Phosphine Fumigation Market by Type (Aluminum Phosphide, Magnesium Phosphide, and Calcium Phosphide), by Application (Soil and Warehouse), by Form (Liquid and Solid), and Region - Global Trends & Forecast to 2022

[131 Pages Report] The phosphine fumigation market, in terms of value, is projected to reach around USD 684.19 Million by 2022, at a CAGR of around 5.46% from 2017.

The market has been segmented on the basis of type, application, form, and region.

The years considered for the study are as follows:

- Base year - 2015

- Estimated year – 2017

- Projected year – 2022

- Forecast period – 2017 to 2022

The Objectives of the Study are as follows:

- To understand and analyze the market segmentation, such as type, application, form, and region

- To understand the structure of the phosphine fumigation market by identifying its various sub segments

- To provide detailed information about the key factors influencing the growth of the market (drivers, restraints, opportunities, and industry-specific challenges)

- To strategically profile key players and comprehensively analyze their market share and core competencies

- For the purpose of this study, only applications pertaining to agriculture have been considered

Research Methodology

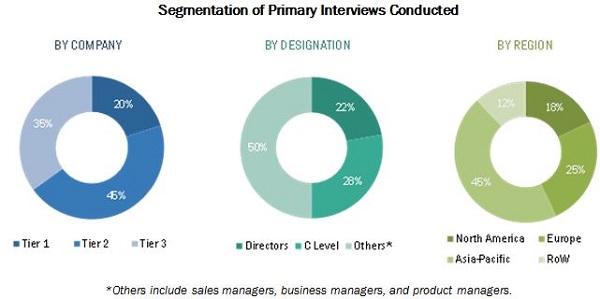

This report includes estimation of market sizes for value (USD Million) and volume (KT). Both top-down and bottom-up approaches have been used to estimate and validate the size of the phosphine fumigation market and various other dependent submarkets in the overall market. Key players in the market have been identified through secondary research (The Business Journal and Digital Journal) and their market share in their respective regions have been determined through primary and secondary research. All percentage shares, splits, and breakdowns have been determined using secondary sources and were verified through primary sources.

To know about the assumptions considered for the study, download the pdf brochure

The phosphine fumigation market comprises manufacturers such as Cytec Solvay Group (U.S.), United Phosphorus Ltd. (U.S.), Nufarm Limited (Australia), and Degesch America, Inc. (U.S), which sell phosphine products to end users to cater to their unique business requirements.

Target Audience

The stakeholders for the report include:

- Government and research organizations

- Associations and industrial bodies

- Traders, distributors, and retailers

- Agriculture & farming industry

- Phosphine manufacturers and suppliers

- Regulatory institutions

- Food safety agencies

- Pesticide traders/suppliers

- Agricultural institutes and universities

“The study answers several questions for stakeholders, primarily which market segments to focus on in the next two to five years for prioritizing efforts and investments.”

Scope of the Report:

This research report categorizes the phosphine fumigation market based on type, application, form, and region.

Based on Type, the market has been segmented as follows:

- Aluminum phosphide

- Magnesium phosphide

- Calcium phosphide

- Others

Based on Application, the market has been segmented as follows:

- Stored processed food

- Raw agricultural commodities

- Warehouses

- Others

Based on Form, the Market has Been Segmented as follows:

- Liquid

- Solid

Based on Region, the market has been segmented as follows:

- North America

- Europe

- Asia-Pacific

- RoW (Rest of the World)

Available Customization

With the given market data, MarketsandMarkets offers customizations according to the client-specific scientific needs.

The following customization options are available for the report:

Regional Analysis

- Further breakdown of the Rest of Europe phosphine fumigation market into Russia, Italy, and Poland

- Further breakdown of the Rest of Asia-Pacific market into New Zealand, Indonesia, Thailand, Vietnam, and South Korea

Company Information

- Detailed analysis and profiling of additional market players (up to five)

The global phosphine fumigation market has grown exponentially in the last few years. The market size is projected to reach USD 684.19 Million by 2022, at a CAGR of around 5.46% from 2017. Factors such as increase in awareness about advanced modes of application of fumigation technology, increasing insect population due to climatic changes, and phasing out of methyl bromide fumigants are expected to drive the market growth. There is high growth potential in developing markets such as Brazil and India, which provides new development opportunities for market players.

The phosphine fumigation market, on the basis of type, has been segmented into aluminum phosphide, magnesium phosphide, calcium phosphide, and others. The aluminum phosphide segment is projected to grow at the highest CAGR during the forecast period. It is used as an alternative for methyl bromide fumigant and is comparatively less costly than methyl bromide. The demand for aluminum phosphide is projected to increase owing to the rapidly growing agrochemical industry. Furthermore, the increased agriculture production has led to increased warehousing facilities, which has fueled the demand and usage of aluminum phosphide to protect the stored agriculture produce.

The phosphine fumigation market, based on application, has been segmented into stored processed food, raw agricultural commodities, warehouse, and others. The warehouse segment accounted for the largest share of the market in 2016. Warehouses are generally used to store food grains or processed food which is highly susceptible to insect infestations and this is one of the main reasons for the usage of phosphine fumigants which has led to warehouse segments being one of the fastest growing segment in the phosphine fumigation industry. The warehouse segment in the phosphine fumigation market is projected to grow at the highest CAGR from 2017 to 2022.

The market has been segmented on the basis of form. The solid segment is projected to grow at the highest CAGR from 2017 to 2022. Solid fumigation is carried out by sprinkling tablets, powders, or pellets of measured quantities of fumigants. Solid fumigants are easy to use, safer than gaseous fumigants, and are less harmful to the environment.

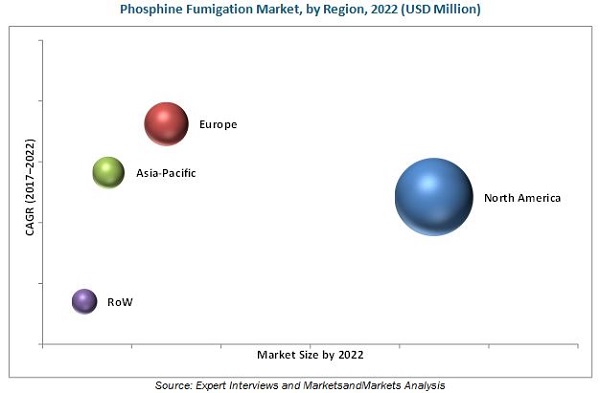

The European market is projected to grow at the highest CAGR during the forecast period. An outstanding growth is observed in this region for the phosphine fumigation market over the past few years. This growth is attributed to the growth in the production of cereals and grains in the region with advancements in storage technologies in warehouses and innovations in farming technologies with higher efficiency in terms of application.

Imposition of new restrictions on phosphine fumigants and stringent regulatory requirements across regions are the restraining factors for the phosphine fumigants market.

The phosphine fumigation market is characterized by moderate competition due to the presence of a number of large- and small-scale firms. The market is dominated by players such as Cytec Solvay Group (U.S.), United Phosphorus Ltd. (U.S.), Nufarm Limited (Australia), and Degesch America, Inc. (U.S). These collectively accounted for the largest portion of the agricultural phosphine fumigation market in 2016. New product launches, acquisitions, and joint ventures are the key strategies adopted by players to ensure their growth in this market. Other players, such as Adama Agricultural Solutions Ltd. (Israel), Excel Crop Care Limited (India), Agrosynth chemicals limited (India), Royal agro organic Pvt. Ltd. (India), Nippon chemical industrial Co. Ltd. (Japan), and National Fumigant (South Africa) also have a strong presence in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 13)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Study Scope

1.4 Periodization Considered for the Study

1.5 Currency Considered

1.6 Unit Considered

1.7 Stakeholders

2 Research Methodology (Page No. - 17)

2.1 Introduction

2.2 Research Data

2.2.1 Secondary Data

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Data

2.2.2.1 Key Data From Primary Sources

2.2.2.2 Key Industry Insights

2.2.2.2.1 Breakdown of Primaries

2.3 Market Size Estimation

2.4 Market Breakdown & Data Triangulation

2.5 Research Assumptions

2.5.1 Assumptions

2.5.2 Limitations

3 Executive Summary (Page No. - 26)

4 Premium Insights (Page No. - 31)

4.1 Attractive Opportunities in the Phosphine Fumigation Market

4.2 Warehouse Application: Leading Segment

4.3 Market, By Type 2017–2022

4.4 European Phosphine Fumigation Market, 2015

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.3 Macroindicators

5.3.1 Growth in Population

5.3.2 Developing Economies With Higher GDP (PPP) to Influence the Phosphine Fumigation Market for Insect Pest Control

5.4 Market Dynamics

5.4.1 Drivers

5.4.1.1 Increasing Insect Population Due to Climatic Changes

5.4.1.2 Increase in Awareness About Advanced Modes of Application of Fumigation Technology

5.4.1.3 Phasing Out of Methyl Bromide Fumigants

5.4.2 Restraints

5.4.2.1 Stringent Regulatory Requirements Across Regions

5.4.2.2 Imposition of New Restrictions on Phosphine Fumigants

5.4.3 Opportunities

5.4.3.1 Expanding Agrochemical Industries in Developing Countries

5.4.4 Challenges

5.4.4.1 Increase in Phosphine Resistance Among Pests

6 Phosphine Fumigation Market, By Type (Page No. - 43)

6.1 Introduction

6.2 Aluminum Phosphide

6.3 Magnesium Phosphide

6.4 Calcium Phosphide

6.5 Others

7 Phosphine Fumigation Market, By Form (Page No. - 50)

7.1 Introduction

7.2 Liquid

7.3 Solid

8 Phosphine Fumigation Market, By Application (Page No. - 56)

8.1 Introduction

8.2 Stored Processed Food

8.3 Raw Agricultural Commodities

8.4 Warehouse

8.5 Others

9 Phosphine Fumigation Market, By Region (Page No. - 64)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.2 Canada

9.2.3 Mexico

9.3 Europe

9.3.1 France

9.3.2 U.K.

9.3.3 Italy

9.3.4 Germany

9.3.5 Rest of Europe

9.4 Asia-Pacific

9.4.1 China

9.4.2 India

9.4.3 Japan

9.4.4 Australia

9.4.5 Rest of Asia-Pacific

9.5 Rest of the World (RoW)

9.5.1 South Africa

9.5.2 Brazil

9.5.3 Argentina

9.5.4 Others

10 Competitive Landscape (Page No. - 95)

10.1 Introduction

10.2 Vanguards, Innovators, Emerging, and Dynamic

10.2.1 Vanguards

10.2.2 Innovators

10.2.3 Dynamic

10.2.4 Emerging

10.3 Competitive Benchmarking

10.3.1 Product Offering

10.3.2 Business Strategy

11 Company Profiles (Page No. - 99)

(Business Overview, Products Offered, Business Strategy, Recent Developments)*

11.1 Cytec Solvay Group

11.2 ADAMA Agricultural Solutions Ltd.

11.3 Nufarm Limited

11.4 United Phosphorus Ltd. (UPL)

11.5 Excel Crop Care Limited

11.6 Degesch America Inc. (DAI)

11.7 Agrosynth Chemical Limited

11.8 Royal Agro Organic Pvt. Ltd.

11.9 Nippon Chemical Industrial Co., Ltd

11.10 National Fumigants (Pty) Ltd.

*Details on Business Overview, Products Offered, Business Strategy, Recent Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 125)

12.1 Discussion Guide

12.2 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.3 Introducing RT: Real-Time Market Intelligence

12.4 Available Customizations

12.5 Related Reports

12.6 Author Details

List of Tables ( 79 Tables)

Table 1 Commodity Operations of Fumigation Protocol: Minimum Fumigation Standards

Table 2 Phosphine Fumigation Market Size, By Type, 2015–2022 (USD Million)

Table 3 Market Size, By Type, 2015–2022 (KT)

Table 4 Aluminum Phosphide: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 5 Aluminum Phosphide: Market Size, By Region, 2015–2022 (KT)

Table 6 Magnesium Phosphide: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 7 Magnesium Phosphide: Market Size, By Region, 2015–2022 (KT)

Table 8 Calcium Phosphide: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 9 Calcium Phosphide: Market Size, By Region, 2015–2022 (KT)

Table 10 Others: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 11 Others: Market Size, By Region, 2015–2022 (KT)

Table 12 Phosphine Fumigation Market Size, By Form, 2015–2022 (USD Million)

Table 13 Market Size, By Form, 2015–2022 (KT)

Table 14 Liquid: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 15 Liquid: Market Size, By Region, 2015–2022 (KT)

Table 16 Solid: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 17 Solid: Market Size, By Region, 2015–2022 (KT)

Table 18 Phosphine Fumigation Market Size, By Application, 2015–2022 (USD Million)

Table 19 Market Size, By Application, 2015–2022 (KT)

Table 20 Stored Processed Food: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 21 Stored Processed Food: Market Size, By Application, 2015–2022 (KT)

Table 22 Raw Agricultural Commodities: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 23 Raw Agricultural Commodities: Market Size, By Region, 2015–2022 (KT)

Table 24 Warehouse: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 25 Warehouse: Market Size, By Region, 2015–2022 (KT)

Table 26 Others: Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 27 Others: Market Size, By Region, 2015–2022 (KT)

Table 28 Phosphine Fumigation Market Size, By Region, 2015–2022 (USD Million)

Table 29 Market Size, By Region, 2015–2022 (KT)

Table 30 North America: Phosphine Fumigation Market Size, By Country, 2015–2022 (USD Million)

Table 31 North America: Market Size, By Country, 2015–2022 (KT)

Table 32 North America: Market Size, By Type, 2015–2022 (USD Million)

Table 33 North America: Market Size, By Type, 2015–2022 (KT)

Table 34 U.S. Market Size, By Type, 2015–2022 (USD Million)

Table 35 U.S.: Market Size, By Type, 2015–2022 (KT)

Table 36 Canada: Market Size, By Type, 2015–2022 (USD Million)

Table 37 Canada: Market Size, By Type, 2015–2022 (KT)

Table 38 Mexico: Market Size, By Type, 2015–2022 (USD Million)

Table 39 Mexico: Market Size, By Type, 2015–2022 (KT)

Table 40 Europe: Phosphine Fumigation Market Size, By Country, 2015–2022 (USD Million)

Table 41 Europe: Market Size, By Country, 2015–2022 (KT)

Table 42 Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 43 Europe: Market Size, By Type, 2015–2022 (KT)

Table 44 France: Market Size, By Type, 2015–2022 (USD Million)

Table 45 France: Market Size, By Type, 2015–2022 (KT)

Table 46 U.K.: Market Size, By Type, 2015–2022 (USD Million)

Table 47 U.K.: Market Size, By Type, 2015–2022 (KT)

Table 48 Italy: Market Size, By Type, 2015–2022 (USD Million)

Table 49 Italy: Market Size, By Type, 2015–2022 (KT)

Table 50 Germany: Market Size, By Type, 2015–2022 (USD Million)

Table 51 Germany: Market Size, By Type, 2015–2022 (KT)

Table 52 Rest of Europe: Market Size, By Type, 2015–2022 (USD Million)

Table 53 Rest of Europe: Market Size, By Type, 2015–2022 (KT)

Table 54 Asia-Pacific: Phosphine Fumigation Market Size, By Country, 2015–2022 (USD Million)

Table 55 Asia-Pacific: Market Size, By Country, 2015–2022 (KT)

Table 56 Asia-Pacific: Market Size, By Type, 2015–2022 (USD Million)

Table 57 Asia-Pacific: Market Size, By Type, 2015–2022 (KT)

Table 58 China: Market Size, By Type, 2015–2022 (USD Million)

Table 59 China: Market Size, By Type, 2015–2022 (KT)

Table 60 India: Market Size, By Type, 2015–2022 (USD Million)

Table 61 India: Market Size, By Type, 2015–2022 (KT)

Table 62 Japan: Market Size, By Type, 2015–2022 (USD Million)

Table 63 Japan: Market Size, By Type, 2015–2022 (KT)

Table 64 Australia: Phosphine Fumigation Market Size, By Type, 2015–2022 (USD Million)

Table 65 Australia: Market Size, By Type, 2015–2022 (KT)

Table 66 Rest of Asia-Pacific: Phosphine Fumigation Market Size, By Type, 2015–2022 (USD Million)

Table 67 Rest of Asia-Pacific: Market Size, By Type, 2015–2022 (KT)

Table 68 RoW: Phosphine Fumigation Market Size, By Country, 2015–2022 (USD Million)

Table 69 RoW: Market Size, By Country, 2015–2022 (KT)

Table 70 RoW: Market Size, By Type, 2015–2022 (USD Million)

Table 71 RoW: Market Size, By Type, 2015–2022 (KT)

Table 72 South Africa: Market Size, By Type, 2015–2022 (USD Million)

Table 73 South Africa: Market Size, By Type, 2015–2022 (KT)

Table 74 Brazil: Market Size, By Type, 2015–2022 (USD Million)

Table 75 Brazil: Market Size, By Type, 2015–2022 (KT)

Table 76 Argentina: Market Size, By Type, 2015–2022 (USD Million)

Table 77 Argentina: Market Size, By Type, 2015–2022 (KT)

Table 78 Others: Phosphine Fumigation Market Size, By Type, 2015–2022 (USD Million)

Table 79 Others: Market Size, By Type, 2015–2022 (KT)

List of Figures (53 Figures)

Figure 1 Phosphine Fumigation Market Segmentation

Figure 2 Phosphine Fumigation Market: Research Design

Figure 3 Market Size Estimation Methodology: Bottom-Up Approach

Figure 4 Market Size Estimation Methodology: Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Phosphine Fumigation Market Growth Trend, 2017 vs 2022 (USD Million)

Figure 7 Aluminum Phosphide Segment Projected to Grow at the Highest Rate Through 2022 (USD Million)

Figure 8 Warehouse Segment Projected to Dominate the Phosphine Fumigation Market Through 2022

Figure 9 Solid Segment Projected to Grow at A Relatively Higher Rate From 2017 to 2022

Figure 10 Phosphine Fumigation Market Share (Value), By Region, 2016

Figure 11 Attractive Opportunities in the Phosphine Fumigation Market, 2017–2022

Figure 12 Warehouse Application is Projected to Grow at A Higher Rate From 2017 to 2022

Figure 13 Aluminum Phosphide Segment is Projected to Grow at the Highest CAGR From 2017 to 2022

Figure 14 Aluminum Segment Accounted for the Largest Share in the European Phosphine Fumigation Market, By Type, 2016

Figure 15 Phosphine Fumigation Market Segmentation, By Type

Figure 16 Market Segmentation, By Application

Figure 17 Market Segmentation, By Form

Figure 18 Market Segmentation, By Region

Figure 19 Population Growth Trend, 1990–2100

Figure 20 Phosphine Fumigation Market

Figure 21 Remaining Quantity of Methyl Bromide Produced Prior to 2005 in the U.S. (Metric Tons)

Figure 22 Aluminum Phosphide Projected to Be the Fastest-Growing Segment During the Forecast Period

Figure 23 Market Size, By Form, 2017 vs 2022 (USD Million)

Figure 24 Warehouse Segment is Projected to Be the Fastest-Growing Segment During the Forecast Period

Figure 25 Geographic Snapshot: Robust Growth Expected in Some European Markets, CAGR (2017–2022)

Figure 26 North America: Phosphine Fumigation Market Snapshot

Figure 27 European Phosphine Fumigation Market Snapshot

Figure 28 Dive Chart

Figure 29 Cytec Solvay Group: Company Snapshot

Figure 30 Cytec Solvay Group: Product Offering Scorecard

Figure 31 Cytec Solvay Group: Business Strategy Scorecard

Figure 32 ADAMA Agricultural Solutions Ltd.: Company Snapshot

Figure 33 ADAMA Agricultural Solutions Ltd.: Product Offering Scorecard

Figure 34 ADAMA Agricultural Solutions Ltd.: Business Strategy Scorecard

Figure 35 Nufarm Limited: Company Snapshot

Figure 36 Nufarm Limited: Product Offering Scorecard

Figure 37 Nufarm Limited: Business Strategy Scorecard

Figure 38 United Phosphorus Ltd.: Company Snapshot

Figure 39 United Phosphorus Ltd.: Product Offering Scorecard

Figure 40 United Phosphorus Ltd.: Business Strategy Scorecard

Figure 41 Excel Crop Care Limited: Company Snapshot

Figure 42 Excel Crop Care Limited: Product Offering Scorecard

Figure 43 Excel Crop Care Limited: Business Strategy Scorecard

Figure 44 Degesch America, Inc.: Product Offering Scorecard

Figure 45 Degesch America, Inc.: Business Strategy Scorecard

Figure 46 Agrosynth Chemicals Limited: Product Offering Scorecard

Figure 47 Agrosynth Chemicals Limited: Business Strategy Scorecard

Figure 48 Royal Agro Organic Pvt. Ltd.: Product Offering Scorecard

Figure 49 Royal Agro Organic Pvt. Ltd.: Business Strategy Scorecard

Figure 50 Nippon Chemical Industrial Co. Ltd.: Product Offering Scorecard

Figure 51 Nippon Chemical Industrial Co. Ltd.: Business Strategy Scorecard

Figure 52 National Fumigants (Pty) Ltd.: Product Offering Scorecard

Figure 53 National Fumigants (Pty) Ltd.: Business Strategy Scorecard

Growth opportunities and latent adjacency in Phosphine Fumigation Market