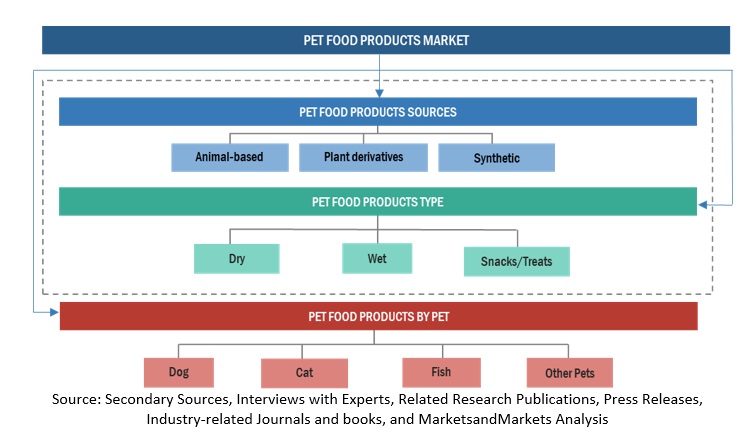

Pet Food Products Market by Product Type (Dry, Wet, and Snacks/Treats), Source (Animal-Based, Plant Derivatives, and Synthetic), Pet (Dogs, Cats, Fish, & Other Pets), Function, Customer Analysis, and Region - Global Forecast to 2029

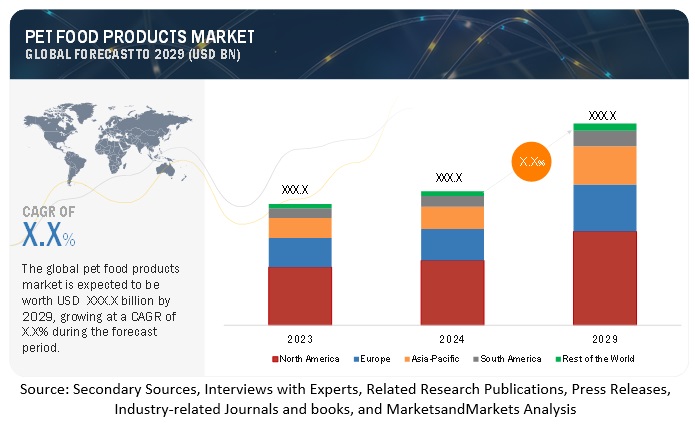

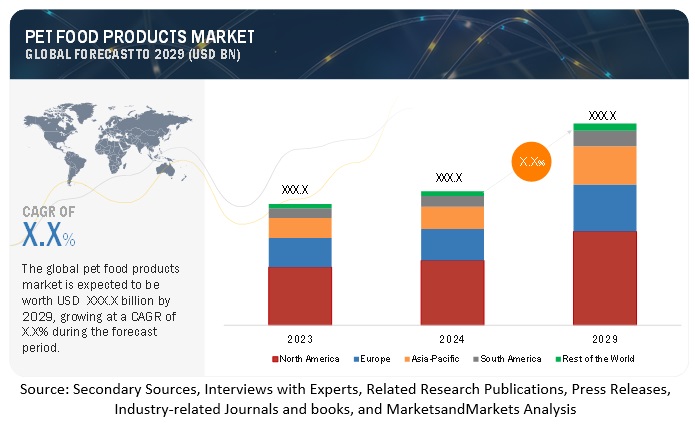

According to MarketsandMarkets, the global Pet food products market size is estimated to be valued at USD XXX.X billion in 2024 and is projected to reach USD XXX.X billion by 2029, recording a CAGR of X.X%.

Factors such as rising pet ownership, the tendency to humanize pets, putting more focus on pet health, and the ever-growing pet food market are the ideas that drive the pet food market. The American Pet Products Association (APPA) reported that last year, in 2021, 70% of households in the US had pets, showing a greater increase in pet food demand. With the humanization movement that pets are not just animals but members of the family, consumers are compelled to look for health and quality-driven products that are in line with the trend of human food, like organic and non-GMO.

The USDA has reported a significant rise in the premium pet food section; thus, many consumers have embraced and funded it. Also, the role of the FDA in the regulation of food safety and food quality standards has encouraged the trust and spending of consumers. The rapid development of online retailing has significantly enhanced the growth of the pet food market, a fact that has been underlined by the US Census Bureau in their data on the increment in online pet food sales. Finally, the global growth of the market, especially in developing countries, has also led to general growth, as the International Trade Administration reported. These factors, laying on the foundation of both the government and the industry databases, are responsible for the aggressive expansion of the pet food market.

Pet owners are more willing to spend extra money on pet foods that offer a special product, such as grain-free, organic, and high-protein diet options. The main reason behind this tendency is the growing level of awareness about pets’ health and wellness. Pet owners assume that these products are healthier rather than vice versa in most cases; therefore, they see them as a good fit for their pets, typically as health and wellness developments in human beings. The improvement in making pet food, like adding functional ingredients aimed at solving diseases through feeding and novel packaging sustainability and portion control, is capturing many consumers. These brands not only fulfill the fewer quality claims but also support the process of feeding more simply while giving convenience and the wish to parent a better experience, considering even the highest quality items as desirable.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

PET FOOD PRODUCTS MARKET DYNAMICS

Drivers: Switch from mass products to organic pet food products

According to the APPA, in the pet industry, the spending on pet food is around one-third of the total spending. In 2016, approximately USD 8.2 billion was spent on organic food products in the US. According to an article published in the UK on dog food, the volume of pet food sold has declined by 3%, whereas the value has increased by 2%, stressing that pet owners are moving toward organic and premium products. Also, there is a rising interest among the US pet owners for natural, locally sourced treats and chews, which has led to the increased sales of organic pet food ingredients. Additionally, an increase in obesity among pets has encouraged pet owners to demand organic, clean, and protein-rich food products.

A pet food study conducted in 2016 in the UK stated that almost half of the pet owners want to know the source of the ingredients used in the pet food they buy. These ingredients are prebiotics and fiber-rich food, which enhance digestion and mitigate joint pains. Transparent companies, for the source of the ingredients used, are expected to gain popularity during the forecast period. Pet food manufacturers harness this opportunity using oats, buckwheat, spelled, sorghum, and quinoa. As these ingredients are low in gluten but rich in fiber and protein and have a low glycemic index, they are most likely to benefit pets with diabetes and obesity. Farmina’s N&D Low Ancestral Grain product line and American Natural Premium’s new legume-free dog food are some examples of ancient grain pet food products.

Restraints: Non-uniformity of regulations hindering international trade

According to the Federal Food, Drug, and Cosmetic Act of 1938 (FFDCA), animal food is required to be safe for consumption and manufactured in sanitary conditions. The foods must not contain harmful substances and should have approximate labeling. The Food Safety Modernization Act of 2010 (FSMA) introduced guidelines related to certification, sterilization, hygiene, and labeling of ingredients for pet food manufacturers in the US. Government monitoring agencies in Europe and North America have strict regulations set for the animal feed industry compared to those in the Asia Pacific and South American regions. The regulations related to pet food ingredients, such as preservatives, ethoxyquin, and food dye, are different in various countries. Due to the lack of a universal regulatory structure, global trading becomes difficult. Huge investments are made in manufacturing pet food products. Different regulations lead to severe losses for manufacturers. It becomes expensive to update the technologies and facilities following the changing guidelines.

Pet food manufacturers must submit patent and approval applications to launch new products in different countries. Huge losses are incurred due to delays in receiving approvals from agencies, such as the European Patent Office and the Canadian Intellectual Property Office, which issue patents for new products. Establishing a universal governing body for the pet food ingredients sector will help smooth business operations worldwide.

Opportunities: Technological Innovations and Wide Industry Scope

The incorporation of cannabis substances extracted from cannabis, particularly cannabidiol (CBD), into pet food products is in a major position to be among the fastest-growing sectors of the pet food market. It is also worth mentioning that CBD can deal with various problems among pets, which are certainly the following: discomfort and inflammation of the joints or bones (osteoarthritis, etc.), anxiety, seizures, and skin diseases - dermal eczema, for example. The previous studies that all of the above points have been proved and the pet animals have been well-tolerated and at the same time, the effectiveness of the drug used in them was also managed as it was proven from the evidence reposited - the data is based on the studies - which could elevate the attractiveness of the pet food products that have this ingredient.

The global market for CBD pet products is quite large. The sales of CBD pet products in the US reached USD 113 million in 2020 and are estimated to be USD 563 million by 2025, growing as a result of a CAGR of 38.3% yearly, as reported by the American Veterinary Medical Association. It is also seen that the increased production of pet wellness products as well as the business-world possibilities of utilizing the developing outlook by rising trends the companies are ideal for both consumer and producer markets, respectively.

Challenges: Ingredient sourcing and supply chain disruptions.

The pet food industry is currently facing significant challenges related to ingredient sourcing and supply chain disruptions. According to the U.S. Department of Agriculture (USDA), fluctuations in the availability and cost of key ingredients, such as animal proteins and grains, have a profound impact on production costs and pricing. For instance, the USDA reported a 20% increase in the cost of certain grains from 2022 to 2023, which has directly affected pet food prices. This increase is a reflection of broader trends in the agricultural sector, where adverse weather conditions, supply chain bottlenecks, and rising demand for pet food have contributed to ingredient scarcity.

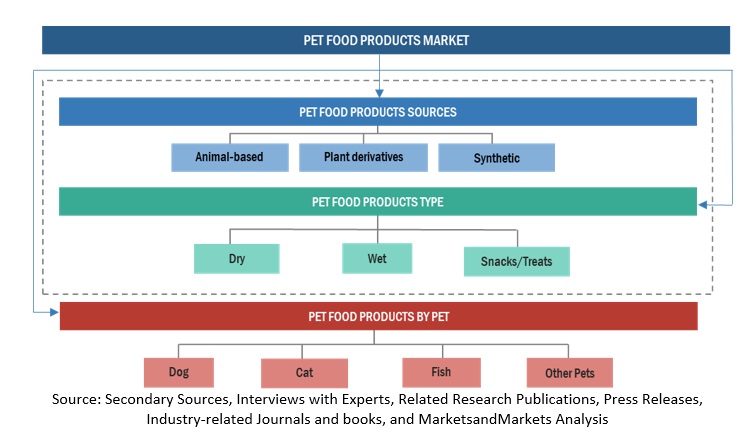

The Pet food products market ecosystem

Animal-based pet food products are projected to be the fastest-growing segment in the pet food products market during the forecast period.

As per the American Pet Products Association (APPA), 68% of pet owners put protein quality and source first, with animal-based products being their favorite. This tendency stands as a broader indication of premiumization, with consumers being ready to spend more on high-quality and health-centered products.

Animal proteins such as chicken, beef, and fish are considered the most digestible and with the most balanced amino acid profiles, which are vital for keeping muscle mass and characterized by high energy, respectively. The U.S. Food and Drug Administration (FDA) endorses this position, highlighting the nutritional advantages that animal-based proteins have. Moreover, the U.S. Department of Agriculture (USDA) confirms that an increasing number of consumers are making a switch to high-quality, protein-rich pet foods, which in turn is driving the market for these products. For instance, innovations in formulations, such as grain-free and freeze-dried options, are intensifying the growth. On the one hand, animal-based pet foods can meet the changing consumer demands for natural and premium diets, and thus, we should naturally anticipate their expansion.

Treats & snacks are projected to experience significant growth in the forecasted period

People consider their animals more and more than part of the family, so they are willing not only for food but, above all, for rewarding aspects or entertainment for them. Furthermore, there is the wellness and health focus, which in turn has bolstered consumer interest in treats that tout benefits related to goods such as immunity support, bone structure, or digestive well-being.

A survey by APPA in 2024 says owners love these dietary supplements with confectionery. The other treats are a change to an organic, grain-free ingredient treat that meets consumer needs for more natural and healthy alternatives. The FDA announced that ingredients in grain-free food, luxury items, and artisanal treats have surpassed those introduced in product lines. This has created the trend of premiumization even for snacks heavily powered by consumers who are willing to pay more when they want gourmet quality products.

The cat food is the fastest-growing segment in the Pet food products market during the forecast period

The percentage of cat ownership is increasing. According to the American Pet Products Association, nearly 42% of the households in the United States now own cats—a fact attributed to the trend of urbanization into smaller living spaces where cats are preferred over larger pets.

Moreover, this growth is also fueled by the premiumization trend in pet food. An increasing number of consumers are paying more for high-end cat food products that offer specialized benefits such as high-protein, grain-free, and health-oriented aspects. This has come as a result of increased awareness about the benefits of tailored nutrition for pets to manage some specific health problems such as obesity, renal, and allergy cases, among others.

Attention to health and well-being in cats has thereby driven the demand for specific diets addressing health issues, thus creating a rush of new formulations and ingredients to meet such demands. For example, Nestlé Purina offers Fancy Feast Gourmet Naturals (flavors)— food with the post of natural ingredients supplemented by nutrients for consumers who are health-conscious. Similarly, Hill's Pet Nutrition is growing the line with targeted Science Diet formulas for common health issues such as urinary health and weight management that have been drawing functional solution seekers to products specifically made for cats. Therefore, the cat food market is growing significantly as demand for such innovative products offering good health advantages and a premium feel to their animals will further entice consumers in this direction.

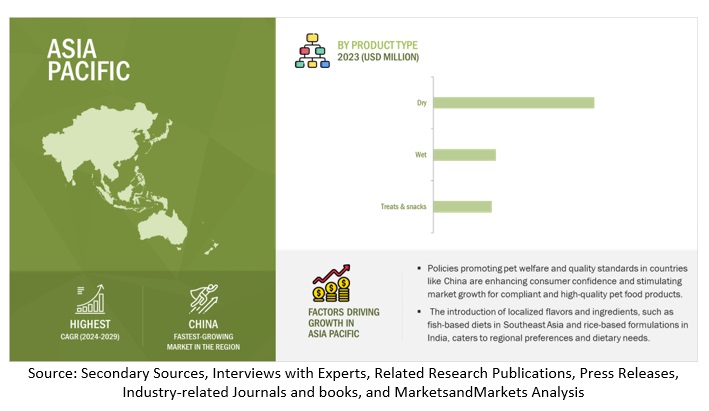

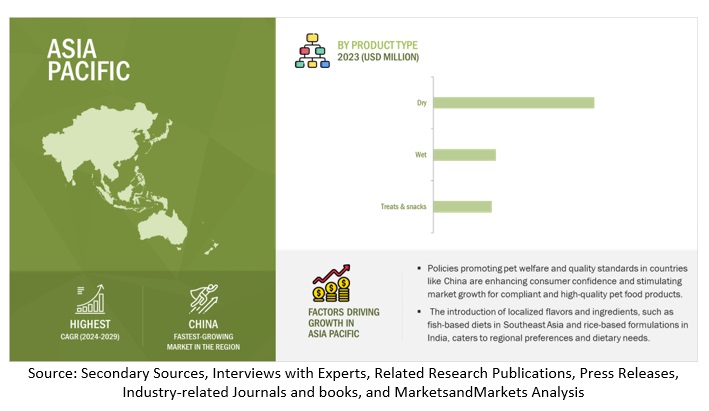

Asia Pacific is poised to experience the highest CAGR in the pet food products market during the forecast period.

The pet food market in China has grown significantly due to a change in government policy allowing for more than one child /family, and therefore, people are starting to keep pets. The growth in pet ownership has seen a double-digit increase each year within urban centers with demand for novel and innovative pet food products. In Japan, the Ministry of Internal Affairs and Communications revealed that nearly 28% of households have pets, with more elderly looking for companionship in their later lives. The rising number of seniors is creating a need for more senior pet diets.

In addition, accordingly to the Thai Pet Food Industry Association, there is a 12% increase in pet food sales in 2022 across Southeast Asia, helped by changes due to regional government regulations and policies on more control of quality. The growing e-commerce is allowing the residents to access premium and niche products easily — as pointed out by a 25% boost in online pet food sales tracked by Vietnam E-commerce and Digital Economy Agency, further driving the regional market growth.

Asia Pacific: Pet food products market SNAPSHOT

Key Market Players

Key players in this market include The J.M. Smucker Company (US), The Hartz Mountain Corporation (US), Nestlé Purina (US), Hill's Pet Nutrition Inc. (US), Mars, Incorporated (US), Blue Buffalo Company, Ltd. (US), Schell & Kampeter, Inc. (US), Tiernahrung Deuerer GmbH (Germany), Lafeber Company (US), 4Legs Pet Food Company (Australia).

Recent Developments

- In May 2024, Mars Incorporated announced a partnership with Tripadvisor, launching a co-branded digital hub to enhance pet-friendly travel experiences. This collaboration includes a new Pet-Friendly Hotel Travelers’ Choice Awards category and aims to connect pet parents with pet-friendly communities while encouraging businesses to accommodate pets. The partnership supports Mars' CESAR® brand’s commitment to making the world more dog-friendly and caters to the growing demand for pet-inclusive travel.

- In March 2024, Nestlé Purina PetCare officially opened its new 1.3-million-square-foot pet food factory in Eden, North Carolina. This USD 450 million facility, repurposing a former brewery, marks the company's first manufacturing site in the state and the 23rd in the US. The factory, designed as a "factory of the future," will employ over 300 people and operate as a zero-waste facility, supporting Purina's commitment to sustainability and innovation in pet care production.

- In February 2023, Nestlé Purina PetCare announced plans to acquire Red Collar Pet Foods' Miami, Oklahoma, treats factory from Arbor Investments. This acquisition, set to close in March, will enhance Purina's in-house production capabilities for dog and cat treats. It marks Purina's 22nd facility in North America, supporting its expansion and innovation efforts, including ongoing investments of over USD 2 billion in factory expansions and new constructions between 2020-2025

According to MarketsandMarkets, the global Pet food products market size is estimated to be valued at USD XXX.X billion in 2024 and is projected to reach USD XXX.X billion by 2029, recording a CAGR of X.X%.

Factors such as rising pet ownership, the tendency to humanize pets, putting more focus on pet health, and the ever-growing pet food market are the ideas that drive the pet food market. The American Pet Products Association (APPA) reported that last year, in 2021, 70% of households in the US had pets, showing a greater increase in pet food demand. With the humanization movement that pets are not just animals but members of the family, consumers are compelled to look for health and quality-driven products that are in line with the trend of human food, like organic and non-GMO.

The USDA has reported a significant rise in the premium pet food section; thus, many consumers have embraced and funded it. Also, the role of the FDA in the regulation of food safety and food quality standards has encouraged the trust and spending of consumers. The rapid development of online retailing has significantly enhanced the growth of the pet food market, a fact that has been underlined by the US Census Bureau in their data on the increment in online pet food sales. Finally, the global growth of the market, especially in developing countries, has also led to general growth, as the International Trade Administration reported. These factors, laying on the foundation of both the government and the industry databases, are responsible for the aggressive expansion of the pet food market.

Pet owners are more willing to spend extra money on pet foods that offer a special product, such as grain-free, organic, and high-protein diet options. The main reason behind this tendency is the growing level of awareness about pets’ health and wellness. Pet owners assume that these products are healthier rather than vice versa in most cases; therefore, they see them as a good fit for their pets, typically as health and wellness developments in human beings. The improvement in making pet food, like adding functional ingredients aimed at solving diseases through feeding and novel packaging sustainability and portion control, is capturing many consumers. These brands not only fulfill the fewer quality claims but also support the process of feeding more simply while giving convenience and the wish to parent a better experience, considering even the highest quality items as desirable.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

PET FOOD PRODUCTS MARKET DYNAMICS

Drivers: Switch from mass products to organic pet food products

According to the APPA, in the pet industry, the spending on pet food is around one-third of the total spending. In 2016, approximately USD 8.2 billion was spent on organic food products in the US. According to an article published in the UK on dog food, the volume of pet food sold has declined by 3%, whereas the value has increased by 2%, stressing that pet owners are moving toward organic and premium products. Also, there is a rising interest among the US pet owners for natural, locally sourced treats and chews, which has led to the increased sales of organic pet food ingredients. Additionally, an increase in obesity among pets has encouraged pet owners to demand organic, clean, and protein-rich food products.

A pet food study conducted in 2016 in the UK stated that almost half of the pet owners want to know the source of the ingredients used in the pet food they buy. These ingredients are prebiotics and fiber-rich food, which enhance digestion and mitigate joint pains. Transparent companies, for the source of the ingredients used, are expected to gain popularity during the forecast period. Pet food manufacturers harness this opportunity using oats, buckwheat, spelled, sorghum, and quinoa. As these ingredients are low in gluten but rich in fiber and protein and have a low glycemic index, they are most likely to benefit pets with diabetes and obesity. Farmina’s N&D Low Ancestral Grain product line and American Natural Premium’s new legume-free dog food are some examples of ancient grain pet food products.

Restraints: Non-uniformity of regulations hindering international trade

According to the Federal Food, Drug, and Cosmetic Act of 1938 (FFDCA), animal food is required to be safe for consumption and manufactured in sanitary conditions. The foods must not contain harmful substances and should have approximate labeling. The Food Safety Modernization Act of 2010 (FSMA) introduced guidelines related to certification, sterilization, hygiene, and labeling of ingredients for pet food manufacturers in the US. Government monitoring agencies in Europe and North America have strict regulations set for the animal feed industry compared to those in the Asia Pacific and South American regions. The regulations related to pet food ingredients, such as preservatives, ethoxyquin, and food dye, are different in various countries. Due to the lack of a universal regulatory structure, global trading becomes difficult. Huge investments are made in manufacturing pet food products. Different regulations lead to severe losses for manufacturers. It becomes expensive to update the technologies and facilities following the changing guidelines.

Pet food manufacturers must submit patent and approval applications to launch new products in different countries. Huge losses are incurred due to delays in receiving approvals from agencies, such as the European Patent Office and the Canadian Intellectual Property Office, which issue patents for new products. Establishing a universal governing body for the pet food ingredients sector will help smooth business operations worldwide.

Opportunities: Technological Innovations and Wide Industry Scope

The incorporation of cannabis substances extracted from cannabis, particularly cannabidiol (CBD), into pet food products is in a major position to be among the fastest-growing sectors of the pet food market. It is also worth mentioning that CBD can deal with various problems among pets, which are certainly the following: discomfort and inflammation of the joints or bones (osteoarthritis, etc.), anxiety, seizures, and skin diseases - dermal eczema, for example. The previous studies that all of the above points have been proved and the pet animals have been well-tolerated and at the same time, the effectiveness of the drug used in them was also managed as it was proven from the evidence reposited - the data is based on the studies - which could elevate the attractiveness of the pet food products that have this ingredient.

The global market for CBD pet products is quite large. The sales of CBD pet products in the US reached USD 113 million in 2020 and are estimated to be USD 563 million by 2025, growing as a result of a CAGR of 38.3% yearly, as reported by the American Veterinary Medical Association. It is also seen that the increased production of pet wellness products as well as the business-world possibilities of utilizing the developing outlook by rising trends the companies are ideal for both consumer and producer markets, respectively.

Challenges: Ingredient sourcing and supply chain disruptions.

The pet food industry is currently facing significant challenges related to ingredient sourcing and supply chain disruptions. According to the U.S. Department of Agriculture (USDA), fluctuations in the availability and cost of key ingredients, such as animal proteins and grains, have a profound impact on production costs and pricing. For instance, the USDA reported a 20% increase in the cost of certain grains from 2022 to 2023, which has directly affected pet food prices. This increase is a reflection of broader trends in the agricultural sector, where adverse weather conditions, supply chain bottlenecks, and rising demand for pet food have contributed to ingredient scarcity.

The Pet food products market ecosystem

Animal-based pet food products are projected to be the fastest-growing segment in the pet food products market during the forecast period.

As per the American Pet Products Association (APPA), 68% of pet owners put protein quality and source first, with animal-based products being their favorite. This tendency stands as a broader indication of premiumization, with consumers being ready to spend more on high-quality and health-centered products.

Animal proteins such as chicken, beef, and fish are considered the most digestible and with the most balanced amino acid profiles, which are vital for keeping muscle mass and characterized by high energy, respectively. The U.S. Food and Drug Administration (FDA) endorses this position, highlighting the nutritional advantages that animal-based proteins have. Moreover, the U.S. Department of Agriculture (USDA) confirms that an increasing number of consumers are making a switch to high-quality, protein-rich pet foods, which in turn is driving the market for these products. For instance, innovations in formulations, such as grain-free and freeze-dried options, are intensifying the growth. On the one hand, animal-based pet foods can meet the changing consumer demands for natural and premium diets, and thus, we should naturally anticipate their expansion.

Treats & snacks are projected to experience significant growth in the forecasted period

People consider their animals more and more than part of the family, so they are willing not only for food but, above all, for rewarding aspects or entertainment for them. Furthermore, there is the wellness and health focus, which in turn has bolstered consumer interest in treats that tout benefits related to goods such as immunity support, bone structure, or digestive well-being.

A survey by APPA in 2024 says owners love these dietary supplements with confectionery. The other treats are a change to an organic, grain-free ingredient treat that meets consumer needs for more natural and healthy alternatives. The FDA announced that ingredients in grain-free food, luxury items, and artisanal treats have surpassed those introduced in product lines. This has created the trend of premiumization even for snacks heavily powered by consumers who are willing to pay more when they want gourmet quality products.

The cat food is the fastest-growing segment in the Pet food products market during the forecast period

The percentage of cat ownership is increasing. According to the American Pet Products Association, nearly 42% of the households in the United States now own cats—a fact attributed to the trend of urbanization into smaller living spaces where cats are preferred over larger pets.

Moreover, this growth is also fueled by the premiumization trend in pet food. An increasing number of consumers are paying more for high-end cat food products that offer specialized benefits such as high-protein, grain-free, and health-oriented aspects. This has come as a result of increased awareness about the benefits of tailored nutrition for pets to manage some specific health problems such as obesity, renal, and allergy cases, among others.

Attention to health and well-being in cats has thereby driven the demand for specific diets addressing health issues, thus creating a rush of new formulations and ingredients to meet such demands. For example, Nestlé Purina offers Fancy Feast Gourmet Naturals (flavors)— food with the post of natural ingredients supplemented by nutrients for consumers who are health-conscious. Similarly, Hill's Pet Nutrition is growing the line with targeted Science Diet formulas for common health issues such as urinary health and weight management that have been drawing functional solution seekers to products specifically made for cats. Therefore, the cat food market is growing significantly as demand for such innovative products offering good health advantages and a premium feel to their animals will further entice consumers in this direction.

Asia Pacific is poised to experience the highest CAGR in the pet food products market during the forecast period.

The pet food market in China has grown significantly due to a change in government policy allowing for more than one child /family, and therefore, people are starting to keep pets. The growth in pet ownership has seen a double-digit increase each year within urban centers with demand for novel and innovative pet food products. In Japan, the Ministry of Internal Affairs and Communications revealed that nearly 28% of households have pets, with more elderly looking for companionship in their later lives. The rising number of seniors is creating a need for more senior pet diets.

In addition, accordingly to the Thai Pet Food Industry Association, there is a 12% increase in pet food sales in 2022 across Southeast Asia, helped by changes due to regional government regulations and policies on more control of quality. The growing e-commerce is allowing the residents to access premium and niche products easily — as pointed out by a 25% boost in online pet food sales tracked by Vietnam E-commerce and Digital Economy Agency, further driving the regional market growth.

Asia Pacific: Pet food products market SNAPSHOT

Key Market Players

Key players in this market include The J.M. Smucker Company (US), The Hartz Mountain Corporation (US), Nestlé Purina (US), Hill's Pet Nutrition Inc. (US), Mars, Incorporated (US), Blue Buffalo Company, Ltd. (US), Schell & Kampeter, Inc. (US), Tiernahrung Deuerer GmbH (Germany), Lafeber Company (US), 4Legs Pet Food Company (Australia).

Recent Developments

- In May 2024, Mars Incorporated announced a partnership with Tripadvisor, launching a co-branded digital hub to enhance pet-friendly travel experiences. This collaboration includes a new Pet-Friendly Hotel Travelers’ Choice Awards category and aims to connect pet parents with pet-friendly communities while encouraging businesses to accommodate pets. The partnership supports Mars' CESAR® brand’s commitment to making the world more dog-friendly and caters to the growing demand for pet-inclusive travel.

- In March 2024, Nestlé Purina PetCare officially opened its new 1.3-million-square-foot pet food factory in Eden, North Carolina. This USD 450 million facility, repurposing a former brewery, marks the company's first manufacturing site in the state and the 23rd in the US. The factory, designed as a "factory of the future," will employ over 300 people and operate as a zero-waste facility, supporting Purina's commitment to sustainability and innovation in pet care production.

- In February 2023, Nestlé Purina PetCare announced plans to acquire Red Collar Pet Foods' Miami, Oklahoma, treats factory from Arbor Investments. This acquisition, set to close in March, will enhance Purina's in-house production capabilities for dog and cat treats. It marks Purina's 22nd facility in North America, supporting its expansion and innovation efforts, including ongoing investments of over USD 2 billion in factory expansions and new constructions between 2020-2025

Frequently Asked Questions (FAQ):

What are the key product types considered in the study for pet food products, and which segments within European pet food products type are projected to experience promising growth?

The study focuses on three major product types: Dry, Wet, Treats & Snacks. Within the European pet food products type, the subsegment Dry emerges as the dominant category, showcasing promising growth potential in the projected market trends.

Is there customizable information available specific to the European pet food products market, and if so, what details are provided?

Yes, Certainly, customization options are available for the European pet food products market across different segments, encompassing market size, dynamics, forecasts, competitive landscape, and company profiles. Exclusive insights will be offered for the specified the European countries below:

- Germany

- France

- UK

- Spain

- Netherlands

What are the key trends driving the growth of the global pet food market?

The global pet food market is primarily driven by the growing pet ownership, the humanization of pets, and increasing consumer awareness of pet nutrition. There is a strong trend towards premiumization, with consumers preferring high-quality, natural, and organic ingredients. The demand for functional pet foods that offer health benefits like joint support, skincare, and digestive health is also on the rise.

Among the regions studied, which one is anticipated to exhibit the CAGR for the pet food products market?

Pacific is the fastest-growing market for pet food products due to the increasing pet ownership due to societal changes, such as China's relaxation of the one-child policy, which has resulted in more families adopting pets. In Japan, the aging population is leading to a rise in pet ownership among elderly citizens seeking companionship. Additionally, government initiatives in countries like Thailand are improving pet food standards, while the rise of e-commerce across the region is making premium and niche products more accessible to a broader audience.

How is the competitive landscape structured in the pet food products market?

Leading companies in the global pet food market include Nestlé Purina, Mars Petcare, Hill's Pet Nutrition, and Royal Canin. These companies are innovating through the introduction of new flavors, textures, and functional ingredients. They are also focusing on sustainability initiatives, such as eco-friendly packaging and sourcing sustainable ingredients. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Growth opportunities and latent adjacency in Pet Food Products Market