Plant-based Butter Market by Source (Soy, Almonds, Oats, Coconut, Others), Flavor (Flavored and Plain), Distribution Channel (Supermarkets & Hypermarkets, Health Food Stores, Convenience Stores, Online, B2B – Food Service) and Key Region - Forecasted to 2027

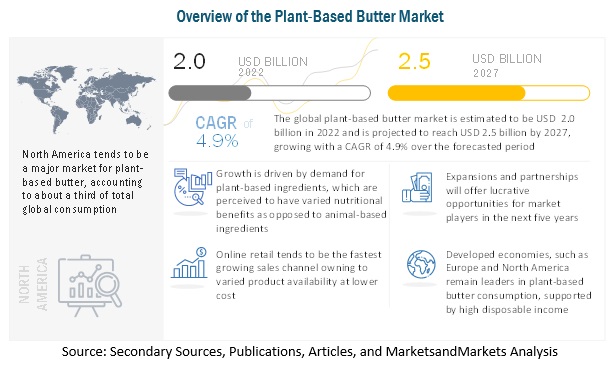

According to MarketsandMarkets, the global Plant-based butter market is estimated to be valued at USD 2.0 billion in 2022. It is projected to reach USD 2.5 billion by 2027, with a CAGR of 4.9%, in terms of value between 2022 and 2027. Major drivers of the market include rising awareness regarding social and environmental values, which plant-based butter offers, thereby creating opportunities for labels, such as clean label and organic plant-based.

Plant-based Butter Market Dynamics

Drivers: Trend of using plant-based butter is supported by social media influencers

Drivers for plant-based market include social media influencers who tend to coax consumers to using plant-based ingredients in their home cooked foods. This is followed by them educating consumers about the nutritional content in plant-based butter, besides speaking about the negative effect of animal-based products on animals and the environment in general.

Restraints: Protection and nurturing the bees turns out to be the biggest constraint

Plant-based butter market is restrained by its higher prices when compared to animal-based ones. The market does not have the benefit of economies of scale, which the animal-based butter market has, thereby inflating plant-based butter prices. High product prices also owe themselves to low maturity of the market and the constant efforts on improving supply chain and product innovation.

Opportunities: Leveraging the labels such as organic and plant-based

Plant-based products are increasingly labelled ‘organic’, ‘plant-based’, ‘non-GMO’, amongst other trending labels. This therefore is expected to be an opportunity for plant-based butter as well, wherein labelling the products with such certifications increases their market value and presence.

Challenges: Taste remains a key challenge, wherein plant-based butters are yet to mimic animal-based ones

Adoption of plant-based butter is hindered by its flavour, which is yet to match that of animal-based butter, and thereby which is creating a hurdle to its market acceptance. However, there is an increase in investments in research around flavour. One such development was made by DTU National Food Institute in Denmark, where the researchers were able to develop natural butter flavour from plant-based butter sources.

By source, oats-based plant-based butter is projected to witness the fastest growth rate during the forecast period.

Oats-based plant-based butter is expected to gain fastest traction in B2C sales channel. This is owing to rising popularity of its linked product, oat milk. Further, brands, such as Miyoko have been labelling their plant-based butter products as ‘gluten free’, ‘non-GMO’, ‘soy free’, etc., which further increases the demand of oats-based butters, albeit through such brands.

By flavor, flavor segment is expected to showcase the fastest growth.

Usage of vegan butter has increased in the bakery industry, with an increasing number of health-conscious consumers demanding bakery items prepared using vegan butter. Furthermore, flavored vegan butter has been gaining traction as well, with manufacturers launching their own lines of flavored vegan butter sticks.

North America tends to be a major market for plant-based butter products, accounting to about a third of total global consumption. The region is especially led by the US, wherein the country has consistently showcased double digit growth in the historical period.

Key Market Players:

Key players in this market include Forager Project (US), Goodmylk (US), JEM Organics (US), Milkadamia (US), Nuts For Cheese (Canada), among others.

FAQs:

- Which are the major Plant-based butter segments considered in this study and which of them are projected to have promising growth rates in the future?

- I am interested in the Asia Pacific market for oats and coconut butter segment. Is the customization available for the same? What all information would be included in the same?

- What are some of the drivers fuelling the growth of the Plant-based butter market?

- I am interested in understanding the research methodology on how you arrived at the market size and segmental splits before making a purchase decision. Can you provide me with an explanation on the same?

- What kind of information is provided in the competitive landscape section?

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 STUDY SCOPE

1.4 REGIONAL SEGMENTATION

1.5 PERIODIZATION CONSIDERED

1.6 CURRENCY CONSIDERED

1.7 VOLUME UNITS CONSIDERED

1.8 STAKEHOLDERS

2 RESEARCH METHODOLOGY

2.1 RESEARCH DATA

2.1.1 SECONDARY DATA

2.1.1.1 Key Data from Secondary Sources

2.1.2 PRIMARY DATA

2.1.2.1 Key Data from Primary Sources

2.1.2.2 Key Industry Insights

2.1.2.3 Breakdown of Primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 MARKET SIZE ESTIMATION - METHOD 1

2.2.2 MARKET SIZE ESTIMATION - METHOD 2

2.3 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR THE STUDY

2.5 LIMITATIONS OF THE STUDY

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

5.2.1 DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY TRENDS

6.1 INTRODUCTION

6.2 VALUE CHAIN/SUPPLY CHAIN ANALYSIS

6.3 TECHNOLOGY ANALYSIS

6.4 PRICING ANALYSIS

6.5 ECOSYSTEM/ MARKET MAP

6.6 TRENDS/ DISRUPTION IMPACTING THE CUSTOMER’S BUSINESS

6.7 PATENT ANALYSIS

6.8 TRADE ANALYSIS

6.9 KEY CONFERENCES AND EVENTS IN 2022-2023

6.10 TARIFF AND REGULATORY LANDSCAPE

6.11 PORTER’S FIVE FORCES ANALYSIS

6.12 KEY STAKEHOLDERS & BUYING CRITERIA

6.13 CASE STUDY ANALYSIS

7 PLANT-BASED BUTTER MARKET, BY SOURCE

7.1 INTRODUCTION

7.2 SOY

7.3 ALMONDS

7.4 OATS

7.5 COCONUT

7.6 OTHER SOURCES

8 PLANT-BASED BUTTER MARKET, BY FLAVOUR

8.1 INTRODUCTION

8.2 FLAVOURED

8.3 PLAIN

9 PLANT-BASED BUTTER MARKET, BY DISTRIBUTION CHANNEL

9.1 INTRODUCTION

9.2 SUPERMARKETS & HYPERMARKETS

9.3 HEALTH FOOD STORES

9.4 CONVENIENCE STORES

9.5 ONLINE

9.6 B2B – FOOD SERVICE

10 PLANT-BASED BUTTER MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 FRANCE

10.3.3 UK

10.3.4 ITALY

10.3.5 SPAIN

10.3.6 REST OF EUROPE

10.4 ASIA PACIFIC

10.4.1 CHINA

10.4.2 INDIA

10.4.3 JAPAN

10.4.4 AUSTRALIA & NEW ZEALAND

10.4.5 REST OF ASIA PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 REST OF THE WORLD

10.6.1 AFRICA

10.6.2 MIDDLE EAST

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET SHARE ANALYSIS*

11.3 KEY PLAYERS STRATEGIES

11.4 COMPANY REVENUE ANALYSIS OF TOP 5 MARKET PLAYERS

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

11.5.5 COMPETITIVE BENCHMARKING

11.6 PRODUCT FOOTPRINTS

11.7 STARTUP/SME EVALUATION QUADRANT

11.7.1 PROGRESSIVE COMPANIES

11.7.2 STARTING BLOCKS

11.7.3 RESPONSIVE COMPANIES

11.7.4 DYNAMIC COMPANIES

11.8 PRODUCT LAUNCHES, DEALS, AND OTHER DEVELOPMENTS

11.8.1 NEW PRODUCT LAUNCHES

11.8.2 DEALS

11.8.3 OTHER DEVELOPMENTS

11.8.4 PARTNERSHIPS, COLLABORATIONS, AND JOINT VENTURES

*Market share analysis will be provided in percentage (value) at Global level

12 COMPANY PROFILES

12.1 CONAGRA BRANDS, INC.

12.2 GOODMYLK

12.3 JEM ORGANICS

12.4 FORAGER PROJECT

12.5 MILKADAMIA

12.6 BUBBLE SUPERFOODS

12.7 BETTERTHANORGAIC PVT. LTD.

12.8 NUTS FOR CHEESE

12.9 MIYOKO’S KITCHEN

Note: Currently, list of only 9 companies have been provided. However, this section covers 12-15 key company profiles which include business overview, recent financials, product offerings, key strategies, and swot analysis. recent financials can be provided-based on data/information availability in public domain. The list of companies mentioned above can be altered depending upon client’s interest

13 APPENDIX

Note: The TOC prepared above is tentative and may subject to change, based on the research progress

Growth opportunities and latent adjacency in Plant-based Butter Market