Polished Concrete Market by Type (Densifier, Sealer & Crack Filler, Conditioner), Method (Dry, Wet), Construction Type (New Construction, Renovation), End-use Sector (Residential, Non-residential), and Region - Global Forecast to 2025

Updated on : August 25, 2025

Polished Concrete Market

The global polished concrete market was valued at USD 2.2 billion in 2020 and is projected to reach USD 3.0 billion by 2025, growing at 5.6% cagr from 2020 to 2025. The market is expected to witness significant growth in the future due to its increased demand in residential and commercial construction. Growth in construction of new residential & commercial spaces, and increase in the demand for durable, attractive, and low maintainence flooring systems, are likely to support the growth of the polished concrete market during the forecast period.

To know about the assumptions considered for the study, Request for Free Sample Report

COVID-19 impact on global polished concrete market

The global polished concrete market is expected to witness the impact of the pandemic on its demand, in 2020-2021. In 2020, the polished concrete market has a nominal impact due to COVID-19 and expected to witness a nominal decline in demand in 2020. Moreover, due to the COVID-19, the market is being hampered owing to slowing raw material production, supply chain disruption, hampered trade movements, declining construction demand, and reduced demand for new projectss.

Polished Concrete Market Dynamics

Driver: Increased demand for polished concrete for flooring applications

The high demand for polished concrete, especially for constructing hotel flooring and other commercial buildings, is a primary factor resulting in an upsurge in demand. This is mainly due to the widespread benefits of the polished concrete, such as good esthetic appeal to floors, along with its resistance to skidding and wear & tear caused by heavy footfall. The demand is expected to grow significantly in Asia Pacific and Middle East & Africa. High investments in housing developments and rapid industrialization in developing countries of these regions are expected to boost the demand for polished concrete. Polished concrete improves the esthetic appeal of an establishment or facility, thereby enhancing its demand over the coming years.

Restraint: Volatility in raw materials prices

Raw material and energy used in manufacturing polished concrete concrete have volatile prices and the trend is set to continue during the forecast period. The instability of petroleum and crude oil costs may cause the price of raw materials to rise, and, in turn, increase the cost of cement, adhesives, and sealants used in polished concrete. Hence, the prices of these materials have a direct impact on the cost of polished concrete. With an increase in the cost of raw materials, vendors increase the price of their products or reduce their profit margins, which will have an adverse effect on market growth.

Opportunity: Rise in renovation and remodelling activities globally

Increasing remodelling and renovation operations in non-residential spaces will accelerate the demand for polished concrete during the forecast year. Furthermore, hotel and resort owners are engaged in renovating the structures of their outlets for improving their customer base and enhancing the accommodation experience. For instance, In September 2019, JW Marriot opened a new hotel in Canberra (Australia), featuring the latest design accents and polished concrete flooring, which further enhances the visual appeal of the floors. Rising investments from industry players in the retail sector and residential construction are further expected to propel the adaptation of polished concrete.

Challenge: Environmental concerns associated with polished concrete

A major component of concrete is cement, which has its own environmental and social impacts and contributes largely to those of concrete. The cement industry is one of the key producers of carbon dioxide, a potent greenhouse gas. Furthermore, the production of Portland cement accounts for approximately 5% of the anthropogenic CO2 emissions worldwide and about 2% of total CO2 emissions in the United States.

Densifier widely preferred type of polished concrete

Based on type, densifier is projected to be the largest segment in the polished concrete market. The growth of the densifier segment can be attributed to the benefits it offers, such as protection to the concrete flooring system against chemical attack, staining, permeable fluids, wear, and degradation. The densifier is widely preferred and demanded for the concrete polishing, and its demand is expected to accelerate during the forecast period, with the increase in the demand from the non- residential sector.

Dry segment to dominate the global polished concrete market

The dry segment to lead the global polished concrete market by 2025. The high demand can be attributed to the higher shine and durability it offers to the polished concrete floors. For the dry concrete polishing method, the surface of the concrete is ground using commercial-scale polishing machines. Each stage of the process requires a different abrasive polishing disk, often incorporating diamond grit, with coarser textures for earlier stages and finer ones to get the final shine.

New construction segment led the global polished concrete market

The new construction segment to lead the global polished concrete market by 2025. The high demand can be attributed to the higher demand for the polished concrete products, majorly for warehousing and office applications. Polished concrete is also preferred for industrial as well as commercial spaces or floorings. The growth in the demand for polished concrete for the new construction segment is due to the longevity, esthetic appeal, and high-performance properties of polished concrete.

Significant increase in the demand for polished concrete for non-residential construction

By End-use sector, the non-residential segment is projected to be the largest segment in the polished concrete market. The non-residential segment generates higher demand for the polished concrete products. The growth in the non-residential segment is due to the longevity, esthetic appeal, and high-performance properties of polished concrete.

North American region to lead the global polished concrete market by 2025

The North American region accounted for the largest market share in 2019. The growth of the polished concrete market in North America is driven by technological advancements in the building & construction industry. In the US, single-family homes are growing, especially in Florida, Georgia, North Carolina, Washington, Utah, Tennessee, Ohio, California, Idaho, and South Carolina. The usage of shiny, glossy and esthetic appeal flooring systems in residential applications has been a key factor driving the polished concrete market.

Polished Concrete Market Players

The polished concrete market is dominated by a few globally established players, such as PPG Industries, Inc. (US), 3M Company (US), BASF SE (Germany), Boral Limited (Australia), The Sherwin-Williams Company (US), UltraTech Cement Limited (India), and SIKA AG (Switzerland), amongst others.

Polished Concrete Market Report Scope

|

Report Metric |

Details |

|

Market size available for years |

2018–2025 |

|

Base year considered |

2019 |

|

Forecast period |

2020–2025 |

|

Forecast units |

Value (USD Million) and Volume (Million Square Feet) |

|

Segments covered |

Type, Method, Construction type, End-use Sector, and Region |

|

Geographies covered |

North America, APAC, Europe, Middle East & Africa, and South America |

|

Companies covered |

BASF SE (Germany), 3M Company (US), Sika AG (Switzerland), The Sherwin Williams Company (US), PPG Industries, Inc. (US), UltraTech Cement Limited (India), and Boral Limited (Australia) |

This research report categorizes the polished concrete market based on type, method, construction type, end-use sector, and region.

On the basis of type:

- Densifier

- Sealer & Crack Filler

- Conditioner

On the basis of method

- Dry

- Wet

On the basis of construction type

- New Construction

- Renovation

On the basis of end-use sector

- Residential

- Non-residential

On the basis of region:

- North America

- Europe

- APAC

- Middle East & Africa

- South America

Recent Developments

- In December 2020, PPG Industries is acquiring Tikkurila (Finland), a finish paint and coatings manufacturer. The acquisition is expected to close in the second quarter of 2021. Tikkurila’s has strong and established decorative brands and product offerings in several Northern and Eastern European countries where PPG has a minimal presence. This acquisition is expected to provide PPG Industries with new cross-selling opportunities, growth opportunities for employees, and product solutions for new segments and customers.

- In November 2020, Sika expands its production capacity in the United Arab Emirates with the commissioning of a new manufacturing facility in Dubai. In addition to concrete admixtures, epoxy resins will be produced locally for the Target Market Flooring. Sika invested in the expansion of its manufacturing facilities at the Dubai site in order to increase flexibility in production, shorten delivery times, optimize cost structures, and reduce inventories.

Frequently Asked Questions (FAQ):

What is the current size of global polished concrete market?

The global polished concrete market size is projected to grow from USD 2.2 billion in 2020 to USD 3.0 billion by 2025, at a CAGR of 5.62% from 2020 to 2025.

How is the polished concrete market aligned?

The polished concrete market is highly fragmented, and has a large number of global, regional and domestic players who have a very strong presence in the market. These players have strong and well-established procurement and distribution networks, which help in cost-efficient production.

Who are the key material manufacturers in the global polished concrete market?

The key players operating in the polished concrete market are PPG Industries, Inc. (US), 3M Company (US), BASF SE (Germany), Boral Limited (Australia), The Sherwin-Williams Company (US), UltraTech Cement Limited (India), and SIKA AG (Switzerland), amongst others.

What are the latest ongoing trends in the polished concrete market?

The players operating in the polished concrete market aim to offer a glossy, durable, and environmentally friendly concrete solutions, owing to a shift in trend (construction of green building, and increase in the demand for attractive flooring solutions) among the end-users who are engaged in the residential, industrial, and commercial construction. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 26)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 INCLUSION AND EXCLUSION

1.4 MARKET SCOPE

FIGURE 1 POLISHED CONCRETE MARKET SEGMENTATION

1.4.1 YEARS CONSIDERED

1.4.2 REGIONAL SCOPE

FIGURE 2 POLISHED CONCRETE MARKET, BY REGION

1.5 CURRENCY CONSIDERED

1.6 UNIT CONSIDERED

1.7 STAKEHOLDERS

1.8 LIMITATIONS

2 RESEARCH METHODOLOGY (Page No. - 30)

2.1 RESEARCH DATA

2.2 MARKET SIZE ESTIMATION

FIGURE 3 TOP-DOWN APPROACH

2.3 DATA TRIANGULATION

FIGURE 4 POLISHED CONCRETE MARKET: DATA TRIANGULATION

FIGURE 5 KEY MARKET INSIGHTS

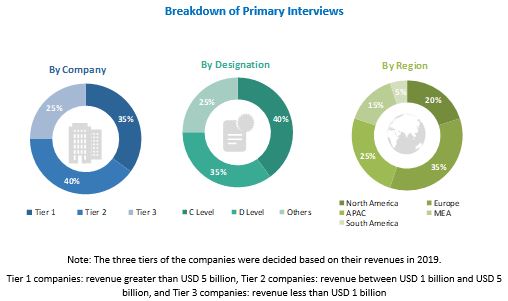

FIGURE 6 LIST OF STAKEHOLDERS INVOLVED AND BREAKDOWN OF PRIMARY INTERVIEWS

2.3.1 ASSUMPTIONS

2.3.2 LIMITATIONS

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 7 DENSIFIER SEGMENT TO DOMINATE THE POLISHED CONCRETE MARKET BY 2025

FIGURE 8 DRY TO BE THE LARGER SEGMENT IN THE POLISHED CONCRETE MARKET DURING THE FORECAST PERIOD

FIGURE 9 NEW CONSTRUCTION SEGMENT TO LEAD THE POLISHED CONCRETE MARKET BY 2025

FIGURE 10 NON-RESIDENTIAL SEGMENT TO GROW AT THE HIGHEST CAGR IN THE POLISHED CONCRETE MARKET DURING THE FORECAST PERIOD

FIGURE 11 NORTH AMERICA LED THE POLISHED CONCRETE MARKET IN 2019

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 HIGHER DEMAND FOR POLISHED CONCRETE IN EMERGING ECONOMIES

FIGURE 12 EMERGING ECONOMIES TO OFFER ATTRACTIVE OPPORTUNITIES IN THE POLISHED CONCRETE MARKET DURING THE FORECAST PERIOD

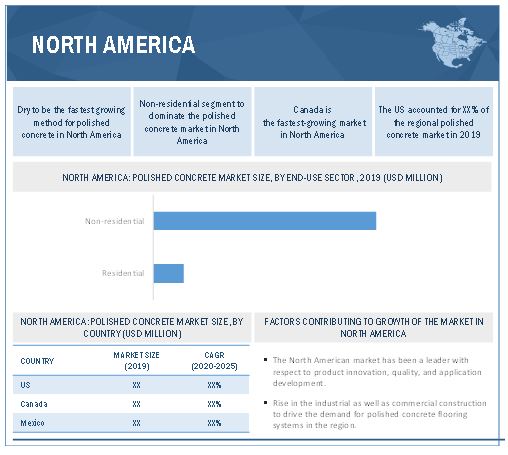

4.2 NORTH AMERICA: POLISHED CONCRETE MARKET, BY END-USE SECTOR AND COUNTRY

FIGURE 13 US WAS THE LARGEST MARKET FOR POLISHED CONCRETE IN NORTH AMERICA IN 2019

4.3 POLISHED CONCRETE MARKET, BY METHOD

FIGURE 14 DRY SEGMENT TO LEAD THE POLISHED CONCRETE MARKET DURING THE FORECAST PERIOD

4.4 POLISHED CONCRETE MARKET, BY CONSTRUCTION TYPE

FIGURE 15 NEW CONSTRUCTION TO BE THE LARGER SEGMENT OF THE POLISHED CONCRETE MARKET BY 2025

4.5 POLISHED CONCRETE MARKET, BY END-USE SECTOR

FIGURE 16 NON-RESIDENTIAL SEGMENT LED THE POLISHED CONCRETE MARKET IN 2019

4.6 POLISHED CONCRETE MARKET, BY COUNTRY

FIGURE 17 POLISHED CONCRETE MARKET IN CHINA TO GROW AT THE HIGHEST CAGR FROM 2020 TO 2025

5 MARKET OVERVIEW (Page No. - 42)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 POLISHED CONCRETE MARKET DYNAMICS

5.2.1 DRIVERS

5.2.1.1 Increasing demand for polished concrete for flooring applications

5.2.1.2 Rise in the demand for cost-effective and green flooring system

5.2.2 RESTRAINTS

5.2.2.1 Volatility in raw material prices

FIGURE 19 CRUDE OIL PRICE TREND

5.2.3 OPPORTUNITIES

5.2.3.1 Population growth and rapid urbanization translating to large number of construction projects

TABLE 1 APAC URBANIZATION TREND, 1990–2050

5.2.3.2 Rise in renovation and remodeling activities globally

5.2.4 CHALLENGES

5.2.4.1 Environmental concerns associated with polished concrete

5.3 YC-YCC DRIVERS

FIGURE 20 YC-YCC DRIVERS

5.4 TARIFF AND REGULATORY ANALYSIS

5.4.1 LIST OF CEMENT STANDARDS AND CONCRETE STANDARDS DEVELOPED BY ASTM INTERNATIONAL

5.4.2 OSHA (OCCUPATIONAL SAFETY AND HEALTH ADMINISTRATION) STANDARDS FOR CEMENT AND CONCRETE

5.5 MARKET MAPPING/ECOSYSTEM MAP

FIGURE 21 ECOSYSTEM MAP

5.6 PATENT ANALYSIS

5.6.1 METHODOLOGY

5.6.2 DOCUMENT TYPE

FIGURE 22 POLISHED CONCRETE: GRANTED PATENT, LIMITED PATENT, AND PATENT APPLICATION

FIGURE 23 PUBLICATION TRENDS - LAST 5 YEARS

5.6.3 INSIGHTS

FIGURE 24 JURISDICTION ANALYSIS

5.6.4 TOP APPLICANTS

FIGURE 25 TOP APPLICANTS OF POLISHED CONCRETE

5.6.5 LIST OF SOME IMPORTANT PATENTS

5.7 TECHNOLOGY ANALYSIS

5.8 PRICING ANALYSIS

5.8.1 POLISHED CONCRETE FLOOR COST PER SQUARE FOOT

5.8.2 POLISHED CONCRETE COST (IN USD)

5.8.3 COST TO POLISH EXISTING CONCRETE FLOORING

5.8.4 COST TO REMOVE EXISTING FLOORING

5.9 CASE STUDY ANALYSIS

5.9.1 POWER TROWEL CONCRETE POLISHING

5.9.2 COMMERCIAL CONCRETE POLISHING

5.9.3 POLISHED CONCRETE FLOOR – VAN NUYS

5.1 TRADE ANALYSIS

5.10.1 CEMENT EXPORTS (BY COUNTRY) IN 2019

5.10.2 CEMENT IMPORTS (BY COUNTRY) IN 2019

6 INDUSTRY TRENDS (Page No. - 58)

6.1 INTRODUCTION

6.2 SUPPLY CHAIN ANALYSIS

FIGURE 26 POLISHED CONCRETE SUPPLY CHAIN

6.2.1 MATERIAL MANUFACTURER

6.2.1.1 Prominent companies

6.2.1.2 Small & medium enterprises

6.2.2 CONTRACTOR/ SERVICE PROVIDER

6.2.2.1 Prominent service providers

6.2.2.2 Small & medium service providers

6.3 PORTER’S FIVE FORCES ANALYSIS

FIGURE 27 PORTER’S FIVE FORCES ANALYSIS OF POLISHED CONCRETE MARKET

6.3.1 THREAT OF NEW ENTRANTS

6.3.2 THREAT OF SUBSTITUTES

6.3.3 BARGAINING POWER OF SUPPLIERS

6.3.4 BARGAINING POWER OF BUYERS

6.3.5 INTENSITY OF COMPETITIVE RIVALRY

7 COVID-19 IMPACT ON POLISHED CONCRETE MARKET (Page No. - 63)

7.1 INTRODUCTION

FIGURE 28 IMPACT OF COVID-19 IN 2020 (Q1) ON DIFFERENT COUNTRIES

7.2 COVID-19 IMPACT ON POLISHED CONCRETE MARKET

7.2.1 IMPACT ON END-USE SECTORS

8 POLISHED CONCRETE MARKET, BY TYPE (Page No. - 66)

8.1 INTRODUCTION

FIGURE 29 DENSIFIER SEGMENT TO EXHIBIT HIGHEST GROWTH DURING THE FORECAST PERIOD

TABLE 2 POLISHED CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

8.2 DENSIFIER

8.2.1 LITHIUM SILICATE

8.2.2 POTASSIUM SILICATE

8.2.3 SODIUM SILICATE

8.3 SEALER & CRACK FILLER

8.4 CONDITIONER

8.4.1 PROTECTORS/STAIN GUARDS

8.4.2 ANTI-SLIP

9 POLISHED CONCRETE MARKET, BY METHOD (Page No. - 69)

9.1 INTRODUCTION

FIGURE 30 DRY SEGMENT TO CONTINUE LEADING THE GLOBAL POLISHED CONCRETE MARKET THROUGH 2025

TABLE 3 POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD MILLION)

TABLE 4 POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (MILLION SQUARE FEET)

9.2 DRY

9.2.1 DRY TO BE THE FASTER-GROWING METHOD FOR POLISHED CONCRETE

9.3 WET

9.3.1 WET POLISHING IS THE OLDEST FORM OF POLISHING

10 POLISHED CONCRETE MARKET, BY CONSTRUCTION TYPE (Page No. - 72)

10.1 INTRODUCTION

FIGURE 31 NEW CONSTRUCTION SEGMENT TO LEAD THE POLISHED CONCRETE MARKET BY 2025

TABLE 5 POLISHED CONCRETE MARKET SIZE, BY CONSTRUCTION TYPE, 2018–2025 (USD MILLION)

TABLE 6 POLISHED CONCRETE MARKET SIZE, BY CONSTRUCTION TYPE, 2018–2025 (MILLION SQUARE FEET)

10.2 NEW CONSTRUCTION

10.2.1 CONSTRUCTION OF NEW NON-RESIDENTIAL BUILDINGS TO BOOST THE MARKET

10.3 RENOVATION

10.3.1 POLISHING AN EXISTING CONCRETE FLOOR ELIMINATES ENERGY COSTS

11 POLISHED CONCRETE MARKET, BY END-USE SECTOR (Page No. - 75)

11.1 INTRODUCTION

FIGURE 32 NON-RESIDENTIAL SEGMENT TO BE THE LARGER SEGMENT OF THE POLISHED CONCRETE MARKET UNTIL 2025

TABLE 7 POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 8 POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

11.2 RESIDENTIAL

11.2.1 POLISHED CONCRETE OFFERS AN ATTRACTIVE SOLUTION FOR RESIDENTIAL FLOORS

11.3 NON-RESIDENTIAL

11.3.1 NON-RESIDENTIAL SEGMENT LED THE POLISHED CONCRETE MARKET IN 2019

12 POLISHED CONCRETE MARKET, BY REGION (Page No. - 78)

12.1 INTRODUCTION

FIGURE 33 REGIONAL SNAPSHOT: CHINA TO BE THE FASTEST-GROWING COUNTRY-LEVEL MARKET FROM 2020 TO 2025

TABLE 9 POLISHED CONCRETE MARKET SIZE, BY REGION, 2018–2025 (USD MILLION)

TABLE 10 POLISHED CONCRETE MARKET SIZE, BY REGION, 2018–2025 (MILLION SQUARE FEET)

TABLE 11 POLISHED CONCRETE MARKET SIZE, BY TYPE, 2018–2025 (USD MILLION)

TABLE 12 POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD MILLION)

TABLE 13 POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (MILLION SQUARE FEET)

TABLE 14 POLISHED CONCRETE MARKET SIZE, BY CONSTRUCTION TYPE, 2018–2025 (USD MILLION)

TABLE 15 POLISHED CONCRETE MARKET SIZE, BY CONSTRUCTION TYPE, 2018–2025 (MILLION SQUARE FEET)

TABLE 16 POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD MILLION)

TABLE 17 POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (MILLION SQUARE FEET)

12.2 NORTH AMERICA

FIGURE 34 NORTH AMERICA: POLISHED CONCRETE MARKET SNAPSHOT

TABLE 18 NORTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 19 NORTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 20 NORTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 21 NORTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 22 NORTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 23 NORTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.2.1 US

12.2.1.1 Growing residential and commercial projects to support demand growth

TABLE 24 US: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 25 US: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 26 US: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 27 US: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.2.2 CANADA

12.2.2.1 Increase in the demand for polished concrete for renovationand remodeling projects

TABLE 28 CANADA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 29 CANADA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 30 CANADA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 31 CANADA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.2.3 MEXICO

12.2.3.1 Significant growth opportunities for polished concrete manufacturers

TABLE 32 MEXICO: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 33 MEXICO: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 34 MEXICO: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 35 MEXICO: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3 EUROPE

TABLE 36 EUROPE: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 37 EUROPE: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 38 EUROPE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 39 EUROPE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 40 EUROPE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 41 EUROPE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3.1 GERMANY

12.3.1.1 Increasing commercial construction to boost the market

TABLE 42 GERMANY: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 43 GERMANY: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 44 GERMANY: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 45 GERMANY: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3.2 UK

12.3.2.1 Construction and renovation activities to boost demand for polished concrete

TABLE 46 UK: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 47 UK: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 48 UK: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 49 UK: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3.3 FRANCE

12.3.3.1 Non-residential projects to provide opportunities to market players

TABLE 50 FRANCE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 51 FRANCE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 52 FRANCE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 53 FRANCE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3.4 RUSSIA

12.3.4.1 Increase in construction activities to drive the consumption of polished concrete

TABLE 54 RUSSIA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 55 RUSSIA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 56 RUSSIA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 57 RUSSIA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3.5 ITALY

12.3.5.1 Growing housing market in the country to propel the demand for polished concrete

TABLE 58 ITALY: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 59 ITALY: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 60 ITALY: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 61 ITALY: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.3.6 REST OF EUROPE

TABLE 62 REST OF EUROPE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 63 REST OF EUROPE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 64 REST OF EUROPE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 65 REST OF EUROPE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.4 APAC

FIGURE 35 APAC: POLISHED CONCRETE MARKET SNAPSHOT

TABLE 66 APAC: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 67 APAC: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 68 APAC: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 69 APAC: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 70 APAC: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 71 APAC: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.4.1 CHINA

12.4.1.1 Significant government support accelerating demand for polished concrete

TABLE 72 CHINA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 73 CHINA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 74 CHINA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 75 CHINA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.4.2 JAPAN

12.4.2.1 Infrastructure and commercial building products to boost the market

TABLE 76 JAPAN: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 77 JAPAN: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 78 JAPAN: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 79 JAPAN: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.4.3 AUSTRALIA

12.4.3.1 New commercial construction to increase the demand for polished concrete

TABLE 80 AUSTRALIA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 81 AUSTRALIA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 82 AUSTRALIA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 83 AUSTRALIA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.4.4 REST OF APAC

TABLE 84 REST OF APAC: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 85 REST OF APAC: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 86 REST OF APAC: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 87 REST OF APAC: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.5 MIDDLE EAST & AFRICA

TABLE 88 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 89 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 90 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 91 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 92 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 93 MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.5.1 UAE

12.5.1.1 Strong demand for durable and low-maintenance flooring system

TABLE 94 UAE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 95 UAE: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 96 UAE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 97 UAE: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.5.2 SAUDI ARABIA

12.5.2.1 Increasing construction activities to drive the market for polished concrete

TABLE 98 SAUDI ARABIA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 99 SAUDI ARABIA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 100 SAUDI ARABIA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 101 SAUDI ARABIA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.5.3 TURKEY

12.5.3.1 Significant infrastructural investments to boost the demand for polished concrete

TABLE 102 TURKEY: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 103 TURKEY: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 104 TURKEY: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 105 TURKEY: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.5.4 REST OF MIDDLE EAST & AFRICA

TABLE 106 REST OF MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 107 REST OF MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 108 REST OF MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 109 REST OF MIDDLE EAST & AFRICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.6 SOUTH AMERICA

TABLE 110 SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (USD THOUSAND)

TABLE 111 SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY COUNTRY, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 112 SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 113 SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 114 SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 115 SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.6.1 BRAZIL

12.6.1.1 Growth in building & construction industry to influence market trends

TABLE 116 BRAZIL: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 117 BRAZIL: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 118 BRAZIL: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 119 BRAZIL: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.6.2 ARGENTINA

12.6.2.1 Growth in non-residential construction to boost the demand for polished concrete

TABLE 120 ARGENTINA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 121 ARGENTINA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 122 ARGENTINA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 123 ARGENTINA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

12.6.3 REST OF SOUTH AMERICA

TABLE 124 REST OF SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (USD THOUSAND)

TABLE 125 REST OF SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY METHOD, 2018–2025 (THOUSAND SQUARE FEET)

TABLE 126 REST OF SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (USD THOUSAND)

TABLE 127 REST OF SOUTH AMERICA: POLISHED CONCRETE MARKET SIZE, BY END-USE SECTOR, 2018–2025 (THOUSAND SQUARE FEET)

13 COMPETITIVE LANDSCAPE (Page No. - 119)

13.1 OVERVIEW

FIGURE 36 COMPANIES ADOPTED EXPANSION & INVESTMENT AS THE KEY GROWTH STRATEGY BETWEEN 2017 AND 2020

13.2 MARKET RANKING

FIGURE 37 MARKET RANKING OF KEY MATERIAL MANUFACTURERS, 2019

13.3 MARKET SHARE ANALYSIS

FIGURE 38 MARKET SHARE OF KEY MATERIAL MANUFACTURERS, 2019

13.4 COMPETITIVE LEADERSHIP MAPPING

13.4.1 STAR

13.4.2 EMERGING LEADERS

13.4.3 PERVASIVE

13.4.4 EMERGING COMPANIES

FIGURE 39 POLISHED CONCRETE MARKET: COMPETITIVE LEADERSHIP MAPPING OF MATERIAL MANUFACTURERS, 2019

13.4.5 STRENGTH OF PRODUCT PORTFOLIO

FIGURE 40 PRODUCT PORTFOLIO ANALYSIS OF TOP PLAYERS IN POLISHED CONCRETE MARKET

13.4.6 BUSINESS STRATEGY EXCELLENCE

FIGURE 41 BUSINESS STRATEGY EXCELLENCE OF TOP PLAYERS IN POLISHED CONCRETE MARKET

13.5 COMPETITIVE SCENARIO

13.5.1 ACQUISITION

TABLE 128 ACQUISITION

13.5.2 NEW PRODUCT DEVELOPMENT

TABLE 129 NEW PRODUCT DEVELOPMENT

13.5.3 EXPANSION & INVESTMENT

TABLE 130 EXPANSION & INVESTMENT

13.5.4 PARTNERSHIP & AGREEMENT

TABLE 131 PARTNERSHIP & AGREEMENT

14 COMPANY PROFILES (Page No. - 128)

(Business Overview, Products Offered, Recent Developments, Financial assessment, Operational assessment, Recent developments, Current focus and strategies, SWOT Analysis, Right to win, MnM View)*

14.1 MATERIAL MANUFACTURERS

14.1.1 PPG INDUSTRIES, INC.

FIGURE 42 PPG INDUSTRIES, INC.: COMPANY SNAPSHOT

TABLE 132 MANUFACTURING SITE LOCATIONS (INDUSTRIAL COATING)

TABLE 133 MANUFACTURING SITE LOCATIONS (ARCHITECTURAL COATING)

TABLE 134 PERFORMANCE COATING: PRIMARY END USERS

TABLE 135 PERFORMANCE AND INDUSTRIAL COATINGS: MAJOR DISTRIBUTION METHODS

FIGURE 43 PPG INDUSTRIES, INC.: SWOT ANALYSIS

14.1.2 BASF SE

FIGURE 44 BASF SE: COMPANY SNAPSHOT

FIGURE 45 BASF SE: SWOT ANALYSIS

14.1.3 3M COMPANY

FIGURE 46 3M COMPANY: COMPANY SNAPSHOT

FIGURE 47 3M COMPANY: SWOT ANALYSIS

14.1.4 THE SHERWIN-WILLIAMS COMPANY

FIGURE 48 THE SHERWIN-WILLIAMS COMPANY: COMPANY SNAPSHOT

FIGURE 49 THE SHERWIN-WILLIAMS COMPANY: SWOT ANALYSIS

14.1.5 BORAL LIMITED

FIGURE 50 BORAL LIMITED: COMPANY SNAPSHOT

14.1.6 SIKA AG

FIGURE 51 SIKA AG: COMPANY SNAPSHOT

TABLE 136 SIKA AG’S KEY INVESTMENTS SINCE 2015 (OVERALL)

14.1.7 ULTRATECH CEMENT LIMITED

FIGURE 52 ULTRATECH CEMENT LIMITED: COMPANY SNAPSHOT

14.1.8 SOLOMON COLORS INC

14.1.9 THE EUCLID CHEMICAL COMPANY

14.1.10 VEXCON CHEMICALS, INC.

14.2 CONTRACTOR/SERVICE PROVIDER

14.2.1 DMF STONE RESTORATION

14.2.2 TSIAC INTERNATIONAL

14.2.3 CRAFT POLISHED CONCRETE

14.2.4 ENVISION POLISHED CONCRETE

14.2.5 CONCRETE TREATMENTS, INC.

14.2.6 DANEK FLOORING, INC.

14.2.7 METRIC CONCRETE CONSTRUCTION & DESIGN INC.

14.2.8 STEYSON GRANOLITHIC CONTRACTORS

14.2.9 POLIGROUND

14.2.10 BRISTOL CONCRETE POLISHING

14.2.11 UNIVERSAL SERVICES GROUP

14.2.12 POLICRETE

14.2.13 POLISHED CONCRETE LTD

14.2.14 CON SEAL INC.

14.2.15 CONCRETE POLISHING UK

*Details on Business Overview, Products Offered, Recent Developments, Financial assessment, Operational assessment, Recent developments, Current focus and strategies, SWOT Analysis, Right to win, MnM View might not be captured in case of unlisted companies.

15 APPENDIX (Page No. - 155)

15.1 DISCUSSION GUIDE

15.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

15.3 AVAILABLE CUSTOMIZATIONS

15.4 RELATED REPORTS

15.5 AUTHOR DETAILS

The study involved four major activities for estimating the current global size of the polished concrete market. The exhaustive secondary research was carried out to collect information on the market, the peer market, and the parent market. The next step was to validate these findings, assumptions, and sizes with the industry experts across the value chain of polished concrete through primary research. The top-down approach was employed to estimate the overall size of the polished concrete market. Thereafter, market breakdown and data triangulation procedures were used to estimate the size of different segments and sub-segments of the market.

Secondary Research

In the secondary research process, various secondary sources such as Hoovers, Factiva, Bloomberg BusinessWeek, and Dun & Bradstreet were referred to, so as to identify and collect information for this study on the polished concrete market. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, regulatory bodies, trade directories, and databases.

Primary Research

Various primary sources from both the supply and demand sides of the polished concrete market were interviewed to obtain qualitative and quantitative information. The primary sources from the supply-side included industry experts, such as Chief Executive Officers (CEOs), vice presidents, marketing directors, sales professionals, and related key executives from various leading companies and organizations operating in the polished concrete industry. The primary sources from the demand-side included key executives from banks, government organizations, and educational institutions. The breakdown of the profiles of primary respondents is as follows:

To know about the assumptions considered for the study,download the pdf brochure

Market Size Estimation

The top-down approach was used to estimate and validate the global size of the polished concrete market. This approach is also used extensively to estimate the size of various dependent segments of the market. The research methodology used to estimate the market size included the following details:

- The key players were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total market was split into several segments and sub-segments. The data triangulation and market breakdown procedures were employed, wherever applicable, to complete the overall market engineering process and arrive at the exact statistics for all segments and sub-segments of the polished concrete market. The data was triangulated by studying various factors and trends from both the demand- and supply-side.

Report Objectives

- To define, analyze, and project the size of the polished concrete market in terms of value and volume based on type, method, construction type, end-use sector, and region

- To project the size of the market and its segments in terms of value and volume, with respect to the five main regions, namely, North America, Europe, Asia Pacific, Middle East & Africa, and South America.

- To provide detailed information about the key factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the market

- To strategically analyze the micromarkets with respect to individual growth trends, future prospects, and their contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a detailed competitive landscape of the market leaders

- To analyze the competitive developments, such as expansions, investments, partnerships, agreements, new product developments, and acquisitions, in the polished concrete market

- To strategically profile the key players operating in the market and comprehensively analyze their market shares and core competencies

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the polished concrete report:

Product Analysis

- Product matrix, which offers a detailed comparison of the product portfolio of companies

Regional Analysis

- Further analysis of the polished concrete market for additional countries

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Polished Concrete Market