PFAS & PFAS Alternatives Market By Type, By Application, By End-Use Industry (Textile & Leather, Paper & Pulp, Consumer Goods, Building & Construction, Automotive, Electronics & Semiconductors, Energy & Power) And Region – Global Forecast To 2029

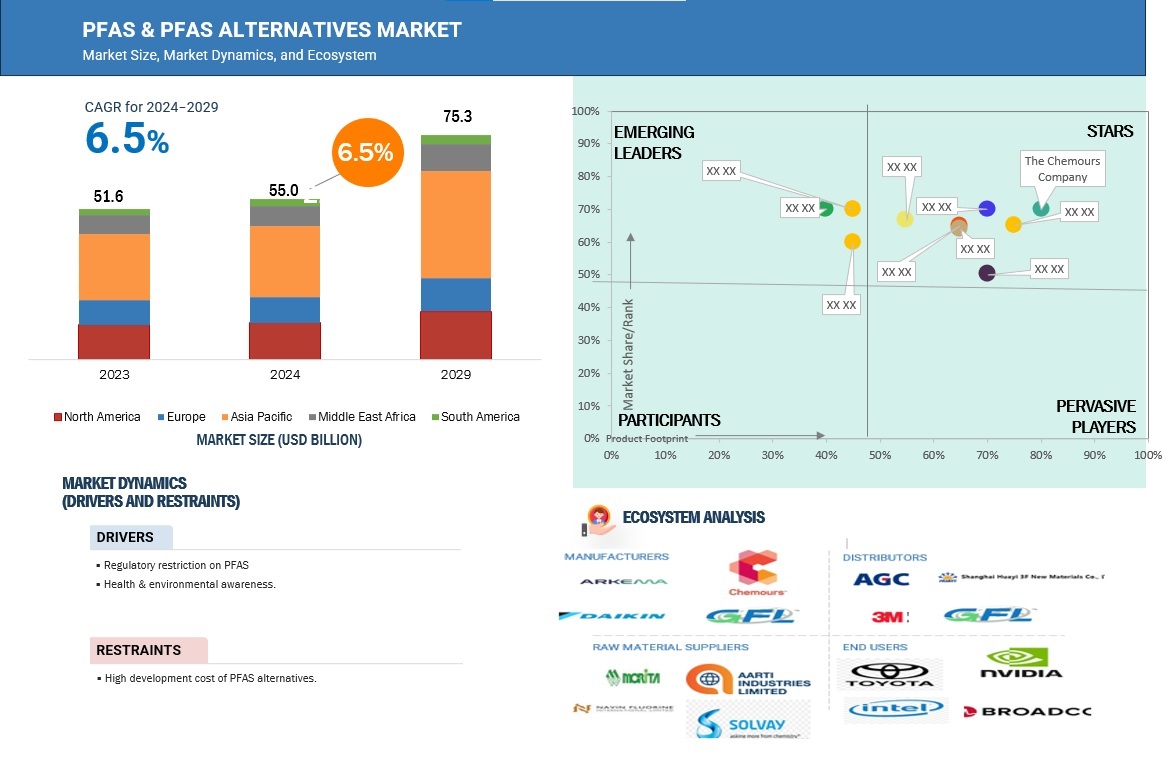

The global PFAS & PFAS alternatives market is projected to grow from USD 55.0 billion in 2024 to USD 75.3 billion by 2029, at a CAGR of 6.5%. The increasing use of PFAS & PFAS alternatives in the electronics & semiconductor and textile & leather, building & construction, automotive industry in emerging economies is expected to drive the market during the forecast period. The strong growth in the electronics & semiconductor industry sector supports the growth of the PFAS & PFAS alternatives market. These substances are highly valued for their special properties. Also, various government initiatives of key countries, namely China, India, Japan, and Germany in the electronics & semiconductor sectors, further propel the demand for PFAS & PFAS alternatives.

Attractive Opportunities in the PFAS & PFAS Alternatives Market

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

Source: Interviews with Experts, Secondary Sources, and MarketsandMarkets Analysis

To know about the assumptions considered for the study, Request for Free Sample Report

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

Source: Expert Interviews, Secondary Sources, and MarketsandMarkets Analysis

PFAS & PFAS Alternatives Market Dynamics

Driver: Regulatory restriction to propel PFAS Alternatives Market

The strict regulation related with PFAS substances is one of the main market factors emerging within the industry since more stringent controls are set out by authorities and environmental institutions regarding its production, use and disposal. PFAS are even called “forever chemicals” because they persist in the environment and within the human body and have shown to be associated with negative effects on health including cancer, hormonal imbalance and developmental disorders. As a result, the US EPA’s PFAS Strategic Roadmap, the REACH regulations of the European Union, or even individual countries’ bans such as Canada or Australia are restricting or seeking to phase out certain PFAS compounds including PFOA and PFOS. These measures include bans on their use in consumer goods, food packaging and other applications. These regulations are pushing forward development and progress towards safer and more environmentally friendly PFAS substitutes.

Restraints: High development cost of PFAS alternatives.

The high cost associated with developing alternatives to PFAS is the main hindrance to the growth of the PFAS alternatives market. It requires a lot of research and innovation to develop such substitutes, that match similar chemical, thermal, water-, and oil-resistant characteristics. Such processes are costly and time consuming and require advanced engineering design, material testing as well as high levels of compliance with regulatory guidelines. Moreover, sites of manufacturing may require expensive additional alterations or total redesigns in order to incorporate these alternatives into mainstream production. The rise in the price associated with many alternatives is compounded by the absence of economies of scale, which make these alternatives ineffective economically, particularly for price sensitive industries such as the textiles or consumer goods industry. This price barrier may considerably result in delay to the PFAS-free solution`s acceptance, as companies are reluctant to move away from the traditional PFAS empowered materials due to higher costs in alternative materials, although there are regulations and the demand in the market.

Opportunity: Rising consumer demand for sustainability.

The sustainable practice and consumer preference trends have opened up a significant opportunity for PFAS alternatives as people seek to use sustainable products. With increasing awareness of health and environmental impact of PFAS chemical- consumers are pressuring various end-use industries to adopt sustainable and greener alternatives. Such transition is quite apparent in growing industries such as textiles, cookware, food packaging, and personal care. The companies which provide PFAS alternatives can tap into this demand & can increase their market presence. This growing trend is however being used by the industries to fulfil their corporate environmental, social, and governance (ESG) responsibilities which helps in attracting green investors and customers. These companies are also changing traditional PFAS materials with newer biocompatible and non-toxic materials to minimize their environmental impact and promote themselves as sustainable innovators.

Challenges: Recycling and waste management challenges.

This problem arises due to their great chemical stability making them indestructible through ordinary disposal or recycling techniques. As materials containing PFAS have been disposed in landfills, it would eventually leach PFAS into the ground soil and water or deep into the ground, potentially contaminating water bodies and ecosystems. Recycling of PFAS containing products is more challenging because separating PFAS from these materials is not economical and also it is very technically challenging. Some of the most accurate and possible technologies available for the destruction of PFAS are mostly high temperature plasma treatment and chemical degradation which are most cases only limited to the research stage or have restrictive scalability proportions rendering them impractical in large proportion waste disposal.

Ecosystem analysis: PFAS & PFAS Alternatives Market

The PFAS & PFAS alternatives ecosystem comprises raw material suppliers providing chemicals, and equipment to manufacturers, manufacturers conducting research & development of the final products for use in various industries, and intermediaries & distributors providing a link between manufacturers and end users by supplying final products. They work together to supply the final products to end users in different industries. It involves a series of processes, from raw material procurement to manufacturing the end products and distributing them to end users for further use in various end-use industries.

The PFAS segment is projected to be the largest type during the forecast period.

Per- and polyfluoroalkyl substances are synthetic chemical compounds with properties of heat, water, oil, and chemical degradation. Such properties made PFAS necessary in various sectors including textiles, automobiles, electronics, construction industries, and food packaging industries. The versatility and outstanding performances in water and oil repellency, nonstick surface, and high levels of chemical resistance make up the largest family of PFAS based on market share. More importantly, they have found some very crucial applications in high technology like manufacturing semiconductor & electronics in which stability and durability features of these materials can never be matched.

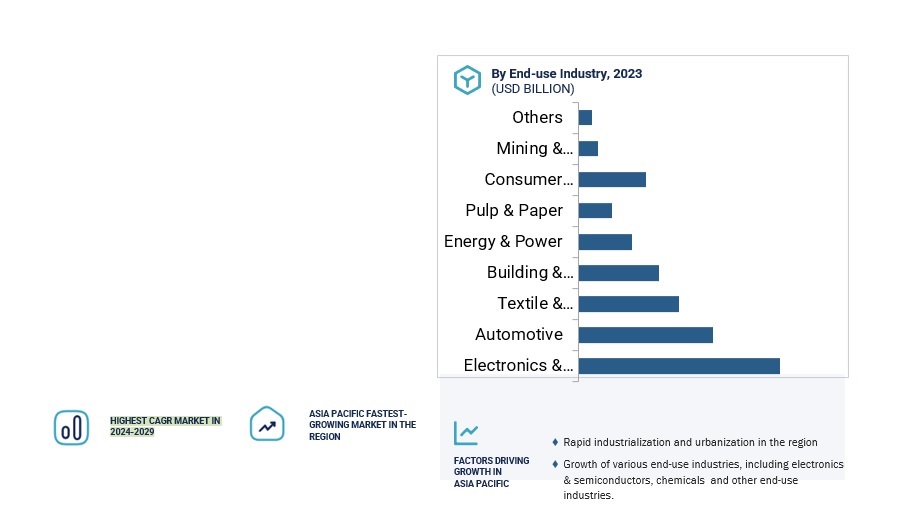

Electronics & Semiconductors end use industry is anticipated to have the largest market share in terms of value, during the forecast period.

Electronics & semiconductors end use industry is estimated to have largest share in end use industry segment in terms of value. The electronics and semiconductor industry is the largest end-use industry for PFAS and PFAS alternative market due to the special properties of these substances that are very essential for advanced manufacturing and the performance of electronic components. These materials have high dielectric properties; they are highly valued as they provide great electrical insulation, which is very essential for printed circuit boards and semiconductors. Another aspect is that chemical and thermal stability allows them to withstand high temperature. Due to the high demand in 5G, IOT, AI, PFAS and their alternatives are now in high demand to formulate high performance electronic devices and components.

Asia Pacific to account for the fastest growth rate during the forecast period.

The availability of low-cost raw materials and labor, as well as the increased growth in automotive, electronics & semiconductor and consumer goods industry, are expected to make Asia Pacific an attractive investment destination for PFAS and PFAS alternative manufacturers. Various countries, including China, India, South Korea, and Japan are heavily investing in electronics & semiconductor industry. The region is also supported by government policies and schemes such as Make in India and Made in China 2025.

To know about the assumptions considered for the study, download the pdf brochure

Key Market Players

- Daikin Industries Ltd.(Japan)

- 3M(US)

- AkzoNobel N.V.(Netherlands)

- Solvay(Belgium)

- Dongyue Group Ltd.(China)

- DuPont(US)

- Mitsubishi Chemical Group Corporation(Japan)

- Asahi Kasei Corporation(Japan)

- Gujarat Fluorochemicals Limited(India)

- Fluroseals(Italy)

- Hubei Everflon Polymer(China)

- Hindustan Fluorocarbons Limited (India)

- Jiangsu Meilan Chemical Co., Ltd.(China)

- Juhua Group Corporation(China)

Recent Developments in PFAS & PFAS Alternatives Market

- In July 2021, Daikin Industries, Ltd. announced the completion of Kashima Integrated Production Center (IPC) at Kashima Plant. This center is producing fluorochemicals since June 2021. The center will integrate all the people, organization, and information related to the operational control, equipment management, and production management at Kashima plant.

- In May 2019, Dongyue Group announced its strategic plan to expand its capacities of PTFE concentrated emulsion and dispersion resin. The important task of this project is to build a device for production of 10,000t/a PTFE dispersion resin, a device for production of 10,000t/a PTFE concentrated emulsion, two sets of devices for production of 12,000t/a PTFE as well as two sets of devices for production of 30,000t/a chlorodifuoromethane along with commonly shared auxiliary facilities and reserve facilities.

- In November 2022, Gujarat Fluorochemicals Limited (GFL) announced a successful development in the use of non-fluorinated polymerization aid (NFPA) technology to manufacture PTFE fine powder and PFA. With this development, the company will be able to manufacture its entire fluoropolymer portfolio without the use of fluorinated polymerization aids.

- In February 2022, Gujarat Fluorochemicals Limited (GFL) has announced an investment into expansion of PTFE & PVDF capacities in its integrated manufacturing facility at Dahej in India. This new plan will further support the growing demand for these fluoropolymers across regions and major industries globally.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Frequently Asked Questions (FAQs):

Which are the major companies in the PFAS & PFAS alternatives market?

Some of the key players in the PFAS & PFAS alternatives market include The Chemours Company (US), Daikin Industries Ltd. (Japan), 3M (US), AkzoNobel (Netherlands), Solvay (Belgium), Dongyue Group Ltd. (China), DuPont (US), Mitsubishi Chemical Company (Japan), and Asahi Kasei (Japan).

What are the drivers and opportunities for the PFAS & PFAS alternatives market?

Rapid growth in the electronics & semiconductor sector and increased investment in emerging countries boost this market. Additionally, the rising demand for sustainability provides an opportunity for the market to grow.

Which region is expected to hold the highest market growth rate?

The Asia Pacific PFAS & PFAS alternatives market is expected to account for the highest market growth rate during the forecast period. It is driven by economic growth in countries such as China and India, along with increasing demand from various end-use industries.

What is the total CAGR expected to be recorded for the PFAS & PFAS alternatives market during 2024–2029?

The market is expected to record a CAGR of 6.5% during 2024–2029.

How is the PFAS & PFAS alternatives market aligned?

The market is highly competitive, prompting many manufacturers to plan various growth strategies such as investment and expansion, partnerships, and the launch of new products to maintain their market presence.

PFAS & PFAS Alternatives Market

Growth opportunities and latent adjacency in PFAS & PFAS Alternatives Market