Patient Lifting Equipment Market by Product (Ceiling/Overhead Lift, Stair Lift, Mobile/Floor Lift, Sit to Stand Lift, Bath & Pool Lift, Lifting Slings, Lifting Accessories), End User (Hospital, Home Care, Elderly Care Facility) - global forecast to 2024

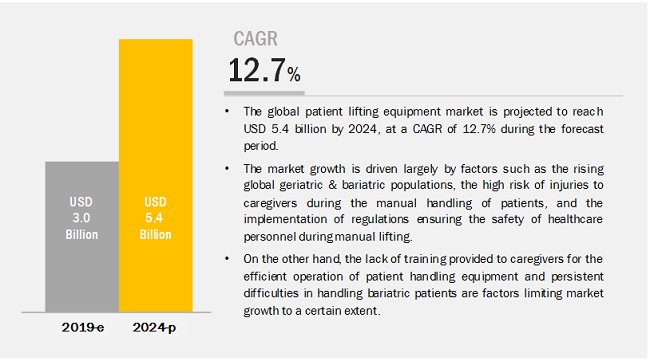

[132 Pages Report] The patient lifting equipment market is projected to reach USD 5.4 billion in 2024 from USD 3.0 billion in 2019, at CAGR of 12.7% during the forecast period. Market growth is largely driven by factors such as increasing research global geriatric & bariatric populations, the high risk of injuries to caregivers during the manual handling of patients, and the implementation of regulations ensuring the safety of healthcare personnel during manual lifting. However, the lack of training provided to caregivers for the efficient operation of patient handling equipment is expected to restrain the growth of this market during the forecast period.

By product, the mobile lifts segment is expected to witness above-average growth in the patient lifting equipment market during the forecast period.

Mobile lifts are expected to show the highest growth in the forecast period. Mobile lifts are sling-based and promote a cost-effective and effortless transfer of heavy patients from one place to another without the need for professional uninstallation and reinstallation, as required for ceiling lifts. These advantages promote the adoption of mobile lifts, especially in home care settings and elderly care facilities.

By end-user, the home care settings segment is growing at the highest rate.

The home care settings segment is projected to register the highest growth rate during the forecast period due to the increasing focus on reducing healthcare costs and government initiatives to promote home healthcare. The growth of the global home healthcare market is expected to subsequently drive the demand for patient lifting equipment.

North America is expected to account for the largest market share during the forecast period.

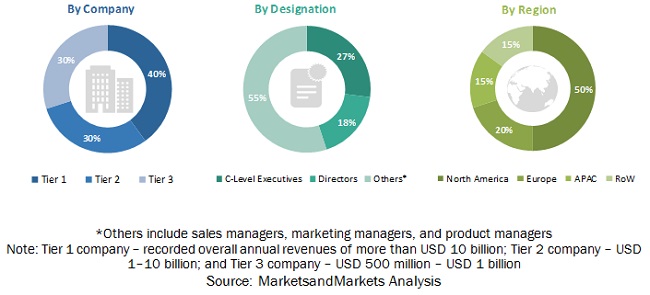

The patient lifting equipment market is divided into four major regions Europe, North America, Asia Pacific, and the Rest of the World (RoW). In 2018, Europe accounted for the largest share of the global market, closely followed by North America. North America is estimated to grow at the highest CAGR during the forecast period. Factors such as the increasing geriatric & bariatric population in the US & Canada, the growth of the North American home healthcare industry, and the growing patient volume in nursing homes & elderly care facilities are the major factors supporting the growth of the North American patient lifting equipment market.Key Market Players

The major companies in the patient lifting equipment market include Arjo (Sweden), DJO global (US), Drive DeVilbiss healthcare (US), ETAC (Sweden), GF Health Products (US), Guldmann (US), Handicare (Sweden), Hill-Rom Holdings, Inc. (US), Invacare (US), Joerns Healthcare (US), Medline Industries (US), Prism Medical UK.

Hill-Rom (US) was the leading player in the market in 2018. The company provides a wide range of patient lifts such as mobile lifts, overhead lifts, free-standing lifts, sit-to-stand lifts, slings and lift sheets, and other lifting accessories. The company makes significant R&D investments, which is an integral part of its operations. Hill-Rom invested USD 0.14 billion towards R&D in 2018 (4.8% of total revenue). This significant investment in product development enabled the company to focus on product innovation. The constant focus on innovation helps the company to enhance its product offerings for the patient lifting equipment market.

Scope of the Report

|

Report Metric |

Details |

|

Market size available for years |

20172024 |

|

Base year considered |

2018 |

|

Forecast period |

20192024 |

|

Forecast units |

Values (USD Million) |

|

Segments covered |

Product, End User, and Region |

|

Geographies covered |

North America, Europe, APAC, and RoW |

|

Companies covered |

Arjo (Sweden), DJO global (US), Drive DeVilbiss healthcare (US), ETAC (Sweden), GF Health Products (US), Guldmann (US), Handicare (Sweden), Hill-rom Holdings, Inc. (US), Invacare (US), Joerns Healthcare (US), Medline Industries (US), Prism Medical UK. |

Based on the product, the patient lifting equipment market is segmented as follows:

- Ceiling Lifts

- Star & Wheelchair Lifts

- Mobile Lifts

- Sit-to-stand lifts

- Bath & Pool Lifts

- Lifting Slings

- Lifting accessories

Based on end users, the patient lifting equipment market is segmented as follows:

- Hospitals

- Home Care Settings

- Elderly Care facilities

- Other End Users (Emergency medical services, long term acute care centers, trauma centers, and nursing homes)

Based on the region, the patient lifting equipment market is segmented as follows:

- North America

- US

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- RoE

- Asia Pacific

- RoW

Recent Developments:

- In August 2016 GF Health products launched Lumex Pro Battery-Powered Floor Lift in the Mobile lift segment.

- In October 2018, Etac launched two new products, Molift Raiser pro in Sit to Stand segment

- In September 2016, Handicare acquired Prism Medical (US & Canada), one of the leading manufacturers of fixed ceiling lifts, portable ceiling lifts, floor lifts, slings, and other ancillary patient handling products.

Key questions addressed by the report:

- Who are the major market players in the patient lifting equipment market?

- What are the regional growth trends and the largest revenue-generating regions for patient lifting equipment market?

- What are the major drivers and challenges in the patient lifting equipment market?

- What are the major product segments in the patient lifting equipment market?

- What are the major end-users for the patient lifting equipment?

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

Table of Contents

1 Introduction (Page No. - 12)

1.1 Objectives of the Study

1.2 Market Definition

1.3 Market Scope

1.3.1 Markets Covered

1.3.2 Years Covered for the Study

1.4 Currency

1.5 Limitations

1.6 Stakeholders

2 Research Methodology (Page No. - 15)

2.1 Research Data

2.1.1 Secondary Sources

2.1.1.1 Key Data From Secondary Sources

2.1.2 Primary Sources

2.1.2.1 Key Data From Primary Sources

2.1.2.2 Key Industry Insights

2.2 Market Size Estimation

2.3 Market Breakdown and Data Triangulation

3 Executive Summary (Page No. - 22)

4 Premium Insights (Page No. - 25)

4.1 Patient Lifting Equipment Market Overview

4.2 Patient Lifting Equipment Market, By Product

4.3 Europe: Market, By Country & End User (2018)

5 Market Overview (Page No. - 28)

5.1 Introduction

5.1.1 Drivers

5.1.1.1 Rising Geriatric and Bariatric Populations

5.1.1.2 High Risk of Injuries to Caregivers During the Manual Handling of Patients

5.1.1.3 Implementation of Regulations Ensuring the Safety of Healthcare Personnel Against Manual Lifting

5.1.2 Restraints

5.1.2.1 Lack of Training Provided to Caregivers for the Efficient Operation of Patient Handling Equipment

5.1.3 Opportunities

5.1.3.1 Growing Patient Volume in Nursing Homes and Rising Demand for Home Healthcare

5.1.4 Challenges

5.1.4.1 Persistent Difficulties in Handling Bariatric Patients

6 Patient Lifting Equipment Market, By Product (Page No. - 32)

6.1 Introduction

6.2 Ceiling Lifts

6.2.1 Ceiling Lifts Accounted for the Largest Share of the Patient Lifting Equipment Market in 2018

6.3 Stair & Wheelchair Lifts

6.3.1 Increasing Preference for Home Care is Driving Market Growth in This Segment

6.4 Mobile Lifts

6.4.1 Advantages of Mobile Lifts have Driven End-User Demand

6.5 Sit-To-Stand Lifts

6.5.1 Growth in the Elderly Population is Expected to Foster the Adoption of Sit-To-Stand Lifts

6.6 Bath & Pool Lifts

6.6.1 Growth of the Aged and Disabled Populations have Driven the Demand for Bath & Pool Lifts

6.7 Lifting Slings

6.7.1 Enhanced Support for Patient Transfer Encourages the Use of Lifting Slings

6.8 Accessories

7 Patient Lifting Equipment Market, By End User (Page No. - 47)

7.1 Introduction

7.2 Hospitals

7.2.1 Increasing Number of Injuries Caused During the Patient Handling Process to Drive the Patient Lifting Equipment Market for Hospitals

7.3 Home Care Settings

7.3.1 Home Care Settings to Witness the Highest Growth During the Forecast Period

7.4 Elderly Care Facilities

7.4.1 Growth in the Elderly Population to Support Market Growth

7.5 Other End Users

8 Patient Lifting Equipment Market, By Region (Page No. - 56)

8.1 Introduction

8.2 Europe

8.2.1 UK

8.2.1.1 Wide Acceptance of No-Lift Approach Resulted in Increased Adoption of Patient Lifting Equipment

8.2.2 Germany

8.2.2.1 Rising Prevalence of Obesity Will Ensure Continued Demand for Patient Lifting Equipment

8.2.3 France

8.2.3.1 Growth in Aging and Disabled Population Will Drive the Market

8.2.4 Italy

8.2.4.1 Adoption of Patient Lifting Techniques in the Italian Healthcare Industry Will Reduce the Economic Burden of Fall Injuries and Msd

8.2.5 Spain

8.2.5.1 Increasing Life Expectancy has Driven the Adoption of Patient Lifting Equipment in Spain

8.2.6 RoE

8.3 North America

8.3.1 US

8.3.1.1 Increasing Prevalence of Msds Among Healthcare Workers is Driving Market Growth in the US

8.3.2 Canada

8.3.2.1 Amendments to Canadian Safety Regulations have Supported the Use of Patient Lifting Equipment

8.4 Asia Pacific

8.4.1 Implementation of Safe Patient Handling Policies are Expected to Drive the Market

8.5 Rest of the World

9 Competitive Landscape (Page No. - 79)

9.1 Overview

9.2 Market Ranking Analysis, 2018

9.3 Competitive Leadership Mapping

9.3.1 Visionary Leaders

9.3.2 Innovators

9.3.3 Dynamic Differentiators

9.3.4 Emerging Companies

9.4 Competitive Benchmarking

9.4.1 Strength of Product Portfolio (25 Players)

9.4.2 Business Strategy Excellence (25 Players)

9.5 Competitive Situation and Trends

9.5.1 Product Launches and Upgrades

9.5.2 Expansions

9.5.3 Acquisitions

9.5.4 Collaborations and Partnerships

9.5.5 Other Strategies

10 Company Profiles (Page No. - 87)

(Business Overview, Products Offered, Recent Developments, MnM View)*

10.1 Arjo

10.2 DJO Global

10.3 Drive Devilbiss Healthcare

10.4 ETAC

10.5 GF Health Products

10.6 Guldmann

10.7 Handicare

10.8 Hill-Rom Holdings, Inc.

10.9 Invacare

10.10 Joerns Healthcare

10.11 Medline Industries

10.12 Prism Medical UK

*Business Overview, Products Offered, Recent Developments, MnM View Might Not Be Captured in Case of Unlisted Companies.

11 Appendix (Page No. - 127)

11.1 Discussion Guide

11.2 Knowledge Store: Marketsandmarkets Subscription Portal

11.3 Available Customizations

11.4 Related Reports

11.5 Author Details

List of Tables (67 Tables)

Table 1 Patient Lifting Equipment: Market, By Product, 20172024 (USD Million)

Table 2 Ceiling Lifts Market, By Region, 20172024 (USD Million)

Table 3 Europe: Ceiling Lifts Market, By Country, 20172024 (USD Million)

Table 4 North America: Ceiling Lifts Market, By Country, 20172024 (USD Million)

Table 5 Stair & Wheelchair Lifts Market, By Region, 20172024 (USD Million)

Table 6 Europe: Stair & Wheelchair Lifts Market, By Country, 20172024 (USD Million)

Table 7 North America: Stair & Wheelchair Lifts Market, By Country, 20172024 (USD Million)

Table 8 Mobile Lifts Market, By Region, 20172024 (USD Million)

Table 9 Europe: Mobile Lifts Market, By Country, 20172024 (USD Million)

Table 10 North America: Mobile Lifts Market, By Country, 20172024 (USD Million)

Table 11 Sit-To-Stand Lifts Market, By Region, 20172024 (USD Million)

Table 12 Europe: Sit-To-Stand Lifts Market, By Country, 20172024 (USD Million)

Table 13 North America: Sit-To-Stand Lifts Market, By Country, 20172024 (USD Million)

Table 14 Bath & Pool Lifts Market, By Region, 20172024 (USD Million)

Table 15 Europe: Bath & Pool Lifts Market, By Country, 20172024 (USD Million)

Table 16 North America: Bath & Pool Lifts Market, By Country, 20172024 (USD Million)

Table 17 Lifting Slings Market, By Region, 20172024 (USD Million)

Table 18 Europe: Lifting Slings Market, By Country, 20172024 (USD Million)

Table 19 North America: Lifting Slings Market, By Country, 20172024 (USD Million)

Table 20 Accessories Market, By Region, 20172024 (USD Million)

Table 21 Europe: Lifting Accessories Market, By Country, 20172024 (USD Million)

Table 22 North America: Accessories Market, By Country, 20172024 (USD Million)

Table 23 Market, By End User, 20172024 (USD Million)

Table 24 Market for Hospitals, By Region, 20172024 (USD Million)

Table 25 Europe: Market for Hospitals, By Country, 20172024 (USD Million)

Table 26 North America: Market for Hospitals, By Country, 20172024 (USD Million)

Table 27 Patient Lifting Equipment Market for Home Care Settings, By Region, 20172024 (USD Million)

Table 28 Europe: Market for Home Care Settings, By Country, 20172024 (USD Million)

Table 29 North America: Market for Home Care Settings, By Country, 20172024 (USD Million)

Table 30 Patient Lifting Equipment Market for Elderly Care Facilities, By Region, 20172024 (USD Million)

Table 31 Europe: Market for Elderly Care Facilities, By Country, 20172024 (USD Million)

Table 32 North America: Market for Elderly Care Facilities, By Country, 20172024 (USD Million)

Table 33 Market for Other End Users, By Region, 20172024 (USD Million)

Table 34 Europe: Market for Other End Users, By Country, 20172024 (USD Million)

Table 35 North America: Market for Other End Users, By Country, 20172024 (USD Million)

Table 36 Market, By Region, 20172024 (USD Million)

Table 37 Europe: Market, By Country, 20172024 (USD Million)

Table 38 Europe: Market, By Product, 20172024 (USD Million)

Table 39 Europe: Market, By End User, 20172024 (USD Million)

Table 40 UK: Market, By Product, 20172024 (USD Million)

Table 41 UK: Market, By End User, 20172024 (USD Million)

Table 42 Germany: Market, By Product, 20172024 (USD Million)

Table 43 Germany: Patient Lifting Equipment Market, By End User, 20172024 (USD Million)

Table 44 France: Market, By Product, 20172024 (USD Million)

Table 45 France: Market, By End User, 20172024 (USD Million)

Table 46 Italy: Patient Lifting Equipment Market, By Product, 20172024 (USD Million)

Table 47 Italy: Market, By End User, 20172024 (USD Million)

Table 48 Spain: Market, By Product, 20172024 (USD Million)

Table 49 Spain: Market, By End User, 20172024 (USD Million)

Table 50 RoE: Market, By Product, 20172024 (USD Million)

Table 51 RoE: Market, By End User, 20172024 (USD Million)

Table 52 North America: Market, By Country, 20172024 (USD Million)

Table 53 North America: Market, By Product, 20172024 (USD Million)

Table 54 North America: Market, By End User, 20172024 (USD Million)

Table 55 US: Market, By Product, 20172024 (USD Million)

Table 56 US: Market, By End User, 20172024 (USD Million)

Table 57 Canada: Market, By Product, 20172024 (USD Million)

Table 58 Canada: Market, By End User, 20172024 (USD Million)

Table 59 Asia Pacific: Market, By Product, 20172024 (USD Million)

Table 60 Asia Pacific: Market, By End User, 20172024 (USD Million)

Table 61 RoW: Market, By Product, 20172024 (USD Million)

Table 62 RoW: Market, By End User, 20172024 (USD Million)

Table 63 Product Launches and Upgrades, 20162019

Table 64 Expansions, 20162019

Table 65 Acquisitions, 20162019

Table 66 Collaborations and Partnerships, 2016-2019

Table 67 Other Strategies, 20162019

List of Figures (21 Figures)

Figure 1 Research Design

Figure 2 Primary Sources

Figure 3 Bottom-Up Approach

Figure 4 Top-Down Approach

Figure 5 Data Triangulation Methodology

Figure 6 Patient Lifting Equipment: Market Share, By Product, 2018

Figure 7 Patient Lifting Equipment: Market, By End User, 2018

Figure 8 Geographical Snapshot of the Patient Lifting Equipment: Market

Figure 9 High Risk of Injuries to Caregivers During the Manual Handling of Patients to Drive the Growth of This Market

Figure 10 Mobile Lifts to Register the Highest Growth During the Forecast Period (20192024)

Figure 11 Patient Lifting Equipment Market : Drivers, Restraints, Opportunities, and Challenges

Figure 12 Geographic Snapshot: North America Will Be the Fastest-Growing Market for Patient Lifting Equipment During the Forecast Period

Figure 13 Europe: Market Snapshot

Figure 14 North America: Market Snapshot

Figure 15 Rank of Top Four Companies in the Patient Lifting Equipment Market, 2018

Figure 16 Patient Lifting Equipment: Market (Global), Competitive Leadership Mapping, 2018

Figure 17 Arjo: Company Snapshot (2018)

Figure 18 DJO Global: Company Snapshot (2018)

Figure 19 Handicare: Company Snapshot (2018)

Figure 20 Hill-Rom Holdings, Inc: Company Snapshot (2018)

Figure 21 Invacare Corporation: Company Snapshot (2018)

The study involved four major activities in estimating the current market size for patient lifting equipment market. Exhaustive research was conducted to collect information on the market as well as its peer and parent markets. The next step was to validate these findings, assumptions, and sizing with industry experts across the value chain through primary research. Both top-down and bottom-up approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the market size of segments and sub-segments.

Secondary Research

In the secondary research process, various sources such as Hoovers, Bloomberg BusinessWeek, Forbes, and Dun & Bradstreet were referred to, to identify and collect information useful for a technical, market-oriented, and commercial study of the patient lifting equipment market. These secondary sources include annual reports, press releases & investor presentations of companies, World Health Organization (WHO), Organisation for Economic Co-operation and Development (OECD), Centers for Disease Control and Prevention (CDC), Food and Drug Administration (FDA), Association of Safe Patient Handling Professionals (ASPHP), Occupational Safety and Health Administration (OSHA), European Medicines Agency (EMA), National Health Service (NHS), Safe Patient Handling and Mobility (SPHM), American Nurses Association (ANA), National Institute for Occupational Safety and Health (NIOSH), Bureau of Labor Statistics (BLS), Association of Occupational Health Professionals (AOHP), Association of Rehabilitation Nurses (ARN), European Agency for Safety and Health at Work (EU-OSHA), European Panel on Patient Handling Ergonomics (EPPHE), Canada Occupational Health and Safety Regulations (COHS) and Australian Nursing Federation (ANF). Secondary research was mainly used to obtain vital information about the industrys supply chain, the total pool of key players, market classification, and segmentation according to industry trends to the bottom-most level and regional markets. It was also used to obtain information about the key developments from a market-oriented perspective.

Primary Research

The patient lifting equipment market comprises several stakeholders such as raw material suppliers, manufacturers of patient lifting equipment, and regulatory organizations in the supply chain. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. The primary interviewees from the demand side include key opinion leaders in hospitals, home care settings, elderly care facilities, nursing homes, and other end users. The primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing directors, technology and innovation directors, and related key executives from various key companies and organizations operating in the patient lifting equipment market. Various primary sources from both the supply and demand sides of the market were interviewed to obtain qualitative and quantitative information. Following is the profile breakup of primary respondents:

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

Both the top-down and bottom-up approaches were used to estimate and validate the total size of the patient lifting equipment market. These approaches were also used extensively to estimate the size of various subsegments in the market. The research methodology used to estimate the market size includes the following:

- The market value of the patient lifting equipment, lifting slings, and accessories have been extracted from the MNM repository and validated through secondary and primary research. The market share of each segment in the patient lifting equipment market was derived and added up to reach the global market value.

- This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives

- All percentage shares, splits, and breakdowns were determined using secondary sources and verified through primary sources.

- All possible parameters that affect the market covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to obtain the final quantitative and qualitative data.

Data Triangulation

After arriving at the overall market sizeusing the market size estimation processes explained abovethe market was split into several segments and subsegments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and subsegment, data triangulation, and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides of the patient lifting equipment market.

Report Objectives

- To define, describe, segment, and forecast the patient lifting equipment market, by product, end user, and region

- To provide detailed information about factors influencing market growth (drivers, restraints, opportunities, and Challenge)

- To strategically analyze micro-markets1 with respect to individual growth trends, prospects, and contributions to the overall market

- To analyze market opportunities for stakeholders and provide details of the competitive landscape for key players

- To forecast the size of market segments in Europe, North America, Asia Pacific (APAC), and the Rest of the World (RoW)

- To profile key players and comprehensively analyze their core competencies in terms of key developments, product portfolios, and financials

- To track and analyze competitive developments such as acquisitions, partnerships, collaborations, product launches & product upgrades, and expansions in the patient lifting equipment market

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Lifting Equipment Market