Planting Equipment Market by Type (Air Seeders, Seed Drills, Planters), Design (Automatic and Mechanical), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), and Region - Global Forecast to 2022

[138 Pages Report] Planting Equipment Market categorizes the Global Market by Type (Air Seeders, Seed Drills, Planters), Design (Automatic and Mechanical), Crop Type (Cereals & Grains, Oilseeds & Pulses, Fruits & Vegetables), and Region. The planting equipment market is estimated at USD 15.82 Billion in 2017, and is projected to reach USD 21.43 Billion by 2022, at a CAGR of 6.27% during the forecast period. The objectives of the report are to define, segment, and estimate the global planting equipment market size, in both quantitative and qualitative terms. The market is segmented on the basis of type, design, crop type, and region. It aims to provide detailed information about the crucial factors influencing the growth of the market, strategical analysis of micromarkets, opportunities for stakeholders, details of the competitive landscape, and profiles of the key players with respect to their market share & competencies.

The years considered for the study are as follows:

- Base year: 2016

- Forecast period: 2017 to 2022

Research Methodology:

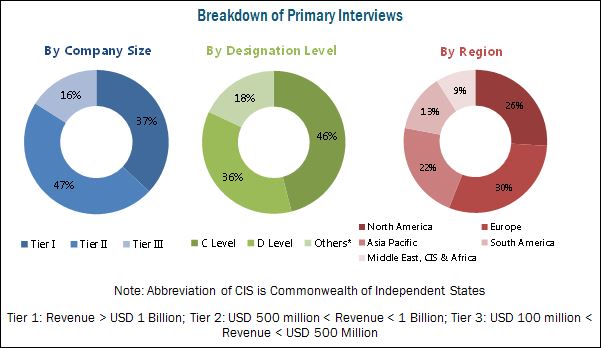

The top-down and bottom-up approaches were used to arrive at the market size and obtain the market forecast. Data triangulation methods were used to perform market estimation and market forecasting for the entire segmentation listed in this report. Extensive secondary research was conducted through databases such as FAOSTAT and World Bank data to understand the market insights and trends, which was further validated through primary interviews. The report provides both qualitative and quantitative analysis of the planting equipment market, the competitive landscape, and the preferred development strategies of key players.

To know about the assumptions considered for the study, download the pdf brochure

The planting equipment market is dominated by various players, depending on their core competencies. The key players in this market are Deere & Company (U.S.), AGCO Corporation (U.S.), Buhler Industries, Inc. (Canada), Kinze Manufacturing, Inc. (U.S.), Case IH Agricultural Equipment, Inc. (U.S.), Bourgault Industries Ltd. (Canada), Seed Hawk Inc. (Canada), SeedMaster Manufacturing Ltd. (Canada), Morris Industries Ltd. (Canada), Stara S/A Indústria de Implementos Agrícolas’ (Brazil), Kasco Manufacturing Co., Inc. (U.S.), and Davimac Pty. Ltd. (Australia).

The stakeholders for the planting equipment market are mentioned below:

- Pre harvest planting manufacturing equipment suppliers

- Agricultural institutes

- Agrochemical & seed manufacturers and suppliers

- Intermediary suppliers

- Wholesalers

- Traders

- Research institutes and organizations

- Regulatory bodies

- Farmers

Scope of the Report:

This research report categorizes the planting equipment market based on the type, design, crop type, and region.

On the basis of Type, the planting equipment market has been segmented into the following:

- Air seeders

- Seed drills

- Planters

- Others (transplanters, broadcast seeders, and box drill seeders)

On the basis of Design, the planting equipment market has been segmented into the following:

- Mechanical

- Automatic

On the basis of Crop Type, the planting equipment market has been segmented into the following:

- Cereals & grains

- Oilseeds & pulses

- Fruits & vegetables

- Others (turf and turf grass)

On the basis of Region, the planting equipment market has been segmented into the following:

- North America

- Europe

- Asia-Pacific

- South America

- Commonwealth of Independent States

- Africa

- Middle East

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to client-specific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Regional Analysis

- Further breakdown of the Rest of Asia-Pacific planting equipment market into Japan, Thailand, and Vietnam

- Further breakdown of the Rest of South America planting equipment market into Chile, Peru, and Paraguay

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The planting equipment market is estimated at USD 15.82 Billion in 2017, and is projected to reach USD 21.43 Billion by 2022. The factors influencing the growth of the planting market are better and increased usage of mechanized equipment in farming over handheld equipment, reducing arable land for agriculture which leads to utilization of the available land for better yield, shortage of labor, and increased participation of corporates in the agriculture industry leading to increase in agreements for contract farming.

The planting equipment market is segmented on the basis of type, design, crop type, and region. On the basis of type, the market is segmented into air seeders, seed drills, planters, and others (transplanters, broadcast seeders, and box drill seeders), among which the seed drills segment accounted for the largest market share in 2016. Seed drills are inexpensive and low in maintenance as compared to other types of seeders and planters. They are also compatible to small and medium sized farm land by acreage owing to which they are preferred.

The planting equipment market, by design, is segmented into automatic and mechanical. The mechanical segment accounted for a larger market share in 2016. This is due to the affordability of the equipment that are mechanical in nature, and their greater suitability in small-to-mid ranged farm land, by acreage.

The planting equipment market, by crop type, is segmented into cereals & grains, oilseeds & pulses, fruits & vegetables, and others (turf and turf grasses). The cereals & grains segment accounted for the largest market share in 2016, due to increase in the area under cultivation for cereals and grains across the globe and better agricultural practices adopted by the farmers which involves the usage of seed drills in planting the seeds.

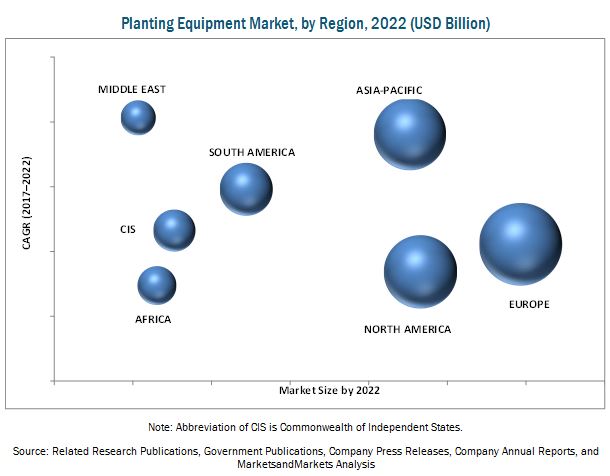

The European region accounted for the largest market share followed by the North American region in 2016. This is due to better adoption of mechanized farming as compared to other regions, access to better research and development facilities, and favorable foreign direct investment (FDI) policies in agriculture.

The major restraining factors are less availability of bigger farm lands in the countries for large-scale fresh produce. The major restraining factor is less availability of consolidated agricultural lands for growing crops, which are required for contract farming; this restricts the usage of air seeders which generally requires large agricultural lands for planting of seeds.

The key players profiled in the planting equipment market are Deere & Company (U.S.), AGCO Corporation (U.S.), Buhler Industries, Inc. (Canada), Kinze Manufacturing, Inc. (U.S.), Case IH Agricultural Equipment, Inc. (U.S.), Bourgault Industries Ltd. (Canada), Seed Hawk Inc. (Canada), SeedMaster Manufacturing Ltd. (Canada), Morris Industries Ltd. (Canada), Stara S/A Indústria de Implementos Agrícolas’ (Brazil), Kasco Manufacturing Co., Inc. (U.S.), and Davimac Pty. Ltd. (Australia

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.4 Periodization Considered

1.5 Currency

1.6 Stakeholders

2 Research Methodology (Page No. - 16)

2.1 Research Data

2.1.1 Secondary Data

2.1.2 Primary Data

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primary Interviews

2.2 Market Size Estimation

2.3 Market Breakdown & Data Triangulation

2.4 Research Assumptions & Limitations

2.4.1 Assumptions

2.4.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 30)

4.1 Attractive Opportunities in the Planting Equipment Market

4.2 Planting Equipment Market, By Type

4.3 Planting Equipment Market, By Region & Crop Type

4.4 Planting Equipment Market: Major Countries

4.5 Planting Equipment Market, By Design

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Dynamics

5.2.1 Drivers

5.2.1.1 Increasing Yield Through Mechanization of Farmlands

5.2.1.2 Shrinking Arable Land

5.2.1.3 Labor Shortage

5.2.1.4 Increasing Attention Towards Contract Farming

5.2.2 Restraints

5.2.2.1 Lack of Awareness Among Farmers in Emerging Economies

5.2.2.2 Small and Fragmented Land Holdings, Especially in Developing Countries

5.2.3 Opportunities

5.2.3.1 Increased Government Subsidies

5.2.4 Challenges

5.2.4.1 Farmers are Reluctant to Adopt Newer Technology

5.3 Value Chain

5.4 Supply Chain

6 Planting Equipment Market, By Type (Page No. - 42)

6.1 Introduction

6.2 Air Seeders

6.3 Seed Drills

6.4 Planters

6.5 Others

7 Planting Equipment Market, By Design (Page No. - 48)

7.1 Introduction

7.2 Mechanical

7.3 Automatic

8 Planting Equipment Market, By Crop Type (Page No. - 52)

8.1 Introduction

8.2 Cereals & Grains

8.3 Oilseeds & Pulses

8.4 Fruits & Vegetables

8.5 Others

9 Planting Equipment Market, By Region (Page No. - 58)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 South America

9.3.1 Brazil

9.3.2 Argentina

9.3.3 Rest of South America

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Australia

9.4.4 Rest of Asia-Pacific

9.5 Europe

9.5.1 France

9.5.2 Germany

9.5.3 U.K.

9.5.4 Spain

9.5.5 Poland

9.5.6 Italy

9.5.7 Rest of Europe

9.6 Commonwealth of Independent States

9.6.1 Russia

9.6.2 Kazakhstan

9.6.3 Ukraine

9.6.4 Turkey

9.7 Africa

9.7.1 South Africa

9.7.2 Kenya

9.7.3 Zimbabwe

9.7.4 Rest of Africa

9.8 Middle East

10 Competitive Landscape (Page No. - 95)

10.1 Introduction

10.2 Market Ranking Analysis

10.3 Competitive Leadership Mapping, 2017

10.3.1 Visionary Leaders

10.3.2 Dynamic Differentiators

10.3.3 Innovators

10.3.4 Emerging Companies

10.4 Competitive Benchmarking

10.4.1 Product Offerings Scorecard (For 25 Players)

10.4.2 Business Strategy Scorecard (For 25 Players)

*Top 25 Companies Analyzed for This Study are – Deere & Company, AGCO Corporation, Buhler Industries Inc., Kinze Manufacturing, Inc., Case IH, Bourgault Industries Ltd., Seed Hawk Inc., Seedmaster Manufacturing Inc., Morris Industries Ltd., Stara S/A Indústria De Implementos Agrícolas, Earthway Products, Inc., Ndume Ltd., Southern Irrigation Chilliwack, Kasco Manufacturing Co, Inc., Lovol Heavy Industry Co. Ltd., National Agro Industries, Kheedut Agro Engineering Pvt. Ltd., Standen Engineering Ltd., Davimac, Great Plains Manufacturing, Inc., Landoll Corporation, Duncan Ag, Willsie Equipment Sales Inc., Truax Company, Inc., Monosem, Inc.

11 Company Profiles (Page No. - 100)

(Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View)*

11.1 Deere & Company

11.2 AGCO Corporation

11.3 Buhler Industries Inc.

11.4 Kinze Manufacturing, Inc.

11.5 Case IH

11.6 Bourgault Industries Ltd.

11.7 Seed Hawk Inc.

11.8 Seedmaster Manufacturing Inc.

11.9 Morris Industries Ltd.

11.10 Stara S/A Industria De Implementos Agricolas.

11.11 Kasco Manufacturing Co., Inc.

11.12 Davimac

*Details on Business Overview, Products Offered & Services Strategies, Key Insights, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 131)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables (68 Tables)

Table 1 Planting Equipment Market Size, By Type ,2015-2022 (USD Million)

Table 2 Air Seeders Market Size, By Region ,2015-2022 (USD Million)

Table 3 Seed Drill Market Size, By Region ,2015-2022 (USD Million)

Table 4 Planters Market Size, By Region ,2015-2022 (USD Million)

Table 5 Others Equipment Market Size, By Region ,2015-2022 (USD Million)

Table 6 Planting Equipment Market Size, By Design, 2015–2022 (USD Million)

Table 7 Mechanical Planting Equipment Market Size, By Region, 2015–2022 (USD Million)

Table 8 Automatic Planting Equipment Market Size, By Region , 2015–2022 (USD Million)

Table 9 Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 10 Cereals & Grains Market Size, By Region, 2015-2022 (USD Million)

Table 11 Oilseeds & Pulses Market Size, By Region, 2015-2022 (USD Million)

Table 12 Fruits & Vegetables Market Size, By Region, 2015-2022 (USD Million)

Table 13 Planting Equipment Market Size for Other Crop Types, By Region, 2015-2022 (USD Million)

Table 14 Planting Equipment Market Size, By Region, 2015–2022 (USD Million)

Table 15 North America: Planting Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 16 North America: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 17 North America: Planting Equipment Market Size, By Design, 2015–2022 (USD Million)

Table 18 North America: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 19 U.S.: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 20 Canada: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 21 Mexico: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 22 South America: Planting Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 23 South America: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 24 South America: Planting Equipment Market Size, By Type, 2015–2022 (Units)

Table 25 South America: Planting Equipment Market Size, By Design, 2015–2022 (USD Million)

Table 26 South America: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 27 Brazil: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 28 Argentina: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 29 Rest of South America: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 30 Asia-Pacific: Planting Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 31 Asia –Pacific :Planting Equipment Market Size, By Type , 2015-2022 (USD Million)

Table 32 Asia-Pacific: Planting Equipment Market Size, By Design, 2015-2022 (USD Million)

Table 33 Asia-Pacific: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 34 China: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 35 India: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 36 Australia: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 37 Rest of Asia-Pacific: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 38 Europe: Planting Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 39 Europe :Planting Equipment Market Size, By Type , 2015-2022 (USD Million)

Table 40 Europe: Planting Equipment Market Size, By Design, 2015-2022 (USD Million)

Table 41 Europe: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 42 France: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 43 Germany: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 44 U.K.: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 45 Spain: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 46 Poland: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 47 Poland: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 48 Rest of Europe: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 49 Commonwealth of Independent States: Planting Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 50 Commonwealth of Independent States :Planting Equipment Market Size, By Type ,2015-2022 (USD Million)

Table 51 Commonwealth of Independent States: Planting Equipment Market Size, By Design, 2015-2022 (USD Million)

Table 52 Commonwealth of Independent States: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 53 Russia: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 54 Kazakhstan: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 55 Ukraine: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 56 Turkey: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 57 Africa: Planting Equipment Market Size, By Country, 2015–2022 (USD Million)

Table 58 Africa :Planting Equipment Market Size, By Type ,2015-2022 (USD Million)

Table 59 Africa: Planting Equipment Market Size, By Design, 2015-2022 (USD Million)

Table 60 Africa: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 61 South Africa: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 62 Kenya: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 63 Zimbabwe: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 64 Rest of Africa: Planting Equipment Market Size, By Type, 2015–2022 (USD Million)

Table 65 Middle East :Planting Equipment Market Size, By Type , 2015-2022 (USD Million)

Table 66 Middle East: Planting Equipment Market Size, By Design, 2015-2022 (USD Million)

Table 67 Middle East: Planting Equipment Market Size, By Crop Type, 2015–2022 (USD Million)

Table 68 Ranking Analysis for Top Five Companies in the Planting Equipment Market

List of Figures (28 Figures)

Figure 1 Planting Equipment: Market Segmentation

Figure 2 Geographic Segmentation

Figure 3 Planting Equipment Market: Research Design

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Market Size Estimation Methodology: Bottom-Up Approach

Figure 6 Planting Equipment Market: Data Triangulation

Figure 7 Europe Dominated the Planting Equipment Market in 2016

Figure 8 Planting Equipment Market Snapshot, By Type, 2017 vs 2022 (USD Billion)

Figure 9 Cereals & Grains Segment is Projected to Dominate the Market Through 2022

Figure 10 Attractive Opportunities in Planting Equipment Market, 2017–2022

Figure 11 Seed Drill Segment Accounted for the Largest Market Share in 2016, in Terms of Value

Figure 12 European Region Was the Largest Market for Planting Equipment Market in 2016

Figure 13 India is Projected to Be the Fastest-Growing Country-Level Market Through 2022

Figure 14 Europe Dominated the Automatic Segment, Whereas North America Dominated the Mechanical Segment in 2016

Figure 15 Planting Equipment Market: Drivers, Restraints, Opportunities, and Challenges

Figure 16 Arable Land Area, Decadal Average (1965–2014)

Figure 17 Value Chain Analysis for Planting Equipment Market: the Most Value is Added During Registration and Manufacturing

Figure 18 Supply Chain of the Planting Equipment Market

Figure 19 Seed Drills to Dominate the Planting Equipment Market Through the Projected Period

Figure 20 Automatic Planting Equipment Market to Grow at A Higher CAGR During the Forecast Period

Figure 21 Cereals & Grains Segment is Projected to Dominate the Planting Equipment Market, By Crop Type, 2017 vs 2022 (USD Million)

Figure 22 Regional Snapshot: Asia-Pacific Planting Equipment Market to Grow at the Highest CAGR

Figure 23 Asia-Pacific: Planting Equipment Market Snapshot

Figure 24 Europe: Planting Equipment Market Snapshot

Figure 25 Competitive Leadership Mapping, 2017

Figure 26 Deere & Company: Company Snapshot

Figure 27 AGCO Corporation: Company Snapshot

Figure 28 Buhler Industries Inc.: Company Snapshot

Growth opportunities and latent adjacency in Planting Equipment Market