Plant-Based Protein Processing Equipment Market

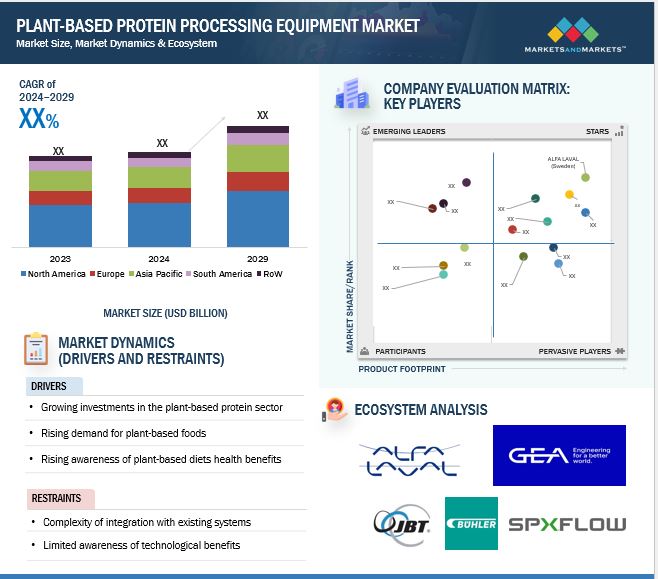

The plant-based protein processing equipment market is estimated at USD XX billion in 2024; it is projected to grow at a CAGR of XX% to reach USD XX billion by 2029. The production of plant proteins offers clear ecological benefits, such as improving soil quality, reducing water use, and minimizing greenhouse gas emissions. These advantages, coupled with an increasing awareness of sustainability, are pushing both governments and private entities to invest in plant-based food solutions. Advanced processing equipment plays a critical role in making these protein-rich products accessible, safe, and appealing to global consumers.

Plant-based protein products, such as meat and dairy analogues, are gaining momentum as healthier, sustainable alternatives to animal-derived options. This shift has spurred demand for versatile and innovative equipment capable of handling diverse raw materials like pulses, grains, and other plant proteins. Advanced machinery, including dryers, extruders, mixers, and filtration systems, ensures that plant-based products meet nutritional and textural expectations while maintaining environmental and economic efficiency. The private sector's emphasis on innovation and affordability has further fueled the demand for high-performance equipment that supports diverse cuisines and local preferences.

Plant-Based Protein Processing Equipment Market Dynamics

Drivers: Growing investments in the plant-based protein sector

The rapid expansion of the plant-based protein industry is being fueled by increasing investments across the value chain. Global players such as Beyond Meat (US), Impossible Foods (US), and Oatly (Sweden) are channeling substantial capital to scale production, improve product quality, and diversify offerings. These investments extend to the processing equipment sector, where manufacturers of dryers, extruders, and filtration systems are seeing increased demand for high-capacity, efficient, and flexible machinery. For instance, startups and established players in Asia, Europe, and North America have benefited from venture capital funding and private equity investments aimed at building innovative processing facilities.

An example includes investments in the development of specialized equipment for precision fermentation and protein isolation, which require sophisticated systems to ensure efficiency and scalability. Moreover, government-backed incentives and grants for sustainable food processing are encouraging innovation in machinery tailored for plant-based protein production, further propelling the market.

Restraints: Complexity of integration with existing systems

Many food processing plants are designed around traditional systems optimized for animal-based products. Transitioning to equipment for plant proteins often involves retrofitting or replacing entire production lines, which can be costly and time-consuming.

Integrating a high-shear mixer or extruder designed for plant protein products into a legacy system might require extensive modifications, such as changes to piping, software, and process layouts. This complexity can slow the adoption of new equipment, particularly for small and medium enterprises (SMEs) with limited budgets. Moreover, achieving seamless compatibility between older systems and advanced technologies like IoT-enabled automation adds another layer of complexity for manufacturers.

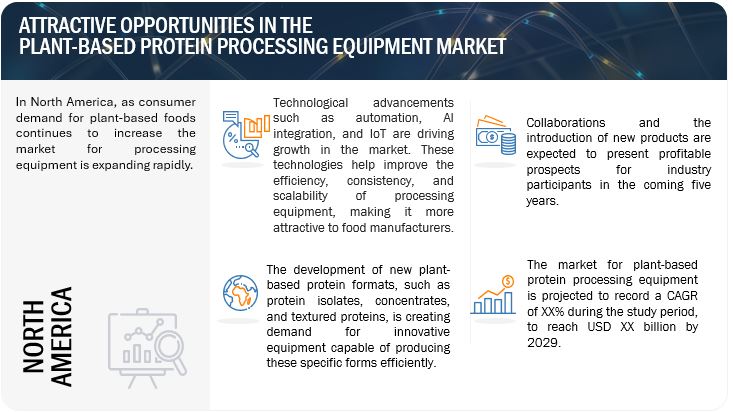

Opportunities: Expanding market for plant-based protein alternatives

The global appetite for plant-based protein alternatives is growing rapidly, presenting significant opportunities for the equipment market. As consumer preferences shift toward healthier, more sustainable diets, the demand for products such as plant-based meat, dairy alternatives, and protein powders is surging. This creates opportunities for equipment manufacturers to innovate and expand their offerings to meet diverse processing requirements.

The rise of hybrid products, which combine plant proteins with traditional animal proteins, has created a demand for specialized mixing and homogenization equipment capable of handling complex formulations. Similarly, the growing popularity of fermented plant-based products like yogurt and cheese has opened avenues for fermentation and enzymatic processing machinery. Companies investing in advanced technologies, such as 3D food printing and microencapsulation, are also tapping into this booming market to create premium, differentiated plant-based products.

Challenges: Adoption of automation technologies

While automation technologies offer immense potential for improving efficiency and reducing costs, their adoption in the plant-based protein processing equipment market faces several hurdles. Many traditional food processing companies, particularly in emerging markets, are hesitant to invest in automation due to the high upfront costs and lack of technical expertise.

Additionally, automated systems require extensive training for operators and maintenance personnel, as well as robust cybersecurity measures to protect IoT-enabled devices. Despite these challenges, companies that embrace automation stand to benefit significantly in terms of scalability and operational efficiency. Automated extrusion systems that monitor temperature, pressure, and protein alignment in real time enable manufacturers to produce higher-quality plant-based meat products while minimizing waste and energy use.

Prominent companies in this market include well-established, financially stable manufacturers of plant-based protein processing equipment. These companies have been operating in the market for several years and possess a diversified product portfolio, state-of-the-art technologies, and strong global sales and marketing networks. Prominent companies in this market include ALFA LAVAL (Sweden), GEA Group Aktiengesellschaft (Germany), JBT (US), Buhler (Switzerland), and Spx Flow (US) among others.

Market Ecosystem

Based on Type, the dryers’ segment is projected to be the dominant segment in the market.

Dryers are essential in plant-based protein processing, particularly for reducing the moisture content of protein isolates, concentrates, and textured proteins to achieve the desired product stability and shelf life. The dominance of this segment is attributed to the increasing use of spray dryers and vacuum dryers in the production of protein powders and concentrates derived from peas, soy, lentils, and chickpeas. Spray dryers, in particular, have gained prominence due to their efficiency in drying liquid protein extracts into fine powder without compromising nutritional content.

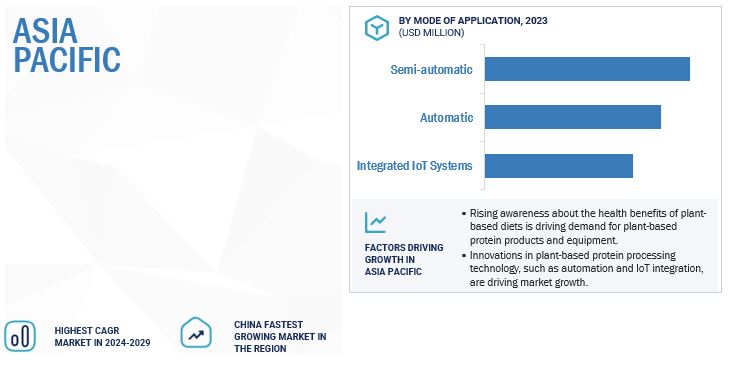

The semi-automatic segment by mode of operation in the plant-based protein processing equipment market is projected to have a significant share.

Semi-automatic systems strike a balance between automation and manual intervention, making them suitable for manufacturers aiming to optimize production efficiency without incurring the high costs of fully automated systems. These systems are particularly favored in regions where labor costs are comparatively low, but operational flexibility is required to cater to diverse product formulations.

The semi-automatic segment’s growing relevance is seen in regional producers in Asia and South America who utilize semi-automatic extruders and grinders for soy and pea protein processing. These systems allow operators to control key parameters, such as extrusion temperature and grinding speed, while automating repetitive tasks to ensure consistency. Companies like JBT (US) offer versatile semi-automatic equipment that caters to niche plant protein applications, further boosting the segment's adoption.

Asia Pacific is the fastest growing region in the plant-based protein processing equipment market.

The Asia Pacific region is emerging as the fastest-growing market for plant-based protein processing equipment, driven by the increasing adoption of plant-based diets and government initiatives promoting sustainable food production. With a government-backed focus on reducing meat consumption under initiatives like the "Healthy China 2030" plan, the demand for plant-based proteins is surging. Thus, major food companies and startups are adopting sophisticated processing equipment like spray dryers and protein mixers to meet the growing consumer demand. This presents lucrative opportunities for manufacturers and investors alike, reinforcing the region's significance in the industry.

Key Market Players

- ALFA LAVAL (Sweden)

- GEA Group Aktiengesellschaft (Germany)

- JBT (US)

- Buhler (Switzerland)

- Spx Flow (US)

- Tetra Pak International S.A. (Switzerland)

- Bepex International LLC (US)

- Pall Corporation (US)

- CRB (US)

- Coperion GmbH (Germany)

- OMVE Americas Inc. (Netherlands)

- Mepaco (US)

- Myande Group (China)

- Wafilin Systems (Netherlands)

- Hasokawa Micron B.V. (Netherlands)

Other players in the market include SiccaDania Group (China), CPM (US), Jinan Sunward Machinery Co., Ltd. (China), Prater Industries (US), and Fulton (US).

These market players are focusing on increasing their presence through agreements and collaborations. These companies have a strong presence in North America, Asia Pacific, Europe, South America, and the Rest of the World. They also have manufacturing facilities along with strong distribution networks across these regions.

Recent Developments

- In June 2024, Tetra Pak International S.A. introduced the Tetra Pak Industrial Protein Mixer, a solution designed to address foaming issues in protein powder mixing, which has long been a challenge in the food and beverage industry. This innovative mixer eliminates air entrapment and reduces the need for de-foaming agents like silicon oil, which helps prevent nutrient oxidation, improves shelf life, and minimizes the need for costly additives. This development is poised to positively impact Tetra Pak's business in the plant-based protein processing sector. With the growing demand for protein-enriched food products particularly plant-based proteins, this mixer offers a much-needed solution to enhance processing efficiency while meeting the rising market demands for health-conscious consumers.

- In January 2024, Bühler unveiled its Protein Application Center in partnership with Endeco (Germany), marking a significant milestone in expanding its food innovation capabilities. The center is designed to offer comprehensive solutions for the entire protein value chain, from pulses and grains to finished products like meat replacements, dairy alternatives, and intermediate ingredients (proteins, fibers, and starches). This facility enhances Bühler’s ability to meet growing consumer demand for plant-based foods, offering both dry and wet processing options for plant proteins.

- In July 2022, JBT acquired Alco-food-machines GmbH & Co. KG (Alco) (Germany), a prominent German provider of advanced food processing solutions. This strategic acquisition expands JBT's product portfolio in plant-based protein processing and convenience meal production lines, aligning with the growing market demand for alternative proteins and ready-to-eat meals. The move strengthens JBT's foothold in the DACH (Germany, Austria, Switzerland) region, enhancing local service support and application expertise.

Frequently Asked Questions (FAQ):

What is the current size of the plant-based protein processing equipment market?

The plant-based protein processing equipment market is estimated at USD XX billion in 2024 and is projected to reach USD XX billion by 2029, at a CAGR of XX% during the same period.

Which are the key players in the market, and how intense is the competition?

ALFA LAVAL (Sweden), GEA Group Aktiengesellschaft (Germany), JBT (US), Buhler (Switzerland), and Spx Flow (US).

The market for plant-based protein processing equipment is expanding rapidly, with more mergers, acquisitions, and product launches. Companies in this sector are also heavily investing in research and development.

Which region is projected to account for the largest share of the plant-based protein processing equipment market?

The North American market is expected to dominate during the forecast period. Increased awareness of environmental sustainability and health benefits is prompting consumers to shift from animal-based products to plant-based alternatives. This has led to an increase in plant-based food production and, consequently, a greater demand for advanced processing equipment.

What kind of information is provided in the company profiles section?

The provided company profiles deliver crucial details, including a thorough business summary that covers different segments, financial results, geographic presence, revenue distribution, and business revenue breakdown. They also offer insights into product lines, key achievements, and expert analyst opinions to better illustrate the company's potential.

What are the factors driving the plant-based protein processing equipment market?

The plant-based protein processing equipment market is driven by a significant rise in the number of vegans and vegetarians across the globe is driving demand for plant-based protein alternatives.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Plant-Based Protein Processing Equipment Market