Plastic Coatings Market by Type (Polyurethane, Acrylic, Epoxy), Process (Electrophoretic Painting, Powder Coating, Dip Coating), End-Use Industry (Automotive, Aerospace & Defense, Building & Construction) and by Region - Global Forecast to 2021

T[177 Pages Report] The plastic coatings market is projected to reach USD 7.76 Billion by 2021, at a CAGR of 5.5% from 2016 to 2021.

The objectives of this study are:

- To define, describe, and forecast the plastic coatings market on the basis of type, process, end– use industry, and region

- To estimate and forecast the plastic coatings market size, in terms of value (USD million), and volume (Kilo Tons)

- To estimate and forecast the plastic coatings market by end-use industry and type in different regions, namely, North America, Europe, Asia- Pacific, Middle East & Africa, and Latin America

- To identify and analyze the key growth drivers, restraints, threats, and opportunities that are influencing the plastic coatings market

- To analyze region-specific trends in North America, Europe, Asia- Pacific, Middle East & Africa, and Latin America

- To strategically identify and profile key market players and analyze their core competencies in each application of the market

- To track and analyze recent market developments and competitive strategies in the plastic coatings market, such as partnerships, agreements, collaborations, mergers & acquisitions, new product developments, and expansions

The years considered for the study are:

- Base Year – 2015

- Estimated Year – 2016

- Projected Year – 2021

- Forecast Period – 2016 to 2021

For company profiles in the report, 2015 has been considered as the base year. Where information was unavailable for the base year, the prior year has been considered.

Research Methodology

This research study involves extensive usage of secondary sources, directories, and databases, such as Hoovers, Bloomberg, Businessweek, Factiva, and OneSource to identify and collect information useful for technical, market-oriented, and commercial aspects of the plastic coatings market. The research methodology used for this study can be explained as follows:

- Analysis of all recent developments in the plastic coatings market across the globe with emphasis on emerging regions

- Analysis of potential applications and existing applications of plastic coatings

- Analysis of country-wise rate of demand of plastic coatings for the past three years

- Estimation of various costs involved, to arrive at the value chain of the plastic coatings market

- Finalization of market size values by triangulation with the supply side data, which includes, product developments, supply chain, and regional demand of plastic coatings across the globe

After arriving at the overall market size, the total market has been split into several segments and subsegments. The figure below shows the breakdown of the primaries based on company, designation, and region conducted during the research study.

To know about the assumptions considered for the study, download the pdf brochure

Market Ecosystem:

The value chain of plastic coatings market starts with raw material manufacturers, followed by product manufacturers and end-use industries. Raw material manufacturers, such as BASF SE (Germany), The Dow Chemical Company (U.S.), Evonik Industries (Germany), & Bayer AG (Germany) supply raw materials to coating resin manufacturers, such as The Dow Chemical Company (U.S.), BASF SE (Germany), Arkema SA (France). Plastic coating resin manufacturers produce coating resins from raw materials. These resins are then used to manufacture coatings for different purposes.

Target Audience:

The stakeholders for the report include:

- Plastic Coatings Manufacturers

- Plastic Coatings Traders, Distributors, and Suppliers

- End Market Application Participants of Different Segments of Plastic coatings

- Government and Research Organizations

- Associations and Industrial Bodies

- Research and Consulting Firms

- R&D Institutions

- Environment Support Agencies

- Investment Banks and Private Equity Firms

Scope of the report: This research report categorizes the plastic coatings market on the basis of end-use industry, material type, process, and region. The report forecasts revenues and analyzes the trends in each submarket.

On the Basis of End-Use Industry:

- Building and Construction

- Automotive

- Aerospace & Defense

- Medical

- Others

On the Basis of Material Type:

- Polyurethane (PU)

- Acrylic

- Epoxy

- Others

On the Basis of Process Type:

- Spray Coating

- Dip Coating

- Powder Coating

- Electrophoretic Painting

- Others

On the Basis of Region:

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific needs. The following customization options are available for the report:

- Application Analysis

Further breakdown of the building & construction application segment into decking, molding, and fencing for top five countries

- Company Information

Detailed analysis and profiling of additional market players (up to five)

The plastic coatings market is projected to reach USD 7.76 Billion by 2021, at a CAGR of 5.5% from 2016 to 2021. This growth can be mainly attributed to the increasing demand from the automotive and building & construction industries.

Major end-use industries for the plastic coatings market include automotive and aerospace & defence industries. In the automotive industry, plastic coatings are used in battery trays, radiator grilles, seat springs and brackets, filler pipes, door handles, and seat belt loops, among others. Plastic coating provides various advantages, such as resistance from corrosion, impact, heat, and wear. Additionally, it is cost-effective and easy to use. Increased use of plastic coatings in automotive manufacturing and growing concern regarding carbon emissions are expected to drive the plastic coatings market during the forecast period.

Based on type, the plastic coatings market has been segmented into polyurethane, acrylics, epoxy, and others that include PTFE, nylon, and HDPE. The polyurethane segment contributed the second-highest share to the plastic coatings market, in terms of value in 2015. For coating applications, a cross-linked film is preferred over thermoplastic urethanes. The polyurethane coating resins market is highly dependent on the growth of markets for automotive, floors, boats, and metal objects. Two features of polyurethane coating resins that are often regarded as disadvantages are its high cost, and handling of potentially hazardous isocyanates that are used as curing agents for manufacturing. However, various industry segments have developed safe handling methods that overcome these disadvantages. Superior performance and the ability to cure at lower baking temperatures make polyurethane a major plastic coating material in various end-use applications.

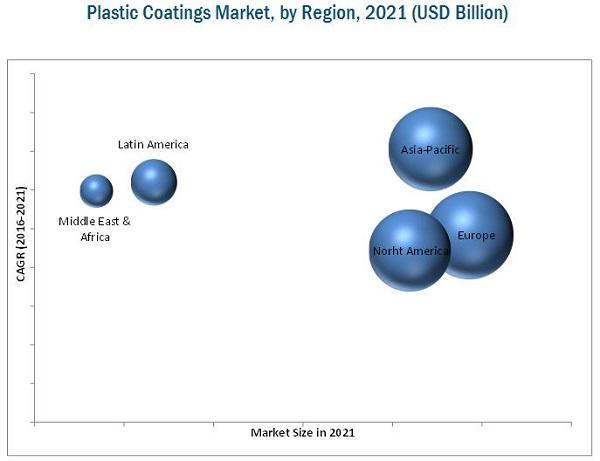

The plastic coatings market in Asia-Pacific is expected to grow at the highest CAGR between 2016 and 2021. The economies in China and India have witnessed growth, which is fuelled by the increased construction activities and investments in the expansion or upgrade of manufacturing facilities. China, Japan, and India are the largest economies in Asia-Pacific and have more opportunities for the growth of plastic coatings market in near future. Initiatives taken by governments to promote growth in the manufacturing sectors will further aid the growth of plastic coatings market in these countries.

Estimating the future demand of plastic coatings is a prime challenge, owing to the economic slowdown in various parts of the globe in the past decade. Many economies in the North America and European region have not recovered completely, which has affected the demand for plastic coatings from major end-use industries in both regions.

PPG Industries Inc. (U.S.), Bayer AG (Germany.), Axalta Coating Systems (U.S.), and Akzonobel N.V. (Netherlands). 3M (U.S.), Eastman Chemical Company (U.S.), Axalta Coatings System LTD. (U.S.), Kansai Paint Co., LTD. (Japan), BASF SE (Germany), Wacker Chemie AG (Germany) are some of the major players operational in the plastic coatings market. These players have a wide market reach with established distribution network and are investing more on research and development activities. They have strong technical and market development capabilities that enable them to upgrade their existing products for new market applications.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 17)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Package Size

1.6 Stakeholders

1.7 Limitations

2 Research Methodology (Page No. - 20)

2.1 Research Data

2.1.1 Secondary Data

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Break Down of Primaries

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

2.4 Assumptions

2.5 Limitations

3 Executive Summary (Page No. - 28)

4 Premium Insights (Page No. - 32)

4.1 Attractive Market Opportunities in the Plastic Coatings Market

4.2 Plastic Coatings Market, By Type

4.3 Plastic Coatings Market

4.4 Plastic Coatings Market Growth

4.5 Plastic Coatings Market, By End-Use Industry

4.6 Plastic Coatings Market: Emerging & Developing Nations

4.7 Life Cycle Analysis, By Region

5 Market Overview (Page No. - 38)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Increasing Demand From End-Use Industry

5.3.1.2 More Durable Coatings With Improved Performance and Better Aesthetics

5.3.2 Restraints

5.3.2.1 Availability and Cost of Specialized Raw Materials

5.3.2.2 Environmental Regulations Regarding Voc Content

5.3.3 Opportunities

5.3.3.1 Growth Prospect in Developing Economies

5.3.3.2 Development of Bio-Based Coatings

5.3.3.3 Development of Automotive Refinish Market

5.3.4 Challenges

5.3.4.1 Growing Price Cutting Measures

6 Industry Trends (Page No. - 45)

6.1 Introduction

6.2 Supply Chain Analysis

6.2.1 Key Influencers

6.3 Industry Trends

6.4 Porter’s Five Forces

6.4.1 Threat of New Entrants

6.4.2 Threat of Substitutes

6.4.3 Bargaining Power of Suppliers

6.4.4 Bargaining Power of Buyers

6.4.5 Intensity of Competitive Rivalry

7 Plastic Coatings Market, By Type (Page No. - 51)

7.1 Introduction

7.2 Polyurethane

7.3 Acrylic

7.4 Epoxy

7.5 Others

8 Plastic Coatings Market, By Process (Page No. - 61)

8.1 Introduction

8.2 DIP Coating

8.3 Spray Coating

8.4 Powder Coating

8.5 Electrophoretic Painting

8.6 Others

9 Plastic Coatings Market, By End-Use Industry (Page No. - 72)

9.1 Introduction

9.2 Automotive

9.3 Aerospace and Defense

9.4 Building and Construction

9.5 Medical

9.6 Others

10 Regional Analysis (Page No. - 83)

10.1 Introduction

10.2 North America

10.2.1 U.S.

10.2.2 Canada

10.2.3 Mexico

10.3 Europe

10.3.1 Germany

10.3.2 Russia

10.3.3 Italy

10.3.4 France

10.3.5 U.K.

10.3.6 The Netherlands

10.3.7 Czech Republic

10.3.8 Rest of Europe

10.4 Asia-Pacific

10.4.1 China: Dominant Market in the Asia-Pacific Region

10.4.2 Japan

10.4.3 India

10.4.4 Indonesia

10.4.5 Rest of Asia-Pacific

10.5 Latin America

10.5.1 Brazil

10.5.2 Argentina

10.5.3 Rest of Latin America

10.6 Middle East & Africa (Mea)

10.6.1 Saudi Arabia

10.6.2 South Africa

10.6.3 Rest of Middle East & Africa

11 Competitive Landscape (Page No. - 124)

11.1 Overview

11.2 Expansions: One of the Most Adopted Growth Strategies

11.3 Maximum Developments in 2015

11.4 Competitive Situation & Trends

11.4.1 Expansions

11.4.2 Mergers & Acquisitions

11.4.3 New Product Launches

11.4.4 Partnerships, Agreements, and Joint Ventures

12 Company Profiles (Page No. - 135)

(Overview, Financial*, Products & Services, Strategy, and Developments)

12.1 Introduction

12.2 3M

12.3 Eastman Chemical Company (Eastman)

12.4 Bayer AG

12.5 Akzonobel N.V.

12.6 Axalta Coating Systems Ltd. (Axalta)

12.7 PPG Industries, Inc.

12.8 Kansai Paint Co., Ltd.

12.9 Valspar Corporation

12.10 BASF SE

12.11 Wacker Chemie AG

12.12 Other Leading Players

*Details Might Not Be Captured in Case of Unlisted Companies.

13 Appendix (Page No. - 170)

13.1 Industry Experts

13.2 Discussion Guide

13.3 Knowledge Store: Marketsandmarkets Subscription Portal

13.4 Introducing RT: Real Time Market Intelligence

13.5 Available Customizations

13.6 Related Reports

List of Tables (104 Tables)

Table 1 Plastic Coatings Market, By End-Use Industry

Table 2 Plastic Coatings Market, By Type

Table 3 Plastic Coatings Market, By Process

Table 4 Plastic Coatings Market, By Region

Table 5 Plastic Coatings Market, By Type, 2014-2021 (Kilo Tons)

Table 6 Plastic Coatings Market, By Type, 2014-2021 (USD Million)

Table 7 Polyurethane: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 8 Polyurethane: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 9 Acrylic: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 10 Acrylic: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 11 Epoxy: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 12 Epoxy: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 13 Others: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 14 Others: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 15 Plastic Coatings Market, By Process, 2014-2021 (Kilo Tons)

Table 16 Plastic Coatings Market, By Process, 2014-2021 (USD Million)

Table 17 DIP Coating: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 18 DIP Coating: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 19 Spray Coating: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 20 Spray Coating: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 21 Powder Coating: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 22 Powder Coating: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 23 Electrophoretic Painting: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 24 Electrophoretic Painting: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 25 Others: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 26 Others: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 27 Plastic Coatings Market, By End-Use Industry, 2014-2021 (Kilo Tons)

Table 28 Plastic Coatings Market, By End-Use Industry, 2014-2021 (USD Million)

Table 29 Automotive: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 30 Automotive: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 31 Aerospace & Defense: Plastic Coatings Market, By Region, 2014-2021(Kilo Tons)

Table 32 Aerospace & Defense: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 33 Building & Construction: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 34 Building & Construction: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 35 Medical: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 36 Medical: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 37 Others: Plastic Coatings Market, By Region, 2014-2021 (Kilo Tons)

Table 38 Others: Plastic Coatings Market, By Region, 2014-2021 (USD Million)

Table 39 Plastic Coatings Market Size, By Region, 2014-2021 (Kilo Tons)

Table 40 Plastic Coatings Market Size, By Region, 2014-2021 (USD Million)

Table 41 North America: Plastic Coatings Market, By Country, 2014-2021 (Kilo Tons)

Table 42 North America: Plastic Coatings Market, By Country, 2014-2021 (USD Million)

Table 43 North America: Plastic Coatings Market, By End-Use Industry, 2014-2021 (Kilo Tons)

Table 44 North America: Plastic Coatings Market, By End-Use Industry, 2014-2021 (USD Million)

Table 45 North America: Plastic Coatings Market, By Material Type, 2014-2021 (Kilo Tons)

Table 46 North America: Plastic Coatings Market, By Material Type, 2014-2021 (USD Million)

Table 47 North America: Plastic Coatings Market, By Process, 2014-2021 (Kilo Tons)

Table 48 North America: Plastic Coatings Market, By Process, 2014-2021 (USD Million)

Table 49 Europe: Plastic Coatings Market Size, By Country, 2014-2021 (Kilo Tons)

Table 50 Europe: Plastic Coatings Market Size, By Country, 2014-2021 (USD Million)

Table 51 Europe: Plastic Coatings Market Size, By End-Use Industry, 2014-2021 (Kilo Tons)

Table 52 Europe: Plastic Coatings Market Size, By End-Use Industry, 2014-2021 (USD Million)

Table 53 Europe: Plastic Coatings Market Size, By Type, 2014-2021 (Kilo Tons)

Table 54 Europe: Plastic Coatings Market Size, By Type, 2014-2021 (USD Million)

Table 55 Europe: Plastic Coatings Market Size, By Process, 2014-2021 (Kilo Tons)

Table 56 Europe: Plastic Coatings Market Size, By Process, 2014-2021 (USD Million)

Table 57 Asia-Pacific: Plastic Coatings Market, By Country, 2014-2021 (Kilo Tons)

Table 58 Asia-Pacific: Plastic Coatings Market, By Country, 2014-2021 (USD Million)

Table 59 Asia-Pacific: Plastic Coatings Market, By End-Use Industry, 2014-2021 (Kilo Tons)

Table 60 Asia-Pacific: Plastic Coatings Market, By End-Use Industry, 2014-2021 (USD Million)

Table 61 Asia-Pacific: Plastic Coatings Market, By Type, 2014-2021 (Kilo Tons)

Table 62 Asia-Pacific: Plastic Coatings Market, By Type, 2014-2021 (USD Million)

Table 63 Asia-Pacific: Plastic Coatings Market, By Process, 2014-2021 (Kilo Tons)

Table 64 Asia-Pacific: Plastic Coatings Market, By Process, 2014-2021 (USD Million)

Table 65 Latin America: Plastic Coatings Market, By Country, 2014-2021 (Kilo Tons)

Table 66 Latin America: Plastic Coatings Market, By Country, 2014-2021 (USD Million)

Table 67 Latin America: Plastic Coatings Market, By End-Use Industry, 2014-2021 (Kilo Tons)

Table 68 Latin America: Plastic Coatings Market, By End-Use Industry, 2014-2021 (USD Million)

Table 69 Latin America: Plastic Coatings Market, By Type, 2014-2021 (Kilo Tons)

Table 70 Latin America: Plastic Coatings Market, By Type, 2014-2021 (USD Million)

Table 71 Latin America: Plastic Coatings Market, By Process, 2014-2021 (Kilo Tons)

Table 72 Latin America: Plastic Coatings Market, By Process, 2014-2021 (USD Million)

Table 73 Middle East & Africa: Plastic Coatings Market, By Country, 2014-2021 (Kilo Tons)

Table 74 Middle East & Africa: Plastic Coatings Market, By Country, 2014-2021 (USD Million)

Table 75 Middle East & Africa: Plastic Coatings Market, By End-Use Industry, 2014-2021 (Kilo Tons)

Table 76 Middle East & Africa: Plastic Coatings Market, By End-Use Industry, 2014-2021 (USD Million)

Table 77 Middle East & Africa: Plastic Coatings Market, By Type, 2014-2021 (Kilo Tons)

Table 78 Middle East & Africa: Plastic Coatings Market, By Type, 2014-2021 (USD Million)

Table 79 Middle East & Africa: Plastic Coatings Market, By Process, 2014-2021 (Kilo Tons)

Table 80 Middle East & Africa: Plastic Coatings Market, By Process, 2014-2021 (USD Million)

Table 81 Expansions

Table 82 Mergers & Acquisitions

Table 83 New Product Launches

Table 84 Partnerships, Agreements & Joint Ventures

Table 85 3M: Products & Services Offered

Table 86 3M: Recent Developments

Table 87 Eastman: Products & Services Offered

Table 88 Eastman : Recent Developments

Table 89 Bayer AG: Products & Services Offered

Table 90 Bayer AG: Recent Developments

Table 91 Akzonobel N.V.: Products Offered

Table 92 Akzonobel N.V.: Recent Developments

Table 93 Axalta Coating Systems Ltd.: Products Offered

Table 94 Axalta Coating Systems Ltd.: Recent Developments

Table 95 PPG Industries, Inc.: Products Offered

Table 96 PPG Industries, Inc.: Recent Developments

Table 97 Kansai Paints Co., Ltd.: Products Offered

Table 98 Kansai Paints Co., Ltd.: Recent Developments

Table 99 Valspar Corporation: Products Offered

Table 100 Valspar Corporation: Recent Developments

Table 101 BASF SE: Products Offered

Table 102 BASF SE.: Recent Developments

Table 103 Wacker Chemie AG: Products Offered

Table 104 Wacker Chemie AG.: Recent Developments

List of Figures (78 Figures)

Figure 1 Plastic Coatings Market: Research Design

Figure 2 Breakdown of Primary Interviews, By Company, Designation, and Region

Figure 3 Market Size Estimation: Top-Down Approach

Figure 4 Market Size Estimation: Bottom-Up Approach

Figure 5 Automotive End-Use Industry is Expected to Drive the Global Plastic Coatings Market During the Forecast Period

Figure 6 Automotive Dominates Across All End-Use Industry for the Plastic Coatings Market (2016)

Figure 7 Plastic Coatings Market Share, By Region, 2015

Figure 8 Asia-Pacific is Projected to Have the Highest Growth Potential in the Plastic Coatings Market, 2016-2021

Figure 9 Plastic Coatings Market is Projected to Witness Substantial Growth During the Forecast Period

Figure 10 Polyurethane Segment is Anticipated to Grow at the Highest CAGR During the Forecast Period

Figure 11 Automotive End-Use Industry to Account for the Largest Share of the Plastic Coatings Market

Figure 12 Asia-Pacific to Grow at the Highest CAGR During the Forecast Period

Figure 13 Automotive End-Use Industry to Account for the Largest Share of the Plastic Coatings Market During the Forecast Period

Figure 14 Emerging Nations to Grow at the Fastest Rate During the Forecast Period

Figure 15 Market in North America on the Verge of Attaining Maturity

Figure 16 Increasing Demand for Plastic Coatings From Emerging Markets to Fuel Market Growth

Figure 17 Supply Chain Analysis

Figure 18 Increasing Global Footprint is A Leading Trend Adopted By Key Market Players

Figure 19 Porter’s Five Forces Analysis

Figure 20 Plastic Coatings Market, By Type, 2016 & 2021 (Kilo Tons)

Figure 21 The Acrylic Plastic Coatings Market in the Asia-Pacific Region is Expected to Witness High Growth During the Forecast Period

Figure 22 Acrylic Plastic Coatings Market, By Region, 2016 & 2021 (USD Million)

Figure 23 Epoxy Plastic Coatings Market, By Region, 2016 & 2021 (USD Million)

Figure 24 Other Plastic Coatings Types Market, By Region, 2016 & 2021 (Kilo Tons)

Figure 25 The European Region is Estimated to Lead the DIP Coating Segment of the Plastic Coatings Market in 2016

Figure 26 The Spray Segment of the Plastic Coatings Market in the Asia-Pacific Region is Expected to Grow at the Highest CAGR During the Forecast Period

Figure 27 The Powder Coating Segment of the Plastic Coatings Market in the Asia-Pacific Region to Grow at the Highest CAGR During the Forecast Period

Figure 28 The Electrophoretic Painting Segment of Plastic Coatings Market to Grow at the Highest CAGR in the Asia-Pacific Region Between 2016 and 2021

Figure 29 Adoption of Various New Coating Processes is Expected to Drive the Plastic Coatings Market During the Forecast Period

Figure 30 Europe Estimated to Contribute the Largest Share to the Automotive Plastic Coatings Market in 2016

Figure 31 Building & Construction Segment in Asia-Pacific Anticipated to Grow at the Highest CAGR Between 2016 and 2021

Figure 32 Medical Plastic Coatings Market in Asia-Pacific Anticipated to Grow at the Highest CAGR Between 2016 and 2021

Figure 33 Development of New Niche Products Expected to Continue to Drive the Market

Figure 34 Regional Growth Snapshot – Emerging Economies are Anticiptaed to Grow at A High Growth Rate

Figure 35 North America: Market Snapshot

Figure 36 U.S. Plastic Coatings Market Size, 20162021

Figure 37 Canada Plastic Coating Market Size, 2016-2021

Figure 38 Mexico Plastic Coating Market Size, 2016-2021

Figure 39 Germany Expected to Grow at the Highest CAGR During the Forecast Period in Europe

Figure 40 Germany: Plastic Coatings Market, 2014-2021

Figure 41 Russia: Plastic Coatings Market, 2014-2021

Figure 42 Italy: Plastic Coatings Market, 2014-2021

Figure 43 France: Plastic Coatings Market, 2014-2021

Figure 44 U.K.: Plastic Coatings Market, 2014-2021

Figure 45 The Netherlands: Plastic Coatings Market, 2014-2021

Figure 46 Czech Republic: Plastic Coatings Market, 2014-2021

Figure 47 Rest of Europe: Plastic Coatings Market, 2014-2021

Figure 48 Asia-Pacific: Plastic Coatings Market Snapshot – Most Lucrative Opportunities

Figure 49 China: Plastic Coatings Market, 2016-2021

Figure 50 Japan: Plastic Coatings Market, 2016-2021

Figure 51 India: Plastic Coatings Market, 2016-2021

Figure 52 Indonesia: Plastic Coatings Market, 2016-2021

Figure 53 Rest of Asia-Pacific: Plastic Coatings Market, 2016-2021

Figure 54 Brazil: Plastic Coatings Market, 2016-2021

Figure 55 Argentina Plastic Coatings Market, 2016-2021

Figure 56 Rest of Latin America Plastic Coatings Market, 2016-2021

Figure 57 Saudi Arabia Plastic Coatings Market, 2016-2021

Figure 58 South Africa : Plastic Coatings Market, 2016-2021

Figure 59 Rest of Middle East & Africa Plastic Coatings Market, 2016-2021

Figure 60 Companies Primarily Adopted Organic Growth Strategies, 2011-2016

Figure 61 Key Growth Strategies in the Plastic Coatings Market, 2011-2016

Figure 62 Plastic Coatings Market: Year-Wise Share of the Total Developments in the Market, 2011–2016

Figure 63 Geographic Revenue Mix of Top Five Market Players

Figure 64 3M: Company Snapshot

Figure 65 3M: SWOT Analysis

Figure 66 Eastman: Business Overview

Figure 67 Eastman: SWOT Analysis

Figure 68 Bayer AG: Company Snapshot

Figure 69 Bayer AG : SWOT Analysis

Figure 70 Akzonobel N.V.: Company Snapshot

Figure 71 Akzonobel N.V.: SWOT Analysis

Figure 72 Axalta Coating Systems Ltd.: Company Snapshot

Figure 73 Axalta Coating Systems Ltd.: SWOT Analysis

Figure 74 PPG Industries, Inc.: Company Snapshot

Figure 75 Kansai Paint Co., Ltd.: Company Snapshot

Figure 76 Valspar Corporation: Company Snapshot

Figure 77 BASF SE: Company Snapshot

Figure 78 Wacker Chemie AG: Company Snapshot

Growth opportunities and latent adjacency in Plastic Coatings Market