUTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 147 SOUTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 148 SOUTH AMERICA: POLYESTER FILM MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 149 SOUTH AMERICA: POLYESTER FILM MARKET, BY THICKNESS, 2019–2022 (USD MILLION)

- TABLE 150 SOUTH AMERICA: POLYESTER FILM MARKET, BY THICKNESS, 2023–2028 (USD MILLION)

- TABLE 151 SOUTH AMERICA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 152 SOUTH AMERICA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 153 SOUTH AMERICA: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 154 SOUTH AMERICA: POLYESTER FILM MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 155 BRAZIL: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 156 BRAZIL: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 157 ARGENTINA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 158 ARGENTINA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 159 REST OF SOUTH AMERICA: POLYESTER FILM MARKET, BY APPLICATION, 2019–2022 (USD MILLION)

- TABLE 160 REST OF SOUTH AMERICA: POLYESTER FILM MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 161 OVERVIEW OF STRATEGIES ADOPTED BY KEY POLYESTER FILM MANUFACTURERS

- TABLE 162 POLYESTER FILM MARKET: DEGREE OF COMPETITION

- TABLE 163 POLYESTER FILM MARKET: KEY COMPANY APPLICATION FOOTPRINT

- TABLE 164 POLYESTER FILM MARKET: KEY COMPANY END-USE INDUSTRY FOOTPRINT

- TABLE 165 POLYESTER FILM MARKET: KEY COMPANY TYPE FOOTPRINT

- TABLE 166 POLYESTER FILM MARKET: KEY COMPANY REGION FOOTPRINT

- TABLE 167 POLYESTER FILM MARKET: DETAILED LIST OF KEY START-UPS/SMES

- TABLE 168 POLYESTER FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES], BY APPLICATION

- TABLE 169 POLYESTER FILMS MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES], BY TYPE

- TABLE 170 POLYESTER FILM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES], BY END-USE INDUSTRY

- TABLE 171 POLYESTER FILM MARKET: COMPETITIVE BENCHMARKING OF KEY PLAYERS [START-UPS/SMES], BY REGION

- TABLE 172 POLYESTER FILM MARKET: PRODUCT LAUNCHES (2019–2023)

- TABLE 173 POLYESTER FILM MARKET: DEALS (2019–2023)

- TABLE 174 POLYESTER FILM: OTHER DEVELOPMENTS (2019–2023)

- TABLE 175 TORAY INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 176 TORAY INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 177 TORAY INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 178 TORAY INDUSTRIES, INC.: OTHER DEVELOPMENTS

- TABLE 179 KOLON INDUSTRIES, INC.: COMPANY OVERVIEW

- TABLE 180 KOLON INDUSTRIES, INC.: PRODUCT OFFERINGS

- TABLE 181 KOLON INDUSTRIES, INC.: PRODUCT LAUNCHES

- TABLE 182 TOYOBO CO., LTD.: COMPANY OVERVIEW

- TABLE 183 TOYOBO CO. LTD.: PRODUCT OFFERINGS

- TABLE 184 TOYOBO CO. LTD.: DEALS

- TABLE 185 TOYOBO CO. LTD.: OTHER DEVELOPMENTS

- TABLE 186 POLYPLEX: COMPANY OVERVIEW

- TABLE 187 POLYPLEX: PRODUCT OFFERINGS

- TABLE 188 POLYPLEX: OTHER DEVELOPMENTS

- TABLE 189 ESTER INDUSTRIES LIMITED: COMPANY OVERVIEW

- TABLE 190 ESTER INDUSTRIES LIMITED: PRODUCT OFFERINGS

- TABLE 191 ESTER INDUSTRIES LIMITED: OTHER DEVELOPMENTS

- TABLE 192 DUPONT TEIJIN FILMS: COMPANY OVERVIEW

- TABLE 193 DUPONT TEIJIN FILMS: PRODUCT OFFERINGS

- TABLE 194 DUPONT TEIJIN FILMS: PRODUCT LAUNCHES

- TABLE 195 DUPONT TEIJIN FILMS: DEALS

- TABLE 196 MITSUBISHI POLYESTER FILM GMBH: COMPANY OVERVIEW

- TABLE 197 MITSUBISHI POLYESTER FILM GMBH: PRODUCT OFFERINGS

- TABLE 198 MITSUBISHI POLYESTER FILM GMBH: OTHER DEVELOPMENTS

- TABLE 199 POLIFILM EXTRUSION GMBH: COMPANY OVERVIEW

- TABLE 200 POLIFILM EXTRUSION GMBH: PRODUCT OFFERINGS

- TABLE 201 POLIFILM EXTRUSION GMBH: DEALS

- TABLE 202 POLIFILM EXTRUSION GMBH: OTHER DEVELOPMENTS

- TABLE 203 TERPHANE: COMPANY OVERVIEW

- TABLE 204 TERPHANE: PRODUCT OFFERINGS

- TABLE 205 TERPHANE: PRODUCT LAUNCHES

- TABLE 206 TERPHANE: DEALS

- TABLE 207 TERPHANE: OTHER DEVELOPMENTS

- TABLE 208 JINDAL POLY FILMS LTD.: COMPANY OVERVIEW

- TABLE 209 JINDAL POLY FILMS LTD.: PRODUCT OFFERINGS

- TABLE 210 JINDAL POLY FILMS LTD.: DEALS

- TABLE 211 JINDAL POLY FILMS LTD.: OTHER DEVELOPMENTS

- TABLE 212 SEALED AIR CORPORATION: COMPANY OVERVIEW

- TABLE 213 OBEN HOLDING GROUP: COMPANY OVERVIEW

- TABLE 214 RADICI PARTECIPAZIONI SPA: COMPANY OVERVIEW

- TABLE 215 AEP INDUSTRIES: COMPANY OVERVIEW

- TABLE 216 UFLEX LIMITED: COMPANY OVERVIEW

- TABLE 217 AMCOR PLC: COMPANY OVERVIEW

- TABLE 218 BERRY GLOBAL GROUP, INC.: COMPANY OVERVIEW

- TABLE 219 DOW: COMPANY OVERVIEW

- TABLE 220 EASTMAN CHEMICAL COMPANY: COMPANY OVERVIEW

- TABLE 221 IMPAK FILMS US LLC : COMPANY OVERVIEW

- TABLE 222 POLINAS: COMPANY OVERVIEW

- TABLE 223 FUTAMURA CHEMICAL CO. LTD.: COMPANY OVERVIEW

- TABLE 224 SUMILON POLYESTER LTD.: COMPANY OVERVIEW

- TABLE 225 AMERPLAST: COMPANY OVERVIEW

- TABLE 226 ZHEJIANG WUZHOU POLYESTER FILM CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 POLYESTER FILM MARKET SEGMENTATION

- FIGURE 2 POLYESTER FILM MARKET: RESEARCH DESIGN

- FIGURE 3 POLYESTER FILM MARKET: DATA TRIANGULATION

- FIGURE 4 BIAXIALLY-ORIENTED FILMS TO LEAD POLYESTER FILM MARKET BETWEEN 2023 AND 2028

- FIGURE 5 <50 MICRONS THICKNESS SEGMENT TO LEAD POLYESTER FILM MARKET BETWEEN 2023 AND 2028

- FIGURE 6 PACKAGING APPLICATION TO LEAD POLYESTER FILM MARKET DURING FORECAST PERIOD

- FIGURE 7 ELECTRICAL & ELECTRONICS SEGMENT TO LEAD POLYESTER FILM MARKET DURING FORECAST PERIOD

- FIGURE 8 ASIA PACIFIC DOMINATES POLYESTER FILM MARKET IN 2023

- FIGURE 9 EXPANSION OF PACKAGING INDUSTRY COUPLED WITH GROWTH OF PHARMACEUTICAL & HEALTHCARE SECTORS TO DRIVE MARKET

- FIGURE 10 BIAXIALLY-ORIENTED FILMS TO BE FASTEST-GROWING TYPE SEGMENT DURING FORECAST PERIOD

- FIGURE 11 ASIA PACIFIC TO BE FASTEST-GROWING POLYESTER FILM MARKET DURING FORECAST PERIOD

- FIGURE 12 <50 MICRONS THICKNESS TO BE FASTEST-GROWING SEGMENT DURING FORECAST PERIOD

- FIGURE 13 PACKAGING TO BE FASTEST-GROWING APPLICATION DURING FORECAST PERIOD

- FIGURE 14 ELECTRICAL & ELECTRONICS TO BE FASTEST-GROWING END-USE INDUSTRY SEGMENT DURING FORECAST PERIOD

- FIGURE 15 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN POLYESTER FILM MARKET

- FIGURE 16 REVENUE SHIFT OF POLYESTER FILM MARKET

- FIGURE 17 OVERVIEW OF POLYESTER FILM MARKET VALUE CHAIN

- FIGURE 18 POLYESTER FILM MARKET: AVERAGE SELLING PRICE TREND, BY REGION

- FIGURE 19 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TOP 3 TYPES

- FIGURE 20 NUMBER OF PATENTS GRANTED OVER LAST 10 YEARS

- FIGURE 21 PATENT ANALYSIS, BY LEGAL STATUS

- FIGURE 22 REGIONAL ANALYSIS OF PATENT GRANTED FOR POLYESTER FILM MARKET, 2023

- FIGURE 23 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENTS IN LAST TEN YEARS

- FIGURE 24 IMPORT OF POLYESTER FILM, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 25 EXPORT OF POLYESTER FILM, BY COUNTRY, 2019–2022 (USD MILLION)

- FIGURE 26 PORTER’S FIVE FORCES ANALYSIS: POLYESTER FILM MARKET

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP FIVE APPLICATIONS

- FIGURE 28 KEY BUYING CRITERIA FOR APPLICATIONS

- FIGURE 29 BIAXIALLY-ORIENTED FILMS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 30 PACKAGING TO LEAD POLYESTER FILM MARKET DURING FORECAST PERIOD

- FIGURE 31 <50 MICRONS FILM SEGMENT TO DOMINATE POLYESTER FILM MARKET DURING FORECAST PERIOD

- FIGURE 32 ELECTRICAL & ELECTRONICS END-USE INDUSTRY TO DOMINATE MARKET DURING FORECAST PERIOD

- FIGURE 33 ASIA PACIFIC TO BE FASTEST-GROWING MARKET DURING FORECAST PERIOD

- FIGURE 34 ASIA PACIFIC: POLYESTER FILM MARKET SNAPSHOT

- FIGURE 35 NORTH AMERICA: POLYESTER FILM MARKET SNAPSHOT

- FIGURE 36 EUROPE: POLYESTER FILM MARKET SNAPSHOT

- FIGURE 37 MIDDLE EAST & AFRICA: POLYESTER FILM MARKET SNAPSHOT

- FIGURE 38 SOUTH AMERICA: POLYESTER FILM MARKET SNAPSHOT

- FIGURE 39 RANKING OF TOP FIVE PLAYERS IN POLYESTER FILM MARKET, 2022

- FIGURE 40 POLYESTER FILM MARKET IN 2022

- FIGURE 41 REVENUE OF KEY PLAYERS, 2020–2024

- FIGURE 42 POLYESTER FILM MARKET: COMPANY EVALUATION MATRIX, 2022 (TIER 1)

- FIGURE 43 POLYESTER FILM MARKET: START-UP/SME EVALUATION MATRIX, 2022

- FIGURE 44 TORAY INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 45 KOLON INDUSTRIES, INC.: COMPANY SNAPSHOT

- FIGURE 46 TOYOBO CO., LTD.: COMPANY SNAPSHOT

- FIGURE 47 POLYPLEX: COMPANY SNAPSHOT

- FIGURE 48 ESTER INDUSTRIES LIMITED: COMPANY SNAPSHOT

- FIGURE 49 JINDAL POLY FILMS LTD.: COMPANY SNAPSHOT

The study involved four major activities in estimating the market size of the Polyester Film market. Exhaustive secondary research was done to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. Thereafter, the market breakdown and data triangulation procedures were used to estimate the market size of the segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information for this study. These secondary sources include annual reports, press releases, investor presentations of companies, white papers, certified publications, trade directories, articles from recognized authors, the gold standard and silver standard websites, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, the monetary chain of the market, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The Polyester Film market comprises several stakeholders in the value chain, which include input suppliers, equipment manufacturers, technology providers, service providers, distribution and logistics, and end users. Various primary sources from the supply and demand sides of the Polyester Film market have been interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in end-use sectors. The primary sources from the supply side include manufacturers, associations, and institutions involved in the Polyurethane catalyst industry.

Primary interviews were conducted to gather insights such as market statistics, data on revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, type, application, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs, were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of Polyurethane Catalystand the outlook of their business, which will affect the overall market.

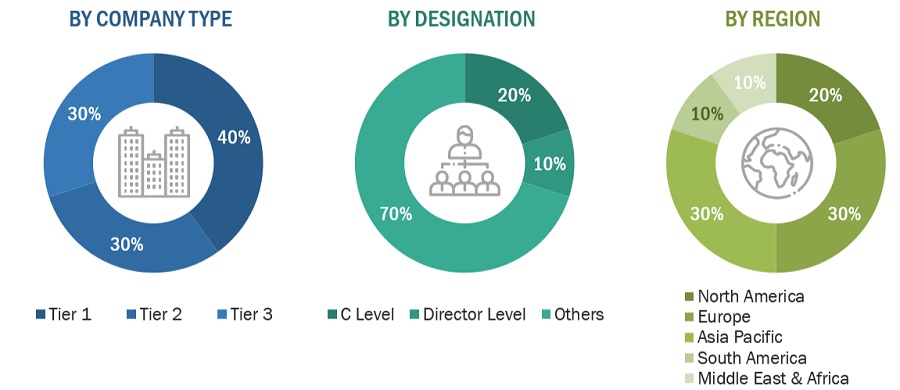

The breakdown of profiles of the primary interviewees is illustrated in the figure below:

Note: Tier 1, Tier 2, and Tier 3 companies are classified based on their market revenue in 2021, available in the public domain, product portfolios, and geographical presence.

Other designations include consultants and sales, marketing, and procurement managers.

To know about the assumptions considered for the study, download the pdf brochure

|

Company Name |

Designation |

|

DuPont Teijin Films |

Individual Industry Expert |

|

Mitsubishi Polyester Film GmbH |

Sales Manager |

|

Kolon Industries, Inc. |

Manager |

|

TOYOBO CO. LTD., |

Marketing Manager |

|

Terphane LLC |

Senior Scientist |

Market Size Estimation

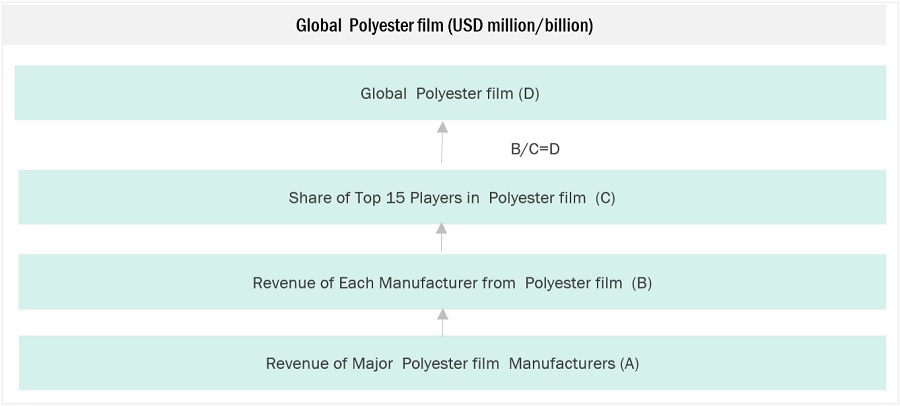

The top-down and bottom-up approaches have been used to estimate and validate the size of the Polyester Film market.

- The key players in the industry have been identified through extensive secondary research.

- The industry's supply chain has been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

- All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

- The research includes the study of reports, reviews, and newsletters of the key market players, along with extensive interviews for opinions with leaders such as directors and marketing executives.

Polyester Film Market: Bottum-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Polyester Film Market: Top-Down Approach

Data Triangulation

After arriving at the total market size from the estimation process explained above, the overall market has been split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics for all the segments and sub-segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data has been triangulated by studying various factors and trends from both the demand and supply sides. Along with this, the market size has been validated by using both the top-down and bottom-up approaches and primary interviews. Hence, for every data segment, there have been three sources—top-down approach, bottom-up approach, and expert interviews. The data was assumed correct when the values arrived from the three sources matched.

Market Definition

The market for polyester film on a global scale encompasses the production, distribution, and consumption of thin, flexible sheets made from polyethylene terephthalate (PET) or other similar polyester materials. These films find extensive application across various industries, including packaging, electrical insulation, graphics, labeling, and industrial uses. The global polyester film market involves manufacturers, suppliers, and consumers engaging in the trade and use of polyester films, where these films serve as versatile solutions due to their exceptional properties, such as high tensile strength, dimensional stability, transparency, and barrier capabilities. The market's dynamics are influenced by factors like technological advancements, environmental considerations, and the demand for sustainable packaging solutions, all of which contribute to the continual evolution and growth of the global polyester film market.

Key Stakeholders

- Raw material suppliers.

- Polyester Film manufacturers.

- Polyester Film traders, distributors, and suppliers.

- End-use industry participants.

- Government and research organizations.

- Associations and industrial bodies.

- Research and consulting firms.

- Research & development (R&D) institutions.

- Environmental support agencies.

Report Objectives

- To define, describe, and forecast the size of the Polyester Film market, in terms of value.

- To provide detailed information regarding the major factors (drivers, opportunities, restraints, and challenges) influencing the growth of the market

- To estimate and forecast the market size based on technology, type, application and region.

- To forecast the size of the market with respect to major regions, namely, Europe, North America, Asia Pacific, Middle East & Africa, and South America, along with their key countries.

- To strategically analyze micromarkets1 with respect to individual growth trends, prospects, and their contribution to the overall market.

- To analyze opportunities in the market for stakeholders and provide a competitive landscape of market leaders.

- To track and analyze recent developments such as expansions, new product launches, partnerships & agreements, and acquisitions in the market.

- To strategically profile key market players and comprehensively analyze their core competencies.

Available Customizations

Along with the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

Regional Analysis

- Further breakdown of a region with respect to a particular country or additional application

Company Information

- Detailed analysis and profiles of additional market players

Growth opportunities and latent adjacency in Polyester Film Market