Pharmaceutical Gelatin Market by Source (Porcine, Bovine Skin, Bovine Bone, Fish, Poultry), Application (Hard Capsule, Soft Capsule, Tablet, Absorbable Hemostat), Function (Stabilizing, Thickening, Gelling), Region - Global Forecasts to 2027

Market Growth Outlook Summary

The global pharmaceutical gelatin market growth forecasted to transform from $1.1 billion in 2022 to $1.5 billion by 2027, driven by a CAGR of 5.5%. Growth of this market is attributable to various factors such as rising demand for pharma gelatin in vaccines, tablets, and other applications. Furthermore, the launch of the novel, technologically advanced, and user-friendly pharma gelatin is likely to increase global demand.

To know about the assumptions considered for the study, Request for Free Sample Report

Pharmaceutical Gelatin Market Dynamics

Drivers: Advantages and properties of gelatin

The unique functional capabilities of gelatin, such as gelling, adhesion, coating, binding, and film-building make it highly advantageous for use in the pharmaceutical industry. Gelatin coating on hard capsules, softgel capsules, and tablets not only masks the odor of medicines but also enables easy ingestion. Moreover, gelatin's properties shield against environmental changes associated with the atmosphere, thereby increasing the shelf-life of these products. These superior functional properties of gelatin are increasing the adoption of gelatin in the pharma industry hence propelling the market growth.

Restraints: Shifts towards non-gelatin capsules

In recent years, there has been a rising trend in veganism across the world, which is defined as the abstinence from animal-based products. These trends have also extended to the pharmaceutical industry, with capsule manufacturers offering non-gelatin capsules or vegetarian capsules manufactured from purely plant-derived materials to meet the demands of consumers. The increasing demand for plant-based pharmaceutical products and subsequent changes in their product portfolios by capsule manufacturers is anticipated to hamper the growth of pharma gelatin market

Opportunities : Demand of pharma gelatin in developing countries

Emerging economies such as the Asia Pacific, the Middle East, Latin America, and Africa provide significant opportunities for the growth of the market. Global raw gelatin and gelatin capsule manufacturers have been capitalizing on this demand by expanding their business presence and production capacities in these regions. The increasing demand in emerging economies, coupled with lower raw material and labor costs, offer lucrative growth opportunities for the growth of the market during the forecast period.

Hard Capsules dominated the application segment.

Based on application, the pharmaceutical gelatin market is segmented into hard capsules, softgel capsules, tablets, absorbable hemostats & other applications. The softgel capsules segment is expected to witness the highest growth in the pharmaceutical gelatin market during the forecast period. The softgel capsules are beneficial for low-dose lipid-soluble drugs as they permit more content uniformity between dosage units are likely to increase the demand, subsequently impacting the growth of the segment.

Porcine held the highest share in the pharmaceutical gelatin market

Porcine source held a dominant share of the market. The market is segmented into porcine, bovine skin, bovine, bone, marine, and poultry. The short manufacturing cycle and economical production with the porcine are some of the major factors driving the segment's growth. Marine segment is expected to gain a substantial share during the forecast period owing to an increased focus on the launch of fish gelatin in market.

Stabilizing agent dominated function segment.

Based on function, the market is segmented into stabilizing agents, thickening agents and gelling agents & other functions. Stabilizing agents held a dominant share in the function segment. Stabilizing agent held dominant share in pharmaceutical gelatin market. Increasing use of gelatin as stabilizer in vaccines is likely to upsurge the segmental growth. Furthermore, gelatin also protects vaccine viruses from freeze-drying or heat, during delivery and transport.

Type B gelatin held highest market share in the pharmaceutical gelatin market

Based on type, the market is segmented into type A and type B gelatin. Type B segment held largest share in pharmaceutical gelatin market. The dominance is attributable to various factors such as low production cost owing to easy availability of raw material and its use in various applications across pharmaceutical industry.

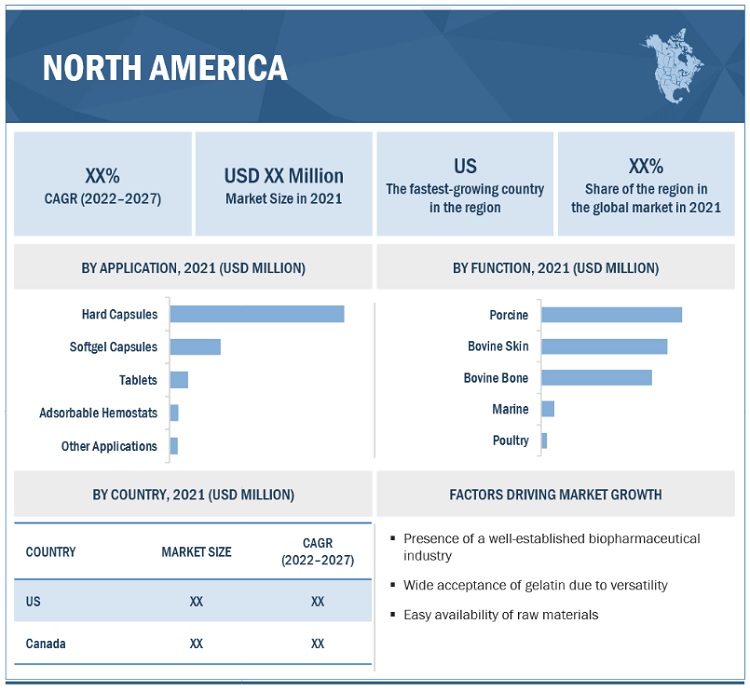

North America accounted for largest share in pharmaceutical gelatin market

The global pharmaceutical gelatin market is segmented into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. North America reported for the largest share of the pharmaceutical gelatin market followed by Europe and Asia Pacific respectively. Asia Pacific is anticipated to grow at faster pace owing to various factors such as availability of raw materials and the presence of capsule manufactures in the region. Furthermore, geographical expansion by key market players in the Asia Pacific region is likely to increase the demand subsequently projecting the market growth during the forecast period.

To know about the assumptions considered for the study, download the pdf brochure

Key players in the pharmaceutical gelatin market includes Darling Ingredients Inc. (US), Nitta Gelatin Inc (Japan), Tessenderlo Group (Belgium), Gelita AG (Germany), Weishardt (France), among others.

Pharmaceutical Gelatin Market Report Scope

|

Report Metric |

Details |

|

Market Revenue in 2022 |

$1.1 billion |

|

Estimated Value by 2027 |

$1.5 billion |

|

Growth Rate |

poised to grow at a CAGR of 5.5% |

|

Largest Share Segments |

Porcine Segment & Type B Gelatin |

|

Market Report Segmentation |

Application, Source, Function, Type & Region |

|

Growth Drivers |

|

|

Growth Opportunities |

|

|

Geographies covered |

North America, Europe, APAC, MEA, and Latin America |

This report categorizes the pharmaceutical gelatin market into the following segments

By Application

- Hard capsules

- Softgel capsules

- Tablets

- Absorbable Hemostats

- Other applications

By Source

- Porcine

- Bovine skin

- Bovine bone

- Marine

- Poultry

By Function

- Stabilizing agent

- Thickening agent

- Gelling agent & other function

By Type

- Type A

- Type B

By Region

-

North America

- US

- Canada

-

Europe

- Germany

- UK

- France

- Italy

- Spain

- Rest of Europe

-

Asia Pacific

- China

- Japan

- India

- Rest of Asia Pacific

- Latin America

- Middle East & Africa

Recent Developments

- In May 2021, Darling Ingredients Inc. announced that its Rousselot brand expanded its range of purified pharmaceutical-grade modified gelatin with the launch of X-Pure GelDAT – Gelatin Desaminotyrosine for biomedical applications.

- In July 2022, Gelita opened a biotech hub for developing proteins from biotechnological processes for applications in nutrition, cosmetics, and pharmaceutical and medical products.

Frequently Asked Questions (FAQs):

What is the size of Pharmaceutical Gelatin Market?

The global pharmaceutical gelatin market size is projected to reach USD 1.5 billion by 2027, growing at a CAGR of 5.5%.

Why is Pharmaceutical Gelatin Market Growing?

Growth of this market is attributable to various factors such as rising demand for pharma gelatin in vaccines, tablets, and other applications. Furthermore, the launch of the novel, technologically advanced, and user-friendly pharma gelatin is likely to increase global demand.

Who all are the prominent players of Pharmaceutical Gelatin Market?

Key players in the pharmaceutical gelatin market includes Darling Ingredients Inc. (US), Nitta Gelatin Inc (Japan), Tessenderlo Group (Belgium), Gelita AG (Germany), Weishardt (France), among others.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 28)

1.1 STUDY OBJECTIVES

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 MARKET SCOPE

1.3.1 YEARS CONSIDERED

1.3.2 CURRENCY CONSIDERED

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 32)

2.1 RESEARCH DATA

FIGURE 1 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.2 PRIMARY DATA

FIGURE 2 PHARMACEUTICAL GELATIN MARKET: BREAKDOWN OF PRIMARIES

2.2 MARKET ESTIMATION METHODOLOGY

2.2.1 REVENUE MAPPING-BASED MARKET ESTIMATION

FIGURE 3 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS (2021)

FIGURE 4 AVERAGE MARKET SIZE ESTIMATION (2021)

2.3 DATA TRIANGULATION APPROACH

FIGURE 5 DATA TRIANGULATION METHODOLOGY

2.4 GROWTH RATE ASSUMPTIONS

2.5 RISK ASSESSMENT

2.6 GROWTH FORECAST

2.6.1 SUPPLY-SIDE ANALYSIS

2.6.1.1 Insights from primary experts

3 EXECUTIVE SUMMARY (Page No. - 41)

FIGURE 6 PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2022 VS. 2027 (USD MILLION)

FIGURE 7 PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2022 VS. 2027 (USD MILLION)

FIGURE 8 PHARMACEUTICAL GELATIN MARKET SHARE, BY FUNCTION, 2021

FIGURE 9 PHARMACEUTICAL GELATIN MARKET SHARE, BY TYPE, 2021

FIGURE 10 GEOGRAPHICAL SNAPSHOT OF PHARMACEUTICAL GELATIN MARKET

4 PREMIUM INSIGHTS (Page No. - 45)

4.1 PHARMACEUTICAL GELATIN MARKET OVERVIEW

FIGURE 11 VERSATILITY OF GELATIN IN PHARMACEUTICAL AND BIOMEDICAL APPLICATIONS TO DRIVE MARKET GROWTH

4.2 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET SHARE, BY APPLICATION (2021)

FIGURE 12 HARD CAPSULES ACCOUNTED FOR LARGEST SHARE IN 2021

4.3 PHARMACEUTICAL GELATIN MARKET SHARE, BY SOURCE, 2022 VS. 2027

FIGURE 13 PORCINE GELATIN TO DOMINATE MARKET DURING FORECAST PERIOD

4.4 PHARMACEUTICAL GELATIN MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 14 CHINA TO REGISTER HIGHEST GROWTH DURING FORECAST PERIOD

5 MARKET OVERVIEW (Page No. - 48)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 15 PHARMACEUTICAL GELATIN MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

5.2.1 DRIVERS

5.2.1.1 Advantages and properties of gelatin

5.2.1.2 Launch of advanced pharma gelatins

5.2.1.3 Increasing biomedical applications of gelatin

5.2.2 RESTRAINTS

5.2.2.1 Cultural restrictions in certain regions

5.2.2.2 Shift toward non-gelatin capsules

5.2.3 OPPORTUNITIES

5.2.3.1 Demand for pharma gelatin in developing countries

5.2.3.2 Adoption of gelatin in vaccines and biomedical applications

5.2.4 CHALLENGES

5.2.4.1 Insufficient raw materials

5.2.4.2 Increasing incidence of animal-borne diseases

5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS’ BUSINESSES

FIGURE 16 REVENUE SHIFTS AND NEW REVENUE POCKETS FOR PHARMACEUTICAL GELATIN

5.4 PRICING ANALYSIS

5.4.1 AVERAGE SELLING PRICE TREND

TABLE 1 AVERAGE SELLING PRICE OF PHARMACEUTICAL GELATIN, BY REGION

5.4.2 INDICATIVE PRICING ANALYSIS, BY MARKET PLAYER

TABLE 2 XIAMEN GELKEN GELATIN: AVERAGE SELLING PRICE OF PHARMACEUTICAL GELATIN

TABLE 3 HENAN BOOM GELATIN: AVERAGE SELLING PRICE OF PHARMACEUTICAL GELATIN

5.5 VALUE CHAIN ANALYSIS

FIGURE 17 PHARMACEUTICAL GELATIN MARKET: VALUE CHAIN ANALYSIS

5.5.1 SOURCING OF RAW MATERIAL

5.5.2 COLLECTION AND TRANSPORT OF RAW MATERIAL

5.5.3 RAW MATERIAL PREPARATION AND PROCESSING

5.5.4 GELATIN PRODUCTION

5.6 ECOSYSTEM ANALYSIS

5.6.1 FARMING INPUT

5.6.2 FARMING

5.6.3 SLAUGHTERING

5.6.4 MANUFACTURING

5.6.5 SUPPLIERS/DISTRIBUTORS

5.6.6 END-PRODUCT MANUFACTURERS

FIGURE 18 PHARMACEUTICAL GELATIN MARKET: ECOSYSTEM ANALYSIS

5.6.7 ROLE IN ECOSYSTEM

5.7 TECHNOLOGY ANALYSIS

TABLE 4 PHARMACEUTICAL GELATIN MARKET: TECHNOLOGICAL ADVANCEMENTS, 2019–2022

5.8 PATENT ANALYSIS

5.8.1 LIST OF MAJOR PATENTS

5.9 PORTER’S FIVE FORCES ANALYSIS

TABLE 5 PHARMACEUTICAL GELATIN MARKET: PORTER’S FIVE FORCES ANALYSIS

5.9.1 COMPETITIVE RIVALRY AMONG EXISTING PLAYERS

5.9.2 BARGAINING POWER OF SUPPLIERS

5.9.3 BARGAINING POWER OF BUYERS

5.9.4 THREAT FROM SUBSTITUTES

5.9.5 THREAT FROM NEW ENTRANTS

5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

FIGURE 19 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR PHARMACEUTICAL GELATIN

FIGURE 20 KEY BUYING CRITERIA FOR PHARMACEUTICAL GELATIN AMONG END USERS

5.11 REGULATORY LANDSCAPE

5.11.1 NORTH AMERICA

5.11.2 EUROPE

5.11.3 ASIA PACIFIC

5.11.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

TABLE 6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

5.12 TRADE ANALYSIS

5.12.1 US

5.12.2 INDIA

TABLE 7 TOP IMPORTERS OF GELATIN FROM INDIA, BY VALUE, 2020-2021 (APR-NOV)

5.12.3 BRAZIL

5.12.4 OVERVIEW OF GELATIN TRADE/IMPEX, BY COUNTRY

5.13 KEY CONFERENCES & EVENTS IN 2022–2023

TABLE 8 PHARMACEUTICAL GELATIN MARKET: DETAILED LIST OF EVENTS AND CONFERENCES

6 PHARMACEUTICAL GELATIN MARKET, BY APPLICATION (Page No. - 67)

6.1 INTRODUCTION

TABLE 9 PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

6.2 HARD CAPSULES

6.2.1 ADVANTAGES OF GELATIN-BASED HARD CAPSULES TO PROPEL MARKET

TABLE 10 TYPICAL HARD GELATIN CAPSULE COMPOSITION

TABLE 11 DIMENSIONS (IN MILLIMETERS) AND VOLUME (IN MILLIMETERS) OF TWO-PIECE HARD CAPSULES

TABLE 12 PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY REGION, 2020–2027 (USD MILLION)

TABLE 13 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 14 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 15 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR HARD CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

6.3 SOFTGEL CAPSULES

6.3.1 RISING DEMAND FOR SOFTGEL CAPSULES IN PHARMA INDUSTRY TO DRIVE GROWTH

TABLE 16 DIFFERENCES BETWEEN HARD CAPSULES AND SOFTGEL CAPSULES

TABLE 17 PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY REGION, 2020–2027 (USD MILLION)

TABLE 18 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 19 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 20 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR SOFTGEL CAPSULES, BY COUNTRY, 2020–2027 (USD MILLION)

6.4 TABLETS

6.4.1 USE OF GELATIN AS BINDERS IN TABLETS TO CONTRIBUTE TO SEGMENTAL GROWTH

TABLE 21 IN VITRO PROPERTIES OF TABLETS WITH GELATIN AS BINDER (CONCENTRATIONS 2.0-8.0%)

TABLE 22 PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY REGION, 2020–2027 (USD MILLION)

TABLE 23 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 24 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 25 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR TABLETS, BY COUNTRY, 2020–2027 (USD MILLION)

6.5 ABSORBABLE HEMOSTATS

6.5.1 INCREASED ADOPTION OF ABSORBABLE HEMOSTATS TO DRIVE MARKET

TABLE 26 PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY REGION, 2020–2027 (USD MILLION)

TABLE 27 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 28 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 29 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR ABSORBABLE HEMOSTATS, BY COUNTRY, 2020–2027 (USD MILLION)

6.6 OTHER APPLICATIONS

TABLE 30 PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 31 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 32 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 33 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR OTHER APPLICATIONS, BY COUNTRY, 2020–2027 (USD MILLION)

7 PHARMACEUTICAL GELATIN MARKET, BY SOURCE (Page No. - 81)

7.1 INTRODUCTION

TABLE 34 AMINO ACID COMPOSITION OF GELATINS, BY SOURCE

TABLE 35 PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 36 PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (KT)

7.2 PORCINE

7.2.1 LOWER MANUFACTURING COSTS OF PORCINE RAW MATERIALS TO PROPEL MARKET GROWTH

TABLE 37 US: PORK EXPORTS IN USD MILLION (2017-2021)

TABLE 38 PORCINE PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 39 NORTH AMERICA: PORCINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 40 EUROPE: PORCINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 41 ASIA PACIFIC: PORCINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.3 BOVINE SKIN

7.3.1 INCREASING AVAILABILITY OF BOVINE SKIN TO BOOST GROWTH

TABLE 42 BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 43 NORTH AMERICA: BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 44 EUROPE: BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 45 ASIA PACIFIC: BOVINE SKIN PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.4 BOVINE BONE

7.4.1 ADVANTAGES OF BOVINE BONE LIKELY TO SUPPORT DEMAND GROWTH

TABLE 46 BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 47 NORTH AMERICA: BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 48 EUROPE: BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 49 ASIA PACIFIC: BOVINE BONE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.5 MARINE

7.5.1 INCIDENCE OF ZOONOTIC DISEASES IN CATTLE AND PIGS TO DRIVE DEMAND FOR MARINE GELATIN

TABLE 50 MARINE PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 51 NORTH AMERICA: MARINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 52 EUROPE: MARINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 53 ASIA PACIFIC: MARINE PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

7.6 POULTRY

7.6.1 AVAILABILITY OF POULTRY AS A RAW MATERIAL TO BOOST UTILITY

TABLE 54 POULTRY PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 55 NORTH AMERICA: POULTRY PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 56 EUROPE: POULTRY PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 57 ASIA PACIFIC: POULTRY PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

8 PHARMACEUTICAL GELATIN MARKET, BY FUNCTION (Page No. - 94)

8.1 INTRODUCTION

TABLE 58 PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

8.2 STABILIZING AGENTS

8.2.1 RISING VACCINE AND CAPSULE PRODUCTION TO DRIVE DEMAND FOR STABILIZING AGENTS

TABLE 59 PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 60 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 61 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 62 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR STABILIZING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

8.3 THICKENING AGENTS

8.3.1 GROWING USE OF GELATIN IN SYRUPS AND LIQUID DOSAGE FORMS TO DRIVE MARKET

TABLE 63 PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY REGION, 2020–2027 (USD MILLION)

TABLE 64 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 65 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 66 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR THICKENING AGENTS, BY COUNTRY, 2020–2027 (USD MILLION)

8.4 GELLING AGENTS & OTHER FUNCTIONS

8.4.1 WIDE APPLICATIONS IN SOFTGEL CAPSULES AND HEMOSTATS TO BOOST DEMAND FOR GELLING AGENTS

TABLE 67 PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY REGION, 2020–2027 (USD MILLION)

TABLE 68 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 69 EUROPE: PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 70 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET FOR GELLING AGENTS & OTHER FUNCTIONS, BY COUNTRY, 2020–2027 (USD MILLION)

9 PHARMACEUTICAL GELATIN MARKET, BY TYPE (Page No. - 102)

9.1 INTRODUCTION

TABLE 71 PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

9.2 TYPE B GELATIN

9.2.1 INCREASED DEMAND FOR BOVINE-BASED GELATIN TO PROPEL MARKET GROWTH

TABLE 72 NUTRITIONAL COMPOSITION OF TYPE B GELATIN

TABLE 73 TYPE B PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 74 NORTH AMERICA: TYPE B PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 75 EUROPE: TYPE B PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 76 ASIA PACIFIC: TYPE B PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

9.3 TYPE A GELATIN

9.3.1 COST-EFFECTIVENESS OF PROCESSING TYPE A GELATIN TO DRIVE GROWTH

TABLE 77 NUTRITIONAL COMPOSITION OF TYPE A GELATIN

TABLE 78 TYPE A PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

TABLE 79 NORTH AMERICA: TYPE A PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 80 EUROPE: TYPE A PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 81 ASIA PACIFIC: TYPE A PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

10 PHARMACEUTICAL GELATIN MARKET, BY REGION (Page No. - 108)

10.1 INTRODUCTION

TABLE 82 PHARMACEUTICAL GELATIN MARKET, BY REGION, 2020–2027 (USD MILLION)

10.2 NORTH AMERICA

FIGURE 21 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET SNAPSHOT

TABLE 83 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 84 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 85 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 86 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 87 NORTH AMERICA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.2.1 US

10.2.1.1 Increased prevalence of chronic diseases to drive market

TABLE 88 US: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 89 US: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 90 US: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 91 US: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.2.2 CANADA

10.2.2.1 Increasing demand for biopharmaceuticals to support growth

TABLE 92 CANADA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 93 CANADA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 94 CANADA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 95 CANADA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3 EUROPE

TABLE 96 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 97 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 98 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 99 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 100 EUROPE: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.1 GERMANY

10.3.1.1 Rising focus and investment in pharmaceutical R&D to promote market growth

TABLE 101 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 102 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 103 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 104 GERMANY: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.2 UK

10.3.2.1 Investments in novel drug development to propel demand for pharmaceutical gelatin

TABLE 105 UK: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 106 UK: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 107 UK: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 108 UK: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.3 FRANCE

10.3.3.1 Increased investment in pharmaceutical R&D to drive demand for pharmaceutical gelatin

TABLE 109 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 110 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 111 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 112 FRANCE: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.4 ITALY

10.3.4.1 Pharma R&D and innovation efforts to boost gelatin usage

TABLE 113 ITALY: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 114 ITALY: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 115 ITALY: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 116 ITALY: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.5 SPAIN

10.3.5.1 Growing pharma manufacturing to fuel demand for gelatin

TABLE 117 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 118 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 119 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 120 SPAIN: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.3.6 REST OF EUROPE

TABLE 121 ROE: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 122 ROE: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 123 ROE: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 124 ROE: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4 ASIA PACIFIC

FIGURE 22 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET SNAPSHOT

TABLE 125 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY COUNTRY, 2020–2027 (USD MILLION)

TABLE 126 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 127 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 128 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 129 ASIA PACIFIC: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.1 JAPAN

10.4.1.1 Increasing aging population to create growth opportunities

TABLE 130 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 131 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 132 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 133 JAPAN: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Large population and availability of raw materials to contribute to market growth in China

TABLE 134 CHINA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 135 CHINA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 136 CHINA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 137 CHINA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.3 INDIA

10.4.3.1 Booming pharmaceutical industry to drive market

TABLE 138 INDIA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 139 INDIA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 140 INDIA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 141 INDIA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.4.4 REST OF ASIA PACIFIC

TABLE 142 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 143 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 144 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 145 ROAPAC: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.5 LATIN AMERICA

10.5.1 RISING DEMAND FOR PHARMA GELATIN IN LATIN AMERICA TO DRIVE MARKET GROWTH

TABLE 146 LATAM: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 147 LATAM: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 148 LATAM: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 149 LATAM: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

10.6 MIDDLE EAST & AFRICA

10.6.1 RISING ADOPTION OF GELATIN-BASED PHARMA PRODUCTS TO PROPEL GROWTH

TABLE 150 MEA: PHARMACEUTICAL GELATIN MARKET, BY APPLICATION, 2020–2027 (USD MILLION)

TABLE 151 MEA: PHARMACEUTICAL GELATIN MARKET, BY SOURCE, 2020–2027 (USD MILLION)

TABLE 152 MEA: PHARMACEUTICAL GELATIN MARKET, BY FUNCTION, 2020–2027 (USD MILLION)

TABLE 153 MEA: PHARMACEUTICAL GELATIN MARKET, BY TYPE, 2020–2027 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 144)

11.1 INTRODUCTION

11.2 RIGHT-TO-WIN APPROACHES ADOPTED BY KEY PLAYERS

FIGURE 23 PHARMACEUTICAL GELATIN MARKET: STRATEGIES ADOPTED

11.3 REVENUE ANALYSIS

FIGURE 24 REVENUE ANALYSIS FOR KEY COMPANIES (2019–2021)

11.4 MARKET SHARE ANALYSIS

FIGURE 25 PHARMACEUTICAL GELATIN MARKET SHARE ANALYSIS, BY KEY PLAYER, 2021

TABLE 154 PHARMACEUTICAL GELATIN MARKET: DEGREE OF COMPETITION

11.5 COMPANY EVALUATION QUADRANT

11.5.1 STARS

11.5.2 EMERGING LEADERS

11.5.3 PERVASIVE PLAYERS

11.5.4 PARTICIPANTS

FIGURE 26 PHARMACEUTICAL GELATIN MARKET: COMPANY EVALUATION QUADRANT, 2021

11.6 COMPANY EVALUATION QUADRANT FOR SMES/START-UPS (2021)

11.6.1 PROGRESSIVE COMPANIES

11.6.2 STARTING BLOCKS

11.6.3 RESPONSIVE COMPANIES

11.6.4 DYNAMIC COMPANIES

FIGURE 27 PHARMACEUTICAL GELATIN MARKET: COMPANY EVALUATION QUADRANT FOR SMES/START-UPS, 2021

11.7 COMPETITIVE BENCHMARKING

TABLE 155 OVERALL COMPANY FOOTPRINT

TABLE 156 COMPANY PRODUCT FOOTPRINT

TABLE 157 COMPANY REGIONAL FOOTPRINT

11.8 COMPETITIVE SCENARIO AND TRENDS

TABLE 158 PHARMACEUTICAL GELATIN MARKET: PRODUCT LAUNCHES, JANUARY 2019–OCTOBER 2022

TABLE 159 PHARMACEUTICAL GELATIN MARKET: DEALS, JANUARY 2019–OCTOBER 2022

TABLE 160 PHARMACEUTICAL GELATIN MARKET: OTHER DEVELOPMENTS, JANUARY 2019–OCTOBER 2022

12 COMPANY PROFILES (Page No. - 156)

12.1 KEY PLAYERS

(Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1.1 DARLING INGREDIENTS

TABLE 161 DARLING INGREDIENTS: BUSINESS OVERVIEW

FIGURE 28 DARLING INGREDIENTS: COMPANY SNAPSHOT (2022)

12.1.2 NITTA GELATIN

TABLE 162 NITTA GELATIN: BUSINESS OVERVIEW

FIGURE 29 NITTA GELATIN: COMPANY SNAPSHOT (2022)

12.1.3 TESSENDERLO GROUP

TABLE 163 TESSENDERLO GROUP: BUSINESS OVERVIEW

FIGURE 30 TESSENDERLO GROUP: COMPANY SNAPSHOT (2022)

12.1.4 GELITA AG

TABLE 164 GELITA AG: BUSINESS OVERVIEW

12.1.5 WEISHARDT

TABLE 165 WEISHARDT: BUSINESS OVERVIEW

12.1.6 TROBAS GELATINE

TABLE 166 TROBAS GELATINE: BUSINESS OVERVIEW

12.1.7 LAPI GELATINE

TABLE 167 LAPI GELATINE S.P.A: BUSINESS OVERVIEW

12.1.8 INDIA GELATINE & CHEMICALS

TABLE 168 INDIA GELATINE & CHEMICALS: BUSINESS OVERVIEW

FIGURE 31 INDIA GELATINE & CHEMICALS: COMPANY SNAPSHOT (2022)

12.1.9 GELNEX

TABLE 169 GELNEX: BUSINESS OVERVIEW

12.1.10 JUNCA GELATINES

TABLE 170 JUNCA GELATINES: BUSINESS OVERVIEW

12.1.11 HEBEI CHENGDA MINGJIAO

TABLE 171 HEBEI CHENGDA MINGJIAO: BUSINESS OVERVIEW

12.1.12 ITALGEL

TABLE 172 ITALGEL: BUSINESS OVERVIEW

12.1.13 XIAMEN GELKEN GELATIN

TABLE 173 XIAMEN GELKEN GELATIN BUSINESS OVERVIEW

12.1.14 GELCO INTERNATIONAL

TABLE 174 GELCO INTERNATIONAL: BUSINESS OVERVIEW

12.1.15 HENAN BOOM GELATIN

TABLE 175 HENAN BOOM GELATIN: BUSINESS OVERVIEW

12.1.16 NORLAND PRODUCTS

TABLE 176 NORLAND PRODUCTS: BUSINESS OVERVIEW

12.1.17 GELIKO

TABLE 177 GELIKO: BUSINESS OVERVIEW

12.1.18 KENNEY & ROSS LIMITED

TABLE 178 KENNEY & ROSS LIMITED: BUSINESS OVERVIEW

12.1.19 BAOTOU DONGBAO BIO-TECH

TABLE 179 BAOTOU DONGBAO BIO-TECH: BUSINESS OVERVIEW

12.1.20 GELTEC

TABLE 180 GELTEC: BUSINESS OVERVIEW

12.1.21 NARMADA GELATINES.

TABLE 181 NARMADA GELATINES: BUSINESS OVERVIEW

FIGURE 32 NARMADA GELATINES: COMPANY SNAPSHOT (2022)

12.1.22 REINERT GRUPPE INGREDIENTS GMBH

TABLE 182 REINERT GRUPPE INGREDIENTS GMBH: BUSINESS OVERVIEW

12.1.23 JELLICE GELATIN & COLLAGEN

TABLE 183 JELLICE GELATIN AND COLLAGEN: BUSINESS OVERVIEW

12.1.24 STERLING GELATIN

TABLE 184 STERLING GELATIN: BUSINESS OVERVIEW

12.1.25 ATHOS COLLAGEN

TABLE 185 ATHOS COLLAGEN: BUSINESS OVERVIEW

*Details on Business Overview, Products Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 190)

13.1 DISCUSSION GUIDE

13.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.3 CUSTOMIZATION OPTIONS

13.4 RELATED REPORTS

13.5 AUTHOR DETAILS

This study involved four major activities in estimating the current size of the pharmaceutical gelatin market. Exhaustive secondary research was carried out to collect information on the market, its peer markets, and its parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation procedures were used to estimate the market size of segments.

Secondary Research

Secondary research was used mainly to identify and collect information for the extensive, technical, market-oriented, and commercial study of the pharmaceutical gelatin market. The secondary sources used for this study include Gelatin Manufacturer’s Institute of America (GMIA), Gelatin Manufacturers Association of Asia Pacific (GMAP), Gelatin Manufacturers Association of Europe (GME), European Federation of Pharmaceutical Industries and Associations (EFPIA), Pharmaceutical Research and Manufacturers of America (PhRMA), US Food and Drug Administration (USFDA), European Food Safety Authority (EFSA), United States Department of Agriculture (USDA), and Organisation for Economic Co-operation and Development (OECD), and corporate filings such as annual reports, SEC filings, investor presentations, and financial statements; press releases; and trade, business, professional associations and among others. These sources were also used to obtain key information about major players, market classification, and segmentation according to industry trends, regional/country-level markets, market developments, and technology perspectives.

Primary Research

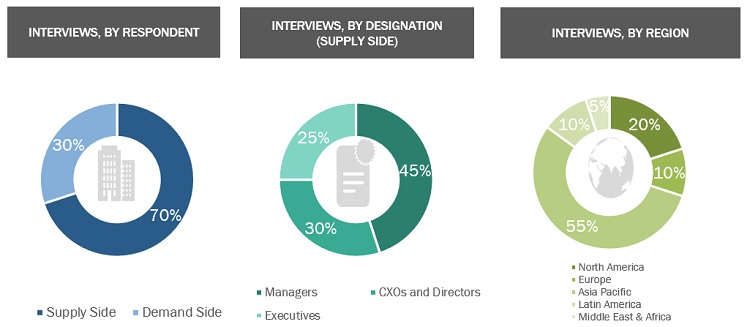

In-depth interviews were conducted with various primary respondents, including key industry participants, subject-matter experts (SMEs), C-level executives of key market players, and industry consultants, among other experts, to obtain and verify the critical qualitative and quantitative information as well as assess future prospects of the market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The following is a breakdown of the primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both top-down and bottom-up approaches were used to estimate and validate the total size of the pharmaceutical gelatin market. These methods were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The key players in the industry and market have been identified through extensive secondary research

- The revenues generated from the pharmaceutical gelatin business of leading players have been determined through primary and secondary research

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources

Data Triangulation

After arriving at the overall market size from the market size estimation process, the total market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics for all segments and subsegments, data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Report Objectives

- To define, describe, and forecast the global pharmaceutical gelatin market based on the application, source, function, type and region

- To provide detailed information regarding the major factors influencing the growth of the market (such as drivers, restraints, and opportunities)

- To strategically analyze micromarkets with respect to individual growth trends, future prospects, and contributions to the overall pharmaceutical gelatin market

- To analyze opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa

- To strategically profile the key players and comprehensively analyze their product portfolios, market positions, and core competencies

- To track and analyze competitive developments such as acquisitions, product launches, expansions, and R&D activities in the pharmaceutical gelatin market.

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for this report:

Company Information

- Detailed analysis and profiling of additional market players (up to five)

Volume

- Volume by region can be provided by function, application and type

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pharmaceutical Gelatin Market