PFAS-Free Coatings Market By Type (Silicone – Based, Wax – Based, Bio – Based), Substrate (Textile, Paper & Cardboards, Metal, Concrete and Masonry), Application (Textiles and Apparel, Food Packaging, Construction, Industrial, Personal Care), End – use Industry (Building & Construction, Automotive & Transportation, Industrial Manufacturing, Healthcare), and Region - Global Forecast to 2030

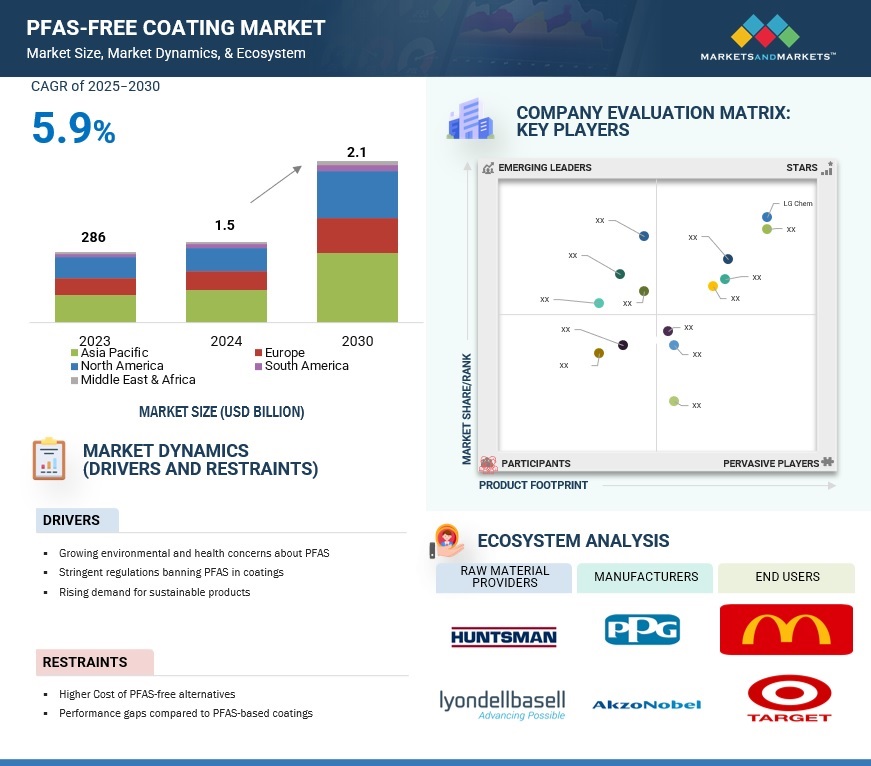

The PFAS–free coating market is projected to grow from USD 1.5 billion in 2024 to USD 2.1 billion by 2030, at a CAGR of 5.9% between 2025 and 2030. Health concerns and developments in the technologies have led to PFAS-free coatings, which serve as substitutes for traditional coatings having per- and polyfluoroalkyl substances (PFAS) in their compositions. These have been common chemicals for which no degradation takes place in the environment as well as in the body, and therefore they have been termed "forever chemicals." These coatings are now being used and explored in many industries such as food packaging, textiles, automotive, and consumer goods. The PFAS - free market segment applies as much for use in construction, and packaging. These sectors grow with the effect of environment and health concerns to drive the demand for PFAS – free coatings products.

The market for PFAS-free coatings has been propelled by several significant factors, including environmental and health issues concerns. Such issues relate to the adverse effects of PFAS on the environment and human health, which all intricate effects have become very apparent. The markets largely lean towards the demands for alternatives that promise safety-wise without compromising in other critical performance indicators. Regulatory pressure has also been a crucial aspect whereby new and stringent regulations worldwide compel industries to convert to PFAS-free coatings in meeting the new standards and avoiding unwanted penalties. Corporate social responsibility and improved brand image are among the agendas that encourage companies to operate in PFAS-free coating systems because of the sustainability and environment-oriented initiatives. Last but not the least, technology has played its role since new innovations in coating technologies have impacted on the effectiveness and versatility of PFAS-free options.

Attractive Opportunities in the PFAS-Free Coating Market

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

PFAS-Free Coating Market Dynamics

Driver: Growing environmental and health concerns about PFAS

PFAS, or per and polyfluoroalkyl substances, are artificial chemicals, with the two being most widely used as they repel water, grease, and stain. Developments regarding these chemicals have alarmingly raised much concern worldwide about their permanence in the environment and the associated health risks of some serious diseases like cancers, liver damage, and effects on the immunity system. Increasing regulatory attention and demand for PFAS-free products by consumers. To that end, different companies have undergone PFAS-free coatings that deliver the same benefits without the associated concerns. Coatings are being applied in sectors like food packaging, textiles, automotive, and consumer goods. All these changes are borne out of new rules demanding compliance with severe regulations as well as the widely differed consumer market shifting dramatically to greener and safer products.

Restraints: Competition from the alternative materials

Higher costs of alternatives without PFAS are far from easy challenges for industries switching from traditional PFAS-containing products. Though PFAS-free coatings are environmentally and human-friendly, procurement of raw materials is costly with processes being complicated and expensive. These aspects would cost in the pricing of the product making them uncompetitive in the market. To many of these companies, this change requires huge investments towards PFAS-free technologies, as it comes with not just the cost of materials, but also specialized equipment and trained staff members. Financially, it is quite severe for smaller companies or those in highly competitive markets where price sensitivity is a significant factor. Stricter regulations on PFAS and rising consumer awareness about the hazards of PFAS are forcing industries to take up these extra costs as part of their sustainability and corporate responsibility commitments.

Opportunity: Innovations in bio-based and eco-friendly chemistries

Technological innovations in sustainable chemistries have changed the coatings industry by providing sustainable replacements for PFAS-based coatings. They are addressing the requirement of high-performance coatings that comply with stringent regulations without compromising functionality for the same. They find uses in many applications, such as packaging, textiles, and industry surfaces.

Green chemistry takes advantage of non-toxic, renewable feed stocks in ensuring the safety and sustainability concerning global trends of greening the manufacturing line. For further improvement of barrier properties, scratch resistance, and weatherability, functionalizing biopolymers and using water-based systems are being studied in the industry. Others are still in the business of developing a scalable production process for cost-competitiveness. Such inventions will not just enjoy the benefits of PFAS compliance within their system against further use of such compounds, but they will also be able to match the trend in the consumer market for new, green, ever, at coatings.

Challenges: Industry resistance due to cost and complexity

Financial complexity issues make industry unwilling to adopt environmental solutions. Such conversion to eco-friendly solution comes at cost in research and development, making it expensive to modify manufacturing processes or it may be costly switching over to PFAS-free coatings. Companies would be put into great restraints concerning cost because they are subject to competition markets with price considerations.

Whereas these present hindrances, they are compelled to bring out innovations before the external or internal environmental breaks, which observe increased regulatory pressures to use manufactured products that are sustainable for the consumers. It means that any stakeholder who embraces such terms through collaboration and adoption of technology as well as a long-term analysis of costs and benefits will find himself ahead of the current trend in sustainability and thus more competitive advantages over addressing environmental and societal concerns.

PFAS-Free Coatings Market Ecosystem

The PFAS-free coatings market ecosystem is a consist of entities that pushes towards sustainable, non-toxic solutions. This allows suppliers of raw materials, manufacturers, regulatory bodies, and end-users, all working together to eliminate the environmental and health hazards linked to per- and polyfluoroalkyl substances (PFAS).

Stakeholder includes, raw material suppliers, works on developing their innovative bio-based and eco-friendly alternative practices, such as silicones, waxes, and functionalized polymers, to ensure performance that can be achieved without PFAS. Manufacturers must ensure that their formulation as well as their production process satisfy the required and expected performance standards of water, grease, and stain resistance in the absence of PFAS. Finally, regulatory bodies set tough and stringent guidelines at a speed that can facilitate compliance and transparency, at the same time hastening the shift. The end-use sectors like food packaging, textiles, automobiles, and construction need products in demand and specify sustainability. The ecosystem thrives in a collaborative environment through research and advancements in technology that offer scalable opportunities in accord with regulatory paper trails and consumer trends requesting greener, safer products, thus changing the future of functional coatings.

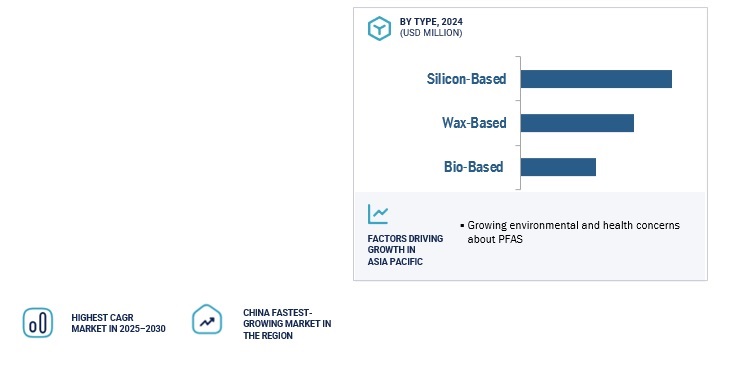

By type, silicone – based coatings accounted for the largest share of the PFAS – free coatings market in terms of value

This explains the use of silicone in the PFAS-free coatings market as it occupies the most share because of its unparalleled performance and versatility. The coatings can very well serve as tough replacements for PFAS because they exhibit features such as excellent water, oil, and stain resistance while being free from much environmental and health risks involved with fluorinated chemicals.

Due to their unique properties such as high thermal stability, UV resistance, and chemical inertness, silicones are highly suited to a wide variety of applications including food packaging, textiles, as well as automotive and industrial surfaces. Furthermore, flexible formulation combines with its ability for manufacturers to meet those set stringent industry-specific standards, thus crossing over industry's boundaries seamlessly.

This is further boosted by the stiffened regulatory drive against PFAS as well as the rising change in consumer psyche towards sustainable solutions. Benefit from advancements in the silicone chemistry that are being made by manufacturers in maximizing performance while minimizing costs and making profitable huge scale production, thus placing silicone-based coatings to be the default choice in emerging eco-friendly and PFAS-free technologies.

Building & Construction segment to accounted for the largest share of the PFAS free coatings market by end use industry in terms of value

Construction and building sector lead the market for PFAS-free coatings due to growing environmental regulations and rising demand for sustainable material usage. These coatings are very essential in functionality; they can provide features such as water and stain resistance along with corrosion protection and durability, which will assist in enhancing performance and the lifespan of construction materials like concrete, metal, and wood.

The trend towards eco-friendly solutions is increasingly being fuelled by stringent regulation terms encouraging the phase-out of PFAS due to their persistence and health danger. Silicone-based and other biobased coatings are appearing now as the most preferred alternative options, offering equivalent performance, which shall also meet green building certification and sustainability goals.

Furthermore, smart buildings and energy buildings have the trend to adopt advanced PFAS-free coatings that enhance surface functionality and aesthetics. In this regard, with a focus on more eco-conscious constructions, it is expected that PFAS-free coatings will play an important role vis-à-vis performance-driven fulfilment in the sustainability worldwide.

North America is the fastest-growing region for PFAS – Free Coating

The PFAS-free coatings market in North America is considerably poised to grow, due to rising regulatory scrutiny and consumer awareness about environmental risks involved in health applications of PFAS. The U.S. Environmental Protection Agency (EPA) has stringent policies on phased bans on the use of certain PFAS compounds, besides which, state regulations such as those of California, Maine, and Washington suppress the use of PFAS in consumer products such as food packaging and textiles. Strong impetus has been provided for various industries since then to make the transition to sustainable PFAS-free alternatives.

Food packaging, non-stick cookware, and textiles are the three segments showing significant application instances for demand generation for PFAS-free coatings in this region. In particular, the food industry is introducing PFAS-free grease resistance schemes to keep up with latest regulations coming up and changes in consumer preference towards being environmentally aware. Other sectors adopting sustainable coatings include automotive and construction in meeting their corporate sustainability vision and regulatory compliances.

Such a developed innovation ecosystem in North America is thus going to accelerate the development of high-performance alternatives, investments from startups and established companies being significant. Way forward for developing innovative bio-based and non-fluorinated coatings has been paved by active collaborations between industry and academia which foster advancements in the field.

The more laws get stricter and the demand from consumers increases for products that are considered environmentally friendly, North America becomes one of the leading markets having sound prospective growths until 2030 for PFAS-free coatings.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

Sherwin Williams(US), PPG Industries(US), AkzoNobel(Netherlands), are the key players in the global PFAS – Free Coatings market.

PPG Industries is a well-known international player in the sustainable coatings space and offers solutions devoid of PFAS for use in the automotive sector, construction industry, and industrial applications. These include innovative product lines such as Aquacron® and Envirocron®, having both the performance and environmental specifications. This coating is widely used on multiple vehicles, equipment and building materials as protective finishes. This indicates that there would be a heavy research and development input on further enhancing eco-friendly technology. Hence, the company will continue upholding its sustainability and regulatory compliance across North America and Europe.

Recent Developments in PFAS-Free Coating Market

- In 2023, AkzoNobel launched Accelstyle™ PFAS-free external coatings for aluminium beverage cans

- In 2023, AkzoNobel launched Accelshield™ 700, a bisphenol- and PFAS-free internal coating.

- In 2023, AkzoNobel, declared that 32 million euros would be invested in a factory based in Spain, which will start producing coatings free from PFAS and bisphenol.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQs):

What are the factors driving the growth of the PFAS – Free Coatings market?

The growing construction market and green projects.

What are the major applications for PFAS – Free Coatings?

The major applications are construction, packaging, and furniture.

Who are the major manufacturers of PFAS – Free Coatings?

Sherwin Williams (US), PPG Industries (US), AkzoNobel (Netherlands) are the key players in the global PFAS – Free Coating market.

What are the reasons behind PFAS – Free Coatings gaining market share?

PFAS – Free Coatings are gaining market share due to increasing concerns about health and safety.

Which is the largest region in the PFAS – Free Coatings market?

North America is the largest region in the PFAS – Free Coatings market.

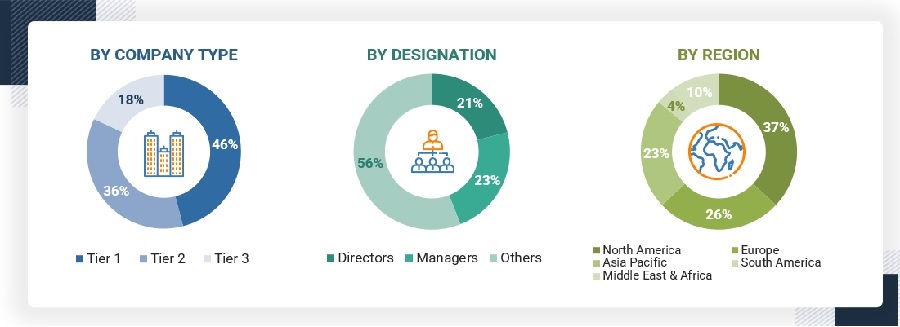

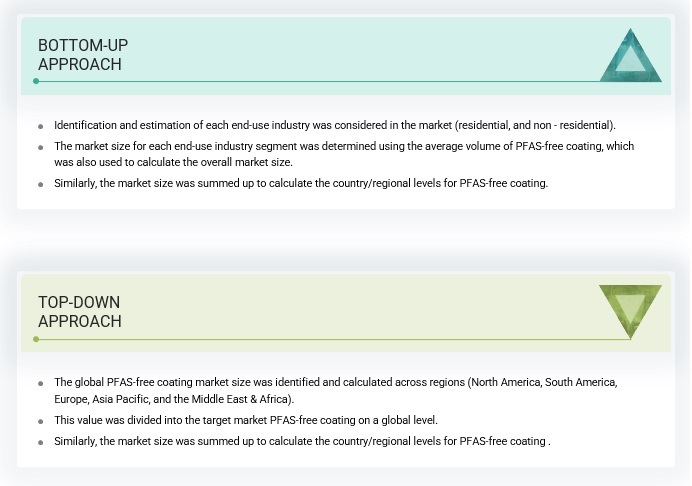

The study involved four major activities in order to estimating the current size of the PFAS – Free Coatings market. Exhaustive secondary research conducted to gather information on the market. The next step was to conduct primary research to validate these findings, assumptions, and sizing with the industry experts across the value chain. Both top-down and bottom-up approaches were used to estimate the total market size. The market size of segments and subsegments was then estimated using market breakdown and data triangulation.

Secondary Research

Secondary sources include annual reports of companies, press releases, investor presentations, white papers, articles by recognized authors, and databases, such as D&B, Bloomberg, Chemical Weekly, and Factiva, and publications and databases from associations.

Primary Research

Extensive primary research was carried out after gathering information about PFAS – Free Coatings market through secondary research. In the primary research process, experts from the supply and demand sides have been interviewed to obtain qualitative and quantitative information and validate the data for this report. Questionnaires, emails, and telephonic interviews were used to collect primary data. Primary sources from the supply side include industry experts, such as chief executive officers (CEOs), vice presidents (VPs), marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the PFAS – Free Coatings market. Primary interviews were conducted to elicit information such as market statistics, revenue data collected from the products and services, market breakdowns, market size estimations, market forecasting, and data triangulation. Primary research also assisted in comprehending the various trends associated to type, applications, end – use industry, and region.

The breakup of Primary Research:

To know about the assumptions considered for the study, download the pdf brochure

PFAS-FREE COATINGS MANUFACTURERS

|

PFAS-Free Coatings Manufaturers |

|

|

PPG Industries |

Sharwin William |

|

AkzoNobel |

Allnex |

|

Axalta |

RPM |

|

Kansai |

Jotun |

PFAS-Free Coatings Market Size Estimation

The following information is part of the research methodology used to estimate the size of the PFAS – Free Coatings market. The market sizing of the PFAS – Free Coatings market was undertaken from the demand side. The market size was estimated based on market size for PFAS – Free Coatings in various technology.

Global PFAS-Free Coatings Market Size: Bottom-Up Approach and Top-Down Approach

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size, the market has been split into several segments. To complete the overall market engineering process and arrive at the exact statistics for all segments, the data triangulation and market breakdown procedures have been employed, wherever applicable. The data was triangulated by studying various factors and trends from the demand and supply sides. Along with this, the market size was validated using both the top-down and bottom-up approaches.

Market Definition

As per American Coatings Association, PFAS-free coatings refer to protective or functional coatings formulated without per- and polyfluoroalkyl substances (PFAS). These substances, known for their water- and oil-repellent properties, have been used in various industries to enhance the durability and resistance of coatings, but are now restricted due to their environmental persistence and potential health risks. PFAS-free alternatives employ non-toxic, sustainable materials that provide similar performance without the harmful impacts of fluorinated compounds. Such coatings are essential in sectors like construction, automotive, and food packaging, where regulatory standards and consumer demand for eco-friendly products are driving a shift towards safer, non-fluorinated solutions.

Key Stakeholder

- End User

- Raw Material Suppliers

- Senior Management

- Procurement Department

Report Objectives:

- To define, describe, segment, and forecast the size of the PFAS-Free coatings market based on width, type, end – use industry, and region.

- To forecast the market size of segments with respect to various regions, including North America, Europe, Asia Pacific, South America, Middle East & Africa, along with major countries in each region

- To identify and analyze key drivers, restraints, opportunities, and challenges influencing the growth of the PFAS-Free Coatings market

- To analyze technological advancements and product launches in the market

- To strategically analyze micromarkets, with respect to their growth trends, prospects, and their contribution to the market

- To identify financial positions, key products, and key developments of leading companies in the market

- To provide a detailed competitive landscape of the market, along with market share analysis

- To provide a comprehensive analysis of business and corporate strategies adopted by the key players in the market

- To strategically profile key players in the market and comprehensively analyze their core competencies

Available Customizations:

MarketsandMarkets offers the following customizations for this market report:

- Additional country-level analysis of the PFAS-Free coatings market

- Profiling of additional market players (up to 5)

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company in the PFAS-Free coatings market

Growth opportunities and latent adjacency in PFAS-Free Coatings Market