Pediatric Interventional Cardiology Market By Congenital Heart Defect Closure Device [ASD, Ventricular Septal Defect, Patent Ductus Arteriosus, Left Atrial Appendage, Aortic Valve, Pulmonary Valve] & Procedures Global Forecasts to 2018

The global pediatric interventional cardiology market is segmented on the basis of type of devices and geography. Based on the type of device, the market is further segmented into congenital heart defect closure devices, transcatheter heart valves, and others (catheters, guidewires, balloons, and stents). Based on geography, this market is divided into four geographic regions, namely, North America, Europe, Asia-Pacific, and the Rest of the World (RoW). This report also includes the number of pediatric interventional cardiology procedures performed across different regions.

The market is expected to witness a healthy growth in the forecast period. This high growth can be attributed to a number of factors such as the rising incidences of congenital heart disease and FDAs initiatives to seep-up the regulatory procedure. Technological advancements, owing to which new and advanced products are being launched in the market, is another factor propelling the growth of this market. The untapped markets in the Asia-Pacific region are major opportunity areas for pediatric interventional cardiology companies. Limited penetration of cardiac devices which are specifically designed for pediatric patients is a major unmet need in this market; it offers a huge array of opportunities for the market to grow. However, varied stringency of regulatory procedures across the globe and the presence of complex regulatory procedures may hinder the growth of this market.

The Asia-Pacific region is expected to witness the highest growth over the next five years. The major reason for this high growth is the improving healthcare infrastructure in this region. Also, the growth in government investments for improving pediatric care facilities, coupled with investments by major players in the APAC region, is another factor that is propelling the growth of this market.

The major players in the market include St. Jude Medical (U.S), Gore Medical (U.S.), Boston Scientific (U.S.), Edward LifeSciences (U.S.), Abbott Vascular (U.S.), GE Healthcare (U.S.), and Siemens Healthcare (Germany).

Scope of the Report

This research report categorizes the global pediatric interventional cardiology market into the following segments and sub-segments:

By Device Type

- Congenital Heart Defect Closure Devices

- Atrial Septal Defect (ASD), Ventricular Septal Defect (VSD), and Patent Foramen Ovale (PFO) Closure Devices

- Patent Ductus Arteriosus (PDA) Closure Devices

- Left Atrial Appendage (LAA) Closure Devices

- Transcatheter Heart Valves

- Transcatheter Pulmonary Valves

- Transcatheter Aortic Valves

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- RoW

In the recent years, the pediatric interventional cardiology market has witnessed a large number of technological advancements, owing to which new and advanced products are being launched in the market. The global market was valued at $894.7 million in 2013 and is expected to reach $1,379.1 million by 2018, at a CAGR of 9.0%. The market is broadly classified based on the type of devices and geography. The numbers of pediatric interventional cardiology procedures performed in each geography are also provided in this report.

The devices market is further divided into structural heart defect closure devices, transcatheter heart valves, and Others. The structural heart defect closure devices segment is sub-divided into artial septal defect closure devices, ventricular septal defect closure devices, patent foramen ovale, patent ductus arteriosus, and left artial appendage closure devices. The transcatheter heart valves segment is classified into transcatheter pulmonary valves and transcatheter aortic valves. The Others segment consist of devices such as catheters, guidewires, stents, and balloons.

The major factors driving the growth of the market include the growth in government support, rising incidences of congenital heart defects, technological advancements, and the advantages of minimally invasive surgeries over traditional surgeries. Moreover, the presence of a large untapped market in emerging countries, high growth potential of transcatheter heart valves market, and advancements in biodegradable devices for pediatric patients represent the growth opportunities for this market.

However, varied stringency of regulatory procedures across the globe and the presence of complex regulatory procedures are the factors that are curbing the growth of this market.

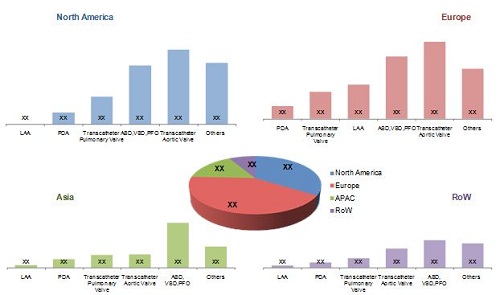

Global Pediatric Interventional Cardiology Market, by Geography, 2013

Source: Annual Reports, SEC Filings, International Children's Heart Foundation, Pediatric Cardiac Intensive Care Society, Association for European Paediatric Cardiology, European Society of Cardiology, Asia-Pacific Pediatric Cardiology Society, Pan-Arab Congenital Heart Disease Association, American Academy of Pediatrics, American Heart Association, Canadian Pediatric Cardiology Association, Austrian Working Group on Interventional Cardiology, Sociedade Portuguesa de Pediatria, Japanese Society of Pediatric Cardiology and Cardiac Surgery, Pediatric Cardiac Society of India, Indian Academy of Pediatrics, Congenital Cardiology Today, Expert Interviews, and MarketsandMarkets Analysis.

The global market is dominated by Europe, followed by North America, APAC, and the Rest of the World (RoW).

Over the next five years, the growth of the global market in the APAC region is likely to be centered at China, Japan, Australia, New Zealand, Singapore, and India. This growth will be driven by new product launches, government initiatives, and investments by major players in the APAC market.

The major players in the pediatric interventional cardiology market include St. Jude Medical, Inc. (U.S.), Medtronic, Inc. (U.S.), W.L. Gore & Associates, Inc. (U.S.), Edwards Lifesciences Corp (U.S.), NuMED, Inc. (U.S.), Cordis Corporation (U.S.), GE Healthcare (U.K.), Siemens Healthcare (Germany), Boston Scientific (U.S.), and Abbott Vascular (U.S.), among others.

Table Of Contents

1 Introduction (Page No. - 19)

1.1 Objectives of the Study

1.2 Report Description

1.3 Markets Covered

1.4 Stakeholders

1.5 Scope

1.6 Research Methodology

1.6.1 Market Size Estimation

1.6.2 Market Crackdown & Data Triangulation

1.6.3 Market Share Calculation

1.6.4 Key Data Points from Primary Sources

1.6.5 Key Data Points from Secondary Sources

1.6.6 Assumptions

2 Executive Summary (Page No. - 31)

3 Premium Insights (Page No. - 35)

3.1 Investment Trends

3.2 Technology Trends

3.3 Regulatory Environment

3.3.1 Regulatory Approval Procedures for Pediatric Cardiology Devices

3.3.1.1 510(K) Application

3.3.1.2 Premarket Approval (Pma) Application

3.3.1.3 Humanitarian Device Exemption (Hde) Application

3.3.2 Intellectual Property Protection and Patent Litigation

3.4 Reimbursement Scenario: Transcatheter Heart Valves

3.5 Porters Five Forces Analysis: Pediatric Interventional Cardiology Imaging Market

3.5.1 Threat of New Entrants

3.5.2 Bargaining Power of Suppliers

3.5.3 Bargaining Power of Buyers

3.5.4 Competitor Rivalry

3.5.5 Threat of Substitutes

3.6 Unmet Need

3.6.1 Pediatric-Specific Cardiac Devices

3.7 Winning Imperatives

3.7.1 Investments in R&D Activities

3.7.2 Acquisitions

4 Market Overview (Page No. - 49)

4.1 Market Dynamics

4.1.1 Market Drivers

4.1.1.1 Pediatric Interventional Cardiology Devices

4.1.1.1.1 Government Support, An Impetus for the Pediatric Interventional Cardiology Market

4.1.1.1.2 Awareness Programs and Conferences to Fuel the Market

4.1.1.1.3 Rising Incidences of Congenital Heart Defects(CHD)to Propel the Pediatric Interventional Cardiology Market

4.1.1.1.4 Technological Advancements to Open New Opportunities for Device Manufacturers

4.1.1.1.5 Advantages of Minimally Invasive Procedures Over Conventional Surgeries to Propel the Market Growth

4.1.1.2 Pediatric Cardiology Imaging

4.1.1.2.1 Fdas Efforts to Bolster the Pediatric Cardiology Imaging Market

4.1.2 Market Restraints

4.1.2.1 Pediatric Interventional Cardiology Devices

4.1.2.1.1 Complex Regulatory Procedures

4.1.2.1.2 Varied Stringency of Regulatory Procedures Delays Product Launches

4.1.2.2 Pediatric Cardiology Imaging

4.1.2.2.1 Implementation of Excise Tax By the U.S. Government

4.1.3 Market Opportunities

4.1.3.1 Pediatric Interventional Cardiology Devices

4.1.3.1.1 Advances In Biodegradable Devices for Pediatric Cardiology

4.1.3.1.2 Asia-Pacific Region Presents Significant Growth Opportunities

4.1.3.1.3 Robust Growth in the Transcatheter Heart Valves Market

4.1.3.2 Pediatric Cardiology Imaging

4.1.3.2.1 Mobile Cath Labs, An Upcoming Opportunity Area

4.1.4 Challenges

4.1.4.1 Pediatric Interventional Cardiology Devices

4.1.4.1.1 Difficulties in Pediatric Clinical Trials

4.1.4.2 Pediatric Cardiology Imaging

4.1.4.2.1 High Cost of Pediatric Interventional Cardiology Imaging Devices

4.1.4.2.2 Survival of Small Players and New Entrants

4.2 Market Share Analysis

4.2.1 Structural Heart Defect Closure Devices

4.2.2 Transcatheter Heart Valves

5 Pediatric Interventional Cardiology Procedures (Page No. - 67)

5.1 Introduction

5.2 North America

5.3 Europe

5.4 APAC

5.5 ROW

6 Pediatric Interventional Cardiology Devices Market (Page No. - 77)

6.1 Introduction

6.2 Heart Defect Closure Devices

6.2.1 ASD, VSD, & PFO Closure Devices

6.2.1.1 Atrial Septal Defect (ASD) Closure Devices

6.2.1.2 Ventricular Septal Defect (VSD) Closure Devices

6.2.1.3 Patent Foramen Ovale (PFO) Closure Devices

6.2.2 Patent Ductus Arteriosus (Pda) Closure Devices

6.2.3 Left Atrial Appendage (Laa) Closure Devices

6.3 Transcatheter Heart Valves

6.3.1 Transcatheter Pulmonary Valves

6.3.2 Transcatheter Aortic Valves (TAV)

6.4 Others

6.4.1 Angioplasty Balloons

6.4.2 Angioplasty Stents

6.4.3 Catheters

6.4.4 Guidewires

7 Geographic Analysis (Page No. - 130)

7.1 Introduction

7.2 Europe

7.2.1 Germany

7.2.2 France

7.2.3 U.K.

7.2.4 Italy

7.2.5 Spain

7.2.6 Roe

7.3 North America

7.3.1 U.S.

7.3.2 Canada

7.4 Asia-Pacific (APAC)

7.5 Rest of the World (ROW)

8 Competitive Landscape (Page No. - 158)

8.1 Pediatric Interventional Cardiology Imaging Market

8.1.1 Introduction

8.1.2 New Product Launches

8.1.3 Acquisitions

8.1.4 Agreements

8.1.5 Expansions

8.1.6 Approvals

8.2 Pediatric Interventional Cardiology Devices Market

8.2.1 Introduction

8.2.2 Acquisitions

8.2.3 Agreements

8.2.4 New Product Launches

8.2.5 Other Developments

8.2.6 Approvals

9 Company Profiles (Overview, Financials, Products & Services, Strategy, & Developments)* (Page No. - 176)

9.1 Imaging Products Companies

9.1.1 Ge Healthcare (Subsidiary of General Electric Company)

9.1.2 Siemens Healthcare (Subsidiary of Siemens AG)

9.1.3 toshiba Corporation

9.2 Pediatric Interventional Cardiology Device Companies

9.2.1 Edwards Lifesciences

9.2.2 Gore Medical (Subsidiary of W.L. Gore & Associates)

9.2.3 Medtronic, Inc.

9.2.4 St. Jude Medical

9.2.5 Abbott Vascular (A Subsidiary of Abbott Laboratories)

9.2.6 Boston Scientific Corporation

9.2.7 Cordis Corporation (Subsidiary of Johnson & Johnson)

9.2.8 Numed, Inc.

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

List of Tables (90 Tables)

Table 1 Pediatric Interventional Cardiology Devices Market, By Geography, 2011-2018 ($Million)

Table 2 Number of Pediatric Interventional Cardiology Procedures, By Geography, 20122018

Table 3 Global Market, By Device Type, 20112018 ($Million)

Table 4 Pediatric Interventional Cardiology Devices Market, By Geography, 20112018 ($Million)

Table 5 North America: Pediatric Interventional Cardiology Devices Market, By Country, 20112018 ($Million)

Table 6 Europe: Pediatric Interventional Cardiology Devices Market, By Country, 20112018 ($Million)

Table 7 Heart Defect Closure Devices Market, By Device Type, 20112018 ($Million)

Table 8 Heart Defect Closure Devices Market, By Geography, 20112018 ($Million)

Table 9 North America: Heart Defect Closure Devices Market, By Country, 20112018 ($Million)

Table 10 Europe: Heart Defect Closure Devices Market, By Country, 20112018 ($Million)

Table 11 Pediatric ASD, VSD, & PFO Closure Devices Market, By Geography, 20112018 ($Million)

Table 12 North America: Pediatric ASD, VSD, & PFO Closure Devices Market, By Country, 20112018 ($Million)

Table 13 Europe: Pediatric ASD, VSD, & PFO Closure Devices Market, By Country, 20112018 ($Million)

Table 14 Major Atrial Septal Devices

Table 15 Major Ventricular Septal Defect Closure Devices

Table 16 Major Patent Foramen Ovale Closure Devices

Table 17 Major Patent Ductus Arteriosus Closure Devices

Table 18 Pediatric Pda Closure Devices Market, By Geography, 20112018 ($Million)

Table 19 North America: Pediatric Pda Closure Devices Market, By Country, 20112018 ($Million)

Table 20 Europe: Pediatric Pda Closure Devices Market, By Country, 20112018 ($Million)

Table 21 Major Left Atrial Appendage Closure Devices

Table 22 Pediatric Laa Closure Devices Market, By Geography, 20112018 ($Million)

Table 23 North America: Pediatric Laa Closure Devices Market, By Country, 20112018 ($Million)

Table 24 Europe: Pediatric Laa Closure Devices Market, By Country, 20112018 ($Million)

Table 25 Transcatheter Heart Valves Market, By Device Type, 20112018 ($Million)

Table 26 Transcatheter Heart Valves Market, By Geography, 20112018 ($Million)

Table 27 North America: Transcatheter Heart Valves Market, By Country, 20112018 ($Million)

Table 28 Europe: Transcatheter Heart Valves Market, By Country, 20112018 ($Million)

Table 29 Major Transcatheter Pulmonary Valve

Table 30 Pediatric Transcatheter Pulmonary Valve Device Market, By Geography, 20112018 ($Million)

Table 31 North America: Transcatheter Pulmonary Valves Market, By Country, 20112018 ($Million)

Table 32 Europe: Transcatheter Pulmonary Valves Market, By Country, 20112018 ($Million)

Table 33 Major Transcatheter Aortic Valves

Table 34 Pediatric Transcatheter Aortic Valve Device Market, By Geography, 20112018 ($Million)

Table 35 North America: Transcatheter Aortic Valves Market, By Country, 20112018 ($Million)

Table 36 Europe: Transcatheter Aortic Valves Market, By Country, 20112018 ($Million)

Table 37 Other Devices Market, By Geography, 20112018 ($Million)

Table 38 North America: Other Devices Market, By Country, 20112018 ($Million)

Table 39 Europe: Other Devices Market, By Country, 20112018 ($Million)

Table 40 Pediatric Interventional Cardiology Devices Market, By Geography, 20112018 ($Million)

Table 41 Europe: Market, By Device Type, 20112018 ($Million)

Table 42 Germany: Market, By Device Type, 20112018 ($Million)

Table 43 France: Market, By Device Type, 20112018 ($Million)

Table 44 U.K.: Market, By Device Type, 20112018 ($Million)

Table 45 Italy: Market, By Device Type, 20112018 ($Million)

Table 46 Spain: Market, By Device Type, 20112018 ($Million)

Table 47 Rest of Europe: Market, By Device Type, 20112018 ($Million)

Table 48 North America: Market, By Device Type, 20112018 ($Million)

Table 49 U.S.: Market, By Device Type, 20112018 ($Million)

Table 50 Canada: Market, By Device Type, 20112018 ($Million)

Table 51 Asia-Pacific (APAC): Market, By Device Type, 20112018 ($Million)

Table 52 ROW: Market, By Device Type, 20112018 ($Million)

Table 53 New Product Launch, 2011-2013

Table 54 Acquisitions, 2011-2013

Table 55 Agreements, 2011-2013

Table 56 Expansions, 2011-2013

Table 57 Approvals, 2011-2013

Table 58 Acqusitions, 2011-2013

Table 59 Agreements, 2011-2013

Table 60 New Product Launch, 2011-2013

Table 61 Other Developments, 2011-2013

Table 62 Approvals, 2011-2014

Table 63 General Electric: Total Revenue and R&D Expenditure, 20112013 ($Million)

Table 64 General Electric: Total Revenue, By Segment, 20112013 ($Million)

Table 65 General Electric: Total Revenue, By Geography, 20112013 ($Billion)

Table 66 Siemens Healthcare: Total Revenue and R&D Expenditure, 20112013 ($Million)

Table 67 Siemens Healthcare: Total Revenue, By Segment, 20112013 ($Million)

Table 68 Siemens Healthcare: Total Revenue, By Geography, 20112013 ($Million)

Table 69 Toshiba Corporation: Total Revenue and R&D Expenditure, 20112013 ($Billion)

Table 70 Toshiba Corporation: Total Revenue, By Segment, 20112013 ($Billion)

Table 71 Toshiba Corporation: Total Revenue, By Geography, 20112013 ($Billion)

Table 72 Edwards Lifesciences: Total Revenue and R&D Expenditure, 20102012 ($Million)

Table 73 Edwards Lifesciences: Total Revenue, By Segment, 20102012 ($Million)

Table 74 Edwards Lifesciences: Total Revenue, By Geography, 20102012 ($Million)

Table 75 Medtronic, Inc.: Total Revenue and R&D Expenditure, 20112013 ($Million)

Table 76 Medtronic, Inc.: Total Revenue, By Segment, 20112013 ($Million)

Table 77 Medtronic, Inc.: Total Revenue, By Geography, 20112013 ($Million)

Table 78 St. Jude Medical: Total Revenue and R&D Expenditure, 20112013 ($Million)

Table 79 St. Jude Medical: Total Revenue, By Segment, 20112013 ($Million)

Table 80 St. Jude Medical: Total Revenue, By Geography, 20112013 ($Million)

Table 81 Abbott Laboratories: Total Revenue and R&D Expenditure, 20112013 ($Million)

Table 82 Abbott Laboratories: Total Revenue, By Segment, 20112013 ($Million)

Table 83 Abbott Laboratories: Total Revenue, By Geography, 20112013 ($Million)

Table 84 Boston Scientific Corporation: Total Revenue and R&D Expenditure, 2011-2013 ($Million)

Table 85 Boston Scientific Corporation: Total Revenue, By Segment, 20112013 ($Million)

Table 86 Boston Scientific Corporation: Total Revenue, By Geography, 20112013 ($Million)

Table 87 Johnson & Johnson: Total Revenue and R&D Expenditure, 20112013 ($Million)

Table 88 Johnson & Johnson: Total Revenue, By Segment, 20112013 ($Million)

Table 89 Johnson & Johnson: Medical Devices and Diagnostic Segment Revenue, By Segment, 20112013 ($Million)

Table 90 Johnson & Johnson: Medical Devices and Diagnostic Segment Revenue, By Geography, 20112013 ($Million)

List of Figures (19 Figures)

Figure 1 Forecast Model

Figure 2 Market Size Estimation Methodology

Figure 3 Data Triangulation

Figure 4 Number of Pediatric Interventional Cardiology Procedures, 20122018

Figure 5 Major Patent Infringement Cases

Figure 6 Porters Five Forces Analysis

Figure 7 Market Dynamics

Figure 8 Structural Heart Defect Closure Devices Market Share Analysis, By Key Players, 2012

Figure 9 Transcatheter Heart Valve Market Share Analysis, By Key Player, 2012

Figure 10 Number of Pediatric Interventional Cardiology Procedures & Prevalence of CHD, By Geography, 20122018

Figure 11 North America: Number of Pediatric Interventional Cardiology Procedures, 20122018

Figure 12 Europe: Number of Pediatric Interventional Cardiology Procedures, 20122018

Figure 13 APAC: Number of Pediatric Interventional Cardiology Procedures, 20122018

Figure 14 ROW: Number of Pediatric Interventional Cardiology Procedures, 20122018

Figure 15 Pediatric Interventional Cardiology Devices Market, By Device Type

Figure 16 Other Devices

Figure 17 Pediatric Interventional Cardiology Devices Market, By Geography, 2013 ($Million)

Figure 18 Key Growth Strategies, Pediatric Interventional Cardiology Imaging Market, 20112014

Figure 19 Key Growth Strategies, Pediatric Interventional Cardiology Devices Market, 20112014

Customization Options:

With the above mentioned TOC, you can also customize the market data that meet your Companys specific needs. Customize to get comprehensive industry standard and detailed analysis of the following parameters such as:

Country Level Market Data

- APAC (Japan, China, India, Australia and New Zealand, and Rest of Asia)

- Rest of the World (Latin America, Middle East, and Africa)

Names of Major Pediatric Cardiology Hospitals in

- U.S.

- France

- Germany

- Greece

- Italy

- Spain

- U.K.

- Rest of Europe

- Australia

- China

- India

- Japan

- Israel

- Malaysia

- New Zealand

- Rest of Asia

Product Analysis

- Comparison of major cardiac imaging systems

- Qualitative information regarding hybrid cath labs and the cost division involved constructing a hybrid cath lab

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Pediatric Interventional Cardiology Market