Device-as-a-Service Market Size, Share and Industry Growth Analysis Report by Offering, Device Type (Desktops; Laptops, Notebooks, Tablets; Smartphones & Peripherals), Organization Size, End User (IT & Telecommunication, BFSI and others) & Region - Global Growth Driver and Industry Forecast

Updated on : Oct 04, 2023

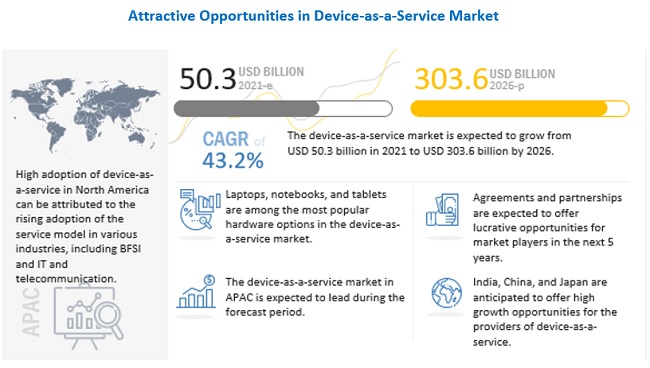

Global device-as-a-service market in terms of revenue was estimated to be worth USD 50.3 billion in 2021 and is poised to reach USD 303.6 billion by 2026, growing at a CAGR of 43.2% from 2021 to 2026. The new research study consists of an industry trend analysis of the market.

The market has been witnessing significant growth over the past years, mainly owing to the rising demand for subscription-based model and the increase in a number of channel partner offering in device-as-a-service. Increasing adoption of cloud computing services in developing countries is also expected to considerably boost the market in the coming years.

To know about the assumptions considered for the study, Request for Free Sample Report

Impact of COVID-19 on Device-as-a-Service Market:

The outbreak of COVID-19 has resulted in an increase in the demand for device-as-a-service industry solutions, especially in 2020 and 2021. The pandemic has forced companies to rapidly adopt remote working practices. The device-as-a-service model is gaining popularity among organizations as it provides pre-configured hardware such as desktops, laptops, tablets, and smartphones, and customized software.

Additionally, after the COVID-19 broke out, cyberattacks have increased, and remote employees have been prime targets for hackers. Here, the device-as-a-service model can be helpful as it is an all-inclusive managed solution, which comes with its own cyber defense toolkit. Also, the service providers are responsible for ensuring that all devices have up-to-date security software and are always free from harmful malware. They are also entitled to ensure that hardware adheres to enterprises' individual security protocols around approved content, passwords, and data logging.

Device-as-a-Service Market Dynamics:

Driver: The rapid adoption of the subscription-based services model

The rapid adoption of the subscription-based services model is one of the major drivers of the device-as-a-service market. Subscription-based device-as-a-service models help customers to transform the high cost of acquiring new technology from a capital expenditure (CapEx) to an operating expense (OpEx). Through this, various businesses—small, mid-sized, and large—can free up cash for investment in strategic initiatives that can drive revenue. Moreover, other benefits such as policy compliance and the ability to use the latest technologies and access customized services, including device configuration, installation, data migration, on-site support, and technology recycling, are also gained. As a subscription service, the device-as-a-service model provides options for an organization to quickly scale up or down based on the current operating environment and business needs. Whether growing or downsizing, organizations can pay for exactly what they need, when they need it.

Restraint: Lack of awareness regarding the benefits offered by the device-as-a-service mode

Lack of awareness regarding the benefits offered by the device-as-a-service model is a major factor hindering the adoption of the device-as-a-service model, thereby restraining its growth. Companies in developing countries such as India, China, Brazil, and Indonesia have a comparatively low adoption of these services as they are unaware of the benefits such as data security, cost efficiency, a large number of devices available to choose from offered by device-as-a-service; thus, they are less willing to adopt this service model. Moreover, some of the security-focused organizations refrain from using such services, as they are afraid of losing their confidential data.

Opportunity: Emergence of wearable-as-a-service (WaaS) model

Wearable devices such as smartwatches, VR headsets, AR glasses, and medical patches are convenient and are becoming increasingly popular among end users, including business enterprises—who are mainly trying to benefit from the mobility and interoperability that comes with wearable devices, along with the vast amount of data generated. Various companies have now started manufacturing wearable devices to promote wearables-as-a-service (WaaS) solutions. For instance, Omate is a Chinese company offering a wearable-as-a-service solution. Similarly, Arkéa, a French banking and insurance company, has launched its WaaS model that allows end users or institutions to rent wearable devices. This eliminates the need for the upfront purchase of wearable devices, which can be an additional hurdle in the sales process. Thus, some device manufacturers have adopted this approach and are developing smartwatches targeted at recreational athletes, children, and the elderly. Wearable technology is now effectively being used in government offices, healthcare organizations, insurance companies, and families for elderly care management.

Challenge: Security and data protection risk associated with device-as-a-service

The demand for device-as-a-service has increased in many sectors, with organizations increasing their general use of cloud-based services, mainly due to security concerns. Moreover, the security budgets and number of cloud platform providers have significantly increased, and many customers are now adopting cloud wherever possible for deploying secure and resilient systems. Thus, security concerns associated with using a new service model are a major factor challenging the complete adoption of device-as-a-service. Cybersecurity and data protection hold significant importance, especially in the financial sector, as the foundation of banking lies in nurturing trust and credibility.

Services segment for device-as-a-service market to grow at highest CAGR during the forecast period

Device-as-a-service model includes a variety of support and maintenance services. It consists of a collection of device lifecycle services, which include installation, deployment and integration, asset recovery services, and repair and maintenance services as per the end user’s requirements. These services offered are flexible since they can be tailored and optimized. Many OEMs offer direct services as per the contract.

In addition, there are managed service providers and value added resellers (VARs) who have been partnering with different hardware manufacturers and software vendors and provide complete device-as-a-service solutions under their own brand names. Continuous support and service ensure the smooth functioning of organizations. Device-as-a-service also encompasses financial services, which provide flexibility for end users in terms of payment. These factors thereby driving the growth of the device-as-a-service market for services.

Smartphone & Peripherals for device-as-a-service market to grow at highest CAGR during the forecast period

Device-as-a-service solutions for smartphones offer organizations the benefits of lower costs, access to recent technologies, more predictable prices, and strong enterprise security. The demand for smartphones has been flattening out over the past few years. New paradigms like device-as-a-service, where users pay subscription fees to always have the latest devices are changing things.

Samsung and Apple are among the largest smartphone manufacturers and providers. Apple is one of the leading players in the market in providing device-as-a-service solutions, whereby users pay for subscriptions known as equipment installation plans (EIPs) to have the latest device. Peripherals that are provided in device-as-a-service models include expansion cards, graphics cards, image scanners, tape drives, microphones, loudspeakers, webcams, and digital cameras. Microsoft is one of the largest providers of peripherals in device-as-a-service solutions.

Small and medium-size enterprise to dominate device-as-a-service market, in terms of size during the forecast period

Small and medium-sized enterprises have been adopting the operating expenses (OpEx) business model over capital expenditure (CapEx), which is one of the key factors leading to high adoption of device-as-a-service in small and medium-sized enterprises. Device-as-a-service enables enterprises to prioritize their investments by leasing hardware and associated services instead of purchasing high-cost hardware devices. The device-as-a-service model minimizes costs and increases profits by tracking expenses daily. Small and medium-sized enterprises have low capital; thus, device-as-a-service is the most preferred solution for such organizations with a low IT budget. It also allows users to refresh their hardware at a faster rate, which ultimately helps organizations to enhance productivity, thus leading to an increase in demand.

IT and Telecommunication end user industry to have the largest market, in terms of size and is also expected to grow at highest CAGR during the forecast period

Access to secure, reliable, and high-performance IT devices are fundamental to operations of the IT and telecommunication industries; thus, the segment generates the most significant demand for IT devices such as desktops, laptops, tablets, notebooks, and smartphones. Moreover, the demand for constant updates of software and related services is more in this industry, thus contributing towards increased demand for device-as-a-service. Device-as-a-service enables timely upgrade and maintenance of hardware and software, allowing companies to reduce IT burdens; moreover, it helps to avoid technological obsolescence, which ultimately enhances productivity.

Implementing device-as-a-service in the IT and telecommunication industries helps companies reduce IT budgets by providing reasonable rates for renting of hardware, decrease downtime, and manage devices properly by providing security and software services. Companies like Accenture and Sprint Connect use device-as-a-service offered by HP; use of device-as-a-service solutions has helped these companies to improve their efficiency and productivity and save time and costs. Moreover, with increasing awareness regarding the benefits offered by device-as-a-service and shifting preference from the CapEx model to the OpEx business model in a bid to reduce additional investments in IT infrastructure, the market for device-as-a-service is set to exhibit an upbeat growth outlook.

To know about the assumptions considered for the study, download the pdf brochure

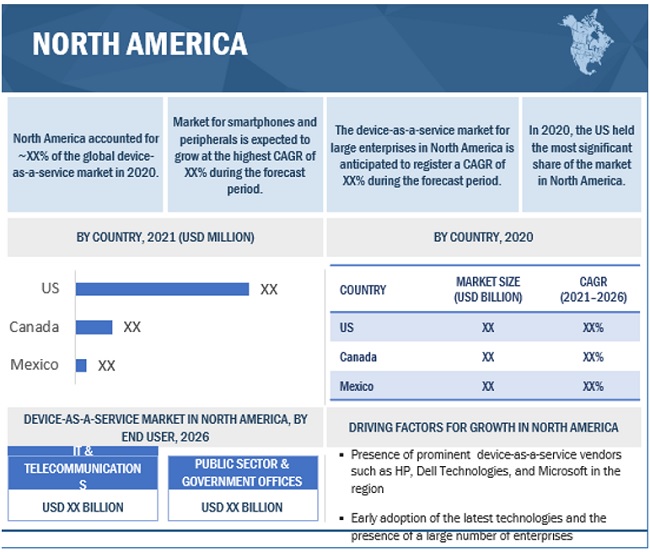

Device-as-a-service market in North America to account for largest market share during the forecast period

In 2020, North America accounted for the largest share of the device-as-a-service market. High demand for device-as-a-service from the IT and telecommunications end users is one of the major factors leading to the growth of the market in North America. Various IT and telecommunication companies such as AT&T, Microsoft, and Apple, are based in this region. Besides, several companies offering device-as-a-service, including Dell Technologies (US), HP (US), and Microsoft (US), also have a presence in this region, which further adds to the growth of the market in North America.

Top Device-as-a-Service Companies - Key Market Players

Dell Technologies (US), Lenovo (China), Hewlett Packard (US), Microsoft (US), Cisco (US), CompuCom(US), 3stepIT (Finland), Telia Company (Sweden), Atea Global Services (Latvia), CHG MERIDIAN (Germany), CSi leasing (US), Computacenter (UK), Econocom (France), GreenFlex (France), GRENKE (Germany), Excellence IT (UK), Foxway (Sweden), and Apple (US) are device-as-a-service companies operating in the market.

Device-as-a-Service Market Report Scope:

|

Report Attributes |

Details |

|

Market Size Value in 2021 |

USD 50.3 Billion |

| Revenue Forecast in 2026 | USD 303.6 Billion |

| Growth Rate | 43.2% |

| Base Year Considered | 2020 |

| Historical Data Available for Years | 2017–2026 |

|

Forecast Period |

2021–2026 |

|

Segments Covered |

|

|

Region Covered |

|

| Market Leaders |

|

| Top Companies in North America |

|

| Key Market Driver | The rapid adoption of the subscription-based services model |

| Key Market Opportunity | Emergence of wearable-as-a-service (WaaS) model |

| Largest Growing Region | North America |

| Largest Market Share Segment | IT and Telecommunication Segment |

| Highest CAGR Segment | Services Segment |

| Largest Application Market Share | Smartphone Application |

This research report categorizes the device-as-a-service market based on offering, device type, organization size, end user, and region.

Device-as-a-Service Market, by Offering

- Hardware

- Software

- Services

Device-as-a-Service Market, by Device Type

- Desktops

- Laptops, Notebooks and Tablets

- Smartphones and Peripherals

Device-as-a-Service Market, by Organization Size

- Small and Medium-sized Enterprises

- Large Enterprises

Device-as-a-Service Market, by End User

- IT & Telecommunications

- Healthcare and Life Sciences

- Educational Institutions

- Banking, Financial Services and Insurance (BFSI)

- Public Sector and Government Offices

- Others

Device-as-a-Service Market, by Geography

- North America (US, Canada, and Mexico)

- Europe (UK, Germany, France, Italy, Netherlands, Belgium, Nordic Countries (Sweden, Finland, Denmark, Norway), and Rest of Europe)

- APAC (China, Japan, Australia, India, and Rest of APAC)

- RoW (South America, and Middle East and Africa)

Recent Developments

- In April 2021, Lenovo's Intelligent Devices Group in North America has developed a new device-as-a-service offering tailored to meeting the needs of small and medium-sized businesses.

- In August 2020, CompuCom and Office Depot partnered to provide a suite of IT hardware and service offerings for small and mid-sized businesses to support their remote workplaces. Companies with between 50 and 1,500 users can access a range of services, including remote IT support, on-site hardware and software repair, and eco-friendly disposal of IT equipment.

- In April 2019, Dell Technologies and Microsoft expanded their partnership to address a wider range of customer needs and help accelerate digital transformations. Through this collaboration, the companies aimed to deliver a fully native, supported, and certified VMware cloud infrastructure on Microsoft Azure. Additionally, the collaboration allowed joint Microsoft 365 and VMware Workspace ONE customers to manage Office 365 across devices via cloud-based integration with Microsoft Intune and Azure Active Directory. VMware also extended the capabilities of Microsoft Windows Virtual Desktop leveraging VMware Horizon Cloud on Microsoft Azure.

Frequently Asked Questions (FAQ):

What are the key strategies adopted by key companies in the device-as-a-service market?

The partnerships and agreements have been and continues to be some of the major strategies adopted by the key players to grow in the device-as-a-service market.

Which is the emerging offering in the device-as-a-service market?

Hardware and software are the dominant segments in the device-as-a-service market in terms of market share, while the services segment is witnessing the highest growth in the device-as-a-service market.

Which is the key end-user industry of the device-as-a-service market?

IT & telecommunication have the highest market share in the end-user-industry in the device-as-a-service market.

Which device type is expected to penetrate significantly in the device-as-a-service market?

Laptop, notebooks, and tablets is currently most popular in the device-as-a-service market and is also expected to hold significant share of the market in the coming years.

Who are the major companies in the device-as-a-service market?

Dell Technologies (US), Lenovo (China), Hewlett Packard (US), Microsoft (US), and Cisco (US) are among the major companies operating in the device-as-a-service market. .

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 34)

1.1 STUDY OBJECTIVES

1.2 DEFINITION

1.2.1 INCLUSIONS AND EXCLUSIONS

1.3 SUMMARY OF CHANGES

1.4 STUDY SCOPE

1.4.1 MARKETS COVERED

FIGURE 1 MARKET SEGMENTATION

1.4.2 GEOGRAPHIC SCOPE

1.4.3 YEARS CONSIDERED

1.5 CURRENCY

1.6 LIMITATIONS

1.7 STAKEHOLDERS

2 RESEARCH METHODOLOGY (Page No. - 39)

2.1 RESEARCH DATA

FIGURE 2 PROCESS FLOW: MARKET SIZE ESTIMATION

FIGURE 3 RESEARCH DESIGN

2.1.1 SECONDARY AND PRIMARY RESEARCH

2.1.2 SECONDARY DATA

2.1.2.1 Secondary sources

2.1.2.2 Key secondary sources

2.1.3 PRIMARY DATA

2.1.3.1 Key data from primary sources

2.1.3.2 Key industry insights

2.1.3.3 Primary interviews with experts

2.1.3.4 List of key primary respondents

2.1.3.5 Breakdown of primaries

2.2 MARKET SIZE ESTIMATION

2.2.1 BOTTOM-UP APPROACH

2.2.1.1 Approach for arriving at market size by bottom-up analysis

FIGURE 4 MARKET: BOTTOM-UP APPROACH

2.2.2 TOP-DOWN APPROACH

2.2.2.1 Approach for capturing market size by top-down analysis

FIGURE 5 MARKET: TOP-DOWN APPROACH

2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

FIGURE 6 DATA TRIANGULATION

2.4 ASSUMPTIONS FOR RESEARCH STUDY

2.5 LIMITATIONS

2.6 RISK ASSESSMENT

TABLE 1 RISKS

3 EXECUTIVE SUMMARY (Page No. - 51)

3.1 MARKET: POST COVID-19

3.1.1 REALISTIC SCENARIO

FIGURE 7 REALISTIC SCENARIO: MARKET, 2017–2026 (USD BILLION)

3.1.2 PESSIMISTIC SCENARIO

FIGURE 8 PESSIMISTIC SCENARIO: MARKET, 2017–2026 (USD BILLION)

3.1.3 OPTIMISTIC SCENARIO

FIGURE 9 OPTIMISTIC SCENARIO: DEVICE-AS-A-SERVICE, 2017–2026 (USD BILLION)

FIGURE 10 IMPACT OF COVID-19 ON MARKET

FIGURE 11 SMALL AND MEDIUM-SIZED ENTERPRISES TO ACCOUNT FOR LARGER MARKET SHARE DURING FORECAST PERIOD

FIGURE 12 SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

FIGURE 13 LAPTOPS, NOTEBOOKS, & TABLETS TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 14 IT AND TELECOMMUNICATIONS SEGMENT TO ACCOUNT FOR LARGEST SIZE OF MARKET DURING FORECAST PERIOD

FIGURE 15 NORTH AMERICA HELD LARGEST MARKET SHARE IN 2020

4 PREMIUM INSIGHTS (Page No. - 57)

4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN MARKET

FIGURE 16 INCREASING ADOPTION OF DEVICE-AS-A-SERVICE IN APAC TO DRIVE MARKET GROWTH

4.2 MARKET, BY OFFERING

FIGURE 17 SERVICES SEGMENT TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

4.3 MARKET, BY DEVICE TYPE

FIGURE 18 LAPTOPS, NOTEBOOKS, & TABLETS HELD LARGEST SHARE OF MARKET IN 2020

4.4 MARKET IN NORTH AMERICA, BY COUNTRY AND END USER

FIGURE 19 US AND IT AND TELECOMMUNICATIONS SEGMENTS TO HOLD LARGEST SHARES OF MARKET IN NORTH AMERICA BY 2026

4.5 MARKET, BY ORGANIZATION SIZE

FIGURE 20 LARGE ENTERPRISES TO EXHIBIT HIGHER CAGR FROM 2021 TO 2026

4.6 MARKET, BY COUNTRY (2021)

FIGURE 21 US TO HOLD LARGEST SHARE OF MARKET IN 2021

5 MARKET OVERVIEW (Page No. - 60)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 22 RAPID ADOPTION OF SUBSCRIPTION-BASED MODEL TO DRIVE MARKET

5.2.1 DRIVERS

5.2.1.1 Rapid adoption of subscription-based service model

5.2.1.2 Increased number of channel partners offering DaaS

FIGURE 23 CHANNEL PARTNERS SELLING DEVICE-AS-A-SERVICE

5.2.1.3 Significant financial benefits aligned with DaaS model, especially for SMEs

5.2.1.4 Reduced workload for IT managers

5.2.1.5 Shorter refresh cycles

TABLE 2 AVERAGE LIFESPAN OF DEVICES

FIGURE 24 IMPACT ANALYSIS: DRIVERS

5.2.2 RESTRAINTS

5.2.2.1 Lack of awareness regarding benefits of DaaS

5.2.2.2 Low refresh cycles of IT devices in developing countries inhibiting growth of DaaS market

FIGURE 25 IMPACT ANALYSIS: RESTRAINTS

5.2.3 OPPORTUNITIES

5.2.3.1 Emergence of wearables-as-a-service (WaaS) model

5.2.3.2 Increasing focus on providing exceptional workplace environment

5.2.3.3 Surge in adoption of cloud computing in developing countries

FIGURE 26 IMPACT ANALYSIS: OPPORTUNITIES

5.2.4 CHALLENGES

5.2.4.1 Difficulties in transitioning to DaaS for large enterprises or businesses with complex infrastructure setups

5.2.4.2 Security and data protection risks associated with DaaS

FIGURE 27 IMPACT ANALYSIS: CHALLENGES

5.3 COVID-19 IMPACT ON MARKET

5.4 VALUE CHAIN ANALYSIS

FIGURE 28 VALUE CHAIN ANALYSIS: MARKET

5.5 PORTER’S FIVE FORCES ANALYSIS

TABLE 3 MARKET: PORTER’S FIVE FORCES ANALYSIS, 2020

5.5.1 THREAT OF NEW ENTRANTS

5.5.2 THREAT OF SUBSTITUTES

5.5.3 BARGAINING POWER OF BUYERS

5.5.4 BARGAINING POWER OF SUPPLIERS

5.5.5 DEGREE OF COMPETITION

5.6 TRADE ANALYSIS

5.6.1 TRADE ANALYSIS FOR MARKET

FIGURE 29 IMPORT VALUE OF AUTOMATIC & PORTABLE DATA-PROCESSING MACHINES IN MAJOR COUNTRIES, 2016–2019

TABLE 4 AUTOMATIC & PORTABLE DATA-PROCESSING MACHINES: GLOBAL IMPORT DATA, 2016–2020 (USD MILLION)

FIGURE 30 EXPORT VALUE OF AUTOMATIC & PORTABLE DATA-PROCESSING MACHINES IN MAJOR COUNTRIES, 2016–2019

TABLE 5 AUTOMATIC & PORTABLE DATA-PROCESSING MACHINES, GLOBAL EXPORT DATA, 2016–2020 (USD MILLION)

5.7 ECOSYSTEM

FIGURE 31 MARKET: ECOSYSTEM

TABLE 6 MARKET: ROLE IN ECOSYSTEM

FIGURE 32 REVENUE SHIFT IN MARKET

5.8 CASE STUDY ANALYSIS

5.8.1 HP DAAS MODEL HELPED L’ORÉAL’S TEAM IN TURKEY TO BECOME MORE EFFICIENT

5.8.2 HP’S DAAS HELPED IMPROVE IT SERVICE RESPONSE TIME ACROSS 8 UNAB CAMPUSES

5.8.3 SHI CUSTOMIZED SERVICES FOR CUSTOMER TO ACCOMMODATE COVID-19 REMOTE WORK EFFORTS

5.8.4 CHG HELPED THE HAUFE GROUP TO PROVIDE BEST IT EQUIPMENT TO EMPLOYEES

5.9 PATENT ANALYSIS

FIGURE 33 NUMBER OF PATENTS GRANTED FOR DESKTOP-AS-A-SERVICE WORLDWIDE, 2010–2021

FIGURE 34 TOP 10 COMPANIES WITH HIGHEST NUMBER OF PATENT APPLICATIONS IN LAST 10 YEARS FOR DESKTOP-AS-A-SERVICE WORLDWIDE, 2010–2020

TABLE 7 TOP 20 PATENT OWNERS (US) FOR DESKTOP-AS-A-SERVICE IN LAST 10 YEARS

5.10 TECHNOLOGY ANALYSIS

5.10.1 CLOUD TECHNOLOGY IS EXPECTED TO PROVIDE NECESSARY STIMULUS TO DAAS MARKET

5.11 MARKET REGULATIONS AND STANDARDS

5.11.1 STANDARDS

5.11.2 REGULATIONS

5.11.2.1 General Data Protection Regulation (GDPR)

5.11.2.2 Import-export laws

5.11.2.3 The Federal Trade Commission Act

6 DEVICE AS A SERVICE MARKET, BY OFFERING (Page No. - 85)

6.1 INTRODUCTION

FIGURE 35 MARKET, BY OFFERING

FIGURE 36 MARKET FOR SERVICES TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

TABLE 8 MARKET, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 9 MARKET, BY OFFERING, 2021–2026 (USD BILLION)

6.2 HARDWARE

6.2.1 INCREASING COMPETITION AMONG OEMS LEADING TO PRODUCT LAUNCHES AND DEVELOPMENTS

6.3 SOFTWARE

6.3.1 DIFFERENT INDEPENDENT SOFTWARE VENDORS CATER TO NEEDS OF END USERS

6.4 SERVICES

6.4.1 GROWING DEMAND FOR SUPPORT AND MAINTENANCE SERVICES TO DRIVE MARKET FOR DEVICE-AS-A-SERVICE

7 DEVICE AS A SERVICE MARKET, BY DEVICE TYPE (Page No. - 89)

7.1 INTRODUCTION

FIGURE 37 LAPTOPS, NOTEBOOKS, AND TABLETS TO HOLD LARGEST SIZE OF MARKET DURING FORECAST PERIOD

TABLE 10 MARKET, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 11 MARKET, BY DEVICE TYPE, 2021–2026 (USD BILLION)

7.2 DESKTOPS

7.2.1 DESKTOPS PROVIDE GREATER EFFICIENCY AND SECURITY AS COMPARED TO LAPTOPS

TABLE 12 MARKET FOR DESKTOPS, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 13 MARKET FOR DESKTOPS, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 14 MARKET FOR DESKTOPS, BY REGION, 2017–2020 (USD BILLION)

TABLE 15 MARKET FOR DESKTOPS, BY REGION, 2021–2026 (USD BILLION)

7.2.2 LAPTOPS, NOTEBOOKS, AND TABLETS

7.2.2.1 Portability and reduced space requirements make laptops, notebooks, and tablets easier to operate than desktops

FIGURE 38 SERVICES SEGMENT TO GROW AT HIGHEST CAGR IN MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS DURING FORECAST PERIOD

TABLE 16 MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 17 MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 18 MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS, BY REGION, 2017–2020 (USD BILLION)

TABLE 19 MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS, BY REGION, 2021–2026 (USD BILLION)

7.2.2.2 MARKET for laptops, notebooks, & tablets: COVID-19 impact

FIGURE 39 IMPACT OF COVID-19 ON MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS

TABLE 20 POST-COVID-19: MARKET FOR LAPTOPS, NOTEBOOKS, & TABLETS, 2017–2026 (USD BILLION)

7.2.3 SMARTPHONES AND PERIPHERALS

7.2.3.1 Vendors are providing smartphones as part of DaaS to encourage more frequent upgrades

TABLE 21 MARKET FOR SMARTPHONES & PERIPHERALS, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 22 MARKET FOR SMARTPHONES & PERIPHERALS, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 23 MARKET FOR SMARTPHONES & PERIPHERALS, BY REGION, 2017–2020 (USD BILLION)

TABLE 24 MARKET FOR SMARTPHONES & PERIPHERALS, BY REGION, 2021–2026 (USD BILLION)

8 DEVICE AS A SERVICE MARKET, BY ORGANIZATION SIZE (Page No. - 99)

8.1 INTRODUCTION

FIGURE 40 MARKET, BY ORGANIZATION SIZE

FIGURE 41 SMALL & MEDIUM-SIZED ENTERPRISES TO HOLD LARGER SIZE OF MARKET DURING FORECAST PERIOD

TABLE 25 MARKET, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 26 DEVICE AS A SERVICE MARKET, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

8.2 SMALL AND MEDIUM-SIZED ENTERPRISES

8.2.1 SHIFTING PREFERENCE OF SMALL AND MEDIUM-SIZED ENTERPRISES TOWARDS OPEX BUSINESS MODEL TO PROPEL MARKET GROWTH

TABLE 27 MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2017–2020 (USD BILLION)

TABLE 28 MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY REGION, 2021–2026 (USD BILLION)

TABLE 29 MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY END USER, 2017–2020 (USD BILLION)

TABLE 30 MARKET FOR SMALL & MEDIUM-SIZED ENTERPRISES, BY END USER, 2021–2026 (USD BILLION)

8.3 LARGE ENTERPRISES

8.3.1 REDUCTION IN IT SUPPORT AND PROCUREMENT WORKLOAD TO CREATE DEMAND FOR DEVICE AS A SERVICE IN THIS SEGMENT

TABLE 31 MARKET FOR LARGE ENTERPRISES, BY REGION, 2017–2020 (USD BILLION)

TABLE 32 MARKET FOR LARGE ENTERPRISES, BY REGION, 2021—2026 (USD BILLION)

TABLE 33 MARKET FOR LARGE ENTERPRISES, BY END USER, 2017–2020 (USD BILLION)

TABLE 34 MARKET FOR LARGE ENTERPRISES, BY END USER, 2021—2026 (USD BILLION)

8.3.1.1 MARKET for large enterprises: COVID-19 impact

FIGURE 42 IMPACT OF COVID-19 ON MARKET FOR LARGE ENTERPRISES

TABLE 35 POST-COVID-19: MARKET FOR LARGE ENTERPRISES, 2017–2026 (USD BILLION)

9 MARKET, BY END USER (Page No. - 107)

9.1 INTRODUCTION

FIGURE 43 IT & TELECOMMUNICATIONS SEGMENT TO EXHIBIT HIGHEST CAGR IN MARKET DURING FORECAST PERIOD

TABLE 36 MARKET, BY END USER, 2017–2020 (USD BILLION)

TABLE 37 MARKET, BY END USER, 2021–2026 (USD BILLION)

9.2 IT & TELECOMMUNICATIONS

9.2.1 TREMENDOUS COMPETITION IN IT AND TELECOMMUNICATION INDUSTRY TO PROPEL DEMAND FOR DEVICE-AS-A-SERVICE

TABLE 38 MARKET FOR IT & TELECOMMUNICATIONS, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 39 MARKET FOR IT & TELECOMMUNICATIONS, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 40 MARKET FOR IT & TELECOMMUNICATIONS, BY REGION, 2017–2020 (USD BILLION)

TABLE 41 MARKET FOR IT & TELECOMMUNICATIONS, BY REGION, 2021–2026 (USD BILLION)

9.2.1.1 MARKET for it and telecommunications: COVID-19 impact

FIGURE 44 IMPACT OF COVID-19 ON MARKET FOR IT AND TELECOMMUNICATIONS

TABLE 42 POST-COVID-19: MARKET FOR IT AND TELECOMMUNICATIONS, 2017–2026 (USD BILLION)

9.3 HEALTHCARE & LIFE SCIENCES

9.3.1 RAPID DIGITAL TRANSFORMATION IN HEALTHCARE & LIFE SCIENCES VERTICAL HAS INCREASED DEMAND FOR DEVICE-AS-A-SERVICE

TABLE 43 MARKET FOR HEALTHCARE & LIFE SCIENCES, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 44 MARKET FOR HEALTHCARE & LIFE SCIENCES, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 45 MARKET FOR HEALTHCARE & LIFE SCIENCES, BY REGION, 2017–2020 (USD BILLION)

TABLE 46 MARKET FOR HEALTHCARE & LIFE SCIENCES, BY REGION, 2021–2026 (USD BILLION)

9.4 EDUCATIONAL INSTITUTIONS

9.4.1 INCREASING USE OF TECHNOLOGY TO TRAIN STUDENTS WILL PROPEL MARKET GROWTH

TABLE 47 MARKET FOR EDUCATIONAL INSTITUTIONS, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 48 MARKET FOR EDUCATIONAL INSTITUTIONS, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 49 MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2017–2020 (USD BILLION)

TABLE 50 MARKET FOR EDUCATIONAL INSTITUTIONS, BY REGION, 2021–2026 (USD BILLION)

9.5 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

9.5.1 MIGRATION TO CLOUD-BASED INFRASTRUCTURE DRIVING DEMAND FOR DEVICE-AS-A-SERVICE AMONG BFSI ORGANIZATIONS

TABLE 51 MARKET FOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI), BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 52 MARKET FOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI), BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 53 MARKET FOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI), BY REGION, 2017–2020 (USD BILLION)

TABLE 54 MARKET FOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI), BY REGION, 2021–2026 (USD BILLION)

9.5.1.1 MARKET for banking, financial services, and insurance(BFSI): COVID-19 impact

FIGURE 45 IMPACT OF COVID-19 ON MARKET FOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

TABLE 55 POST-COVID-19: MARKET FOR BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI), 2017–2026 (USD BILLION)

9.6 PUBLIC SECTOR AND GOVERNMENT OFFICES

9.6.1 FOCUS ON IMPROVING IT INFRASTRUCTURE WOULD PROPEL ADOPTION OF DAAS IN PUBLIC SECTOR ANF GOVERNMENT OFFICES

TABLE 56 MARKET FOR PUBLIC SECTOR & GOVERNMENT OFFICES, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 57 MARKET FOR PUBLIC SECTOR & GOVERNMENT OFFICES, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 58 MARKET FOR PUBLIC SECTOR & GOVERNMENT OFFICES, BY REGION, 2017–2020 (USD BILLION)

TABLE 59 MARKET FOR PUBLIC SECTOR & GOVERNMENT OFFICES, BY REGION, 2021–2026 (USD BILLION)

9.7 OTHERS

TABLE 60 MARKET FOR OTHER END USERS, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 61 MARKET FOR OTHER END USERS, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 62 MARKET FOR OTHER END USERS, BY REGION, 2017–2020 (USD BILLION)

TABLE 63 MARKET FOR OTHER END USERS, BY REGION, 2021–2026 (USD BILLION)

10 MARKET, BY REGION (Page No. - 123)

10.1 INTRODUCTION

FIGURE 46 GEOGRAPHIC SNAPSHOT OF MARKET

FIGURE 47 APAC TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

TABLE 64 MARKET, BY REGION, 2017–2020 (USD BILLION)

TABLE 65 MARKET, BY REGION, 2021–2026 (USD BILLION)

10.2 NORTH AMERICA

FIGURE 48 SNAPSHOT: MARKET IN NORTH AMERICA

10.2.1 MARKET IN NORTH AMERICA: COVID-19 IMPACT

FIGURE 49 IMPACT OF COVID-19 ON MARKET IN NORTH AMERICA

TABLE 66 POST-COVID-19: MARKET IN NORTH AMERICA, 2017–2026 (USD BILLION)

TABLE 67 MARKET IN NORTH AMERICA, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 68 MARKET IN NORTH AMERICA, BY DEVICE TYPE, 2021–2026 (USD BILLION)

TABLE 69 MARKET IN NORTH AMERICA, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 70 MARKET IN NORTH AMERICA, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 71 MARKET IN NORTH AMERICA, BY END USER, 2017–2020 (USD BILLION)

TABLE 72 MARKET IN NORTH AMERICA, BY END USER, 2021—2026 (USD BILLION)

TABLE 73 MARKET IN NORTH AMERICA, BY COUNTRY, 2017—2020 (USD BILLION)

TABLE 74 MARKET IN NORTH AMERICA, BY COUNTRY, 2021—2026 (USD BILLION)

10.2.2 US

10.2.2.1 Suitable environment, in terms of government regulations and compliance, to support market growth in US

TABLE 75 MARKET IN US, BY END USER, 2017–2020 (USD MILLION)

TABLE 76 MARKET IN US, BY END USER, 2021–2026 (USD MILLION)

10.2.3 CANADA

10.2.3.1 Small and medium-sized enterprises to fuel demand for device-as-a-service in Canada

TABLE 77 MARKET IN CANADA, BY END USER, 2017–2020 (USD MILLION)

TABLE 78 MARKET IN CANADA, BY END USER, 2021–2026 (USD MILLION)

10.2.4 MEXICO

10.2.4.1 Limited demand for IT infrastructure may restrict MARKET growth in Mexico

TABLE 79 MARKET IN MEXICO, BY END USER, 2017–2020 (USD MILLION)

TABLE 80 MARKET IN MEXICO, BY END USER, 2021–2026 (USD MILLION)

10.3 EUROPE

FIGURE 50 SNAPSHOT: MARKET IN EUROPE

10.3.1 MARKET IN EUROPE: COVID-19 IMPACT

FIGURE 51 IMPACT OF COVID-19 ON MARKET IN EUROPE

TABLE 81 POST-COVID-19: MARKET IN EUROPE, 2017–2026 (USD BILLION)

TABLE 82 MARKET IN EUROPE, BY OFFERING, 2017–2020 (USD BILLION)

TABLE 83 MARKET IN EUROPE, BY OFFERING, 2021–2026 (USD BILLION)

TABLE 84 MARKET IN EUROPE, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 85 MARKET IN EUROPE, BY DEVICE TYPE, 2021–2026 (USD BILLION)

TABLE 86 MARKET IN EUROPE, BY ORGANIZATION SIZE, 2017–2020 (USD BILLION)

TABLE 87 MARKET IN EUROPE, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 88 MARKET IN EUROPE, BY END USER, 2017–2020 (USD BILLION)

TABLE 89 MARKET IN EUROPE, BY END USER, 2021–2026 (USD BILLION)

TABLE 90 MARKET IN EUROPE, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 91 MARKET IN EUROPE, BY COUNTRY, 2021–2026 (USD MILLION)

10.3.2 UK

10.3.2.1 Large-scale adoption of DaaS model by SMEs to support market growth in UK

FIGURE 52 NUMBER OF PRIVATE SECTOR BUSINESSES IN UK

TABLE 92 MARKET IN UK, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 93 MARKET IN UK, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 94 MARKET IN UK, BY END USER, 2017–2020 (USD MILLION)

TABLE 95 MARKET IN UK, BY END USER, 2021–2026 (USD MILLION)

10.3.3 GERMANY

10.3.3.1 Small and medium-sized enterprises to substantiate MARKET growth in Germany

TABLE 96 MARKET IN GERMANY, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 97 MARKET IN GERMANY, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 98 MARKET IN GERMANY, BY END USER, 2017–2020 (USD MILLION)

TABLE 99 MARKET IN GERMANY, BY END USER, 2021–2026 (USD MILLION)

10.3.4 FRANCE

10.3.4.1 Adoption of cloud computing will push growth of DaaS model in France

TABLE 100 MARKET IN FRANCE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 101 MARKET IN FRANCE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 102 MARKET IN FRANCE, BY END USER, 2017–2020 (USD MILLION)

TABLE 103 MARKET IN FRANCE, BY END USER, 2021–2026 (USD MILLION)

10.3.5 ITALY

10.3.5.1 Demand from healthcare and life sciences organizations will push market growth in Italy

TABLE 104 MARKET IN ITALY, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 105 MARKET IN ITALY, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 106 MARKET IN ITALY, BY END USER, 2017–2020 (USD MILLION)

TABLE 107 MARKET IN ITALY, BY END USER, 2021–2026 (USD MILLION)

10.3.6 NETHERLANDS

10.3.6.1 Increase in partnerships among local DaaS providers and established global players to catalyze market growth in Netherlands

TABLE 108 MARKET IN NETHERLANDS, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 109 MARKET IN NETHERLANDS, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 110 MARKET IN NETHERLANDS, BY END USER, 2017–2020 (USD MILLION)

TABLE 111 MARKET IN NETHERLANDS, BY END USER, 2021–2026 (USD MILLION)

10.3.7 BELGIUM

10.3.7.1 Operational presence of established DaaS providers to boost market growth in Belgium

TABLE 112 MARKET IN BELGIUM, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 113 MARKET IN BELGIUM, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 114 MARKET IN BELGIUM, BY END USER, 2017–2020 (USD MILLION)

TABLE 115 MARKET IN BELGIUM, BY END USER, 2021–2026 (USD MILLION)

10.3.8 NORDIC COUNTRIES

TABLE 116 MARKET IN NORDIC COUNTRIES, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 117 MARKET IN NORDIC COUNTRIES, BY COUNTRY, 2021–2026 (USD MILLION)

TABLE 118 MARKET IN NORDIC COUNTRIES, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 119 MARKET IN NORDIC COUNTRIES, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 120 MARKET IN NORDIC COUNTRIES, BY END USER, 2017–2020 (USD MILLION)

TABLE 121 MARKET IN NORDIC COUNTRIES, BY END USER, 2021–2026 (USD MILLION)

10.3.8.1 Sweden

10.3.8.1.1 Increased demand for mobile devices to favor market growth

10.3.8.2 Finland

10.3.8.2.1 Increasing demand for IT asset renting in Finland to boost market growth

10.3.8.3 Denmark

10.3.8.3.1 Large number of medtech companies to contribute towards demand for device-as-a-service

10.3.8.4 Norway

10.3.8.4.1 Third-party service provider to substantiate market growth in Norway

10.3.9 REST OF EUROPE

TABLE 122 MARKET IN REST OF EUROPE, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 123 MARKET IN REST OF EUROPE, BY ORGANIZATION SIZE, 2021–2026 (USD MILLION)

TABLE 124 MARKET IN REST OF EUROPE, BY END USER, 2017–2020 (USD MILLION)

TABLE 125 MARKET IN REST OF EUROPE, BY END USER, 2021–2026 (USD MILLION)

10.4 APAC

FIGURE 53 SNAPSHOT: MARKET IN APAC

10.4.1 MARKET IN APAC: COVID-19 IMPACT

FIGURE 54 IMPACT OF COVID-19 ON MARKET IN APAC

TABLE 126 POST-COVID-19: MARKET IN APAC, 2017–2026 (USD BILLION)

TABLE 127 MARKET IN APAC, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 128 MARKET IN APAC, BY DEVICE TYPE, 2021–2026 (USD BILLION)

TABLE 129 MARKET IN APAC, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 130 MARKET IN APAC, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 131 MARKET IN APAC, BY END USER, 2017–2020 (USD BILLION)

TABLE 132 MARKET IN APAC, BY END USER, 2021–2026 (USD BILLION)

TABLE 133 MARKET IN APAC, BY COUNTRY, 2017–2020 (USD MILLION)

TABLE 134 MARKET IN APAC, BY COUNTRY, 2021–2026 (USD MILLION)

10.4.2 CHINA

10.4.2.1 Impressive growth of IT industry to foster DaaS market growth in China

TABLE 135 MARKET IN CHINA, BY END USER, 2017–2020 (USD MILLION)

TABLE 136 MARKET IN CHINA, BY END USER, 2021–2026 (USD MILLION)

10.4.3 JAPAN

10.4.3.1 Increasing adoption of device-as-a-service in education, government, and BFSI verticals is driving Japanese market

TABLE 137 MARKET IN JAPAN, BY END USER, 2017–2020 (USD MILLION)

TABLE 138 MARKET IN JAPAN, BY END USER, 2021–2026 (USD MILLION)

10.4.4 INDIA

10.4.4.1 Focus on digital transformation will fuel demand for device-as-a-service model

TABLE 139 MARKET IN INDIA, BY END USER, 2017–2020 (USD MILLION)

TABLE 140 MARKET IN INDIA, BY END USER, 2021–2026 (USD MILLION)

10.4.5 AUSTRALIA

10.4.5.1 Entry of leading OEMs to catalyze market growth in Australia

TABLE 141 MARKET IN AUSTRALIA, BY END USER, 2017–2020 (USD MILLION)

TABLE 142 MARKET IN AUSTRALIA, BY END USER, 2021–2026 (USD MILLION)

10.4.6 REST OF APAC

TABLE 143 MARKET IN REST OF APAC, BY END USER, 2017–2020 (USD MILLION)

TABLE 144 MARKET IN REST OF APAC, BY END USER, 2021–2026 (USD MILLION)

10.5 REST OF THE WORLD

TABLE 145 MARKET IN ROW, BY DEVICE TYPE, 2017–2020 (USD BILLION)

TABLE 146 MARKET IN ROW, BY DEVICE TYPE, 2021–2026 (USD BILLION)

TABLE 147 MARKET IN ROW, BY ORGANIZATION SIZE, 2017–2020 (USD MILLION)

TABLE 148 MARKET IN ROW, BY ORGANIZATION SIZE, 2021–2026 (USD BILLION)

TABLE 149 MARKET IN ROW, BY END USER, 2017–2020 (USD MILLION)

TABLE 150 MARKET IN ROW, BY END USER, 2021–2026 (USD MILLION)

TABLE 151 MARKET IN ROW, BY REGION, 2017–2020 (USD MILLION)

TABLE 152 MARKET IN ROW, BY REGION, 2021–2026 (USD MILLION)

10.5.1 SOUTH AMERICA

10.5.1.1 Third-party service providers are major contributors to MARKET in South America

TABLE 153 MARKET IN SOUTH AMERICA, BY END USER, 2017–2020 (USD MILLION)

TABLE 154 MARKET IN SOUTH AMERICA, BY END USER, 2021–2026 (USD MILLION)

10.5.2 MIDDLE EAST AND AFRICA

10.5.2.1 Lower total cost of ownership would boost adoption of DaaS in Middle East and Africa region

TABLE 155 MARKET IN MIDDLE EAST AND AFRICA, BY END USER, 2017–2020 (USD MILLION)

TABLE 156 MARKET IN MIDDLE EAST AND AFRICA, BY END USER, 2021–2026 (USD MILLION)

11 COMPETITIVE LANDSCAPE (Page No. - 170)

11.1 OVERVIEW

11.2 REVENUE ANALYSIS OF TOP 5 COMPANIES

FIGURE 55 REVENUE ANALYSIS (USD BILLION), 2017–2020

11.3 MARKET SHARE ANALYSIS, 2020

TABLE 157 GLOBAL MARKET: DEGREE OF COMPETITION

FIGURE 56 MARKET SHARE ANALYSIS: GLOBAL MARKET, 2020

11.4 COMPANY EVALUATION MATRIX

11.4.1 STAR

11.4.2 EMERGING LEADER

11.4.3 PERVASIVE

11.4.4 PARTICIPANT

FIGURE 57 MARKET COMPETITIVE LEADERSHIP MAPPING, 2020

11.4.5 COMPANY FOOTPRINT

TABLE 158 COMPANY FOOTPRINT: MARKET

TABLE 159 COMPANY INDUSTRY FOOTPRINT: MARKET

TABLE 160 COMPANY DEVICE TYPE FOOTPRINT: MARKET

TABLE 161 COMPANY REGION FOOTPRINT: MARKET

11.5 MARKET STARTUP/SME EVALUATION MATRIX, 2020

11.5.1 PROGRESSIVE COMPANY

11.5.2 RESPONSIVE COMPANY

11.5.3 DYNAMIC COMPANY

11.5.4 STARTING BLOCK

FIGURE 58 MARKET, STARTUP/SME EVALUATION MATRIX, 2020

11.6 COMPETITIVE SITUATIONS AND TRENDS

11.6.1 DEALS

TABLE 162 DEALS, 2019–2020

12 COMPANY PROFILES (Page No. - 183)

(Business Overview, Products/ Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats))*

12.1 KEY PLAYERS

12.1.1 HEWLETT PACKARD

TABLE 163 HEWLETT PACKARD: BUSINESS OVERVIEW

FIGURE 59 HEWLETT PACKARD: COMPANY SNAPSHOT

12.1.2 DELL TECHNOLOGIES

TABLE 164 DELL TECHNOLOGIES: BUSINESS OVERVIEW

FIGURE 60 DELL TECHNOLOGIES: COMPANY SNAPSHOT

12.1.3 LENOVO

TABLE 165 LENOVO: BUSINESS OVERVIEW

FIGURE 61 LENOVO: COMPANY SNAPSHOT

12.1.4 MICROSOFT

TABLE 166 MICROSOFT: BUSINESS OVERVIEW

FIGURE 62 MICROSOFT: COMPANY SNAPSHOT

12.1.5 CISCO

TABLE 167 CISCO: BUSINESS OVERVIEW

FIGURE 63 CISCO: COMPANY SNAPSHOT

12.1.6 COMPUCOM

TABLE 168 COMPUCOM: BUSINESS OVERVIEW

FIGURE 64 COMPUCOM: COMPANY SNAPSHOT

12.1.7 HEWLETT PACKARD ENTERPRISE

TABLE 169 HEWLETT PACKARD ENTERPRISE: BUSINESS OVERVIEW

FIGURE 65 HEWLETT PACKARD ENTERPRISE: COMPANY SNAPSHOT

12.1.8 3STEPIT

TABLE 170 3STEPIT: BUSINESS OVERVIEW

FIGURE 66 3STEPIT: COMPANY SNAPSHOT

12.1.9 TELIA COMPANY

TABLE 171 TELIA COMPANY: BUSINESS OVERVIEW

FIGURE 67 TELIA COMPANY: COMPANY SNAPSHOT

12.1.10 ATEA GLOBAL SERVICES

TABLE 172 ATEA GLOBAL SERVICES: BUSINESS OVERVIEW

FIGURE 68 ATEA GLOBAL SERVICES: COMPANY SNAPSHOT

12.1.11 CHG MERIDIAN

TABLE 173 CHG MERIDIAN: BUSINESS OVERVIEW

12.1.12 CSI LEASING

TABLE 174 CSI LEASING: BUSINESS OVERVIEW

FIGURE 69 CSI LEASING: COMPANY SNAPSHOT

12.1.13 COMPUTACENTER

TABLE 175 COMPUTACENTER: BUSINESS OVERVIEW

FIGURE 70 COMPUTACENTER: COMPANY SNAPSHOT

12.1.14 ECONOCOM

TABLE 176 ECONOCOM: BUSINESS OVERVIEW

12.1.15 GREENFLEX

TABLE 177 GREENFLEX: BUSINESS OVERVIEW

12.1.16 GRENKE

TABLE 178 GRENKE: BUSINESS OVERVIEW

FIGURE 71 GRENKE: COMPANY SNAPSHOT

12.1.17 EXCELLENCE IT

TABLE 179 EXCELLENCE IT: BUSINESS OVERVIEW

12.1.18 FOXWAY

TABLE 180 FOXWAY: BUSINESS OVERVIEW

12.1.19 APPLE

TABLE 181 APPLE: BUSINESS OVERVIEW

FIGURE 72 APPLE: COMPANY SNAPSHOT

12.2 OTHER KEY PLAYERS

12.2.1 HEMMERSBACH GMBH

12.2.2 SHI INTERNATIONAL

12.2.3 STARHUB

12.2.4 COMPUTER SYSTEMS AUSTRALIA (CSA)

12.2.5 PC CONNECTION

12.2.6 SOFTCAT

12.2.7 SYNNEX CORPORATION

*Details on Business Overview, Products/ Services Offered, Recent Developments, and MnM View (Key strengths/Right to Win, Strategic Choices Made, and Weaknesses and Competitive Threats) might not be captured in case of unlisted companies.

13 APPENDIX (Page No. - 231)

13.1 INSIGHTS OF INDUSTRY EXPERTS

13.2 DISCUSSION GUIDE

13.3 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

13.4 AVAILABLE CUSTOMIZATIONS

13.5 RELATED REPORTS

13.6 AUTHOR DETAILS

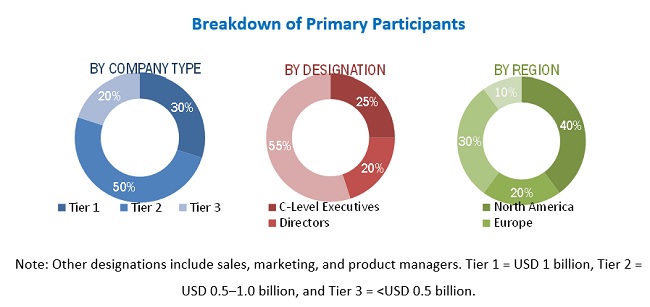

The study involved four major activities in estimating the current size of the device-as-a-service market. Exhaustive secondary research was done to collect information on the market and its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the total market size. After that, market breakdown and data triangulation were employed to estimate the market size of segments and subsegments.

Secondary Research

In the secondary research process, various secondary sources have been referred to for identifying and collecting information important for this study. These secondary sources include device-as-a-service technology journals and magazines, IEEE journals; annual reports, press releases, and investor presentations of companies; white papers; certified publications and articles from recognized authors; and directories and databases such as Factiva, Hoovers, and OneSource.

Primary Research

In the primary research process, various primary sources from both supply and demand sides have been interviewed to obtain qualitative and quantitative information important for this report. The primary sources from the supply side included industry experts such as CEOs, VPs, marketing directors, technology and innovation directors, and related executives from key companies and organizations operating in the device-as-a-service market. After complete market engineering (including calculations regarding market statistics, market breakdown, market size estimations, market forecasting, and data triangulation), extensive primary research was conducted to gather information as well as to verify and validate the critical numbers arrived at.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

In the complete market engineering process, both top-down and bottom-up approaches have been implemented, along with several data triangulation methods, to estimate and validate the size of the device-as-a-service market and other dependent submarkets listed in this report.

- Key players in the industry and markets have been identified through extensive secondary research.

- In terms of value, the industry’s supply chain and market size have been determined through primary and secondary research processes.

- All percentage shares, splits, and breakdowns have been determined using secondary sources and verified through primary sources.

To know about the assumptions considered for the study, Request for Free Sample Report

Data Triangulation

After arriving at the overall market size from the estimation process explained above, the global market has been split into several segments and subsegments. To complete the overall market engineering process and arrive at exact statistics for all segments and subsegments, market breakdown and data triangulation procedures have been employed wherever applicable. The data has been triangulated by studying various factors and trends identified from both demand and supply sides.

Report Objectives

The following are the primary objectives of the study.

- To define, describe, and forecast the Device-as-a-service (DaaS) market size, by offering, device type, organization size, and end user, in terms of value

- To provide the size of the market across 4 main regions, namely, North America, Europe, Asia Pacific (APAC), and the Rest of the World (RoW), along with their respective country-level market sizes, in terms of value

- To provide detailed information regarding the drivers, restraints, opportunities, and challenges that influence the market growth

- To provide a detailed overview of the device-as-a-service value chain

- To strategically analyze micromarkets with respect to individual growth trends, prospects, and contributions to the total market

- To analyze key trends related to services, device types, and applications that shape and influence the global device-as-a-service market

- To profile key players and comprehensively analyze their rankings based on their revenues and core competencies

- To analyze opportunities in the market for stakeholders and provide a detailed overview of the competitive landscape of the market

- To analyze competitive developments in the device-as-a-service market, such as expansions, agreements, partnerships, contracts, product developments, and research and development (R&D)

Available Customizations

With the given market data, MarketsandMarkets offers customizations according to a company’s specific needs. The following customization options are available for the report:

Company Information:

- Detailed analysis and profiling of additional market players (up to 5)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Device-as-a-Service Market

Different types of devices are used in PC as a Service model. What are those devices and their market share in PC as a Service market?

What are the growth opportunities for the PC as a Service market? What are the market dynamics? Who are the key players in this market?

Who are the key players in PC as a Service market? We are looking for market share analysis and the top players, along with their product offerings and business growth opportunities in this market.