Pneumatic Actuators Market by motion (Linear and Rotary), Type (Diaphragm and piston type), End Use (Flow Control and Motion control), Application (Aerospace & Defense, Oil & Gas, Food &Beverages, Healthcare), Region - Global Forecast to 2025

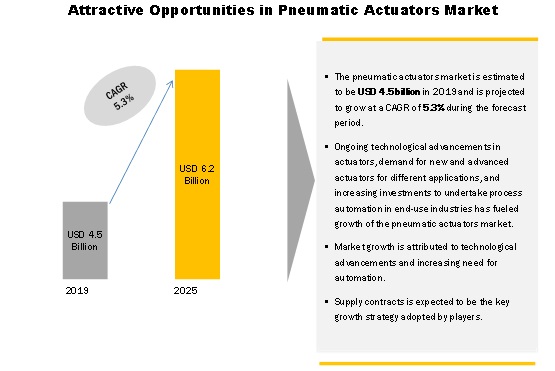

The pneumatic actuators market is estimated to be USD 4.5 billion in 2019 and is projected to reach USD 6.2 billion by 2025, at a CAGR of 5.3 % from 2019 to 2025. The need to increase productivity & reduce downtime in industrial facilities & manufacturing activities worldwide are the major factors expected to drive the market for pneumatic actuators globally. The development of advanced & cost-effective actuators and increasing demand for industrial robots & process automation in different industrial verticals are some of the opportunities impacting the growth of the pneumatic actuators market.

By type, the Linear actuator segment is expected to grow at the highest CAGR durisng the forecast period

Based on type, the given market is segmented into linear and rotary. The linear segment is projected to grow at the highest CAGR during the forecast period. Linear actuators are used primarily in automation applications. They are used in a wide range of industries where positioning is needed.

The motion control segment is expected to grow at the highest CAGR in the pneumatic actuators market from 2019 to 2025

Based on end use, the pneumatic actuators market has been segmented into flow control and motion control. Industries such as automotive and electrical & electronics have shown higher adoption of motion control technology. Other sectors such as pharmaceutical, pulp & paper, oil gas, and food & beverages are expected to incline more towards the flow control application by increasing adoption of automation by small- and medium-sized enterprises.

The oil & gas application segment to account for the largest market share in the pneumatic actuators market

Based on application, the oil & gas segment is projected to lead the pneumatic actuators market during the forecast period. This sector is attracting heavy investments from all over the world; this trend is automatically increasing the demand for pneumatic actuators as this are the critical part of oil & gas plant architecture.

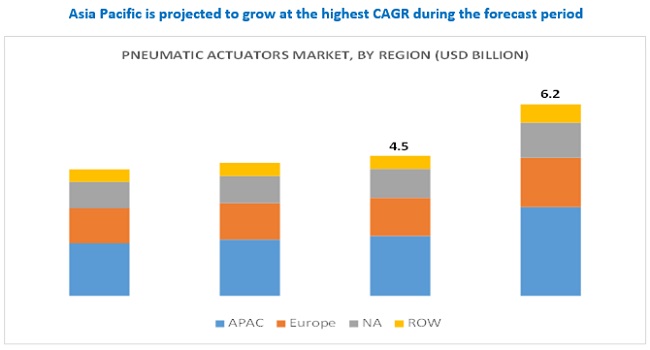

The pneumatic actuators market has been growing at a significant rate, and this trend is expected to continue during the forecast period. However, the development of advanced & cost-effective pneumatic actuators, and increasing demand for industrial robots and industrial automation in different industrial verticals are some of the opportunities impacting the growth of the pneumatic actuators market. China and Japan are primarily investing in automation to enhance and gain a tactical edge. This factor is an excellent opportunity for pneumatic actuator manufacturers to strengthen their businesses in the Asia Pacific region.

Key Market Players

The major players in the pneumatic actuators market include ABB (Switzerland), Parker Hannifin (US), Emerson (US), Rotork (US), SMC (Japan), Cameron (US), and Festo (Germany). ABB is one of the leading players in the pneumatic actuators market. The company has high-value contracts with countries, such as China. It holds a greater share in automating the industrial process across different industrial verticals. The company has also been focusing on the acquisition of small players to increase its product offerings as well as market share. It has adopted several other strategies, such as partnerships, agreements, and the establishment of new manufacturing facilities to strengthen its market position as well as ensure future growth.

Recent Developments

- In August 2018, Rockwell Automation received a contract from the National Copper Corporation, Chile to supply control systems for the Chuquicamata underground mine at USD 50 million. This contract includes the supply, configuration, and assembly of four systems which comprise mine control systems

- In November 2018, ABB received a contract from China Petroleum Engineering and Construction Corporation (CPECC), China valued at USD 79.0 million for upgrading the Bab Onshore Field in Abu Dhabi. This contract includes the fully integrated ABB Electrical, Control and Telecommunication (ECT) solution as well as centralized automation system which is expected to reduce the operation cost of the oilfield by 10 – 15%

- IMI Orton, a subsidiary of IMI PLC, received 8 contracts from 3 different customers to supply valves and actuators for the Yamal LNG project

- Rotork plc acquired Masso Ind s.p.a. (Italy), an established manufacturer of innovative shipboard Valve Remote Control Systems (VRCS). This acquisition is expected to strengthen the company’s presence in the flow control market as well as broaden the scope of the Group’s activities in the marine and offshore markets

Table of Contents

1 Introduction

1.1 Objectives of the Study

1.2 Market Definition

1.2.1 Markets Covered

1.2.2 Years Considered for the Study

1.3 Currency

1.4 Limitations

1.5 Market Stakeholders

2 Research Methodology

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Breakdown of Primaries

2.2 Market Definition & Scope

2.3 Research Approach & Methodology

2.3.1 Bottom-Up Approach

2.3.2 Top-Down Approach

2.4 Data Triangulation & Validation

2.5 Research Assumptions

2.6 Risks

3 Executive Summary

4 Premium Insights

5 Market Overview

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Technological Advancements in Actuators

5.2.2 Restraints

5.2.2.1 High Overall Installation Cost for Low-Volume Production

5.2.3 Opportunities

5.2.3.1 Use of Advanced Actuators in Different Verticals

5.2.4 Challenges

5.2.4.1 Power Consumption, Noise, And Leak Issues

6 Industry Trends

6.1 Introduction

6.2 Evolution of Technology

6.3 Technology Trends

6.3.1 Smart Actuators

6.3.2 Hybrid Actuators

6.4 Innovations & Patent Registrations

7 Pneumatic Actuators Market, By Type

7.1 Introduction

7.2 Diaphragm Actuators

7.3 Piston Actuators

8 Pneumatic Actuators Market, By Motion

8.1 Introduction

8.2 Linear Actuators

8.2.1 Belt Type

8.2.2 Rod Type

8.2.3 Screw Type

8.3 Rotary Actuators

8.3.1 Rack & Pinion

8.3.2 Scotch & Yoke

8.3.3 Vane Type

9 Pneumatic Actuators Market, By End Use

9.1 Introduction

9.2 Flow Control

9.3 Motion Control

10 Pneumatic Actuators Market, By Vertical

10.1 Introduction

10.2 Food & Beverages

10.3 Oil & Gas

10.4 Metals, Mining, And Machinery

10.5 Power Generation

10.6 Chemicals, Paper, And Plastics

10.7 Pharmaceutical & Healthcare

10.8 Automotive

10.9 Aerospace & Defense

10.10 Marine

10.11 Electronics & Electrical

10.12 Others

11 Regional Analysis

11.1 Introduction

11.2 North America

11.2.1 US

11.2.2 Canada

11.2.3 Mexico

11.3 Europe

11.3.1 Germany

11.3.2 France

11.3.3 UK

11.3.4 Italy

11.3.5 Switzerland

11.3.6 Rest of Europe

11.4 Asia Pacific

11.4.1 China

11.4.2 Japan

11.4.3 India

11.4.4 South Korea

11.4.5 Taiwan

11.4.6 Rest of Asia Pacific

11.5 Rest of the World (RoW)

11.5.1 Middle East

11.5.2 Latin America

11.5.3 Africa

12 Competitive Landscape

12.1 Introduction

12.2 Competitive Scenario

12.2.1 New Product Launches

12.2.2 Aquisitions

12.2.3 Contracts

12.2.4 Partnerships/Collaborations

12.3 Ranking of Key Players, 2018

13 Company Profiles

(Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View)*

13.1 Introduction

13.2 Emerson

13.3 Honeywell

13.4 Rotork

13.5 Parker Hannifin

13.6 ABB

13.7 Airtec

13.8 Cameron

13.9 SMC Corporation

13.10 Eaton

13.11 Rotex Automation

13.12 Nutork Corp

13.13 Flowserve

13.14 Imi Precision

13.15 Tolomatic Inc

13.16 Festo

*Details On Business Overview, Products Offered, Recent Developments, SWOT Analysis, MnM View Might Not Be Captured in Case of Unlisted Companies.

14 Appendix

14.1 Discussion Guide

14.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

14.3 Available Customizations

14.4 Related Reports

14.5 Author Details

Growth opportunities and latent adjacency in Pneumatic Actuators Market