PCB Repair or Rework Market - Global Market to 2030

The demand for PCB driven electronics devices has tremendously increased over the years, which has further accelerated the complexities for PCB boards. With the stringent safety and quality regulations for electronics components, the PCB manufacturers are taking several steps to ensure the PCB performance as expected. The high value of several PCB boards demands the repair feature. Even the less expensive assemblies require repair owing to tightly controlled production and just in time manufacturing which result in little space for shortage.

The PCB repair services offers the repair services for various electronics components and internal assemblies. PCB repair services overcome the physical damages that has been done to the PCB mainly pad or trace lifting, eyelet replacement, and laminate repair.

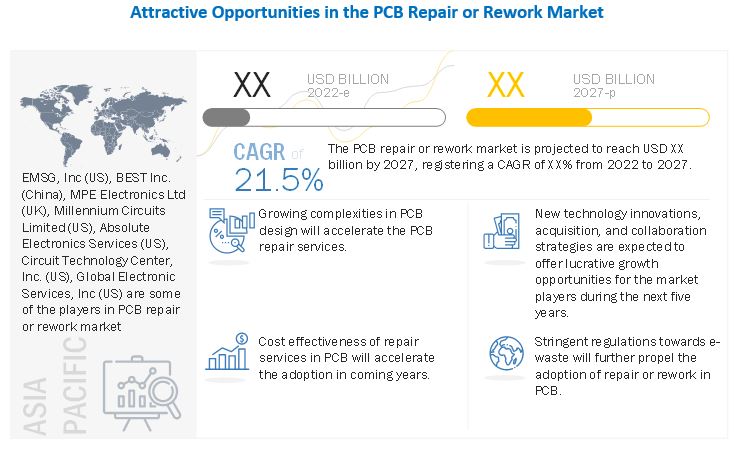

The global PCB repair or rework market size is expected to grow from USD XX million in 2024 to USD XX million by 2030, at a CAGR of XX%. Increasing demand for compact features in PCB design and development is the key factor driving the market growth.

To know about the assumptions considered for the study, Request for Free Sample Report

Drivers: Growing complexities in PCB design will accelerate the PCB repair services

Proliferation of compact features and continuous shrinking of electronics components has accelerated the design complexities to accommodate miniaturization of PCB components. Therefore, this translates into the development of smaller boards with miniature puzzle pieces fit of electronics component. With the advancement of technology, the designing and development of PCB boards has become thinner and less bulky boards, which are more susceptible to damages. The trace damages might affect the conductivity of boards and circuits which leads to component failure. This will accelerate the requirement for PCB repair services which helps to identify common PCB issues.

Drivers: Cost effectiveness of repair or rework on PCB as compared to building of new PCB

E-waste or the material which includes electronics is another merging problem in current scenario. Around 50 million tons of electronics are discarded every year and if this continues the annual amount of e-waste can reach to 120 million tons every year. Several stringent regulations towards e-waste have propelled the demand for repair or rework of PCBs rather than replacing with new one. Moreover, the repairing of PCB board is much more economical rather than rebuilding. The refurbishing or repairing of PCB can save up to 70% of the cost as compared to the rebuilding of product from scratch.

Challenges: High complexities in repairing advanced printed circuit boards

The advancement in technology has resulted in development of circuit boards with compact, thinner, and less bulkier boards. This has resulted in tricky and complex PCB repair process, as there are several different types of PCB varying in design and size. Today’s printed circuit boards are integrated with fine line circuits, pitch components, and ball grid arrays, which makes them a challenge to repair. Moreover, repairing these complex PCB requires high end technical knowledge and manual skills to deliver high reliability PCB.

Key Market Players

EMSG, Inc (US), BEST Inc. (US), MPE Electronics Ltd (UK), Millennium Circuits Limited (US), Absolute Electronics Services (US), Circuit Technology Center, Inc. (US), Global Electronic Services, Inc (US) are some of the players in PCB repair or rework market.

Recent Developments

- In September 2022, Pulsar Circuits, a provider of PCB solutions in Canada and US has announced their revamped PCB assembly services, which helps to deliver fast PCB fabrication and assembly at low cost with high quality product.

- In April 2022, TestEquity which is engaged in distribution of electronics test and measurement solution has announced to become an official authorized distributor of Kurtz Ersa products. Kurtz Ersa offers product and application knowledge which helps to meet the stringent demand of customers engaged in manufacturing and repair of PCBs.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 Introduction

1.1. Study Objectives

1.2. Definition

1.3. Study Scope

1.3.1. Markets Covered

1.3.2. Geographic Scope

1.3.3. Years Considered

1.4. Currency

1.5. Key Stakeholders

1.6. Summary of Changes

2 Research Methodology

2.1. Research Data

2.2. Secondary Data

2.2.1. Major Secondary Sources

2.2.2. Key Data from Secondary Sources

2.3. Primary Data

2.3.1. Key Data from Primary Sources

2.3.2. Key Participants in Primary Processes across Market Value Chain

2.3.3. Breakdown Of Primary Interviews

2.3.4. Key Industry Insights

2.4. Market Size Estimation

2.5. Market Breakdown and Data Triangulation

2.6. Risk Analysis

2.7. Research Assumptions and Limitations

3 Executive Summary

3.1. Scenario Analysis

3.1.1. Optimistic (Post-COVID-19)

3.1.2. Realistic (Post-COVID-19)

3.1.3. Pessimistic (Post-COVID-19)

4 Premium Insights

5 Industry Trends and Market Overview

5.1. Introduction

5.2. Value Chain Analysis

5.3. Market Dynamics

5.3.1. Drivers

5.3.2. Restraints

5.3.3. Opportunities

5.3.4. Challenges

5.4. Revenue Shift and New Revenue Pockets for Market Players

5.5. Market Ecosystem/Market Map

5.6. Key Industry Trends

5.7. Pricing Analysis

5.8. Case Study Analysis

5.9. Patent Analysis

5.10. Trade Analysis

5.11. Porter’s Five Forces Analysis

5.12. Key Stakeholders and Buying Criteria

5.13. Regulatory Landscape

6 PCB Repair/Rework Market, by Type

6.1. Introduction

6.2. Rigid PCB

6.3. Flex PCB

6.4. Rigid-flex PCB

6.5. HDI PCB

6.6. Others

7 PCB Repair/Rework Market, by Repair Work Type

7.1. Introduction

7.2. Physical Damage

7.3. Component Failure

7.4. Trace Damage

7.5. Design Issue

7.6. Power Failure

7.7. Others

8 PCB Repair/Rework Market, by End-use Industry

8.1. Introduction

8.2. Business/Retail

8.3. IT & Telecom

8.4. Consumer Electronics

8.5. Industrial

8.6. Healthcare

8.7. Automotive

8.8. Government/Military/Defense

8.9. Others

9 PCB Repair/Rework Market, by Region

9.1. Introduction

9.2. North America

9.2.1. US

9.2.2. Canada

9.2.3. Mexico

9.3. Europe

9.3.1. UK

9.3.2. Germany

9.3.3. France

9.3.4. Italy

9.3.5. Rest of Europe

9.4. APAC

9.4.1. China

9.4.2. Japan

9.4.3. India

9.4.4. Rest of APAC

9.5. RoW

9.5.1. South America

9.5.2. Middle East

9.5.3. Africa

10 Competitive Landscape

10.1. Overview

10.2. 5-Year Revenue Analysis- Top 5 Companies

10.3. Market Share Analysis: PCB Repair/Rework Market (Top 5)

10.4. Company Evaluation Quadrant, 2021

10.4.1. Star

10.4.2. Pervasive

10.4.3. Participant

10.4.4. Emerging Leader

10.5. Competitive Benchmarking

10.6. Startup/SME Evaluation Quadrant, 2021

10.6.1. Progressive Companies

10.6.2. Responsive Companies

10.6.3. Dynamic Companies

10.6.4. Starting Blocks

10.6.5. Startup/ SME Data Table

10.6.6. Competitive Benchmarking of Key Startups/SMEs

10.7. Competitive Situations and Trends

11 Company Profiles

11.1. Introduction

11.2. Key Players

11.2.1. EMSG, Inc.

11.2.1.1. Business Overview

11.2.1.2. Products Offered

11.2.1.3. Recent Developments

11.2.1.4. MNM View

11.2.1.4.1. Key Strengths/Right to Win

11.2.1.4.2. Strategic Choices Made

11.2.1.4.3. Weaknesses And Competitive Threats

Note: Similar Information Would Be Provided for Top 5 (Key Players)

11.2.2. BEST Inc.

11.2.3. Millennium Circuits Limited

11.2.4. Nippon Mektron Ltd.

11.2.5. Zhen Ding Technology

11.2.6. TTM Technologies

11.2.7. Flex Ltd.

11.2.8. SMTC Corp.

11.2.9. Advanced Circuitry International

11.2.10. Unimicron

11.2.11. RayMing Technology

11.2.12. Shennan Circuits

11.2.13. Tripod Technology

11.2.14. Global Electronic Services, Inc.

Note: The above list of companies is tentative and might change during due course of research

12 Appendix

Growth opportunities and latent adjacency in PCB Repair or Rework Market