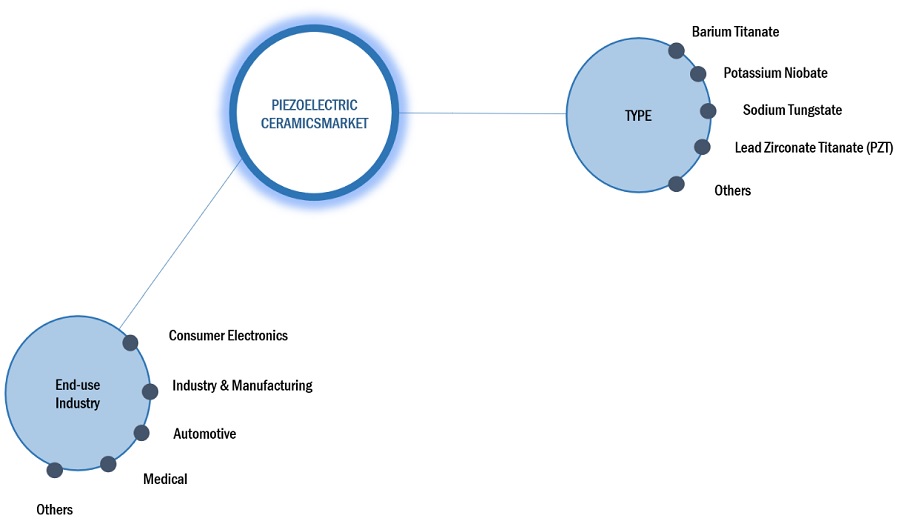

Piezoelectric Ceramics Market by Type (Barium Titanate, Potassium Niobate, Sodium Tungstate, Lead Zirconate Titanate), End user (Consumer Electronics, Industry & Manufacturing, Automotive, Medical), and Region – Global Forecast to 2028

Updated on : July 17, 2025

Piezoelectric Ceramics Market

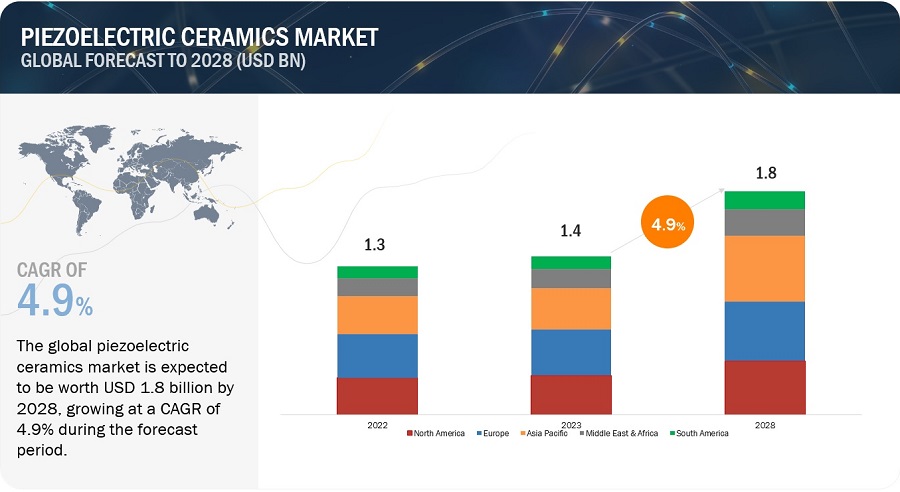

The global piezoelectric ceramics market was valued at USD 1.4 billion in 2023 and is projected to reach USD 1.8 billion by 2028, growing at 4.9% cagr from 2023 to 2028. The growing demand for piezoelectric ceramics is due to growing need for high-performance sensors. Moreover, rising demand of piezoelectric energy harvesting technology and rising demand from medical sectors in emerging economies such as India, China, Brazil, and others.

Global Piezoelectric Ceramics Market Trend

To know about the assumptions considered for the study, Request for Free Sample Report

Piezoelectric Ceramics Market Dynamics

Driver: Growing need for high-performance sensors

The growing need for high-performance sensors is a major driver for the increased demand for piezoelectric ceramics. High-performance sensors are crucial in various industries and applications where accurate and reliable measurements are essential. Piezoelectric ceramics exhibit excellent sensitivity, allowing them to convert mechanical signals such as pressure, force, or vibration into electrical signals with high precision. This accuracy is vital in applications where precise measurements are required, such as industrial process control, automotive testing, medical diagnostics, and environmental monitoring.

Restraint: High cost of piezoelectric ceramics material

The high cost of piezoelectric ceramics poses a significant restraint to their widespread adoption in various industries. The production of high-quality piezoelectric ceramics involves complex manufacturing processes. These processes typically include the preparation of raw materials, mixing, shaping, sintering, and poling. Each step requires specialized equipment and expertise, which adds to the overall production cost. The raw materials used in piezoelectric ceramics, such as lead zirconate titanate (PZT), are often costly. These materials are engineered with specific compositions to exhibit the desired piezoelectric properties. The procurement and refinement of these materials can contribute significantly to the overall cost of the ceramics.

Opportunity:Emergence of Internet of Things (IoT) technology

The IoT revolution is driving the demand for sensors and actuators that enable connectivity and intelligence in various applications. Piezoelectric ceramics can provide accurate and responsive sensing capabilities for IoT devices, such as environmental monitoring, structural health monitoring, and smart home systems. The IoT is a network of interconnected devices and systems that collect, exchange, and analyze data to enable intelligent decision-making and automation. Piezoelectric ceramics play a vital role in this ecosystem due to their unique sensing capabilities and energy-harvesting potential. The IoT relies on a wide array of sensors to gather data from the physical world. Piezoelectric ceramics can convert mechanical strain, pressure, or vibrations into electrical signals, enabling accurate and responsive sensing. In the IoT ecosystem, piezoelectric sensors find applications in environmental.

Challenges: Limited raw material options

The limited material options available for piezoelectric ceramics pose a significant challenge to their widespread adoption and growth in the market. Traditionally, piezoelectric ceramics have been primarily based on lead-containing materials, such as lead zirconate titanate (PZT). However, the environmental concerns associated with lead content have led to increasing restrictions and regulations on its usage. The commercial availability and cost-effectiveness of suitable piezoelectric ceramic materials can be a limiting factor. Some high-performance materials may be difficult to procure in large quantities or may come with a high price tag, making them less accessible for widespread industrial applications. Overcoming the limited material options for piezoelectric ceramics researchers are constantly exploring new material compositions, searching for substitutes, and investigating methods to enhance the performance of existing materials.

Market Ecosystem

By type, potassium niobate is the fourth largest in piezoelectric ceramics market, in 2022.

Potassium niobate (KNbO3) is a type of piezoelectric ceramic that holds significant importance in the piezoelectric ceramics market. Potassium niobate exhibits a high piezoelectric coefficient, which means it can generate a strong electric charge in response to mechanical stress. It also has a wide operating frequency range, spanning from a few hertz to gigahertz. This property makes it ideal for various applications including medical imaging, non-destructive testing, underwater communication, and frequency control devices.

By end-use industry, automotive segment is the third largest in piezoelectric ceramics market, in 2022.

The automotive industry is one of the largest and most significant sectors for the application of piezoelectric ceramics. ADAS technologies, including collision detection, lane departure warning, and adaptive cruise control, rely on accurate sensing and actuation capabilities. Piezoelectric ceramics are employed in these systems for their ability to convert mechanical signals into electrical signals, enabling precise detection and response to environmental changes.

Asia Pacific is projected to be fastest growing amongst other regions in the piezoelectric ceramics market market, in terms of value.

Based on the region, the piezoelectric ceramics market is segmented into Asia Pacific, North America, Europe, South America, and the Middle East & Africa. Currently, Asia Pacific is the fastest growing market for piezoelectric ceramics. Asia Pacific is known as a global manufacturing hub, with countries like China, Japan, South Korea, and Taiwan leading in the production of various electronic components. This region's strong manufacturing capabilities and expertise make it an ideal location for the production of piezoelectric ceramics. The presence of a well-established supply chain, skilled labor, and advanced manufacturing infrastructure contributes to the growth of the piezoelectric ceramics market in the region.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Some of the key players operating in the piezoelectric ceramics market include KYOCERA Corporation (Japan), CeramTec GmbH (Germany), CTS Corporation (US), Murata Manufacturing Co., Ltd (Japan), TDK Corporation (Japan), Physik Instrumente (PI) GmbH & Co. (Germany), APC International, Ltd (US), L3Harris Technologies, Inc (US), HOERBIGER Motion Control GmbH (Germany), and Piezo Technologies (US).

These companies have adopted various organic as well as inorganic growth strategies between 2018 and 2022 to strengthen their positions in the market. The new product launch is the key growth strategy adopted by these leading players to enhance regional presence and develop product portfolios to meet the growing demand for piezoelectric ceramics from emerging economies.

Piezoelectric Ceramics Market Report Scope

|

Report Metric |

Details |

|

Market Size Value in 2023 |

USD 1.4 billion |

|

Revenue Forecast in 2028 |

USD 1.8 billion |

|

CAGR |

4.9% |

|

Years considered for the study |

2019-2028 |

|

Base Year |

2022 |

|

Forecast period |

2023–2028 |

|

Units considered |

Value (USD Million/Billion) |

|

Segments |

Type, End-Use Industry, and Region |

|

Regions |

Asia Pacific, North America, Europe, Middle East & Africa, and South America |

|

Companies |

KYOCERA Corporation (Japan), CeramTec GmbH (Germany), CTS Corporation (US), Murata Manufacturing Co., Ltd (Japan), TDK Corporation (Japan), Physik Instrumente (PI) GmbH & Co. (Germany), APC International, Ltd (US), L3Harris Technologies, Inc (US), HOERBIGER Motion Control GmbH (Germany), and Piezo Technologies (US) are the key players in the market. |

This report categorizes the global piezoelectric ceramics market based on type, end-use industry, and region.

On the basis of type, the piezoelectric ceramics market has been segmented as follows:

- Barium Titanate

- Potassium Niobate

- Sodium Tungstate

- Lead Zirconate Titanate (PZT)

- Others

On the basis of end use industry, the piezoelectric ceramics market has been segmented as follows:

- Consumer Electronics

- Industry & Manufacturing

- Automotive

- Medical

- Others

On the basis of region, the piezoelectric ceramics market has been segmented as follows:

- North America

- Asia Pacific

- Europe

- South America

- The Middle East & Africa

The piezoelectric ceramics market has been further analyzed based on key countries in each of these regions.

Recent Developments

- In 2021, KYOCERA Corporation announced an investment of USD 97 million to build two additional production facilities at its Kokubu plant campus in Kagoshima, Japan. The area of one factory will be 5,174 m2 and another will be 6,996 m2. This has helped the company to strengthened its geographical presence in Asia Pacific region.

- In 2021, KYOCERA Corporation started construction of a new research and development center in January 2021 at its Kokubu campus in Kirishima City, Kagoshima, Japan. Kyocera has executed a location agreement with the mayor of Kirishima City for the new R&D center, which will focus on innovations in the fields of information and communications, environmental preservation, and smart energy..

- In 2020, CeramTec GmbH (Germany) expanded its existing production capabilities to meet the rising demand for high-quality piezoelectric elements and materials. The internationally operating company with sites in Europe, the UK, the US, and Asia has invested in two additional machinery units at its Piezoceramic Centre of Excellence in Lauf, Germany, which further multiply existing high-volume manufacturing capabilities for piezoceramic components, such as discs, rings, and tubes, as well as increase automation..

- In 2023, CTS Corporation has acquired maglab AG a Switzerland-based innovator in electric vehicle sensors. This acquisition has helped the company to strengthen its product portfolio in the automotive application in the Europe region.

- In 2022, CTS Corporation has acquired Ferroperm Piezoceramics from Meggitt PLC Denmark based high-quality and innovative piezoceramic technology. This has helped the company to strengthen its geographical presence in Europe and North America.

Frequently Asked Questions (FAQ):

What is the current size of the global piezoelectric ceramics market?

Global piezoelectric ceramics market size is estimated to reach USD 1.8 billion by 2028 from USD 1.4 billion in 2023, at a CAGR of 4.9% during the forecast period.

Who are the winners in the global piezoelectric ceramics market?

Companies such as include KYOCERA Corporation (Japan), CeramTec GmbH (Germany), CTS Corporation (US), Murata Manufacturing Co., Ltd (Japan), TDK Corporation (Japan), Physik Instrumente (PI) GmbH & Co. (Germany), APC International, Ltd (US), L3Harris Technologies, Inc (US), HOERBIGER Motion Control GmbH (Germany), and Piezo Technologies (US).. They have the potential to broaden their product portfolio and compete with other key market players.

What are some of the drivers in the market?

Growing need for high-performance sensors, rising demand from medical sector, and rising demand of piezoelectric energy harvesting technology.

What are the major end-use industries of piezoelectric ceramics?

Consumer electronics, Industrial & manufacturing, Automotive, Medical and Others are some of the major end use industry.

What are the various types of piezoelectric ceramics?

Lead Zirconate Titanate (PZT), Barium Titanate, Sodium Tungstate are some major type of piezoelectric ceramics. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

- 5.2 RECESSION IMPACT

-

5.3 MARKET DYNAMICSDRIVERS- Rising demand for piezoelectric energy harvesting technology- Rising demand from medical industry- Growing need for high-performance sensorsRESTRAINTS- High cost of piezoelectric ceramics material- Stringent government policies mandating use of lead-free piezoelectric materialsOPPORTUNITIES- Emergence of IoT technology- Rapid innovations in automotive sectorCHALLENGES- Limited raw material options

-

5.4 VALUE CHAIN ANALYSISRAW MATERIAL SUPPLIERSMANUFACTURERSDISTRIBUTORSEND-USE INDUSTRIES

-

5.5 PORTER’S FIVE FORCES ANALYSISTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSTHREAT OF NEW ENTRANTSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

5.6 MACROECONOMIC INDICATORSGLOBAL GDP TRENDS

-

5.7 TARIFFS & REGULATIONSREGULATIONS- Europe- US- OthersTARIFFS- StandardsREGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

-

5.8 TECHNOLOGY ANALYSISNEW TECHNOLOGIES: PIEZOELECTRIC CERAMICS

-

5.9 RAW MATERIAL ANALYSISLEAD ZIRCONATE TITANATEBARIUM TITANATEPOTASSIUM NIOBATE

-

5.10 TRADE ANALYSISIMPORT TRADE ANALYSISEXPORT TRADE ANALYSIS

-

5.11 PRICING ANALYSISAVERAGE SELLING PRICE, BY REGIONAVERAGE SELLING PRICE, BY TYPEAVERAGE SELLING PRICE, BY COMPANY

-

5.12 ECOSYSTEM MAPPING

-

5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES & EVENTS IN 2023–2024

-

5.15 KEY FACTORS AFFECTING BUYING DECISIONQUALITYSERVICE

-

5.16 CASE STUDY ANALYSISMEDICAL ULTRASOUND IMAGING BY CTS CORPORATIONTDK CORPORATION’S PIEZOELECTRIC SENSORS AND ACTUATORS

-

5.17 PATENT ANALYSISINTRODUCTIONDOCUMENT TYPEPUBLICATION TRENDS—LAST 10 YEARSINSIGHTJURISDICTION ANALYSISTOP COMPANIES/APPLICANTS

- 6.1 INTRODUCTION

- 6.2 BARIUM TITANATE

- 6.3 POTASSIUM NIOBATE

- 6.4 LEAD ZIRCONATE TITANATE

- 6.5 SODIUM TUNGSTATE

- 6.6 OTHER TYPES

- 7.1 INTRODUCTION

- 7.2 CONSUMER ELECTRONICS

- 7.3 INDUSTRIAL & MANUFACTURING

- 7.4 AUTOMOTIVE

- 7.5 MEDICAL

- 7.6 OTHER END-USE INDUSTRIES

- 8.1 INTRODUCTION

-

8.2 ASIA PACIFICIMPACT OF RECESSIONCHINA- Rapid industrialization and flourishing end-use industries to boost marketJAPAN- Growing trends for smart homes, smartphones, and smart offices to increase demand for consumer electronicsINDIA- Growing FDI in manufacturing sector to drive marketSOUTH KOREA- Significant production of passenger vehicles to drive marketREST OF ASIA PACIFIC

-

8.3 NORTH AMERICAIMPACT OF RECESSIONUS- Growing telecom, EV, and renewable energy industries to drive marketCANADA- Low-cost-structures, skilled workforce, and favorable investment schemes to drive marketMEXICO- Private investments in manufacturing and automotive sectors to boost economic growth

-

8.4 EUROPEIMPACT OF RECESSIONGERMANY- Strong industrial and automotive base to increase consumption of piezoelectric ceramicsFRANCE- High demand for piezoelectric medical devices to increase demand for piezoelectric ceramicsUK- Ongoing public and private partnerships for EV infrastructure to boost EV production and piezoelectric ceramics consumptionITALY- Established healthcare system to provide a competitive edge in medical equipment marketSPAIN- Rising investments in electronics and EV sectors to boost demandREST OF EUROPE

-

8.5 MIDDLE EAST & AFRICAIMPACT OF RECESSIONSAUDI ARABIA- Sale of smartphones and wearable electronics to boost demandSOUTH AFRICA- Strong skill base and flexible, responsive, and innovative technology centers to drive growthREST OF MIDDLE EAST & AFRICA

-

8.6 SOUTH AMERICAIMPACT OF RECESSIONBRAZIL- Various initiatives to encourage companies to increase their presenceARGENTINA- Major market for air conditioners, mobile phones, advanced TVs, and microwavesREST OF SOUTH AMERICA

- 9.1 OVERVIEW

- 9.2 STRATEGIES ADOPTED BY KEY PLAYERS

- 9.3 REVENUE ANALYSIS

-

9.4 RANKING OF KEY PLAYERSCERAMTEC GMBHKYOCERA CORPORATIONCTS CORPORATIONMURATA MANUFACTURING CO., LTDTDK CORPORATION

- 9.5 MARKET SHARE ANALYSIS

-

9.6 COMPANY EVALUATION MATRIX (TIER 1)STARSPERVASIVE PLAYERSEMERGING LEADERSPARTICIPANTS

-

9.7 COMPANY EVALUATION MATRIX (STARTUPS AND SMES)PROGRESSIVE COMPANIESRESPONSIVE COMPANIESSTARTING BLOCKSDYNAMIC COMPANIES

- 9.8 COMPETITIVE BENCHMARKING

-

9.9 COMPETITIVE SITUATIONS AND TRENDSPRODUCT LAUNCHES/DEVELOPMENTSDEALSOTHERS

-

10.1 KEY PLAYERSKYOCERA CORPORATION- Business overview- Products offered- Recent developments- MnM viewCERAMTEC GMBH- Business overview- Products offered- Recent developments- MnM viewCTS CORPORATION- Business overview- Products offered- Recent developments- MnM viewMURATA MANUFACTURING CO., LTD- Business overview- Products offered- MnM viewTDK CORPORATION- Business overview- Products offered- Recent developments- MnM viewPHYSIK INSTRUMENTE (PI) GMBH & CO.- Business overview- Products offered- Recent developmentsAPC INTERNATIONAL, LTD.- Business overview- Products offeredL3HARRIS TECHNOLOGIES, INC.- Business overview- Products offered- Recent developmentsHOERBIGER MOTION CONTROL GMBH- Business overview- Products offered- Recent developmentsPIEZO TECHNOLOGIES- Business overview- Products offered

-

10.2 OTHER PLAYERSTAIYO YUDEN CO., LTDBOSTON PIEZO-OPTICS INC.TRS TECHNOLOGIES, INC.PIEZO KINETICS, INC.SIANSONICSENSORTECH CANADAOMEGA PIEZO TECHNOLOGIESSPARKLER CERAMICS PVT. LTD.CENTRAL ELECTRONICS LIMITEDEBL PRODUCTS, INC.DEL PIEZO SPECIALTIES LLCNITERRA CO., LTD.PIEZO DIRECTKUNSHAN RISHENG ELECTRONIC CO., LTD.ZIBO YUHAI ELECTRONIC CERAMICS CO., LTD.

- 11.1 DISCUSSION GUIDE

- 11.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 11.3 CUSTOMIZATION OPTIONS

- 11.4 RELATED REPORTS

- 11.5 AUTHOR DETAILS

- TABLE 1 PIEZOELECTRIC CERAMICS: VALUE CHAIN STAKEHOLDERS

- TABLE 2 PIEZOELECTRIC CERAMICS: PORTER’S FIVE FORCES ANALYSIS

- TABLE 3 TRENDS OF PER CAPITA GDP (USD) 2020–2022

- TABLE 4 GDP GROWTH ESTIMATE AND PROJECTION OF KEY COUNTRIES, 2023–2027

- TABLE 5 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 6 REGION-WISE IMPORT TRADE (USD THOUSAND)

- TABLE 7 REGION-WISE EXPORT TRADE (USD THOUSAND)

- TABLE 8 AVERAGE SELLING PRICE, BY TYPE (USD/KILOTON)

- TABLE 9 AVERAGE SELLING PRICE, BY COMPANY (USD/KILOTON)

- TABLE 10 PIEZOELECTRIC CERAMICS MARKET: DETAILED LIST OF CONFERENCES & EVENTS

- TABLE 11 LIST OF PATENTS BY CANON KABUSHIKI KAISHA

- TABLE 12 LIST OF PATENTS BY ADVANCED MATERIAL TECH INC.

- TABLE 13 LIST OF PATENTS BY DALIAN UNIVERSITY OF TECHNOLOGY

- TABLE 14 LIST OF PATENTS BY GENERAL ELECTRIC COMPANY

- TABLE 15 TOP 10 PATENT OWNERS (US) IN LAST 10 YEARS

- TABLE 16 PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 17 PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 18 PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 19 PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 20 PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 21 PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 22 PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 23 PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 24 PIEZOELECTRIC CERAMICS MARKET, BY REGION, 2019–2022 (USD MILLION)

- TABLE 25 PIEZOELECTRIC CERAMICS MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 PIEZOELECTRIC CERAMICS MARKET, BY REGION, 2019–2022 (KILOTON)

- TABLE 27 PIEZOELECTRIC CERAMICS MARKET, BY REGION, 2023–2028 (KILOTON)

- TABLE 28 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 29 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 30 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 31 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 32 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 33 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 34 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 35 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 36 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 37 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 38 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 39 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 40 CHINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 41 CHINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 42 CHINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 43 CHINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 44 JAPAN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 45 JAPAN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 46 JAPAN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 47 JAPAN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 48 INDIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 49 INDIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 50 INDIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 51 INDIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 52 SOUTH KOREA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 53 SOUTH KOREA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 54 SOUTH KOREA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 55 SOUTH KOREA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 56 REST OF ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 57 REST OF ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 58 REST OF ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 59 REST OF ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 60 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 61 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 62 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 63 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 64 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 65 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 66 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 67 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 68 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 69 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 70 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 71 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 72 US: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 73 US: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 74 US: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 75 US: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 76 CANADA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 77 CANADA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 78 CANADA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 79 CANADA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 80 MEXICO: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 81 MEXICO: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 82 MEXICO: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 83 MEXICO: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 84 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 85 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 86 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 87 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 88 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 89 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 90 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 91 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 92 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 93 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 94 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 95 EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 96 GERMANY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 97 GERMANY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 98 GERMANY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 99 GERMANY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 100 FRANCE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 101 FRANCE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 102 FRANCE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 103 FRANCE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 104 UK: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 105 UK: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 106 UK: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 107 UK: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 108 ITALY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 109 ITALY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 110 ITALY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 111 ITALY: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 112 SPAIN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 113 SPAIN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 114 SPAIN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 115 SPAIN: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 116 REST OF EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 117 REST OF EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 118 REST OF EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 119 REST OF EUROPE: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 120 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 121 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 122 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 123 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 124 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 125 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 126 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 127 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 128 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 129 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 130 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 131 MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 132 SAUDI ARABIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 133 SAUDI ARABIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 134 SAUDI ARABIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 135 SAUDI ARABIA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 136 SOUTH AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 137 SOUTH AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 138 SOUTH AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 139 SOUTH AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 140 REST OF MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 141 REST OF MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 142 REST OF MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 143 REST OF MIDDLE EAST & AFRICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 144 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (USD MILLION)

- TABLE 145 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2019–2022 (KILOTON)

- TABLE 147 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY COUNTRY, 2023–2028 (KILOTON)

- TABLE 148 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (USD MILLION)

- TABLE 149 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 150 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2019–2022 (KILOTON)

- TABLE 151 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY TYPE, 2023–2028 (KILOTON)

- TABLE 152 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 153 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 154 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 155 SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 156 BRAZIL: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 157 BRAZIL: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 158 BRAZIL: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 159 BRAZIL: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 160 ARGENTINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (USD MILLION)

- TABLE 161 ARGENTINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 162 ARGENTINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 163 ARGENTINA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 164 REST OF SOUTH AMERICA PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY 2019–2022 (USD MILLION)

- TABLE 165 REST OF SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (USD MILLION)

- TABLE 166 REST OF SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2019–2022 (KILOTON)

- TABLE 167 REST OF SOUTH AMERICA: PIEZOELECTRIC CERAMICS MARKET, BY END-USE INDUSTRY, 2023–2028 (KILOTON)

- TABLE 168 REVENUE ANALYSIS OF KEY COMPANIES (2020–2022)

- TABLE 169 PIEZOELECTRIC CERAMICS MARKET: INTENSITY OF COMPETITIVE RIVALRY

- TABLE 170 DETAILED LIST OF COMPANIES

- TABLE 171 COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY TYPE

- TABLE 172 COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY END-USE INDUSTRY

- TABLE 173 COMPETITIVE BENCHMARKING OF KEY PLAYERS, BY REGION

- TABLE 174 PRODUCT LAUNCHES/DEVELOPMENTS, 2018–2023

- TABLE 175 DEALS, 2018–2023

- TABLE 176 OTHERS, 2018–2023

- TABLE 177 KYOCERA CORPORATION: BUSINESS OVERVIEW

- TABLE 178 KYOCERA CORPORATION: PRODUCT OFFERING

- TABLE 179 KYOCERA CORPORATION: DEALS

- TABLE 180 KYOCERA CORPORATION: OTHERS

- TABLE 181 CERAMTEC GMBH: BUSINESS OVERVIEW

- TABLE 182 CERAMTEC GMBH: PRODUCT OFFERING

- TABLE 183 CERAMTEC GMBH: PRODUCT LAUNCH

- TABLE 184 CERAMTEC GMBH: OTHERS

- TABLE 185 CTS CORPORATION: BUSINESS OVERVIEW

- TABLE 186 CTS CORPORATION: PRODUCT OFFERING

- TABLE 187 CTS CORPORATION: PRODUCT LAUNCHES

- TABLE 188 CTS CORPORATION: DEALS

- TABLE 189 MURATA MANUFACTURING CO., LTD: BUSINESS OVERVIEW

- TABLE 190 MURATA MANUFACTURING CO., LTD: PRODUCT OFFERING

- TABLE 191 TDK CORPORATION: BUSINESS OVERVIEW

- TABLE 192 TDK CORPORATION: PRODUCT OFFERING

- TABLE 193 TDK CORPORATION: OTHERS

- TABLE 194 PHYSIK INSTRUMENTE (PI) GMBH & CO.: BUSINESS OVERVIEW

- TABLE 195 PHYSIK INSTRUMENTE (PI) GMBH & CO.: PRODUCT OFFERING

- TABLE 196 PHYSIK INSTRUMENTE (PI) GMBH & CO.: OTHERS

- TABLE 197 APC INTERNATIONAL, LTD: BUSINESS OVERVIEW

- TABLE 198 APC INTERNATIONAL, LTD: PRODUCT OFFERING

- TABLE 199 L3HARRIS TECHNOLOGIES, INC.: BUSINESS OVERVIEW

- TABLE 200 L3HARRIS TECHNOLOGIES, INC: PRODUCT OFFERING

- TABLE 201 L3HARRIS TECHNOLOGIES, INC: DEALS

- TABLE 202 HOERBIGER MOTION CONTROL GMBH: BUSINESS OVERVIEW

- TABLE 203 HOERBIGER MOTION CONTROL GMBH: PRODUCT OFFERING

- TABLE 204 HOERBIGER MOTION CONTROL GMBH: DEALS

- TABLE 205 PIEZO TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 206 PIEZO TECHNOLOGIES: PRODUCT OFFERING

- TABLE 207 TAIYO YUDEN CO., LTD.: COMPANY OVERVIEW

- TABLE 208 BOSTON PIEZO-OPTICS INC.: COMPANY OVERVIEW

- TABLE 209 TRS TECHNOLOGIES, INC.: COMPANY OVERVIEW

- TABLE 210 PIEZO KINETICS, INC.: COMPANY OVERVIEW

- TABLE 211 SIANSONIC: COMPANY OVERVIEW

- TABLE 212 SENSORTECH CANADA: COMPANY OVERVIEW

- TABLE 213 OMEGA PIEZO TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 214 SPARKLER CERAMICS PVT. LTD.: COMPANY OVERVIEW

- TABLE 215 CENTRAL ELECTRONICS LIMITED: COMPANY OVERVIEW

- TABLE 216 EBL PRODUCTS, INC.: COMPANY OVERVIEW

- TABLE 217 DEL PIEZO SPECIALTIES LLC: COMPANY OVERVIEW

- TABLE 218 NITERRA CO., LTD.: COMPANY OVERVIEW

- TABLE 219 PIEZO DIRECT: COMPANY OVERVIEW

- TABLE 220 KUNSHAN RISHENG ELECTRONIC CO., LTD.: COMPANY OVERVIEW

- TABLE 221 ZIBO YUHAI ELECTRONIC CERAMICS CO., LTD.: COMPANY OVERVIEW

- FIGURE 1 PIEZOELECTRIC CERAMICS: MARKET SEGMENTATION

- FIGURE 2 PIEZOELECTRIC CERAMICS MARKET: RESEARCH DESIGN

- FIGURE 3 PIEZOELECTRIC CERAMICS MARKET SIZE ESTIMATION

- FIGURE 4 TOP-DOWN APPROACH

- FIGURE 5 BOTTOM-UP APPROACH

- FIGURE 6 PIEZOELECTRIC CERAMICS MARKET: DATA TRIANGULATION

- FIGURE 7 LEAD ZIRCONATE TITANATE TO ACCOUNT FOR LARGEST SHARE OF OVERALL PIEZOELECTRIC CERAMICS MARKET

- FIGURE 8 MEDICAL TO BE FASTEST GROWING END-USE INDUSTRY IN PIEZOELECTRIC CERAMICS MARKET

- FIGURE 9 ASIA PACIFIC ACCOUNTED FOR LARGEST SHARE OF PIEZOELECTRIC CERAMICS MARKET

- FIGURE 10 ASIA PACIFIC TO OFFER ATTRACTIVE OPPORTUNITIES IN PIEZOELECTRIC CERAMICS MARKET DURING FORECAST PERIOD

- FIGURE 11 BARIUM TITANATE SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 12 INDUSTRY & MANUFACTURING END-USE INDUSTRY TO LEAD MARKET

- FIGURE 13 INDIAN MARKET TO GROW AT HIGHEST CAGR

- FIGURE 14 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES IN PIEZOELECTRIC CERAMICS MARKET

- FIGURE 15 OVERVIEW OF PIEZOELECTRIC CERAMICS MARKET VALUE CHAIN

- FIGURE 16 PIEZOELECTRIC CERAMICS MARKET: PORTER’S FIVE FORCES ANALYSIS

- FIGURE 17 REGION-WISE IMPORT TRADE (USD THOUSAND)

- FIGURE 18 REGION-WISE EXPORT TRADE (USD THOUSAND)

- FIGURE 19 AVERAGE SELLING PRICE, BY REGION (USD/KILOTON)

- FIGURE 20 PIEZOELECTRIC CERAMICS MARKET ECOSYSTEM

- FIGURE 21 INDUSTRY & MANUFACTURING SEGMENT TO DRIVE GROWTH

- FIGURE 22 SUPPLIER SELECTION CRITERIA

- FIGURE 23 PATENTS REGISTERED (2012 TO 2022)

- FIGURE 24 NUMBER OF PATENTS IN LAST 10 YEARS

- FIGURE 25 TOP JURISDICTIONS

- FIGURE 26 TOP APPLICANTS’ ANALYSIS

- FIGURE 27 LEAD ZIRCONATE TITANATE ACCOUNTED FOR LARGEST MARKET SHARE

- FIGURE 28 INDUSTRY & MANUFACTURING END-USE INDUSTRY ACCOUNTED FOR LARGEST MARKET SHARE

- FIGURE 29 PIEZOELECTRIC CERAMICS MARKET IN INDIA TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 30 ASIA PACIFIC: PIEZOELECTRIC CERAMICS MARKET SNAPSHOT

- FIGURE 31 NORTH AMERICA: PIEZOELECTRIC CERAMICS MARKET SNAPSHOT

- FIGURE 32 EUROPE: PIEZOELECTRIC CERAMICS MARKET SNAPSHOT

- FIGURE 33 COMPANIES ADOPTED INVESTMENTS & EXPANSIONS AND ACQUISITIONS AS KEY GROWTH STRATEGIES BETWEEN 2018 AND 2023

- FIGURE 34 RANKING OF TOP FIVE PLAYERS IN PIEZOELECTRIC CERAMICS MARKET

- FIGURE 35 PIEZOELECTRIC CERAMICS MARKET SHARE, BY COMPANY (2022)

- FIGURE 36 PIEZOELECTRIC CERAMICS MARKET: COMPANY EVALUATION MATRIX FOR TIER 1 COMPANIES, 2022

- FIGURE 37 PIEZOELECTRIC CERAMICS MARKET: COMPANY EVALUATION MATRIX FOR STARTUPS AND SMES, 2022

- FIGURE 38 KYOCERA CORPORATION: COMPANY SNAPSHOT

- FIGURE 39 CERAMTEC GMBH: COMPANY SNAPSHOT

- FIGURE 40 CTS CORPORATION: COMPANY SNAPSHOT

- FIGURE 41 MURATA MANUFACTURING CO., LTD: COMPANY SNAPSHOT

- FIGURE 42 TDK CORPORATION: COMPANY SNAPSHOT

- FIGURE 43 L3HARRIS TECHNOLOGIES, INC.: COMPANY SNAPSHOT

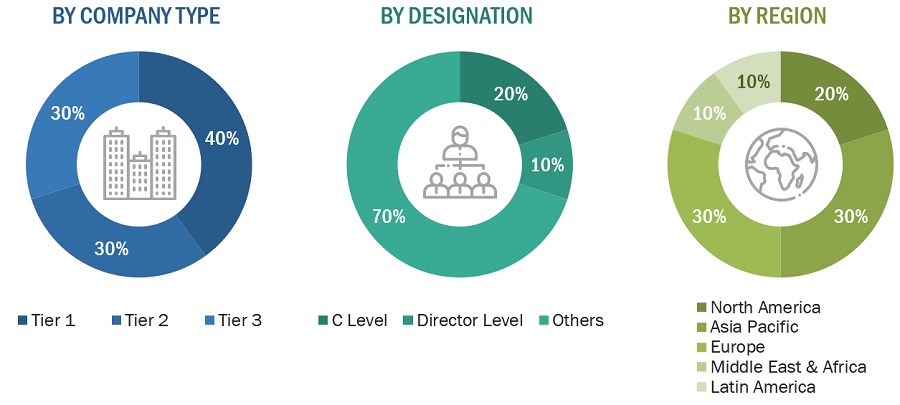

The study involved four major activities in estimating the current market size for piezoelectric ceramics. Exhaustive secondary research was conducted to collect information on the market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, the market breakdown and data triangulation methodologies were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources such as Factiva, Zauba, Hoovers, and Bloomberg BusinessWeek were referred to for identifying and collecting information for this study. These secondary sources included annual reports, press releases & investor presentations of companies, white papers, certified publications, articles by recognized authors, The US Advanced Ceramics Association (USACA), regulatory bodies, and databases.

Secondary research has been used to obtain key information about the value chain of the industry, monetary chain of the market, the total pool of key players, market classification and segmentation according to industry trends to the bottom-most level, and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The piezoelectric ceramics market comprises several stakeholders, such as raw material suppliers, distributors of piezoelectric ceramics, end-product manufacturers, and regulatory organizations in the supply chain. The demand side of this market consists of various industries such as consumer electronics, industry & manufacturing, automotive, medical, and others. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information.

Primary interviews were conducted to gather insights such as market statistics, data of revenue collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also helped in understanding the various trends related to technology, raw material, type, end-use industries, and region. Stakeholders from the demand side, such as CIOs, CTOs, and CSOs were interviewed to understand the buyer’s perspective on the suppliers, products, component providers, and their current usage of piezoelectric ceramics and future outlook of their business which will affect the overall market.

Following is the breakdown of primary respondents.

To know about the assumptions considered for the study, download the pdf brochure

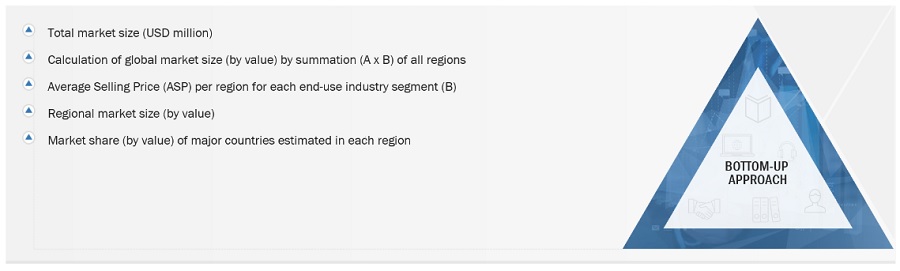

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the piezoelectric ceramics market. These methods were also used extensively to determine the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and markets were identified through extensive secondary research.

- The industry’s supply chain and market size, in terms of value and volume, were determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

Piezoelectric Ceramics Market: Bottom-Up Approach

Note: All the shares are based on the global market size.

Source: Secondary Research, Interviews with Experts, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Piezoelectric Ceramics Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size—using the market size estimation process explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, the data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply of piezoelectric ceramics and their applications.

Market Definition

Piezoelectric ceramics are a type of ceramic material that possesses the property of piezoelectricity. Piezoelectricity refers to the ability of certain materials to generate an electric charge in response to applied mechanical stress or strain, and vice versa, to undergo mechanical deformation or vibration when an electric field is applied. Piezoelectric ceramics are typically made from various compositions of metal oxides, such as lead zirconate titanate (PZT), barium titanate (BaTiO3), or potassium niobate (KNbO3). These ceramics have a crystalline structure that is asymmetrical, with positive and negative charges arranged in a non-centrosymmetric manner. This structural arrangement allows them to exhibit the piezoelectric effect. When an external force or pressure is applied to a piezoelectric ceramic, the crystal lattice of the material deforms, causing a displacement of positive and negative charges. This displacement results in the generation of an electric field and an electric charge across the material. Similarly, when an electric field is applied to the ceramic, it causes a mechanical deformation or vibration due to the movement of charges within the crystal lattice.

Key Stakeholders

- Senior Management

- End User

- Finance/Procurement Department

- R&D Department

Objectives of the Study:

- To define, describe, and forecast the piezoelectric ceramics market, in terms of value.

- To provide detailed information about the key factors (drivers, restraints, opportunities, and challenges) influencing the market growth

- To analyze and forecast the market by type and end-use industry.

- To forecast the size of the market for five regions, namely, Asia Pacific, Europe, North America, South America, and the Middle East & Africa along with their key countries

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contribution to the total market

- To analyze the opportunities in the market for stakeholders and provide a competitive landscape for market leaders.

- To analyze competitive developments, such as new product launch, acquisition, and expansion undertaken in the market

- To strategically profile key players and comprehensively analyze their market ranking and core competencies.

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the specific requirements of companies. The following customization options are available for the report:

Regional Analysis:

- Country-level analysis of the piezoelectric ceramics market

Company Information:

- Detailed analysis and profiling of additional market players

Growth opportunities and latent adjacency in Piezoelectric Ceramics Market