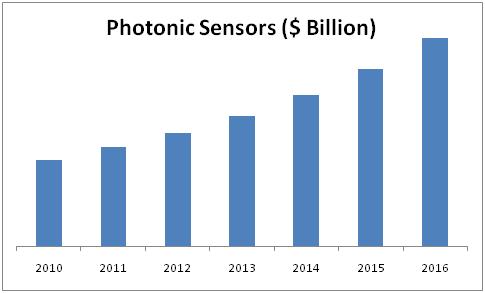

Photonic Sensor Market (2011 - 2016): Global Forecast - By Type (Laser, Biophotonic, Fiber Optic) & Application (Oil & Gas, Military & Aerospace, Energy & Infrastructure, Industrial Automation, Medical and Others)

APAC is expected to generate $2.61 billion by 2016 at a CAGR of 21.31%; followed by Europe, North America, and ROW at a CAGR of 14.56%, 13.56%, and 12.94% respectively from 2011 to 2016. Among the countries in APAC, China is expected to be the biggest emerging market for photonic sensors.

Photonic sensing technology incorporates emission of light, transmission, deflection, amplification, and detection by optical components, instruments, lasers, other light sources, fiber optics, electro-optical instrumentation, and sophisticated nanophotonic systems. It provides smaller, cheaper, lighter, and faster components and products, with greater functionality while using less energy.

Off late, photonics has been recognized as an enabling technology that impacts, extends across, and underpins a host of industrial sectors, from healthcare to security, manufacturing to telecommunications, energy to the environment, and aerospace to biotechnology. In all these sectors, photonics sensing activity can be recognized via the intelligent application of light (“optical radiation”) either in an entirely novel context such as a new photodynamic medical treatment, or as a replacement to an older, outdated technology such as signage and lighting based on the use of incandescent lamps.

Photonic sensors are now key technologies in oil and gas exploration in the market of Europe, due to which it is the second fastest growing market after APAC.

A market in industrial category requires global commercialization for it to generate revenue for the major players on the continuous basis. Currently, photonic sensors face a major challenge in product compatibility and shortage of skilled and trained personnel who lack the required technical expertise to adapt to the latest technology. From an end-user perspective, it is important to recognize that no matter how good the sensor is, there needs to be some level of incorporation into a system, often an instrument, for it to actually fill an economically useful note.

Regarding laser sensors, the market of Europe is expected to be slow and reluctant in the next five years; Asia is a strong market whereas the U.S. is faced by many highs and lows, mainly due to unstable customer preferences and regularly changing technologies.

Scope of the report

This photonic sensors market research report segments the global market on the basis of applications, types, and geographical analysis, forecasting revenue, and analyzing trends in the market.

On the basis of application

The application market is segmented into industrial applications. The major applications are further classified into military, homeland security, industrial process, factory automation, civil structures, transportation, and biomedical over wide range of applications. The market trends for these applications are discussed.

On the basis of technology

The types of technologies discussed in the report include Polarization, Spectrally-based fiber optic sensors, Multiplexing, and Distributed Sensors. The distributed fiber sensing technology is further classified into Interferometric, Bragg gratings, Raman scattering, and Brillouin scattering.

On the basis of geography

- North America

- Europe

- Asia-Pacific

- ROW

Each section will provide access to market data, market drivers, trends and opportunities, key players, and competitive outlook. It will also provide market tables for covering the sub-segments and micro-markets. In addition, the report provides more than 17 company profiles covering all the sub-segments.

Photonics, as a field, began in 1960, with the invention of the laser, followed in 1970s by the development of optical fibers as a medium for transmitting information using light beams. Until recently, biophotonics was included under the “basic research” segment of photonics science. Photonic sensors have been developed for use in many laboratories and industrial environments for detection of a wide variety of physical, biological, and chemical parameters.

Photonic sensors can be interpreted as the set of techniques and scientific knowledge applied to the generation, propagation, control, amplification, detection, storage, and processing of signals of the optical spectrum, along with their technologies and derived uses.

In recent years, photonic sensors have been recognized as technology that impacts, extends across, and strengthens a whole host of industrial sectors, from healthcare to security, from manufacturing to telecommunications, from energy to the environment, and from aerospace to biotechnology.

Photonic sensors market is categorized mainly by types and applications. Type wise it is categorized into fiber optic sensors, laser-based sensors, and biophotonic sensors. Application wise, it is segmented into construction, energy industry, oil and gas, military and aerospace, medical and industrial application.

Photonic sensors market is diverse and fragmented. This technology has found its way into the industry, surgeries, and the ordinary life besides its use in research laboratories.

Fiber optic sensors market is expected to grow at a very high rate as it is gaining significance in the areas of oil & gas exploration, civil engineering; basically including border security and fencing.

The photonic sensors market is slowly moving from making general purpose instruments to complicated tasks such as aircraft manufacturing applications that require maximized accuracy.

The companies involved in design, development, and supply of photonic sensors are Prime Photonics (U.S.), Smart Fibres (U.K.), and Mitsubishi Electric Corporation (Japan).

Source: MarketsandMarkets

TABLE OF CONTENTS

1 INTRODUCTION

1.1 KEY TAKE-AWAYS

1.2 REPORT DESCRIPTION

1.3 MARKETS COVERED

1.4 STAKEHOLDERS

1.5 RESEARCH METHODOLOGY

1.5.1 MARKET SIZE

1.5.2 KEY DATA POINTS FROM SECONDARY SOURCES

1.5.3 KEY DATA POINTS FROM PRIMARY SOURCES

1.5.4 ASSUMPTIONS MADE FOR THIS REPORT

1.5.5 LIST OF COMPANIES CONTACTED

2 EXECUTIVE SUMMARY

2.1 OBJECTIVES

2.2 MARKET SIZE

2.3 OPPORTUNITIES

3 MARKET OVERVIEW

3.1 INTRODUCTION

3.2 PHOTONIC SENSORS – MARKET DEFINITION

3.3 EVOLUTION OF PHOTONIC SENSORS

3.4 MARKET DYNAMICS

3.4.1 DRIVERS

3.4.1.1 Need for safety & security

3.4.1.2 Alternate for a failed technology

3.4.1.3 Growth in wireless sensing technology

3.4.2 RESTRAINTS

3.4.2.1 Lack of industry standards

3.4.2.2 High cost

3.4.3 OPPORTUNITIES

3.4.3.1 Industrial assets safety

3.4.3.2 Structural health monitoring

3.5 BURNING ISSUE

3.5.1 PRODUCT COMPATIBILITY

3.6 PATENT ANALYSIS

4 PHOTONIC SENSORS MARKET, BY TYPES

4.1 INTRODUCTION

4.2 FIBER OPTIC SENSORS

4.2.1 DRIVERS

4.2.1.1 Utility in diverse industrial markets

4.2.1.2 Increased application of wind power

4.2.1.3 Distributed sensing

4.2.1.4 Need for oil reserves

4.2.2 DISTRIBUTED SENSORS

4.2.3 POINT SENSORS

4.3 LASER SENSORS

4.3.1 DRIVER

4.3.1.1 High growth in industrial/factory automation

4.3.2 ANALOG LASER SENSORS

4.3.3 DIGITAL LASER SENSORS

4.4 BIOPHOTONIC SENSORS

4.4.1 DRIVERS

4.4.1.1 Need for effective treatment of diabetes

4.4.1.2 Requirement of reliable health monitoring systems

4.4.2 INTRINSIC BIOPHOTONIC SENSOR

4.4.3 EXTRINSIC BIOPHOTONIC SENSOR

5 APPLICATION MARKET

5.1 INTRODUCTION

5.2 FIBER OPTIC SENSORS, BY APPLICATIONS

5.3 BIOPHOTONIC SENSORS, BY APPLICATIONS

5.4 LASER SENSORS, BY APPLICATIONS

6 PHOTONIC SENSORS , BY TECHNOLOGY

6.1 INTRODUCTION

6.1.1 FIBER OPTIC SENSORS, BY TECHNOLOGY

6.1.1.1 Intensity-based fiber optic sensors

6.1.1.2 Spectrally-based fiber optic sensors

6.1.1.3 Polarization-based fiber optic sensors

6.1.1.4 Distributed & multiplexing sensing

6.1.1.4.1 Multiplexing sensing

6.1.1.4.2 Distributed sensing

6.1.1.4.2.1 Distributed fiber optic sensing technology

6.1.2 BIOPHOTONIC SENSORS

7 GEOGRAPHICAL ANALYSIS

7.1 INTRODUCTION

7.2 NORTH AMERICA

7.3 EUROPE

7.4 APAC

7.5 ROW

8 COMPETITIVE LANDSCAPE

8.1 KEY GROWTH STRATEGIES

9 COMPANY PROFILES

9.1 BANNER ENGINEERING CORP

9.1.1 OVERVIEW

9.1.2 PRODUCTS & SERVICES

9.1.3 FINANCIALS

9.1.4 STRATEGY

9.1.5 DEVELOPMENTS

9.2 BAUMER HOLDING AG

9.2.1 OVERVIEW

9.2.2 PRODUCTS & SERVICES

9.2.3 STRATEGY

9.2.4 DEVELOPMENTS

9.3 BAYSPEC INC

9.3.1 OVERVIEW

9.3.2 PRODUCTS & SERVICES

9.3.3 FINANCIALS

9.3.4 STRATEGY

9.3.5 DEVELOPMENTS

9.4 FIBER OPTIC SYSTEMS TECHNOLOGY INC (FOX-TEK)

9.4.1 OVERVIEW

9.4.2 PRODUCTS & SERVICES

9.4.3 FINANCIALS

9.4.4 STRATEGY

9.4.5 DEVELOPMENTS

9.5 ST. JUDE MEDICAL INC

9.5.1 OVERVIEW

9.5.2 PRODUCTS & SERVICES

9.5.3 FINANCIALS

9.5.4 STRATEGY

9.5.5 DEVELOPMENTS

9.6 OMRON CORPORATION

9.6.1 OVERVIEW

9.6.2 PRODUCTS & SERVICES

9.6.3 FINANCIALS

9.6.4 STRATEGY

9.6.4.1 Strengthening existing business

9.6.4.2 Business expansion in emerging markets

9.6.4.3 Creating new business horizons

9.6.5 DEVELOPMENTS

9.7 LAP LASER LLC

9.7.1 OVERVIEW

9.7.2 PRODUCTS & SERVICES

9.7.3 FINANCIALS

9.7.4 STRATEGY

9.7.5 DEVELOPMENTS

9.8 BBN INTERNATIONAL LIMITED

9.8.1 OVERVIEW

9.8.2 PRODUCTS & SERVICES

9.8.3 FINANCIALS

9.8.4 STRATEGY

9.8.5 DEVELOPMENTS

9.9 QOREX LLC

9.9.1 OVERVIEW

9.9.2 PRODUCTS & SERVICES

9.9.3 FINANCIALS

9.9.4 STRATEGY

9.9.5 DEVELOPMENTS

9.10 FIBERTRONIX AB

9.10.1 OVERVIEW

9.10.2 PRODUCTS & SERVICES

9.10.3 FINANCIALS

9.10.4 STRATEGY

9.10.5 DEVELOPMENTS

9.11 FISO TECHNOLOGIES INC

9.11.1 OVERVIEW

9.11.2 PRODUCTS & SERVICES

9.11.3 FINANCIALS

9.11.4 STRATEGY

9.11.5 DEVELOPMENTS

9.12 IBSEN PHOTONICS A/S

9.12.1 OVERVIEW

9.12.2 PRODUCTS & SERVICES

9.12.3 FINANCIALS

9.12.4 STRATEGY

9.12.5 DEVELOPMENTS

9.13 IFOS

9.13.1 OVERVIEW

9.13.2 PRODUCTS & SERVICES

9.13.3 FINANCIALS

9.13.4 STRATEGY

9.13.5 DEVELOPMENTS

9.14 PRIME PHOTONICS LC

9.14.1 OVERVIEW

9.14.2 PRODUCTS & SERVICES

9.14.3 FINANCIALS

9.14.4 STRATEGY

9.14.5 DEVELOPMENTS

9.15 SMART FIBRES LIMITED

9.15.1 OVERVIEW

9.15.2 PRODUCTS & SERVICES

9.15.3 FINANCIALS

9.15.4 STRATEGY

9.15.5 DEVELOPMENTS

9.16 MITSUBISHI ELECTRIC CORPORATION

9.16.1 OVERVIEW

9.16.2 PRODUCTS & SERVICES

9.16.3 FINANCIALS

9.16.4 STRATEGY

9.17 HONEYWELL INTERNATIONAL INC

9.17.1 OVERVIEW

9.17.2 PRODUCTS & SERVICES

9.17.3 FINANCIALS

9.17.4 DEVELOPMENTS

APPENDIX

U.S. PATENTS

EUROPE PATENTS

JAPAN PATENTS

LIST OF TABLES

TABLE 1 PHOTONIC SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 2 PHOTONIC SENSORS MARKET REVENUE, BY TYPES, 2010 – 2016 ($BILLION)

TABLE 3 FIBER OPTIC SENSORS MARKET REVENUE, BY TYPES, 2010 – 2016 ($BILLION)

TABLE 4 FIBER OPTIC SENSORS MARKET REVENUE, BY TYPES, 2010 – 2016 ($BILLION)

TABLE 5 FIBER OPTIC SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 6 DISTRIBUTED SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 7 POINT SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 8 LASER SENSORS MARKET REVENUE, BY TYPES, 2010 – 2016 ($BILLION)

TABLE 9 LASER-BASED SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 10 ANALOG SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 11 DIGITAL SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 – 2016 ($BILLION)

TABLE 12 BIOPHOTONIC SENSORS MARKET REVENUE, BY TYPES, 2010 - 2016 ($BILLION)

TABLE 13 BIOPHOTONIC SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 - 2016 ($BILLION)

TABLE 14 INTRINSIC BIOPHOTONIC SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 - 2016 ($BILLION)

TABLE 15 EXTRINSIC BIOPHOTONIC SENSORS MARKET REVENUE, BY GEOGRAPHY, 2010 - 2016 ($ BILLION)

TABLE 16 FIBER OPTIC SENSORS MARKET REVENUE, BY APPLICATIONS, 2010 - 2016 ($BILLION)

TABLE 17 BIOPHOTONIC SENSORS MARKET REVENUE, BY APPLICATIONS, 2010 - 2016 ($ BILLION)

TABLE 18 LASER SENSORS MARKET REVENUE, BY APPLICATIONS, 2010 - 2016 ($BILLION)

TABLE 19 MERGERS & ACQUISITIONS, 2009 – 2011

TABLE 20 NEW PRODUCTS LAUNCH, 2009 – 2011

TABLE 21 COLLABORATIONS/PARTNERSHIPS/AGREEMENTS/ JOINT VENTURES, 2009 – 2011

TABLE 22 OTHERS, 2009 -2011

TABLE 23 FIBER OPTIC SYSTEMS TECHNOLOGY INC: MARKET REVENUE, 2009 – 2010 ($MILLION)

LIST OF FIGURES

FIGURE 1 WORKING PRINCIPLE

FIGURE 2 PHOTONIC SENSORS MARKET CLASSIFICATION

FIGURE 3 IMPACT ANALYSIS OF DRIVERS

FIGURE 4 IMPACT ANALYSIS OF RESTRAINTS

FIGURE 5 PHOTONIC SENSORS PATENTS, BY GEOGRAPHY, 2011

FIGURE 6 FIBER OPTIC SENSORS PATENTS, BY GEOGRAPHY, 2011

FIGURE 7 LASER SENSORS PATENTS, BY GEOGRAPHY, 2011

FIGURE 8 FIBER OPTIC SENSORS CLASSIFICATION

FIGURE 9 FIBER OPTIC SENSORS: MARKET GROWTH RATES, BY TYPES, 2011 – 2016 (%)

FIGURE 10 LASER SENSORS: MARKET GROWTH RATES, BY TYPES, 2011 – 2016 (%)

FIGURE 11 BIOPHOTONIC SENSORS CLASSIFICATION

FIGURE 12 BIOPHOTONIC SENSORS: MARKET GROWTH RATES, BY TYPES, 2011 – 2016 (%)

FIGURE 13 FIBER OPTIC SENSORS CLASSIFICATION

FIGURE 14 FIBER OPTIC DISTRIBUTED SENSORS CLASSIFICATION

FIGURE 15 DISTRIBUTED FIBER OPTIC SENSING MARKET REVENUE, BY TECHNOLOGY, 2006 – 2015 ($MILLION)

FIGURE 16 NORTH AMERICA: PHOTONIC SENSORS MARKET REVENUE, 2010 - 2016 ($BILLION)

FIGURE 17 EUROPE: PHOTONIC SENSORS MARKET REVENUE, 2010 - 2016 ($BILLION)

FIGURE 18 APAC: PHOTONIC SENSORS MARKET REVENUE, 2010 - 2016 ($BILLION)

FIGURE 19 ROW: PHOTONIC SENSORS MARKET REVENUE, 2010 - 2016 ($BILLION)

FIGURE 20 KEY GROWTH STRATEGIES, JANUARY 2009 - OCTOBER 2011

Growth opportunities and latent adjacency in Photonic Sensor Market

Interested in information on: APD and PIN diode component market analytics by world geography, product segment, and market segment. Second layer info on: sensor products and modules built on APD and PIN diodes.