Pet Services Market by Service Type (Grooming, Training, Boarding), Animal Type (Cats, Dogs), Delivery Channel (Clinics, Commercial facilities) and Region - Global Forecast to 2027

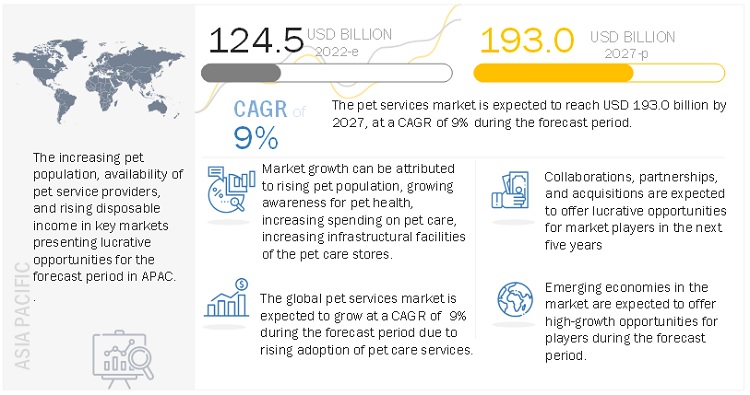

The global pet services market size is projected to reach USD 193.0 billion by 2027 from USD 124.5 billion in 2022, at a CAGR of 9% during the forecast period. Market is driven by factors such as rising pet population, growing awareness for pet health, increasing spending on pet care, increasing infrastructural facilities of the pet care stores. On the other hand, high cost of pet services and shortage of skilled personnel is expected to limit market growth to a certain extent in the coming years.

Some of the key drivers impacting the market include increased penetration of premium and subscription services, incorporation of data science within marketplace mechanics, operational efficiency, post-pandemic return to normal, and expansion of pet types and services offerings. For instance, premium services drive cross-selling to other service types, thus fueling the revenue growth. Premium subscribers also tend to opt for long-term plans that can increase customer loyalty and use of services. For instance, approximately one fourth of Wag Lab’s premium subscribers select annual plans. The growing adoption of online channels for marketing as well as service delivery is anticipated to fuel the market growth.

Pet Services Market

To know about the assumptions considered for the study, Request for Free Sample Report

“The dogs segment accounted for the largest market share in the pet services market, by animal type, during the forecast period”

The pet services market is segmented into cats, dogs, and others (exotics, small mammals, birds, aquatic animals), by animal type. In 2021, the dogs segment accounted for the largest market share in the pet services market, by animal type. The increasing pet ownership, expenditure on pets, pet humanization, and premiumization of pet products and services are attributed to the market growth.

The commercial facilities segment accounted for the largest market share in the pet services market, by delivery channel, during the forecast period

The pet services market is segmented into clinics, commercial facilities, and others (at-home, clinics, outdoors, etc.). In 2021, the commercial facilities segment accounted for the largest market share in the pet services market. The growth of the segment can be attributed to a large number of commercial facilities providing pet services, a wide variety of service portfolios, and the adoption of omnichannel sales and marketing strategies.

“APAC region accounted for the highest CAGR”

The global pet services market is divided into five regions: North America, Asia-Pacific, Europe, Latin America, and the Middle East and Africa. According to the regional analysis, the Asia-Pacific region is likely to retain a significant market share in 2021 and the future. The Asia-Pacific Pet services market is being propelled by the factors, such as increasing pet population, availability of pet service providers, and rising disposable income in key markets presenting lucrative opportunities for the forecast period in the Asia Pacific region.

To know about the assumptions considered for the study, download the pdf brochure

Competitive Landscape

Key Industry Developments:

The key market players are involved in strategic collaborations, regional expansions, and new product launches to sustain the competition. Leading companies are involved in deploying strategic initiatives that include service expansion, competitive pricing strategies, sales and marketing initiatives, partnerships, and mergers and acquisitions. For instance, in November 2020, Walmart expanded its offerings lineup by launching Walmart Pet Care in collaboration with Rover. This enabled Rover and the pet care providers on Rover to connect to Walmart’s wide audience of pet owners. In February 2022, Wag Labs, Inc.- an online pet services marketplace merged with a blank check company formed to facilitate a merger or similar business combination - CHWAcquisition Corporation. With this, Wag intends to become listed on the Nasdaq.

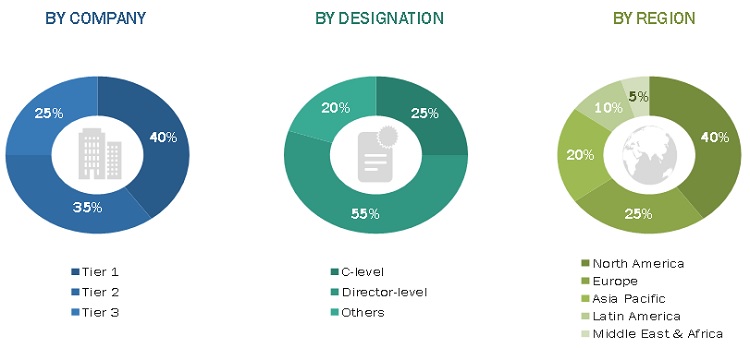

The primary interviews conducted for this report can be categorized as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America – 6% , and the Middle East & Africa – 4%

Lits of Companies Profiled in the Report:

- Mars, Incorporated

- A place for Rover, Inc.

- Wag Labs, Inc.

- Highland Canine Training, LLC

- Petbacker

- Dogtopia Enterprises

- Pooch Dog Spa

- American Pet Resort, LLC.

- Pets at Home Group Plc

- Pawz and Company

- Airpets International

- Paradise 4 Paws, LLC

Scope of the report

|

Report Metric |

Details |

|

Market size available for years |

2020–2027 |

|

Base year considered |

2021 |

|

Forecast period |

2022–2027 |

|

Forecast units |

Million/Billion (USD) |

|

Segments covered |

Service Type, Animal Type, Delivery Channel, and region. |

|

Geographies covered |

North America, Europe, Asia Pacific, Latin America, and Middle East and Africa |

|

Companies covered |

A Place for Rover, Inc., Pets at Home, Inc., Wag Labs, Inc., Highland Canine Training, LLC, Dogtopia Enterprises, Pooch Dog SPA, American Pet Resort, LLC, Pawz and CA Place for Rover, Inc., Pets at Home, Inc., Wag Labs, Inc., Highland Canine Training, LLC, Dogtopia Enterprises, Pooch Dog SPA, American Pet Resort, LLC, Pawz and Company, AirPets International, Paradise 4 Paws, LLC, and others. |

The study categorizes the pet services market based on service type, animal type at regional and global level.

Pet Services Market, By Service Type

- Introduction

- Boarding

- Long term

- Short term

- Training

- Transportation

- Grooming

- Others (Pet finding, Portrait & Photography, Poop Scooping, etc.)

Pet Services Market, By Animal Type

- Cats

- Dogs

- Large Breed

- Medium Breed

- Small Breed

- Others(Exotics, Small mammals, Birds, Aquatic animals)

Pet Services Market, By Delivery Channel

- Introduction

- Hospitals and Clinics

- Commercial Facilities

- Others (At-home, Online, Outdoors etc.)

Pet Services Market, by Region

- North America

- US

- Canada

- Europe

- Germany

- France

- UK

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Rest of Asia Pacific

- Latin America

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIOND AND EXCLUSIONS

1.2.2 MARKETS COVERED

1.2.3 YEARS CONSIDERED FOR STUDY

1.3 CURRENCY

1.4 LIMITATIONS

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

2.1 RESEARCH APPROACH

2.2 MARKET SIZE ESTIMATION

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

2.4 MARKET SHARE ESTIMATION

2.5 SECONDARY SOURCES

2.5.1 KEY DATA FROM SECONDARY SOURCES

2.6 PRIMARY SOURCES

2.6.1 KEY DATA FROM PRIMARY SOURCES

2.6.2 KEY INDUSTRY INSIGHTS

2.7 ASSUMPTIONS FOR THE STUDY

2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

5 MARKET OVERVIEW

5.1 INTRODUCTION

5.2 KEY MARKET DYNAMICS

5.2.1 MARKET DRIVERS

5.2.2 RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.4 CHALLENGES

6 INDUSTRY INSIGHTS

6.1 INDUSTRY TRENDS

6.2 REGULATORY ANALYSIS

6.2.1 REGULATORY BODIES, GOVERNMENT AGENCIES AND OTHER ORGANIZATIONS

6.3 MARKET ECOSYSTEM ANALYSIS

6.4 TECHNOLOGY ANALYSIS

6.5 KEY CONFERENCES & EVENTS IN 2022-23

6.6 KEY STAKEHOLDERS & BUYING CRITERIA

6.6.1 KEY STAKEHOLDERS IN BUYING PROCESS

6.6.2 BUYING CRITERIA

NOTE-IN SECTION 6, GIVEN ANLYSIS ARE BASED ON PRELIMINARY RESEARCH AND MAY VARY IN THE FINAL REPORT

7 PET SERVICES MARKET, BY SERVICE TYPE

7.1 INTRODUCTION

7.2 GROOMING

7.3 TRAINING

7.4 BOARDING

7.4.1 LONG TERM

7.4.2 SHORT TERM

7.5 TRANSPORATATION

7.6 OTHERS (PET FINDING, PORTRAIT & PHOTOGRAPHY, POOP SCOOPING, ETC.)

8 PET SERVICES MARKET, BY ANIMAL TYPE

8.1 INTRODUCTION

8.2 CATS

8.3 DOGS

8.3.1 LARGE BREED

8.3.2 MEDIUM BREED

8.3.3 SMALLBREED

8.3 OTHERS (EXOCTICS, SMALL MAMMALS, BIRDS, ACQUATIC ANIMALS)

9 PET SERVICES MARKET, BY DELIVERY CHANNEL

9.1 INTRODUCTION

9.2 CLINICS

9.3 COMMERICAL FACILITIES

9.4 OTHERS (AT-HOME, ONLINE, ETC., OUTDOORS)

10 PET SERVICES MARKET, BY REGION

10.1 INTRODUCTION

10.2 NORTH AMERICA

10.2.1 US

10.2.2 CANADA

10.3 EUROPE

10.3.1 UK

10.3.2 FRANCE

10.3.3 GERMANY

10.3.4 SPAIN

10.3.5 ITALY

10.3.6 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 JAPAN

10.4.2 CHINA

10.4.3 INDIA

10.4.4 REST OF ASIA-PACIFIC

10.5 LATIN AMERICA

10.5.1 BRAZIL

10.5.2 MEXICO

10.5.3 REST OF LATIN AMERICA

10.6 MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

11.1 OVERVIEW

11.2 MARKET EVALUATION FRAMEWORK

11.3 PRODUCT PORTFOLIO MATRIX

11.3.1 COMPANY END USER FOOTPRINT

11.3.2 COMPANY PRODUCT FOOTPRINT

11.3.4 COMPANY PRODUCT FOOTPRINT

11.4 MARKET SHARE/RANKING ANALYSIS (2021)

11.5 GEOGRAPHIC REACH OF THE TOP MARKET PLAYERS

11.6 R&D EXPENDITURE: KEY PLAYERS IN THE MARKET

11.7 COMPETITIVE SITUATIONS AND TRENDS

11.7.1 DEALS

11.7.2 OTHER DEVELOPMENTS

11.7.3 PRODUCT LAUNCHES & APPROVALS

11.8 COMPANY EVALUATION QUADRANT

11.8.1 STARS

11.8.2 EMERGING LEADERS

11.8.3 PERVASIVE PLAYERS

11.8.4 PARTICIPANTS

11.9 START-UP/SME EVALUATION QUADRANT

11.9.1 PROGRESSIVE COMPANIES

11.9.2 STARTING BLOCKS

11.9.3 RESPONSIVE COMPANIES

11.9.4 DYNAMIC COMPANIES

11.10 COMPETITIVE BENCHMARKING

12 COMPANY PROFILES

12.1 INTRODUCTION

12.2 MARS, INCORPORATED

12.3 A PLACE FOR ROVER, INC.

12.4 WAG LABS, INC.

12.5 HIGHLAND CANINE TRAINING, LLC

12.6 PETBACKER

12.7 DOGTOPIA ENTERPRISES

12.8 POOCH DOG SPA

12.9 AMERICAN PET RESORT, LLC.

12.10 PETS AT HOME GROUP PLC

12.11 PAWZ AND COMPANY

12.12 AIRPETS INTERNATIONAL

12.13 PARADISE 4 PAWS, LLC

13 APPENDIX

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 INTRODUCING RT: REAL-TIME MARKET INTELLIGENCE

13.5 AVAILABLE CUSTOMIZATIONS

13.6 RELATED REPORTS

13.7 AUTHOR DETAILS

Note:

The factors mentioned in the ToC are based on preliminary research and may vary in the final report

The list of companies mentioned above is indicative only and might change during the study

The top 25 leading market players would be profiled in the report

Details on key financials might not be captured in the case of unlisted companies

The global pet services market is projected to grow at an exponential rate during the forecast period. The major factors driving the growth of the pet services market include increasing affection between pet owners and their pets coupled with rising disposable income as well as surging market penetration of different pet insurance schemes and increasing population of companion animals. However, on the other hand, shortage of skilled personnel, and the increasing cost of pet services are anticipated to hamper the market growth.

In this report, the pet services market, by the service type, animal type, delivery channel, and region are covered.

This research study involved the extensive use of both primary and secondary sources. Various factors affecting the industry were studied to identify segmentation types; industry trends; key players; the competitive landscape of the market; and key market dynamics, such as drivers, restraints, opportunities, challenges, and key player strategies.

Secondary Research

This research study involved the use of secondary sources; directories; databases such as Dun & Bradstreet, Bloomberg Businessweek, and Factiva; white papers; annual reports; and Companies’ House documents. Secondary research was used to identify and collect information for this extensive, technical, market-oriented, and commercial study of the pet services market. It was also used to obtain important information about the top players, market classification, segmentation according to industry trends to the bottom-most level, geographic markets, and key developments related to the market. A database of the key industry leaders was also prepared using secondary research.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary sources from the supply side include CEOs, vice presidents & managing directors, marketing heads, directors and sales directors, marketing managers, regional/area sales managers, product managers, technology experts of pet services. Primary sources from the demand side include industry experts such as directors of hospitals and veterinarians.

A breakdown of the primary respondents is provided below:

*Others include sales managers, marketing managers, and product managers.

Note: Tiers are defined based on a company’s total revenue, as of 2020: Tier 1 = >USD 1 billion, Tier 2 = USD 500 million to USD 1 billion, and Tier 3 = To know about the assumptions considered for the study, download the pdf brochure The total size of the pet services market was arrived at after data triangulation from three different approaches, as mentioned below. After each approach, the weighted average of approaches was taken based on the level of assumptions used. The size of the pet services market was estimated through segmental extrapolation using the bottom-up approach. The methodology used is as given below: The total revenue in the global pet services market was determined by extrapolating the service type segment revenue. To know about the assumptions considered for the study, Request for Free Sample Report With the given market data, MarketsandMarkets offers customizations as per your company’s specific needs. The following customization options are available for the report:Market Size Estimation

Data Triangulation

Global Pet Services Market Size: Top-Down Approach

Objectives of the Study

Available Customizations

Company Information

Geographic Analysis

Growth opportunities and latent adjacency in Pet Services Market