Pet Supplements Market by Functional Application (Skin & Coat, Hips & Joints, Digestive Health, Immune Support), Supplement Type (Multivitamin, Glucosamine, Antioxidants), Pet, Form, Distribution Channel, and Region - Global Forecast to 2029

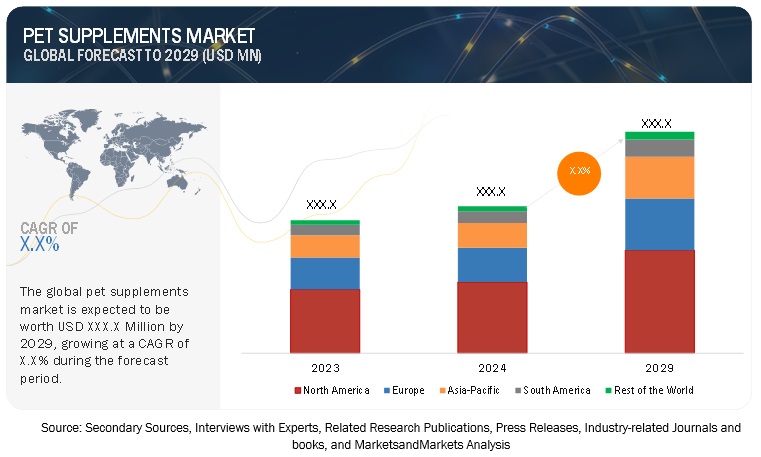

According to MarketsandMarkets, the global pet supplements market is estimated to be valued at USD XXX.X million in 2024 and is projected to reach USD XXX.X million by 2029, recording a CAGR of X.X%.

The increasing priority of holistic health and well-being of pets by pet owners propels robust growth in the supplements segment. According to the American Pet Products Association, the US pet industry is expected to reach USD 150.6 billion in 2024 as the larger consumer base increasingly embraces an ever-expanding product line focused on improving the health of their pets beyond mere nutrition. Another driver for the pet supplements market is increasing awareness among pet owners regarding the animals' preventive health care. It is expected that, as pet owners are trying to improve the quality of life and longevity of their pets, the demand for supplements related to joint health, skin condition, and overall wellness is expected to increase in the coming years. This trend is further enhanced through advancements in veterinary science and an increasing interest in holistic pet care. The humanization of pets has also encouraged spending toward high-end products, thereby driving market growth.

Key players are launching new products and extending their reach in the pet supplements market. For instance, in June 2024, the launch of ADM functional pet supplements in Europe is just another reflection of this trend. Their products include soft chews and supplement powders, formulated to answer very specific wellness needs such as calming, dental health, and gut support. As a matter of fact, it supports the findings that 85% of global pet parents consider proper nutrition and supplements to be crucial for their pets. As the market opens, new supplements become an integral part of preventative care with specific benefits that appeal to a growing consumer interest in overall pet health.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

PET SUPPLEMENTS MARKET DYNAMICS

Drivers: Increasing pet ownership globally.

The rising number of pets in key countries will lead to an increased demand for supplements for them. More households worldwide are adopting pets, creating a growing need for products that can ensure the health and well-being of these pets. In regions with high pet ownership, such as European countries, US, and China, the focus on pet health has intensified, leading to a surge in the adoption of pet supplements.

Pet owners are becoming more aware of the benefits of these supplements, including improved joint health, enhanced immune function, and better coat quality, driving further growth in this market. Additionally, the trend for the humanization of pets and treatment of animals as family members is another growth factor for increasing spending towards pet care products in general, and supplements, in particular. This growing emphasis on preventive healthcare for pets is likely to boost the growth in the pet supplements market in the coming years.

Restraints: Stringent regulations to retrain the market growth

Supplements and nutraceutical products intended for pets face very strict regulatory oversight, especially in the major developed nations like the US, Germany, and others. Such products must undergo proper testing and quality checks from their manufacturers to verify total compliance with the stringent standards that are imposed at each link of the supply chain before making their availability in the market. The regulatory framework concerning ingredients for pet supplements, including those about cannabidiol and other related compounds, varies considerably in different countries. Therefore, their manufacturing has to be done in conformance with the different regulatory requirements of respective jurisdictions. This often enhances production costs due to the various regulatory requirements. In addition, strict regulations over the commercialization of pet supplements further add to the impediments, as they help raise the cost and thereby complicate the process of developing new products. These could also essentially depress the growth of the global pet supplements market in most cases, as they form entry barriers and limit the scope for innovation and the introduction of new products for a manufacturer.

Opportunities: Plant-based supplements are a new opportunity for the pet supplements market.

The rising trend of pet humanization has led to the increased spending on premium pet food products by pet owners. They consistently demand pet food that adds value to the diets of pets and enhances their growth and development. Therefore, the demand for natural and plant-based pet supplements has been growing remarkably over the last few years, as they provide various health benefits and aid in the healthier growth of animals.

Challenges: High capital investment

Pet food manufacturers require high capital investments to install different machinery and equipment. This equipment has high installation costs and requires timely maintenance, which is an additional cost. Pet food manufacturers look for more economical options, such as equipment rentals, contract processing, and other related facilities. Renting equipment or contract manufacturing requires less capital investment and avoids annual maintenance costs, which rental companies incur. However, capital investments are one-time investments usually offset in the long run.

The dog segment is projected to dominate the animal type segment of the pet supplements market.

The dog segment of the pet supplements market has gained much ground with the growing awareness regarding pet health and well-being among pet owners. Probiotics, vitamins, and joint support supplements have been a significant demand since these tackle the most general health problems in dogs, such as digestive health, immune support, and mobility. One such trend is well-illustrated by the digestive probiotic supplement Powder for Dogs launched in October 2023 by Mars Petcare's GREENIES brand. The new product is a scientifically supported way to maintain a healthy intestinal microbiome in dogs of all ages and to support general digestive health. The new supplement represents an emerging need for functional supplements that are easy to administer and improve overall pet health.

By functional application, the skin & coat is expected to hold a significant market share in the forecasted period.

The skin and coat functional application segment represents a substantial share of the market in pet supplements, mainly because of increased awareness among owners of such pets about health and general appeal. Indeed, due to the emerging trend of keeping dogs and any other pets as part of the family, demand is being made for supplements that enhance skin and coat qualities. Most of these supplements comprise essential fatty acids, minerals, and vitamins that facilitate a healthy, shining skin coat while catering to dryness, itching, and inflammation. The movement to natural and organic products increases this segment's growth further as people look for safe and effective remedies against the dermatological issues of their pets. Companies also target the specific health needs of pets within the supplement market for skin and coat with the launch of TurmerItch Paste by The Golden Paste Company in August 2024. The new products launched by the companies indicate the rising demands & opportunities within the skin & coat application segment.

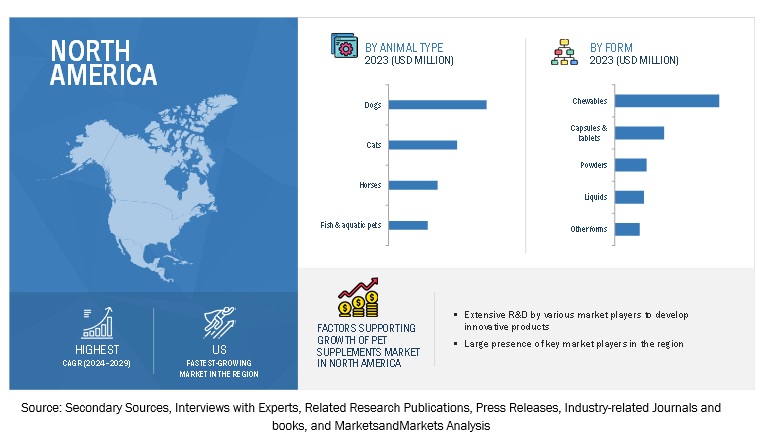

North America is poised to experience a significant market share in the pet supplements market during the forecast period.

North America is having the largest share for pet supplements due to an increase in the number of people owning pets and increased awareness regarding the health and well-being of pets. According to Forbes Media LLC in January 2024, in the United States regarding pet ownership, is as follows: 66% of families, or around 86.9 million houses, claimed to keep pets. This represents a considerable increase from 56% in 1988. To be more specific, dogs are the most frequent pets, accounting for 65.1 million households, followed by cats (46.5 million households) and freshwater fish (11.1 million households). In addition, as more people now have pets, there is also a corresponding demand for its supplements as people seek various products to help their pets become even healthier.

The key players in the North American pet supplements market include leading companies such as Mars Petcare (US), Nestlé Purina Petcare (US), and Spectrum Brands Holdings (US). These companies are developing more products considering the increasing need in almost every region.

NORTH AMERICA: PET SUPPLEMENTS market SNAPSHOT

Key Market Players

Key players in this market include ADM (US), Nestlé (Switzerland), Nutramax Laboratories, Inc. (US), Zoetis Services LLC (US), Virbac (France), Zesty Paws (US), These players have adopted strategies of product launches, expansions, agreements/partnerships, and mergers and acquisitions to grow in the market. All key product manufacturers that are part of the pet supplements ecosystem have been considered under the company profiles section.

Recent Developments

- In June 2024, ADM ?(US) introduced seven formulas to new pet products for the European market, keeping the main focus on functional treats and supplements, answering mainly the growth in demand for pets' well-being. These formulas take the form of soft chews and supplement powder sachets designed for digestion, mobility, skin health, or overall health in pets.

- ChromaDex (US) partnered with a US-based company, Zesty Paws, in October 2023 to develop a new canine product called "Healthy Aging NAD+ Precursor." As a nutritional supplement, this would contain a proprietary ingredient called Niagen, helping dogs with energy boosts while rebuilding cells in the aging process.

- Mars Petcare launched new varieties of Pedigree multivitamins for dogs, entering the pet supplements category in March 2023. Soft chew supplements containing 100 percent natural chicken and a minimum of eight vitamins were selected in support of immunity, digestive health, and joints. This launch is to fill the gap in the market.

Frequently Asked Questions (FAQ):

What are the major pet types considered within the study in pet supplements, and which segments are expected to witness promising growth in the Asia Pacific pet supplements market?

The report considers dogs, cats, horses, fishes & aquatic pets, & others. Within the subsegment dogs, the category is the most dominating among all the subsegments of Asia Pacific animal types, promising good prospects in the market forecasts.

Does any custom information available regarding the European pet supplements market, and if yes, what information is provided?

Yes, the customization for the European pet supplements market can be provided, insights include market size, dynamics, forecasts, competitive landscape, and company profiles. Dedicated insights will be provided to the European countries specified below:

- Germany

- Italy

- France

- Netherlands

- Spain

What are the opportunities in the pet supplements market for new entrants?

With an increasing number of health-conscious pet owners, supplements for pets are also in demand. More and more owners have started taking initiative ways to proactively enhance the health of their pets, much as is observable in trends of human health. This growing interest opens up opportunities for new brands to introduce innovative products.

What are some of the major challenges in the pet supplements market?

The manufacturing of products through various regulations in different regions is quite complicated. The fact that different countries have different regulations makes it hard for companies to operate and be in compliance with the regulations binding in their local laws.

What kind of information can be seen in the section Company Profiles?

Business profiles included in the report provide the requisite information, starting with an in-depth business description covering various segments, financial results of the company across geographical regions, revenue breakdown by segment as well as business segment analysis. In addition, the report provides information on product lines, key achievements, and analyst's opinions for an enhanced understanding of the company's potential. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Pet Supplements Market