Perovskite Solar Cell Market Size, Share, Trends & Industry Analysis by Type of Structure (Planar and Mesoporous), Product (Rigid and Flexible), Vertical (Aerospace & Defense, Residential, Commercial, Industrial, and Utility), Type, Application, Technology and Region – Global Forecast to 2028

Updated on : October 22, 2024

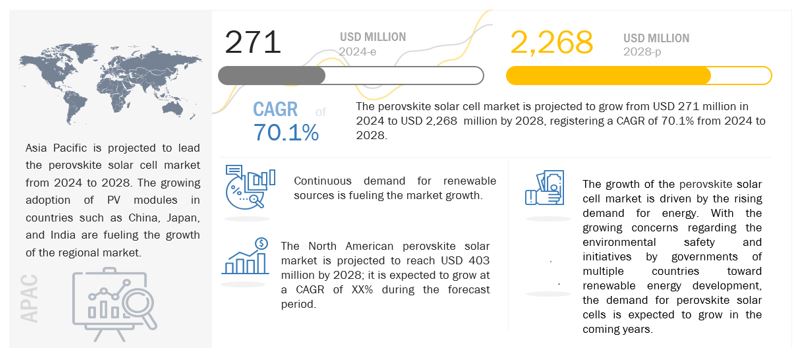

The global perovskite solar cell market size is projected to grow from USD 271 million in 2024 to USD 2,268 million by 2028; growing at a CAGR of 70.1% from 2024 to 2028. The major growth opportunity for the perovskite solar cell market during the forecast period is the upsurge in the demand for renewable energy.

Perovskite Solar Cell Market Forecast to 2028

To know about the assumptions considered for the study, Request for Free Sample Report

Perovskite Solar Cell Market Dynamics

Driver : Various advantages of perovskite solar cells over traditional solar cells

Perovskite solar cells have competitive power conversion efficiencies (PCE) with the potential for higher performance than traditional solar cells. Perovskite solar cells can convert sunlight into electricity even if the sunlight is indoor, outdoor, or if the light is artificial. A few of the benefits of perovskite solar cells are that the cells are much cheaper to fabricate than traditional solar cells and thinner. Perovskite solar cells offer better efficiency in low and variable lights and have better spectral absorption.

Restraint: Presence of toxic substances in perovskite solar cells

Perovskites have a crystal structure like the perovskite mineral, which consists of calcium titanium oxide (CaTiO3). When the perovskite cell breaks down, it produces toxic substances called Pbl, which affects the human respiratory system. This substance also contains lead, which can affect the environment by contaminating air, water, and soil. The harmful effects of perovskite solar cells, hence, act as a restraint for market growth.

Opportunity : Rising investments and funding in development of perovskite solar cells

The solar industry has witnessed various fast-paced technological developments in the past few years. Perovskite is the newest solar material with a crystal structure suitable for solar absorption. Perovskite cells also work better than silicon at lower lighting intensities, on cloudy days, or indoors, thus enabling higher conversion efficiency. The main benefit of making solar cells from perovskite is that the material is cheap and abundant and can produce low-cost solar power. As perovskite solar cells have benefits over traditional cells, companies in the solar cell industry are working to develop the cell and make it commercially available by 2024. The companies working on developing perovskite solar cells are raising funds for research and innovations. For instance, in January 2021, Microquanta Semiconductor announced a Series C round of funding. Lead investors include Three George Capitals, Beijing Energy Holding, and Quzhou Financial Holding. This funding will be used for the 100 MW production line expansion of the perovskite tandem project. Similarly, in November 2020, Oxford PV was funded by the Brandenburg Ministry of Economics as part of the EU’s Regional Development Program. The grant was used in perovskite solar cell manufacturing. Continuous funding for research and development of perovskite solar cells is creating growth opportunities for the market players.

Challenge: Stability and efficiency of perovskite solar cell

Perovskites can decompose when they react with moisture and oxygen or when they spend extended time exposed to light, heat, or applied voltage. The perovskite research and development (R&D) community is highly focused on improving operational lifetime and is working on multiple approaches to understand and improve stability and degradation. The research is going to decrease the reactivity of the perovskite surface, and finding alternative materials for formulations of perovskite materials.

Residential vertical to account for the highest CAGR in the perovskite solar cell market by 2028

The perovskite solar cell industry for the residential vertical is expected to register the highest CAGR during the forecast period. In the residential vertical, perovskite solar cell-based PV systems are expected to be installed on the rooftop or at locations where adequate sunlight is available to fulfill the home electricity needs.

Solar panel segment to account for the largest market share by 2028

Solar panels help in generating electricity from solar energy. The solar panel works so that when photons present in the light hits the solar cell, it loses the electrons from its atoms. Proper attachment of conductors on the positive and negative sides of a cell can transform the whole into an electrical circuit. Electrons flowing through the circuit help in generating electricity. Currently, solar panels are mostly made up of silicon material. Constant research and development projects have been set up worldwide on perovskite solar cells to check the material’s performance, efficiency, and operational life. Perovskite solar cells are expected to be commercialized by 2024.

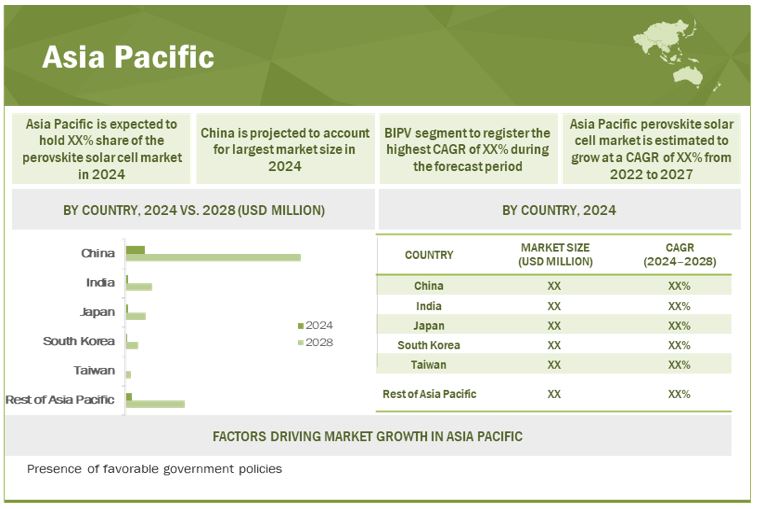

Asia Pacific to grow at the highest CAGR in the perovskite solar cell market during the forecast period

The perovskite solar cell market in Asia Pacific is projected to grow at the highest CAGR from 2024 to 2028. The global market players are experiencing increased demand for solar cells from countries such as China, Japan, India, and South Korea. India and China are the major contributors to the growth of the regional market due to the expanding solar cell market in the countries.

To know about the assumptions considered for the study, download the pdf brochure

Top Perovskite Solar Cell Companies - Key Market Players:

Hanwha Q CELLS (South Korea), Microquanta Semiconductor (China), Greatcell Energy (Australia), Oxford PV (UK), Saule Technologies (Poland), CubicPV (US), EneCoat Technologies (Japan), P3C (India), and PEROVSKIA SOLAR AG (Switzerland) are the key players operating in the perovskite solar cell companies.

Perovskite Solar Cell Market Report Scope :

|

Report Metric |

Details |

| Estimated Market Size | USD 271 Million |

| Projected Market Size | USD 2,268 Million |

| Growth Rate | At a CAGR of 70.1% |

|

Market Size Available for Years |

2024–2028 |

|

Estimated Year |

2024 |

|

Forecast Period |

2024–2028 |

|

Forecast Units |

USD Million |

|

Segments Covered |

|

|

Regions Covered |

|

|

Companies Covered |

Hanwha Q CELLS (South Korea), CubicPV (US), EneCoat Technologies (Japan), Microquanta Semiconductor (China), Greatcell Energy (Australia), Oxford PV (UK), P3C (India), PEROVSKIA SOLAR AG (Switzerland), and Saule Technologies (Poland) are among the key players operating in the perovskite solar cell market. |

| Key Market Driver | Various advantages of perovskite solar cells over traditional solar cells |

| Key Market Opportunity | Rising investments and funding in development of perovskite solar cells |

| Largest Growing Region | Asia Pacific |

| Largest Market Share Segment | Solar panel |

| Highest CAGR Segment | Residential vertical |

Perovskite Solar Cell Market Highlights

This research report categorizes the perovskite solar cell market based on Type of Structure, Type, Product, Application, Vertical, Technology, and Region

|

Report Metric |

Details |

|

By Type Of Structure |

|

|

By Type |

|

|

By Product |

|

|

By Vertical |

|

|

By Application |

|

|

By Technology |

|

|

By Region |

|

Recent Developments In Perovskite Solar Cell Industry

- In February 2022, Microquanta Semiconductor announced that it is building a perovskite solar power plant in Quzhou in Zhejiang Province, China. The solar plant will cover 250 acres and has a capacity of 12 MW.

- In July 2021, Oxford PV announced that it had completed the build-out of its manufacturing site in Brandenburg an der Havel, Germany. The site will be one of the world’s first volume manufacturing lines for Oxford PV’s innovative perovskite-on-silicon tandem solar cells. The annual target manufacturing capacity is 100 MW.

Critical questions answered by this report:

What are the key strategies adopted by the major companies in the perovskite solar cell market?

Partnerships and collaborations have been and continue to be the major strategies adopted by the key players to grow in the perovskite solar cell market.

Which region will dominate the perovskite solar cell market?

Asia Pacific will dominate the perovskite solar cell market .

Which are the major companies in the perovskite solar cell market?

Hanwha Q CELLS (South Korea), Microquanta Semiconductor (Chin), Greatcell Energy (Australia), Oxford PV (UK), and Saule Technologies (Poland) are the key companies in this market.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

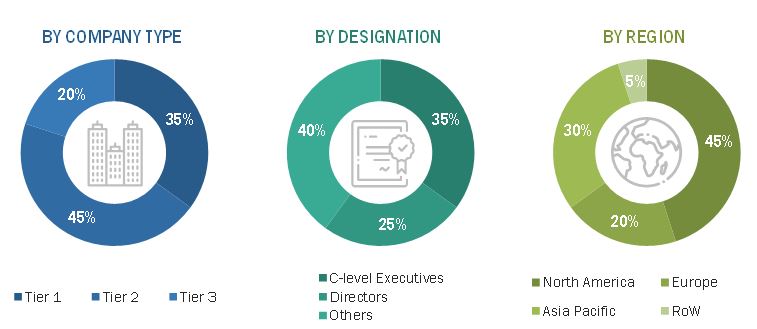

The study involved four major activities in estimating the current size of the perovskite solar cell market. Exhaustive secondary research has been done to collect information on the market and its peer and parent markets. In the next step, the findings, assumptions, and sizes have been validated by industry experts across the value chain through primary research. Both top-down and bottom-up approaches have been employed to estimate the total market size. After that, market breakdown and data triangulation have been employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include perovskite solar cell journals and magazines, press releases of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the perovskite solar cell market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research has been conducted to gather information and verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the perovskite solar cell market and other dependent submarkets listed in this report.

- Key players in the markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

Perovskite Solar Cell Market: Top-Down Approach

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. Market breakdown and data triangulation procedures have been employed wherever applicable to complete the overall market engineering process and arrive at exact statistics for all segments and subsegments. The data has been triangulated by studying various factors and trends identified from both the demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To describe and forecast the perovskite solar cell market based on type of structure, type, product, application, vertical, and technology, in terms of value.

-

To describe and forecast the perovskite solar cell market, in terms of value, for four key regions—

North America, Europe, Asia Pacific, and the Rest of the World (RoW) - To provide detailed information regarding drivers, restraints, opportunities, and challenges influencing the market growth

- To strategically analyze the micromarkets1 with respect to individual growth trends, prospects, and contribution to the overall perovskite solar cell market

- To provide a detailed overview of the supply/value chain and ecosystem pertaining to the perovskite solar cell market

- To strategically analyze the ecosystem, tariffs and regulations, patent landscape, trade landscape, and case studies pertaining to the market under study

- To profile the key players and comprehensively analyze their market positions in terms of ranking and core competencies2

To analyze the competitive developments such as joint ventures, mergers and acquisitions, product developments, and research and development (R&D) in the perovskite solar cell market

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Perovskite Solar Cell Market