Patient Portal Market by Type (Standalone, and Integrated portal), by Delivery Mode (Web-Based, and Cloud- Based), & by End Users (Providers, Payers, Pharmacies, and Others) - Global Forecast to 2020

The patient portal market size is projected to grow at a CAGR of 18.1%. The growth of this market can be contributed to the federal mandates like meaning use, growing patient centric approach in healthcare delivery, increasing EHR adoption rate, and growing popularity of patient portals among the elderly. On the other hand, data security & privacy concerns, high cost of deployment of patient portal solutions, and requirement of infrastructural investments to support patient portals are some of the factors expected to restrain the growth of the market to a certain extent.

Patient portals are an important form of patient engagement solutions that are gaining popularity across the globe. The use of health information technologies and online resources in healthcare boosts care quality by improving care access, efficiency, chronic disease management, and patient & family involvement.

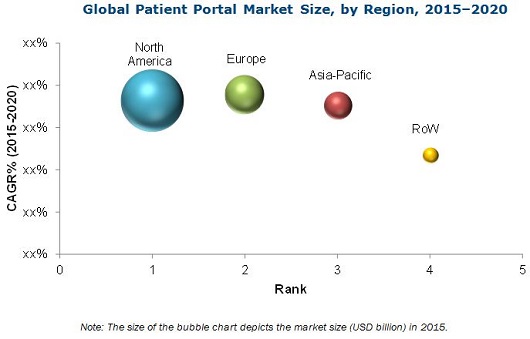

The market is expected to be dominated by North America, followed by Europe, Asia-Pacific, and the Rest of the World (RoW). The European region is expected to grow at the highest rate during the forecast period.

Based on type, the market has been divided into standalone and integrated patient portals. Integrated patient portals operate as a module added onto an existing EMR/EHR (electronic medical records/electronic health records) or any other healthcare IT system. Integrated portals are estimated to account for the largest share of the global market, by type. This large share can be attributed to the fact that these solutions offer increased efficiency and low requirement of expensive custom development to build a bridge between systems. Most integrated portals are provided by the same vendor as an EHR system. Moreover, these solutions allow a user to complete multiple business functions from within the same interface. As they provide a one-stop solution, they are cheaper, favored, and therefore high in demand.

By delivery mode, the market has been segmented into web-based and cloud-based modes. The web-based mode of delivery accounts for the major share of the market. However, the cloud-based mode of delivery is expected to grow at a higher CAGR, as cloud-based services can help healthcare organizations share and integrate information from disparate locations or systems in real time and generate a database registry.

The market, by end user, is segmented into providers, payers, pharmacies, and others. Providers include hospitals, ambulatory care centers, home healthcare agencies, nursing homes, diagnostic & imaging centers, and physicians. Other end users include employer groups and government entities. Providers are expected to account for the major share of the patient portal market globally. The growing need to improve the profitability of healthcare operations while containing costs, along with government initiatives to improve the quality of care and various incentive programs for providers, is among the factors propelling the use of patient portal solutions among providers across the globe.

Government mandates, growing consumerism, rising EHR usage, and the growing popularity of patient portals among the elderly are some factors expected to drive the growth of the market. However, the requirement of infrastructural investments to support patient portals, coupled with other factors like data security & privacy concerns, and the high cost of deployment of patient portal solutions are expected to restrain the growth of the market to a certain extent. In addition to this, the lack of health literacy poses a major challenge for market growth.

The development of cloud-based patient portal solutions is a lucrative growth opportunity for players in the market.

On the basis of region, this market is categorized into North America, Europe, Asia-Pacific, and the Rest of the World (RoW).

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Source: Center for Patient and Consumer Engagement, Society for Participatory Medicine, Association for Patient Experience, Institute of Patient and Family Centered Care, Patient Engagement Advisory Committee, American Association of Healthcare Administrative Management (AAHAM), Institute for Health Technology Transformation (iHT2), The Health Foundation, Healthcare Information and Management Systems Society (HIMSS), American Medical Group Association (AMGA), Agency for Healthcare Research and Quality (AHRQ), Health Research & Educational Trust (HRET), American Hospital Association (AHA), International Association of Health Policy (IAHP), Institute of Population and Public Health (IPPH), Public Health Agency of Canada, WHO, OECD, Expert Interviews, and MarketsandMarkets Analysis

some of the key players in the patient portal market are Allscripts Healthcare Solutions, Inc. (U.S.), McKesson Corporation (U.S.), athenahealth, Inc. (U.S.), Cerner Corporation (U.S.), eClinicalWorks (U.S.), CureMD (U.S.), NextGen Healthcare Information Systems, LLC (U.S.), Greenway Health, LLC (U.S.), Medfusion (U.S.), Epic Corporation Inc. (U.S.), GE Healthcare (U.K.), and Intelichart (U.S.)

Target Audience:

- Healthcare Institutions/Providers (Hospitals, Medical Groups, Physician Practices, Diagnostic Centers, Pharmacies, Ambulatory Centers and Outpatient Clinics)

- Healthcare Insurance Companies/Payers

- Healthcare IT Service Providers

- Venture Capitalists

- Corporate Entities

- Accountable Care Organizations

Patient Portal Market Report Scope

This research report categorizes the global market into the following segments:

By Type

- Standalone Patient Portals

- Integrated Patient Portals

By Delivery Mode

- Web-Based Delivery

- Cloud-Based Delivery

By End Users

- Providers

- Payers

- Pharmacies

- Others (Employer Groups and Government Bodies)

By Region

-

North America

- U.S.

- Canada

-

Europe

- Germany

- U.K.

- France

- Italy

- Rest of Europe (RoE)

-

Asia-Pacific

- Japan

- China

- Rest of APAC (ROAPAC)

- Rest of the World (RoW)

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization option is available for the report:

Portfolio Assessment

Product Matrix, which gives a detailed comparison of the product portfolios of the top three companies in the market.

Frequently Asked Questions (FAQ):

What is the size of Patient Portal Market ?

The global Patient Portal Market size is growing at a CAGR of 18.1%

What are the major growth factors of Patient Portal Market ?

The growth of the overall patient portals market can be contributed to the federal mandates like meaning use, growing patient centric approach in healthcare delivery, increasing EHR adoption rate, and growing popularity of patient portals among the elderly. On the other hand, data security & privacy concerns, high cost of deployment of patient portal solutions, and requirement of infrastructural investments to support patient portals are some of the factors expected to restrain the growth of the market to a certain extent.

Who all are the prominent players of Patient Portal Market ?

some of the key players in the patient portal market are Allscripts Healthcare Solutions, Inc. (U.S.), McKesson Corporation (U.S.), athenahealth, Inc. (U.S.), Cerner Corporation (U.S.), eClinicalWorks (U.S.), CureMD (U.S.), NextGen Healthcare Information Systems, LLC (U.S.), Greenway Health, LLC (U.S.), Medfusion (U.S.), Epic Corporation Inc. (U.S.), GE Healthcare (U.K.), and Intelichart (U.S.) .

Table of Contents

1 Introduction (Page No. - 15)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Considered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 18)

2.1 Research Methodology Steps

2.2 Secondary and Primary Research Methodology

2.2.1 Secondary Research

2.2.1.1 Key Data From Secondary Sources

2.2.2 Primary Research

2.2.2.1 Key Industry Insights

2.2.2.2 Key Data From Primary Sources

2.2.2.3 Key Insights From Primary Sources

2.3 Market Size Estimation Methodology

2.4 Market Forecast Methodology

2.5 Market Data Validation and Triangulation

2.6 Assumptions

3 Executive Summary (Page No. - 28)

3.1 Introduction

3.2 Current Scenario

3.3 Future Outlook

4 Premium Insights (Page No. - 32)

4.1 Global Patient Portal Market

4.2 Geographic Analysis: Market, By End User

4.3 Market, By Type (2015 vs 2020)

5 Market Overview (Page No. - 35)

5.1 Introduction

5.2 Market Segmentation

5.3 Market Dynamics

5.3.1 Drivers

5.3.1.1 Federal Mandates to Encourage the Adoption of Patient Portal Solutions Among Stakeholders

5.3.1.2 Adoption of A Patient-Centric Approach By Healthcare Payers & Providers

5.3.1.3 Growing Usage of EHR Solutions

5.3.1.4 Growing Popularity of Patient Portals Among the Elderly Population

5.3.2 Restraints

5.3.2.1 Data Privacy & Security Concerns

5.3.2.2 High Cost of Deployment

5.3.2.3 Requirement of Infrastructural Investments to Support Patient Portals

5.3.3 Opportunity

5.3.3.1 Cloud-Based Patient Portal Solutions

5.3.4 Challenge

5.3.4.1 Lack of Health Literacy

6 Patient Portal Market, By Type (Page No. - 44)

6.1 Introduction

6.2 Integrated Patient Portals

6.3 Standalone Patient Portals

7 Patient Portal Market, By Delivery Mode (Page No. - 50)

7.1 Introduction

7.2 Web-Based Delivery

7.3 Cloud-Based Delivery

8 Patient Portal Market, By End User (Page No. - 56)

8.1 Introduction

8.2 Providers

8.3 Payers

8.4 Pharmacies

8.5 Others

9 Patient Portal Market, By Region (Page No. - 66)

9.1 Introduction

9.2 North America

9.2.1 U.S.

9.2.1.1 Federal Mandates

9.2.1.2 Acos As End Users for Patient Portal Platforms

9.2.1.3 Rising Aging Population

9.2.1.4 Rising Need to Curtail Escalating Healthcare Costs

9.2.2 Canada

9.2.2.1 Canada’s Efforts to Enhance Healthcare Delivery

9.2.2.2 Digital Health in Canada

9.3 Europe

9.3.1 Germany

9.3.1.1 Rising Demand for Advanced Healthcare Solutions and Efficient Healthcare Delivery

9.3.2 U.K.

9.3.2.1 Government Focus on Integrating Hcit Solutions in Healthcare

9.3.3 France

9.3.3.1 Aging Population and Government Initiatives

9.3.4 Italy

9.3.4.1 Increasing Focus on Ensuring Interoperability of Patient Health Records

9.3.5 Rest of Europe (RoE)

9.3.5.1 Increasing Focus on the Deployment of EHR-Based It Solutions

9.4 Asia-Pacific (APAC)

9.4.1 Japan

9.4.1.1 Growing Initiatives for Japan’s ICT Fund

9.4.2 China

9.4.2.1 Investments and Reforms to Modernize China’s Healthcare Infrastructure

9.4.3 Rest of APAC

9.4.3.1 Implementation of Hcit Programs in Australia and New Zealand

9.4.3.2 Rapidly Growing Indian Healthcare Industry

9.4.3.3 ‘One Singaporean, One Health Record’ Initiative to Spur Adoption of Patient Portal Solutions

9.5 Rest of World (RoW)

9.5.1 Healthcare Investments in the Middle East

9.5.2 Rising Awareness on Hcit Solutions in Brazil

10 Competitive Landscape (Page No. - 103)

10.1 Overview

10.2 Competitive Situation and Trends

10.2.1 Product Deployment

10.2.2 Agreements, Alliances, Partnerships, and Collaborations

10.2.3 New Product Launches

10.2.4 Acquisitions/Mergers

10.2.5 Expansions

10.2.6 Other Strategies

11 Company Profiles (Page No. - 111)

(Overview, Financials, Products & Services, Strategy, & Developments)*

11.1 Introduction

11.2 Allscripts Healthcare Solutions, Inc.

11.3 Mckesson Corporation

11.4 Athenahealth

11.5 Cerner Corporation

11.6 Eclinicalworks

11.7 Curemd

11.8 Nextgen Healthcare Information Systems,LLC (Subsidiary of Quality Systems, Inc.)

11.9 Greenway Health,LLC

11.10 Medfusion, Inc.

11.11 Epic Corporation, Inc.

*Details on Financials, Product & Services, Strategy, & Developments Might Not Be Captured in Case of Unlisted Companies.

12 Appendix (Page No. - 142)

12.1 Discussion Guide

12.2 Company Developments (2012–2015)

12.2.1 Allscripts Healthcare Solutions, Inc.

12.2.2 Athenahealth

12.2.3 Cerner Corporation

12.2.4 Eclinicalworks

12.2.5 Curemd

12.2.6 Nextgen Healthcare Information Systems,LLC

12.2.7 Greenway Health,LLC

12.2.8 Medfusion, Inc.

12.3 Knowledge Store: Marketsandmarkets’ Subscription Portal

12.4 Introducing RT: Real-Time Market Intelligence

12.5 Available Customizations

12.6 Related Reports

List of Tables (80 Tables)

Table 1 Federal Mandates are Propelling the Growth of the Global Market

Table 2 Data Privacy and Security Concerns are Limiting the Adoption of Patient Portal Solutions

Table 3 Cloud-Based Patient Portal Solutions Have A Huge Potential for the Patient Portal Market

Table 4 Lack of Health Literacy is A Major Challenge Faced By the Market

Table 5 Global Size, By Type, 2013–2020 (USD Million)

Table 6 Integrated Patient Portals Market Size, By Region, 2013–2020 (USD Million)

Table 7 Integrated Patient Portals Market Size, By Country, 2013–2020 (USD Million)

Table 8 Standalone Patient Portals Market Size, By Region, 2013–2020 (USD Million)

Table 9 Standalone Patient Portals Market Size, By Country, 2013–2020 (USD Million)

Table 10 Global Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 11 Web-Based Delivery Market for Patient Portals, By Region, 2013–2020 (USD Million)

Table 12 Web-Based Delivery Market for Patient Portals, By Country, 2013–2020 (USD Million)

Table 13 Cloud-Based Delivery Market for Patient Portals, By Region, 2013–2020 (USD Million)

Table 14 Cloud-Based Delivery Market for Patient Portals, By Country, 2013–2020 (USD Million)

Table 15 Global Market, By End User, 2013–2020 (USD Million)

Table 16 Providers Market for Patient Portals, By Region, 2013–2020 (USD Million)

Table 17 Providers Market for Patient Portals, By Country, 2013–2020 (USD Million)

Table 18 Payers Market for Patient Portals, By Region, 2013–2020 (USD Million)

Table 19 Payers Market for Patient Portals, By Country, 2013–2020 (USD Million)

Table 20 Pharmacies Market for Patient Portals, By Region, 2013–2020 (USD Million)

Table 21 Pharmacies Market for Patient Portals, By Country, 2013–2020 (USD Million)

Table 22 Other End Users Market for Patient Portals, By Region, 2013–2020 (USD Million)

Table 23 Other End Users Market for Patient Portals, By Country, 2013–2020 (USD Million)

Table 24 Market Size, By Region, 2013–2020 (USD Million)

Table 25 North America: Market Size, By Country, 2013–2020 (USD Million)

Table 26 North America: Market Size, By Type, 2013–2020 (USD Million)

Table 27 North America: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 28 North America: Market Size, By End User, 2013–2020 (USD Million)

Table 29 U.S.: Market Size, By Type, 2013–2020 (USD Million)

Table 30 U.S.: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 31 U.S.: Market Size, By End User, 2013–2020 (USD Million)

Table 32 Canada: Market Size, By Type, 2013–2020 (USD Million)

Table 33 Canada: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 34 Canada: Market Size, By End User, 2013–2020 (USD Million)

Table 35 Europe: Market Size, By Country, 2013–2020 (USD Million)

Table 36 Europe: Market Size, By Type, 2013–2020 (USD Million)

Table 37 Europe: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 38 Europe: Market Size, By End User, 2013–2020 (USD Million)

Table 39 Germany: Macroeconomic Indicators for Healthcare Delivery

Table 40 Germany: Market Size, By Type, 2013–2020 (USD Million)

Table 41 Germany: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 42 Germany: Market Size, By End User, 2013–2020 (USD Million)

Table 43 U.K.: Macroeconomic Indicators for Healthcare Delivery

Table 44 U.K.: Market Size, By Type, 2013–2020 (USD Million)

Table 45 U.K.: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 46 U.K.: Market Size, By End User, 2013–2020 (USD Million)

Table 47 France: Macroeconomic Indicators for Healthcare Delivery

Table 48 France: Market Size, By Type, 2013–2020 (USD Million)

Table 49 France: Patient Portal Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 50 France: Market Size, By End User, 2013–2020 (USD Million)

Table 51 Italy: Macroeconomic Indicators for Healthcare Delivery

Table 52 Italy: Market Size, By Type, 2013–2020 (USD Million)

Table 53 Italy: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 54 Italy: Market Size, By End User, 2013–2020 (USD Million)

Table 55 Recent EHR-Based Deployments in RoE

Table 56 RoE: Patient Portal Market Size, By Type, 2013–2020 (USD Million)

Table 57 RoE: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 58 RoE: Market Size, By End User, 2013–2020 (USD Million)

Table 59 APAC: Patient Portal Market Size, By Country, 2013–2020 (USD Million)

Table 60 APAC: Market Size, By Type, 2013–2020 (USD Million)

Table 61 APAC: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 62 APAC: Market Size, By End User, 2013–2020 (USD Million)

Table 63 Japan: Patient Portal Market Size, By Type, 2013–2020 (USD Million)

Table 64 Japan: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 65 Japan: Market Size, By End User, 2013–2020 (USD Million)

Table 66 China: Patient Portal Market Size, By Type, 2013–2020 (USD Million)

Table 67 China: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 68 China: Market Size, By End User, 2013–2020 (USD Million)

Table 69 RoAPAC: Patient Portal Market Size, By Type, 2013–2020 (USD Million)

Table 70 RoAPAC: Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 71 RoAPAC: Market Size, By End User, 2013–2020 (USD Million)

Table 72 RoW: Patient Portal Market Size, By Type, 2013–2020 (USD Million)

Table 73 RoW: Patient Portal Market Size, By Delivery Mode, 2013–2020 (USD Million)

Table 74 RoW: Patient Portal Market Size, By End User, 2013–2020 (USD Million)

Table 75 Product Deployment, (2013–Jan 2016)

Table 76 Agreements, Alliances, Partnerships, and Collaborations, (2013–Jan 2016)

Table 77 New Product Launches, (2013–Jan 2016)

Table 78 Acquisitions/Mergers, (2013–Jan 2016)

Table 79 Expansions, (2013–Jan 2016)

Table 80 Other Strategies, (2013–Jan 2016)

List of Figures (32 Figures)

Figure 1 Global Patient Portal Market: Research Methodology Steps

Figure 2 Sampling Frame: Primary Research

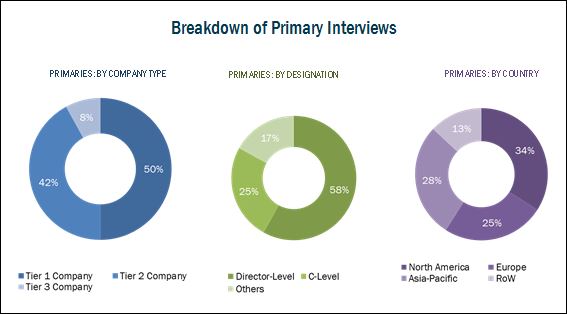

Figure 3 Breakdown of Primary Interviews: By Company Type, Designation, and Region

Figure 4 Market Size Estimation Methodology: Bottom-Up Approach

Figure 5 Market Size Estimation Methodology: Top-Down Approach

Figure 6 Research Design

Figure 7 Data Triangulation Methodology

Figure 8 North America to Dominate the Global Patient Portal Market

Figure 9 Providers Segment to Witness the Highest CAGR During the Forecast Period

Figure 10 European Market to Witness Highest Growth During the Forecast Period

Figure 11 North America Accounts for the Major Share in the Patient Portal Market

Figure 12 North America Dominated the Patient Portal Market in 2015

Figure 13 European Region to Witness the Highest Growth Rate During the Forecast Period

Figure 14 Integrated Patient Portals Commanded the Largest Share in 2015

Figure 15 Global Market Segmentation

Figure 16 Drivers, Restraints, Opportunities, & Challenges

Figure 17 Integrated Patient Portals to Account for the Largest Share of Patient Portal Market in 2015

Figure 18 Web-Based Mode of Delivery to Account for the Largest Share in 2015

Figure 19 Providers Accounted for the Largest Share for Patient Portal Market in 2015

Figure 20 European Region to Grow at the Highest CAGR in the Market in 2015

Figure 21 U.S. Commands the Largest Share in the Market in North America

Figure 22 Germany to Dominate the European Patient Portal Market in 2015

Figure 23 China, the Fastest-Growing Segment of the APAC Market

Figure 24 Web-Based Delivery Mode Segment to Dominate the RoW Market

Figure 25 Top 5 Strategies Adopted By Market Players Over the Last 3 Years (2013–Jan 2016)

Figure 26 Battle for Market Share: Product Deployment Was the Key Strategy Adopted By Market Players (2013–Jan 2016)

Figure 27 Geographic Revenue Mix of Market Players

Figure 28 Allscripts Healthcare Solutions, Inc.: Company Snapshot

Figure 29 Mckesson Corporation: Company Snapshot

Figure 30 Athenahealth: Company Snapshot

Figure 31 Cerner Corporation: Company Snapshot

Figure 32 Nextgen Healthcare Information Systems,LLC (Subsidiary of Quality Systems, Inc.): Company Snapshot

Top-down and bottom-up approaches were used to validate the size of the global patient portal market and estimate the size of various other dependent submarkets in the overall market Various secondary sources such as directories, industry journals, databases such as Hoover’s, Bloomberg Business, Factiva, and Avention, and annual reports of the companies have been used to identify and collect information useful for the study of this market. Primary sources such as experts from both supply and demand sides have been interviewed to obtain and validate information as well as to assess dynamics of this market. The breakdown of profiles of primaries is shown in the figure below:

To know about the assumptions considered for the study, download the pdf brochure

Objectives of the Study

- To define and measure the global market on the basis of type, delivery mode, end user, and region

- To identify the key micromarkets1 and their drivers within the global patient portal market, which are expected to show impressive growth opportunities in the coming years

- To identify the market trends and opportunities for all the stakeholders

- To strategically analyze the market structure and profile the key players of the global market and comprehensively analyze their core competencies

- To track and analyze competitive developments such as product deployments; agreements, alliances, collaborations, and partnerships; new product launches and product enhancements; mergers and acquisitions; expansions; and other strategies (divestment, funding, and product integration)

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Portal Market