Pest Control Market by Control Method (Chemical, Mechanical, Biological, Software & Services), Pest Type (Insects, Rodents, Termites, Wildlife), Mode of Application (Sprays, Traps, Baits, Pellets, Powder), Application and Region - Global Forecast to 2028

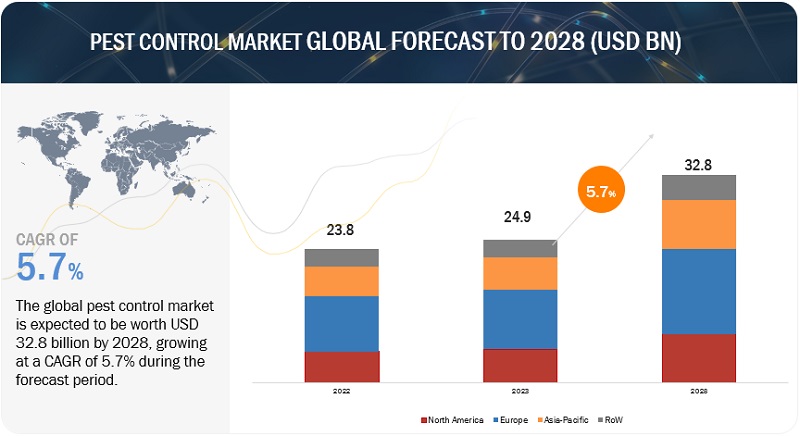

The global pest control market is projected to reach $32.8 billion by 2028 from an estimated $24.9 billion in 2023, at a CAGR of 5.7% during the forecast period in terms of value. Several important factors are augmenting the demand for pest control products and services on a global scale. Increasing awareness of the health risks posed by pests and the diseases they can transmit is driving individuals and businesses to prioritize pest prevention and control. This heightened concern for health and hygiene fuels the demand for pest control services. Moreover, advancements in pest control technologies and methods have improved the efficacy, precision, and sustainability of treatments, making them more appealing to consumers.

To know about the assumptions considered for the study, Request for Free Sample Report

To know about the assumptions considered for the study, download the pdf brochure

Market Dynamics

Driver: Impact of climate change on pest proliferation

Changing climatic patterns could influence pest distribution, behaviors, and population dynamics. As pests adapt to new conditions, they can become more challenging to control, intensifying the demand for effective pest management. The change in climate conditions is a significant factor that has contributed to the growth of the insect pest control market. This is attributed to global warming, which leads to changes in the population dynamics of insects and their ecosystems, as they are found prominently in warmer climates. According to an article published by FAO in 2021, a new research study states that plant pests that decimate economically significant crops are becoming more destructive as a result of the effects of climate change, posing a rising threat to food security and the environment. FAO also states that annually up to 40% of global crop production is lost because of pests and each year plant diseases cost the global economy over USD 220 billion, and the cost due to invasive insects is estimated to be at least USD70 billion. Therefore, in order to mitigate the impact of these pests on plants and human health proper pest management should be in place.

Restraint: High registration costs and interminable time for product approval

Strict and rigorous regulatory requirements in the environmental protection sector are applicable to the pest control manufacturers’ production processes and their production environments. Furthermore, these vary with the policies of each country. According to an article published by Royal Society of Chemistry in 2021, Martin Clough, the head of technology and digital integration at agrochemicals company Syngenta, stated that, it takes nearly 10 years and approximately USD 200 for the development of a new pesticide, and the development also involves stringent guidelines, massive costs, and slow-paced processes. Therefore, these factors pose as a challenge to the growth of the pest control industry.

In India, the pesticide regulations are majorly governed by two different bodies, that includes the Central Insecticides Board and Registration Committee (CIBRC) and the Food Safety and Standards Authority of India (FSSAI). Although these regulatory bodies are setup to regulate the use of pest control products, but process of complying with pesticide regulations, such as conducting safety studies, obtaining approvals, and maintaining compliance, are expensive. These costs are often borne by pesticide manufacturers, which can lead to higher prices for consumers and potential financial strain on smaller companies.

Opportunity: Emergence of biological pest control solutions

The use of biological insecticides has relatively few or no side effects on human health, is gaining high acceptance among pest service providers. Major factors impacting the market growth include the change in regulations and the development of resistance among pest organisms. The ban on neonicotinoid pesticide use in Europe is an example of the acceptance of biological control solutions as compared to chemicals. Various companies are also focusing on introducing biological method of pest control in the market. For instance, in 2022, FMC Corporation acquired BioPhero, a Denmark-based pheromone research and production company. This acquisition enabled FMC to introduce biologically produced pheromone insect control technology in the pest control market, thereby expanding its product portfolio and strengthen its position as one of the leading players in the pest control market. These initiatives by the companies helps in boosting the biological pest control solution market, since these solutions offer multiple benefits to the pest control industry, ranging from environmental sustainability and reduced chemical use to improved long-term pest management strategies.

Challenge: Growth in pest resistance against chemical compounds

Growing pesticide resistance is a serious issue that could potentially impede the expansion of the pest management sector. Pesticide resistance occurs when pests develop the ability to withstand the effects of commonly used pesticides, rendering these treatments ineffective over time. As pests evolve and adapt to chemical interventions, the effectiveness of traditional pest control methods diminishes, leading to decreased control over infestations. This not only undermines the efficacy of pest management efforts but also necessitates the development of new, more potent, and often more expensive pesticide formulations. The usage of plant-derived chemicals, the adoption of integrated pest management practices, and availing the services of pest management professionals can lower the risks of insecticide resistance.

Key Highlights the Pest Control Market

The pest control market has seen significant growth and evolution in recent years, driven by various factors. Here are some key highlights of the pest control market:

- Pest Control Market Growth: The pest control industry has experienced steady growth due to increasing awareness of pest-related health and property risks. This growth is expected to continue in the coming years.

- Urbanization: Rapid urbanization has led to more conducive environments for pests. As urban areas expand, the demand for pest control services has risen, particularly in densely populated cities.

- Regulatory Changes: Stricter regulations related to pesticide use and environmental concerns have led to the development of more eco-friendly and sustainable pest control methods and products.

- Technological Advancements: Pest control companies are adopting advanced technologies such as IoT (Internet of Things), data analytics, and remote monitoring to improve their services and efficiency.

- Integrated Pest Management (IPM): IPM approaches, which focus on prevention and long-term solutions rather than solely relying on chemicals, are gaining popularity. This trend aligns with the demand for more sustainable pest control practices.

- Residential and Commercial Sectors: Pest control services are in demand not only in residential properties but also in commercial and industrial settings. Businesses are increasingly recognizing the importance of pest management for maintaining hygiene and protecting their brand reputation.

- Eco-Friendly Products: There's a growing demand for natural and organic pest control products, reflecting the broader trend towards environmentally friendly solutions.

Pest Control Market Ecosystem

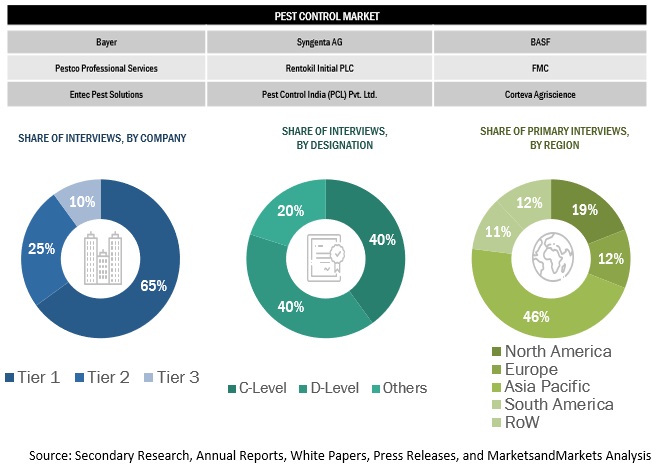

Leading companies in this market include well-established, financially stable manufacturers of pest control products and service providers. These companies have been operating in the market for several years and possess a diversified service portfolio, state-of-the-art laboratory & technologies, and strong global sales and marketing networks. Prominent companies in this market include Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Rentokil Initial plc (UK), Anticimex (Sweden), Rollins, Inc. (US), ATGC Biotech Pvt Ltd. (India), Ecolab Inc. (US), FMC Corporation (US), De Sangosse (France), Bell Laboratories (US), PelGar International (UK), and Fort Products Limited (UK).

Within the application segment, residential application is projected to have the highest market rate during the forecast period.

Pest control products for residential use are essential in maintaining a safe and comfortable living environment for homeowners. These products are designed to address common household pests, including insects like ants, cockroaches, spiders, and termites, as well as rodents like mice and rats. Residential pest control products come in various forms, such as sprays, baits, traps, and repellents, providing homeowners with a range of options to suit their specific needs and preferences. They are typically formulated to be effective yet safe for use around humans and pets when applied according to the instructions. Therefore, such factors contribute to the growth of the market and residential category being the fastest growing segment in application segment, it is expected to propel the market growth further.

Within the mode of application segment, sprays are predicted to have the largest market value during the forecast period.

Sprays are utilized for the application of pest control in specified amounts to different surfaces and areas. Spraying allows for a widespread and even distribution of pest control products, reaching areas that might be difficult to access through other methods. This method is particularly useful for both indoor and outdoor applications, making it suitable for a wide range of pest control scenarios. Additionally, advancements in spray technology have led to the development of more targeted and eco-friendly formulations that minimize the impact on non-target species and the environment.

Within the pest type segment, insects are anticipated to have leading market share during the forecast period.

The demand for pest control against insect pests is steadily increasing due to a combination of factors that highlight the urgent need for effective management. Insect pests pose a significant threat to public health and property, compelling individuals, businesses, and governments to seek professional pest control solutions. As global populations expand, urbanization intensifies, and climate conditions change, the conducive environments for insect infestations multiply. Additionally, the fact that insects can carry diseases, such as the Zika virus or malaria, highlights how crucial it is to keep their populations under control in order to safeguard the public's health. The need for pest control strategies that specifically target these pests is growing as a result of these issues and increased awareness of the negative effects insect pests have on the economy, human health, and the environment.

Within the control method segment, chemical is projected to have biggest market value during the forecast period.

Chemical control is based on substances that are toxic or poisonous to pests. Chemical pesticides are used to control pests and diseases caused due to pests. The use of chemical pesticides is widespread due to their relatively low cost, the simplicity of application, and their effectiveness, availability, and stability. Chemical pest control systems have been widely used to combat pest problems effectively. Some chemical pesticides offer broad-spectrum control, effectively managing multiple pest species simultaneously. This can be particularly advantageous in situations with diverse pest populations. These are some of the factors that are driving the demand of chemical control method in the pest control market.

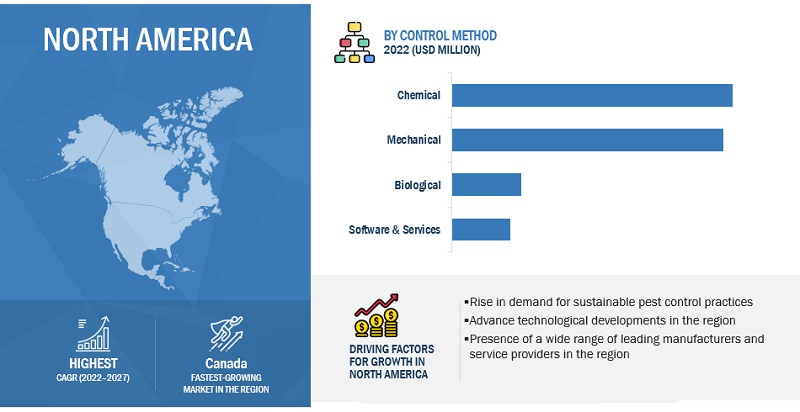

North America is expected to have the largest market share during the forecast period.

The market for pest control is growing in North America owing to the widening scope of applications in not only residential or commercial but also in livestock and for industrial purposes, such as in the food and pharmaceutical industries. The pest control market in North America is experiencing notable growth owing to a convergence of factors. Moreover, there are numerous companies in North America providing pest control products and services. Apart from major players, there are many local players in the market. The presence of numerous pest control companies in the region also indicates that there is high demand for the pest control management. Stringent regulations in industries such as food safety and hospitality further bolster the market's expansion. Innovations in pest control technologies, including eco-friendly solutions and integrated approaches, enhance efficacy and appeal to environmentally conscious consumers.

North America is Expected to Have Market Value During the Forecast Period

Key Market Players

The key players in this include Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Rentokil Initial plc (UK), Anticimex (Sweden), Rollins, Inc. (US), ATGC Biotech Pvt Ltd. (India), Ecolab Inc. (US), FMC Corporation (US), De Sangosse (France), Bell Laboratories (US), PelGar International (UK), and Fort Products Limited (UK). Companies are emphasizing on expanding their production facilities by entering into partnerships and agreements as well as by launching new products to grow their businesses and their market shares. New product launches because of extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the pest control market.

Scope of the Report

|

Report Metric |

Details |

|

Market size value in 2023 |

USD 24.9 billion |

|

Revenue forecast in 2028 |

USD 32.8 billion |

|

Growth Rate |

CAGR of 5.7% from 2023 to 2028 |

|

Market size available for years |

2018–2028 |

|

Base year considered |

2022 |

|

Pest Control Market Forecast period |

2023–2028 |

|

Forecast units |

Value (USD) |

|

Segments Covered |

Pest Type, Application, Mode of Application,Control Type, and Region. |

|

Regions covered |

North America, Europe, Asia Pacific, South America, and RoW |

|

Companies covered |

|

|

Pest Control Market Drivers |

|

This research report categorizes the pest control market based on pest type, application, mode of application,control type, and region.

Based on application, the market has been segmented as follows:

- Residential

- Commercial

- Industrial

- Livestock

- Other applications

Based on the mode of application, the market has been segmented as follows:

- Powder

- Sprays

- Pellets

- Traps

- Baits

Based on the control method, the market has been segmented as follows:

-

Chemical

- Insecticides

- Rodenticides

- Other chemicals2

-

Biological

- Microbials

- Plant extracts

- Predatory insects

-

Mechanical

-

Traps

- Light traps

- Adhesive traps

- Malaise traps

- UV radiation devices

- Mesh screens

- Ultrasonic vibrations

-

Traps

- Software & services

Based on the pest type, the market has been segmented as follows:

- Insects

- Termites

- Rodents

- Wildlife

- Other pest types1

Based on the region, the market has been segmented as follows:

- North America

- Europe

- Asia Pacific

- South America

- RoW (the Middle East & South Africa)

Recent Developments

- In June 2023, Bayer AG’s agricultural division Bayer CropScience partnered with Crystal Crop Protection Ltd. to develop and launch groundbreaking solutions for pest control that are aimed at benefiting paddy growers across India. This partnership indicates a critical turning point in the quest to improve rice farmer yields and crop protection techniques in India.

- In June 2023, Corteva Agriscience opened a combined crop protection and seed research laboratory in Eschbach, Germany. This research centre would help the company in driving innovation and deliver sustainable solutions for farmers. The expansion would also enable the company to conduct state-of-the-art crop protection studies to help develop solutions which protect crops from pests and diseases, thus boosting the pest control market.

- In April 2023, Rollins, Inc. acquired Fox Pest Control through its own brand, HomeTeam Pest Defense. The acquisition is expected to augment Rollins long term growth strategy in new geographies across the US market.

- In September 2022, Syngenta Crop Protection collaborated with a Swiss agricultural startup, Gamaya SA, for the development and launch of a digital tool to detect harmful nematodes through satellite images. This is a commercial digital diagnosis and mapping solution for harmful nematode pests.

Frequently Asked Questions (FAQ):

Which are the major companies in the pest control market? What are their major strategies to strengthen their market presence?

The key players in this include Bayer AG (Germany), Corteva Agriscience (US), BASF SE (Germany), Sumitomo Chemical Co. Ltd. (Japan), Syngenta AG (Switzerland), Rentokil Initial plc (UK), Anticimex (Sweden), Rollins, Inc. (US), ATGC Biotech Pvt Ltd. (India), Ecolab Inc. (US), FMC Corporation (US), De Sangosse (France), Bell Laboratories (US), PelGar International (UK), and Fort Products Limited (UK). Companies are focusing on expanding their production facilities by entering into collaborations and partnerships as well as by launching new products to expand their businesses and increase consumer base across various geographical areas. New product launches due to extensive research & development (R&D) initiatives, geographical expansion to tap the potential of emerging economies, and strategic acquisitions to gain a foothold over the large extent of the supply chain are the key strategies adopted by companies in the pest control market.

What are the drivers and opportunities for the pest control market?

Increase in instances of vector-borne disease outbreaks to encourage public health initiatives, impact of climate change on pest proliferation, and rising adoption of digital applications and technology are some of the major drivers. The upcoming opportunities include increasing usage of Artificial Intelligence (AI) in pest control.

Which region is expected to hold the highest market share?

The market in North America will dominate the market share in 2023, showcasing strong demand for pest control products and service in the region. Over the predicted period, it is anticipated that the regional market continues to be the largest market. This can be linked to the rising awareness regarding the health risks associated with pests drives both residential and commercial property owners to seek effective pest control measures. Furthermore, the prevalence of invasive species, climate fluctuations, and a desire for well-maintained properties contribute to the growing need for pest control services in North America, underscoring the sustained upward trajectory of the market.

Which are the key technology trends prevailing in the pest control market?

The pest control industry is experiencing technological innovations as companies engaged in the pest control market are offering faster and more accurate technologies such as CRISPR. CRISPR (clustered regularly interspaced short palindromic repeats) technology is a gene-editing tool used to alter key genes that regulate the fertility and sex determination of pests. This technology is safe, self-limiting, and scalable for the genetic population of a specific species. Some of the advantages of the CRISPR technology includes precision targeting of pest species, reduction in environmental impact, reduced resistance development in pests, and many more. Companies such as Bayer, Dupont, and Monsanto have signed license agreements with biotech companies for the use of CRISPR in their pest control products.

What is the total CAGR expected to be recorded for the pest control market during 2023-2028?

The CAGR is expected to record a CAGR of 5.7% from 2023-2028.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

- 5.1 INTRODUCTION

-

5.2 MACROECONOMIC INDICATORSINCREASING POPULATION DENSITYEFFECTS OF RAPID URBANIZATION ON PEST POPULATIONGROWTH OPPORTUNITIES IN DEVELOPING REGIONS SUCH AS ASIA PACIFIC AND SOUTH AMERICA

-

5.3 MARKET DYNAMICSDRIVERS- Increasing instances of vector-borne disease outbreaks to encourage public health initiatives- Impact of climate change on pest proliferation- Rising adoption of digital applications and technologyRESTRAINTS- High registration costs and interminable time for product approvalOPPORTUNITIES- Emergence of biological pest control solutions- Increasing usage of Artificial Intelligence (AI) in pest controlCHALLENGES- Growth in pest resistance against chemical compounds

- 6.1 INTRODUCTION

-

6.2 SUPPLY CHAIN ANALYSISPEST CONTROL MANUFACTURERSRESEARCH & TESTINGMANUFACTURINGPACKAGINGDISTRIBUTION, MARKETING, AND SALESPEST CONTROL SOFTWARE & SERVICE PROVIDERSRESEARCH & DEVELOPMENT OF PRODUCTRAW MATERIALS & MANUFACTURINGASSEMBLY

-

6.3 TECHNOLOGY ANALYSISINTERNET OF THINGS (IOT)CRISPRARTIFICIAL INTELLIGENCE (AI)

- 6.4 IOT ADOPTION IN ASIA PACIFIC

- 6.5 BUYING BEHAVIOR ON SOCIAL MEDIA OF SMALL- AND MEDIUM-SIZED PEST CONTROL COMPANIES IN ASIA PACIFIC

- 6.6 AVERAGE SELLING PRICE TREND

-

6.7 ECOSYSTEM ANALYSISMANUFACTURERSSOFTWARE & SERVICE PROVIDERSEND USER COMPANIESVALUE-ADDED SERVICE PROVIDERS

-

6.8 TRENDS/DISRUPTIONS IMPACTING BUYERS

-

6.9 PORTER’S FIVE FORCES ANALYSISPEST CONTROL MARKET: PORTER’S FIVE FORCES ANALYSISTHREAT OF NEW ENTRANTSTHREAT OF SUBSTITUTESBARGAINING POWER OF SUPPLIERSBARGAINING POWER OF BUYERSINTENSITY OF COMPETITIVE RIVALRY

-

6.10 PATENT ANALYSIS

-

6.11 CASE STUDY ANALYSISUSE CASE 1: ANTICIMEX’S IOT SOLUTION HELPED CREATE DIGITAL CONNECTED TRAPSUSE CASE 2: RENTOKIL USED IOT SOLUTIONS TO INCREASE ITS CUSTOMER BASE AND IMPROVE CUSTOMER RETENTION

-

6.12 REGULATORY FRAMEWORKNORTH AMERICA- US- CanadaEUROPE- Confederation of Europe Pest Management Association (CEPA)- European Food Safety Authority (EFSA)- European Committee for Standardization (CEN)- Biocidal Product Regulation (BPR)- Commission Implementing Regulation (EU) 2017/1376- UKASIA PACIFIC- India- China- AustraliaSOUTH AMERICA- Brazil- ArgentinaREST OF WORLD- South Africa- UAE

- 7.1 INTRODUCTION

-

7.2 COMMERCIALSTRONG GOVERNMENT REGULATIONS AND HYGIENE REQUIREMENTS TO DRIVE MARKET

-

7.3 RESIDENTIALRISING CONSUMER AWARENESS AND URBAN LIFESTYLE TO CONTRIBUTE TO PROPEL MARKET

-

7.4 LIVESTOCKNEED FOR PRECAUTIONARY MEASURES TO PREVENT DISEASES TO STRENGTHEN MARKET

-

7.5 INDUSTRIALADOPTION OF REGIONAL LAWS PERTAINING TO HYGIENIC WORK ENVIRONMENT TO DRIVE MARKET EXPANSION

- 7.6 OTHER APPLICATIONS

- 8.1 INTRODUCTION

-

8.2 POWDERINCREASED DEMAND FOR POWDER APPLICATIONS TO DRIVE MARKET

-

8.3 SPRAYSHIGH DEMAND FOR LIQUID FORMULATIONS TO PROPEL GROWTH IN SPRAY APPLICATIONS

-

8.4 PELLETSINCREASING USE OF PELLETS IN URBAN AREAS FOR WILDLIFE CONTROL TO BOOST MARKET

-

8.5 TRAPSDEVELOPMENTS IN TECHNOLOGY AND CONNECTED SOLUTIONS TO FOSTER GROWTH

-

8.6 BAITSFOSTERING INCIDENCES OF RODENT AND TERMITE CONTROL TO DRIVE DEMAND

- 9.1 INTRODUCTION

-

9.2 INSECTSCLIMATE CHANGE AND INCREASED URBANIZATION TO BOLSTER GROWTH

-

9.3 RODENTSLACK OF HYGIENE AND WASTE MANAGEMENT ISSUES TO INCREASE RODENT POPULATION IN URBAN AREAS

-

9.4 TERMITESADOPTION OF NEW TECHNOLOGIES TO BOLSTER GROWTH IN TERMITE CONTROL SOLUTIONS

-

9.5 WILDLIFEINCREASED SUBURBAN ACTIVITY AND WILDLIFE HABITAT DESTRUCTION TO LEAD TO INCREASED DEMAND FOR WILDLIFE PEST CONTROL

- 9.6 OTHER PEST TYPES

- 10.1 INTRODUCTION

-

10.2 CHEMICALINCREASING PEST-CAUSING DISEASES TO DRIVE DEMAND FOR CHEMICAL CONTROL METHODSINSECTICIDESRODENTICIDESOTHER CHEMICALS

-

10.3 MECHANICALDEMAND FOR ADVANCED MECHANICAL CONTROL METHODS TO PREVENT PEST-CAUSING DISEASES TO SPUR MARKETTRAPPING- Light traps- Adhesive traps- Malaise trapsMESH SCREENSULTRASONIC VIBRATIONS

-

10.4 BIOLOGICALNEED FOR BIOLOGICAL CONTROL METHODS TO PREVENT PEST-CAUSING DISEASES TO DRIVE MARKETMICROBIALSPLANT EXTRACTSPREDATORY INSECTS

-

10.5 SOFTWARE & SERVICESINCREASING TECHNOLOGICAL ADVANCEMENTS IN SOFTWARE & SERVICES TO DRIVE GROWTH

- 11.1 INTRODUCTION

-

11.2 NORTH AMERICANORTH AMERICA: RECESSION IMPACT ANALYSIS- US- Canada- Mexico

-

11.3 EUROPEEUROPE: RECESSION IMPACT ANALYSIS- Germany- France- UK- Spain- Italy- Rest of Europe

-

11.4 ASIA PACIFICASIA PACIFIC: RECESSION IMPACT ANALYSIS- China- India- Australia- Japan- Rest of Asia Pacific

-

11.5 SOUTH AMERICASOUTH AMERICA: RECESSION IMPACT ANALYSIS- Brazil- Argentina- Rest of South America

-

11.6 REST OF WORLD (ROW)ROW: RECESSION IMPACT ANALYSIS- Middle East- Africa

- 12.1 OVERVIEW

- 12.2 MARKET SHARE ANALYSIS, 2022

- 12.3 KEY PLAYER STRATEGIES

- 12.4 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS

-

12.5 COMPANY EVALUATION MATRIX FOR KEY PLAYERS, 2022STARSEMERGING LEADERSPERVASIVE PLAYERSPARTICIPANTSPRODUCT FOOTPRINT

-

12.6 COMPANY EVALUATION MATRIX FOR STARTUPS/SMES, 2022PROGRESSIVE COMPANIESSTARTING BLOCKSRESPONSIVE COMPANIESDYNAMIC COMPANIESCOMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

-

12.7 COMPETITIVE SCENARIOPRODUCT LAUNCHESESDEALSOTHERS

-

13.1 KEY PLAYERS (MANUFACTURERS & SERVICE PROVIDERS)BAYER AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCORTEVA AGRISCIENCE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBASF- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSUMITOMO CHEMICAL CO. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewSYNGENTA AG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewRENTOKIL INITIAL PLC- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewANTICIMEX- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewROLLINS, INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewATGC BIOTECH PVT. LTD.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewECOLAB INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewFMC CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewDE SANGOSSE- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBELL LABORATORIES INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewPELGAR INTERNATIONAL- Business overview- Recent developments- MnM viewFORT PRODUCTS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM view

-

13.2 OTHER PLAYERS (MANUFACTURERS & SERVICE PROVIDERS)JT EATON & C0., INC.- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewBRANDENBURG- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewGHARDA CHEMICALS LIMITED- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewWOODSTREAM CORPORATION- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewV3 SMART TECHNOLOGIES- Business overview- Products/Solutions/Services offered- Recent developments- MnM viewCHEMRONGAIAGEN TECHNOLOGIES PRIVATE LIMITEDAGRI PHERO SOLUTIONZGREENZONESHREE PESTICIDE PVT LTD.

- 14.1 INTRODUCTION

-

14.2 INSECT PEST CONTROL MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWINSECT PEST CONTROL MARKET, BY INSECT TYPEINSECT PEST CONTROL MARKET, BY REGION

-

14.3 RODENTICIDES MARKETLIMITATIONSMARKET DEFINITIONMARKET OVERVIEWRODENTICIDES MARKET, BY TYPERODENTICIDES MARKET, BY REGION

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS

- TABLE 1 USD EXCHANGE RATES, 2018–2022

- TABLE 2 RESEARCH ASUMPTIONS

- TABLE 3 LIMITATIONS AND RISK ASSESSMENT

- TABLE 4 PEST CONTROL MARKET SNAPSHOT, 2023 VS. 2028

- TABLE 5 POPULATION DENSITY, BY TOP 5 COUNTRIES, 2020

- TABLE 6 GEOGRAPHICAL DISTRIBUTION OF DISEASES TRANSMITTED BY INSECTS AND TICKS

- TABLE 7 ASIA PACIFIC PEST CONTROL MARKET: IOT ADOPTION (2020)

- TABLE 8 ECOSYSTEM ANALYSIS

- TABLE 9 KEY PATENTS FILED IN PEST CONTROL MARKET, 2022–2023

- TABLE 10 US: REGISTRATION FEE FOR INSECTICIDES

- TABLE 11 CANADA: REGISTRATION FEE FOR PEST CONTROL PRODUCTS (OTHER THAN SEMIOCHEMICAL OR MICROBIAL AGENT)

- TABLE 12 CANADA: REGISTRATION FEE FOR SEMIOCHEMICAL OR MICROBIAL AGENT-BASED PEST CONTROL PRODUCTS

- TABLE 13 CANADA: REGISTRATION FEE FOR OTHER APPLICATIONS OF PEST CONTROL PRODUCTS

- TABLE 14 PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 15 PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 16 COMMERCIAL: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 17 COMMERCIAL: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 18 RESIDENTIAL: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 19 RESIDENTIAL: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 20 LIVESTOCK: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 21 LIVESTOCK: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 22 INDUSTRIAL: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 23 INDUSTRIAL: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 24 OTHER APPLICATIONS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 25 OTHER APPLICATIONS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 26 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 27 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 28 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (TONS)

- TABLE 29 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (TONS)

- TABLE 30 POWDER: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 31 POWDER: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 32 POWDER: PEST CONTROL MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 33 POWDER: PEST CONTROL MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 34 SPRAYS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 35 SPRAYS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 36 SPRAYS: PEST CONTROL MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 37 SPRAYS: PEST CONTROL MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 38 PELLETS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 39 PELLETS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 40 PELLETS: PEST CONTROL MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 41 PELLETS: PEST CONTROL MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 42 TRAPS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 43 TRAPS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 44 TRAPS: PEST CONTROL MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 45 TRAPS: PEST CONTROL MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 46 BAITS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 47 BAITS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 48 BAITS: PEST CONTROL MARKET, BY REGION, 2018–2022 (TONS)

- TABLE 49 BAITS: PEST CONTROL MARKET, BY REGION, 2023–2028 (TONS)

- TABLE 50 PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 51 PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 52 INSECTS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 53 INSECTS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 54 RODENTS: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 55 RODENTS: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 56 TERMITES: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 57 TERMITES: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 58 WILDLIFE: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 59 WILDLIFE: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 60 OTHER PEST TYPES: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 61 OTHER PEST TYPES: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 62 PEST CONTROL MARKET, BY CONTROL METHOD, 2018–2022 (USD MILLION)

- TABLE 63 PEST CONTROL MARKET, BY CONTROL METHOD, 2023–2028 (USD MILLION)

- TABLE 64 CHEMICAL: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 65 CHEMICAL: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 66 CHEMICAL: PEST CONTROL MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 67 CHEMICAL: PEST CONTROL MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 68 ACUTE TOXICITY CLASSIFICATION - RODENTICIDES

- TABLE 69 MECHANICAL: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 70 MECHANICAL: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 71 MECHANICAL: PEST CONTROL MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 72 MECHANICAL: PEST CONTROL MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 73 TRAPPING MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 74 TRAPPING MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 75 BIOLOGICAL: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 76 BIOLOGICAL: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 77 BIOLOGICAL: PEST CONTROL MARKET, BY TYPE, 2018–2022 (USD MILLION)

- TABLE 78 BIOLOGICAL: PEST CONTROL MARKET, BY TYPE, 2023–2028 (USD MILLION)

- TABLE 79 SOFTWARE & SERVICE: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 80 SOFTWARE & SERVICE: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 81 PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 82 PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 83 NORTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 84 NORTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 85 NORTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 86 NORTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 87 NORTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2018–2022 (USD MILLION)

- TABLE 88 NORTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2023–2028 (USD MILLION)

- TABLE 89 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 90 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 91 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (TONS)

- TABLE 92 NORTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (TONS)

- TABLE 93 NORTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 94 NORTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 95 TOP 5 CITIES WITH CHANGE IN NUMBER OF DISEASE DANGER DAYS SINCE 1970

- TABLE 96 US: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 97 US: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 98 US: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 99 US: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 100 CANADA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 101 CANADA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 102 CANADA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 103 CANADA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 104 MEXICO: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 105 MEXICO: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 106 MEXICO: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 107 MEXICO: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 108 EUROPE: PEST CONTROL MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 109 EUROPE: PEST CONTROL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 110 EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 111 EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 112 EUROPE: PEST CONTROL MARKET, BY CONTROL METHOD, 2018–2022 (USD MILLION)

- TABLE 113 EUROPE: PEST CONTROL MARKET, BY CONTROL METHOD, 2023–2028 (USD MILLION)

- TABLE 114 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 115 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 116 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (TONS)

- TABLE 117 EUROPE: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (TONS)

- TABLE 118 EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 119 EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 120 GERMANY: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 121 GERMANY: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 122 GERMANY: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 123 GERMANY: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 124 FRANCE: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 125 FRANCE: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 126 FRANCE: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 127 FRANCE: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 128 UK: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 129 UK: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 130 UK: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 131 UK: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 132 SPAIN: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 133 SPAIN: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 134 SPAIN: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 135 SPAIN: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 136 ITALY: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 137 ITALY: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 138 ITALY: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 139 ITALY: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 140 REST OF EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 141 REST OF EUROPE: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 142 REST OF EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 143 REST OF EUROPE: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 144 ASIA PACIFIC: PEST CONTROL MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 145 ASIA PACIFIC: PEST CONTROL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 146 ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 147 ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 148 ASIA PACIFIC: PEST CONTROL MARKET, BY CONTROL METHOD, 2018–2022 (USD MILLION)

- TABLE 149 ASIA PACIFIC: PEST CONTROL MARKET, BY CONTROL METHOD, 2023–2028 (USD MILLION)

- TABLE 150 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 151 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 152 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (TONS)

- TABLE 153 ASIA PACIFIC: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (TONS)

- TABLE 154 ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 155 ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 156 CHINA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 157 CHINA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 158 CHINA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 159 CHINA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 160 INDIA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 161 INDIA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 162 INDIA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 163 INDIA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 164 AUSTRALIA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 165 AUSTRALIA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 166 AUSTRALIA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 167 AUSTRALIA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 168 JAPAN: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 169 JAPAN: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 170 JAPAN: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 171 JAPAN: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 172 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 173 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 174 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 175 REST OF ASIA PACIFIC: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 176 SOUTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2018–2022 (USD MILLION)

- TABLE 177 SOUTH AMERICA: PEST CONTROL MARKET, BY COUNTRY, 2023–2028 (USD MILLION)

- TABLE 178 SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 179 SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 180 SOUTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2018–2022 (USD MILLION)

- TABLE 181 SOUTH AMERICA: PEST CONTROL MARKET, BY CONTROL METHOD, 2023–2028 (USD MILLION)

- TABLE 182 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 183 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 184 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (TONS)

- TABLE 185 SOUTH AMERICA: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (TONS)

- TABLE 186 SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 187 SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 188 BRAZIL: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 189 BRAZIL: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 190 BRAZIL: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 191 BRAZIL: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 192 ARGENTINA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 193 ARGENTINA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 194 ARGENTINA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 195 ARGENTINA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 196 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 197 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 198 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 199 REST OF SOUTH AMERICA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 200 ROW: PEST CONTROL MARKET, BY REGION, 2018–2022 (USD MILLION)

- TABLE 201 ROW: PEST CONTROL MARKET, BY REGION, 2023–2028 (USD MILLION)

- TABLE 202 ROW: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 203 ROW: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 204 ROW: PEST CONTROL MARKET, BY CONTROL METHOD, 2018–2022 (USD MILLION)

- TABLE 205 ROW: PEST CONTROL MARKET, BY CONTROL METHOD, 2023–2028 (USD MILLION)

- TABLE 206 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (USD MILLION)

- TABLE 207 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (USD MILLION)

- TABLE 208 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2018–2022 (TONS)

- TABLE 209 ROW: PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023–2028 (TONS)

- TABLE 210 ROW: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 211 ROW: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 212 MIDDLE EAST: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 213 MIDDLE EAST: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 214 MIDDLE EAST: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 215 MIDDLE EAST: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 216 AFRICA: PEST CONTROL MARKET, BY PEST TYPE, 2018–2022 (USD MILLION)

- TABLE 217 AFRICA: PEST CONTROL MARKET, BY PEST TYPE, 2023–2028 (USD MILLION)

- TABLE 218 AFRICA: PEST CONTROL MARKET, BY APPLICATION, 2018–2022 (USD MILLION)

- TABLE 219 AFRICA: PEST CONTROL MARKET, BY APPLICATION, 2023–2028 (USD MILLION)

- TABLE 220 PEST CONTROL MARKET: DEGREE OF COMPETITION

- TABLE 221 COMPANY FOOTPRINT, BY PEST TYPE

- TABLE 222 COMPANY FOOTPRINT, BY APPLICATION

- TABLE 223 COMPANY FOOTPRINT, BY REGION

- TABLE 224 OVERALL COMPANY FOOTPRINT

- TABLE 225 DETAILED LIST OF KEY STARTUPS/SMES

- TABLE 226 PEST CONTROL MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- TABLE 227 PEST CONTROL: PRODUCT LAUNCHESES

- TABLE 228 PEST CONTROL: DEALS

- TABLE 229 PEST CONTROL: OTHERS

- TABLE 230 BAYER AG: BUSINESS OVERVIEW

- TABLE 231 BAYER AG: PRODUCTS OFFERED

- TABLE 232 BAYER AG: PRODUCT LAUNCHESES

- TABLE 233 BAYER AG: DEALS

- TABLE 234 CORTEVA AGRISCIENCE: BUSINESS OVERVIEW

- TABLE 235 CORTEVA AGRISCIENCE: PRODUCTS OFFERED

- TABLE 236 CORTEVA AGRISCIENCE: DEALS

- TABLE 237 CORTEVA AGRISCIENCE: OTHERS

- TABLE 238 BASF: BUSINESS OVERVIEW

- TABLE 239 BASF: PRODUCTS OFFERED

- TABLE 240 BASF: PRODUCT LAUNCHESES

- TABLE 241 BASF: DEALS

- TABLE 242 SUMITOMO CHEMICAL CO. LTD.: BUSINESS OVERVIEW

- TABLE 243 SUMITOMO CHEMICAL CO. LTD.: PRODUCTS OFFERED

- TABLE 244 SUMITOMO CHEMICAL CO. LTD: PRODUCT LAUNCHES

- TABLE 245 SUMITOMO CHEMICAL CO. LTD: DEALS

- TABLE 246 SYNGENTA AG: BUSINESS OVERVIEW

- TABLE 247 SYNGENTA AG: PRODUCTS OFFERED

- TABLE 248 SYNGENTA AG: PRODUCT LAUNCHESES

- TABLE 249 SYNGENTA AG: DEALS

- TABLE 250 RENTOKIL INITIAL PLC: BUSINESS OVERVIEW

- TABLE 251 RENTOKIL INITIAL PLC: PRODUCTS & SERVICES OFFERED

- TABLE 252 RENTOKIL INITIAL PLC: PRODUCT LAUNCHES

- TABLE 253 RENTOKIL INITIAL PLC: DEALS

- TABLE 254 ANTICIMEX: BUSINESS OVERVIEW

- TABLE 255 ANTICIMEX: PRODUCTS & SERVICES OFFERED

- TABLE 256 ANTICIMEX: DEALS

- TABLE 257 ROLLINS, INC.: BUSINESS OVERVIEW

- TABLE 258 ROLLINS, INC.: SERVICES OFFERED

- TABLE 259 ROLLINS, INC.: DEALS

- TABLE 260 ROLLINS, INC.: OTHERS

- TABLE 261 ATGC BIOTECH PVT. LTD.: BUSINESS OVERVIEW

- TABLE 262 ATGC BIOTECH PVT. LTD.: PRODUCTS OFFERED

- TABLE 263 ECOLAB INC.: BUSINESS OVERVIEW

- TABLE 264 ECOLAB INC.: SERVICES OFFERED

- TABLE 265 ECOLAB INC.: DEALS

- TABLE 266 FMC CORPORATION: BUSINESS OVERVIEW

- TABLE 267 FMC CORPORATION: PRODUCTS OFFERED

- TABLE 268 FMC CORPORATION: DEALS

- TABLE 269 DE SANGOSSE: BUSINESS OVERVIEW

- TABLE 270 DE SANGOSSE: PRODUCTS OFFERED

- TABLE 271 BELL LABORATORIES INC.: BUSINESS OVERVIEW

- TABLE 272 BELL LABORATORIES INC.: PRODUCTS OFFERED

- TABLE 273 BELL LABORATORIES INC.: PRODUCT LAUNCHESES

- TABLE 274 PELGAR INTERNATIONAL: BUSINESS OVERVIEW

- TABLE 275 PELGAR INTERNATIONAL: PRODUCTS OFFERED

- TABLE 276 PELGAR INTERNATIONAL: PRODUCT LAUNCHESES

- TABLE 277 FORT PRODUCTS LIMITED: BUSINESS OVERVIEW

- TABLE 278 FORT PRODUCTS LIMITED: PRODUCTS OFFERED

- TABLE 279 JT EATON & CO., INC.: BUSINESS OVERVIEW

- TABLE 280 JT EATON & CO., INC.: PRODUCTS OFFERED

- TABLE 281 BRANDENBURG: BUSINESS OVERVIEW

- TABLE 282 BRANDENBURG: PRODUCTS OFFERED

- TABLE 283 GHARDA CHEMICALS LIMITED: BUSINESS OVERVIEW

- TABLE 284 GHARDA CHEMICALS LIMITED: PRODUCTS OFFERED

- TABLE 285 WOODSTREAM CORPORATION: BUSINESS OVERVIEW

- TABLE 286 WOODSTREAM CORPORATION: PRODUCTS OFFERED

- TABLE 287 V3 SMART TECHNOLOGIES: BUSINESS OVERVIEW

- TABLE 288 V3 SMART TECHNOLOGIES: SERVICES OFFERED

- TABLE 289 INSECT PEST CONTROL MARKET, BY INSECT TYPE, 2017–2026 (USD MILLION)

- TABLE 290 INSECT PEST CONTROL MARKET, BY REGION, 2017–2026 (USD MILLION)

- TABLE 291 RODENTICIDES MARKET, BY TYPE, 2016–2027 (USD MILLION)

- TABLE 292 RODENTICIDES MARKET, BY REGION, 2016–2027 (USD MILLION)

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 PEST CONTROL MARKET SIZE ESTIMATION: BOTTOM-UP APPROACH

- FIGURE 5 PEST CONTROL MARKET SIZE ESTIMATION (DEMAND SIDE)

- FIGURE 6 PEST CONTROL MARKET SIZE ESTIMATION: TOP-DOWN APPROACH

- FIGURE 7 PEST CONTROL MARKET SIZE ESTIMATION, BY TYPE (SUPPLY SIDE)

- FIGURE 8 DATA TRIANGULATION

- FIGURE 9 INDICATORS OF RECESSION

- FIGURE 10 WORLD INFLATION RATE: 2011–2021

- FIGURE 11 GLOBAL GDP: 2011-2021 (USD TRILLION)

- FIGURE 12 RECESSION INDICATORS AND THEIR IMPACT ON PEST CONTROL MARKET

- FIGURE 13 PEST CONTROL MARKET: EARLIER FORECAST VS. RECESSION FORECAST

- FIGURE 14 PEST CONTROL MARKET, BY PEST TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 15 PEST CONTROL MARKET, BY APPLICATION, 2023 VS. 2028

- FIGURE 16 PEST CONTROL MARKET, BY MODE OF APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 17 PEST CONTROL MARKET, BY CONTROL METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 18 NORTH AMERICA ACCOUNTED FOR LARGEST SHARE IN 2022

- FIGURE 19 INCREASING DEMAND FOR DISEASE PREVENTION AND PROTECTION TO DRIVE MARKET

- FIGURE 20 NORTH AMERICA TO ACCOUNT FOR LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 21 HARDWARE OFFERING SEGMENT AND CHINA TO ACCOUNT FOR SIGNIFICANT SHARE IN 2023

- FIGURE 22 INSECTS SEGMENT TO LEAD MARKET IN 2023 IN TERMS OF VALUE

- FIGURE 23 SPRAY SEGMENT TO ACCOUNT FOR LARGEST SHARE DURING FORECAST PERIOD IN TERMS OF VALUE

- FIGURE 24 GLOBAL POPULATION, 2010–2022

- FIGURE 25 URBAN POPULATION (% OF TOTAL POPULATION), 2010-2022

- FIGURE 26 PESTICIDE USAGE IN AGRICULTURE, BY REGION, 2019–2020 (TONNES)

- FIGURE 27 MARKET DYNAMICS: PEST CONTROL MARKET

- FIGURE 28 PEST CONTROL MANUFACTURERS (B2C PLAYERS): SUPPLY CHAIN

- FIGURE 29 PEST CONTROL SOFTWARE & SERVICE PROVIDERS (B2B PLAYERS): SUPPLY CHAIN

- FIGURE 30 PEST CONTROL MARKET: PRICING ANALYSIS, BY MODE OF APPLICATION, 2018–2022 (USD/KG)

- FIGURE 31 YCC: REVENUE SHIFT FOR PEST CONTROL MARKET

- FIGURE 32 LIST OF TOP PATENTS IN MARKET FOR LAST TEN YEARS

- FIGURE 33 PEST CONTROL MARKET, BY APPLICATION, 2023 VS. 2028 (USD MILLION)

- FIGURE 34 PEST CONTROL MARKET SHARE, BY MODE OF APPLICATION, 2023 VS. 2028 (VALUE)

- FIGURE 35 PEST CONTROL MARKET, BY PEST TYPE, 2023 VS. 2028 (USD MILLION)

- FIGURE 36 PEST CONTROL MARKET, BY CONTROL METHOD, 2023 VS. 2028 (USD MILLION)

- FIGURE 37 NORTH AMERICA: MARKET SNAPSHOT

- FIGURE 38 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 39 NORTH AMERICA PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 40 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 41 EUROPE PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 42 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 43 ASIA PACIFIC: RECESSION IMPACT ANALYSIS, 2022

- FIGURE 44 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 45 SOUTH AMERICA PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 46 INFLATION: COUNTRY-LEVEL DATA (2017-2021)

- FIGURE 47 PEST CONTROL MARKET: RECESSION IMPACT ANALYSIS

- FIGURE 48 SEGMENTAL REVENUE ANALYSIS OF KEY PLAYERS, 2018–2022 (USD BILLION)

- FIGURE 49 COMPANY EVALUATION QUADRANT FOR KEY PLAYERS, 2022

- FIGURE 50 COMPANY EVALUATION QUADRANT FOR STARTUPS/SMES, 2022

- FIGURE 51 BAYER AG: COMPANY SNAPSHOT

- FIGURE 52 CORTEVA AGRISCIENCE: COMPANY SNAPSHOT

- FIGURE 53 BASF: COMPANY SNAPSHOT

- FIGURE 54 SUMITOMO CHEMICAL CO. LTD.: COMPANY SNAPSHOT

- FIGURE 55 SYNGENTA AG: COMPANY SNAPSHOT

- FIGURE 56 RENTOKIL INITIAL PLC: COMPANY SNAPSHOT

- FIGURE 57 ANTICIMEX: COMPANY SNAPSHOT

- FIGURE 58 ROLLINS, INC.: COMPANY SNAPSHOT

- FIGURE 59 ECOLAB INC.: COMPANY SNAPSHOT

- FIGURE 60 FMC CORPORATION: COMPANY SNAPSHOT

Exhaustive secondary research was done to collect information on the Market, peer market, and parent market. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, sources such as annual reports, press releases, investor presentations of companies, white papers, certified publications, articles from regulatory bodies, trade directories by recognized authors, and databases were used to identify and collect information for this study.

Secondary research was used to obtain key information about the industry’s supply chain, the total pool of key players, market classification, and segmentation according to the industry trends to the bottom-most level, geographic markets, and key developments from both Market- and technology-oriented perspectives.

Primary Research

The pest control market includes several stakeholders in the supply chain, including raw material suppliers, technology and service providers, and regulatory organizations. The demand side of the Market is characterized by manufacturing companies and startups. Key technology and service providers and suppliers of raw materials characterize the supply side.

Various primary sources from the supply and demand sides were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders, executives, vice presidents, and CEOs from the insect repellents sectors. The primary sources from the supply side include key opinion leaders and key manufacturers in the pest control Market.

To know about the assumptions considered for the study, download the pdf brochure

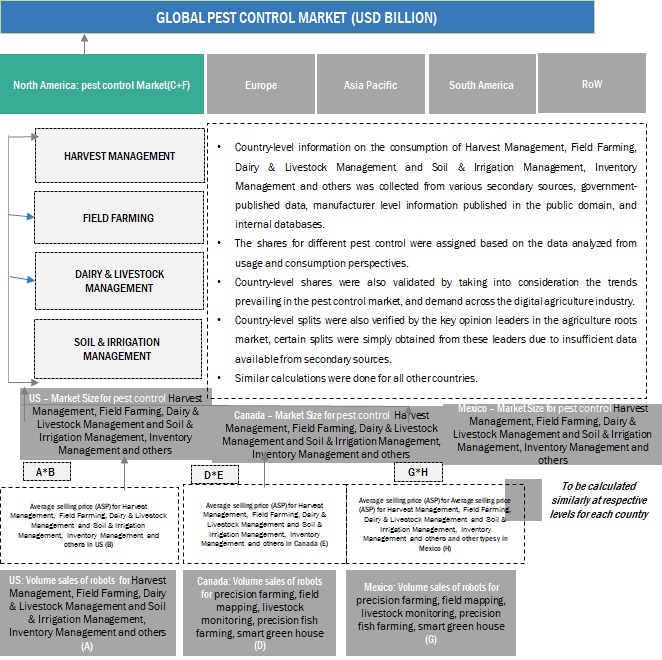

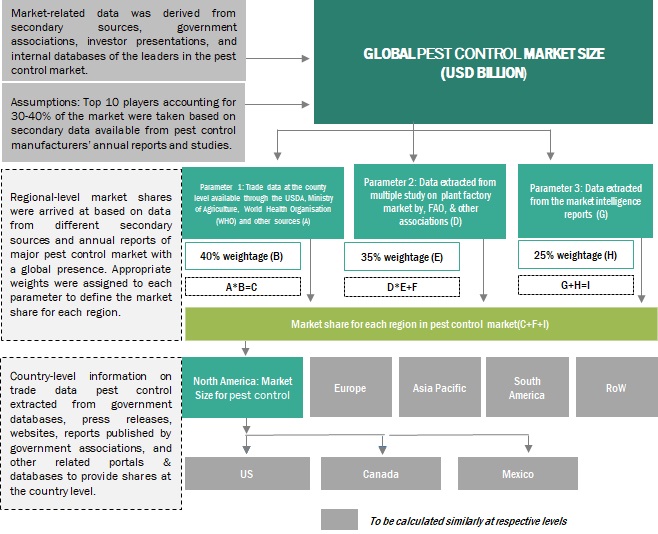

Pest Control Market Size Estimation

The top-down and bottom-up approaches were used to estimate and validate the total size of the pest control market. These approaches were also used extensively to estimate the size of various subsegments in the Market. The research methodology used to estimate the market size includes the following details.

-

Top-down approach:

- The key industry and market players were identified through extensive secondary research.

- The industry’s supply chain and market size were determined through primary and secondary research.

- All percentage share splits and breakdowns were determined using secondary sources and verified through primary sources.

- The adjacent markets—the insect repellant market and insecticides market—were considered to validate further the market details of the pest control Market.

-

Bottom-up approach:

- The market size was analyzed based on the share of each offering of pest control and growing systems at regional and country levels. Thus, the global Market was estimated with a bottom-up approach at the country level.

- Other factors include demand for pest control produced through different growing systems across various facility types; pricing trends; adoption rate and price factors; patents registered; and organic and inorganic growth attempts.

- All macroeconomic and microeconomic factors affecting the pest control market were considered while estimating the market size.

- All possible parameters that affect the Market covered in this research study were accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain final quantitative and qualitative data.

Global pest control Size: Bottom-Up Approach

The bottom-up approach used the data extracted from secondary research to validate the market segment sizes obtained. This approach was employed to determine the overall size of the pest control market in particular regions. Its share in the pest control market at the country and regional levels was validated through primary interviews conducted with suppliers, dealers, and distributors.

To know about the assumptions considered for the study, Request for Free Sample Report

Global pest control market Size: Top-Down Approach

In the top-down approach, the overall market size was used to estimate the size of individual markets (mentioned in the segmentation) through percentage splits from secondary and primary research.

The top-down approach used to triangulate the data obtained through this study is explained in the next section:

- In the pest control market, related secondary sources such as the US Department of Agriculture (USDA), the Ministry of Agriculture, Forestry and Fisheries (MAFF), and the World Health Organisation (WHO) Annual Reports of all major players were considered to arrive at the global market size.

- The global number of pest control arrived after giving certain weightage factors for the data obtained from these secondary and primary sources.

- With the data triangulation procedure and data validation through primaries (from both supply and demand sides), the shares and sizes of the regional markets and individual markets were determined and confirmed.

- Data on company revenues, area harvested, product launches, and global regulations for the pest control Market in the last four years was used to arrive at the country-wise market size. CAGR estimation of offering and application segments was used and then validated from primary sources.

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the total Market was split into several segments and subsegments. Where applicable, the data triangulation and market breakdown procedures were employed to estimate the overall market and arrive at the exact statistics for all segments and subsegments. The data was triangulated by studying various factors and trends from the demand and supply sides. The market size was also validated using both the top-down and bottom-up approaches.

Market Definition

The term ‘pest’ is derived from the French word ‘peste’ and the Latin term ‘pestis’ that means a plague or contagious disease. Pests include insects, animals, germs, or other organisms that damage property such as residential buildings, commercial institutions, factories and manufacturing plants, destroy food crops, and undesirably affect the environment. Pest control is the process of minimizing or eradicating a wide range of undesirable insects and other pests from areas used for productive purposes. Pest control aims to suppress pests to a point where the existence or damage level is acceptable.

According to Bayswater Pest Control—one of the pest control service providers in domestic and commercial pest control—pest management can be defined as “the method of reducing or eliminating different types of unwanted insects, such as cockroaches, ants, wasps, bees, spiders, silverfish, termites, and bedbugs, from places occupied by humans. It may or may not involve the use of chemicals for impeding the infestation of such organisms and the damage that they might cause.”

Key Stakeholders

- Pest Control manufacturers

- Pest Control importers and exporters

- Pest Control manufactures

- Pest Control tporters and exporters

- Intermediary suppliers, such as traders and distributors of Insect repellent active ingredients, such as DEET, PICARIDIN/ICARIDIN/SALTIDIN, EBAAP/ IR3535, P-Methane-3,8-Diol (PMD), DEPA, nootkatone, diethyl carbate, and ethyl hexanediol

-

Associations and industry bodies:

- The World Health Organization (WHO)

- Environmental Protection Agency (EPA)

- Pest Management Regulatory Agency (PMRA)

Report Objectives

Market Intelligence

- Determining and projecting the size of the Pest control Market based on mode of application, and region over a five-year period ranging from 2023 to 2028.

- Identifying the attractive opportunities in the Market by determining the largest and fastest-growing segments across the key regions

-

Analyzing the demand-side factors based on the following:

- Impact of macro- and microeconomic factors on the Market

- Shifts in demand patterns across different subsegments and regions.

- Providing detailed information about the key factors influencing the growth of the Market (drivers, restraints, opportunities, and industry-specific challenges)

- To analyze the opportunities in the Market for stakeholders and provide a competitive landscape for market leaders.

- To strategically profile the key players and comprehensively analyze their core competencies.

- To analyze competitive developments such as joint ventures, mergers & acquisitions, new product developments, and research & development (R&D) in the Pest control Market

Competitive Intelligence

- Identifying and profiling the key market players in the Pest control Market

-

Providing a comparative analysis of the market leaders based on the following:

- Product offerings

- Business strategies

- Strengths and weaknesses

- Key financials

- Understanding the competitive landscape and identifying the major growth strategies adopted by players across the key region.

- Analyzing the value chain and regulatory frameworks across regions and their impact on prominent market players

- Providing insights into the key investments and product innovations, and technology in the Pest control Market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to the company’s specific scientific needs.

The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolio of each company

Geographic Analysis

- Further breakdown of the Rest of Europe pest control market into Netherlands, Poland, Greece, and Denmark.

- Further breakdown of the Rest of Asia Pacific pest control market into New Zealand, Indonesia, Vietnam, South Korea, and Singapore.

Company Information

- Detailed analyses and profiling of additional market players (up to five)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pest Control Market

How large is the pest control market in North America?

Can you provide pest control industry statistics for EU region separately?

Are local u.s. pest control companies covered in this report?

I need a sample of strategic analysis of the u.s. structural pest control industry

I want to know the market share, most substantial regional presence, products, and pricing for the Pest Control Market study.