Patient Lateral Transfer Market by Product (Air Assisted Transfer Device (Type (Regular Mattress, Split Legs Mattress, Half Mattress), Usage (Single Patient Use, Reusable)), Sliding Sheets, Accessories), End User (Hospitals) & Region - Global Forecast to 2025

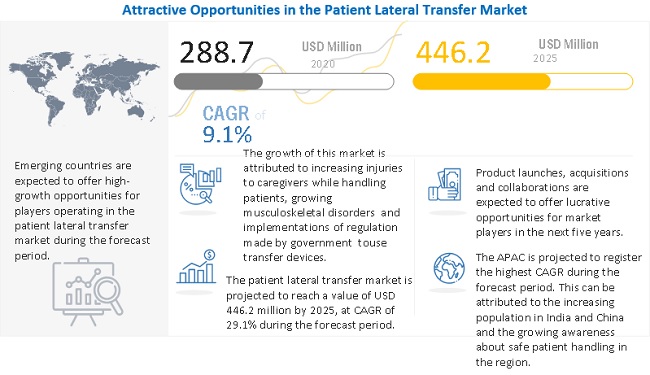

The global patient lateral transfer market in terms of revenue was estimated to be worth $288.7 million in 2020 and is poised to reach $446.2 million by 2025, growing at a CAGR of 9.1% from 2020 to 2025. The new research study consists of an industry trend analysis of the market. The new research study consists of industry trends, pricing analysis, patent analysis, conference and webinar materials, key stakeholders, and buying behaviour in the market. Due to the outbreak of corona virus globally, there is a sudden rise in the demand for patient lateral transfer services. The Growth in this market will majorly be driven by the high risk of musculoskeletal injuries to caregivers during manual handling of patients and the implementation of regulations to minimize manual patient handling. However, the lack of training to caregivers for the efficient operation of patient handling equipment is a key challenge in this market.

In this report, the patient lateral transfer market is segmented based on product and end user.

Patient Lateral Transfer Market Dynamics

Driver: High risk of injuries to caregivers during manual handling of patients

Manual handling of disabled patients may result in severe musculoskeletal injuries to caregivers, it can cause caregiver injury and put patients at risk of falls, fractures, bruises, and skin tears. With age, healthcare workers statistically become more vulnerable to infections and musculoskeletal injuries. According to OSHA (Occupational Safety and Health Administration), approximately 34% of all injuries occurring in hospital workforce are related to patient interactions and patient handling; of these, back injuries are the most prevalent. The risk of back injuries increases during lateral transfer, as caregivers must reach over the stretcher to the bed and physically pull the patient across onto a stretcher. Thus, to prevent injuries among caregiver’s, lateral patient transfer device demand has increased over the years and this is expected to increase further.

Restrain: Lack of training provided to caregivers for efficient operation of patient handling equipment

Effective training programs need to be implemented to create awareness regarding safe patient handling and enable caregivers to efficiently operate transfer devices. The lack of training can result in injuries in caregivers or patients during patient handling procedures. Also, in the case of inadequate training, caregivers may gradually shift to manual handling as they have a better understanding of manual handling techniques and may find the use of patient handling equipment cumbersome. This, in turn, can retrain the adoption of patient handling equipment.

Opportunity: Growing demand of home health care services

Globally, an increasing number of government regulations are being implemented for reducing the duration and cost involved in healthcare treatments. For instance, the Centers for Medicare and Medicaid Services (CMS) has implemented steps to provide incentives to healthcare providers for reducing hospitalization costs. Under this initiative, the CMS is promoting healthcare settings such as nursing homes and approaches such as home healthcare as they can provide quality care at reduced costs (as compared to the cost of hospitalization). Homecare settings are expected to account for 28.3% of the patient handling equipment market in the US. Owing to this, private nursing institutions and geriatric care homes have become highly viable end-user segments in the US. market. This will eventually increase opportunity for home healthcare services in patient lateral transfer market

The regular air-assisted transfer mattress segment is estimated to grow at the highest CAGR in the patient lateral transfer industry, by products market, in 2019

Based on product, the patient lateral transfer market is segmented into air-assisted lateral transfer mattresses, sliding sheets, and accessories. The air-assisted lateral transfer mattresses segment accounted for the largest market share in 2019. The large share of this segment can be attributed to the advantages of these mattresses in overcoming persistent difficulties while handling patients with special conditions.

The regular air-assisted transfer mattress segment will dominate the patient lateral transfer industry, by type, during the forecast period

Based on type, the patient lateral transfer market has been segmented into regular, split-leg, and half mattresses. In 2019, the regular mattresses segment accounted for the largest market share. The large share of this segment can primarily be attributed to their wide range of benefits and high usage in a variety of settings, such as critical care and emergency settings and operation theaters.

Hospitals are the largest end users of patient lateral transfer industry.

Based on end users, the patient lateral transfer market is segmented into hospitals, ambulatory surgery centers, and other end users. Hospitals accounted for the largest share of the market in 2019. This can be attributed to many patient admissions in hospitals, rising prevalence of various chronic conditions, and growing regulatory norms to use safe patient transfer equipment.

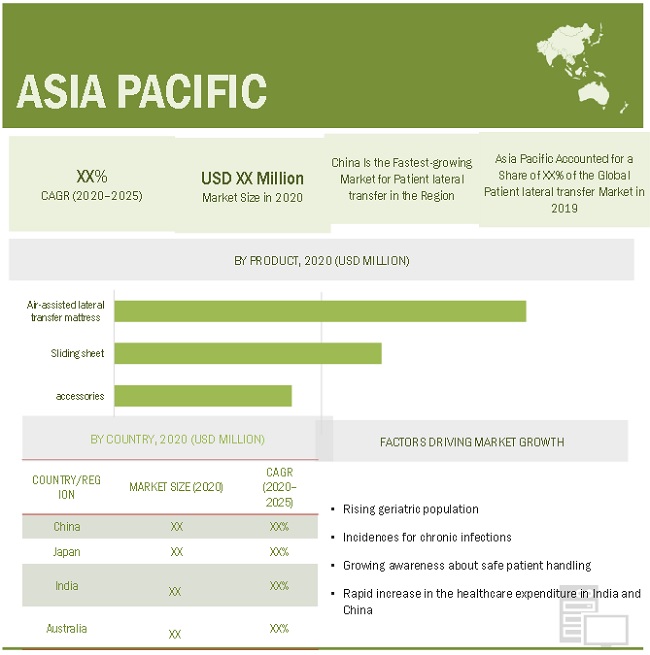

Asia Pacific market to witness the highest growth in the patient lateral transfer industry during the forecast period

The patient lateral transfer market is divided into five regions—North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. These regions are further analyzed at the country levels. North America held the largest share of the patient lateral transfer market in 2019, followed by Europe and the Asia Pacific. The Asia Pacific market is projected to grow at the highest CAGR during the forecast period. The Asia Pacific market is primarily driven by the increasing awareness regarding the benefits of safe patient handling, the presence of a large population base, growth in the geriatric population, and the rising prevalence of chronic diseases.

The products and services market is dominated by a few globally established players such as Stryker Corporation (US), Hill-Rom (US), Arjo (Sweden), Handicare (Sweden) and Etac Group (Sweden)

Scope of the Patient Lateral Transfer Industry:

|

Report Metric |

Details |

|

Market Revenue in 2020 |

$288.7 million |

|

Estimated Value by 2025 |

$446.2 million |

|

Revenue Rate |

Poised to grow at a CAGR of 9.1% |

|

Market Driver |

High risk of injuries to caregivers during manual handling of patients |

|

Market Opportunity |

Growing demand of home health care services |

The study categorizes the patient lateral transfer market to forecast revenue and analyze trends in each of the following submarkets:

By Products

-

Air-assisted lateral transfer mattress, by type

- Regular mattress

- Split-leg mattress

- Half mattress

-

Air-assisted lateral transfer mattress, by usage

- Reusable air-assisted lateral transfer mattress

- Disposable air-assisted lateral transfer mattress

- Sliding sheets

- Accessories

By End Users

- Hospitals

- Ambulatory surgical Center

- Others

Recent Developments of Patient Lateral Transfer Industry

- In April 2020, Handicare divested its Patient Handling Europe business to Direct Healthcare Group (UK).

- In February 2020, Sizewise signed an agreement with LINET (Europe).

- In January 2020, MedLine acquired Medi-Select (Canada), a distributor of medical and dental supplies.

- In May 2019, Handicare signed an agreement to divest its distributor of medical consumables- Puls AS to Mediq International BV

- In March 2019, Hill-Rom entered into an agreement to acquire Voalte (US).

Frequently Asked Questions (FAQ):

What is the projected market revenue value of the global patient lateral transfer market?

The global patient lateral transfer market boasts a total revenue value of $446.2 million by 2025.

What is the estimated growth rate (CAGR) of the global patient lateral transfer market?

The global patient lateral transfer market has an estimated compound annual growth rate (CAGR) of 9.1% and a revenue size in the region of $288.7 million in 2020.

To speak to our analyst for a discussion on the above findings, click Speak to Analyst

TABLE OF CONTENTS

1 INTRODUCTION (Page No. - 21)

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.2.1 INCLUSIONS & EXCLUSIONS

1.3 MARKETS COVERED

FIGURE 1 PATIENT LATERAL TRANSFER MARKET SEGMENTATION

1.3.1 YEARS CONSIDERED FOR THE STUDY

1.4 CURRENCY

1.5 STAKEHOLDERS

1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY (Page No. - 25)

2.1 RESEARCH APPROACH

FIGURE 2 RESEARCH DESIGN

2.1.1 SECONDARY DATA

2.1.1.1 Key data from secondary sources

2.1.2 PRIMARY DATA

FIGURE 3 PRIMARY SOURCES

2.1.2.1 Key data from primary sources

2.1.2.2 Industry insights

FIGURE 4 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

2.2 MARKET SIZE ESTIMATION

FIGURE 5 MARKET SIZE ESTIMATION: REVENUE SHARE ANALYSIS

FIGURE 6 REVENUE SHARE ANALYSIS ILLUSTRATION

FIGURE 7 COUNTRY-LEVEL ANALYSIS OF THE PATIENT LATERAL TRANSFER INDUSTRY

2.3 MARKET BREAKDOWN & DATA TRIANGULATION

FIGURE 8 MARKET DATA TRIANGULATION METHODOLOGY

2.4 MARKET SHARE ANALYSIS

2.5 ASSUMPTIONS FOR THE STUDY

3 EXECUTIVE SUMMARY (Page No. - 35)

FIGURE 9 PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2020 VS. 2025 (USD MILLION)

FIGURE 10 AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2020 VS. 2025 (USD MILLION)

FIGURE 11 AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2020 VS. 2025 (USD MILLION)

FIGURE 12 MARKET, BY END USER, 2020 VS. 2025 (USD MILLION)

FIGURE 13 GEOGRAPHICAL SNAPSHOT OF THE MARKET

4 PREMIUM INSIGHTS (Page No. - 39)

4.1 PATIENT LATERAL TRANSFER MARKET OVERVIEW

FIGURE 14 GROWING DEMAND FOR HOME HEALTHCARE SERVICES TO OFFER GROWTH OPPORTUNITIES FOR MARKET PLAYERS

4.2 ASIA PACIFIC: MARKET, BY PRODUCT & COUNTRY (2019)

FIGURE 15 AIR-ASSISTED LATERAL TRANSFER MATTRESSES SEGMENT ACCOUNTED FOR THE LARGEST MARKET SHARE IN 2019

4.3 PATIENT LATERAL TRANSFER INDUSTRY: GEOGRAPHIC GROWTH OPPORTUNITIES

FIGURE 16 CHINA TO REGISTER THE HIGHEST GROWTH RATE DURING THE FORECAST PERIOD

4.4 REGIONAL MIX: MARKET (2020−2025)

FIGURE 17 NORTH AMERICA WILL CONTINUE TO DOMINATE THE MARKET IN 2025

5 MARKET OVERVIEW (Page No. - 43)

5.1 INTRODUCTION

5.2 MARKET DYNAMICS

FIGURE 18 PATIENT LATERAL TRANSFER MARKET: DRIVERS, RESTRAINTS, AND OPPORTUNITIES

5.2.1 DRIVERS

5.2.1.1 High risk of injuries to caregivers during the manual handling of patients

5.2.1.2 Implementation of regulations to ensure safe patient handling

TABLE 1 SAFE PATIENT HANDLING LAWS ENACTED IN THE US

5.2.1.3 Advantages of lateral transfer devices in overcoming persistent difficulties in handling patients with special conditions

5.2.2 RESTRAINTS

5.2.2.1 Lack of training provided to caregivers for the efficient operation of patient handling equipment

5.2.3 OPPORTUNITIES

5.2.3.1 Growing demand for home healthcare services

5.3 IMPACT OF THE COVID-19 PANDEMIC ON THE PATIENT LATERAL TRANSFER INDUSTRY

5.4 VALUE CHAIN ANALYSIS

FIGURE 19 MARKET: VALUE CHAIN ANALYSIS

5.5 ECOSYSTEM MARKET MAP

FIGURE 20 MARKET: ECOSYSTEM MARKET MAP

6 PATIENT LATERAL TRANSFER MARKET, BY PRODUCT (Page No. - 50)

6.1 INTRODUCTION

TABLE 2 PATIENT LATERAL TRANSFER INDUSTRY, BY PRODUCT, 2018–2025 (USD MILLION)

6.2 AIR-ASSISTED LATERAL TRANSFER MATTRESSES, BY TYPE

TABLE 3 AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

6.2.1 REGULAR MATTRESSES

6.2.1.1 Regular mattresses accounted for the largest market share

TABLE 4 REGULAR MATTRESSES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.2 SPLIT-LEG MATTRESSES

6.2.2.1 These mattresses increase stability during patient transfer and reduce the chances of bruising

TABLE 5 SPLIT-LEG MATTRESSES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.2.3 HALF MATTRESSES

6.2.3.1 Growing prevalence of gynecological disorders is supporting the growth of this segment

TABLE 6 HALF MATTRESSES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3 AIR-ASSISTED LATERAL TRANSFER MATTRESSES, BY USAGE

TABLE 7 AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

6.3.1 REUSABLE MATTRESSES

6.3.1.1 Reusable mattresses have an antibacterial coating for enhanced infection control

TABLE 8 REUSABLE MATTRESSES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.3.2 SINGLE-PATIENT-USE MATTRESSES

6.3.2.1 Low cost and minimal maintenance are driving the adoption of these mattresses

TABLE 9 SINGLE-PATIENT-USE MATTRESSES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.4 SLIDING SHEETS

6.4.1 LOW COST AND EASE OF USE ARE SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 10 SLIDING SHEETS MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

6.5 ACCESSORIES

6.5.1 GROWING DEMAND FOR TRANSFER MATTRESSES IS SUPPORTING THE GROWTH OF THIS SEGMENT

TABLE 11 ACCESSORIES MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

7 PATIENT LATERAL TRANSFER MARKET, BY END USER (Page No. - 60)

7.1 INTRODUCTION

TABLE 12 PATIENT LATERAL TRANSFER INDUSTRY, BY END USER, 2018–2025 (USD MILLION)

7.2 HOSPITALS

7.2.1 INCREASED HOSPITALIZATION RATE DUE TO COVID-19 IS DRIVING THE GROWTH OF THIS SEGMENT

TABLE 13 MARKET FOR HOSPITALS, BY COUNTRY, 2018–2025 (USD MILLION)

7.3 AMBULATORY SURGERY CENTERS

7.3.1 GROWING NUMBER OF AMBULATORY SURGERY CENTERS WILL DRIVE THE GROWTH OF THIS SEGMENT

TABLE 14 MARKET FOR AMBULATORY SURGERY CENTERS, BY COUNTRY, 2018–2025 (USD MILLION)

7.4 OTHER END USERS

TABLE 15 MARKET FOR OTHER END USERS, BY COUNTRY, 2018–2025 (USD MILLION)

8 PATIENT LATERAL TRANSFER MARKET, BY REGION (Page No. - 65)

8.1 INTRODUCTION

FIGURE 21 PATIENT LATERAL TRANSFER INDUSTRY, BY COUNTRY/REGION, 2020−2025

TABLE 16 MARKET, BY REGION, 2018–2025 (USD MILLION)

8.2 NORTH AMERICA

FIGURE 22 NORTH AMERICA: MARKET SNAPSHOT

TABLE 17 NORTH AMERICA: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 18 NORTH AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 19 NORTH AMERICA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 20 NORTH AMERICA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 21 NORTH AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2.1 US

8.2.1.1 The US is the largest market for patient transfer products in North America

FIGURE 23 SHARE OF THE GERIATRIC POPULATION (65 AND ABOVE) IN THE TOTAL US POPULATION, 2010-2050

FIGURE 24 US: COVID-19 CASES (MARCH−JUNE 21, 2020)

TABLE 22 US: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 23 US: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 24 US: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 25 US: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.2.2 CANADA

8.2.2.1 Increasing number of people with disabilities to drive market growth in Canada

TABLE 26 CANADA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 27 CANADA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 28 CANADA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 29 CANADA: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3 EUROPE

TABLE 30 EUROPE: PATIENT LATERAL TRANSFER MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 31 EUROPE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 32 EUROPE: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 33 EUROPE: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 34 EUROPE: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3.1 UK

8.3.1.1 Favorable government initiatives are driving the adoption of patient lateral transfer equipment in the UK

TABLE 35 UK: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 36 UK: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 37 UK: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 38 UK: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3.2 GERMANY

8.3.2.1 Large geriatric population in the country to support market growth

TABLE 39 GERMANY: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 40 GERMANY: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 41 GERMANY: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 42 GERMANY: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3.3 FRANCE

8.3.3.1 Rising geriatric population in the country to propel market growth

TABLE 43 FRANCE: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 44 FRANCE: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 45 FRANCE: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 46 FRANCE: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3.4 ITALY

8.3.4.1 Large number of COVID-19 cases in the country is driving market growth

TABLE 47 ITALY: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 48 ITALY: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 49 ITALY: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 50 ITALY: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3.5 SPAIN

8.3.5.1 High prevalence of obesity in the country to drive the demand for patient transfer equipment

TABLE 51 SPAIN: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 52 SPAIN: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 53 SPAIN: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 54 SPAIN: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.3.6 REST OF EUROPE

TABLE 55 ROE: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 56 ROE: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 57 ROE: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 58 ROE: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.4 ASIA PACIFIC

FIGURE 25 ASIA PACIFIC: MARKET SNAPSHOT

TABLE 59 ASIA PACIFIC: MARKET, BY COUNTRY, 2018–2025 (USD MILLION)

TABLE 60 ASIA PACIFIC: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 61 ASIA PACIFIC: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 62 ASIA PACIFIC: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 63 ASIA PACIFIC: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.4.1 CHINA

8.4.1.1 China is the largest & fastest growing market for patient lateral transfer in the APAC

TABLE 64 CHINA: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 65 CHINA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 66 CHINA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 67 CHINA: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.4.2 JAPAN

8.4.2.1 Large geriatric population in the country is propelling the demand for patient lateral transfer equipment

FIGURE 26 JAPAN: GERIATRIC POPULATION (65 AND ABOVE), 2010-2018

TABLE 68 JAPAN: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 69 JAPAN: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 70 JAPAN: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 71 JAPAN: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.4.3 AUSTRALIA

8.4.3.1 Government regulations to support the growth of the patient lateral transfer market in Australia

TABLE 72 AUSTRALIA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 73 AUSTRALIA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 74 AUSTRALIA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 75 AUSTRALIA: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.4.4 INDIA

8.4.4.1 High prevalence of musculoskeletal disorders in the country to support market growth

TABLE 76 INDIA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 77 INDIA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 78 INDIA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 79 INDIA: MARKET, BY END USER, 2019–2025 (USD MILLION)

8.4.5 REST OF ASIA PACIFIC

TABLE 80 ROAPAC: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 81 ROAPAC: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 82 ROAPAC: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 83 ROAPAC: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.5 LATIN AMERICA

8.5.1 INCREASING HEALTHCARE EXPENDITURE TO SUPPORT MARKET GROWTH

TABLE 84 LATIN AMERICA: MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 85 LATIN AMERICA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 86 LATIN AMERICA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 87 LATIN AMERICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

8.6 MIDDLE EAST & AFRICA

8.6.1 DEVELOPMENTS IN HEALTHCARE INFRASTRUCTURE TO DRIVE MARKET GROWTH

TABLE 88 MIDDLE EAST & AFRICA: PATIENT LATERAL TRANSFER MARKET, BY PRODUCT, 2018–2025 (USD MILLION)

TABLE 89 MIDDLE EAST & AFRICA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY TYPE, 2018–2025 (USD MILLION)

TABLE 90 MIDDLE EAST & AFRICA: AIR-ASSISTED LATERAL TRANSFER MATTRESSES MARKET, BY USAGE, 2018–2025 (USD MILLION)

TABLE 91 MIDDLE EAST & AFRICA: MARKET, BY END USER, 2018–2025 (USD MILLION)

9 COMPETITIVE LANDSCAPE (Page No. - 102)

9.1 OVERVIEW

FIGURE 27 AGREEMENTS, PARTNERSHIPS, & COLLABORATIONS—KEY GROWTH STRATEGIES ADOPTED BY MARKET PLAYERS BETWEEN JANUARY 2017 & MAY 2020

9.2 MARKET EVALUATION FRAMEWORK

FIGURE 28 MARKET EVALUATION FRAMEWORK: PARTNERSHIPS, COLLABORATIONS, & AGREEMENTS WERE THE MOST WIDELY ADOPTED GROWTH STRATEGIES

9.3 MARKET SHARE ANALYSIS

9.3.1 MARKET SHARE ANALYSIS: PATIENT LATERAL TRANSFER MARKET

FIGURE 29 PATIENT LATERAL TRANSFER INDUSTRY SHARE ANALYSIS, BY KEY PLAYER, 2019

9.4 PATIENT LATERAL TRANSFER INDUSTRY: GEOGRAPHICAL ASSESSMENT

FIGURE 30 GEOGRAPHICAL ASSESSMENT OF KEY PLAYERS IN THE MARKET

9.5 REVENUE ANALYSIS OF KEY MARKET PLAYERS

FIGURE 31 REVENUE ANALYSIS: MARKET

9.6 COMPETITIVE SITUATION AND TRENDS

9.6.1 PRODUCT LAUNCHES

TABLE 92 KEY PRODUCT LAUNCHES, JANUARY 2017–JUNE 2020

9.6.2 EXPANSIONS

TABLE 93 KEY EXPANSIONS, JANUARY 2017-JUNE 2020

9.6.3 ACQUISITIONS & DIVESTITURES

TABLE 94 KEY ACQUISITIONS & DIVESTITURES, JANUARY 2017–JUNE 2020

9.6.4 AGREEMENTS, PARTNERSHIPS, & COLLABORATIONS

TABLE 95 KEY AGREEMENTS, PARTNERSHIPS, & COLLABORATIONS, JANUARY 2017–JUNE 2020

10 COMPANY EVALUATION MATRIX & COMPANY PROFILES (Page No. - 109)

10.1 COMPANY EVALUATION MATRIX DEFINITION & METHODOLOGY

TABLE 96 PRODUCT PORTFOLIO MATRIX: MARKET

10.1.1 STAR

10.1.2 EMERGING LEADERS

10.1.3 PERVASIVE

10.1.4 EMERGING COMPANIES

FIGURE 32 COMPANY EVALUATION MATRIX: PATIENT LATERAL TRANSFER MARKET

10.2 COMPANY PROFILES

(Business overview, Products offered, Recent developments, MNM view)*

10.2.1 STRYKER CORPORATION

FIGURE 33 STRYKER CORPORATION: COMPANY SNAPSHOT (2019)

10.2.2 HILL-ROM HOLDINGS, INC.

FIGURE 34 HILL-ROM HOLDINGS, INC.: COMPANY SNAPSHOT (2019)

10.2.3 ARJO

FIGURE 35 ARJO: COMPANY SNAPSHOT (2019)

10.2.4 HANDICARE

FIGURE 36 HANDICARE: COMPANY SNAPSHOT (2019)

10.2.5 ETAC AB

10.2.6 SIZEWISE

10.2.7 AIRPAL, INC.

10.2.8 PATIENT POSITIONING SYSTEMS, LLC

10.2.9 MEDLINE INDUSTRIES, INC.

10.2.10 EZ WAY, INC.

10.2.11 MCAULEY MEDICAL, INC.

10.2.12 AIR-MATT INC.

10.2.13 SCAN MEDICAL

10.2.14 HAINES MEDICAL AUSTRALIA

10.2.15 SAMARIT MEDICAL AG

10.2.16 BLUE CHIP MEDICAL PRODUCTS, INC.

10.2.17 WY’EAST MEDICAL

10.2.18 GBUK GROUP

10.2.19 ALIMED

10.2.20 JOERNS HEALTHCARE

*Business overview, Products offered, Recent developments, MNM view might not be captured in case of unlisted companies.

11 APPENDIX (Page No. - 141)

11.1 DISCUSSION GUIDE

11.2 KNOWLEDGE STORE: MARKETSANDMARKETS’ SUBSCRIPTION PORTAL

11.3 AVAILABLE CUSTOMIZATIONS

11.4 RELATED REPORTS

11.5 AUTHOR DETAILS

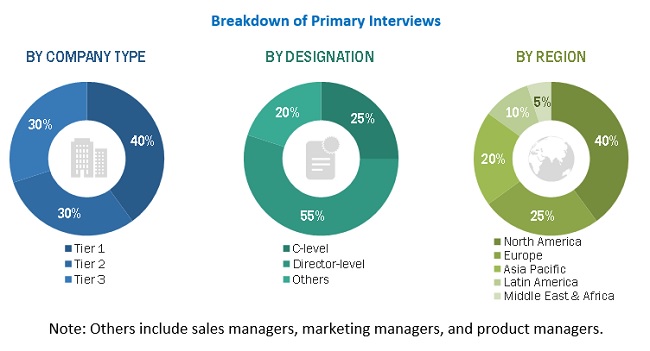

This study involved four major activities for estimating the current size of the patient lateral transfer market. Exhaustive secondary research was conducted to collect information on the market as well as its peer and parent markets. The next step focused on validating these findings, assumptions, and sizing with industry experts across the value chain through primary research. Revenue Share Analysis, Parent Market and top-down approaches were employed to estimate the complete market size. After that, market breakdown and data triangulation were used to estimate the sizes of segments and sub-segments.

Secondary Research

In the secondary research process, various secondary sources such as D&B Hoovers, Bloomberg Business, and Factiva have been referred to identify and collect information for this study. These secondary sources include annual reports, press releases and investor presentations of companies, white papers, certified publications, articles by recognized authors, gold-standard and silver-standard websites, regulatory bodies, and databases.

Primary Research

In the primary research process, various sources from both the supply and demand sides were interviewed to obtain qualitative and quantitative information for this report. Primary sources from the supply side include industry experts such as CEOs, vice presidents, marketing and sales directors, technology and innovation directors, and related key executives from various key companies operating in the patient lateral transfer market. Primary sources from the demand side include experts from hospitals and ambulatory surgical centres and research and academic laboratories. Primary research was conducted to validate the market segmentation, identify key players in the market, and gather insights on the key industry trends and key market dynamics, such as market drivers, restraints, challenges, and opportunities.

To know about the assumptions considered for the study, download the pdf brochure

Market Size Estimation

The total size of the patient lateral transfer market was arrived at after data triangulation from two different approaches, as mentioned below.

Approach to calculate the revenue of different players in the patient lateral transfer market

The size of the patient lateral transfer market was obtained from annual reports, SEC filings, online publications, and extensive primary interviews. A percentage split was applied to arrive at the size of market segments. Further splits were applied to arrive at the size for each sub-segment. These percentage splits were validated by primary participants. The country-level market sizes obtained from the annual reports, SEC filings, online publications, and extensive primary interviews were added up to reach the total market size for regions. By adding up the market sizes for all the regions, the global patient lateral transfer market was derived.

Approach to derive the market size and estimate market growth

The market size and market growth were estimated through primary interviews on a regional and global level. All responses were collated, and a weighted average was taken to derive a probabilistic estimate of the market size and growth rate.

Data Triangulation

After arriving at the overall market size—using the market size estimation processes explained above—the market was split into several segments and sub-segments. To complete the overall market engineering process and arrive at the exact statistics of each market segment and sub-segment, the data triangulation and market breakdown procedures were employed, wherever applicable. The data was triangulated by studying various factors and trends from both the demand and supply sides.

Objectives of the Study

- To define, describe, and forecast the patient lateral transfer market based on product and end user

- To provide detailed information regarding the major factors influencing the market growth (drivers, restraints, opportunities, and challenges)

- To strategically analyze micromarkets1 with respect to the individual growth trends, prospects, and contributions to the overall market

- To analyze the opportunities in the market for stakeholders and provide details of the competitive landscape for market leaders

- To forecast the size of the market segments with respect to five main regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa, along with major countries in these regions

- To strategically profile the key players and comprehensively analyze their market shares and core competencies2 in the patient lateral transfer market

- To track and analyze competitive developments such as partnerships, agreements, collaborations, acquisitions, new product developments, geographic expansions, and research and development activities in the patient lateral transfer market

Available Customizations

With the given market data, MarketsandMarkets offers customizations as per the company’s specific needs. The following customization options are available for the report:

Product Analysis

- Product matrix, which gives a detailed comparison of the product portfolios of the top companies

Geographic Analysis

- Further breakdown of the RoAPAC market into South Korea, New Zealand, Australia, Singapore, and other countries

- Further breakdown of the RoE market into Russia, the Netherlands, Switzerland, and other countries

Company Information

- Detailed analysis and profiling of additional market players, up to five

Generating Response ...

Generating Response ...

Growth opportunities and latent adjacency in Patient Lateral Transfer Market